Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

How to pay BBMP property tax online and offline, view the bill, and download the receipt in 2025?

Table of Contents

BBMP Property Tax is a mandatory tax paid by property owners in Bangalore and is collected by Bruhat Bengaluru Mahanagar Palike. The Bangalore property tax is essential for the city’s development and maintenance of roads, drainage, street lights and other public services. Property owners must pay the BBMP house tax annually without any delay to avoid penalties.

Property owners can pay the taxes online through the official website or at any Bangalore One Centers or BBMP offices. All property owners who pay their taxes in full before the due date, April 30, 2025, will get a 5% rebate. If you pay on time, you will save yourself from interest penalties.

BBMP Property Tax Details Bangalore 2025: Quick Info

| Key Points | Details |

|---|---|

| Official login Link | https://bbmptax.karnataka.gov.in/login.aspx |

| Tax Period | April 1 to March 31 of the subsequent year. |

| Due Date | March 31 of the subsequent financial year. For instance, for FY 2023-24, the due date is March 31, 2025. |

| Rebate | 5% rebate if paid in a single installment before June 30. Extension announced for 2025 until July 31. |

| Penalty for Late Payment | 2% per month or 24% per annum. |

| Calculation Method | Unit Area Value (UAV) System. Formula: (G - I) * 20% + Cess (24% of property tax). G = Gross unit area value, I = Depreciation. Depreciation rate depends on the age of the property. |

| Tax Rates | Zone A: Tenanted - ₹5/sq ft, Self-occupied - ₹2.50/sq ft. Zone B: Tenanted - ₹4/sq ft, Self-occupied - ₹2/sq ft. Zone C: Tenanted - ₹3.60/sq ft, Self-occupied - ₹1.80/sq ft. Zone D: Tenanted - ₹3.20/sq ft, Self-occupied - ₹1.60/sq ft. Zone E: Tenanted - ₹2.40/sq ft, Self-occupied - ₹1.20/sq ft. Zone F: Tenanted - ₹2/sq ft, Self-occupied - ₹1/sq ft. |

| Payment Methods | Online through BBMP Property Tax portal, banks authorized include Canara Bank, Axis Bank, HDFC Bank, ICICI Bank, IDBI, Corporation Bank, Indian Overseas Bank, YES Bank, Kotak Mahindra, Indian Bank, SBI, Maharashtra Bank, IndusInd Bank. You can also pay property tax via NoBroker. |

| Forms | Form I: Property with PID. Form II: Property with Khata number. Form III: Property without PID or Khata number. Form IV: No change in property details. Form V: Changes in property details. Form VI: Payment of service charges for exempt properties. |

| Properties Covered | Residential houses, Flats, Factories, Godowns, Offices, Shops. |

| Status Check | Available online through the BBMP Property Tax portal by entering the application number and owner’s name. |

| Contact Details | BBMP Head Office: Hudson Circle, Bengaluru, Karnataka 560002, India. Email: comm@bbmp.gov.in. Phone: 080-22660000. |

Bangalore Property Tax Offline Payment List

Bangalore One Center, which comes under Karnataka One, allows citizens to pay for property tax offline through the nearest centres in Bangalore. Below is the list of some of the centres with their addresses:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Center Name | Address |

| Airport Road | S-7 Sub Division, Bescom, Airport Road, Bangalore-560017 |

| Banashankari | BDA Shopping Complex, 2nd Stage, Banashankari, Bangalore-560070 |

| Basaveshwaranagar | Opp Chord Road Hospital, Basaveshwaranagar, Bangalore-560079 |

| Chickpet | Ward No. 109 , BBMP Office , 1st Floor , Opposite to UG Deluxe , Near to Upparpet Police Station , Chickpet, Bangalore-560053. |

| Devasandra | Old BBMP Office, Next to DK Mohan Babu House, Sidhappa Reddy layout, Devasandra, Bangalore-560036 |

| Gurappanapalya | Ward No. 171, BBMP Building, Behind Hopcoms,7th 'A' Main Road, GurappanaPalya, BTM 1st Stage, Bangalore-560029 |

| HSR Layout | BDA Shopping Complex, HSR Layout, Bangalore - 560034 |

| Jayanagar | BBMP Office, 9th Cross, 9th Main, 2nd Block, Bangalore-560011 |

| Koramangala | BDA Shopping Complex, 3rd Block, Koramangala, Bangalore-560034 |

| Yelahanka Old Town | Ward No 1, New BBMP Building, Yelahanka Old Town, Bangalore -560064 |

Why do We Have to Pay Property Tax to BBMP?

In Bangalore, maintaining a high standard of living and quality of life is a priority. The city's recognition as the best on ease of living parameters underscores this commitment. To sustain and enhance these standards, the role of BBMP (Bruhat Bengaluru Mahanagara Palike) is crucial. BBMP ensures that all citizens receive the necessary services, funded through tax collection. As responsible property owners, it is our duty to contribute our share by paying property tax to BBMP on time.

Does BBMP Collect Property Tax for all Types of Property?

You are liable to pay property tax to BBMP if you have properties like –

- An independent building (residential or commercial)

- A flat

- An apartment

- A shop

- A factory

- A godown

- A plot of land (vacant)

In Bangalore, the tax payment rules are clear and uncomplicated. Irrespective of the building type, BBMP Property Tax must be paid. Whether you reside in the property or not, rent it out, lease it, or provide it for free use, as long as the property is registered under your name, BBMP property tax payment is mandatory.

Read: An In-Depth Look at Property Registration in Bangalore

How to pay BBMP property tax online in 2025?

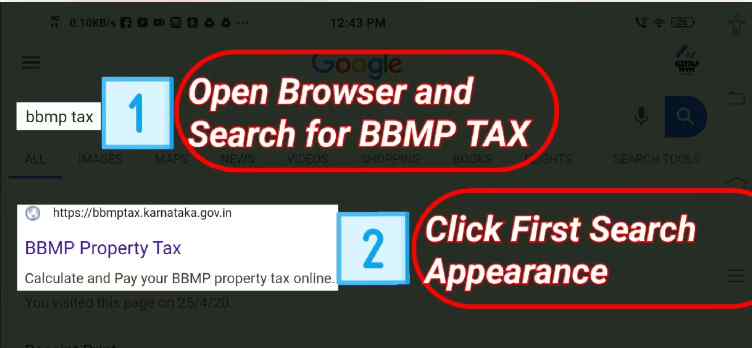

Struggling with first-time property tax payments in Bangalore? Here are the steps for house tax online payment in Bangalore:

Step 1: Know your property: If it’s your first property tax payment in Bangalore, I’m sure you won’t know where to start, and we suggest getting your property's details. Check if you have all the required documents, check the size, built-up area

Step 2: Visit the BBMP (Bruhat Bangalore Mahanagara Palike) property tax website. This site is comprehensive and has most of the information that you need explained in a simple way. Go to: https://bbmptax.karnataka.gov.in/

Step 3: Go through the rules. The document on property tax rules is really helpful. It clearly defines terms that will make your property tax online payment easier.

Step 4: Find your Zone, sub-division, and ward. Each road has been divided into zones, and each zone has been given a value or Guidance Value bandwidth for residential and non-residential property.

Step 5: Find out your depreciation value from the table based on the age of your building.

Step 6: Follow the online help document. This has everything you need to know about the BBMP Property tax online filing process. If you still need additional help, the FAQ document is also available.

Step 7: Fill out the form. Now that you have armed yourself with all the information you need to fill out the form, the process will be a breeze. The form is found on the website's homepage, or you can click here.

Once you fill in your form, take screenshots or printouts. This will be a cheat sheet for filling out your tax forms next year.

How To Pay BBPM Property Tax Online Through NoBroker Pay?

You can use our NoBroker Pay Services for a hassle-free payment experience. You can follow these steps for property tax payment online through NoBroker:

- Open the NoBroker App.

- Go to the NoBroker Pay option.

- Select the bill payment option.

- Select Municipal Taxes.

- Select your state and enter the Property ID

- Finally, make the payment.

How to change the name on BBMP property tax in 2025?

In 2025, if you're considering changing the name on your BBMP property tax records, here's what you need to know. Whether due to marriage, inheritance, or other reasons, updating your property tax records is crucial for legal compliance and accurate communication. Here's a simplified process for changing the name on your BBMP property tax records in 2025:

- Document Verification: Gather all necessary documents, including proof of name change (marriage certificate, legal document, etc.), property documents, and identity proof.

- Visit BBMP Office: Visit the BBMP office responsible for property tax records in your jurisdiction.

- Fill Application Form: Obtain the application form for name change and fill it out accurately with the updated information.

- Submit Documents: Submit the filled application form along with the required documents to the designated BBMP officer.

- Verification and Approval: The BBMP officer will verify the submitted documents and process your request for a name change.

- Payment of Fees (if applicable): Pay any applicable fees for the name change process, if required by BBMP.

- Receive Confirmation: Once the name change request is approved, you'll receive a confirmation from BBMP.

- Update Records: BBMP will update your property tax records with the new name, ensuring accurate communication and legal compliance.

Where Can You Pay Your Property Tax in Bangalore?

The simplest way to pay property tax online by using the steps provided above. If you choose to, you’re your property tax offline, then you can head to any Bangalore 1 centre or ARO office. BBMP has also tied up with a few Nationalised Banks and they are authorised to collect property tax. The approved Nationalised Banks are –

- Canara Bank

- Corporation Bank

- HDFC Bank

- IDBI Bank

- Induslnd Bank

- Indian Overseas Bank

- Kotak Mahindra Bank

- Yes Bank

- ING Vysya Bank

How to use the BBMP property tax calculator?

BBMP uses three ways to calculate property tax -

- The Annual Rental Value System

- The Capital Value System

- The Unit Area System.

- The Annual Rental Value System – here, the BBMP fixes the gross yearly rent that a property can get and levies a tax based on this anticipated value.

- The Capital Value System – Here BBMP property tax is calculated as per the property’s market value, they use this market value to forecast the tax applicable to the property. The market value of the property is given by the area’s stamp duty department, it is not done by BBMP.

- Unit Area System – in this system of calculation, property tax is charged on the property’s per-unit price of carpet area. A property’s value is multiplied by its carpet area in order to determine the amount of tax applicable.

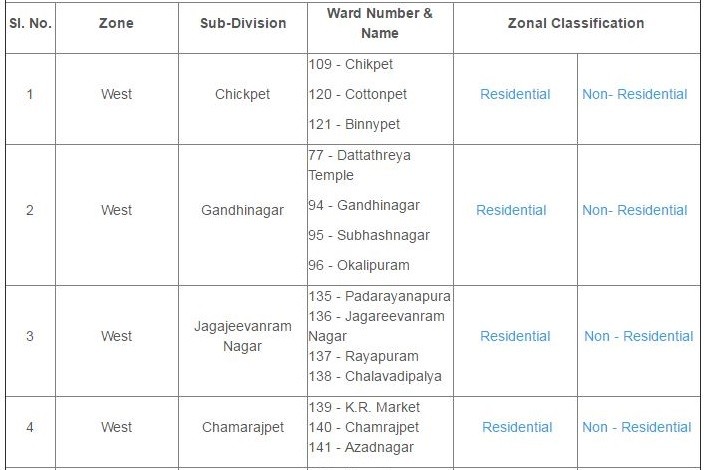

The rate at which property tax is levied is also based on the zone in which the property is located. In Bangalore there are 6 value zones, below are the zones, the sub-divisions, the ward numbers and the names you need to know –

| Zone | Sub–Division | Ward Number and Name |

| West | Chickpet | 109 – Chikpet 120 – Cottonpet 121 – Binnypet |

| West | Gandhinagar | 77 – Dattathreya Temple 94 – Gandhinagar 95 – Subhashnagar 96 – Okalipuram |

| West | Jagajeevanram Nagar | 135 – Padarayanapura 136 – Jagareevanram Nagar 137 – Rayapuram 138 – Chalavadipalya |

| West | Chamarajpet | 139 – K.R. Market 140 – Chamrajpet 141 – Azadnagar |

| West | Govindrajanagar | 103 – Kaveripura 104 – Govindrajnagara 105 – Agrahara Dasarahalli 106 – Dr. Rajkumar Ward 125 – Marenahalli |

| West | Chandralayout | 126 – Maruthi Mandira Ward 127 – Moodalapalya 128 – Nagarabhavi 131 – Nayandanahalli |

| West | Rajajinagar | 99 – Rajajinagar 100 – Basaveshwaranagar 101 – Kamakshipalya 107 – Shivanagar |

| West | Srirammandira | 97 – Dayanandanagar 98 – Prakashnagar 108 – Srirammandira ward |

| West | Mathikere | 35 – Aramane Nagar 36 – Mathikere 45 – Malleshwaram |

| West | Malleshwaram | 64 – Rajamahal 65 – Kadumalleshwara 66 – Subramanyanagar 76 – Gayathrinagar |

| West | Nagapura | 67 – Nagapura 75 – Shankaramata 102 – Vrushabhavathinagar |

| West | Mahalakshmi Layout | 43 – Nandini Layout 44 – Marappanahalli 68 – Mahalakshmipuram 74 – Shakthiganapathi nagar |

| South | Kempegowda Nagar | 118 – Sudamnagar 119 – Dharmarayaswamy Temple Road 142 – Sunkenahalli 143 – Vishweshrapuram |

| South | Hombegowda Nagar | 144 – Siddapura 145 – Hombegowdanagar 153 – Jayanagar |

| South | Vijayanagar | 122 – Kempapura Agrahara 123 – Vijaynagar 124 – Hosahalli 134 – Bapujinagar |

| South | Gali Anjaneyaswamy Temple | 132 – Attiguppe 133 – Hampinagar 157 – Gali Anjaneya swamy Temple Ward 158 – Deepanjali Nagar |

| South | Basavanagudi | 154 – Basavanagudi 155 – Hanumanthanagar 164 – Vidyapeetha Ward |

| South | Girinagar | 156 – Srinagar 162 – Girinagar 163 – Katriguppe |

| South | Padmanabha Nagar | 161 – Hosakerehalli 181 – Kumaraswamylayout 182 – Padmanabhanagar 183 – Chikkallasandra |

| South | Banashankari | 165 – Ganeshmandira Ward 166 – Karisandra 167 – Yadiyuru 180 – Banashankari Temple Ward |

| South | B.T.M. Layout | 146 – Lakkasandra 152 – Sudduguntepalya 172 – Madiwala 176 – BTM Layout |

| South | Koramangala | 147 – Adugodi 148 – Ejipura 151 – Koramangala 173 – Jakkasandra |

| South | Jayanagar | 168 – Pattabhiramnagar 169 – Byrasandra 170 – Jayanagar East 171 – Gurappanapalya |

| South | J.P.Nagar | 177 – J.P.Nagar 178 – Sarakki 179 – Shakambarinagar |

| East | Hebbal | 18 – Radhakrishna Temple Ward 19 – Sanjaynagar 20 – Ganganagar 21 – Hebbal |

| East | J.C. Nagar | 22 – Vishwanatha Nagenahalli 33 – Manorayanapalya 34 – Gangenahalli 46 – Jayachamarajendra Nagar |

| East | K.G. Halli | 31 – Kushalnagar 32 – Kavalbyrasandra 48 – Muneshwaranagar 60 – Sagayapuram |

| East | Pulikeshinagar | 47 – Devarajeevanahalli 61 – S.K. Garden 78 – Pulikeshinagar |

| East | Maruthisevanagar | 27 – Banasawadi 28 – Kammanahalli 49 – Lingarajapura 59 – Maruthiseva Nagar |

| East | H.B.R. Layout | 23 – Nagavara 24 – HBR Layout 29 – Kacharakanahalli 30 – Kadugondanahalli |

| East | Jeevanbhimanagar | 80 – Hoysalanagar 88 – Jeevanbhimanagar 113 – Konena Agrahara |

| East | C.V. Ramannagar | 50 – Benniganahalli 57 – C.V. Ramannagar 58 – Hosathippasandra 79 – Sarvagnanagar |

| East | Shanthinagar | 111 – Shanthala Nagar 116 – Neelasandra 117 – Shanthinagar |

| East | Domlur | 89 – Jogupalya 112 – Domlur 114 – Agaram 115 – Vannarpet |

| East | Shivajinagar | 90 – Ulsoor 91 – Bharathinagar 92 – Shivajinagar |

| East | Vasanthanagar | 62 – Ramaswamy palya 63 – Jayamahal 93 – Vasanthnagar 110 – Sampangiramnagar |

| Yelahanka | Yelahanka | 1 – Kempegowda Ward 2–Chowdeshwari Ward |

| Yelahanka | Yelahanka Satellite Town | 3 – Attur 4 – Yelahanka Satellite town |

| Yelahanka | Byatarayanapura | 5 – Jakkur 6 – Thanisandra |

| Yelahanka | Kodigehalli | 7 – Byatarayanapura 8 – Kodigehalli |

| Yelahanka | Vidyaranyapura | 9 – Vidyaranyapura 10 – Doddabommasandra 11 – Kuvempunagar |

| Mahadevapura | Horamavu | 25 – Horamavu 26 – Ramamurthynagar 51 – Vijinapura |

| Mahadevapura | K.R.Puram | 52 – K.R.Puram 53 – Basavanapura 55 – Devasandra |

| Mahadevapura | HAL Airport | 56 – A. Narayanapura 81 – Vignananagar 87 – HAL Airport |

| Mahadevapura | Hoodi | 54 – Hoodi 82 – Garudacharpalya 85 – Doddanekkundi |

| Mahadevapura | Whitefield | 83 – Kadugodi 84 – Hagadooru 149 – Varthur |

| Mahadevapura | Marathalli | 86 – Marathalli 150 – Bellandur |

| Bommanahalli | Bommanahalli | 175 – Bommanahalli 188 – Bilekahalli 189 – Hongasandra |

| Bommanahalli | Arakere | 186 – Jaraganahalli 187 – Puttenahalli 193 – Arakere |

| Bommanahalli | HSR Layout | 174 – HSR Layout 190 – Mangammanapalya |

| Bommanahalli | Begur | 191 – Singasandra 192 – Begur |

| Bommanahalli | Anjanapura | 194 – Gottigere 196 – Anjanapura |

| Bommanahalli | Yelachenahalli | 195 – Konanakunte 185 – Yelachenahalli |

| Bommanahalli | Uttarahalli | 184 – Uttarahalli 197 –Vasanthapura |

| Rajarajeshwari Nagar | Rajarajeshwari Nagar | 160 – Rajarajeshwarinagar 129 – Jnanabharathi ward |

| Rajarajeshwari Nagar | Laggere | 69 – Laggere 73 – Kottigepalya |

| Rajarajeshwari Nagar | Lakshmidevinagar | 38 – H.M.T 42 – Lakshmidevinagar |

| Rajarajeshwari Nagar | Yeshwanthpur | 16 – Jalahalli 17 – J.P.Park 37 – Yeshwanthpur |

| Rajarajeshwari Nagar | Kengeri | 130 – Ullalu 159 – Kengeri 198 – Hemmigepura |

| Rajarajeshwari Nagar | Herohalli | 40 – Doddabidarakallu 72 – Herohalli |

| Dasarahalli | T–Dasarahalli | 14 – Bagalagunte 15 – T. Dasarahalli |

| Dasarahalli | Shettyhalli | 12 – Shettyhalli 13 – Mallasandra |

| Dasarahalli | Hegganahalli | 70 – Rajagopalanagar 71 – Hegganahalli |

| Dasarahalli | Peenya Industrial Area | 39– Chokkasandra 41– Peenya Industrial Area |

BBMP Tax Calculator: https://bbmptax.karnataka.gov.in/Forms/Calculator.aspx

Here you must choose the right option from the dropdowns and click submit! It’s an easy and error-free way to get your property tax amount.

The basic formula to calculate property tax in Bangalore is - Gross Unit Area Value - Depreciation Amount * 20%.

Here is a sample of how the property tax is calculated

https://bbmptax.karnataka.gov.in/documents/samplePTCalculation.pdf

What is the BBMP property tax rebate for 2025?

If you’re looking for a rebate on your BBMP property tax, then you’re in luck, there is one way to get a rebate. You need to pay your full property tax amount in one instalment to be applicable to get a 5% BBMP property tax rebate.

Read Everything You Need to Know About Income Tax Benefits on Home Loans

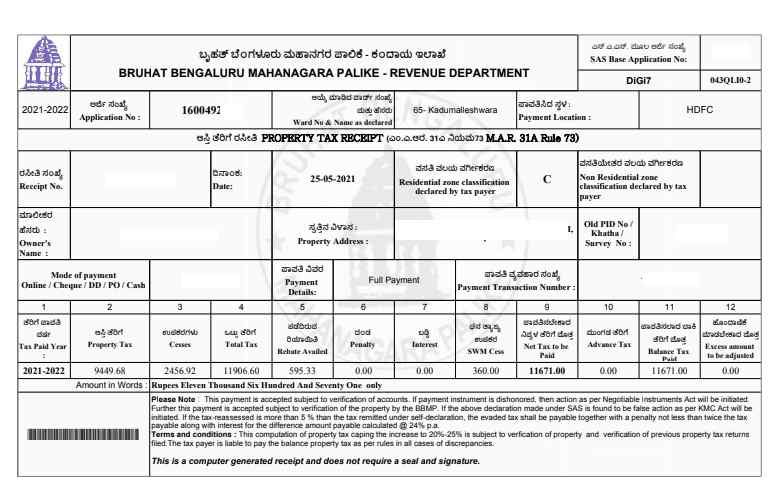

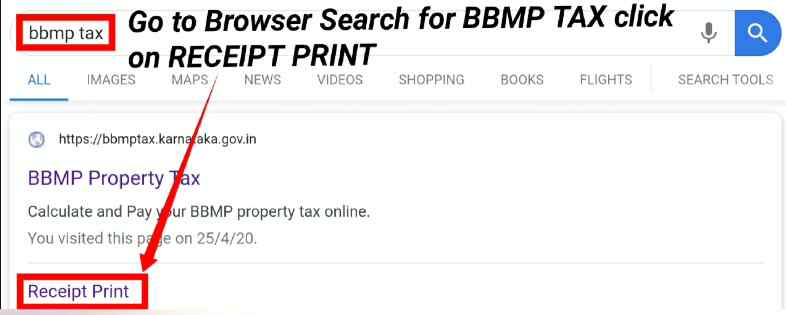

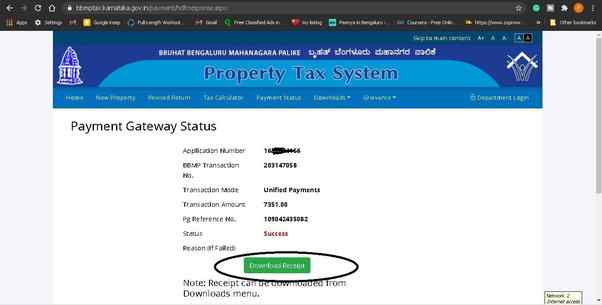

How to download the BBMP property tax receipt/ challan in 2025?

For BBMP property tax online payment, you can get a tax-paid receipt by going to - https://bbmptax.karnataka.gov.in/forms/PrintForms.aspx?rptype=3

Here you need to enter your assessment year, application number and captcha. Hit enter and you will get a printable BBMP tax-paid receipt.

If you are paying BBMP property tax offline through DD or CASH, a tax-paid receipt can be generated instantly. If you are paying your property tax through cheques, then a receipt will be generated only after your cheque clears.

How to print the BBMP property tax application in 2025?

In 2025, obtaining a printout of your BBMP property tax application is essential for Bengaluru residents to maintain accurate records and ensure compliance with local regulations. Here's a straightforward guide on how to print your BBMP property tax application for the year 2025:

- Visit the BBMP Official Website: Start by accessing the official website of the Bruhat Bengaluru Mahanagara Palike (BBMP) through your web browser.

- Navigate to the Property Tax Section: Once on the BBMP website, locate the section dedicated to property tax. This section may be labelled as "Property Tax" or "Online Services".

- Log in to Your Account: If you have a registered account on the BBMP website, log in using your credentials. If not, you may need to create an account to access certain features.

- Access Your Property Tax Application: After logging in, navigate to the section where you can view and manage your property tax applications.

- Locate Your Application: Find the specific property tax application for which you need to obtain a printout. This application should contain details of your property and associated tax payments.

- Select the Print Option: Once you've located your application, look for the option to print it. This option is typically represented by a printer icon or a "Print" button.

- Adjust Print Settings (if necessary): Before printing, you may have the option to adjust settings such as paper size, orientation, and quality. Make any necessary adjustments based on your preferences.

- Print Your Application: Click on the print option, and your BBMP property tax application will be sent to your printer for printing.

- Review the Printout: Once the printout is complete, review it to ensure that all information is accurate and legible. This printout serves as an official record of your property tax application for the year 2025.

- Store the Printout Securely: After reviewing the printout, store it in a safe and easily accessible location for future reference. This printout may be required for verification purposes or in case of any queries related to your property tax application.

What is the last date to pay BBMP property tax in 2025?

The last date for BBMP property tax payments is April 30th of every year. It's essential to keep an eye on official announcements and notifications from BBMP regarding the specific deadline for property tax payments in the year 2025. Stay informed to ensure timely payment and avoid penalties.

What is the BBMP Property Tax Due Date?

According to the latest update from BBMP officials, property owners must pay their taxes by March 31, 2025, to avoid penalties. This year, the BBMP house tax payment is a little stricter as the BBMP officials have decided to impose a 100% penalty on unpaid property tax starting from April 1, 2025. This action was taken as many houseowners have not paid their taxes since 2023.

Also, the taxpayer can pay their taxes in two installments, one in March and the other until 31 July 2025, to avoid interest charges. But remember that the 5% rebate is only applicable when the tax is paid in full before the due date.

Is there any Fine for Late Payment of Property Tax in Bangalore?

Yes, if you fail to pay your BBMP property tax by 31st March 2025., you will have to pay a penalty. The penalty or fine is calculated at the rate of 2% extra on your property tax per month. If you find it hard to make your property tax payment in one instalment you can break it up into 2, but this way you will not be eligible for the 5% BBMP property tax rebate.

How to check the BBMP property tax payment status in 2025?

As a Bengaluru resident, it's crucial to stay updated on your BBMP property tax payment status for 2025 to maintain compliance with local regulations and avoid any penalties. Here are a few steps on how to check your property payment status:

- Visit the BBMP Official Website: Begin by accessing the official website of the Bruhat Bengaluru Mahanagara Palike (BBMP). You can easily find this by searching for "BBMP property tax" in your preferred search engine.

- Navigate to the Property Tax Section: Once on the BBMP website homepage, look for the section related to property tax. This section may be labelled as "Property Tax" or "Online Services" depending on the website layout.

- Select the Payment Status Option: Within the property tax section, there should be an option to check your payment status. Click on this option to proceed.

- Enter Property Details: You will be prompted to enter specific details about your property, such as the Property Identification Number (PID) or Khata number. These details are essential for accurately identifying your property tax record.

- Verify Your Details: After entering your property details, double-check to ensure accuracy. Any errors in the entered information could lead to incorrect payment status results.

- Submit Your Request: Once you've verified your property details, submit your request to check the payment status. The system will then process your request and retrieve the relevant information from the BBMP database.

- Review the Payment Status: After processing your request, the BBMP website will display the payment status of your property tax. This status will indicate whether your payments are up-to-date or if there are any outstanding dues.

- Take Necessary Action: Depending on the payment status displayed, take appropriate action. If your payments are up-to-date, you can rest assured that your property tax obligations for 2025 have been fulfilled. However, if there are any outstanding dues, make arrangements to clear them promptly to avoid penalties.

- Keep Records: After checking your BBMP property tax payment status, it's essential to keep a record of the results for your reference. You may want to save a screenshot or print a copy of the payment status page for your records.

How to update the BBMP property tax mobile number in 2025?

Stay informed and connected with BBMP Property Tax updates by ensuring your mobile number is up-to-date for 2025. Here's how to conveniently update your contact details for seamless communication.

- Step 1: Visit the BBMP Official Website

- Access the official BBMP website to initiate the mobile number update process for property tax notifications.

- Step 2: Navigate to Update Contact Information

- Locate the section for updating contact information or mobile number specifically for property tax notifications.

- Step 3: Enter Property Details

- Provide necessary property details such as the Property Identification Number (PID) to verify ownership.

- Step 4: Update Mobile Number

- Enter your new mobile number accurately and double-check for any errors before proceeding.

- Step 5: Verify and Confirm

- Review the updated mobile number to ensure accuracy, then confirm the changes to finalise the update process.

- Step 6: Receive Confirmation

- Upon successful update, you will receive a confirmation message acknowledging the change in your mobile number for BBMP property tax notifications.

BBMP Property Tax Latest News

- Good news for Bangalore residents! The Karnataka government has ruled out a property tax revision for Bengaluru for the 2025-26 fiscal year. This means property tax rates will remain the same as those implemented in 2016.

- This decision comes after initial confusion caused by government statements suggesting a new property tax calculation method based on guidance values. However, those plans have been scrapped for the 2025-26 period.

- The Bruhat Bengaluru Mahanagara Palike (BBMP) has extended the deadline for the 5% rebate on property tax payments. Previously applicable for the first two months of the financial year (April-May), the deadline has been extended to July 31st, 2025. This provides additional time for property owners to benefit from the discount.

Homeowners in Karnataka received some relief with the passing of the BBMP Amendment Bill in February 2025. This bill reduces the penalty for unpaid property taxes by 50%. Additionally, underprivileged communities will be exempt from penalties and enjoy benefits related to social welfare housing and slums. There's also a new five-year cap on property tax penalties for residential and mixed properties.

Explore Property Tax Payment Options City-Wise in India

How NoBroker Can Help?

If you're searching for a house to buy, look no further than NoBroker. We offer a wide selection of homes for you to choose from. And if you're planning to sell your house, we can also assist you with that! Click below to discover how NoBroker can support you in your real estate endeavours.

Frequently Asked Questions

Ans: It’s easy to pay your property tax online if you have a property in Bangalore. All you need to do is visit the BBMP property tax portal and follow the simple instructions given. You can even read the detailed instructions in this article.

Ans: The last date to pay your BBMP property tax 2023 dues is by 31st March 2025.

Ans: No, to pay your property tax you can do it offline at any Bangalore 1 centre, or Assistant Revenue Officer offices. There are a few banks that are also authorised to collect property tax such as –

Canara Bank

Axis Bank

HDFC Bank

ICICI Bank

You can even pay online using the BBMP portal, this is the most suggested payment method.

Ans: To calculate how much property tax you have to pay, you need to visit - https://bbmptax.karnataka.gov.in/forms/forms.aspx

Here you need to fill in the complete self-assessment form and you will get the amount that you need to pay as property tax. You can even decide if you want to make the full payment or pay by instalments.

Ans: If you are not comfortable making online payments, the next best thing is going offline and making your property tax payments in Bangalore. You can pay at any Bangalore 1 centre, or Assistant Revenue Officer's office. There are a few banks that are also authorised to collect property tax.

Ans: To pay your property tax online in BBMP, visit the official BBMP website or the designated property tax payment portal, enter your property details, select the payment mode, and complete the transaction securely to receive a confirmation receipt.

Ans: To check BBMP property details online, visit the official BBMP website, navigate to the property tax section, and enter your property identification details such as the PID to access the relevant property information.

Ans: To obtain a BBMP application number, submit the required application form along with the necessary documents to the designated BBMP office. Upon processing, you will receive the application number for reference and tracking purposes.

Ans: There have been no significant changes reported in BBMP property tax rates or regulations. However, it's advisable to regularly check the official BBMP website or contact BBMP directly for any updates or amendments to property tax policies.

Ans: The house tax in Bangalore, also known as property tax, varies depending on factors like property size, location, and usage. It's calculated based on the property's Annual Rental Value (ARV) multiplied by the applicable tax rate set by the Bruhat Bengaluru Mahanagara Palike (BBMP).

Ans: Form 5 is filled by property owners under the Self Assessment Scheme (SAS), when they want to change their property details. It could be changes in property usage, build-up areas, occupancy or other modifications that will affect the calculation of the taxes. The form is available at the official website of BBMP Property Tax.

Recommended Reading

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

120421+ views

BBMP e-Aasthi: Search Property Details, Download Certificates, and Check Status Online

April 10, 2025

85545+ views

What are the current Stamp Duty and Property Registration Charges in Karnataka

January 23, 2025

77829+ views

EC Online Bangalore: Importance, Online Application and Status Check in 2026

June 1, 2025

67207+ views

Guidance Value Bangalore 2025: Changes, Trends & Impact on Property Market

May 2, 2025

59248+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115302+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193019+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132186+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

127632+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!