Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Form 16 - Why Is It Important for Your Income Tax Returns

Table of Contents

If you are an earning citizen of the country, you must have heard about Form 16. But do you really know why this document is important for you?

The annual return is the only way to report to the Indian Revenue Service (IRS) the income and expenses that were generated during the financial year, in order to contribute to the payment of taxes. This is a document that taxpayers, whether an individual or a legal entity, must present and/or send to the tax authority.

The process to do this is different according to the type of taxpayer and the regime in which they are registered. As a salaried individual, you are allowed to do the procedure either online or by visiting an administrative office. While there are certain documents that are mandatory to be submitted by salaried individuals during the filing of your income tax return, Form 16 is one of those vital documents to complete the procedure.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Form 16 is required to prove your tax compliance and is a valid document for loan sanctions. All employer issues Form 16 to their employees before the 31st of May of each financial year. Form 16 means that TDS (Tax Deducted at Source) has been deducted and deposited with the Government of India on behalf of the employee.

In this article, we will take a deep dive into the Form 16 format, its importance and how to download Form 16 online.

What is Form 16?

Income Tax form 16 is essentially a ‘salary certificate’ that employers in India are obligated to issue to employees as per Section 203 of the Income Tax Act, 1961. It contains a detailed description of the salary issued to the employee by the company in a particular financial year and the TDS deducted. The TDS is calculated based on the Income Tax slab rates for that particular financial year.

The Income Tax Form 16 details provide a lot of benefits to salaried individuals. Let’s take a look at how:

- You can easily file your Income Tax Return with the form 16 details without needing the help of any accountants or financial planners.

- Form 16 is considered an important document for tax compliance. During any income tax-related investigation, an individual can produce their form 16 to prove that they have paid tax according to government regulations.

- Banks and financial institutions that lend money also consider Form 16 as valid income proof. This is particularly true in the case of loan applications where Form 16 is mandatory for verification.

- If you are switching jobs, a lot of employers demand Form 16 from previous employers during their onboarding process.

- Not only this, a lot of visa checklists such as the Schengen visa for 26 European nations mention Form 16 as a mandatory document.

Form 16 is important for both your business and travel needs. The TDS form 16 certificate has two components- A and B. Let’s get into the details.

What Does Part A of Form 16 Include?

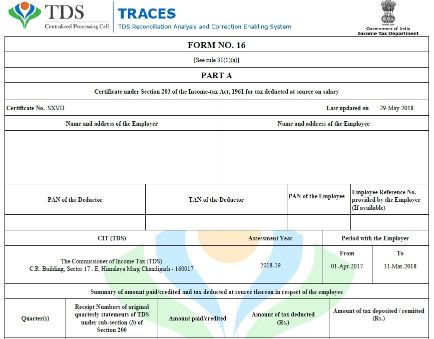

Form 16A for salaried individuals contains details of the TDS amount deducted and deposited quarterly, along with PAN and TAN details of the employer. It also contains the name and address of the employer and the employee's PAN details.

A lot of people often use the terms form 16 and form 16A interchangeably. However, in reality, the difference is vast. The difference is in who issues it. Form 16A for salaried individuals has details of the TDS deducted on incurred income other than the salary.

For example, if you have a Fixed Deposit then the bank will deduct a TDS on the interest generated by the FD. Hence, the bank will issue you Form 16A. In other cases where Form 16A is generated are TDS on rent receipts, insurance commissions and any other cases which are liable for deduction.

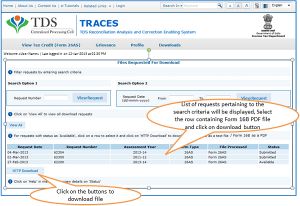

Kindly note that if an individual cannot download his/her Form 16A, the employer should always download and issue it to the employees. Employees can download Form 16 through the TRACES portal. The employer should authenticate all the contents before handing them to employees.

What is Included in Part B of Form 16?

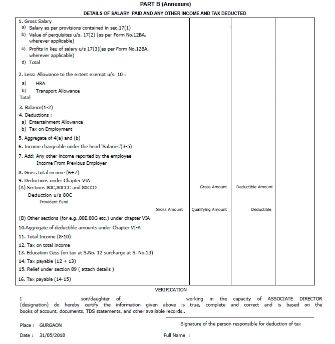

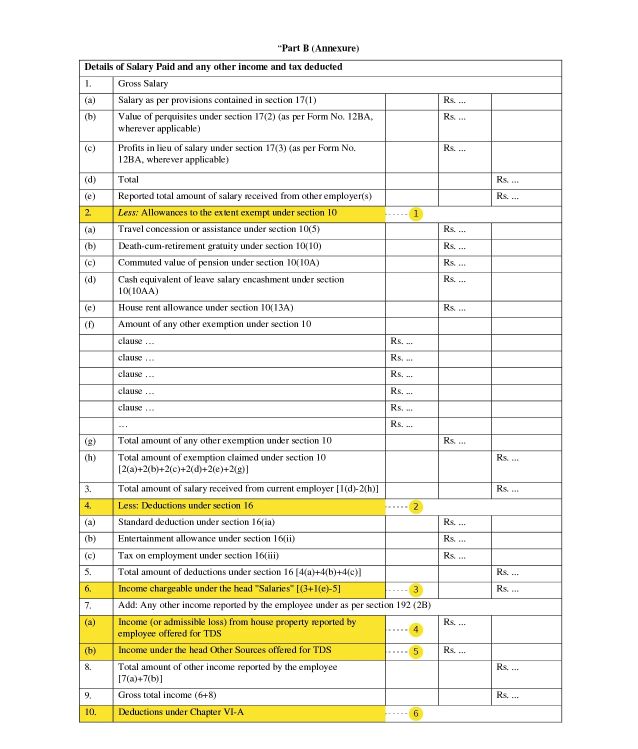

This is an annexure to part B of Income Tax Form 16. According to the Form 16 format, part B contains the full breakup of your salary details and other deductions as mandated by Section VI A. Chapter VI A of Income Tax Act basically comprises a lot of subsections of section 80 based on which an assessee can claim deductions from the gross total income.

Form 16 Online Contains the Following Components

- Gross salary incurred: The structure of the salary is further broken down into several parts namely the House Rent Allowance, Leave Encashment, Leave Travel Allowance, Gratuity along with many other components.

- Exemptions: According to Sec (10) of the Income Tax Act, 1961, this includes Conveyance, House rent (HRA), Children’s education, hostel expenditure and medical costs.

- Gross Income: This is the total of the salary received from the office and from other sources such as income earned from house/property etc. If there is an additional source of income, one should share it with the employer during the submission of investment proofs.

- Part of Salary Deductions: If you have made investments in schemes like Life Insurance policies, Sukanya Samriddhi Yojna, Public Provident Fund (PPF), any Recognized Pension Scheme, or Mutual Funds, as mentioned in Section 80 C / 80 CCC / 80 CCD, these investments are considered as partial deductions from your salary. Apart from the above-mentioned categories, deductions towards MediClaims, education loans, and donations are covered under section 80D/80G/80E. The deductions cannot cross the limit of INR. 1,50,000. All employees need to submit all such investment supporting documents to the employer as and when required.

- Net Taxable Salary: The total sum of deductions as mandated under “Chapter IV-A” to be subtracted from your gross income. This is your Net Taxable salary. This is the amount taken into account for the calculation of your net payable taxes.

- Some other components of the form are, Education Cess and surcharges, tax deducted and the balance tax due or refund applicable, rebate under Section 87, total payable tax on income, and relief under Section 89, if applicable.

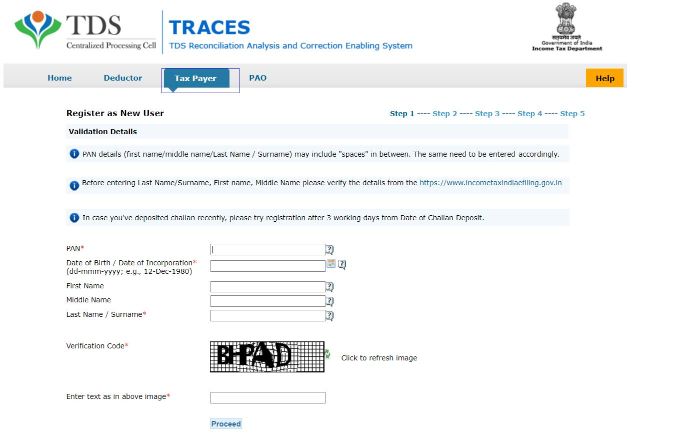

The employee can download Form 16B from the TRACES site by following a few simple steps:

a) Firstly, register on the TRACES site as a new user with the help of your PAN number. The User Id is your PAN no and the password is of your choice

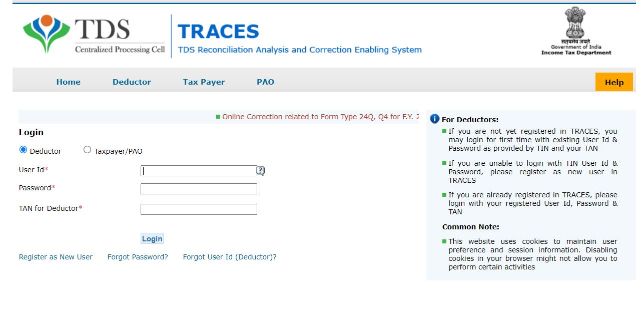

b) If you are already registered, then visit the official TRACES website and log in by entering your User ID and Form 16 password.

c) Click the Downloads Tab.

d) Select Form 16B

e) Enter the required details and click on ‘Go’.

f) You can choose which file to download from the list

Approved Deductions Under the Income Tax Act

- Deductions from salary in the form of a premium paid for life insurance deductions, PPF contributions and others under Section 80C as well as Deduction for contribution to pension funds under Section 80CCC

- Under section 80CCD (1) it is mandatory to make deductions in favour of contributions to pension schemes made by the employees

- Deduction towards a notified pension scheme as the taxpayer’s self-contribution is also approved under Section 80CCD(1B)

- Employer’s contribution to any pension scheme, also falls under the category of permitted deductions, under Section 80CCD (2)

- The deduction is based on the amount of premium paid for health insurance under Section 80D

- Deductions based on interest paid on higher education loans under Section 80E

- Deductions based on donations are mandated as per Section 80G

- Deductions based on Savings account interest incomes under Section 80TTA

Details Required While Filing Your Return from Form 16

Part B annexure form

Deductions

As you can see in the images above, you will need certain details from your Income-tax form 16 while filing your Income Tax Return:

- Exempted allowances as mandated under Section 10

- Deduction breakups as mandated under Section16

- Amount of the salary taxable

- Income or loss incurred from house property in the form of TDS

- Income that falls under the heading Other Sources paid as TDS

- Section 80C Deductions and the breakup

- The aggregate of gross and net deductible allowances, under Section 80C Deductions

- Due Tax Payable

What are the Eligibility Criteria for Form 16?

As mandated by the Finance Ministry of the Indian government, all salaried individuals who fall under the income tax bracket are eligible for form no 16. In cases where the employee does not fall under this bracket, TDS is not deducted. Under these circumstances, the employer is not obligated to issue a Form 16. However, nowadays a lot of organizations issue Form no 16 for such employees too as a good work ethic.

Things to Remember While Checking Form 16

- Once an employee receives his/her Form 16, it is very important to check all the information and ensure that it is correct.

- Go through your personal details thoroughly and also verify the gross income and deducted TDS details.

- Make sure to double-check the PAN number. Any discrepancy will lead to legal complications. In the event of any discrepancies, one must immediately contact the Human Resource, Finance or Payroll Department and get the information corrected

- The employer will thereby issue an error-free and updated TDS form 16 to the employee. The employer will also be responsible for updating the Income Tax details to make sure the salary is credited to the right PAN account.

Upload Form 16 and File Income Tax Return

You can file your Income Tax returns both offline and online. To upload your Form 16 online, you don’t need to do much. Simply, click here and add your form 16. The software will automatically pick up relevant information from your Form 16 and file your Income Tax return.

Form 16 is an extremely vital document for filing your Income Tax returns. The above details will make this process a little less complex. However, if you're looking for a way to save on tax, the BEST way is by investing in real estate! If you're looking to buy a house, check NoBroker for plenty of options for every budget. Click the link below and get started on your search.

FAQ's

Ans. Your TDS form 16 is very important in proving your tax compliance. It is particularly helpful when banks/ financial institutions do salary verifications before sanctioning a loan.

Ans. Any salaried individual who falls under the tax bracket of the current financial year is eligible to be issued a Form 16.

Ans. The employee should immediately contact the HR/Payroll/Finance Department and get the information corrected.

Ans. You can download Form 16B from the TRACES official website.

Ans. No. They are vastly different. Income tax Form 16 refers to the TDS deducted on your salary while Form 16A is issued by banks or financial commissions to inform you of TDS deducted on your other sources of income or assets.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

60131+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

48135+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

43005+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

38905+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

33216+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115277+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

192900+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132012+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

127513+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!