Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Circle Rates Gurgaon 2025: A Guide to Property Registration Process in Gurgaon 2025

Table of Contents

While buying any property, the circle rates of the area is an important factor in determining the property’s price. In Gurgaon, the circle rate is calculated based on the demand for properties in an area. The circle rates Gurgaon has been revised recently on January 10, 2024, and with this increase in registration charges in Gurgaon, there has been a significant increase in the Gurgaon property rates in 2024 as well. Do you want to know what is the meaning of circle rate Gurgaon and how the registry charges in Gurgaon affect the property’s rate? Read this blog to know more.

What is the Circle Rate in Gurgaon 2025?

The circle rate of an area is the minimum designated amount per sq. ft of the property, below which the property can’t be registered for sale. Just to clarify any confusion, the circle rate is no different than the collector’s rate of Gurgaon, guidance value or the ready-reckoner rates of a property. These are different names used across the states of India for marking the same factor, the minimum fixed price for property registration in an area. For instance, circle rate Gurgaon is the benchmark below which the property can’t be registered with the government. This is an important parameter to determine the stamp duty and registration charges against the immovable assets that the government will register in their records. The Gurgaon stamp duty is also dependent on the circle rates of the areas. Since, the increase in circle rate Gurgaon 2025, the stamp duty Gurgaon has also been revised. Let’s take a look at locality-wise circle rates in Gurgaon and how the flat registry charges in Gurgaon affect the stamp duty charges in Gurgaon.

Circle Rate in Gurgaon 2025: Key Areas and Major Localities

The commercial circle rate in Gurgaon is revised twice a year and they are kept different for men and women. The registry rate in Gurgaon also varies depending on the area and deal value. Let’s take a look at area-wise property registry charges in Gurgaon.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Sector | Circle rate Gurgaon 2025 (per square yard) |

| Sector 63 | Rs.3,500 |

| Sector 62 | Rs.3,500 |

| Sector 61 | Rs.3,500 |

| Sector 60 | Rs.3,500 |

| Sector 59 | Rs.3,500 |

| Sector 58 | Rs.3,500 |

| Sector 57 | Rs.5,000 |

| Sector 56 | Rs.5,000 |

| Sector 55 | Rs.5,000 |

| Sector 54 | Rs.5,000 |

| Sector 53 | Rs.5,000 |

| Sector 52 | Rs.5,000 |

| Sector 51 | Rs.5,000 |

| Sector 50 | Rs.5,000 |

| Sector 46 | Rs.5,000 |

| Sector 43 | Rs.5,000 |

| Sector 41 | Rs.5,000 |

| Sector 40 | Rs.5,000 |

| Sector 31 - 32A | Rs.5,000 |

| Sector 30 | Rs.5,000 |

(Source: https://gurugram.gov.in/document/collector-rate-2nd-phase-2019-20-dated-27-12-2019-tehsil-gurugram/)

Here is the Circle Rate Gurgaon 2025 for HUDA Sectors:

| Locality | Circle rate per sq yard |

| Sectors 104, 105, 106, 109, 110, 110A, 111, 112, 113, 114 | Rs 30,000 |

| Sectors 25 | NA |

| Sectors 18, 19, 20 | NA |

| Sectors 1, 2, 3, 3A, 4, 5, 6, 7, 12, 12A, 13 | Rs 35,000 |

| Sectors 21, 22, 22A, 23, 23A | Rs 35,000 |

| Sector 38 | Rs 40,000 |

| Sectors 14, 15, 16, 17, 4o | Rs 45,000 |

| Sectors 42, 43 | Rs 50,000 |

The house registration charges in Gurgaon is different for licenced colonies. Here is the circle rate in Gurgaon for licenced colonies:

| Locality | Circle rate per sq yard |

| DLF Phase II | Rs 7,000 |

| Palam Vihar | Rs 6,600 |

| License colonies in Sectors | Rs 25,500 |

Circle rate in multi-storey group housing by builder’s floor in Gurgaon is:

| Locality | Circle rate per square yard |

| DLF Colony Old | Rs 54,000 |

| Housing board colony | Rs 38,00 |

| Sectors 104 to 115 | Rs 3,000 |

| Sectors 1, 2, 3, 3A, 4, 5, 6, 7, 12, 12A, 13, 14, 15, 16, 17, 21,22, 22A, 23, 23A, 38, 40 42, 43 | Rs 5,000 |

Factors Affecting the Circle Rate in Gurgaon

As we saw already, the circle rate in Gurgaon affects the stamp duty charges in Gurgaon and the house registration charges in Gurgaon. The circle rate is directly proportional to the area’s ability to attract real estate investment. This means the circle rate of more developed areas with well-developed, functional amenities is higher than the circle rate of an underdeveloped area. Here are some of the major factors that can affect the circle rates in Gurgaon:

- Type of the property

- Infrastructure and Amenities of the property

- Usage of the property

- Stamp & Registration Value of the property.

How the Circle Rate in Gurgaon Affects the Stamp Duty Gurgaon

The stamp duty Gurgaon is a charge levied by the government on property transactions. Here is the latest stamp duty rate in Gurgaon 2025:

| Jurisdiction | Men | Women | Joint |

| Areas under the municipal limit | 7% | 5% | 6% |

| Areas outside of the municipal limit | 5% | 3% | 4% |

Property Registration Charges in Gurgaon

Depending on the deal value, the buyer has to pay the property stamp duty and registration charges in Gurgaon on the property transaction. The Gurgaon property registration charges are listed as below:

| Deal value | Gurgaon Registration charge |

| Up to Rs 50,000 | Rs 100 |

| Rs 50,001 – Rs 1,00,000 | Rs 1,000 |

| Rs 5,00,001 – Rs 10,00,000 | Rs 5,000 |

| Rs 10,00,001 – Rs 20,00,000 | Rs 10,000 |

| Rs 20,00,001 – Rs 25,00,000 | Rs 12,500 |

| Above Rs 25 lakhs | Rs 15,000 |

How To Calculate the Stamp Duty Charges in Gurgaon Using the Circle Rates in Gurgaon?

There is a very simple method to calculate the applicable stamp duty charges in Gurgaon based on the circle rate of the area. If you want to calculate the stamp duty charges in Gurgaon using the circle rates in Gurgaon, you need to be aware of a few details like:

- Built-up area and amenities of the property

- Type of property whether commercial, independent unit etc.

- The locality of the property

Based on these factors, you can easily calculate the stamp duty charges in Gurgaon. Here is the formula applicable for different types:

- Stamp Duty in Gurgaon for Flats and Apartments – Carpet area x circle rate (per square yard)

- Stamp Duty in Gurgaon for Builder floor – Carpet area x circle rate (per square yard)

- Stamp Duty in Gurgaon for a Plot - Plot area in square yard x circle rate (per square yard)

- Stamp Duty in Gurgaon for homes built on plots: Plot area in square yard x circle rate (per square yard) + carpet area (per square yard) x minimum construction cost (per square yard)

More About Gurgaon Property Registration Process and the Stamp Duty on Rent Agreement in Gurgaon

The process of property registration in Gurgaon is very simple and can be completed online in a few simple steps. For offline property registration in Gurgaon, visit your nearest Tehsil with all the documents. Pay the Gurgaon builder floor registry charges to the Tehsildar and submit the documents for verification. Note that the home registry charges in Gurgaon are different from the commercial property registration charges in Gurgaon. Pay the stamp duty charges accordingly and get your property registered. The Tehsil follows a token system for appointments and a challan system for the collection of apartments and flat registration charges in Gurgaon. For the online process, here are the steps

Steps For Gurgaon Property Registration Process Online

- Login to https://gurugram.gov.in/

- Check the circle rate Gurgaon to register a property under the Revenue section from the drop-down menu

- Create your account and login

- Upload the required documents and pay the charges whether for a home registry, commercial property registry or rent agreement registration charges in Gurgaon.

- Download payment receipt for future reference.

Documents Required to Pay Registry Charges in Gurgaon

For registering property and paying the registry charges in Gurgaon, the following documents need to be submitted to the Registrar.

- Ownership Documents

- Certified copy of original

- Identification Proof

- Voter ID, Ration Card, Aadhaar Card, Driving License, PAN Card or Identity Card

- GPA Verification Proof

- NOC for Property

- Two witnesses and their ID proof.

- Description of property and plan.

- Photograph of the property

The stamp duty charges in Gurgaon is an important factor for the government to maintain their treasuries and the upkeep of infrastructure of an area. The stamp duty charges in Gurgaon is impacted by the circle rate Gurgaon. The circle rate Gurgaon is revised twice a year and with the recent revision, registry charges in Gurgaon have significantly increased. However, the circle rate is also dependent on the deal value and hence, it’s a conditional parameter that can be saved diligently. As the circle rate in Gurgaon is based on the amenities present in the area, it varies significantly for more developed and posh areas than average or developing areas. With the increase in circle rate, the property prices have increased in the city too. This makes finding affordable housing options difficult as property prices in Gurgaon are already at an all-time high. If you are looking for commercial property or residential flat in Gurgaon, end your search today with NoBroker. We guarantee you the house of your dreams plus additional savings with our zero-brokerage promise. Reach out to us for any of your property requirements and our executive team will be in touch with you shortly.

Stamp Duty in Gurgaon

Stamp duty is a legal tax payable in full. It acts as proof for any sale or purchase of a property.

Here are the rates of the stamp duty in Gurgaon:

| Transaction | Rate of stamp duty | |

| Rural area | Urban area | |

| Conveyance Deed, Sale Deed or Certificate of Sale. | 5% | 7% (Including 2% of Municipality duty2% exemption of S.D. on instruments of sale executed in favour of women in rural or urban) |

| Gift Deed, Mortgage Deed with Possession | 3% | 5% |

| Mortgage Deed without Possession, Settlement Deed, Partition Deed | 1.5% | 1.5% |

| Special Power of Attorney | Rs. 100 | Rs. 100 |

| General Power of Attorney | Rs. 300 | Rs. 300 |

| Exchange of Property | 5% | 7% |

| Affidavit | Rs. 10 | Rs. 10 |

| Security Bond, Release of Ancestral, Property, Surrender of the lease. | Rs. 15 | Rs. 15 |

| Partnership Deed | Rs. 22.5 | Rs. 22.5 |

| Trust Deed | Rs. 45 | Rs. 45 |

| Adoption Deed | Rs. 37.50 | Rs. 37.50 |

| Equitable Mortgage or deposit of title deed, pawn or pledge | 0.2445% if such a loan is repayable on demand or in more than three months. 0.12225% if such loan is repayable in not more than three months. |

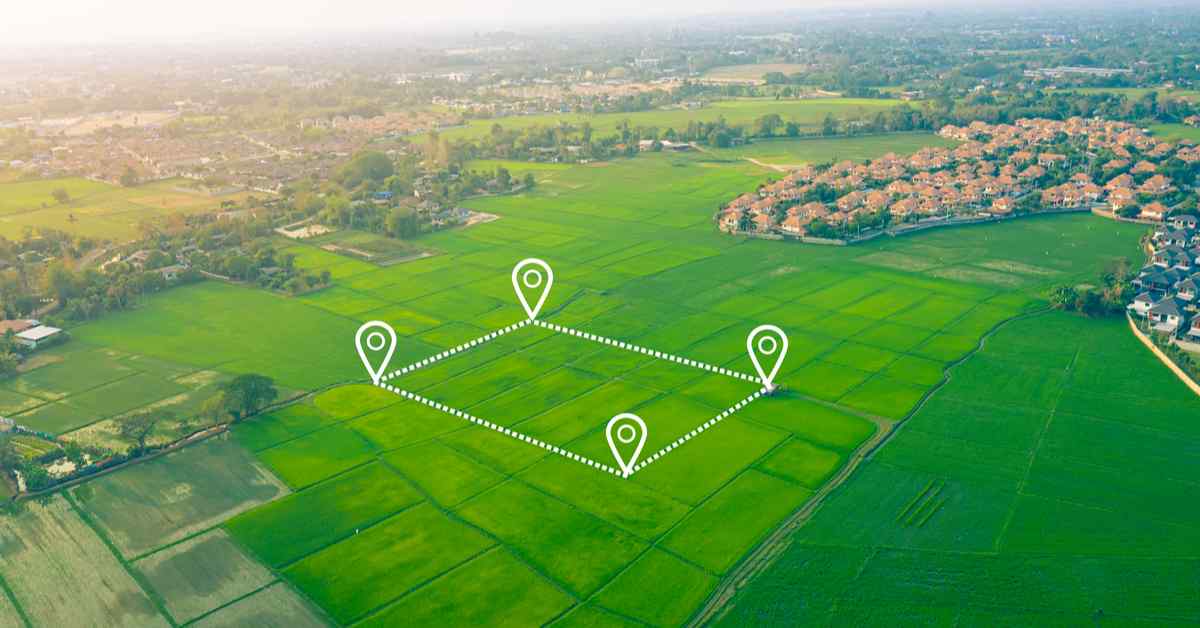

How to Register a Deed: Procedure for Registering a Deed in Gurgaon

Property deed registration guidelines for Gurgaon are as follows:

1. Visit the Jamabandi website and download the desired deed.

2. Fill in all the details

3. Vist the office of the Sub Registrar on the given date and time. The Registration clerk will forward the deeds to the Sub-registrar.

4. Once the Sub-registrar has marked the deed, the deed data and the photo of the buyer will be recorded in the Haryana Land Record Integrated System(HALRIS).

5. While you register in HALRIS, the officer will update buyer and seller details. The E-stamp number and transaction fees will also be updated, following which real-time photos captured.

6. Once the deed is registered in the system, the SRO officer will regularise it by obtaining the biometrics of the buyer and seller.

7. After regularising the deed, the registry of the land is printed with pictures of the buyer, seller and witness and their signatures.

8. The copies of the deed are provided to the parties. The Tehsil office will also upload the same on the Jamadani web portal.

How to Procure E-Stamp Online

You can procure the E-Stamp online in Gurgaon using the e-Gras web portal.

FAQ’s

Ans. The circle rate of an area is the fixed-rate below which a property transaction can’t take place. This is also called the ready reckoner rate, guidance value, collectors' rate or registry rate. For instance, the circle rate in Gurgaon sector 43 is Rs. 5,000.

Ans. Here are some of the major factors that can affect the circle rates in Gurgaon:

Type of the property

Infrastructure and Amenities of the property

Usage of the property

Stamp & Registration Value of the property.

Ans. The stamp duty charges in Gurgaon are classified based on the fact whether the area lies within the municipal limit or not. If the property is under municipal limits, the stamp duty charges in Gurgaon is 7% for male buyers, 5% for female buyers and 6% for joint buyers. In case the property is outside the municipality’s limits, the property stamp duty and registration charges in Gurgaon is 5% for male buyer, 3% for female buyers and 4% for joint buyers.

Ans. The stamp duty in Gurgaon can be paid online at the official portal of the Department of Land and Revenue, Haryana. Here is the link: https://egrashry.nic.in/

Ans. Yes, stamp duty in Gurgaon is affected by a change in the circle rate in Gurgaon. For instance, a recent increase in the circle rate in Gurgaon has increased the stamp duty charges in Gurgaon which in turn has increased property prices in the area.

Recommended Reading

How to Get a Stay Order in India: Step-by-Step Legal Process in 2025

May 31, 2025

92540+ views

FSI in Mumbai 2025: Calculate FSI in Mumbai Municipal Corporation

January 31, 2025

90557+ views

Tamil Nadu Property Registration: Online Process, Stamp Duty, Fees and Document Checklist 2025

May 31, 2025

74008+ views

How to Convert Agricultural Land to Residential Land: Process, Eligibility and Documentation

October 10, 2025

72860+ views

Maharashtra Stamp Act: Meaning, Duty Rates, Benefits and Registration Rules in 2025

January 31, 2025

70741+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115350+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193214+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132644+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

127906+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!