Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Cibil Score for Home Loan: How to Check and Minimum Requirements

Table of Contents

The CIBIL (Credit Information Bureau India Ltd) score is a three-digit number that assesses a person's creditworthiness. A person's creditworthiness is determined through credit history, which includes loans, credit cards, and other credit facilities. A score of 750 or more is often regarded as excellent and raises your chances of authorising a loan.

While a low score might result in loan denial or higher interest rates, a strong score increases your chances of loan approval and reduces interest rates. The ability to negotiate better loan conditions with your lender is another benefit of having a strong credit score and helping you be accepted for a house loan.

This blog post will tell you everything there is to know about the CIBIL score for a home loan, including the minimum score, how to improve it, how will the CIBIL score impact your home loan approval and many more.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Understanding the Role of CIBIL Score in Home Loan Approval

Your CIBIL score is a significant component that lenders consider when deciding whether to grant you a house loan. This is because it demonstrates your dependability as a borrower, and lenders use it to determine the risk of giving a loan to you.

Your chances of being accepted for a house loan might be improved with a high CIBIL score. It's a sign that you have a solid credit history and will probably be able to repay the loan on schedule. A poor CIBIL score, on the other hand, may result in a loan being declined or higher interest rates.

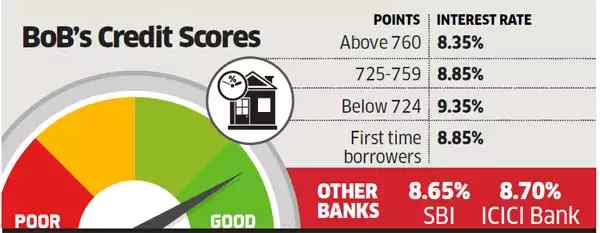

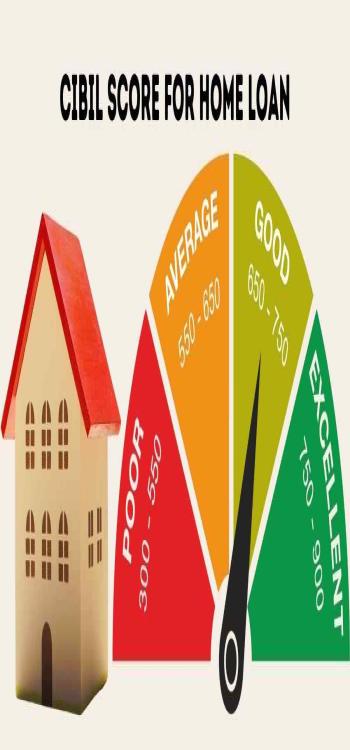

A table is provided below to help you comprehend the results of each CIBIL score range.

| Range | Explanation |

| 750 - 900 | Very high possibility of getting a loan approved with reduced interest rates. |

| 650 - 749 | Strong probability of getting approved and getting favourable interest rates. |

| 550 - 649 | Only fewer alternatives are available with a chance of getting higher interest rates. |

| 300 - 549 | The chances of approval are quite minimal. |

You should always pay your bills on time, keep your credit usage low, avoid defaulting on any credit facilities, and routinely check your credit report for mistakes or inconsistencies to maintain a high CIBIL score.

Minimum CIBIL Score Requirements for Home Loans

Your CIBIL score is one of lenders' most important considerations when applying for a house loan. A score of 750 or more is acceptable and might boost your chances of being approved for a house loan with favourable terms and interest rates; however, the minimum CIBIL score required for home loans may vary from lender to lender but is generally 650.

Lenders may still consider your application if your credit score is below 750, but you can be subject to higher interest rates and stricter eligibility requirements. On the other hand, if your credit score is below 650, it may be difficult for you to get accepted for a house loan, so you should focus on raising it before you apply.

How Your CIBIL Score Impacts Home Loan Interest Rates?

Banks assess your creditworthiness by looking at your CIBIL score, which is based on your repayment track record of existing loans and credit card bills. A high CIBIL score indicates a good credit history, and lenders will be more likely to offer attractive interest rates. A low score, on the other hand, will make it difficult for you to get the best loan terms and interest rates.

The better your CIBIL score, the more likely you will get approved for a home loan with a lower interest rate. Lenders look at various factors, including your credit score, to assess your creditworthiness and determine the interest rate you can get. Those with a CIBIL score of 750 or higher will have the best chance of getting the best home loan interest rates.

It is important to remember that a good CIBIL score doesn't guarantee the best home loan interest rate. Other factors, such as your income, the type of loan you're applying for, and the loan amount, also play a role. Therefore, you should compare different offers to get the best rates.

It's also critical to keep in mind that if you have other obligations or responsibilities, you will require more than just a high credit score. Lenders carefully consider your financial commitments and take them into account when making decisions. As a result, in addition to your CIBIL score, your income, current loans, and obligations will also be taken into account.

Factors Affecting Your CIBIL Score

Various things might affect your CIBIL score, both favourably and adversely. Some of the most important elements might influence your CIBIL score.

- Credit Usage Ratio–Your credit utilisation ratio is the amount of credit you're utilising compared to your overall credit limit. Utilising too much of your credit limit might harm your score, whilst keeping your credit use ratio low will help it.

- Payment Record–Your payment history is one of the most important elements that might affect your CIBIL score. Making on-time payments and not missing any payments will boost your credit score. However, late payments or defaulting on loans might lower it.

- The Quantity of Credit Inquiries–Every time you apply for credit, a hard inquiry is placed on your credit report, which might lower your score. Numerous queries in a short period might make you look hazardous to lenders.

- Length of Credit History–Another aspect that might affect your CIBIL score is the duration of your credit history. A longer credit history with a strong payment record might be beneficial, but a short or no credit history can be detrimental.

- Credit Types–The sorts of credit you hold might also affect your CIBIL score. A combination of credit kinds, such as credit cards, loans, and a mortgage, can be beneficial. However, having only one type of credit might be detrimental.

Remember these elements and check your credit report frequently to verify the information is correct.

Tips to Improve Your CIBIL Score for a Home Loan

Here are some helpful pointers you may use to raise your CIBIL score.

1. Periodically check your credit report

Your CIBIL score may suffer if your credit report has errors or inaccuracies. Therefore, it's crucial to routinely check your credit report to ensure all the information is correct. You can dispute any inaccuracies with the credit bureau if you find any.

2. Pay your invoices promptly

One of the most crucial things that affect your CIBIL score is your ability to make prompt payments on all of your obligations, including utility bills, credit card bills, and loan EMIs. Late or missing payments can drastically lower your credit score. You may set up recurring payments or reminders to avoid forgetting due dates.

3. Diversify Your Credit Portfolio

Having various credit products in your portfolio, including credit cards, personal loans, and a mortgage, will help your credit score. Yet it's important to keep things in check and avoid taking on too much debt you can't handle.

4. Maintain Credit Usage Low

Your credit utilisation ratio is the proportion of your overall credit limit that you are currently utilising. It is recommended to keep this ratio under 30% to maintain a high score. For example, if your credit limit is Rs. 5 lakhs, try to spend at most Rs. 1,15,000 at any moment.

5. Limit Credit Applications

As each application causes a hard inquiry on your credit report, applying for several loans or credit cards quickly will lower your CIBIL score. Therefore, applying for credit should only be done when essential.

How to Check Your CIBIL Score Before Applying for a Home Loan?

- Visit TransUnion CIBIL's official website.

- At the top right corner of the screen, select "Receive your CIBIL score."

- Choose one of the available plans to join CIBIL.

- You can receive daily updates, notifications, and personalised loan offers with a subscription membership, which also allows you to check your credit score continuously.

Visit free CIBIL score to check your CIBIL score for a house loan for free.

- When given the option to subscribe, select "No thanks" and then "Get your free CIBIL score."

- Your name, mobile number, email address, and PIN code must all be entered. Next, input the ID number and choose an ID type for identification verification.

- To establish a new account on CIBIL, click "Accept and Proceed."

- Add more personal information, such as your address, birthday, Aadhaar number, and PAN.

- Enter the OTP that was provided to your email or phone number next.

- You will next be required to confirm your loan account information, credit card information, etc.

- Now, you can now obtain your CIBIL report.

Home Loan Options for Low CIBIL Score Applicants

Obtaining a house loan with a low CIBIL score may appear to be an unachievable dream. There are, however, certain house loan choices open to you. Here is a list of some of the possibilities.

Collateral-based Loan:

If you have any valuable assets, such as real estate or a vehicle, you may want to explore obtaining a collateral-based loan. In this type of loan, lenders will look at the size of the collateral instead of the CIBIL score. Because an asset backs these loans, the lender may be more ready to grant the loan even if your CIBIL score is poor.

Loan with a Cosigner:

A cosigner is liable for loan repayment if the borrower defaults. You can apply for a house loan with a co-applicant with an excellent credit score. The creditworthiness of the co-applicant might significantly boost your chances of loan approval.

Loan Against Fixed Deposit:

If you have a bank fixed deposit, you may be able to borrow against it. This option is beneficial as the bank will not check your credit score since the loan is already secured. Because your fixed deposit backs the loan, the bank may not take your CIBIL score into account when approving the loan.

Government-backed Loans:

Several government-backed initiatives, like the PMAY (Pradhan Mantri Awas Yojana) and CLSS (Credit-Linked Subsidy Scheme), provide house loans at discounted interest rates to low-income applicants. These loans come with lower interest rates and longer repayment tenure, making them more suitable for borrowers with a low CIBIL score.

Your CIBIL score for a home loan significantly impacts your ability to obtain a home loan. A high CIBIL score makes it easier to secure a loan with favourable interest rates and terms easier, while a low CIBIL score can make getting approved for a loan more challenging.

Therefore, it's crucial to be aware of the factors that affect your CIBIL score and take measures to improve it before applying for a home loan. By keeping a close watch on your CIBIL score and making efforts to maintain or enhance it, you can increase your chances of getting approved for a home loan and fulfilling your dream of owning a home.

To know more, visit the NoBroker website.

FAQ's

A1. A CIBIL score is a number based on your credit history that represents your creditworthiness. A higher score implies a stronger credit profile, which makes it simpler to get a house loan with favourable conditions. A poor CIBIL score, on the other hand, might make it difficult to have a loan accepted.

A2. You may check your CIBIL score online at the CIBIL website. To retrieve your score, you must first give certain personal information, such as your name, date of birth, and PAN card data.

A3. When it comes to CIBIL ratings for house loans, different lenders have different criteria. Most banks and financial organisations, however, prefer a score of 750 or above.

A4. Sure, obtaining a house loan with a low CIBIL score is feasible, although it may be difficult. To boost your chances of approval, you may need to examine alternate lending choices such as collateral-based loans or government-backed programmes.

A5. Paying your obligations and invoices on time, keeping your credit usage ratio low, maintaining a healthy credit mix, and avoiding numerous loan applications are all ways to boost your CIBIL score. You may also seek expert assistance from credit counselling companies to help you better manage your money.

Loved what you read? Share it with others!

Most Viewed Articles

Home Loan Interest Rates for All Banks in November 2025

November 3, 2024

25713+ views

ICICI Home Loan Interest Rates - Updated in November 2025

November 3, 2024

22930+ views

SBI Home Loan Interest Rates - Updated in January 2025

January 16, 2025

22623+ views

SBI Home Loan Interest Certificate: Benefits, Offline and Online Options, Get via Yono App in 2025

December 23, 2024

19661+ views

Understanding Home Loan Tenure and Why It's Important

August 22, 2022

16215+ views

Recent blogs in

January 18, 2025 by Priyanka Saha

SBI Home Loan Interest Rates - Updated in January 2025

January 16, 2025 by Siri Hegde K

Home Loan Overdraft Facility in India

January 15, 2025 by Krishnanunni H M

The Subvention Scheme: Meaning, Importance,and More

January 15, 2025 by Kruthi

1.5 Crore Home Loan EMI With Calculator And Interest Rates 2025

January 15, 2025 by Siri Hegde K

Join the conversation!