Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Commercial Property Investment in Bangalore: A Guide for Investors

Table of Contents

Investors wishing to profit from Bangalore's booming economy and real estate industry can consider commercial property investing. Bangalore, India's Silicon Valley, draws global enterprises, tech startups, research institutes, and manufacturing companies. Due to the city's strong economy and considerable demand for office, retail, and industrial space, investors can earn substantial rental returns with commercial property investment in Bangalore. In this changing industry, rigorous research, due diligence, and strategic planning are needed to find profitable possibilities and avoid risks. Let’s learn more in this blog.

Why Invest in Commercial Property in Bangalore?

Bangalore's strong economy and business climate make commercial property investment appealing. Known as the Silicon Valley of India, Bangalore has grown rapidly due to its booming IT/ITES industry, which attracts global firms and innovative startups. This surge of enterprises has made Bangalore an economic powerhouse in India, creating a favourable business climate for commercial property investment.

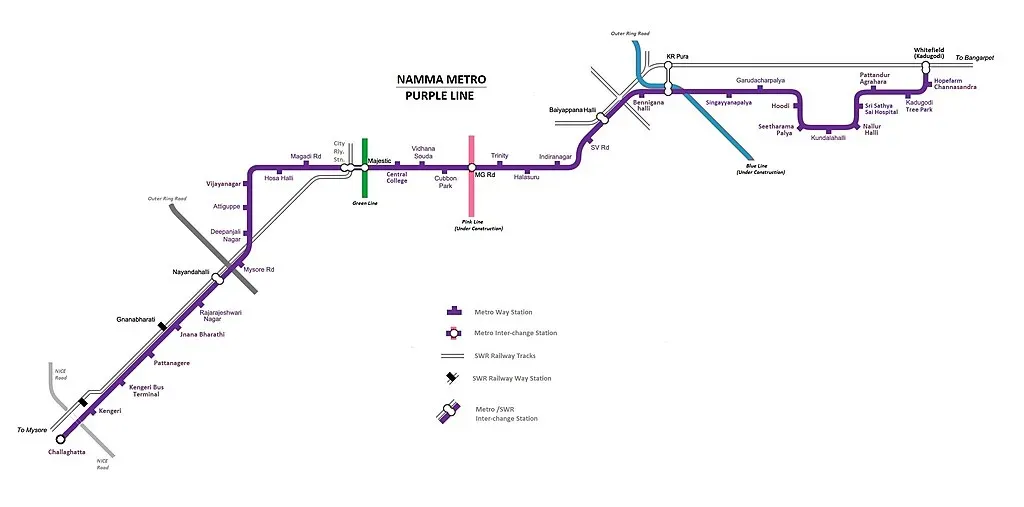

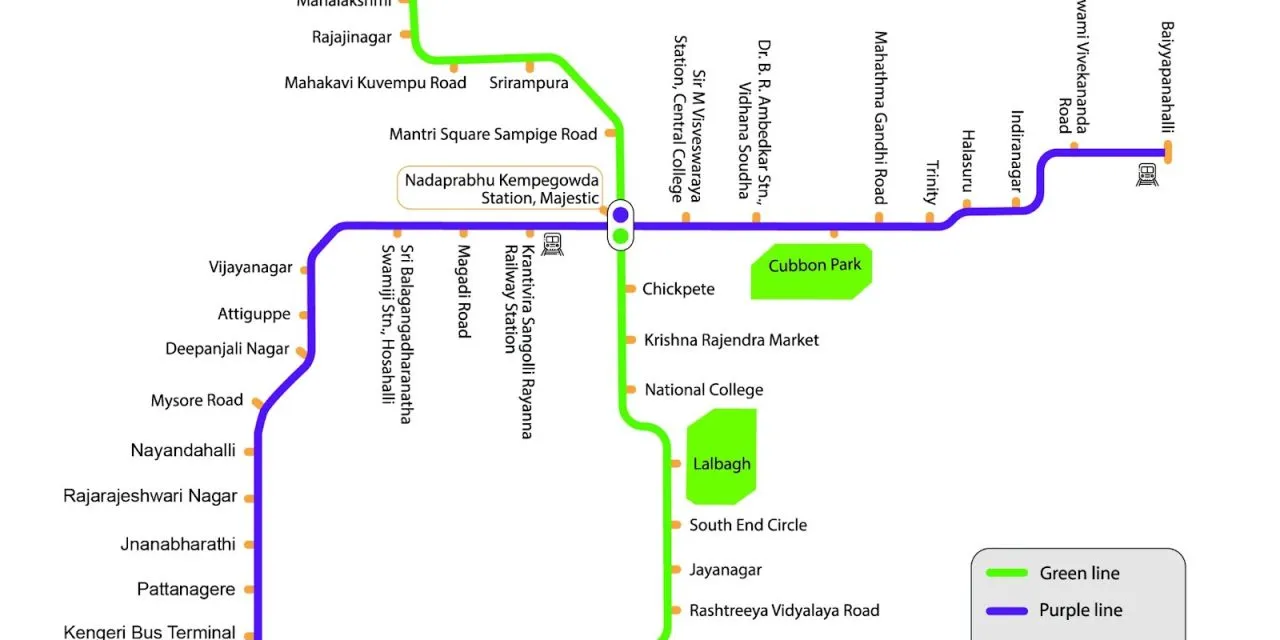

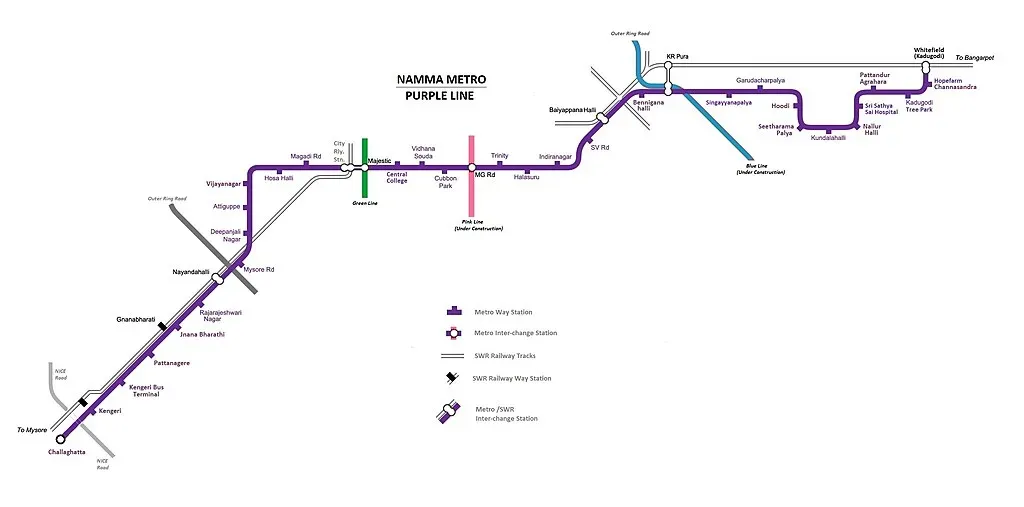

Bangalore's continuing infrastructural development, including metro lines, roads, tech parks, and industrial zone expansions, has raised commercial space demand. The city's fast-rising population and urbanization tendencies increase the demand for office, retail, and industrial space.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Commercial property investment in Bangalore has several advantages:

1. Rental Income: Stable and Recurring

Rental agreements with tenants provide reliable revenue for Bangalore commercial buildings. The city's thriving economy drives demand for commercial property, giving owners stable rental income and cash flow.

2. Long-Term Capital Appreciation:

Bangalore's vibrant real estate industry promises long-term capital appreciation. Prime commercial buildings will certainly appreciate in value as the city grows, which may boost property owners' ROI.

In conclusion, Bangalore's robust economic growth, excellent business climate, and rising commercial space demand provide investors the chance to profit. Commercial property investment in Bangalore is appealing to local and foreign investors seeking diversification and sustained profits due to its consistent rental income and long-term capital appreciation.

Types of Commercial Properties for Investment

The varieties of commercial properties available for investment provide different possibilities and profits. Various categories to invest in commercial property in Bangalore:

- One of the most frequent commercial assets for investment is office space. These include tiny office spaces in business parks and high-rise corporate skyscrapers in excellent locations. As a renowned IT and technology center, Bangalore's office spaces are in high demand, making them attractive to investors.

- Retail Outlets: Shopping malls, independent retailers, and strip malls are retail properties. Bangalore's burgeoning consumer market and spending power have increased demand for retail space, particularly in high-traffic regions and established commercial districts.

- Industrial Properties: Warehouses, factories, distribution centres, and parks are examples of industrial properties. Bangalore's developing manufacturing and logistics industries make industrial buildings appealing to investment prospects, especially in critical areas with adequate transit links.

- Mixed-Use Developments: These properties include commercial, residential, and occasionally recreational areas. Retail, office, and residential units are commonly included in these complexes to meet various demands and maximize space. Mixed-use complexes are growing in Bangalore, giving investors more investment alternatives.

- Hospitality Properties: Hotels, serviced apartments, and resorts. For investors seeking tourist and corporate travel revenue, Bangalore's flourishing tourism sector and standing as a business and technology hub make hospitality assets an attractive investment.

- Specialty Properties: Examples include healthcare, education, data centres, and leisure facilities. These assets serve specialized markets or industries and, depending on demand, provide unique investment possibilities.

Location, demand dynamics, rental yields, tenant characteristics, and regulatory environment are crucial for commercial real estate investment in Bangalore. Market research and due diligence are essential to finding the suitable property type for your investment objectives and risk tolerance. Real estate specialists and consultants may also assist investors in understanding commercial property investing and optimizing profits.

Choosing the Right Investment Option

Commercial property success depends on choosing the correct investment. Consider these variables while selecting an investment:

- Clearly define investing goals: Do you want stable rental income, long-term capital appreciation, or both? Understanding your investing goals can help you choose solutions that meet your financial goals.

- Risk Tolerance: Determine your risk tolerance. Different business assets have other risks. Office spaces in established commercial districts may provide stability but lower yields, whereas retail buildings in up-and-coming places may produce better returns but higher risks.

- Conduct detailed market research to discover trends, demand-supply dynamics, and growth opportunities. To evaluate property types and locations for investment, consider vacancy rates, rental patterns, economic indicators, and future development plans.

- Location is a crucial aspect of commercial property ownership. Properties near commercial centres, transit hubs, educational institutions, and amenities are in high demand. Prime properties get greater rents and are appreciated quickly.

- Tenant Profile: Identify desired renters and their needs. Assess renters' creditworthiness, lease lengths, and property type-specific vacancy risks. Diversifying your tenants reduces risk and stabilizes revenue.

- Financial Analysis: Detailed financial analysis of proposed investments should include cash flow predictions, ROI, IRR, and NPV. Compare property financial indicators to find the best investments.

- Legal and Regulatory Considerations: Understand the target location's commercial property investing laws. Zoning, construction, environmental, and leasing rules must be followed. Verify property titles, ownership rights, and legal difficulties with extensive due diligence.

- Exit Strategy: Prepare an exit plan. When choosing an investment, consider liquidity, market circumstances, and resale value. A clear exit strategy can assist you in deciding whether to rent or sell the property for capital appreciation.

By considering these variables and doing your homework, you may pick a commercial property investment in Bangalore that matches your investment goals, risk tolerance, and financial aspirations. Real estate and financial consultants may also assist you in making intelligent investments.

Investing Strategically

Strategic Bangalore Commercial Property Investment

- Direct Property Purchase: Full ownership and control are appealing. This technique requires significant upfront money and attentive property management, but it may provide better rental income and capital appreciation, especially in desirable locations.

- REITs: REITs are more passive investments. Investors in REITs receive access to professionally managed commercial property portfolios. Diversification lowers risk, and REIT shares are more liquid than direct property ownership, making entrance and exit simpler. However, market circumstances and REIT management choices affect returns.

- Newer option: fractional ownership platforms. They let investors share high-value homes and split expenses and earnings. This method provides diversity and competent management, but investors must evaluate platform fees and lose control against shared ownership.

Each technique has pros and downsides, so investors must match their risk tolerance, financial objectives, and property management participation. Financial advisers and thorough research may help investors make educated selections based on their circumstances.

Benefits of Working with a Commercial Real Estate Consultant

Investors navigating market difficulties might benefit from hiring a commercial real estate consultant. Some benefits of hiring a commercial real estate consultant:

- Market Expertise: Commercial real estate consultants are well-versed in local market trends, dynamics, and investment prospects. Their experience helps them find profitable investments, negotiate good agreements, and understand market complexity.

- Customized Solutions: Consultants provide personalized recommendations based on investors' requirements, preferences, and goals. They tailor investment plans to individuals' financial objectives, risk tolerance, and market expectations after rigorous evaluations.

- Due Diligence: Consultants undertake rigorous research, analyze market data, and evaluate investment prospects for investors. Their thorough due diligence approach helps investors reduce risks and make educated investment choices.

- Negotiation abilities: Consulting professionals have developed their negotiation abilities via industry experience. They negotiate transactions, pricing, and leasing arrangements for investors to maximize profits and reduce risks.

- Legal and Regulatory Compliance: Consultants guide investors through commercial real estate transaction laws. They oversee zoning, property, and contractual compliance to reduce legal risks and protect investors' interests throughout the transaction.

In the dynamic and competitive commercial real estate market, engaging with a consultant can improve your ROI on Commercial Property Investment in Bangalore.

Contact NoBroker for Wise Commercial Property Investments in Bangalore.

Working with a commercial real estate consultant like NoBroker can give market insights, knowledge, and assistance for Commercial Property Investment in Bangalore. We are here to help investors navigate the market and maximize their investment potential with individualized guidance, unique opportunities, due diligence, negotiation, and portfolio management. Investors can benefit from Bangalore's strong commercial property market and accomplish their long-term financial objectives by carefully examining investment possibilities, using clever tactics, and teaming with our specialists.

Frequently Asked Questions

Ans: It is essential to consider factors like accessibility to tech parks, commercial areas, transit hubs, and amenities. The area's general economic outlook, market demand, and infrastructural development should also be taken into account.

Ans: The kind of property, its location, and the state of the market may all affect rental returns. Rental yields in major business regions typically range from 7% to 10%, but lesser returns may be obtained in peripheral locales.

Ans: Risks include:

1. Market saturation increases competition.

2. Regulatory changes that damage property prices.

3. Economic downturns that affect tenant demand.

Risks unique to a particular property, such as vacancy rates, tenant defaults, and maintenance expenses, should also be taken into account.

Ans: Investors need to be aware of taxes such as property tax, capital gains tax on property sales, and Goods and Services Tax (GST) on rental revenue. By consulting with tax specialists, investors may better understand their tax responsibilities and maximize their tax strategy.

Ans: Traditional bank loans, non-banking financial institutions (NBFCs), and private lenders are some examples of financing choices. Additionally, investors have the opportunity to investigate joint ventures, partnerships, and crowdfunding websites. Making an educated choice requires analyzing the conditions, interest rates, and repayment alternatives of each financing plan.

Recommended Reading

Property Rates in Bangalore in 2025: Current Price for Residential and Commercial Spaces

March 13, 2025

24788+ views

20 Best Schools in Bangalore: Admission Process with Fee Structure in 2025-26

March 12, 2025

20056+ views

Whitefield Metro Station Bangalore: Station List, Timing, Map and Fares in 2025

March 3, 2025

262+ views

Jalahalli Metro Station Bangalore: Maps, Routes, Timings, Parinking and Fares in 2025

March 3, 2025

412+ views

Garudacharapalya Metro Station Bangalore: Map, Routes, Timings, Parking and Fares in 2025

March 1, 2025

152+ views

Loved what you read? Share it with others!

Most Viewed Articles

Top 26 Cleanest City of India: List of the Best Cities Ranking Wise in 2025

January 22, 2025

134185+ views

Auspicious Dates and Good Nakshatra for Property Registration in 2025

January 27, 2025

90113+ views

CIDCO Lottery 2025 - CIDCO Starts Registration for 5730 Homes in Navi Mumbai

January 31, 2025

64185+ views

Breaking Down House Construction Costs in India: Easy Tips for Your Budget" in better way

January 31, 2025

61268+ views

How To Check the Market Value in Andhra Pradesh?

February 12, 2025

55042+ views

Recent blogs in

Property Rates in Bangalore in 2025: Current Price for Residential and Commercial Spaces

March 13, 2025 by Vivek Mishra

Best Place to Invest in Noida (2025): Top Sectors Listed For High Returns

February 13, 2025 by Suju

Best Place to Invest in Gurgaon: Real Estate Guide!

February 13, 2025 by Priyanka Saha

12 Best Place to Invest in Chennai: Real Estate Investment and Top Trends for 2025

February 13, 2025 by Vivek Mishra

10 Best Places for Real Estate Investment in Pune in 2025

February 13, 2025 by Vivek Mishra

Join the conversation!