Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Circle Rate in Delhi: Meaning, Latest Updates and Calculation 2025

Table of Contents

Price speculations of various properties have forced the state government to come out with a ready reckoner to inform the public at large of the various circle rates in the city for different localities. In view of the escalating property prices right across Delhi, Chief Minister Arvind Kejriwal in a cabinet meeting on February 5, 2022, along with his ministers took a decision to cut circle rates by a flat 20% across categories, including residential, commercial and industrial buildings. These new reduced rates would be applicable for all properties in Delhi and would be in force till September 30, 2022.

What is the Circle Rate in Delhi?

Circle rates are the minimum property price at which a piece of property can be sold. In New Delhi the circle rates are fixed by the Delhi Government, these are reviewed yearly to avoid any ambiguity with the prevalent market rates.

In the Union Budget 2022-23, the finance minister Nirmala Sitharaman, allowed home buyers to purchase homes at 20% lower value than the circle rates, without attracting additional tax liability. This new law would be effective only for properties priced below Rs.2 crores, till June 30, 2022. Those interested in buying a property in Delhi should be aware that the property registration process in Delhi, and charges such as stamp duty, are based on the declared property value and the price calculated as per circle rate applicable for the sector or area of Delhi.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Latest Updates: Govt Extends 20% Reduction in Circle Rates in Delhi till December 31

The AAP-led Delhi state Government has decided to extend the current scheme for stamp duty charges in Delhi and the circle rates for all categories. The current scheme, which reduced the stamp duty and property registration charges in Delhi by 20% will be applicable till 31 December. The Arvind Kejriwal led state government is hoping for a turnaround in the city’s declining real estate scenario with these schemes and reductions. Under this scheme, the circle rates in different areas of Delhi are categorised into eight different classes from ‘A’ to ‘H’. Where Class A has posh areas of Delhi like Vasanth Kunj with circle rates for property registration as high as Rs 7.74 lakh per square metre, Class H features areas like Nand Nagri with circle rates costing Rs 23,280 per square metre.

How does one Calculate Circle Rates in Delhi?

Commercial properties have a higher circle rate as compared to residential properties. New Delhi circle rates may also vary, based on the type of property and the construction date of the property. Those Properties built post the year 2000 have a maximum multiplier of 1, however, older buildings have it in the range of 0.5-0.9.

Delhi government’s online registration information system can help you calculate and ascertain the circle rates in Delhi.

One can also Calculate the Circle Rate in Delhi by

- Firstly, checking out if this property is for commercial use or residential.

- Secondly, what kind of a property is it, an apartment, a plot of land, an independent home or a studio apartment?

- Thirdly, what is the area of the said property?

- Fourthly where is this property located, is it upmarket?

- Lastly, if one knows the year of construction one should use the ‘age multiplier’ to arrive at property valuation and determine the circle rate accordingly.

- To Calculate the Property Price for an Independent Plot: Multiply the plot area with the applicable circle rate (in Rs/sq metre)

- To Calculate the Property Price for Builder Floors, DDA Flats, Society Flats: Multiply the minimum construction cost with the built-up area (in sq. metres) and then multiply the product with the applicable age factor.

- To Calculate the Property Price of Multi-storey Flats: Multiply the flat’s built-up area with the applicable circle rates for the multiple storeyed flats in Rupees per square metre.

- For a House That is Constructed on a Plot of Land: Multiply the plot area with the applicable circle rate for land in that respective zone. Multiply the house’s built-up area with the minimum construction cost. Multiply the product with the applicable age factor for the construction.

Things to Remember When Calculating Circle Rate in Delhi

While calculating the circle rate of a flat in Delhi, be sure to know the purpose of the property used as the circle rate can differ as per the locality. For instance, the rate for commercial usage is higher than residential usage. Understand the form of the property, as the rate can differ based on it being an apartment, a bungalow, an independent house or even just a parcel of land. Finally, take the help of real-estate legal experts in case you face any issues in rates being suspiciously high in places, as you may need to take that to the attention of the right Delhi authorities.

How to Find the Circle Rate of Property/Land?

This method shows us how to calculate the circle rate of the property. You can also find the online circle rate.

- Make sure you know the property’s built-up area, age of the construction, plot area, floors and so on.

- Figure out what kind of property it is, if it's commercial or residential if it is a plot, a shop, a unit, house, apartment, etc.

- Select the locality.

- Lastly, calculate the minimum assessment figure according to the circle rats given.

To make it easier, you can alternatively use this formula, which states that, Property value = the built-up area in square metres X the circle rate for the locality in rupees per square metre.

Circle Rate of Property in Delhi Category-Wise Classification of Areas

The various Delhi localities are segregated into categories ranging from A to H, which help decide which circle rate applies to a property in Delhi. The circle rate in Delhi category-wise spans from the lowest in Category A to the poshest in Category H. The category-wise classification of areas are as below:

| Category | Localities |

| A | Kalindi Colony, Maharani Bagh, Friends Colony (East & West), Golf Links, Lodi Road Industrial Area, Shanti Niketan, Nehru Place, Bhikaji Cama Place, Basant Lok DDA Complex, Panchshila Park, Vasant Vihar, Rajendra Place, Sunder Nagar, New Friends Colony, Anand Niketan, Friends Colony |

| B | Anand Lok, Defence Colony, Pamposh Enclave, Sarvodaya Enclave, Greater Kailash (I II III and IV), Green Park, Hamdard Nagar, Andrews Ganj, Maurice Nagar, Neeti Bagh, Nizamuddin East, Panchsheel Park, Gulmohar Park, Hauz Khas, Munrika Vihar, Nehru Enclave, Safdarjung Enclave, Sarvapriya Vihar |

| C | Alaknanda, Civil Lines, East Patel Nagar, Kailash Hill, Chittaranjan Park, East of Kailash, Jhandewalan Area, Kalkaji, Malviya Nagar, Lajpat Nagar (I, II, III and IV), Munirka, Punjabi Bagh, Vasant Kunj, Masjid Moth, Nizamuddin West, Som Vihar, Panchsheel Extension |

| D | Jasola Vihar, Kirti Nagar, Rajinder Nagar (New & Old), Mayur Vihar, Karol Bagh, Rajouri Garden, Daryaganj, East End Apartments, Hudson Lane, Janakpuri, Jangpura Extension, Anand Vihar, Dwarka, Gagan Vihar, Indraprastha Extension, Jangpura A |

| E | Chandni Chowk, Gagan Vihar Extension, Jama Masjid, Khirki Extension, Mahavir Nagar, Pahar Ganj, Rohini, East End Enclave, Hauz Qazi, Kashmere Gate, Madhuban Enclave, Moti Nagar, Pandav Nagar, Sarai Rihilla |

| F | Majnu Ka Tila, Nand Nagri, Zakir Nagar Okhla, Arjun Nagar, Dilshad Colony, BR Ambedkar Colony, Govindpuri, Jangpura B, Mukherjee Park Extension, Uttam Nagar, Anand Prabhat, Daya Basti, Dilshad Garden, Ganesh Nagar, Hari Nagar, Madhu Vihar |

| G | Ambedkar Nagar Jahangirpuri, Amber Vihar, Dakshinpuri, Hari Nagar Extension, Tagore Garden, Ambedkar Nagar East Delhi, Dabri Extension, Dashrath Puri, Vivek Vihar Phase I |

| H | Sultanpur Majra |

What are the Multiplying Factors on Which Circle Rate in Delhi Depends?

The circle rate of the land is determined by including a few factors including the type of land, the area it covers, the number of floors, amenities, age of construction etc. To calculate the circle rate, for example, you can get an approximation by multiplying the area of the land or plot in square meters with the circle rate for the land in the locality in terms of Rupees per square meter. The following circle rates for flats in Delhi and the calculated factors will help you understand with some examples.

To understand the land circle rate in Delhi, it is important to keep some factors in mind. They are- Area, DDA, Private builder flats (per square metre) and lastly, multiplying factors for private colonies.

Here’s a table showing making it easy for you to find the circle rate for various combination of factors–

| Property Area | DDA Worth | Private Builder Flats Worth | Circle Rate |

| Up to 30 sq. meters | Rs. 50,400 | Rs. 55,400 | 1.1 |

| 30-50 sq. meters | Rs. 54,440 | Rs. 62,652 | 1.15 |

| 50-100 sq. meters | Rs. 66,240 | Rs. 79,488 | 1.2 |

| More than 100 sq. meters | Rs. 76,200 | Rs. 95,250 | 1.25 |

| Multi-storey building | Rs. 87,840 | Rs. 1.1 lakh | 1.25 |

Age Factor for Circle Rates

This table provides information about the age factor that is used to determine circle rates for properties in Delhi. The table outlines the different circle rates for properties built during different decades, ranging from 0.5 for properties built before 1960 to 1 for those built post-2000.

| Age Factor | Circle Rate |

| Before 1960 | 0.5 |

| 1960-1969 | 0.6 |

| 1970-1979 | 0.7 |

| 1980-1989 | 0.8 |

| 1990-1999 | 0.9 |

| After 2000 | 1 |

Circle Rates for Residential and Commercial Plots in New Delhi

To make this easier for everyone, Delhi categorised the properties into 8 categories, i.e. A-H.

Delhi’s posher areas are in category A, and the lower-valued properties are in category H.

Here is a table of Delhi's property categories. The table shows Delhi's property categories from A to H, which are determined by the land cost per square meter. Category A is the most expensive, while Category H is the least expensive. The table also includes the residential and commercial costs of construction for each category.

| Category | Land Cost (per sq. meter) | Residential Cost (per sq. ft.) | Commercial Cost (per sq. ft.) |

| A | Rs. 7.74 lakhs | Rs. 21,960 | Rs. 25,200 |

| B | Rs. 2.46 lakhs | Rs. 17,400 | Rs. 19,920 |

| C | Rs. 1.6 lakhs | Rs. 13,920 | Rs. 15,960 |

| D | Rs. 1.28 lakhs | Rs. 11,160 | Rs. 12,840 |

| E | Rs. 70,080 | Rs. 9,360 | Rs. 10,800 |

| F | Rs. 56,640 | Rs. 8,220 | Rs. 8,220 |

| G | Rs. 46,200 | Rs. 6,960 | Rs. 8,040 |

| H | Rs. 23,280 | Rs. 3,480 | Rs. 3,960 |

Circle Rates for Agricultural Land in New Delhi

The Delhi government announced a 10-fold hike in the circle rates for agricultural land in December 2019. Since the announcement, the circle rate for agricultural land has been increased from Rs. 53 lakhs per acre to Rs. 2.25-5 crores/acre.

If you're planning to buy or sell property in Delhi, it's important to understand the circle rates for different districts. Circle rates are the minimum values at which properties have to be registered in case of a transfer of ownership. To help you out, here is a table summarizing the circle rates for Green Belt, Urbanized, and Rural Villages in different districts of Delhi.

| District | Green Belt Villages | Urbanised Villages | Rural Villages |

|---|---|---|---|

| South | 5 crores/acre | 5 crores/acre | 5 crores/acre |

| North | 3 crores/acre | 3 crores/acre | 3 crores/acre |

| West | 3 crores/acre | 3 crores/acre | 3 crores/acre |

| North-West | 3 crores/acre | 3 crores/acre | 3 crores/acre |

| South-West | 3 crores/acre | 4 crores/acre | 3 crores/acre |

| New Delhi | 5 crores/acre | 5 crores/acre | 5 crores/acre |

| Central | N.A. | 2.5 crores/acre | 2.5 crores/acre |

| South-East | N.A. | 4 crores/acre | 2.5 crores/acre |

| Shahdara | 2.3 crores/acre | 2.3 crores/acre | 2.3 crores/acre |

| North-East | N.A. | 2.3 crores/acre | 2.3 crores/acre |

| East | N.A. | 2.3 crores/acre | 2.3 crores/acre |

Delhi Circle Rate Category-wise: Ready Reckoner Rates for Residential Plots in Delhi

This table outlines the circle rate categories for residential plots in Delhi. It includes the cost of construction and land for each category.

| Category | Cost of Construction (per sq. meter) | Cost of Land (per sq. meter) |

| A | Rs.21,960 | Rs.7.74 lakh |

| B | Rs.17,400 | Rs.2.46 lakh |

| C | Rs.13,920 | Rs.1.60 lakh |

| D | Rs.11,160 | Rs.1.28 lakh |

| E | Rs.9,360 | Rs.70,080 |

| F | Rs.8,220 | Rs.56,640 |

| G | Rs.6,960 | Rs.46,200 |

| H | Rs.3,480 | Rs.23,280 |

Ready Reckoner Rates for Flats in Delhi

Here’s a table that provides ready reckoner rates for flats in Delhi based on their size and builder type. It includes rates for private builder flats and DDA or society flats.

| Type of Flat | Private Builder Flat | DDA/Society Flat |

| Above 100 sq. meter | Rs.95,250 | Rs.76,200 |

| 50-100 sq. meter | Rs.79,488 | Rs.66,240 |

| 30-50 sq. meter | Rs.62,652 | Rs.54,480 |

| Up to 30 sq. meter | Rs.55,440 | Rs.50,400 |

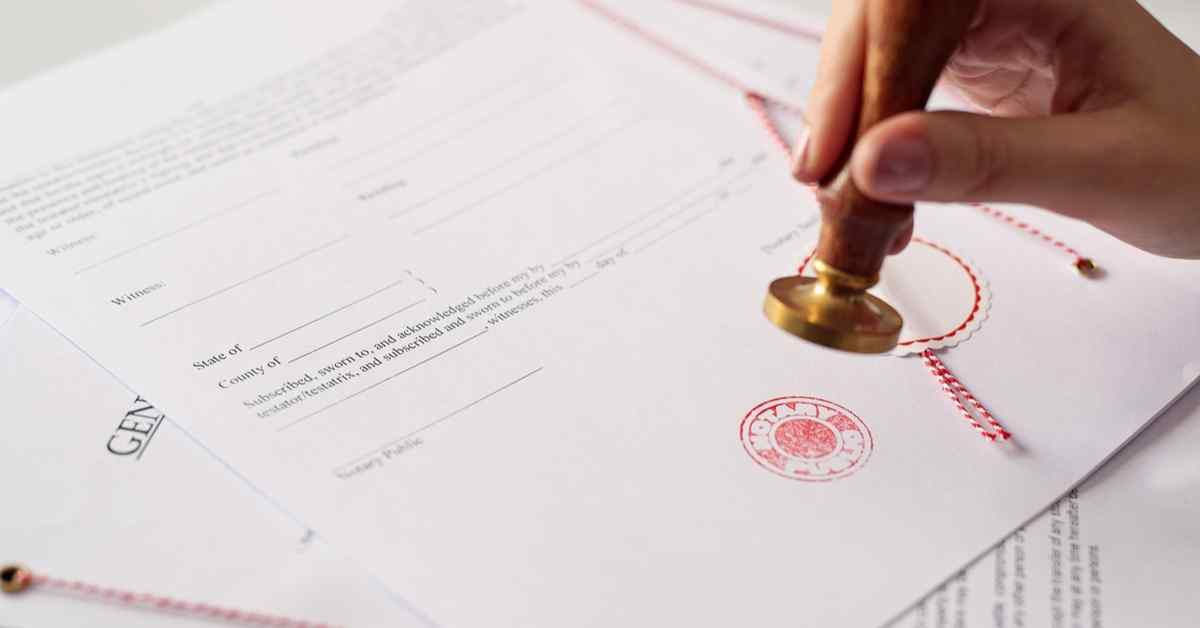

Stamp Duty and Property Registration Charges in Delhi

The stamp duty and property registration charges are one of the largest sources of revenue for the Delhi State Government. Both Property Registration Charges and Stamp Duty are based on:

- The Registered price of the property

- Ready reckoner rate

The ready reckoner rate is another name for the circle rate. Registration charges are the extra tax that one pays on the stamp duty for the property. We have to pay this tax so that the government can run the registration offices easily.

Click here to know more about Stamp Duty.

Stamp Duty Rates by Ownership Category

The following table showcases the different stamp duty rates applicable to property owners based on their gender or joint ownership status. These rates play a crucial role in understanding the costs associated with buying or transferring a property.

| Category | Stamp Duty |

| Joint Owners | 5% |

| Females | 4% |

| Males | 6% |

How the Rising Circle Rate of Delhi Affects Property Prices?

The circle rate has a direct impact on property prices in Delhi.

When the circle rate increases, the transaction value of the property also increases, as stamp duty and registration charges are calculated based on the circle rate. This leads to an increase in property prices, making it more expensive for buyers to purchase property in Delhi.

Moreover, a high circle rate also impacts the resale value of properties. If the circle rate is high, the sale price of the property cannot be lower than the circle rate. This means that sellers may have to increase the price of their property to match the circle rate, leading to higher property prices.

How to Calculate Offline Circle Rate in Delhi?

Calculating the circle rate in Delhi is a complex process that involves multiple factors. However, it is possible to calculate the circle rate offline by visiting the local sub-registrar's office or the Delhi government's official website.

To calculate the circle rate offline, one needs to provide the details of the property such as the location, type of property, floor, etc. Based on these details, the sub-registrar will calculate the circle rate for the property.

Alternatively, one can also calculate the circle rate by visiting the Delhi government's official website. The website provides a circle rate calculator tool that can be used to calculate the circle rate for a particular property in Delhi.

Overall, calculating the circle rate is an important step in property transactions in Delhi, and it is essential to understand the multiplying factors that go into the calculation to make informed decisions while buying or selling property in the city.

When it comes to big investments, it’s important to have every detail done perfectly, and also know exactly what you’re getting to. At NoBroker, our experts will guide and help you with this process. Click the link below to know more about how we can help You can even drop us a comment below with any questions and we’ll be happy to answer.

FAQ's

Circle rates the minimum property price at which a piece of property can be sold. For example, circle rate in Pitampura Delhi will decide the rate for property in Pitampura. In New Delhi the circle rates are fixed by the Delhi Government, these are reviewed yearly to avoid any ambiguity with the prevalent market rates.

These are the stamp duty rates according to category:

For joint owners, the stamp duty rate is 5%.

For females, the stamp duty rate is 4%.

For males, the stamp duty rate is 6%.

Firstly, check out if this property is for commercial use or residential. Depending on the classification, it will fall under the residential, and commercial circle rate in Delhi or the Delhi agriculture land circle rate.

Secondly, what kind of property is it, an apartment, a plot of land, an independent home or a studio apartment?

Thirdly, what is the area of the said property? Fourthly where is this property located is it upmarket?

Lastly, if one knows the year of construction one should use the ‘age multiplier’ to arrive at property valuation and determine the circle rate accordingly.

To make it easier, you can alternatively use this formula, which states that,

Property value = the built-up area in square metres X the circle rate for the locality in rupees per square metre.

Arvind Kejriwal in a cabinet meeting on February 5, 2022, along with his ministers took a decision to Delhi circle rate category-wise by a flat 20%

Recommended Reading

How to Get a Stay Order in India: Step-by-Step Legal Process in 2025

May 31, 2025

92632+ views

FSI in Mumbai 2025: Calculate FSI in Mumbai Municipal Corporation

January 31, 2025

90664+ views

Delhi Police Tenant Verification: Everything You Need to Know

January 31, 2025

82617+ views

How to Convert Agricultural Land to Residential Land: Process, Eligibility and Documentation

October 10, 2025

73003+ views

Maharashtra Stamp Act: Meaning, Duty Rates, Benefits and Registration Rules in 2025

January 31, 2025

70879+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115418+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193413+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132982+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

128175+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!