Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Apply Encumbrance Certificate Online and Offline: Update and Download Certificate 2025

Table of Contents

When purchasing a property, it’s crucial to ensure that there are no hidden legal or financial issues tied to it. One way to do this is by checking the encumbrance certificate, which confirms that the property is free from any loans or unpaid dues. This certificate is also required by banks if you’re applying for a loan or using your property as collateral. To avoid unexpected troubles and secure your investment, understanding the encumbrance certificate is key. We’ll guide you through everything you need to know about it.

Encumbrance Certificate - Quick Info 2025

An Encumbrance Certificate (EC) verifies property ownership and ensures no legal dues. It's crucial for property transactions, loan approvals, and legal clarity.

| Category | Details |

| Validity of EC Certificate | Valid for 1 year and can be renewed. |

| Modes of Application | Online via the official website and offline at designated centres. |

| Mandatory Fields | Name, Address, Voter ID, Age, Gender, Contact Information. |

| Application Status | Can be tracked online via the official website. |

| Offline Availability | Yes, at designated centres. |

| Required Documents | Voter ID, Address Proof, Identity Proof, Passport-size photograph. |

| Application Fees | No fee for online applications; nominal fee for offline applications. |

| Processing Time | Approximately 15-30 days. |

| Legal Implications | Mandatory for voter registration, voting, and other electoral processes. |

| Contact for Help | Electoral Commission Office, official website helpline. |

What is an Encumbrance Certificate?

An Encumbrance Certificate (EC) is an official document issued by the government that shows whether a property has any legal dues or loans on it. It confirms that the property is free from any financial liabilities like mortgages or unpaid debts. This certificate is important when buying or selling property, applying for a loan, or verifying the ownership of a property. It ensures that the property is clear of any legal issues, protecting both the buyer and the seller.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Why is an Encumbrance Certificate Required?

An Encumbrance Certificate (EC) is a crucial document used as evidence of free title/possession of a property. The document is needed while purchasing or selling a property or when applying for a home loan or loan against property to confirm that the particular property is free of any economic or legal liabilities.

Types of Encumbrance Certificates

There are many encumbrances, but four of the most common are easements, deed restrictions, encroachments, and liens.

1. Lien

A lien is the most common type of encumbrance, and it can be placed on a property to receive a financial obligation from the homeowner, i.e., a mortgage. The lien remains on the property until the mortgage is fully paid. It can also include tax liens for unpaid taxes.

Additionally, a contractor can obtain a lien when they have not received payment for repairs done to the property. If the lien is not satisfied, it can lead to the foreclosure of the house, with the proceeds of the sale going toward the payment of the owner’s debts.

2. Deed Restriction

A deed restriction places a restriction on what can be done to the property. It is also known as a restrictive covenant. The restriction can be anything from banning placing a satellite on the roof to designating where cars can be parked. It can also limit the construction of anything on the land.

Deed restrictions help create a standard for what the property can be used for and are often used to protect the value of the property. The restrictions are usually placed on properties with historical significance.

3. Easement

An easement gives a person or entity the right to use the property even though they don’t own it. For example, a utility company might obtain an easement to place power grids on a farmer’s property. A common easement is one that allows the owner of an adjacent property to use the driveway of another property for access.

Another common easement is one that exists when a common walkway to the beach cuts through one owner’s property. The easement is on the land, not the property itself.

4. Encroachment

An encroachment exists when a section of one property extends over to an adjacent property. This can include, for example, a fence that is built along with the adjacent property or a tree branch that hangs over a neighbouring property. Usually, the property owner encroached upon will want the encroachment to be removed, as an encroachment often makes it harder to transfer their property title to a new owner.

Eligibility Criteria for Applying Encumbrance Certificate

An Encumbrance Certificate (EC) is an essential document for verifying a property's financial and legal status in India. While there are no rigid eligibility rules, applicants must meet certain basic conditions. Here’s what to consider:

- Property Stakeholder: Anyone who holds a valid interest in a property can apply for an EC. This includes property owners, potential buyers, or legal representatives seeking to confirm the property's encumbrance-free status.

- Document Submission: The applicant must submit essential documents such as:

- Identity Proof (Aadhaar card, PAN card, etc.)

- Address Proof

- Property Details

- Recent Property Tax Receipts.

These documents are critical to process the application smoothly.

Documents Required for Obtaining Encumbrance Certificate

- Application form

- Attested copy of address proof

- A photocopy of any previously executed deed of the said property such as sale deeds, gift deeds, partition deeds, release deeds, etc.

- Details about the property and its title details

- The registered deed number, date, book number, volume/ CD number, and signature of the applicant should be affixed with it.

- Period for which the EC is required

- The purpose for which the EC is applied for

- Copy of Power of Attorney, in case of application, is made by the attorney holder

- Aadhar card

- Property card, if available

What are the uses of an Encumbrance Certificate?

The following circumstances, in general, necessitate the use of an encumbrance certificate:

- EC for Purchase: When buying a property, a non-encumbrance certificate is necessary to ensure the property is free of any loans or legal claims.

- EC for Sale: Sellers need to present the encumbrance certificate along with other documents to show the property is clear of any financial liabilities.

- EC for Property Mutation: After purchasing a property, an encumbrance certificate is required for the official transfer of ownership.

- EC for Loans: Banks often require an encumbrance certificate before sanctioning a home loan to verify that the property is free from legal issues.

- EC for PF Withdrawal: If you plan to use your Provident Fund (PF) for a property down payment, your employer will ask for the encumbrance certificate.

How to Apply for an Encumbrance Certificate Offline?

Applying for an Encumbrance Certificate (EC) offline involves a straightforward process. Below is a step-by-step guide to help you:

- Step 1: Locate the sub-registrar's Office: Identify the sub-registrar's Office responsible for the property. This Office must be where the property is registered.

- Step 2: Gather Required Documents: Collect necessary documents such as property and title deed details, property sale deed, gift deed, partition deed, release deed, property registration document, and address proof.

- Step 3: Visit the sub-registrar's Office: Go to the sub-registrar's Office and obtain the application form for the Encumbrance Certificate.

- Step 4: Fill out and Submit the Application: Complete the application form with accurate details. Submit it with the required documents, non-judicial stamp paper, and the purpose for requesting the EC.

- Step 5: Pay the Application Fee: Make the required payment to process the application. The fee may vary based on state regulations.

- Step 6: Receive Acknowledgement Receipt: Collect an acknowledgement receipt containing a unique ID. Use this ID to track the status of your application.

- Step 7: Collect the Encumbrance Certificate: Once the process is complete, visit the Office to collect your EC. The time taken may vary depending on the location.

What are the Documents Required for an Encumbrance Certificate Offline?

To apply for an Encumbrance Certificate (EC) offline, applicants must provide essential documents verifying identity, property details, and ownership history. Below is a complete list of documents needed for the Encumbrance certificate:

- Mandatory Documents: A PAN card or Form 60 is required for all applicants.

- Identity and Address Proof: Aadhar card, PAN card, voter ID, or utility bills like electricity or water bills.

- Property Details: Survey number, plot number, location, and property boundaries.

- Deed Details: Sale deed, partition deed, or gift deed, if executed previously.

- Property Registration Documents: Title or possession deeds to confirm ownership.

What is the Process to Apply for Encumbrance Certificate Online?

If you want to apply for an Encumbrance Certificate (EC) online, you can currently do so in the following states: Gujarat, Andhra Pradesh, Telangana, Karnataka, Tamil Nadu, Puducherry, Kerala, and Odisha. These states offer the convenience of online EC applications, allowing you to avoid the hassle of visiting government offices in person.

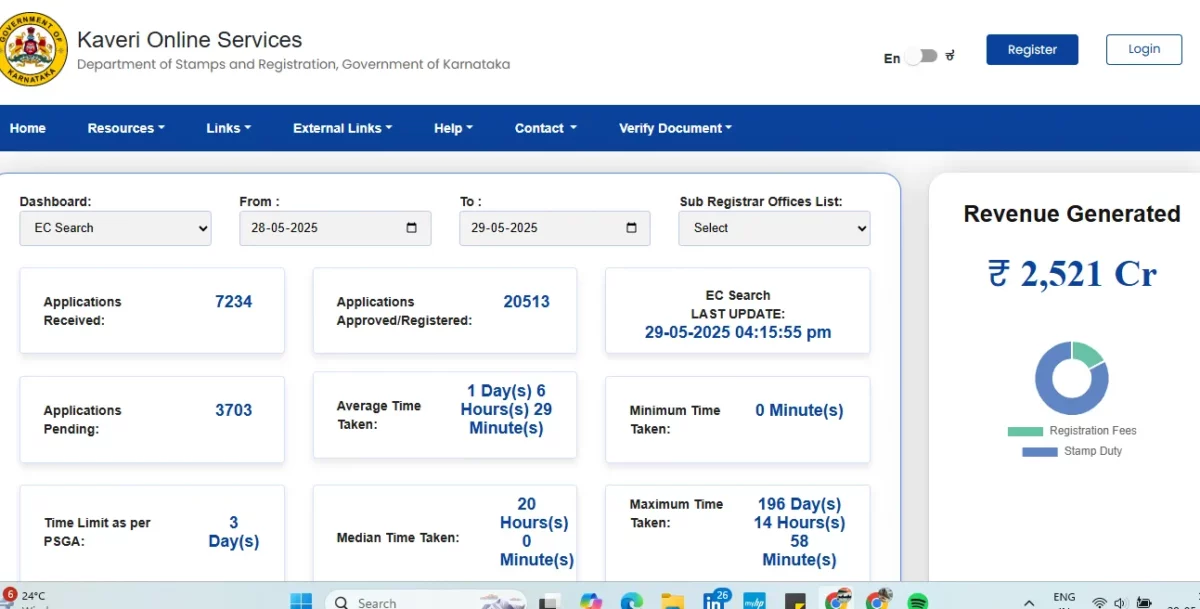

- Step 1: Visit - https://kaverionline.karnataka.gov.in

- Step 2: Create an account by clicking on ‘Register as New User’

- Step 3: Fill in the registration form and submit it by clicking on ‘Register’

- Step 4: Use the activation code to log in (this will be sent to your email address and mobile number) and click ‘Activate’

- Step 5: Login and change the password

- Step 6: Click on the ‘Services’ tab and select ‘Online EC’

- Step 7: Select the property registration year (details post-2003 only are available)

- Step 8: Fill in the required property details, and when you have checked it and it is correct, click on ‘Send OTP to View Document’

- Step 9: When you receive the OTP, enter the same and view the document or download it.

How to View Encumbrance Certificate?

The EC online view process allows you to track and download your Encumbrance Certificate conveniently. You can also use the EC online view option to check the status. Below is a detailed table:

- Step 1: Visit the Portal: Access the official website, such as TNREGINET, for EC services.

- Step 2: Click on "Certificate" Navigate to the "Certificate" section and select "Encumbrance Certificate."

- Step 3: Choose "EC Status" Opt for the "EC Status" option to track your certificate online.

- Step 4: Enter Transaction Details: Provide the required details, including property-related transaction information.

- Step 5: Fill in the CAPTCHA: Complete the CAPTCHA for verification.

- Step 6: Select "Check Status" Click on "Check Status" to view the EC status.

- Step 7: Save or Download: The EC status will appear on the screen. Save or download it for future use.

How to Check the Status of an Encumbrance Certificate?

Checking the status of an Encumbrance Certificate (EC) online is a simple process. This allows you to track whether the property is encumbrance-free or if there are any legal or financial claims against it. Below is how you can check the status:

- Step 1: Log in to the Official Portal: Access the website of your state's land records or registration department. Ensure you're on the official portal to avoid fraudulent sites.

- Step 2: Find the EC Section: Look for the "Encumbrance Certificate" or "Property Documents" section on the portal. This is typically found under the "E-Services" or "Documents" menu.

- Step 3: Input Property Details: Enter the required details, such as the property's registration number, survey number, and any other specific information requested by the portal.

- Step 4: Submit and Verify: Click on the "Submit" button to check the EC status. The system will process the details and display the status of the Encumbrance Certificate. If the property is free of encumbrances, you will also have the option to download the certificate.

Updating an Encumbrance Certificate: A Guide for Indian Homebuyers

Encumbrance Certificate (EC) is an important document proving a property's ownership and its clear title. It is a must-have document for homebuyers looking to purchase a property, as it serves as evidence of the property's transaction history and the absence of any legal liabilities or claims against the property. But what if you need to update your EC? Here's a step-by-step guide on how to update an EC in India.

An EC is usually valid for 30 years and must be updated regularly to ensure that it reflects the property's current status. Updating an EC is straightforward: Obtain a new certificate from the relevant authority and update the property's transaction history.

Here are a few things to keep in mind while updating your EC:

- Verify the ownership of the property

- Ensure that all taxes and other liabilities have been paid

- Check for any ongoing legal disputes

- Get the latest copy of the EC

- Update the transaction history of the property

Get Your EC Up-to-date in a Jiffy with These Simple Steps

Updating your EC is a breeze when you follow these simple steps:

- Step 1: Verify the Ownership of the Property

- Check the latest property deed

- Obtain a No Objection Certificate (NOC) from the current owner

- Step 2: Check for Any Liabilities

- Ensure that all taxes and other liabilities have been paid

- Get a receipt for the same

- Step 3: Check for Any Legal Disputes

- Verify if there are any ongoing legal disputes related to the property

- Get the Latest EC

- Step 4: Visit the relevant authority's website (e.g., Karnataka, Bangalore Development Authority, etc.)

- Download the EC application form

- Fill in the required details

- Submit the form along with the necessary documents (property deed, NOC, receipts, etc.)

- Step 5: Update the Transaction History of the Property

- Once the EC has been updated, ensure that the transaction history of the property reflects the latest information

How to Update EC Certificate?

Here's a handy table to help you keep track of what you need to do while updating your EC:

| STEP | TASK | DOCUMENTS REQUIRED |

| 1 | Verify Ownership | Property Deed, NOC |

| 2 | Check for Liabilities | Receipts for Taxes and Other Liabilities |

| 3 | Check for Legal Disputes | Information on Ongoing Legal Disputes |

| 4 | Get the Latest EC | EC Application Form, Filled in with Required Details |

| 5 | Update Transaction History | Updated EC Reflecting the Latest Information |

Here are the simple steps for updating the encumbrance certificate:

- Step 1: Verify the ownership of the property

- Step 2: Check the latest property deed

- Step 3: Obtain a No Objection Certificate (NOC) from the current owner

- Step 4: Check for any liabilities

- Step 5: Ensure that all taxes and other liabilities have been paid

- Step 6: Get a receipt for the same

- Step 7: Check for any legal disputes

- Step 8: Verify if there are any ongoing legal disputes related to the property

- Step 8: Get the latest EC

- Step 10: Visit the relevant authority's website (e.g., Karnataka, Bangalore Development Authority, etc.)

- Step 11: Download the EC application form

- Step 12: Fill in the required details- Submit the form and the necessary documents (property deed, NOC, receipts, etc.)

- Step 13: Update the transaction history of the property- Once the EC has been updated, ensure that the transaction history of the property reflects the latest information

Updating an Encumbrance Certificate (EC) is an important task for homeowners and buyers in India, as it helps ensure that the property's title is clear and free from any legal liabilities or claims. With the help of this guide, updating your EC has never been easier!

But what if you need professional help with the EC updating process? That's where NoBroker comes in! Our legal services team can help you navigate the complexities of the EC updating process and ensure that your property has a clear title. Get in touch with us today to learn more!

How to Download the EC Online?

Downloading your Encumbrance Certificate (EC) online is a straightforward process that ensures you can access this crucial document anytime. Follow these simple steps to download your Encumbrance certificate download :

- Step 1: Visit the Official Property Registration Portal: Go to the relevant government website to register for property.

- Step 2: Login: Use your registered credentials to log in to your account.

- Step 3: Locate the EC Section: On the dashboard, look for the "EC Online" or "Encumbrance Certificate" option.

- Step 4: Enter Property Details: Provide the required information, such as Document Number, Survey Number, or other relevant details.

- Step 5: Pay Fees (if applicable): Complete any fee payment process as the portal requires.

- Step 6: Submit and Download: Once your request is processed, submit it and download your Encumbrance Certificate.

Difference Between Encumbrance Certificate, Completion Certificate and Occupancy Certificate

Purchasing a property is stressful, and the different legal documents usually cause buyers to get perplexed. The distinction between Encumbrance Certificate, Completion Certificate, and Occupancy Certificate is the one that people most frequently get wrong. For clarification on the crucial differences between the 3, see the following:

Here is a table with the information:

| Certificate | Description |

|---|---|

| Encumbrance Certificate (EC) | A legal document certifying that a property is free from debts or legal obligations. |

| Completion Certificate (CC) | A legal document issued when a building is completed according to the approved building plan and specifications. |

| Occupancy Certificate (OC) | A legal document confirming that a building is safe to occupy, issued after receiving the Completion Certificate (CC). |

Common Issues and Solutions While Apply EC Certificate

Encountering common issues when applying for an Encumbrance Certificate can be frustrating. To assist with these problems, here are some common issues and solutions:

- Incorrect Details: Ensure property and personal details match records to avoid delays or errors.

- Missing Documents: Double-check required documents, like Sale Deeds, to avoid rejection.

- Technical Glitches: Resolve portal issues by clearing the cache, using another browser, or checking your internet connection.

- Delayed Processing: Follow up with the registrar's office if processing takes longer than expected.

- Login Issues: Reset your password or contact support if you're unable to log in.

- Payment Errors: Ensure accurate payment details and retry if payment fails due to network or entry issues.

Importance of Encumbrance Certificate for Flats

An Encumbrance Certificate (EC) is crucial for verifying the legal status of flats, ensuring no hidden liabilities, and facilitating smooth transactions. Here's why it's important:

- Legal Verification: The EC is essential for confirming that the property is free from any legal disputes, such as unpaid mortgages, pending litigation, or unresolved claims. This document guarantees the legal clarity of the property, assuring both buyers and sellers that the property has no financial or legal burdens attached.

- Ownership: The EC provides proof of clear ownership, confirming that the seller is the rightful owner of the flat without any legal encumbrances or disputes. It helps establish the legitimacy of the property title during the sale process.

- Tax Record: The EC ensures that the property’s tax records are up to date, showing that the flat has no outstanding dues. This helps in maintaining the property’s legal standing and simplifies the process of transferring ownership.

- Loan Applications: Financial institutions require an EC when processing loan applications. It confirms that the flat is free from encumbrances, ensuring that the bank has a valid asset to secure the loan. This is essential for smooth loan approval.

- Property Mutation: When transferring ownership, the EC is crucial for property mutation, which involves updating the property records with the local authorities. This process is necessary for legal recognition of the new owner and ensures that the flat’s title is correctly updated in government records.

Encumbrance Certificate Charges for Different States

The charges for obtaining an Encumbrance Certificate (EC) vary across states in India. These fees depend on state policies and can include application, search, and certification charges. Below is a table highlighting the cost of getting a certificate of encumbrance across different states:

| Location | Fees |

| Delhi | The request fee begins at ₹200 And increases depending on the locality and the years requested. |

| Andhra Pradesh | ₹300 for information up to 30 years, ₹500 for more than 30 years. |

| Telangana | ₹200 for 30 years of information, 500 for more than 30 years, plus a service charge of ₹ 25. |

| Tamil Nadu | The application fee is ₹ 1. First-year information costs ₹15, and each additional year costs ₹5. |

Encumbrance Certificate Format

An Encumbrance Certificate (EC) has a general format. Below is a general format of an Encumbrance Certificate:

| Registrar Office: [Name of Registrar Office] Address: [Registrar Office Address] Contact: [Registrar Office Contact Information] Email: [Registrar Office Email Address] Certificate No: [Certificate Number] Date of Issue: [Date of Issue] Property Details: Property Owner(s): [Name(s) of Property Owner(s)] Property Address: [Full Property Address] Survey Number: [Survey Number] Plot/Flat No: [Plot/Flat Number] Area: [Area in Square Meters/Square Feet] Boundaries: North: [Boundary Description] South: [Boundary Description] East: [Boundary Description] West: [Boundary Description] Encumbrance Period: From: [From Date] To: [To Date] Transaction Details: Date: [Transaction Date] Type of Transaction: [Sale/Purchase/Lease/Mortgage/Gift, etc.] Document No: [Document Number of Transaction] Parties Involved: [Names of Parties Involved] Description: [Brief Description of Transaction] (Repeat the above fields for each transaction during the encumbrance period) Certification: This is to certify that the property described above is free from any encumbrances during the specified period, as per the records available in our office. Any transactions that occurred during this period have been listed above. No other encumbrances have been registered against this property. Registrar: [Registrar Name] [Designation] Signature: ___________________ Date: [Date] Seal of the Registrar Office |

How NoBroker can Help?

There is so much an Encumbrance Certificate can tell you about a property. Why wait now? Happy Investing! Looking to buy or sell a property? It's time to trust the experts at NoBroker! Get an expert legal team to review all your documents so that you don't invest in a property with legal issues. This could cost you plenty of time and money. Be smart and get the right team to help you with the whole process. Click the link below.

For a seamless property transaction and expert assistance in acquiring your Encumbrance Certificate, trust NoBroker to guide you through every step. Our legal services offer personalised support, transparent processes, and a team of experienced professionals dedicated to making your property journey stress-free. With NoBroker, you get reliable legal solutions tailored to your needs, ensuring peace of mind at every process stage.

Frequently Asked Questions

Ans. EC is known as an Encumbrance Certificate, and OC is an Occupational Certificate. An OC states that the certificate or a document declaring the occupational activity of the property. If any property holds an OC, it can be used in various means such as residential, commercial, etc. It states the accommodation activity of the property and its safety to use. An Occupational Certificate cannot be obtained for properties that are under construction or not cleared by government agencies.

Ans. An EC is the Encumbrance Certificate, and a CC is a Completion Certificate. A completion certificate is a document which is issued by the municipal corporation of the area, in which the property is situated. Having a Completion Certificate means that the property is now constructed entirely, following all the guidelines of the municipal and the initial plan or blueprint of the property has been observed. A completion certificate doesn't make the property fit to be used by people. It means that the construction of the property is completed as per the guidelines laid.

Ans. The states which are currently issuing the EC online are Gujarat, Andhra Pradesh, Telangana, Karnataka, Tamil Nadu, Puducherry, Kerala, and Odisha. While the other states are actively working on speedily beginning the online services for the application of an Encumbrance Certificate, they are actively accepting the handwritten and signed copy by Registrar as a valid EC.

Ans. The charges to issue an encumbrance certificate depend on the number of years you publish the certificate. It usually ranges between two hundred rupees to five hundred rupees. Different states also have additional charges and different processing fees.

Ans. An EC is a document that ensures that your property is free from any financial and legal issues. It is generally asked for, during the sale or purchase of a property. It is also needed to demand a loan to purchase the property or to ask for a loan against the property.

Ans. If you are getting an encumbrance certificate offline, you will need to go to the Sub-Registrar’s Office. They are the authority in charge of issuing encumbrance certificates.

Ans. To apply for an encumbrance certificate you will need -

• Application form

• Address proof (attested)

• Property and title deed details

• The last or latest deed of the property (sale deeds, gift deeds, partition deeds, release deeds, etc.)

• The time period for which the EC is required

• The reason for applying for an EC

• Aadhar card

• Property card if available

Ans. There are two types of encumbrance certificates available –

Form 15: If your property has encumbrances during the time period that you have asked for the certificate.

Form 16: If your property has no encumbrances during the period for which you have requested in the certificate.

Ans. If all the details that you have provided are correct, you could get an encumbrance certificate in about 2-3 working days.

Ans. The maximum time period for which you can ask for an Encumbrance Certificate is for a period of 30 years.

Recommended Reading

Doctrine of Adverse Possession: What It Means and How to Claim Property Rights in 2025

May 28, 2025

89294+ views

EC Online Bangalore: Importance, Online Application and Status Check in 2026

June 1, 2025

67267+ views

How to Apply Encumbrance Certificate in Tamilnadu Online and Offline 2025

May 1, 2025

43730+ views

Encumbrance Certificate Karnataka - Online and Offline Application Process in 2025

January 2, 2025

43481+ views

Everything You Need to Know About NOCs for Property Transfer in India

January 31, 2025

36133+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115349+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193201+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132631+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

127896+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!