Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Understanding Fake Rent Receipts and their Consequences

Table of Contents

Let's dive into the concept of fake rent receipts and their significance in the financial world. Fake rent receipts, as the name suggests, are fraudulent documents that mimic legitimate rent receipts but contain false information.

You might be wondering why someone would resort to using fake rent receipts for HRA exemptions. These receipts are often used by individuals to claim House Rent Allowance (HRA) exemptions, which is a component of their salary that is exempt from taxes. By submitting fake rent receipts for HRA exemptions to the employer or tax authorities, they aim to show higher rent expenses than they incurred, thereby reducing their taxable income.

However, the use of fake rent receipts is illegal and comes with severe legal and financial consequences. Not only can it result in fines, penalties, and even imprisonment, but it also undermines the credibility of the financial system.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Penalties for Fake Rent Receipts

As you make financial decisions, it's crucial to remember that integrity and transparency are key principles in building a solid financial foundation. Using fake house rent receipts to reduce your taxable income is a breach of these principles and carries severe consequences.

The Income Tax Department closely monitors such activities, and any suspicious activity could lead to a legal notice seeking proof of your claims.

If you cannot provide evidence, your claimed exemptions may be disallowed. In more serious cases, the IT department may determine your claims be false, leading to penalties for misreporting or under-reporting of income.

Under the Income Tax Act, of 1961, the authorities have the power to impose penalties of up to 50% for under-reporting of income and up to 200% if the misreporting is intentional. Furthermore, you may be required to pay interest as per sections 234A, 234B, and 234C of the Income Tax Act.

Not only can fake house rent receipts result in legal penalties, but they can also harm your credit score and future financial opportunities. Your credit score is a crucial factor in determining your financial credibility, and a tarnished score can limit your ability to secure loans, credit cards, or other financial products.

Common Red Flags to Look Out for When Reviewing a Fake Rent Receipt

As a responsible individual, it is important to be vigilant when it comes to your finances, especially when it comes to HRA exemptions and rent receipts. Here are some common red flags to look out for when reviewing a rent receipt:

- Absence of rent agreement: When claiming HRA by providing a rent receipt, it is important to have a valid rent agreement in place. If there is no rent agreement present, it could indicate that the rent receipt is not genuine.

- Wrong or fake PAN details: Ensure that the PAN details of the landlord mentioned in the rent receipt are correct and match the PAN details on file with the Income Tax Department. If the PAN details are fake, it is a clear indication of a fake rent receipt.

- Non-declaration of HRA benefit: If your employer has not declared the HRA benefit in your Form 16, it could mean that the rent receipt is not genuine.

- Claims made by close relatives: If an employee has claimed HRA against a rent receipt issued by a close relative in the absence of proper supporting documents, it could be an indication of a fake rent receipt.

- Suspicious dates: If the rent receipt has a date that doesn't align with your rental history, it could be a fake.

- Unusual rent amounts: If the rent amount is significantly different from what you typically pay, it could indicate a fake receipt.

The Role of Proper Documentation in Preventing Fake Rent Receipts

Proper documentation is essential to maintain all the necessary records and documents that can support the HRA claims made by the employee. The following documents must be kept in order to avoid any discrepancies or fraudulent activities:

- Rent Agreement - A valid rent agreement signed by both the tenant and the landlord can serve as proof of the rental arrangement between the two parties.

- PAN details of the landlord - The PAN details of the landlord mentioned in the rent receipt must match the actual PAN details of the landlord.

- Form 16 - Employers must declare the HRA benefit received by the employee in the Form 16.

- Proof of payment - It is advisable to maintain proper records of the payments made towards rent. This can include bank statements, cheque copies, or any other supporting documents.

Alternatives to Using Fake Rent Receipts

As you strive to reduce your taxable income and maximize your financial well-being, it is important to understand that using fake rent receipts is not the only solution. There are several legal and ethical alternatives that you can use to claim HRA exemptions without putting your financial future at risk.

One alternative is to use legitimate rent receipts that are backed by proper documentation. This includes having a valid rent agreement in place, declaring HRA benefits in Form 16, and providing accurate PAN details of the landlord. By using legitimate rent receipts, you can avoid penalties, protect your credit score, and ensure compliance with tax laws.

Another way to obtain legitimate rent receipts is by using services like NoBroker. NoBroker offers assistance in obtaining rent receipts from verified landlords. With our expertise and experience, you can ensure that your rent receipts are legitimate and meet all tax requirements.

The Impact of Fake Rent Receipts on the Real Estate Market

The use of fake rent receipts has a significant impact on the real estate market, causing harm to both tenants and landlords.

- Effect on Rental Market: Fake rent receipts have the potential to distort rental prices and skew the rental market. It allows tenants to claim HRA exemptions based on higher rent amounts than they pay, thereby reducing the taxable income. When such false claims become widespread, it can cause rental prices to rise, making it difficult for genuine tenants to afford the rent.

- Role of Proptech Companies: With the rise of proptech companies, fake rent receipts can be quickly detected and prevented. These companies use technology to verify the authenticity of rent receipts and prevent fraudulent activities in the rental market. They can assist landlords in identifying tenants who make false claims, thereby safeguarding the rental market from such malpractices.

- Long-term Consequences: Widespread use of fake rent receipts can have long-term consequences on the real estate market. If the Income Tax Department finds that a substantial number of tenants have claimed HRA exemptions based on fake rent receipts, it can lead to an investigation. This, in turn, can harm the reputation of the real estate market and cause a decline in investor confidence.

Wrapping Up

It is your responsibility to ensure the legitimacy of your rent receipts. By reviewing the documents carefully and seeking clarification from the authorities, you can take the necessary steps to avoid the use of fake rent receipts.

NoBroker's legal experts can assist in ensuring the legitimacy of rent receipts and help in claiming HRA exemptions. We offer a transparent and responsible solution, preventing the use of fake rent receipts and the negative consequences associated with them. Explore NoBroker's legal services by clicking the link below. If you have any inquiries, feel free to leave a comment and our team will assist you.

FAQ's

A1: Yes, it is illegal to create and use a fake rent receipt. Under the Income Tax Act, of 1961, the production and use of false rent receipts can result in penalties for misreporting or under-reporting of income. In some cases, the penalty can be as high as 200% if the misreporting is intentional. Additionally, the use of fake rent receipts can hurt an individual's credit score and future financial opportunities.

A2: A rent receipt must include the date of payment, the name and address of the landlord, the name of the tenant, the amount paid, and the rental period for which the payment covers. Additionally, the receipt should be signed and stamped by the landlord to serve as proof of payment. It's important to ensure all information on the receipt is accurate to avoid any potential legal consequences.

A3: Yes, a rent receipt can be created electronically using software or online platforms. This can streamline the process of keeping track of rent payments and can ensure that the information included on the receipt is accurate. However, it's important to verify the authenticity of any electronically generated rent receipts and ensure that they include all the required information, such as the date, amount, and signatures of both the landlord and tenant.

A4: No, there are no legitimate reasons for creating or using fake rent receipts. Not only is it unethical and illegal, but it can also result in severe financial penalties and negatively impact your credit score. It is always advisable to avoid fake rent receipts and instead use legitimate rent receipts that accurately reflect your rental transactions.

A5: Some alternatives to using fake rent receipts include using legitimate rent receipts, taking advantage of legal and ethical ways to claim HRA exemptions, and seeking the assistance of proptech companies like NoBroker to obtain legitimate rent receipts and ensure the legitimacy of HRA exemptions.

Recommended Reading

Understanding Fake Rent Receipts and their Consequences

January 31, 2025

7015+ views

Loved what you read? Share it with others!

Most Viewed Articles

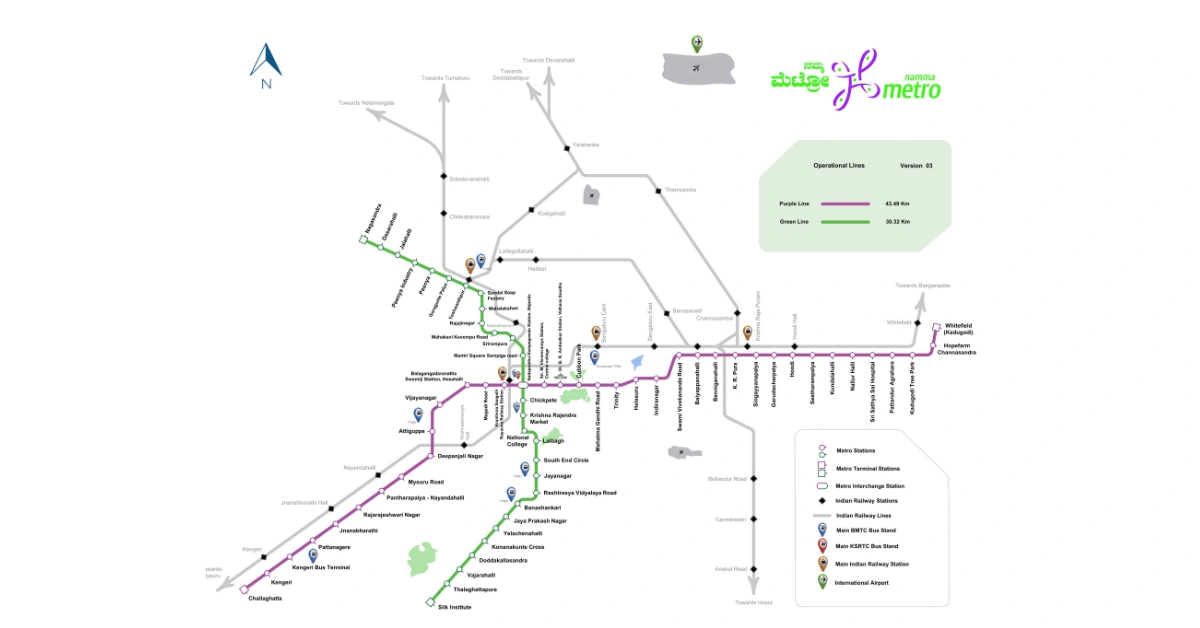

Bangalore Metro: Map Route, Timings, Lines, Stations List and Updated News 2026

May 4, 2025

485701+ views

Top 12 Richest Cities in India: Population, Area, GDP and Ranking in 2026

March 13, 2025

352732+ views

Purple Line Metro Bangalore: Routes, Maps and Timings and Fares

May 1, 2025

269552+ views

Yellow Line Metro Bangalore: Route, Map Timings, Stations and Fares in 2026

May 2, 2025

256135+ views

The Green Line Metro Bangalore: Routes, Maps, fares and Nearby Residential Areas

April 10, 2025

224418+ views

Recent blogs in

Nallurhalli Metro Station: Map, Parking, Station Lists and Nearby Residential Areas to Live in 2026

February 19, 2026 by Krishnanunni H M

Welcome Metro Station Delhi: Parking, Stations, Timings and Nearby Localities to Live in 2026

February 19, 2026 by Krishnanunni H M

February 19, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!