Table of Contents

Get End-to-end Assistance in Buying a Property

Buyer Benefits Worth Rs.2 Lakh

Complete Property Legal Assistance

Get up to 90% of Property Funding

Up to 25% Off on Home Interior

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Credit Linked Subsidy Scheme - One Step Forward to Owning a Home in India

Table of Contents

The credit linked subsidy scheme is one of the vital propositions under the Pradhan Mantri Awas Yojana, which aims to push forward affordable housing for the urban poor population of India. Intended to provide ‘Housing for All’ by 2022, The Pm Awas Yojana Credit Linked Subsidy offers home loans to lower and middle-income families at reduced EMIs. Beneficiaries can get a 6.5% subsidy on home loan interests under this scheme.

Recommended Reading

Retirement Living Homes in India For 2025

January 31, 2025

4954+ views

CIDCO Lottery 2025 - CIDCO Starts Registration for 5730 Homes in Navi Mumbai

January 31, 2025

66349+ views

Basava Vasati Yojana 2025 - Scheme Details and How to Apply

January 31, 2025

9575+ views

DDA Housing Scheme: Application Form, Eligibility, Payment & More

January 31, 2025

8041+ views

TAHDCO - Meaning, Benefit and Scheme Details

January 31, 2025

13212+ views

If you are planning to purchase your first home but are sceptical about all those big-budget housing society ads, this scheme is ideal for you. Continue reading to know the necessary details and how you can apply for one.

What Is a Credit Linked Subsidy Scheme?

Credit linked subsidy or the CLSS is a beneficial instrument under the umbrella of the housing project undertaken by the Government of India. This project, also known as the Pradhan Mantri Awas Yojana (PMAY), aims to provide affordable housing for all by 2022.

Get End-to-end Assistance in Buying a Property

Buyer Benefits Worth Rs.2 Lakh

Complete Property Legal Assistance

Get up to 90% of Property Funding

Up to 25% Off on Home Interior

The target beneficiaries for this scheme are Economically Weaker Sections, Lower Income Groups and Middle-Income groups of India. Interested individuals will have to apply and the Government provides them with a subsidy on the home loan interest rates. Although everyone can apply for this scheme, households with lower incomes are often given preference.

Central Nodal Agency for PMAY CLSS:

- The National Housing Bank (NHB)

- Housing and Urban Development Corporation (HUDCO)

- State Bank of India (SBI)

When Was the Credit Linked Subsidy Scheme Introduced?

(More and more people are availing of the CLSS scheme which is an important component reinforcing the slogan ‘Housing for All’)

This scheme was introduced in 2015 by Prime Minister Narendra Modi under the Pradhan Mantri Awas Yojana. This scheme has the tagline ‘Housing for All’ and aims to rehabilitate people living in slums. Credit Linked Subsidy Scheme for Housing seeks to provide a roof to the less fortunate by offering subsidies for independent house construction and renovation projects.

Who Are the Beneficiaries of the Scheme?

Economically Weaker Sections (EWS), Lower Income Group families, and the Middle-Income Group Families are the Credit Linked Subsidy Scheme beneficiaries.

How Does CLSS Work?

The Government of India disburses large amounts of money each year to uplift and rehabilitate lower-income group families. This credit flow is supervised by three leading organisations- the NHB, HUDCO and SBI. This scheme has been a very successful one till now, with 185 primary lending organisations registered under this scheme. Check this site for the complete list of registered organisations.

If you are eligible, you can approach a bank or the NBFC with an application for a home loan. Your lender will initially credit your incentive to your account. Then the lender adjusts the EMI rates based on the amount credited. The beneficiary can use this credit to build a new house or do renovation work. Preference is given to women, SC/STs, families from backward classes and people with physical disabilities.

What Are the Documents Required for PMAY CLSS?

Here is a list of documents required for completing your application:

Identity Proof

For salaried individuals, PAN Card is mandatory for identification. Additionally, you need any one of these documents:

- Voter ID

- Aadhar Card

- Valid Passport

- Driving License

- Photo Credit card

- Photo Identity Card issued by government organisations

- A letter from a recognised public body with verification of the customer identity with a photograph (This photo should not be more than 30 days old)

As Address Proof for the PM credit-linked subsidy scheme, any one of the following documents is needed:

- Voter ID

- Aadhar card

- A valid Passport

- A letter from any public authority verifying the customer identity and address

- Latest Utility Bill

- Rent agreement on Stamp Paper

- Commercial/Nationalized Bank Statements

- Credit Card Statements (No older than three months)

- Life Insurance Policies

- Residence Address Certificate from the employer

- Property Sale Deed copy

- Municipal/Property Tax receipt

- Post Office Savings Bank Account Statement

- Family Pension payment orders issued to retired government employees

- Accommodation allotment letters issued by State or Central Government departments, statutory and regulatory bodies and PSUs. Likewise, Leave and Licence agreements with employers allotting these official accommodations are also admissible

- Documents issued by foreign governments or letter from foreign embassies in India

You also need proof of income. This document is very vital in assessing your interest subsidy and EMI rates. In addition, you will need the last two months' salary slip, your bank statement for the previous six months and the Latest Form 16/ITR.

Any documents regarding running loans along with bank statements of repayments are also necessary.

Property Documents:

You will need all of these documents:

- Complete chain documents copy

- Sale Agreement copies (if applicable)

- Allotment Letter/ Buyer agreement copy, if applicable

- Copy of the receipt of payment made to the developer, if any

For self-employed people:

For self-employed people also, PAN Card is mandatory. Additionally, you need any one of these documents:

- Voter ID

- Aadhar Card

- Valid Passport

- Driving License

- Photo Credit card

- Photo Identity Card issued by government organisations

- A letter from a recognised public body with verification of the customer identity with a photograph (This photo should not be more than 30 days old)

As Address Proof for the PM credit linked subsidy scheme, any one of the following documents is needed:

- Certificate for your shop/establishment

- Trade License Certificate

- SSI Registration Certificate

- PAN Card/ Sales Tax/ VAT Registration Certificate

- Export-Import Code Certificate or the Memorandum of Association for companies

- Professional qualification Certificates for professionals

- SEBI Registration Certificate

- ROC issued Registration Number

You also need proof of income. This document is vital in assessing your interest subsidy and EMI rates. You will need your Income Tax Returns for the last two financial years, your balance sheet and profit/loss account, which has been duly audited and the previous six months statement of your current account. You will also need to deposit your Savings account statement.

Any documents regarding running loans along with bank statements of repayments are also necessary. You also need copies of the following documents for the PMAY credit linked subsidy scheme:

- Latest list of your holding shares (certified by a CA/CS)

- MOA (For Pvt. Ltd companies)

- Partnership deeds for Partnership firms

Credit Linked Subsidy Scheme Eligibility

You must fall into any one of the following sections to avail the benefits of the Pradhan Mantri Credit Linked Subsidy:

- Economically Weaker Section (EWS) (Annual income 3 lakh-6 lakh)

- Middle Income Group I (MIG) (Annual income 6 lakh- 12 lakh)

- Middle Income Group-II (Annual Income 12 lakh- 18 lakh)

Some other Pradham Mantri Awas Yojana Subsidy Eligibility for Lower Income Group, MIG and EWS:

- One female member is mandatory for property ownership

- A female member of the family should be the co-owner

- The applicant should not have any pucca house in their name

- The location of the property should be within the 2011 statutory towns

- The applicant should not have benefitted from government housing schemes before

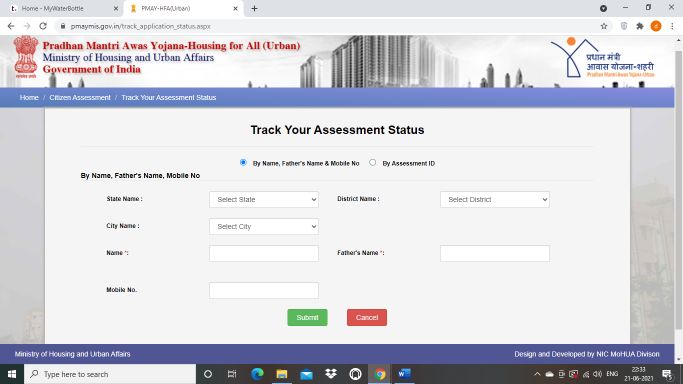

How To Check the Status of Credit Linked Subsidy Scheme?

Applying for Pradhan Mantri Awas Yojana is an easy process. You can check the status of your PMAY online. Follow the below-mentioned steps:

- Visit the official website.

- From the drop-down menu, click on the "Citizen Assessment" tab

- Then click on the 'Track Your Assessment Status' tab.

Once you click, the site will automatically redirect you to a "Track Assessment Form", where you can complete the PMAY check by using any of the following two options:

- By Name, Fathers Name and Mobile No- Fill in your name, Father's name and registered mobile number and click on the Submit button. You can now see your credit linked subsidy scheme status.

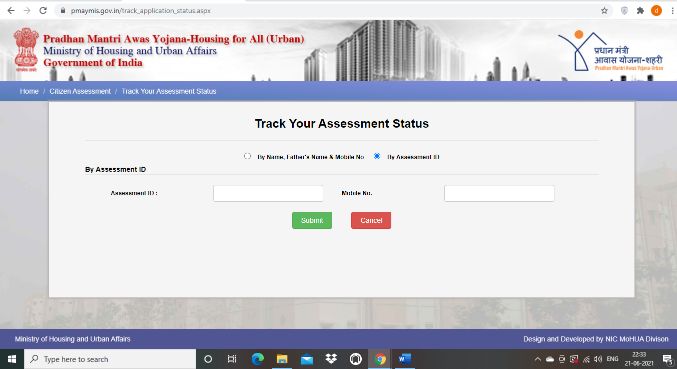

- By Assessment ID

When you register with the PMAY website, you will be given a unique ID or registration number. This number is your Assessment ID. On submission, you can view the status of your application.

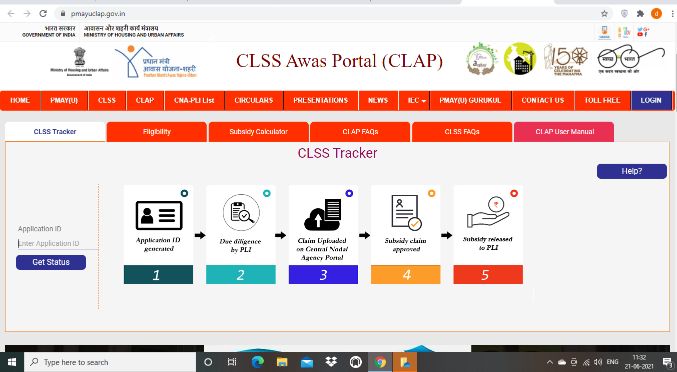

CLSS tracking

Follow these steps:

- Visit the CLSS Awas Portal.

- Enter your application ID and click on the Get Status Tab

- Next, the system will send an OTP to your registered mobile number.

- Then, the system will display these below-mentioned five stages of application status. Passed steps will be marked green while the in-process stages are marked blue.

There are five stages of credit linked subsidy scheme status:

- Application ID generated

- Due diligence by PLI

- Claim uploaded on the Central Nodal Agency Portal

- Approval of subsidy claim

- Subsidy release to the concerned PLI

CLSS For Weaker Class and Low-income Group

If you are under this category, then you are eligible for a 6.5% subsidy in the home loan interest rates. This subsidy is valid for either 20 years or the whole tenure of your home loan, whichever is lower. Then, you can approach a bank/NBFC for a home loan. First, the entire incentive amount will be credited to your account. After that, the lender will slash the EMI rates as per the credited amount.

You can use this credit linked subsidy scheme PMAY to construct your own house or renovate your current home.

Kindly note that in both the income categories, women, SC/STs, backward classes, minorities and persons with disabilities will be given a clear preference.

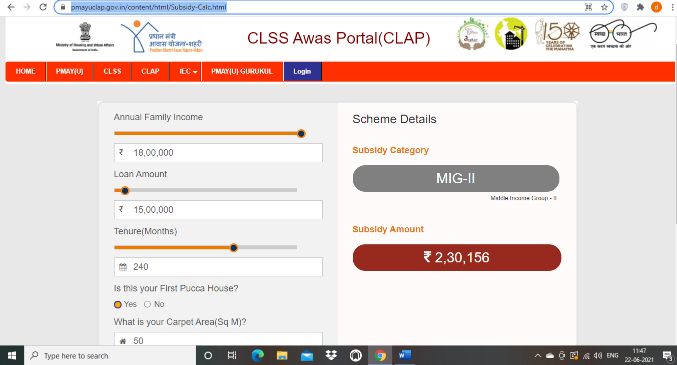

CLSS For Middle-class Income Group

The middle-class income beneficiaries are divided into two groups. MIG, I include families whose household income is from Rs 6 lakh to Rs 12 lakh. MIG II refers to families whose annual income ranges from 12 lakh to 18 lakh a year. The MIG I families receive an interest discount of 4%, while the MIG II families can avail of a 3% reduction. As a result, MIG II families get a better home loan amount than the MIG I group.

How Interest Subsidy Is Calculated Under CLSS

Let's say your income is 12 lakh per annum.

(Your maximum subsidised loan amount is nine lakhs. Subsidy rate: 4%)

Now, your original loan amount is Rs 9 lakh.

Rate of Interest: 9%

EMI: Rs 8098

Total Interest (20 years): Rs 10.43 lakhs

At 4% subsidy, NPV of

the whole interest subsidy amount is reduced to Rs 2.35

Now, your loan amount is Rs 6.65 lakhs.

Rate of Interest: 9%

EMI: Rs 5983

The total interest amount for 20 years= Rs 7.70 lakh

So, what do you gain in total?

The overall reduction in EMI is Rs 2114.

The net savings in Interest is Rs 2,72,445.

You can also calculate your credit-linked subsidy scheme amount by visiting the official PMAY calculator. Then, fill in the required details and submit.

How To Avail of the CLSS Subsidy Scheme

You can approach your local financial institutions, which are registered under the PMAY scheme. They will provide you with an application form which you will have to fill duly. Submit that application along with the other necessary documents. Once verified, the whole housing loan amount will be credited to your account. Then, your lender will approach the appointed nodal agencies to start crediting your account.

Interested families can also avail of this scheme by CLSS subsidy online application. First, visit the official site and register with PMAY. Then log in using your credentials and apply.

Credit Linked Subsidy Scheme Helpline Number

Suppose you are not comfortable with the online procedures; you can directly contact the nodal agencies to know the status of your subsidy application or any other general queries you might have. Here are the helpline numbers of all the central nodal agencies:

| Central Nodal Agency (CNA) | Toll-Free Number |

| NHB | 1800-11-3377, 1800-11-3388 |

| HUDCO | 1800-11-6163 |

| SBI | 1800-11-2018 |

Buying a house is now possible, even with a limited income. This credit-linked housing subsidy scheme will help provide you with the accommodation you can call your own. To know more about different government projects and schemes, you can visit our official site. You can also get help with your queries regarding this scheme and other similar government projects from our experts at NoBroker.

FAQ's

Ans. Yes, now you can buy a house under the Pradhan Mantri credit-linked home loan subsidy scheme.

Ans. The central nodal agencies for credit linked subsidies are NHB, HUDCO and SBI.

Ans. Yes, you can calculate the subsidy amount beforehand at the official PMAY calculator.

Ans. The subsidized interest rate will be 6.5% for LIG and weaker sections, while MIG I and MIG II enjoys a 4% and 3% subsidized interest.

Ans. Yes. To apply online, visit the official website.

Loved what you read? Share it with others!

Most Viewed Articles

Top 26 Cleanest City of India: List of the Best Cities Ranking Wise in 2025

March 17, 2025

147997+ views

Auspicious Dates and Good Nakshatra for Property Registration in 2025

January 27, 2025

102079+ views

CIDCO Lottery 2025 - CIDCO Starts Registration for 5730 Homes in Navi Mumbai

January 31, 2025

66349+ views

Breaking Down House Construction Costs in India: Easy Tips for Your Budget" in better way

January 31, 2025

65612+ views

How To Check the Market Value in Andhra Pradesh?

February 12, 2025

60332+ views

Recent blogs in

April 17, 2025 by Vivek Mishra

Top 26 Cleanest City of India: List of the Best Cities Ranking Wise in 2025

March 17, 2025 by Ananth

Property Rates in Bangalore in 2025: Current Price for Residential and Commercial Spaces

March 13, 2025 by Vivek Mishra

Best Place to Invest in Noida (2025): Top Sectors Listed For High Returns

February 13, 2025 by Suju

Best Place to Invest in Gurgaon: Real Estate Guide!

February 13, 2025 by Priyanka Saha

Join the conversation!