Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Ambernath Property Tax: Payment, Rebates, and Calculation in 2025

Table of Contents

Ambernath property tax is a local tax levied by the Ambernath Municipal Council on property owners. It helps fund public services like infrastructure and maintenance. Property owners must pay it annually based on their property’s value and type. Ambernath Municipal Corporation Property Tax can only be paid offline. There is no online payment option. This is a very simple process. This blog will show you how to pay your property tax offline. We’ll make it so easy that you can pay your taxes without any trouble. Keep reading, and let’s make paying your taxes quick and simple.

Ambernath Property Tax - A Quick Info

Here is the quick info for Ambernath property tax:

| Information | Details |

| Ambarnath Municipal Council address | Nagarparishad Ambarnath office, Taluka Ambarnath, Thane District, 421501 |

| chiefofficerambarnath@gmail.com | |

| Phone | 0251-2682353 |

| Ambernath Municipal Council's official website | https://thane.nic.in/public-utility/ambarnath-nagarpalika/ |

How to Pay Ambernath Property Tax Online in 2025

Unfortunately, there is no option to pay Ambernath property tax online. Below have explained how you can pay offline

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

How to Pay Ambernath Property Tax Offline in 2025

Paying property tax offline is easy and simple. You just need to visit the Ambernath municipal corporation. You can follow the steps to pay the property tax offline easily:

- Visit the Municipal Office: Go to the Ambernath Municipal Council (AMC) office. This is where you will pay your tax.

- Gather your Documents: You need to keep all the documents before you visit the office.

- Fill out the Tax Payment Form: Fill this form with property details.

- Make the Payment: Complete the payment either by cash or cheque.

How to Print Ambernath Property Tax Receipt?

Here is how to print Ambernath property tax receipt online:

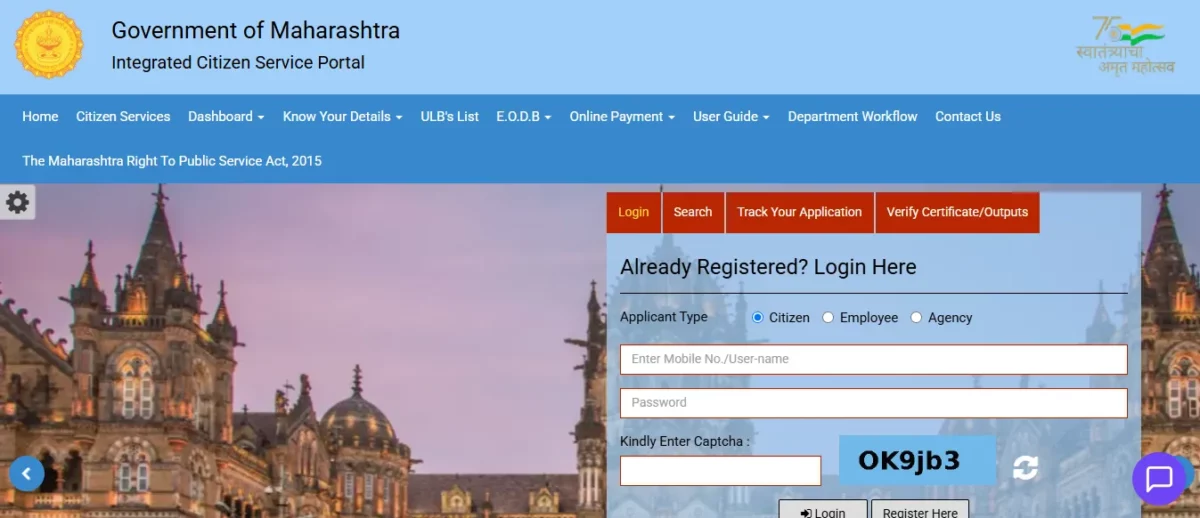

1. Visit the official website Maharashtra - https://mahaulb.in

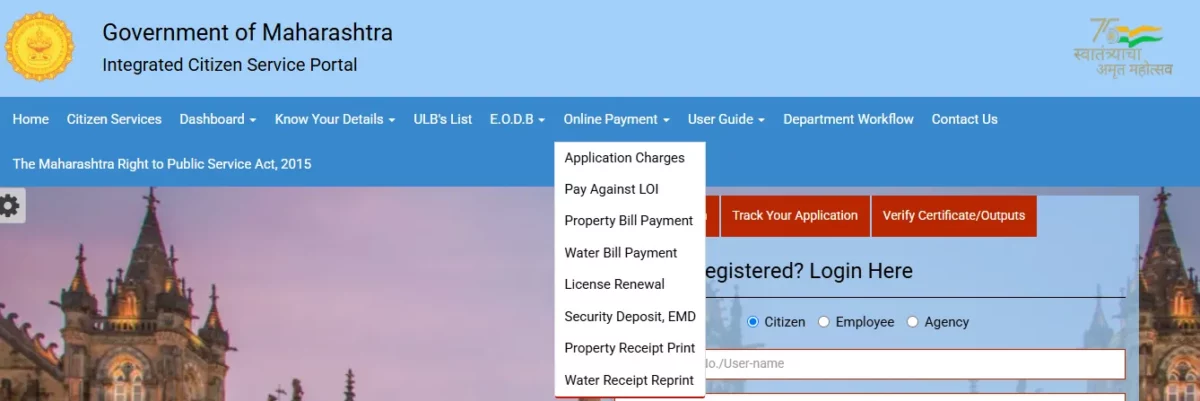

2. On the home page, under the online payment option, click on the property receipt print option.

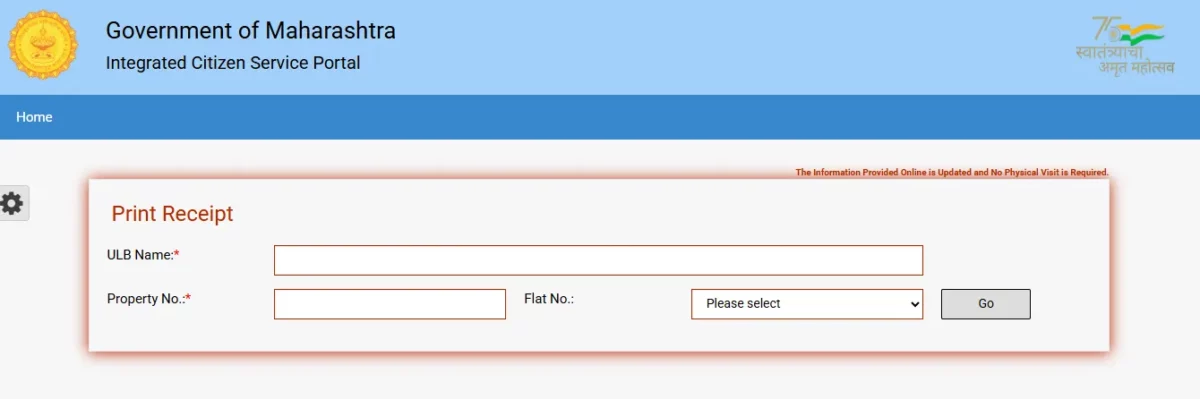

3. Enter all the details, including ULB name, property number and flat number.

4. Then, press the go option.

5. Print or save the property tax receipt for future reference.

Last date to pay Ambernath Property Tax

The last date to pay Ambernath Property Tax was June 15, 2025. You should always pay before the last to get a 10% discount in the second half of the financial year. If you fail to pay before the due date, you need to pay a 2% penalty until the total amount is paid.

Benefits of Paying Property Tax Offline in Ambernath

Paying the property tax offline has many advantages. They are:

- Personal Assistance: When you pay offline, you can get help from the staff at the municipal office. They can answer your questions and guide you through the payment process. This makes it easier to understand everything.

- No Internet Issues: Sometimes, online payments can have problems due to slow internet or technical issues. When you pay in person, you don’t have to worry about these things. You can complete your payment without any hassles.

- Instant Confirmation: After you pay your tax, you receive a receipt right away. This means you have proof of your payment immediately. It can help you if you need to show that you have paid.

- Opportunity to Check Details: By visiting the office, you can check if your property details are correct. You can also ask for updates on your account. This way, you can be sure everything is in order.

- Easy Access to Discounts: When you pay offline, you can ask the staff about any available discounts. This can help you save money, especially if you pay before the deadline.

Documents Required for Property Tax Payment in Ambernath

There are a few documents required for Ambernath property tax payment. They are:

- Your property papers.

- Previous tax payment receipts (if available).

- Any other documents related to your property.

Contact Information for Ambernath Municipal Corporation

The contact details for Ambernath Municipal Corporation are as follows:

- Address: Nagarparishad Ambarnath Office, Taluka Ambarnath, District Thane, Pin code 421501

- E-mail: chiefofficerambarnath@gmail.com

- Phone: 0251 268 2353

Explore Property Tax Payment Options City-Wise in India

Manage Your Property Journey with NoBroker Services

Paying your property tax offline in Ambernath is simple and offers many benefits. You get help from staff, quick proof of payment, and a chance to fix any details. Plus, paying on time might save you money with discounts. For an even easier way to handle your property needs, try NoBroker. NoBroker helps you buy, sell, or rent homes without needing any middlemen. It’s fast, saves you money, and makes everything stress-free. Let NoBroker make your property tasks easy today!

Frequently Asked Questions

Ans: Yes, you will receive a receipt immediately after paying.

Ans: Yes, you can update your property details when you visit the office.

Ans: Yes, the staff at the office can help you fill out the form if needed.

Ans: You can request a duplicate receipt from the municipal office.

Ans: You can correct any mistakes at the municipal office before submitting the form

Ans: You can log in to pay your property tax bill online by visiting the MahaULB portal. Enter your property details or registered credentials to access your bill and make payments.

Ans: To view and download the Ambernath property tax bill PDF, visit the Thane Municipal Corporation website, go to the property tax section, enter your property details, and select the option to download the bill in PDF format.

Ans: The property tax in Thane is 38.7%.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

60198+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

48180+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

43042+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

38934+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

33239+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115333+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193115+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132430+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

127797+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!