Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Bhopal Property Tax: Online Payment, Bill Download 2025

Table of Contents

The Bhopal Property Tax is a mandatory collection that every city property owner must make to the local municipal corporation. It is calculated based on factors like property size and location. This tax is used for the maintenance of the roads, waste management, water supply, and other services. We will guide you through Bhopal's entire property tax system in 2025, like online payment, bill calculations, rebates, and legal help. Whether you're a homeowner, investor, or business owner, this blog will help you handle your property tax responsibilities smoothly and effectively.

Bhopal Property Tax: A Quick Info Updated in 2025

Here is the quick info for Bhopal Nagar Nigam property tax:

| Information | Details |

| Authority | Bhopal Municipal Corporation (BMC) |

| Official website | https://www.bmconline.gov.in |

| Property tax rate | 5%-20% |

| Last due date | June 30, 2025 |

| Helpline number | 1800 233 5522 |

How to pay Bhopal property tax online?

To pay the Bhopal Property Tax online, you can follow the steps below:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

- Go to the official website https://www.mpenagarpalika.gov.in/.

- Go to “Quick services.”

- Select “Property Tax Payment” from the dropdown menu.

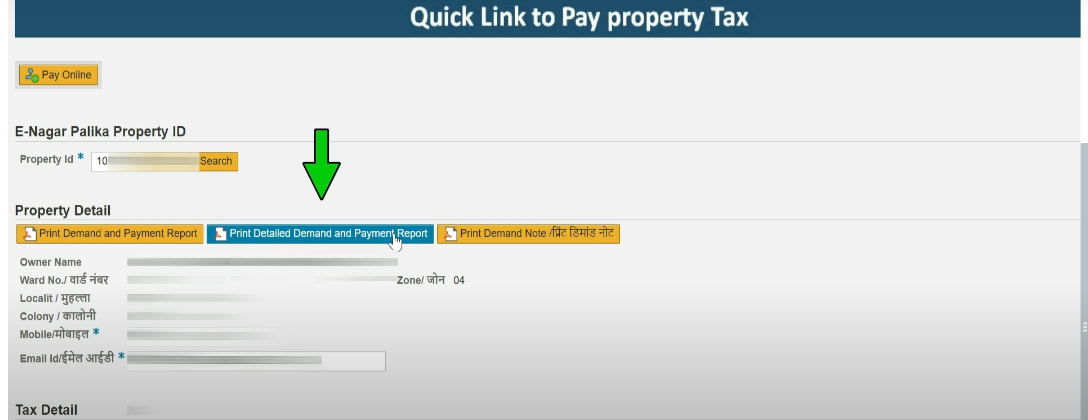

- After heading over to the “Property Tax Payment” window, enter your property ID and search for it.

- After searching for your property details, enter all the details required.

- Once the details have been entered, click on the submit button and select “Print Detailed Demand and Payment Report” in the following page.

- Click “Pay Online” and choose the payment option of your choice.

How to pay Bhopal property tax offline?

To pay the Bhopal Property tax Offline, you can follow the below steps:

- Start by finding the BMC office in your area.

- Once you've located it, visit the ward office and go to the designated counter where Property Tax payments are accepted.

- Present all required documents, such as your property bill, to the staff at the counter.

- Submit the specified amount to them, and collect your receipt for future reference.

What are the benefits of online payment?

Online payments have a lot of advantages. They are as follows:

- It can be paid anytime at your convenience. The service is available 24*7

- Online payment fees are comparatively lower than any other payment option.

- The confirmation of the transaction will be received immediately.

- The digital payment receipts are available for future records.

- You will receive reminders if you set up automatic payments. This will help you meet the deadline.

How to Download Bhopal Property Tax Receipt Online?

Here is how to download the BMC property tax receipt:

1. Visit the official website of Bhopal property tax - https://www.bmconline.gov.in

2. On the home page, under the print receipt option, click on the property tax receipt option.

3. Then, enter your customer ID and fiscal year and click the submit button.

4. Finally, print or download your Bhopal property tax receipt.

How to use the Bhopal property tax calculator?

ARV is a method the municipal body uses to determine property tax based on the estimated gross annual rent of a property. Here's the formula for calculating property tax in Bhopal:

Bhopal Nagar Nigam Property Tax = Built-up Area × Age Factor × Value of Base× Building Type × Usage Category × Factor of Floor

The term means:

- Built-up area: Total property size.

- Age factor: The age of the property.

- Base value: The base value of the property.

- Type of building: Whether the property is residential or commercial.

- Category of use: Whether the property is self-owned or rented.

- Floor factor: Whether the property is a multi-floor or single-floor building.

What are the property tax rebates available in Bhopal?

You will receive a rebate of 6.25% if the BMC property tax is paid before the due date. The properties owned by widows, abandoned individuals, minors, or those who are physically or mentally disabled are exempted from taxes if the amount of tax is ₹12,000 or the annual property value, whichever is higher.

What is the property tax rate in Bhopal 2025?

The Bhopal Property Tax ranges from 5% to 20%. This includes all properties, whether commercial or residential. You are always advised to visit the official website for the exact rates.

What is the Bhopal property tax app, and how can it be used?

The Bhopal Property Tax App used for managing online payments is “Bhopal Municipal Corporation”. You can install it from the Play Store or App Store. This app will help you manage everything about the property. It is designed to make the process of property tax payment easy and simple.

What is the helpline number for Bhopal property tax?

During an emergency or to register a complaint, you can call them at 18002335522.

You can also visit their office at the Directorate, Urban Administration & Development, Palika Bhawan, Shivaji Nagar, Bhopal, Madhya Pradesh 462016.

What is the last due date for Bhopal property tax?

The Bhopal Property Tax is paid two times a year. You can pay the first half at the end of June, and for the second half, you can pay at the end of December. There will be a penalty of 2% if it is not paid before the due date.

How to pay the Bhopal property tax bill using NoBroker Pay?

NoBroker Pay offers secure and transparent ways to pay your bills. Here are the simple steps you have to follow:

- Download the NoBroker Pay app.

- If you are a first-time user, fill out your bank details and set up the account.

- Then, select the type of property tax from the options.

- Enter the details of your property tax.

- Review the bill information.

- Select your preferred payment method.

- Confirm your property tax payment and download the receipt for your records.

Legal Services Offered by NoBroker

NoBroker offers comprehensive legal assistance tailored to property transactions. The following are our services:

- Document Scrutiny: Our legal team carefully examines vital documents like title deeds and sale agreements to detect any potential issues before you finalise your property transaction.

- Protection Measures: We safeguard you from fraud by checking for ongoing legal disputes related to the property and verifying ownership.

- Service Packages: NoBroker offers a range of legal service packages, including:

- Buyer Assistance: Guidance and support throughout the property purchase process.

- Registration: Handling property registration to save you time and simplify the process.

- On-Demand Services: Tailored solutions such as property title checks, advice on market value, assistance with missing documents, and verification of occupancy certificates are ideal for those who don’t need comprehensive legal assistance.

- NoBroker Pay: Securely and conveniently manage your Bhopal property tax payments through NoBroker Pay, with the added benefit of tracking all your payments in one convenient location.

How to Book NoBroker Legal Services?

Here are the simple steps to follow for a smooth and secure NoBroker service:

- Download the app or visit the NoBroker website.

- Navigate to the NoBroker Legal Services section.

- Browse our offerings, such as drafting agreements, property verification, and legal consultations.

- Fill in the details required and select your payment choice.

- Submit the form.

- An expert from NoBroker will contact you via phone or chat to gather more information. You can also schedule a free consultation call if you have any questions.

- Additionally, on the legal services page, you can purchase and customise online rental agreements directly through the NoBroker website.

Why Choose NoBroker Legal Services?

Here are some key reasons to choose NoBroker legal services:

- Convenience: You can handle legal matters from home without visiting a lawyer's office.

- Affordability: We offer comparatively lower prices than other traditional legal services.

- Professional Lawyers: NoBroker partners with professional lawyers who have more than 15 years of experience and are certified by the Bar Council.

- Streamlined Process: NoBroker simplifies the legal journey with predefined packages and manages communication with the lawyer on your behalf.

- Technology-Driven: We leverage technology for tasks like document management, enhancing efficiency and the overall service experience.

Simplify Bhopal Property Tax Management with NoBroker

NoBroker makes managing Bhopal's property tax requirements simple. Whether you need to pay your taxes online or get expert legal advice for property transactions, NoBroker is always ready to help you. Their platform allows easy online payments and also follows the guidelines according to the Bhopal Municipal Corporation regulations. This will help you avoid penalties and know the latest tax rates and deadlines. You can also get expert legal help to ensure your property transactions are safe. Schedule a free consultation with NoBroker and use their secure NoBroker Pay platform for hassle-free payments today.

Explore Property Tax Payment Options City-Wise in India

Frequently Asked Questions

Ans: You can download your Bhopal property tax receipt online after completing your payment through the official BMC portal.

Ans: No, property taxes are not taxable.

Ans: To pay Bhopal property tax offline, you need to visit the BMC office and submit the bill of the property and any verified identification documents.

Ans: The Bhopal property tax can be checked through their official website.

Ans: Yes, Bhopal property tax can be paid in instalments. It can be paid two times a year for reducing the financial burden on the property owners.

Ans: The house property tax in Bhopal is 5% to 20% for both commercial and residential properties.

Ans: For the resale of property in Bhopal, the tax rate is 5%.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61636+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

50162+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44369+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39821+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34122+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116749+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

199676+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

144367+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135176+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Mobile Home Lease Agreement: Types, Rights, Rules & Legal Requirements in 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!