Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

An Insight into Home Loans with EMI Waivers

Table of Contents

For most people, buying a home in India is possible only with the help of home loans. So, when you depend so heavily on home loans when you hear there is an EMI waiver, you instantly want to opt for this offer, before doing so, here is what you need to know.

What is a Home Loan EMI Waiver?

A house loan EMI waiver reduces borrower repayment, as the term implies. The length of the offer's validity will determine how much of a discount is offered. Depending on the point at which you obtain the waiver, the amount of the decrease may also change. Each month, a different amount of principal and interest is included in the EMI. Additionally, the interest component of a long-term loan, such as a mortgage, will continue to be higher than the principal sum for almost half the loan's duration. Everything will have an impact on the actual reduction. Now, whether the lender grants you the waiver all at once or in instalments relies on them.

Where to find Home Loans with EMI Waiver?

As of now, only Axis bank and LICHFL are offering you home loan EMI waivers. Shubh Aarambh by Axis bank was launched in 2017, here you get a total of 12 EMI waivers, and 4 EMIS will be waived off at the end of the 4th, 8th and 12th year.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

LIC Housing Finance Ltd (LICHFL) has newly launched a scheme called ‘2020 Home Loan Offer’ and is available for only ready-to-move-in houses. Unlike Axis bank, LICHFL only waives off 6 months of EMI, two EMIs each at the end of the 5th, 10th and 15th year.

Read: Everything You Need to Know About Income Tax Benefits on Home Loans

What Are the Terms I Should be Aware of?

For the loan by LICHFL, you need to keep in mind –

- The scheme is applicable only for ready-to-move-in houses/flats and not valid for the home interiors on emi

- The house/flat has to have an occupation certificate

- The maximum tenure of this loan is 30 years

- The maximum loan amount is Rs 5 crore

- This offer is available only till February 29th2020 and disbursement must be before March 15th2020

- No pre-payments can be made in the first five years

- The EMI must be paid regularly, on time and without any cheque bounce or non-repayment issues to be eligible for the waivers

- The loan can’t be transferred to another bank

For Axis Bank Shubh Aarambh Home Loan, you need to keep in mind –

- The scheme is applicable for any house/flat that is either under construction, a resale, or ready-move-in

- The tenure should be for a minimum of 20 years

- The maximum loan amount is Rs30 lakh

- The loan can’t be prepaid for until 4 years are completed

- The processing fee is 1% of the loan amount

- It is available only to Indian Citizens

- The EMI payments need to be made regularly, they can’t be overdue for more than 90-plus days, or they can’t be late more than 3 times for more than 30 days or the EMIs will not be waived.

Is it a Good Idea to opt for a Home Loan with EMI Waivers?

These home loans have been made for people who have modest incomes and who won’t be likely to pre-pay their loans. Axis bank’s Shubh Aarambh aims at those looking only at affordable housing options; hence the loan is capped at Rs.30 lakh.

[widget_emi_calci]If you make enough money and are looking at your incoming increase, then these loans won’t work in your benefit as they are very hard to pre-close or pre-pay. With any loan, pre-payment is always recommended. The RBI also encourages pre-payment as it is a means to be debt-free and it instantly improves your credit score.

EMI Waiver vs Balance Transfer

You have the most prospects for a balance transfer arrangement at much lower interest rates when taking out a long-term loan like a home loan. Will accepting this offer be worthwhile given that the EMI waiver-backed house loan won't give you that leverage? Let’s take an example for convenience. The interest paid on a 60 lakh rupee home loan with no monthly payments equals 57,75,876 rupees. How much will your entire interest cost be if you take a standard house loan for the same amount and duration and then receive a balance transfer opportunity after 5 years at 7.50% annually?

Compared to the savings of INR 5,01,860 you would probably have with an EMI waiver, the savings on a balance transfer come to INR 2,70,725, which is considerably less. Additionally, the new lender will impose a fixed fee for a balance transfer. As a result, a balance transfer will save you less money than an EMI waiver-backed loan. The situation may substantially change, though, if the balance transfer offer is offered at a significantly reduced rate.

It is also seen that most borrowers tend to close loans in 8 years, so waivers within this period are beneficial. Anything after 8 years is not really beneficial for most borrowers.

The fact that you can’t transfer these loans to another bank that will offer you lower interest rates is another huge drawback.

One should choose a home loan only if the interest rate, processing fee and terms are agreeable. Waivers should not be the only thing to look at.

If you’re looking to buy a home, then check out some options on NoBroker by clicking below, you can even get home loan options that can help you get your dream house with ease.

Loved what you read? Share it with others!

Most Viewed Articles

15 Safety Rules at Home for Kids

May 18, 2020

403853+ views

Vastu for Kitchen: Top 10 Tips for Kitchen as per Vastu

December 17, 2024

50854+ views

Breaking Down House Construction Costs in India: Easy Tips for Your Budget" in better way

December 17, 2024

48036+ views

Celebrity Houses in Mumbai: Glitz & Grandeur in Bandra & Juhu

December 17, 2024

44602+ views

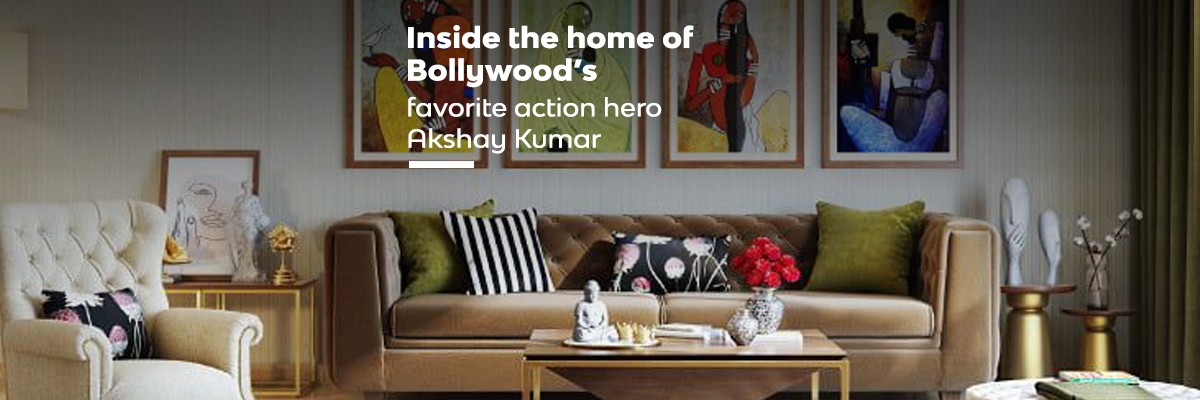

Akshay Kumar House Bollywood’s Favourite Action Hero

December 19, 2024

44244+ views

Recent blogs in

Essential Vastu Tips for Students' Success

January 15, 2025 by Prakhar Sushant

Indoor Plants Vastu: 20 Best Indoor Plants, Directions, and Tips for Positive Energy

January 15, 2025 by NoBroker.com

Legal Documents You Need To Buy And Sell Property: Essential Guide

January 15, 2025 by NoBroker.com

Quick and Easy Vastu Remedies for Rented Homes

January 15, 2025 by Simon Ghosh

Join the conversation!