Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Best Rent Payment Mobile App: List of Top 10 Apps in India to Pay Rent Online

Table of Contents

Digital payment methods have made rent payments easier in today's fast-paced society. Many rent payment applications have arisen in India, where the digital economy is growing, enabling renters and landlords to manage rent conveniently and securely. Renters can use Best rent payment mobile app for rent payments, removing the need for cash or cheques.

Now that UPI and digital wallets are available, renters can do rent payments with a few clicks on their cell phones. These applications make scheduling regular payments, tracking payment history, and receiving notifications for impending dues easy. Many of these services provide rebates, discounts, and perks to encourage digital rent payments.

List of Top 10 Best Rent Payment Mobile Apps

| App | Rating |

| NoBroker Pay | 4.9 |

| PayZapp | 4.3 |

| Paytm | 4.6 |

| PhonePe | 4.1 |

| Freecharge | 4.3 |

| CRED | 4.5 |

| Google Pay | 4.6 |

| Amazon Pay | 4.5 |

| Airtel Payment Banks | 4.2 |

| BHIM UPI | 4.2 |

10 Best Rent Payment Apps

1. NoBroker Pay:

The NoBroker is an app for rent payment, which mainly focuses on enabling property rents and sales without brokers, has a payment option called NoBroker Pay incorporated into it. Tenants may use the NoBroker app to pay their landlords directly for rent without having to pay any transaction fees. The platform gives customers the ability to choose from a variety of payment methods, such as UPI, cards, and net banking, while providing a smooth and safe payment experience. Users can effortlessly manage their rental transactions in addition to their property search and maintenance activities, thanks to its inclusion inside the NoBroker ecosystem. NoBroker Pay allows users to pay rent in instalments, saving renters and landlords time and aggravation by doing away with the need for cash or checks.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Subscription Fee: NoBroker Pay doesn't charge users any subscription fee. It's a free service provided within the NoBroker platform.

Pros:

- Zero transaction fees for rent payments.

- Seamless integration within the NoBroker ecosystem.

- Multiple payment options, including UPI, cards, and net banking.

- Secure transactions are ensured through encryption and authentication.

Cons:

- Restricted to users of the NoBroker platform.

2. PayZapp:.

HDFC Bank provides a mobile payment app called PayZapp to pay rent online. It enables customers to carry out several tasks, such as cash transfers, recharges, and bill payments. PayZapp also facilitates rent payments. PayZapp's user-friendly UI and secure payment gateway make the payment procedure simpler. For straightforward transactions, users may connect the app to their bank accounts and credit cards. Additionally, PayZapp provides special incentives and rebates for purchases made using the platform, improving the customer experience overall.

Subscription Fee: There is no subscription fee for using PayZapp. However, transaction fees may apply depending on the type of transaction or additional services opted for.

Pros:

- Offers a wide range of services beyond rent payments.

- Secure transactions with HDFC Bank's encryption standards.

- Rewards and cashback offers are available for transactions.

Cons:

- Non-HDFC Bank users may need additional verification steps.

- Some users report occasional technical glitches.

3. Paytm

Paytm is one of the top digital payment companies in India. It provides a wide range of services, such as online shopping, bill payment, and recharges. It also makes it easier for renters and landlords to pay rent directly to one another. Paytm's user-friendly design and variety of payment choices streamline the payment procedure. Payments may be made using cards, connected bank accounts, or the amount in the user's Paytm wallet. Paytm is a well-liked option for rent payments and other financial activities since it provides cashback, discounts, and prizes for transactions.

Subscription Fee: Paytm doesn't charge a subscription fee for essential services. However, transaction fees may apply for certain transactions or additional services.

Pros:

- High acceptance among merchants and service providers.

- Cashback, discounts, and rewards are offered for transactions.

- User-friendly interface with multiple payment options.

Cons:

- Transaction fees may apply for certain transactions.

- Customer service response time may vary during peak periods.

4. PhonePe

In India, PhonePe is a well-known digital payment platform that offers services, including bill payment, recharge, and UPI payments. Rent payments may also be made using the PhonePe app. PhonePe's user-friendly UI and speedy transaction processing makes for a smooth payment experience. For simple financial transfers, users may connect the app to their bank accounts. Additionally, PhonePe provides discounts, prizes, and cashback on purchases, which improves the customer experience overall.

Subscription Fee: PhonePe does not charge a subscription fee for its essential services.

Pros:

- Seamless integration with UPI for instant bank-to-bank transfers.

- Offers cashback and rewards for transactions.

- User-friendly interface with features like bill splitting and reminders.

Cons:

- Limited acceptance compared to other payment apps.

- Occasional technical issues were reported during transactions.

5. Freecharge

Axis Bank owns the digital payment network Freecharge, which is a payment mobile app and lets customers pay bills, recharge phones, and conduct online transactions. It also supports rent payments. Freecharge's user-friendly UI and speedy transaction processing make paying easier. For easy transactions, users may connect the app to their bank accounts or credit cards. Users use Freecharge for rent payments and other financial activities since it also provides cashback, discounts, and points for transactions.

Subscription cost: Freecharge does not impose a subscription cost; nevertheless, certain services or transactions may be subject to transaction fees.

Pros:

- Quick and secure transactions with bank-grade encryption.

- Cashback and rewards are offered for transactions.

- Simple and intuitive interface for users.

Cons:

- Limited acceptance compared to other payment apps.

- Customer support may have delayed response times.

6. CRED

Users of the credit card management app CRED are rewarded for making on-time credit card payments. Although it's not a rent payment software, it does let users pay with credit cards and gives them incentives for online rent payment services. CRED's intuitive UI and tailored suggestions make credit card management more effortless. Through the app, users may use their credit cards to pay their rent, receiving incentives and advantages in exchange. To improve the whole customer experience, CRED also provides partner companies with unique offers and discounts.

Subscription Fee: For Rs. 1,000 per month, CRED provides a premium membership known as CRED PRO. The basic functionalities are free.

Pros:

- Rewards users for timely credit card bill payments.

- Allows rent payments through credit cards to earn rewards.

- Offers exclusive deals and discounts from partner brands.

Cons:

- Premium membership may only be valuable for some users.

- Limited to credit card payments for rent, which may incur additional fees.

- It may not suit users preferring debit or bank transfers for rent payments.

7. Google Pay

In India, Google Pay—formerly known as Tez—is a popular digital payment app. It is based on the Unified Payments Interface (UPI) system, which enables customers to transfer money directly between banks, even for rent. By connecting with the user's bank account, Google Pay streamlines transactions by removing the need for the user to input extensive information each time they make a payment. Its intuitive UI allows for easy navigation and makes sending and receiving money with a few clicks effortless for users. Furthermore, Google Pay goes beyond only paying rent; it can also be used for bill payments, recharges, and ticket purchases.

Subscription price: There isn't a monthly price associated with using Google Pay.

Pros:

- Simple and intuitive interface for making payments.

- Offers cashback and rewards for transactions.

- Secure transactions are ensured through UPI PIN authentication.

- Wide acceptance among merchants and service providers.

Cons:

- Limited customer support options.

- Users reported occasional technical glitches.

8. Amazon Pay

Payments on the Amazon platform and partner websites may be made with the help of Amazon Pay, a digital wallet service. Rent payments are also supported by it. Users may finish transactions with Amazon Pay by using their remembered payment methods; this eliminates the need for them to input their card information again for every purchase. Because of the service's flawless integration with the Amazon ecosystem, customers may use their Amazon Pay balance for both online shopping and rent payments. By offering a range of cashback options, discounts, and transaction incentives, Amazon Pay improves consumer satisfaction and adds value.

Subscription Fee: Amazon Pay does not impose a subscription cost on its essential services.

Pros:

- Seamless integration with the Amazon ecosystem for easy payments.

- Offers cashback, discounts, and rewards for transactions.

- User-friendly interface with multiple payment options.

- Secure transactions are ensured through Amazon's robust security measures.

Cons:

- Limited acceptance outside of the Amazon ecosystem.

- It may offer fewer features than dedicated payment apps.

9. Airtel Payments Bank

One of the top telecom providers in India, Bharti Airtel, offers the digital payment platform Airtel Payments Bank. Users may transfer money, recharge phones, and make payments using it. Rent payments are made accessible for consumers by Airtel Payments Bank, which allows them to pay their landlords utilising the app. Its connection with Airtel's cellular services makes it simple for consumers to handle their money and make payments. The platform improves the overall user experience by providing a variety of cashback and rewards programs. Due to its widespread acceptance by service providers and retailers, Airtel Payments Bank is a practical option for performing financial transactions such as rent payments.

Subscription Fee: Airtel Payments Bank does not impose a subscription cost on its essential services.

Pros:

- Integration with Airtel's telecom services for easy payments.

- Offers cashback and rewards for transactions.

- Wide acceptance among merchants and service providers.

- User-friendly interface with multiple payment options.

Cons:

- Limited to Airtel customers.

- Additional verification steps may be required for non-Airtel users.

10. BHIM UPI

Bharat Interface for Money, or BHIM, the Unified Payments Interface (UPI), UPI is a government-backed digital payment app that offers the best way to pay rent electronically. It eliminates the need for cash or cheques by allowing the users to pay their rent straight from their bank accounts. With money transmitted straight between the sender and recipient accounts, BHIM UPI provides a straightforward and safe platform for performing transactions. BHIM UPI is a dependable and easy way to pay for rent and other financial transactions since banks and retailers widely accept it. BHIM UPI is an affordable option for users since it doesn't impose any transaction fees on payments.

Subscription Fee: There is no membership cost associated with using BHIM UPI's services.

Pros:

- A government-backed platform for secure transactions.

- No transaction fees for UPI payments.

- Widely accepted among banks and merchants.

- Simple and intuitive interface for users.

Cons:

- Limited features compared to other payment apps.

- Occasional technical issues were reported during peak usage periods.

These Best rent payment mobile apps are accessible, secure, and efficient for renters and landlords. Technology simplifies rental payment with these applications, enabling a variety of payment choices, banking connectivity, and improved security.

Use NoBroker Pay for Hassle-Free Rent Payment

Rent payments using credit cards, debit cards, or even UPI can be made securely with NoBroker. For rent payment services in India, NoBroker Pay has a PCI-compliant payment gateway and is 100% safe. Use NoBroker's rent payment services to pay your home's rent and receive cashback, attractive prizes, and quick rent payments.

Frequently Asked Questions

Ans: Yes, user transaction security is given top priority in the majority of Indian mobile applications for rent payments. To safeguard sensitive data, they use secure payment channels and encryption technologies. To provide even more protection, a lot of applications need authentication techniques like UPI PIN or OTP verification for every transaction.

Ans: Mobile applications for paying rent usually accept a number of payment options, such as digital wallets, debit/credit cards, net banking, and the Unified Payments Interface (UPI). The payment option that works best for both the user and their landlords is available to them.

Ans: While the majority of rent payment applications don't charge a fee for simple-rent payments, some could offer extra services or specific payment methods. Before making any payments, users should read each app's terms and conditions to understand any relevant costs.

Ans: Yes, you can set up regular payments using many rent payment smartphone applications. Tenants may use this tool to set up automated rent payments, which eliminates the need for human participation on a monthly basis.

Ans: If you have any problems with online rent payments, such as an unsuccessful payment or an inaccurate amount deducted, you should contact the app's customer service staff immediately. The majority of applications include specific support channels, such as helplines, email assistance, and in-app chat support, to help customers quickly resolve payment-related problems.

Recommended Reading

Best Rent Payment Mobile App: List of Top 10 Apps in India to Pay Rent Online

January 15, 2025

30747+ views

Rupay Vs Visa Vs Mastercard: Learn About How RuPay Card is Different From Visa And Mastercard

January 31, 2025

29921+ views

Pay Rent with Credit Card: Experience Secure Online Rent Payments

August 18, 2023

12802+ views

Best App to Pay Rent: Ultimate Guide for Digital Transactions

January 31, 2025

11819+ views

Balance Transfer Credit Cards: A Smart Debt Management Solution

August 18, 2023

5775+ views

Loved what you read? Share it with others!

Most Viewed Articles

August 12, 2025

449211+ views

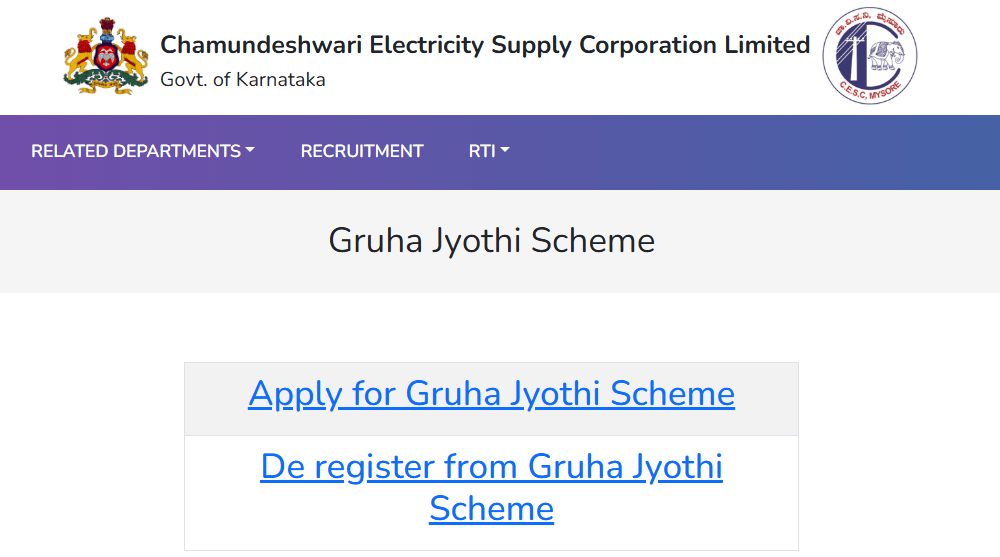

Gruha Jyothi Scheme Karnataka: Application Process, Eligibility and Documentation in 2026

September 12, 2025

68772+ views

How to Apply Online LPG Gas Connection: Application Process, Documents and Fees in 2026

June 1, 2025

59405+ views

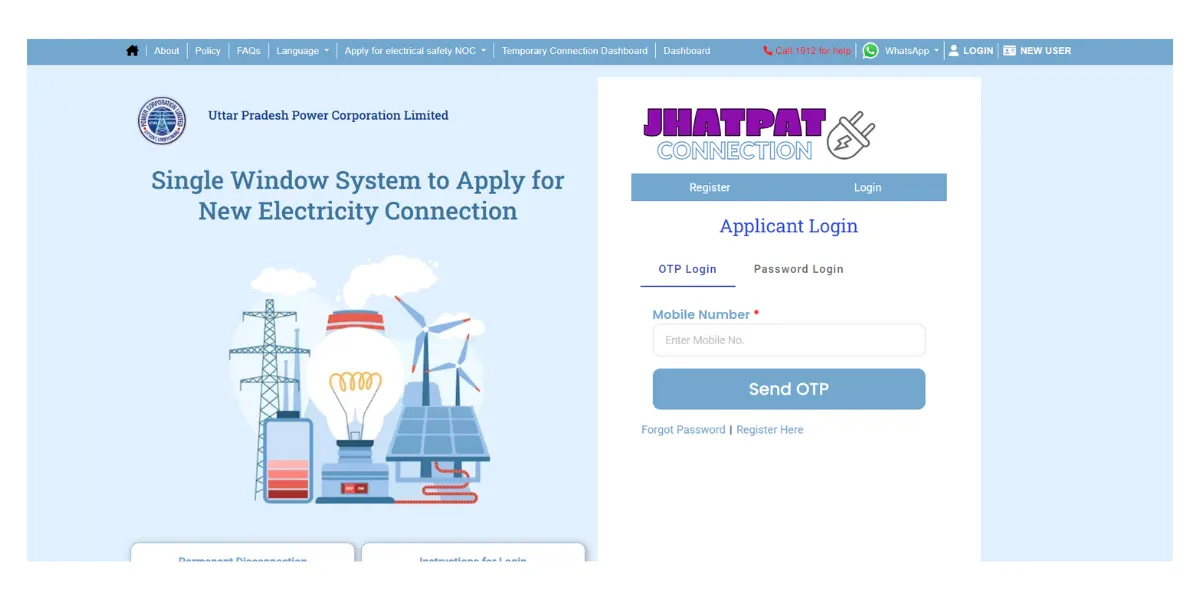

UPPCL Jhatpat Portal for New Electricity Connection: Process, Status Tracking and Charges in 2026

January 31, 2025

49553+ views

May 24, 2025

44152+ views

Recent blogs in

NBPDCL Bill Payment Online: Check, Download & Pay Bihar Electricity Bill in 2026

February 19, 2026 by Manu Mausam

CSPDCL Bill Payment Online: How to Check Bill Status and Download Receipt in 2026

February 18, 2026 by Manu Mausam

MPEB Bill Payment Online: Check, Download & Pay MP Electricity Bill in 2026

February 18, 2026 by Manu Mausam

JBVNL Bill Payment Online: Check Bill Status and Payment Methods in 2026

February 18, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!