Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

EDMC Property Tax Delhi: Pay Tax Online, Offline, Bill View, Receipt Download and Check Status in 2025

Table of Contents

Considering making changes to your EDMC property? How will it affect your property tax assessment? EDMC property tax is a mandatory payment that East Delhi residents must make to the East Delhi Municipal Corporation. This tax funds essential civic services like road maintenance, street lighting, and waste management. Paying your EDMC property tax on time helps ensure the smooth functioning of these public services and contributes to the region's overall development.

Knowing the due dates, payment methods, and applicable rebates can make the process easier and more efficient. You can avoid penalties and take advantage of available discounts by staying informed.

EDMC Property Tax: A Quick Details

Here is the quick info on EDMC Property tax:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Information | Details |

| Authority | East Delhi Municipal Corporation |

| Official website | https://mcdonline.nic.in |

| Property tax rate | Residential properties - 12%Non-residential properties - 20% |

| Last date due | 30th June |

| Late payment penalties | 1% p.m. |

| Helpline number | 155305 |

What are the Areas Served by EDMC in 2025?

East Delhi Municipal Corporation (EDMC) facilitates property tax collection across two primary zones, each encompassing several wards and colonies:

Shahdara North Zone:

- Babar Pur

- Usmanpur

- Yamuna Vihar

- Maujpur

- Karawal Nagar East

- Arvind Nagar

- Shastri Park (Seelampur)

- Gautampuri (Jaffrabad)

- Kardampuri

- Mustafabad

Shahdara South Zone:

- Trilokpuri East

- Dallupura

- Mayur Vihar Phase I

- Kondli

- Shakarpur

- Mandawali

- Ghazipur Dairy Farm

- Nanakpura Shakarpur

- Usha Enclave

- Shashi Garden

Residents in these areas can conveniently pay their EDMC property tax online or offline at designated centres.

Options for Paying Your EDMC Property Tax in 2025

East Delhi Municipal Corporation (EDMC) offers online and offline methods for paying property tax. You can conveniently pay from home using the online platform or visit a local centre to complete your payment in person.

How to Pay EDMC Property Tax Online in 2025

Paying your property tax in East Delhi has never been easier, thanks to the EDMC's user-friendly online payment system. Whether at home or on the go, you can settle your dues efficiently using this digital platform.

- Visit the Official Website: Start by visiting the EDMC website. You can access it directly by clicking on this link: EDMC Property Tax Portal.

- Select Property Tax: From the homepage, find and select the 'Property Tax' option to begin the process.

- edmc-property-tax-payment-online: Provide the necessary information, such as your property reference ID, the name of the owner, or the property location, as required.

- Submit the Information: After entering the details, click on 'Submit' to proceed. This will take you to a new page where you can review the dues that need to be paid.

- Choose Payment Method: Select your preferred payment method from the available options, which typically include net banking, credit card, or debit card.

- Finish the Payment: Follow the instructions displayed on the screen to finalise the payment. Make sure all the details are correct before finalising the transaction.

- Download Receipt: Once the payment is successful, a receipt will be generated. Be sure to save and store this receipt for future reference.

Pay Your EDMC Property Tax Online Payment with NoBroker

Using NoBroker Pay is another efficient method to settle your EDMC property tax. This platform offers a straightforward and secure way to make payments online, helping you manage your dues without any hassle.

Here's how to pay your East Delhi Municipal Corporation property tax using NoBroker Pay:

- Access NoBroker Pay: Log in to your NoBroker Pay account to get started. You can also use their mobile app for easy access.

- Go to Bill Payment: Head to the bill payment section once logged in. Look for the 'Property Tax' category, type ‘EDMC property tax’ in the search bar, and select it.

- Enter Your Details: Input your customer ID or account number as required to fetch your tax details.

- Choose a Payment Method: Select from the available payment options like net banking, credit card, or debit card to proceed with your payment.

- Complete the Payment: Follow the prompts to finalise the transaction. Ensure all details are correct to avoid any issues.

- Stay Updated with Payment Confirmation: Once your payment is processed successfully, you will receive a confirmation message. Make sure to save this confirmation for your records, as it serves as proof of your payment.

How to Pay EDMC Property Tax Offline in 2025

For those who prefer in-person transactions or may not have consistent internet access, paying your EDMC house tax offline is a straightforward option.

Here's how you can make an offline at the EDMC property tax office:

- Visit an ITZ Cash Counter: Locate and visit the nearest ITZ Cash Counter designated for EDMC property tax payments. These centres are strategically placed across East Delhi.

- Provide Your Property Information: At the counter, provide your property ID or any other required details to the staff. This helps in retrieving your tax payment information.

- Check the Tax Amount Due: The counter staff will help confirm the amount of property tax you must pay, ensuring you are informed about any due or arrears.

- Make the Payment: You can pay the tax in cash or by cheque. Some centres may offer additional payment methods like card payments.

- Obtain Your Receipt: Ensure you receive an official receipt after making the payment. This document is crucial as it serves as proof of your payment.

- Store Your Receipt Safely: Keep the receipt secure for future reference. It might be required for subsequent verifications or during the next tax payment cycle.

Benefits of Online Payment of EDMC Property Tax

Paying your EDMC property tax online is convenient and saves time. Here are some key benefits:

- Quick and Easy: You can pay from anywhere, anytime. Just log in, fill in your details, and pay.

- Safe Transactions: Online payments are secure. Your information stays protected.

- Immediate Confirmation: You get a receipt right after payment, which serves as proof.

- No Queues: Forget about standing in long lines. Online payment eliminates this hassle.

- 24/7 Availability: The online system works around the clock. Pay your tax even on holidays.

How is the EDMC Property Tax Receipt Downloaded?

Downloading your EDMC property tax receipt is straightforward. Here’s how you can do it:

- Log in to the Portal: First, access the EDMC official website and log in with your credentials.

- Scroll to the Tax Section: Once logged in, go to the 'Property Tax' section.

- View Your Payments: Find the option labelled ‘Property Tax Receipts’. Click on this to see your payment history.

- Select the Receipt: From the list of payments, select the relevant tax payment for which you need the receipt.

- Download the Receipt: There will be an option to download the receipt next to your payment details. Click this to download your receipt.

- Save or Print the Receipt: Once downloaded, save the receipt on your device for future reference or print it if needed.

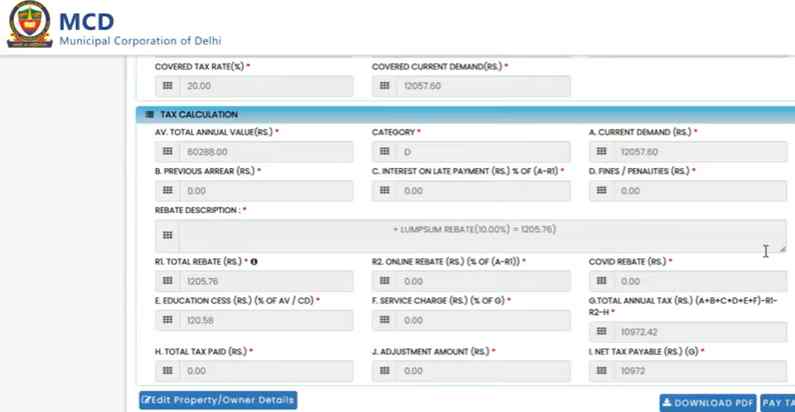

Easy Guide to Using the EDMC Property Tax Calculator 2024

Calculating your property tax for EDMC has never been simpler. Here's how you can quickly figure out what you owe for the year 2025.

- Visit the EDMC Website: First, go to the official EDMC website.

- Access the Tax Calculator: Click on the 'Property Tax Calculator' link. This tool is designed to help you estimate your tax based on several factors.

- Enter Property Details: Input details about your property, such as the zone, area, type of property (residential or commercial), and floor factor.

- Add Property Uses: Specify how you use the property. This could be fully self-occupied, rented out, or a mix of both.

- Check the Calculation: The calculator uses the unit area system, considering the property's built-up area and other factors like age and structure type.

- Review the Result: After entering all the information, the calculator will display the tax you must pay. This amount includes any applicable cess and rebate for timely payments.

EDMC Property Tax Rate 2025

East Delhi Municipal Corporation (EDMC) has structured its property tax rates to cater to various types of properties. Here’s what you need to know:

Residential Properties:

- Sector A: 12%

- Sector B: 12%

- Sector C: 11%

- Sector D: 11%

- Sector E: 11%

- Sector F: 7%

- Sector G: 7%

- Sector H: 7%

Commercial Properties:

- All sectors (A to H): 20%

Industrial Properties:

- Sector A to E: 15%

- Sector F to H: 10%

Unit Area Value – Rate per Square Metre:

- Sector A: ₹630

- Sector B: ₹500

- Sector C: ₹400

- Sector D: ₹320

- Sector E: ₹270

- Sector F: ₹230

- Sector G: ₹200

- Sector H: ₹100

EDMC Property Tax Rebate 2025

EDMC encourages timely and online payments by offering attractive rebates on property taxes. Here’s how you can benefit:

- Under Section 123 (B) 3 if you pay your full property tax before the 30th of June of the current fiscal year and enjoy a 10% rebate. This reward is designed to encourage taxpayers to settle their dues early. However, if you pay your property tax quarterly, you will not be entitled to this rebate. On the other hand, late tax payments might incur 1% interest every month of delay.

- Under Section 114B: A 30% rebate will be provided to a certain category of people owning covered residential property of 100 sq. metres. This rebate applies to either singly or jointly owned by ex-servicemen, senior citizens, physically challenged people and women. However, you can only avail yourself of rebates under this section. Irrespective of your being qualified for more than one rebate under this section.

- A 2% additional rebate is available for all taxpayers who got rebates under the above two sections. This is applicable if you pay your residential property tax online. This incentive applies to taxes up to ₹10,000, promoting the convenience and efficiency of digital transactions.

- A 90% rebate is available for schools aided by MCD. However, they can avail of them only if they pay their entire property tax.

- Service charge-paying departments are not eligible to get any rebate.

EDMC Property Tax Transfer Online 2025

Handling property tax transfers within EDMC is now straightforward with their online system. Here’s how to complete a property tax transfer online efficiently:

- Access the EDMC Portal: First, visit the official EDMC website dedicated to property tax services.

- Access Your Account: Enter your credentials to sign in. If you don’t have an account, you must create one by providing the necessary information.

- Select the Transfer Option: Once logged in, look for the option labelled ‘Property Tax Transfer’ or similar. This section deals specifically with changes in property ownership.

- Enter Property Details: Input all required property details, such as the property ID and the new owner’s information. Double-check all information to avoid any issues.

- Submit the Required Documents: Upload any documents the system requires for a property transfer. This usually includes proof of sale or transfer documents.

- Confirm and Submit: Review all the information for accuracy and then submit your transfer request.

- Receive Confirmation: Once the transfer is processed, you will receive a confirmation. Keep this for your records.

EDMC Property Tax Transfer Charges 2025

Certain fees apply when transferring property within the East Delhi Municipal Corporation (EDMC) area. Here's a simple breakdown of these charges:

- Transfer Duty Rates: If the new property owner is a female (including third gender), the transfer duty rate is 2%. For males and other entities, the rate increases to 3%.

- Education Cess: Additionally, there is an education cess. This amounts to 1% of the annual property tax due on vacant lands and buildings, as specified under section 113(2) of the Delhi Municipal Corporation (DMC) Act, 1957 (amended).

Stay Updated with the EDMC Property Tax App in 2025

EDMC has introduced its own app to help you efficiently manage your property tax. This app ensures you never miss any updates and allows you to track and pay your taxes with ease.

- Efficient Tax Tracking: The app helps you keep track of your property tax details and due dates, ensuring timely payments.

- Easy Payments: Pay your property taxes directly through the app using credit cards, debit cards, or net banking.

- Download Bills and Receipts: You can download your property tax bills and receipts instantly, making record-keeping simple.

- Stay Informed: Receive notifications and updates about your property tax, so you stay informed about any changes or important dates.

EDMC Property Tax Last Due Date 2025

Mark your calendars to avoid late fees and penalties on your EDMC property tax. Here are the key details:

- Due Date: The last date to pay your EDMC property tax for 2025 is June 30th. Make sure to pay before this date to avoid any penalties.

- Rebates: Paying your property tax before the due date can also make you eligible for certain rebates, reducing your overall tax liability.

- Penalties: Missing the deadline will result in additional charges. It's important to pay on time to avoid these extra costs.

EDMC Property Tax Helpline Number 2025

If you have questions or need help with your EDMC property tax, the East Delhi Municipal Corporation offers a dedicated helpline. Here are the contact details:

Shahdara North

- Helpline Number: 011-22824294

- Email: dyancsnz@mcd.org.in

Shahdara South

- Helpline Number: 011-22501117

- Email: dyancssz@mcd.org.in

Recent News and Developments of EDMC Property Tax 2025

Delhi Mayor Mahesh Khichi announced that the MCD will soon launch a house tax waiver scheme to ease citizens' financial burdens. Under this scheme, owners can get a complete waiver on past dues by paying the current year's tax within a set timeframe. From the next financial year, residents with houses or shops under 83 sqm will be exempt from house tax, while those between 83 sqm and 418 sqm will get 50% relief.

Additionally, 1,300 housing apartments will receive a 25% rebate for the first time. AAP leader Sanjay Singh and MCD in-charge Durgesh Pathak confirmed plans to regularise 12,000 ad hoc workers. However, opposition leader Raja Iqbal Singh criticised the move, calling it an eyewash due to pending approvals from key committees.

Explore Property Tax Payment Options City-Wise in India

Manage EDMC Property Tax Payments Easily with NoBroker Pay!

Paying your EDMC property tax on time is crucial to avoid penalties and enjoy rebates. NoBroker Pay simplifies this process and assists you with efficient payments, reminders and notifications, a user-friendly interface, and secured transactions. Pay your EDMC property tax payments online on time to avoid penalties and take advantage of rebates. Use NoBroker Pay for an efficient, hassle-free payment experience. Visit NoBroker Pay today and make your property tax payment easy and quick!

Frequently Asked Questions

Ans: EDMC property tax is calculated based on the property's size, location, and type of construction.

Ans: Yes, EDMC property tax can be paid online through the official NDMC website or mobile app.

Ans: Yes, EDMC offers rebates for certain categories, such as senior citizens, women, and physically challenged individuals.

Ans: You can contact the EDMC helpline at 1533 for assistance with any queries regarding property tax.

Ans: Yes, the last due date for EDMC property tax payments is typically mentioned in the tax bill or announced by the authorities.

Ans: To download house tax receipts in East Delhi, log in to the EDMC official website using your credentials. Navigate to the 'Property Tax' section and look for the ‘Property Tax Receipts’ option to view your payment history. Select the relevant tax payment and click on the download option next to it. Save the receipt on your device.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

60203+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

48188+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

43045+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

38942+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

33246+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115343+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193156+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132525+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

127837+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!