Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Fractional Ownership and How It Is Affecting the Commercial Real Estate World

Table of Contents

Did you know that experts predict that Fractional Ownership in India will reach $5 Billion in a few years? As a society, we have placed a lot of trust and loyalty in real estate investments. Ownership of land is considered one of the most significant class symbols that ensures your position in the uppermost strata of the community. However, even though the past few generations were able to invest their life savings in gold and real estate relatively quickly, the urbanites of the present era have been limited to investing in residential apartments or small plots of land. At the same time, we as a human populace also face several scarcities making successful investments difficult to attain.

Especially, in a nation where the population is increasing, our nation faces a scarcity of land, which ultimately means that real estate has proven to be a successful investment. But at the same time is out of reach for people looking to join the landowner bandwagon. Instead of investing in depreciating assets, people want to look into Commercial Real Estate (CRE) that ensures better rental cash flow. However, CRE requires better connections, comprehensive knowledge of the real estate market, and considerable money. As a result, High Networth Individuals (HNIs) or the Ultra HNIs are the only ones who can partake in this top section of the investment world.

After the pandemic took everyone for a financial run, Fractional ownership of CRE has emerged as a promising concept for reliable investments that would provide long-term capital appreciation and daily returns as well. Owing to its low risk and high return properties, fractional ownership real estate ownership is a boon for average citizens looking to make profitable investments. Read more to find out about fractional property ownership and how it can benefit an ordinary citizen.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

What is Fractional Ownership?

Ownership in itself dictates our sole right over any property. But fractional ownership, as the nomenclature suggests, is the concept of owning just a fraction of any property rather than being the exclusive proprietor with the rightful benefits. Commercial Real Estate in India is a profitable investment right now and comes with specific financial barriers that limit the entry of average citizens into the market.

For example - There's a luxury office space worth Rs 100 crore in one of the prime locations of Delhi. Considering the very high range of capital investment, no one except a High Networth Individual (HNI) can afford to purchase it. Even though it promises multiple benefits and is a safe investment option, an average citizen offering just Rs 10 Lakh cannot lay claim to it. But what if multiple people come together, pool all their savings, and make an offer for the Commercial Real Estate in question? That would mean that each person gets to own a part of the office and split the benefits equally. As time passes and the market value of real estate increases, all the people who invested in the office space could earn rental returns and avail themselves of the long-term capital benefits as well.

That is precisely what the concept of fractional ownership of real estate plans to do. It empowers people with limited capital to be part-owners of Commercial Real Estate.

Why is Fractional Ownership of Commercial Real Estate Growing?

Fractional Ownership of Commercial Real Estate is steadily rising in India as the CRE market is expected to grow by 13% to 16% in the next five years. Some of the reasons for this predicted boom could be related to the fact that the country is looking at an augmented demand for office space in upcoming years, an increase in the number of large institutional investors, and a huge investment of foreign money related to multiple commercial projects. All these factors contribute towards a potential for high capital appreciation.

Commercial Real Estate usually involves Grade A properties that are often leased by Multinational Corporations, Banks, Warehouses, Factories, or Information Technology establishments with a considerable budget. Unlike residential tenants, such organisations do not tend to vacate the premises at short notice and leave the property owner in a bind. On the other hand, a rental lease for allocating commercial spaces is three years long or more. Therefore, one significant benefit of renting property to commercial organisations is that they pay the rent on time and set the entire area themselves according to their needs. In addition, considering that they use the property as an office, they put all their efforts into keeping the space organised and are more likely to renew their lease instead of looking to set up an office somewhere else.

Seeing a monthly deposit in the bank account and the constant increase in the market value of a property is resulting in many interested parties looking to invest in fractional shares of Commercial Real Estate.

Possible Approaches / Models of Fractional Ownership

While you need to know the co-ownership agreement structure and the process as a first step towards buying a property, it is also important to know the different models offering several benefits. The first model is known as the 'Pay-to-use' model wherein the co-owners make a payment of a pre-agreed 'usage fee' for a daily or weekly usage. This usage fee, in addition to any other income through the rent for the property, is used to pay the expenditures of ownership. If the total income along with usage fees and rental income is collectively greater than the expenses, then the surplus amount is divisible among the property owners. Furthermore, the purchase price and the ownership of the property is divided on the basis of what every co-owner can afford, what their investment goals are, as well as any other criteria that the owners' group collectively finds useful.

The second model that is used to allocate usage rights is the 'Usage Assignment' model, wherein every owner is given the right to exclusively use the property for a certain period of days, weeks or even months within a year. The periods of such usage can be variable or fixed or even a combination of the two. Moreover, during every co-owner's allocated period of use, the property can be used by the co-owner to be rented out, swapped, or even leave it unoccupied.

Essentially, the types of usage as part of the fractional ownership model involves the different ways of sharing the benefits of the usage of the asset, the rights involved from every member, ensuring priority access, and providing those at reduced market rates. The only difference between fractional and timeshare ownership is that fractional ownership is where the investor gets to own a part of the property instead of units of time. This means if the asset grows in its value, the benefits and surplus shared by the co-owners increase as well.

Does Fractional Property Investment Support Liquidity?

The process of converting an asset into cash without harming its market price is called liquidity. When looking to invest, liquidity is a rather important concept that is equally beneficial for companies and investors. Technically speaking, cash is the most liquid asset as currency in any form can be used in transactions. Generally, rare metals are considered more fluid, and commercial properties are deemed illiquid assets.

With the introduction of fractional ownership Commercial Real Estate can be easily liquidated by the part-owner. For example - if a person with fractional property investment wants to sell their share, they can quickly transfer their portion of the property to another willing investor. Also, note that exclusive ownership of property doesn't allow the proprietor the same kind of freedom to switch between investments.

Fractional Ownership Vs. Real Estate Investment Trust (REIT) - Which is More Beneficial?

Investment and risk go hand in hand. There's no way to ensure that your investment will carry zero risks over a while and will guarantee big bucks to fill your pockets. However, you can always study the market, look at the current trends and take expert advice on how the real estate world might look in upcoming years. At present, Commercial Real Estate is in high demand considering its ever-increasing market value. However, CRE has limitations, like the huge capital amount that retail investors cannot afford. As a result, CREs were fair play for High Networth Individuals (HNI) only.

But with the introduction of concepts like REITs and fractional ownership, an average citizen can purchase a part of CRE and gain monetary benefits generated by monthly rental income or the interest generated on the security deposit amount. But how does REIT vs fractional ownership compare?

REIT (Real Estate Investment Trust) is a lot like mutual funds. Just like mutual funds pool the money and make investments like government bonds, direct equity, stocks, etc., REITs pool money to invest in profitable real estate on your behalf. Such properties are leased out to business organisations, through which the part-owner gets their share of the capital. But REITs do not allow you the freedom to pick the property to invest in.

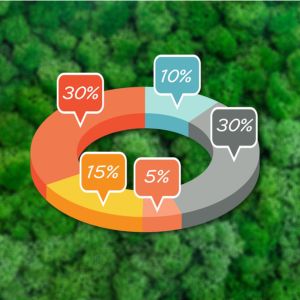

Fractional real estate investing, on the other hand, happens with your choice. First, fractional ownership platforms list the CRE property that investors are welcome to check out. Then, based on the market price of each property, the minimum ticket size or fractional real estate investment is decided. Finally, based on the ticket amount, you can choose how many portions you want to own. One of the more ideal fractional ownership examples is to imagine if there are a total of 10 tickets available and you decide to purchase 2 of them, you now own 20% of the property and get your share of the money generated through it.

Fractional Ownership V/S Vacation Ownership

Fractional owners must make arrangements with the property management companies to utilise the house for personal purposes. The amount of time fraction ownership may spend at the vacation home is subject to limitations set by each property or management business. Fractional owners are not compelled to use all of their allotted time themselves. They could allow their loved ones, friends, coworkers, and even staff to use some of their time. Fractional owners may lease their unused time to other owners or make it available to non-owner third parties by informing the property managers in advance.

Differences Between REIT and Fractional Ownership

- Fractional ownership allows you to diversify and invest in multiple properties in different locations. REITs present a set portfolio with a fixed number of assets in it.

- Fractional ownership allows liquidity, and you are free to sell your share whenever you want. REITs cannot be transferred or sold as per the investor's choice.

- There's no minimum value set for investing in CRE via fractional ownership. REITs have a minimum value of Rs 500 crore, which ultimately reduces the options of property.

- Fractional ownership can undertake properties that are under construction or not in use presently. According to SEBI guidelines, REITs must have at least 80% of their investment in income-generating properties.

Things to Keep in Mind Before Diving into Fractional Ownership

Investing in CREs is considered a wise choice due to the high number of benefits, complete transparency, and safety. But there's no substitute for experience when it comes to fractional ownership real estate investment. The factors mentioned below can help you make a better decision regarding CRE investments.

- Extensive market Research: Fractional ownership is a relatively new concept in India, and only a few start-ups provide the opportunity to invest in CREs. Most of these start-ups are run by successful investors. It is best to conduct your research and figure out the company with capable leaders and an extensive investor network.

- Get the best Deal: Searching for a property with the highest return on minimum investment is a fairly easy task compared to other factors like evaluating the current market price of that particular property. Experienced investors know to look for a deal where they do not pay more than the market price for a property.

- Check for customer-oriented solutions: Look for businesses or prop-tech firms that provide you with easy exit options and ensure maximum capital gains with a high yield in the long run.

You must have heard the phrase - "the rich get richer and the poor get poorer." This statement could be considered accurate for investment options in our country where promising opportunities like Commercial Real Estate (CRE) could only be afforded by High Networth Individuals (HNIs). At the same time, the retail investors could only dabble in high-risk share markets or low-return provident funds. However, with the introduction of fractional ownership, the CRE market has been democratised and can now reach the average citizen. Already prominent in most western countries, Singapore, Hong Kong, etc., fractional ownership is a new yet promising concept in India that allows multiple investors to come together, pool their money, and buy a CRE property. If you are looking to invest in CRE, reach out to professionals at the Financial Department of NoBroker who will advise you at a minimal cost.

FAQ's

Ans. Yes, fractional ownership is a good option for investing in CRE compared to timeshares. As the market value for CRE keeps increasing, your share value keeps growing as well.

Ans. You can invest in fractional ownership by taking a mortgage but considering its low popularity in India, you might face some trouble finding a regional bank that will comply.

Ans. REIT does not allow the investor to use the money wherever wanted, while fractional ownership is more democratic and works according to the investor's choice.

Ans. Yes, fractional property ownership applies to buildings under construction and not in use presently.

Ans. You can purchase multiple tickets based on your budget and own the resulting percentage of CRE property.

Recommended Reading

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115324+ views

Revenue Stamp in India: Meaning, Types, Uses, Legal Value & Where to Buy in 2025

January 31, 2025

127481+ views

How to Get a Stay Order in India: Step-by-Step Legal Process in 2025

May 31, 2025

92473+ views

FSI in Mumbai 2025: Calculate FSI in Mumbai Municipal Corporation

January 31, 2025

90484+ views

What are Society Transfer Charges as per the Housing Act and Rules in 2026?

January 31, 2025

82219+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115324+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193097+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132389+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

127770+ views

We’d love to hear your thoughts

Join the conversation!

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

ravi

Thank you for sharing the information. I appreciate your time and efforts in collecting and sharing valuable information on Fractional Ownership.

March 28, 2023, 1:51 pmKaran shetty

Do check out www.claravest.com, its an upcoming startup focused on fractional real estate.

May 27, 2023, 5:29 pm