Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

EWS Housing Scheme Eligibility Benefits and Application Process

Table of Contents

EWS or the Economically Weaker Section of Society is an unreserved community of the Indian population that houses families whose annual income is less than ₹8 lakhs. These families do not belong to any other special bracket like STs, SCs or OBCs as those already have reservations and benefits associated with them.

In January 2019, the central government passed a bill that allowed the EWS community to benefit from a 10% reservation (private sector jobs and education). However, this can only be used by individuals who do not belong to any other specialised community like the ones mentioned above. Individuals mentioned in the OBS state list, but not on the central list can also apply for EWS certificates.

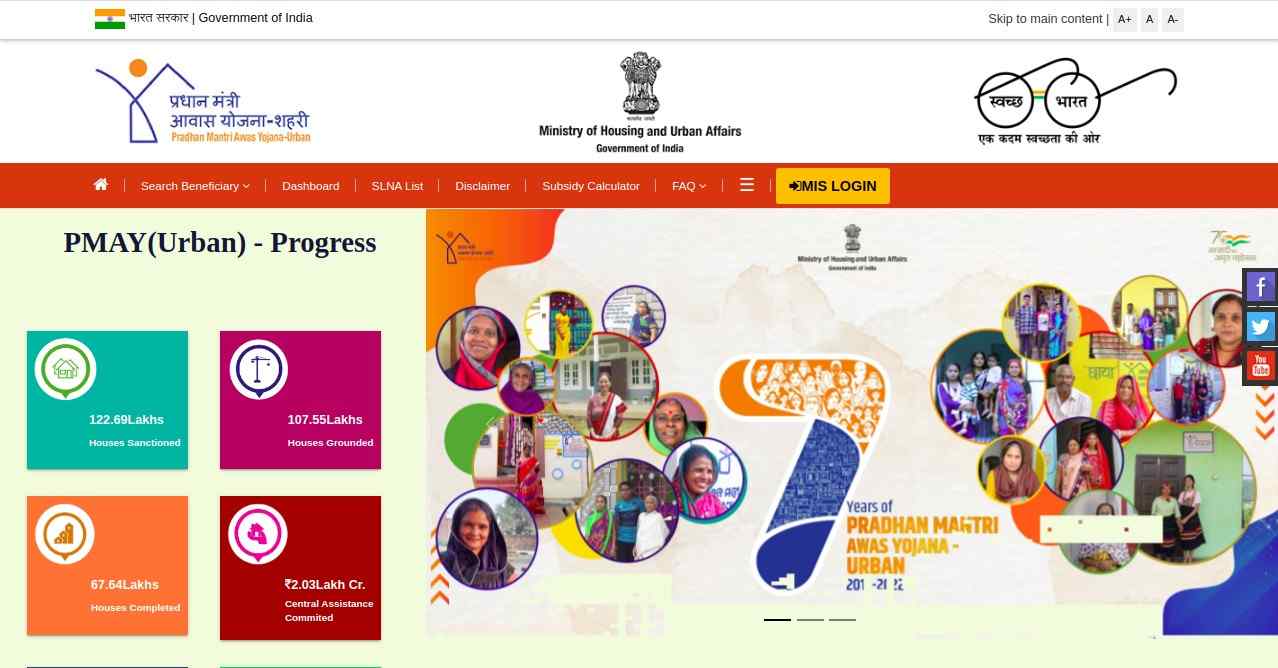

The Pradhan Mantri Awas Yojana- Housing for All mission was flagged off in 2015. It ensures lower income groups can apply for housing loans at subsidised rates and long tenures. Additionally, the houses are all built sustainably, using eco-friendly components.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

In this article, readers will learn the basics regarding EWS housing plans and how they function. We will go over other important aspects like eligibility, benefits, application, and many other things.

What is EWS Housing?

Under the Pradhan Mantri Awas Yojana- Housing for All, special assistance is provided to state agencies in order to develop urban areas. Applicants need to match up to a set of parameters, and once they pass, they can apply for a housing loan at a special rate of 6.5%.

They can even stretch the tenure up to 20 years. Contractors will build all EWS flats as per BIS and National Building Codes. The entire plan will last for four years, and construction will be carried out in three phases. Overall, The government has included 4041 urban areas and towns. However, the top 500 cities listed under Class 1 will be given preference.

Broad Criteria to Qualify for EWS

As stated, there are certain parameters that an applicant must pass in order to qualify for the Pradhan Mantri Awas Yojana.

| Particulars | Criteria |

| Maximum allotted carpet area | 30 sq mt |

| Household income | Lower than ₹8 lac per annum |

| Longest allowed loan tenure | 20 years |

| Interest subsidy | 6.5% per annum |

| Maximum permitted loan amount | ₹6 lac |

| Maximum interest subsidy (in rupees) | ₹2.67 lac |

| Approved building designs | Mandatory |

| Female owner/co-owner | Mandatory for a new purchase/ not necessary for an extension |

| Discounted NPV (Net Present Value) rate | 9% |

Who is Eligible for EWS housing plans?

Once the parameters are met, there is the question of eligibility. To be eligible for these schemes, you must:

- Have an annual family income of lower than ₹8 lakhs.

- Be equal to or more than 18 years of age.

- Be a citizen of India.

- Not own any pucca house all over India.

- Not availed of any other housing scheme in the past.

- Not have any family members that have availed of the PMAY-CLSS (Credit Linked Subsidy) while borrowing from Private Lending Institutions (PLIs).

- Agree to joint ownership while applying with your partner.

Is EWS Certificate Eligibility the Same for all Indian States?

The eligibility criteria broadly remains the same for all states across India. Key points like age, citizenship and couple application are hard set by the central government. However, some determining factors, like family income, owned agricultural land, etc., can be altered by state governments.

The parameters that state governments can change are:

| Parameters | Value set by the Central Government |

| Ownership of agricultural land permitted (in acres) | Below 5 acres |

| Residential area (in sq ft) | Below 1000 sq ft |

| Residential plot area in a notified municipal sector (in sq yds) | Below 100 sq yds |

| Residential plot area not in a notified municipal sector (in sq yds) | Below 200 sq yds |

Additionally, the EWS certificate can also be used by individuals to benefit from a 10% reservation for higher education. However, all applicants must be from the general category.

Keeping that in mind, the following states have opted for the 10% quota:

| Bihar | Andhra Pradesh | Delhi | Chhattisgarh |

| Gujarat | Goa | Himachal Pradesh | Haryana |

| Karnataka | Jharkhand | Madhya Pradesh | Kerala |

| Uttar Pradesh | Rajasthan | West Bengal | Uttarakhand |

Two states have made amendments to the criteria so far. They are–

1. Kerala: An amendment passed in October 2021 states that:

- The family income should be below 4 lac.

- The family should not own greater than 2.5 acres of Panchayat Land or 75 cents within a municipal area or 50 cents in an area governed by a municipal corporation.

- The family should not own housing plots exceeding 20 and 15 cents in municipal and municipal corporation areas, respectively.

2. Maharashtra: The government amended the criteria to allow Maratha Community to avail of the quota benefit along with the general category.

Authorities that Issue the EWS Certificate

You can get your EWS certificate from these authorities–

- SDO (Sub-Divisional Officer)

- Presidency Magistrate/Chief Presidency Magistrate/Additional Chief Presidency Magistrate

- Revenue Officer (at least a Tehsildar)

- Collector/District Magistrate/Deputy Commissioner/Additional District Magistrate/Magistrate/First Class Stipendiary/Additional Deputy Commissioner/Sub-Divisional Magistrate/Taluka Magistrate/Executive Magistrate/Extra Assistant Commissioner

Validity of EWS Certificate

An EWS certificate is valid only for one year from the date of issuing. However, it depends on the authority in each state.

What does Family imply?

The eligibility parameters often mention the terms family and household.

A family according to the PMAY, includes the applicant and their

- Parents

- spouse

- siblings and children under the age of 18

PMAY Schemes: Different Divisions

The Pradhan Mantri Awas Yojana has two separate divisions that cater to different people. They are–

1. Pradhan Mantri Awas Yojana Gramin

PMAY Gramin scheme caters to the rural population of India (excluding citizens of Delhi and Chandigarh). The central and state governments share the budget in this scheme. The general sharing ratio is 60:40 (centre: state). However, some states, like the ones in North East India, feature a 90:10 (centre: state) ratio.

2. Pradhan Mantri Awas Yojana Urban

PMAY Urban plan works towards providing pucca homes to the residents of urban India. This scheme covers over 40,000 towns in India and is being carried out in three phases.

- Phase 1: This covered 100 cities and UTs (Union Territories) and lasted from 2015 to 2017.

- Phase 2: This phase covered an additional 200 cities and UTs and was started and completed in 2017.

- Phase 3: This phase lasted till March 2022 and completed all the remaining towns and cities.

What is PMAY-CLSS?

PMAY-CLSS stands for Pradhan Mantri Awas Yojana-Credit Linked Subsidy. The central government offers a financial benefit that allows individuals from lower and medium-income groups to take home loans with lower EMIs.

The subsidy is given to the family in advance, making home loans more affordable. However, it all depends on the loan’s tenure and the property’s size.

Benefits of EWS Housing

- Housing for All: The main motto of the Pradhan Mantri Awas Yojana is to build homes for every needy family in India. This mission has been undertaken to raise the standard of living and eradicate poverty to an extent. States like Andhra Pradesh, Bihar and Chhattisgarh have already begun delivering completed homes.

- CLSS: The Credit Linked Subsidy allows borrowers to take loans at a very affordable rate and also not fret over high EMIs.

- Empowers women: Any Indian woman equal to or more than 18 years of age can apply for EWS housing. However, a man can only apply by making his wife the owner or after applying for joint ownership. This has been done to provide Indian women with financial stability and make them self-reliant.

- No barriers: The PMAY does not discriminate in terms of race or creed. Its sole agenda is housing for all. Hence, people from all groups like Scheduled Tribes (STs), Scheduled Castes (SCs) and Other Backward Classes (OBCs) can apply.

- Environmentally sustainable: All EWS housing plans are built with eco-friendly materials, hence making them sustainable. However, the quality remains top-tier, and they are all weatherproof.

- Slum eradication: The PMAY is also focused on slum rehabilitation. This implies the replacement of slums with proper pucca homes.

How to Apply for EWS Housing?

Households and families can apply for EWS housing plans offline and online. This has been done to aid convenience as only some individuals from the lower income group are comfortable with the online application. However, all applicants must possess an EWS certificate and aadhaar card beforehand.

Offline EWS Housing Application

To apply via the offline method, applicants must visit their nearest CSC (Common Service Center) and purchase the form for EWS Housing which will cost them a very nominal fee. Once attained, they must carefully fill in all the details and submit the same.

Online EWS Housing Application

Some states allow online registration under PMAY EWS housing plans. The form for the application is similar for all states, with minor changes like the ones mentioned above.

- Log in to the relevant website for your state. For instance, citizens of Andhra Pradesh can log onto the AP MeeSeva website, and applicants from Jharkhand can use the UDHD portal.

- Enter your name and complete Aadhaar verification.

- Click on the check box and then click Check.

- Fill in your identity and income details.

- Upload the scanned copies of the required documents.

- and make the payment via a chosen gateway and method.

A receipt will be generated, which applicants need to store safely for future reference.

Documents Needed for EWS Housing

Here are the documents that you need to submit for the EWS housing application–

- Proof of Identity: Applicants need to submit a copy of a document that serves as a POI, like Aadhar, Driver’s Licence, Passport, etc.

- Proof of Age: Applicants also need to prove that they are older than 18 years of age.

- Affidavit: An official affidavit stating that none of the family members owns a pucca house.

- Address proof: Applicants need to share their current address and permanent address information along with relevant proof like a rent agreement, land registration deed, etc.

- Proof of Income: This needs to be submitted once for each member of the family. Salary slips and Form 16s can be shared for this.

- Bank Statement: The bank statements of all members of the family for the last six months should be shared as well.

- Loan Details: The details pertaining to any ongoing loans should be shared.

- No Objection Certificate (NOC): A NOC issued by any housing society must also be shared.

- Cheque: The processing fee payment should be made by cheque. The account used to make the payment should either be the salaried or business account of the applicant.

- Allotment Letter: The Letter of Allotment or Sale Agreement document should be submitted as well.

PMAY Beneficiary List

The Pradhan Mantri Awas Yojana Beneficiary list is a document that mentions all sanctioned applicants under the EWS housing plans. Applicants can check this list regularly after submitting and getting approval for the form mentioned above. However, there are a few steps that need to be completed in order to check the list.

- Log onto the official PMAY website.

- click Beneficiary Wise Funds Released from Next, Search Beneficiary option.

- Enter the registered mobile number to view the results.

After completing these steps applicants can check the details about the house allotted, village name, registration number, amount released and EMIs paid.

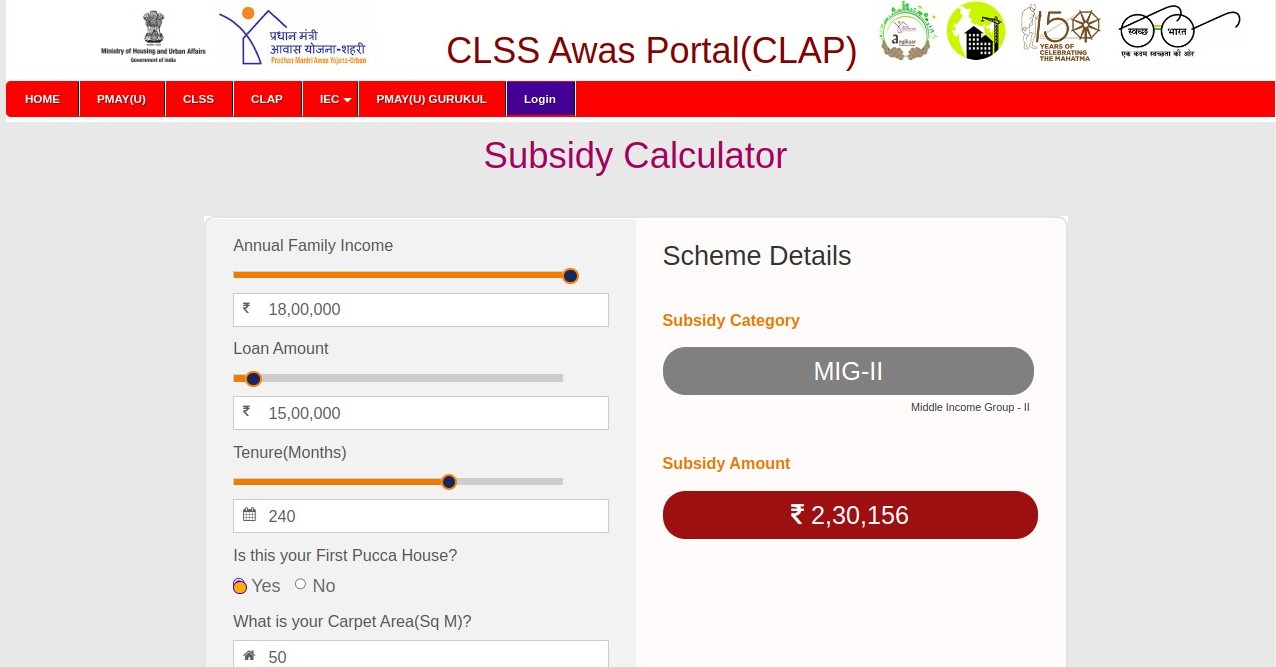

PMAY Subsidy Calculator

While applying for EWS housing plans, applicants are eligible for a subsidy against the interest amount of their home loan. The government pays this subsidy to the lender as soon as the loan is disbursed. This helps lower the EMI amount.

The subsidy is calculated on the basis of the tenure and loan amount. For instance, a loan of 6 lacs for 20 years will have a higher subsidy than one with a lending amount of 5 lacs. The government has also added a subsidy calculator to their page to ensure transparency. Applicants can follow a few simple steps to know their subsidy amount.

- Log on to the PMAY CLAP Portal.

- Click on Subsidy Calculator on the bottom ribbon.

- A calculator will be displayed.

Here, applicants can easily alter the Annual Family Income, Loan Amount and Tenure as per their requirements. Likewise, the Subsidy Category will change accordingly, along with the Subsidy Amount.

The highest subsidy output possible is ₹2,67,280, and applicants can achieve it by getting a loan worth six lacs for a tenure of at least 20 years. However, the Annual Family Income must be below six lakhs.

The poor population of India from the general category have finally received much-needed aid in the form of the PMAY. That said, this article has covered topics like eligibility, EWS certificate, PMAY schemes and Credit Linked Subsidy as well. Additionally, we have also discussed the benefits of these schemes and how to apply them.

NoBroker has always been a great place to meet buyers, sellers and renters. However, our blog and article wing-NoBroker Times aims to educate the masses about what is most relevant to them. With this EWS housing article, we want to help the uninformed population who can use these schemes to lead a better life. Log in to NoBroker and we can help you with the application of important documents like PAN and Ration Cards. Additionally, you can also use our platform to pay rent.

FAQ's

Ans. Broadly speaking, the main agenda for the Pradhan Mantri Awas Yojana is ‘Housing for All’. These schemes aim to provide a house for every family in India. As a result, it will raise the standard of living and eradicate poverty.

Ans. The PMAY has schemes for the EWS, LIG, MIG I and MIG II households. However, the eligibility criteria for them, as far as family income is concerned, differ.

EWS: Annual income must be below 3 lac.

LIG: Annual income must be between 3 lac- 6 lac.

MIG I: Annual income must be between 6 lac- 12 lac.

MIG II: Annual income must be between 12 lac- 18 lac.

Ans. The government will pay the subsidy for the interest amount of the housing loan under an EWS scheme to the lending institution as soon as the loan is disbursed. This will be directly credited to the loan account, which will readjust the EMIs and lower them considerably.

Ans. As long as individuals or any of the members of their families do not own pucca houses, they can apply. However, the owned plot needs to be within the required parameters as set by the state government.

Ans. Yes. However, the entire loan must be repaid in order to gain full ownership before attempting to resell the property. It does not classify under any special category after being paid for in full.

Recommended Reading

CIDCO Lottery 2025: Apply for Affordable Homes in Navi Mumbai

April 30, 2025

135869+ views

5 Lakh Budget House Plans With Smart Layouts and Cost-Effective Designs in 2026

January 31, 2025

83827+ views

Builder Floors: A Budget-Friendly Path to Your Dream Home in 2026

January 31, 2025

57095+ views

Indira Awas Yojana 2026: Meaning, Application, Documentation and Benefits in India

January 19, 2026

37645+ views

GPRA And the Pool of Information You Need to Know About How to Apply

April 10, 2021

30707+ views

Loved what you read? Share it with others!

Most Viewed Articles

GFRG Panels: A New Technology in Building Construction

January 31, 2025

261920+ views

Top Cleanest Cities in India: Swachh Survekshan Top Ranked List

July 25, 2025

221150+ views

Auspicious Dates and Good Nakshatras for Land and Property Registration in 2026

May 21, 2025

200322+ views

How Mivan Construction Technology Is Transforming the Art of Building!

January 31, 2025

178548+ views

CIDCO Lottery 2025: Apply for Affordable Homes in Navi Mumbai

April 30, 2025

135869+ views

Recent blogs in

Indira Awas Yojana 2026: Meaning, Application, Documentation and Benefits in India

January 19, 2026 by Kruthi

Unique Homes Around the World: 5 Extraordinary Houses You Must See in 2026

January 19, 2026 by NoBroker.com

Top Residential Projects In Bangalore: Luxury , Affordable & Upcoming Launches in 2026

January 17, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!