Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

E Stamp Process in India: Documents, Benefits and E Verification

Table of Contents

Planning a property or legal transaction? What details do you need to have ready to complete the e-stamp process online in India successfully? Electronic stamping, often known as e-stamping, is a technique of electronically paying the government non-judicial stamp tax. Previously, stamp duty for registration had to be paid in person at the sub-office. Now, this process enables individuals to pay stamp duty through online portals and receive an e-stamp certificate with a unique identification number (UIN) instantly. This service is currently available in 22 Indian states. In this blog, we will explain the meaning of the e-stamp, the online e-stamp payment system, the download process, and much more.

Key Facts About E-Stamping in India - Quick Information

E-stamping in India is a modern, secure, and convenient method introduced to replace traditional stamp papers and prevent fraud. Below is the quick info on e-stamping in India:

| Features | Details |

| Introduced by | Stock Holding Corporation of India Limited (SHCIL) |

| Purpose | To reduce fraud, errors, and provide a secure, convenient method of paying stamp duty |

| Availability | Available in most states in India through authorised collection centres and online portals |

| Documents Covered | Lease deeds, mortgage deeds, agreements, conveyance deeds and other legal documents. |

| Verification | It can be verified online using the Unique Identification Number (UIN) on the certificate |

| Validity | Valid across the state of issue; does not have an expiry unless misused or cancelled |

When Was E-Stamp Paper Introduced in India?

In July 2013, the Indian government started the India e-stamping system. This effort attempted to reduce fraud and errors in stamp duty receipts. In India, the Central Record Keeping Agency (CRA), the Stock Holding Corporation of India Limited (SHCILestamp), can issue e-stamp certificates. Authorised Collection Centres (ACCs) are designated intermediaries, such as a bank or a post office, in charge of issuing e-stamp paper in place of CRA. State governments establish various ACCs.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Stamp duty is a tax levied by governments on legal documents used to transfer property or assets. Governments levy stamp duties, sometimes known as stamp taxes, on documents necessary to legally record certain types of transactions. The Indian Stamp Act covers the levying of stamp duty, the documents on which stamp duty may be imposed, and the various stamp duty rates (1899).

Historically, governments imposed these taxes to raise revenue for government programmes and initiatives. Stamps are thought to have originated in 17th-century Spain. These taxes were known as stamp duties because a tangible stamp was affixed on the document as proof that the document had been recorded and the tax due had been paid.

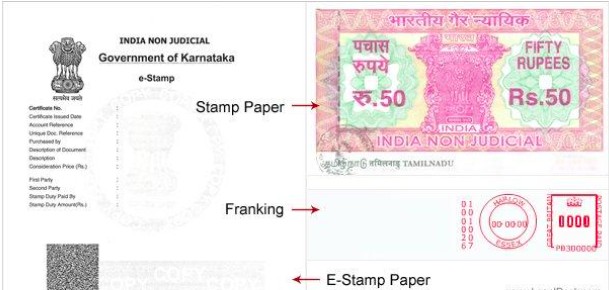

Stamp duty has traditionally been paid by hand; however, with technological advancements, online stamp duty payment has emerged as a simple and cost-effective solution for businesses. Consideration price, meaning in e-stamp, refers to the total value of money involved in a purchase or sale transaction between two parties.

What is E Stamp Paper?

E-stamp paper, also known as electronic stamping or e-stamping, is not a physical piece of paper. It's a digital method for paying the government's non-judicial stamp duty on a property or document.

Traditionally, people had to buy physical stamp papers with specific denominations to meet the stamp duty requirement. E-stamping eliminates the need for physical papers and offers a more convenient way to pay this tax. Stamping in agriculture means the use of a metal stamping process to create parts for farm equipment.

Online Stamp Duty Payment for E-Stamp Documents

E-stamping, also known as digital Stamping, is a technique that allows for the safe and lawful online payment of stamp duty, as well as the digital rendering of stamp papers that can be affixed to electronic documents. In a nutshell, it is an online service that facilitates the e-stamping of process documents.

India's stamping system is a two-part process for paying a tax called stamp duty on various legal documents and property transactions. By digitally stamping papers, businesses can speed up the documentation process while securely stamping documents from anywhere and at any time.

The following steps are involved in E-Stamping:

- Step 1: Visit the website and log in to the electronic stamping portal.[1]

- Step 2: Upload or generate a stampable document; templates can also be used to draft papers.

- Step 3: The user enters transaction information for e-stamping, such as state, stamp denominations, first and second-party information, and other details. These can also be filled out automatically.

- Step 4: The user must fill out the application and submit it to the collection centre.

- Step 5: To make the necessary payment, the user must submit the application using Credit Cards, Debit Cards, e-stamp Checks, Demand Drafts, online payment, and online banking.

- Step 6: The document is stamped and combined with the stamp paper sample required. After that, the user obtains the e-stamp certificate, which can be validated using a QR code.

How To Generate Stamp Duty Payment Slips?

There are several payment methods available for e-stamp paper registration. You can pay the cost using cash, check, NEFT, RTGS, or account transfer.

- Step 1: To go to the new SHCILestamp users, click the 'Register Now' option on the website.[2]

- Step 2: Enter your User ID, password, security question, and bank account information.

- Step 3: To access your services, enter your user ID and password. This will happen after you confirm using the activation link sent to your registered email.

- Step 4: Log in with your enabled username and password.

- Step 5: Choose the state in which you wish to pay the stamp duty.

- Step 6: Choose the 'Nearest SHCIL Branch' option to generate a referral number for any amount that can be paid using net banking, debit card, NEFT, RTGS, or FT. This option, which includes 1st Party Name, 2nd Party Name, Article No, Stamp Duty Payable, and Stamp Duty Amount, is required.

- Step 7: Take a printout of your non-judicial stamp paper Online Reference Confirmation Number to your local Stock Holding Branch. The final print of the e-stamp paper can be obtained from there.

Using the Mobile Application for E Stamp

The E-Stamping smartphone app can validate the e-stamp paper. Download the app from AppStore or Google Play. You will have two verification options in this app: scanning the QR code accessible on the e-stamp paper or manually checking. Please note that QR codes are not available on certificates issued prior to February 13, 2019.

Scan a QR code with the app's camera, and all the information will be displayed. You can do it manually by clicking the manual button and selecting the state. After that, input the e-stamp certificate number, the date the certificate was issued, the unique document number, the amount reference, who purchased the document, the document's content, the stamp duty amount, the consideration price, the first party, and the third party.

E Stamps Verification

There are two main ways to verify an e-stamp certificate in India:

Online Verification

- Visit the Stock Holding Corporation of India (SHCIL) website, the official authority for e-stamping in India [SHCIL eStamp].

- Click on "Verify e-Stamp Certificate" on the homepage.

- Enter the required details, which typically include:

- State where the e-Stamp certificate was issued

- Certificate Number (UIN) - a unique identification number

- Stamp Duty Type (e.g., description of the document)

- Certificate Issue Date

- Verification Code (if displayed)

- Click "Verify" to see if the e-stamp certificate is genuine.

Mobile App

- Download the SHCIL EStamp Verification app from the Google Play Store.

- You can either scan the QR code on the e-stamp certificate or manually enter the certificate details.

- The app will then retrieve and display the full details of the certificate for verification, even offline.

Documents That Require E-Stamping

E-stamping is mandatory for several documents where stamp duty needs to be paid. Some of the key documents that require e-stamping include:

- Property documents - Sale deeds, gift deeds, exchange deeds, conveyance deeds.

- Lease and rental agreements - Lease deeds, tenancy agreements, license agreements.

- Affidavits and declarations

- Business and commercial agreements

- Financial documents

- Power of attorney

- Settlement and partition deeds

8 Benefits of Using E Stamps

E-stamps have transformed the way stamp duty is paid in India, providing a secure and efficient alternative to traditional stamp papers. Here are the eight benefits of using e-stamps:

- Simple to apply - You no longer need to stamp papers individually with an e-stamp, as you would with traditional stamps. A single e-stamp can be applied to several documents.

- Reduces counterfeiting - Because they use "layered security" technology, e-stamps should reduce the possibility of document falsification.

- Electronic certificate authentication - E-stamps include electronic certificates that validate papers, prove document ownership, ensure document authenticity, and are legally binding.

- Meets the demands of the digital age - The transition from traditional to digital stamps is consistent with the overall deployment of strategies and procedures to ease corporate activities in the digital era. Digital transformation is utilised to boost business productivity effectively and efficiently.

- No face-to-face interaction - E-stamps could be used remotely and do not require face-to-face interaction between the seller and the buyer. This was very important during the pandemic. E-stamping can be accomplished using a smartphone application too.

- Efficient and effective - Every firm requires some level of record-keeping. Legal documents must typically be signed both externally and internally by a corporation. Businesses no longer need to physically print and mail papers because of e-stamps and digital signatures, saving money on paper, printer & ink costs, and courier fees.

- Legality of E Stamps - PSTE Government Oversight No. 71 of 2019 regarding the Adoption of Electronic Systems & Transactions governs e-stamps. Because it carries an electronic certificate, an e-stamp is as lawful as a traditional stamp and is legally binding. E stamps serve the same purpose as traditional stamps: to authenticate letters or documents. The stamp is often used as a sign of approval by superiors in commercial agreements and correspondence.

- Complementing digital signatures - E-stamps are legal items that are legally binding when used in conjunction with digital signatures. They also help to reinforce decision outcomes on specific document sheets. The e-stamp confirms that the decision has been reached and that the letter or document is genuine. The parties to the e-stamped document are obligated to follow the requirements outlined in the document. The e-stamp works similarly to a digital signature; therefore, they complement each other.

Book Your Legal Requirements Via NoBroker Legal Services

The e-stamp document description provides details about the property or transaction, including the consideration price, for accurate stamp duty calculation. To summarise, stamp duty is required when purchasing or selling property in India. With the advancement of technology, the government launched E-stamping, an electronic and secure method of paying non-judicial stamp duty to the government. In July 2013, the government launched this campaign to decrease errors and counterfeits.

Legal assistance is often a hurdle that first-time and experienced property investors tend to face. Many property buyers and sellers trust NoBroker to guide them regarding every legal aspect of the transaction. If you need legal assistance, you can speak with NoBroker's legal experts by clicking on this link.

Frequently Asked Questions

Ans: To find your local sub-registrar, go to the SHCIL e-stamp website, then to e-stamping, and finally to the state. After you have decided on a state, look for the local sub-office. registrar's

Ans: You can use the Stock Holding e-stamp gateway to pay your stamp duty online. Fees can be paid with cash, card, NEFT/ RTGS, or any other manner.

Ans: The Stock Holding e-stamping website has no e Stamp registration cost. However, because the land in India is state-subject, you must pay stamp duty payments to the state government.

Ans: No, the authority will not supply a duplicate copy of the e-stamp paper; after the e-stamp certificate is generated, it cannot be modified.

Ans: The process of getting documents stamped is referred to as franking. This method marks or stamps the documents to indicate that they are legal and that any stamp duty payable has been paid.

Ans: E-stamping is a secure, digital-based method of paying stamp duty in India.

Ans: It is the value of the transaction or agreement on which stamp duty is calculated.

Ans: An e-stamp certificate is issued with a Unique Identification Number (UIN) that can be verified online, making it tamper-proof and legally valid.

Recommended Reading

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116750+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135177+ views

Revenue Stamp in India: Meaning, Types, Uses, Legal Value & Where to Buy in 2025

January 31, 2025

131748+ views

How to Get a Stay Order in India: Step-by-Step Legal Process in 2025

May 31, 2025

96365+ views

Doctrine of Adverse Possession: What It Means and How to Claim Property Rights in 2025

May 28, 2025

92890+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116750+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

199681+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

144373+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135177+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Mobile Home Lease Agreement: Types, Rights, Rules & Legal Requirements in 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!