Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Everything You Must Know about E Filing 2.0 Portal

Table of Contents

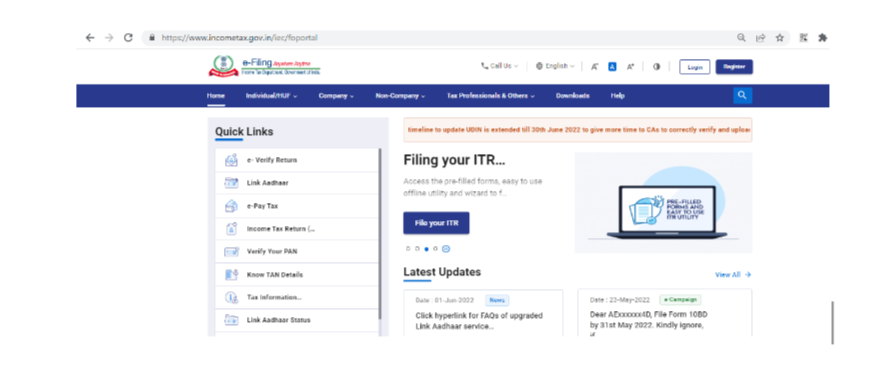

The Income Tax (I-T) Department in India introduced the income tax new portal, also known as E filing 2.0, on June 7, 2021, intending to provide Indian taxpayers with a user experience that is easier to use. It is an updated and more streamlined version of the one that came before it at the address www.incometax.gov.in. You may access the most recent version of the online filing portal. www.incometaxindiaefiling.gov.in was the address of the previous version of the online filing site. After the switch, all actions about I-T should be performed on the new income tax e-filing 2.0 site.

Features of E Filing 2.0

The following are some of the new features that are available in E Filing 2.0:

A one-stop solution: all interactions, uploads, or pending activities will be shown on a single dashboard, and taxpayers will be responsible for any necessary follow-up measures. Refunds that are processed more quickly Integrated with the rapid processing of the income tax return 2.0(ITRs) to ensure that taxpayers get their money as quickly as possible

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

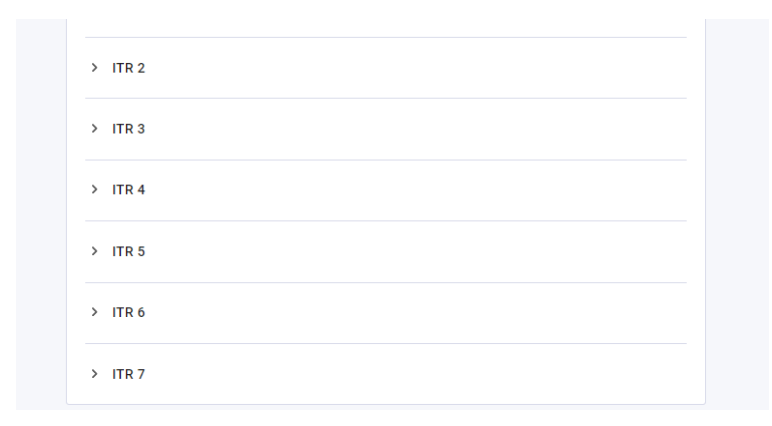

Free ITR preparation is now attainable with the availability of a cost-free ITR preparation programme that includes interactive questions. In addition, the submission of ITRs 1 and 4 (both online and offline) and ITR 2 will be easier for taxpayers due to this (offline). In the future, the facility that allows for preparing ITRs 3, 5, 6, and 7 will also be made accessible.

After the TDS and SFT statements have been posted, pre-filled ITR forms will be accessible. These pre-filled ITR forms will include salary income, interest income, dividend income, and capital gains. The information taxpayers supply to update their profiles and provide specific income data, including salary, home property, business or profession, will subsequently be utilised to pre-fill their ITRs. Taxpayers will have the ability to do this.

Contact centre: A brand-new call centre has been established to support taxpayers and provide timely responses to questions.

For taxpayers, quick and precise results improve the user experience. Through ongoing participation, raise taxpayer awareness, educate and encourage voluntarily paying taxes.

Tutorials for users include in-depth Frequently Asked Questions (FAQs), user manuals, videos, and chatbots or live agents.

New features: New features are made accessible for filing I-T forms, adding tax experts, making comments to notifications under impersonal inspection, and appealing decisions.

E-filing 2.0 permits tax payments made by RTGS/NEFT, credit card, UPI, and net banking, expanding the range of payment alternatives previously available.

E Filing 2.0 Features

- These new functionalities are included in E Filing 2.0:

- One-stop-shop: For taxpayer follow-up actions, all interactions, uploads, or pending actions will be shown on a single dashboard.

- Refunds are issued to taxpayers more quickly because of the integrated rapid processing of income tax returns (ITRs).

- Free ITR preparation: Interactive questions are provided in a free ITR preparation program. This will assist taxpayers in submitting ITRs 1, 4, and ITR 2 (both online and offline) (offline). Later, a facility for ITRs 3, 5, 6, and 7 preparations will also be made available.

- Pre-filled ITR forms: After the TDS and SFT statements have been submitted, pre-filled ITRs containing salary income, interest, dividends, and capital gains will be available. In addition, taxpayers can update their profiles and enter information about their income sources, such as their salaries, real estate holdings, and businesses or professions, which will be used to pre-fill their ITRs.

- New features: It is now possible to send comments to notices under anonymous scrutiny or appeals, add tax professionals, file I-T forms, and more.

- More choices for paying taxes: E-filing 2.0 now allows payments via RTGS/NEFT, credit card, UPI, and net banking.

- A new call centre for taxpayer assistance will provide quick responses to inquiries.

- Detailed FAQs, user guides, videos, and chatbot/live agent are all examples of useful tutorials.

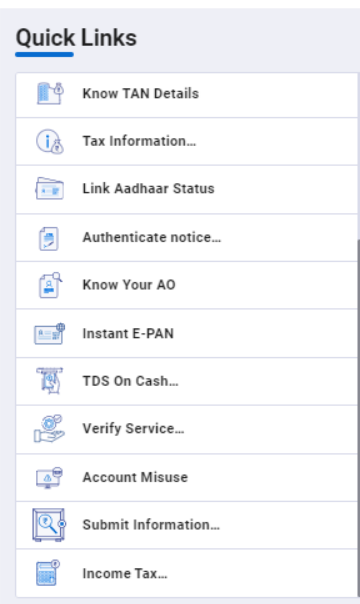

Income tax new portal: Quick links for taxpayers

The new electronic filing site is constructed on the pillars of speed, accuracy, convenience, and usability to better serve its users. Access to certain features even before users log in.

The tabs for accessing persona-based support information, including Home, Individual, Company, Non-Company, Tax-Professional, and Others, as well as Downloads and Help, may be found at the very top of the page. Services You may see some of the services, such as e-verify return, linking Aadhar, seeing the status of linking Aadhar, knowing the current status of your refund, and viewing your ITR status as you scroll down the page.

You will find an improved and user-friendly support area when you scroll down further.

In addition, both a chatbot and a hotline are at your disposal to provide you with directed support.

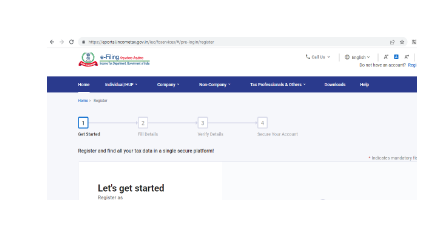

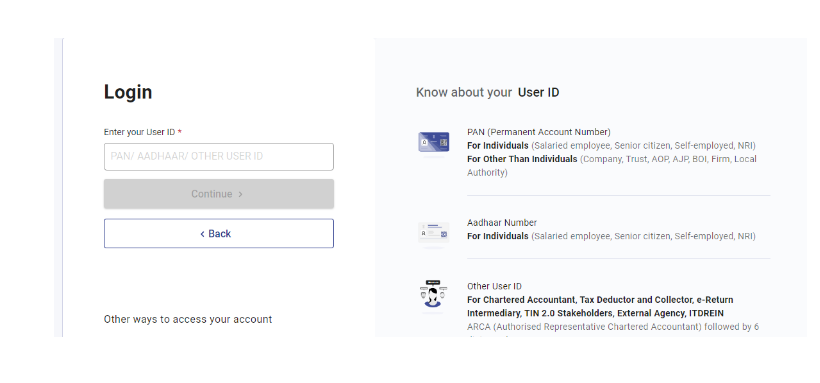

To access any of the services provided by the portal, you will need to log in. If you are not already a registered user at the efiling 2.0 login portal, you will also need to register on the site to utilise any of the services.

After logging in, the dashboard will provide you with many tabs, including E-file, Authorised Partners, Services, Pending Actions, and Grievances, all located at the very top.

You can see, change, and keep your profile up to date. Your data and contact details must be kept up to date accurately to guarantee smooth communication between taxpayers and the Income Tax Department.

On the left-hand side of the screen, you will find the items you need to complete your profile of efiling income tax 2.0 to make the most of the portal and to ensure that you promptly get contact from the department. The site is available to users in several different regional languages.

You will soon be able to use a wide range of tax-related services by downloading a brand-new mobile app that will be accessible to you very soon.

Income tax new portal: Quick links for taxpayers

Income tax new portal: Services for Individuals and HUFs

Efiling 2.0: Registration

Income Tax Login 2.0

Income Tax 2.0: Tutorials

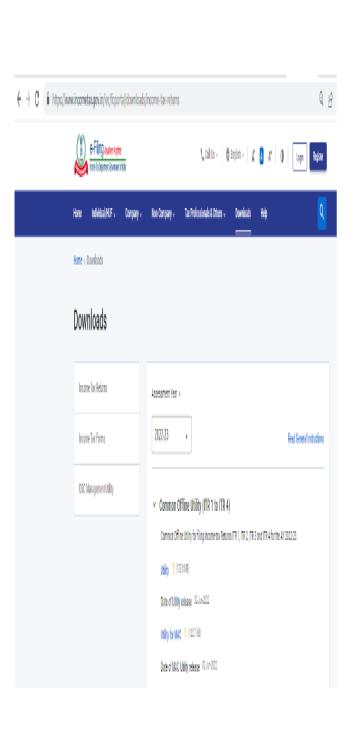

Efiling 2.0 downloads

E filing: Helpline numbers

Helpline numbers for electronic filing

Questions pertaining to the income tax in general

When: every day from 8 AM to 10 PM (Monday to Saturday)

Phone: 1800 180 1961

Questions about the income tax e filing 2.0 of ITRs or forms and other value-added services, as well as questions regarding intimation, correction, reimbursement, and other aspects of the tax return processing procedure.

When: every day from 8 AM to 10 PM (Monday to Friday)

From 9 a.m. till 6 p.m. (On Saturday)

Phone Numbers

1800 103 0025

1800 419 0025

+91-80-61464700

+91-80-46122000

Form 16, Tax Credit (Form 26AS), and inquiries relating to TDS statements and Form 15CA processing are all handled by TRACES, which stands for the TDS Reconciliation Analysis and Correction Enabling System.

Timing: 10 AM to 6 PM (Monday to Saturday)

Phone Numbers:

+91-120-4814600

1800 103 0344

Known as NSDL, the Tax Information Network

Questions about the submission of an application to NSDL for the issue or update of a PAN or TAN.

Timing: 7 AM to 11 PM (All Days)

Phone: +91-20-27218080

e-filing unit of the Income Tax Department's Centralised Processing Centre (CPC), Bengaluru 560500

ITR.helpdesk@incometax.gov.in should be sent with any questions about the income tax return (ITR 1 through ITR 7).

TAR.helpdesk@incometax.gov.in should be sent with any questions about the tax audit report at e filing 2.0 login (Forms 3CA-3CD and 3CB-3CD).

Questions about anything else should be sent to efilingwebmanager@incometax.gov.in

Filing taxes has always been a headache for many taxpayers in India due to various issues. The e-filing 2.0 portals developed by the government have enabled millions of taxpayers to easily file taxes and have a hassle-free experience doing it. If you need professional help, you can always consult the tax experts at NoBroker. They will understand your needs, review the documents and help you successfully file the taxes with ease. If you need help in filing property taxes, please comment below the article; our experts will be in touch with you shortly.

Frequently Asked Questions About E Filing 2.0

Answer: E Filing was launched on 7th June 2021.

Answer: The major improvements in the updated portal were about improving the user experience and making tax payments easier than ever for individuals.

Answer - The address for the new income tax portal is www.incometax.gov.in

Answer: The online tax filing form, after filling, needs to be printed and submitted to CPC, Bangalore and this process takes time of 120 days.

Answer: Income tax e-filing is submitting an income tax return (ITR) in the required format to the government tax authorities online. E-filing is currently required for most tax assessees under the country's current income tax laws, taking the place of the ITR's previous paper-based filing system.

Loved what you read? Share it with others!

Most Viewed Articles

SBI Bank Holidays List Across India: National, State-wise and Weekend Closures in 2026

December 24, 2025

39959+ views

HDFC Bank Holidays List in 2026: National, State-Wise and Weekly Closures

December 26, 2025

38705+ views

Update Your Aadhaar Card Address: Quick and Convenient

January 31, 2025

34058+ views

Bandhan Bank Holidays 2026: List of National, Festival & State-Wise Dates

December 24, 2025

32798+ views

Canara Bank Holidays List in 2026: National, State-wise and Weekend Closures

December 24, 2025

32176+ views

Recent blogs in

UCO Bank Holidays List: National and State-Wise Branch Closures in 2026

December 26, 2025 by Priyanka Saha

HDFC Bank Holidays List in 2026: National, State-Wise and Weekly Closures

December 26, 2025 by Priyanka Saha

Indian Bank Holidays List in 2026: State-Wise National and Regional Bank Holidays

December 26, 2025 by Suju

Full RM + FRM support

Full RM + FRM support

Join the conversation!