Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Commercial Property Insurance: Types, Coverage and Cost

Table of Contents

Are you a business owner, commercial property owner, or property manager in India? If so, you may be wondering about the importance and cost of commercial property insurance. Whether you own a factory, office building, warehouse, or any other type of commercial property, having the right insurance coverage can provide you with financial protection against unexpected losses. In this blog, we’ll cover the basics of commercial property insurance in India, factors that affect its cost, how to choose the right policy, and more. We’ll also provide you with expert insights and tips to help you make informed decisions about your insurance needs.

The Basics of Commercial Property Insurance in India

Commercial property insurance is a type of insurance that covers physical assets owned by businesses. This type of insurance is designed to protect businesses from financial losses due to damage, theft, or destruction of their commercial properties.

What does commercial property insurance cover and what it doesn't cover in India

In India, commercial property insurance typically covers damages caused by fire, natural disasters, theft, and vandalism. It also covers losses due to business interruption caused by the damage or loss of property. However, it is important to note that not all types of damages are covered by commercial property insurance policies. For example, damages caused by war or nuclear risks are generally excluded from coverage.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Types of commercial property insurance policies in India

There are several types of commercial property insurance policies available in India. Some of the most common types include:

- Standard Fire and Special Perils Policy: This policy covers damages caused by fire, lightning, explosion, implosion, storm, cyclone, flood, inundation, earthquake, and other perils.

- Burglary and Housebreaking Insurance: This policy covers losses caused by burglary and housebreaking.

- Machinery Breakdown Insurance: This policy covers losses caused by the breakdown of machinery.

- Business Interruption Insurance: This policy covers losses caused by interruption of business operations due to damage to the insured property.

The importance of having commercial property insurance in India

Having commercial property insurance in India is important because it provides financial protection to businesses against unexpected losses. Commercial properties are subject to various risks, such as fire, theft, natural disasters, and accidents, which can cause significant damage and financial losses. Having the right insurance coverage can help businesses recover from such losses and continue their operations without facing financial difficulties.

Factors Affecting the Cost of Commercial Property Insurance in India

The cost of commercial property insurance in India can vary depending on various factors, such as location, building characteristics, type of business and industry, history of claims and risk management practices, coverage limits, and deductibles.

Location and building characteristics

The location and building characteristics of commercial properties play a significant role in determining the cost of insurance. Properties located in areas with higher risks of natural disasters or crime are considered riskier and may attract higher premiums.

Type of business and industry

The type of business and industry also affects the cost of commercial property insurance. Businesses that are more prone to risks, such as manufacturing and heavy industries, may attract higher premiums than service-based businesses.

History of claims and risk management practices

Insurance companies take into account the history of claims and risk management practices of businesses before offering insurance coverage. Businesses with a history of frequent claims or poor risk management practices are considered riskier and may attract higher premiums.

Coverage limits and deductibles

The coverage limits and deductibles chosen by businesses can also affect the cost of commercial property insurance. Higher coverage limits and lower deductibles typically lead to higher premiums, while lower coverage limits and higher deductibles lead to lower premiums.

How to Choose the Right Commercial Property Insurance Policy

Choosing the right commercial property insurance policy can be overwhelming, but it is crucial to protect your business from unexpected events. Here are some essential tips to help you choose the right policy.

Assessing risks and identifying coverage needs

Before choosing a policy, assess the risks associated with your business and identify who needs commercial property insurance. This includes evaluating potential hazards such as natural disasters, theft, and liability risks. You can also consider the size of your business and the value of your property to determine the coverage amount required.

Commercial property insurance comparison and quotes from multiple insurers

To get the best deal on your insurance policy, it is essential to compare policies and quotes from multiple insurers. Consider the coverage limits, exclusions, and endorsements offered by each policy to ensure you are getting the right coverage for your business. It is also important to consider the reputation of the insurance provider and their claims handling process.

Understanding policy exclusions and endorsements

Policy exclusions and endorsements can impact the coverage provided by your commercial property insurance policy. Make sure to read the fine print and understand what is excluded from the policy, such as natural disasters or criminal acts. Endorsements can also be added to the policy to enhance coverage for specific risks that are not typically covered.

Working with a knowledgeable insurance agent or broker

Working with a knowledgeable insurance agent or broker can help you navigate the complexities of commercial property insurance and find the right policy for your business. They can also assist you in identifying coverage gaps and recommending the appropriate coverage.

Understanding Commercial Property Insurance Claims

In the event of an unexpected loss, filing a commercial property insurance claim can be a complicated process. Here are some essential tips to help you understand the claims process.

Filing a claim and working with the insurer

To file a commercial property insurance claim, you must notify your insurance provider as soon as possible. You should cooperate fully with the adjuster and provide all necessary documentation, such as photos, business property insurance estimates, and receipts.

Common pitfalls to avoid during the claims process

During the claims process, it is essential to avoid common pitfalls that could result in a denied claim or reduced pay-out. For example, failing to report the loss promptly or misrepresenting the facts can result in a denied claim. It is also important to document the damage and keep records of all expenses related to the loss.

The role of insurance adjusters and other professionals

Insurance adjusters play a critical role in the claims process. They investigate the loss, determine the extent of the damage, and assess the value of the claim. Other professionals, such as engineers or appraisers, may also be involved to help determine the extent of the damage and the appropriate compensation.

Resolving disputes and maximizing claim pay-outs

In some cases, disputes may arise between the policyholder and the insurance provider over the amount of the claim pay-out. To resolve disputes, it is important to understand the terms of the policy and negotiate with the insurer in good faith. Policyholders can also seek the assistance of an attorney or public adjuster to help maximize the claim pay-out.

Additional Considerations for Commercial Property Insurance

When it comes to commercial property insurance, there are some additional factors to consider beyond the basics of coverage and cost. Here are a few key considerations:

Special coverage needs for certain industries or businesses

Certain industries or businesses may have specific insurance needs that go beyond a standard commercial property insurance policy. For example, a restaurant may need coverage for food spoilage or liquor liability, while a construction company may need coverage for equipment breakdown or contractor's liability.

Bundling insurance policies to save money

Bundling insurance policies can often result in cost savings for businesses. For example, purchasing industrial building insurance comes with multiple types of policies, such as commercial property, liability, and workers' compensation, from the same insurer. By doing so, businesses can often qualify for discounts on their premiums.

Managing risks and preventing losses with loss control services

Many insurers offer loss control services to help businesses manage risks and prevent losses. These services may include safety training, risk assessments, and recommendations for loss prevention measures. By implementing these measures within commercial building insurance, businesses can potentially lower their risk of accidents or losses, which can in turn lower their insurance premiums.

Staying up-to-date on industry trends and regulatory changes

The insurance industry is constantly evolving, and it's important for businesses to stay up-to-date on industry trends and regulatory changes that may impact their coverage needs or premiums. Working with an experienced insurance professional can help ensure that businesses are aware of these changes and able to adjust their coverage accordingly.

How NoBroker Can Help with Your Commercial Property Insurance Needs

Instead of getting you the first cheap commercial property insurance, NoBroker is a leading online platform that can help businesses find the right commercial property insurance coverage. Here's how:

Get a quote online in minutes

NoBroker makes it easy to get a quote for commercial property insurance online. Businesses can simply provide some basic information about their property and insurance needs, and NoBroker will provide a quote in minutes.

Compare policies from top insurers

NoBroker works with top insurers in India to provide businesses with a range of policy options to choose from. Businesses can compare policies side-by-side to find the coverage that best fits their needs and budget.

Work with experienced insurance professionals to find the right coverage

NoBroker's team of experienced insurance professionals can help businesses navigate the complexities of commercial property insurance and find the coverage that's right for them. They can also provide guidance on risk management and loss control measures to help businesses prevent losses and reduce their premiums.

Benefit from NoBroker's cutting-edge technology and personalized service

NoBroker's cutting-edge platform simplifies commercial property insurance. Rest assured, you'll receive personalised service from our experts. With NoBroker, you can easily compare policies, get a quote in minutes, and find the right coverage for your commercial property insurance needs. Don't leave your business vulnerable to unforeseen circumstances. Protect it with our advanced technology and expert guidance. Click on the link to explore our wide range of services and secure your business today. For any legal advice or services, including Commercial Property Insurance, turn to NoBroker's trusted legal service.

FAQ's

A1. Commercial property insurance is a type of insurance that provides coverage for physical damage to a business’s property caused by natural disasters, theft, vandalism, and other covered events. It also covers loss of income due to the damage or destruction of the property.

A2. Commercial property insurance or commercial premises insurance provides coverage for physical damage to a business's property caused by natural disasters, theft, vandalism, and other covered events. It also covers business interruption and extra expense coverage, which provides reimbursement for lost income due to the damage or destruction of the property.

A3. The commercial property insurance cost per square foot in India varies depending on the size and type of business, the location of the property, and the amount of coverage needed. Generally, the premiums for commercial property insurance cost per square foot can range from a few thousand rupees to several lakhs of rupees per year.

A4. Yes, many insurers in India offer discounts for businesses that have certain safety features or that take certain preventative measures to reduce the risk of their property being damaged. These discounts can significantly reduce the cost of commercial property insurance.

A5. The claim process for commercial property insurance in India typically involves the policyholder filing a claim with the insurer, providing evidence of the damage and proof of ownership, submitting an estimate of the cost of repairs or replacements, and waiting for the insurer to approve the claim.

A6: Commercial property is a type of real estate that includes buildings or land intended to generate a profit, either from capital gain or rental income. Commercial property can include office buildings, retail stores, warehouses, apartment buildings, and land for development.

A7: Vacant commercial property insurance is a type of insurance designed to cover the costs associated with owning and operating a vacant commercial property. This type of insurance helps protect the owner from financial loss in the event of a covered occurrence, such as vandalism, theft, fire, or other disasters. It also helps cover the costs of repairs and replacement of any property lost due to these occurrences. The coverage typically includes protection against liability claims resulting from injury or damage to third parties.

A8: Commercial liability coverage typically includes protection against third-party bodily injury, property damage, and advertising injury claims that may arise in connection with your business operations. It helps safeguard your business from legal and financial consequences in case of accidents or lawsuits.

A9. Business renters insurance is a specialised insurance policy designed to protect businesses that rent or lease commercial space. It covers the business's assets and liability within the rented premises, offering financial protection in case of damage, theft, or certain unforeseen events.

A10. No, commercial liability insurance coverage is not universally mandatory, but it is highly recommended for most businesses. While some states or industries may require it, having this coverage can help protect your business from potential legal and financial risks associated with liability claims.

A11: Several factors impact your business property insurance estimate, including the location of your property, its size, construction materials, security measures, and your industry's risk profile. An insurance agent can provide a tailored estimate based on these details.

Recommended Reading

Freehold Property and How It Can Affect Your Property Purchase in 2025

January 15, 2025

15598+ views

Property Circle Rate in Ghaziabad – What You Need to Know About it

January 15, 2025

8265+ views

Land Acquisition Act 2013: Balancing Demand and Compensation

January 15, 2025

4164+ views

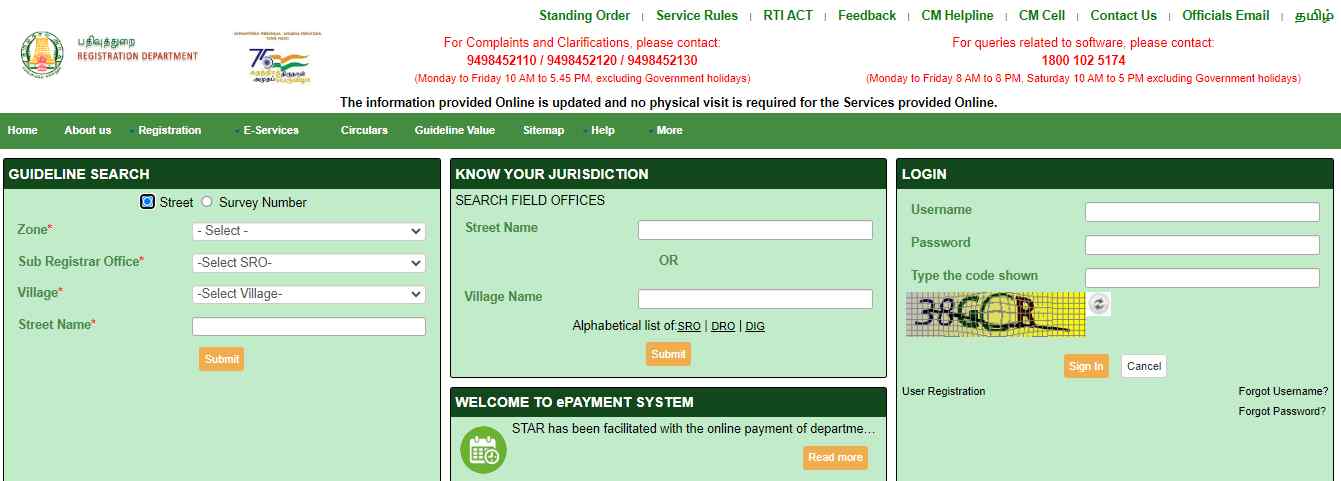

Tnreginet: A Source of Land and Property-Related Information

January 15, 2025

12728+ views

Floor Space Index (FSI) in Bangalore: Everything You Need to Know

December 31, 2024

11618+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

December 31, 2024

1046630+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

January 16, 2025

81803+ views

Supreme Court Verdict on Society Maintenance Charges

December 17, 2024

71776+ views

All You Need to Know about Revenue Stamps

December 17, 2024

60368+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

52669+ views

Recent blogs in

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

January 28, 2025 by Nivriti Saha

Stamp Duty and Property Registration Charges in Mumbai 2025

January 23, 2025 by Kruthi

What are the current Stamp Duty and Property Registration Charges in Karnataka for 2025?

January 23, 2025 by Prakhar Sushant

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025 by Vivek Mishra

Join the conversation!