Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Guidance Value Bangalore 2025: Changes, Trends & Impact on Property Market

Table of Contents

The state government of Karnataka, effective October 1, 2023, increased the guidance value, the minimum price set by the government for property transactions, by an average of 25% to 30% across the city. This became a major relief for the real estate sector in the city, which continued to push back after the pandemic and the effects of the lockdown. But do you know how guidance value in Bangalore is calculated? Let’s take a look at the conventions and guidelines for determining the sub-registrar guideline value in Bangalore 2025 and find out how an individual can calculate the property guideline value in Bangalore.

What is the Sub-Registrar Guidance Value in Bangalore?

Guidance or guideline value is the minimum amount at which a property transaction can be formally registered. The Department of Stamps and Registrations decides the guidance value in Bangalore. Even a slight change in the guidance value of a property in Bangalore can have a huge impact on the property price since it directly impacts the property's value. In other words, the guidance value for flats in Bangalore is also called the ready reckoner value of the property. The recent revision by the government means the property prices in Bangalore will be slashed accordingly.

The term ‘Guidance Value’ or ‘Guideline Value’ is used interchangeably and means the same thing. It can also be known as the ready reckoner rate or the circle rate of the property. It is important to pay attention to these rates as they directly affect the property tax value and impact the price of a property. As already mentioned, the state government’s Department of Stamps and Registrations is responsible for maintaining the guidelines and conventions for seamless collection of the guidance value of a property.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

In a conference in 2023, Karnataka’s Revenue Minister R Ashoka spoke at length about how the government expects some turnaround from the real estate sector with the move to cut property guidance value in the state for 3 months.

The government hopes the cut in guidance value for apartments in Bangalore will encourage home registration even though it may affect the state treasury for a while. “Slashing guidance value may result in some loss to the treasury, but we expect more property registrations,” Ashoka said

Importance of Paying the Guideline Value of a Property in Bangalore 2025

The government guidance value is an important source of income for the state to maintain its treasury. Through the means of property registrations and the collection of guidance value, the state government declares the legal ownership details and rights around the property. It is important to pay the property guidance value to have a legal claim on the property. This helps in case a legal dispute is raised around the property. The courts will decide the legal owner based on the documents maintained by the state’s Stamps and Revenue Department.

Difference between Guidance Value in Bangalore and Market Value

The guidance and market values are the two key factors influencing property transactions in Bangalore, each serving a distinct purpose.

| Guidance Value | Market Value |

| The minimum price set by the government for a property. | The actual price at which a property is bought/sold in the open market. |

| The value is calculated based on the standardised formula set by government authorities. | The value is calculated based on the actual real estate market conditions. |

| It serves legal and administrative purposes. | It is related to real estate transactions. |

| It reflects long-term trends. | It reflects short-term external factors. |

| The guidance value is fixed and inflexible. | Market value is highly flexible. |

How to pay the Latest Guidance Value in Bangalore 2025?

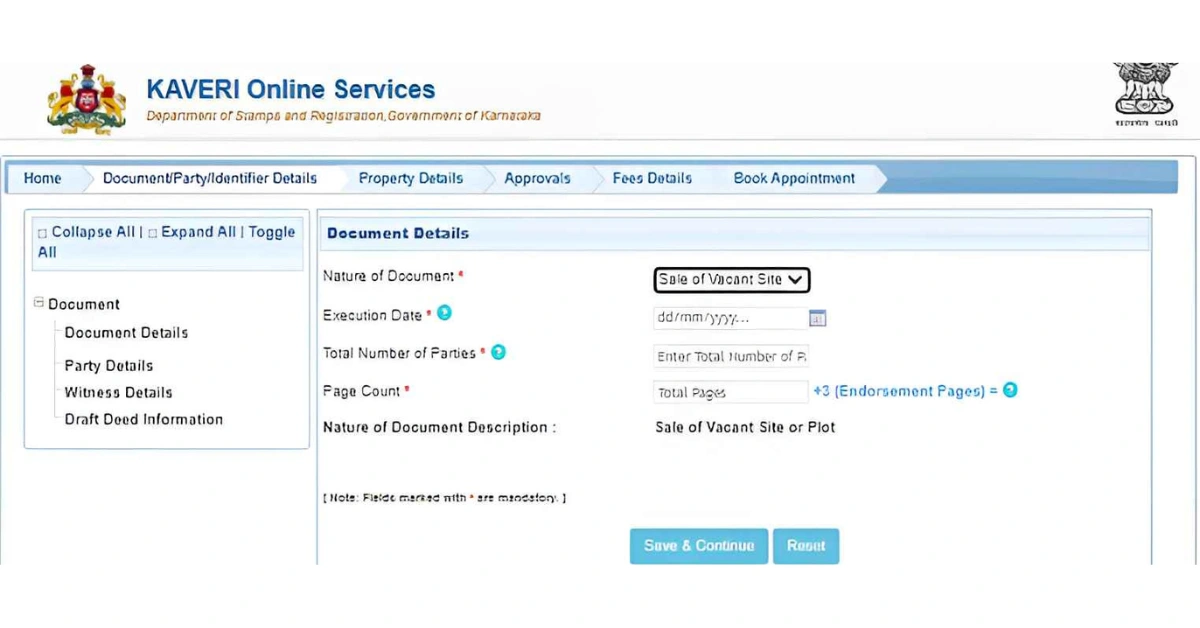

These days, property registrations can be made through both online and offline platforms for convenience. In Bangalore, you can pay the guidance value offline at the sub-registrar's office. Paying the BBMP guidance value offline can be confusing and a bit hectic, especially during the pandemic when all offices operate with regulated manpower. The most convenient method to pay the property guideline value in Bangalore is online through the Kaveri guidance value web portal. Here is a step-by-step guide to help you calculate the guidance value of property in Bangalore in 2025.

Guidance Value Calculator Bangalore

- Visit the KAVERI land valuation web portal

- You will get two search options on the homepage – Basic Search and Advanced Search

- Select ‘District’ from the drop-down menu provided on the website

- Select your Area under the tab for ‘Area Name’

- Choose from – Property Usage Type, Total Area, and Measurement Unit.

- Under the Advanced Search mode, you need to furnish extra details like Registration District and SRO Office.

Through these simple steps, prospective buyers can use the Kaveri Guideline value portal to get an idea of the applicable rates and calculate the guidance value in Bangalore. Let’s take a look at the prevalent rates of guideline value in Bangalore 2025.

How to Check Guidance Value Bangalore Offline 2025?

To check the guidance value for a property in Bangalore offline in 2025, visit the nearest sub-registrar office that covers the area where the property is located. Here's how to do it:

- Find out the sub-registrar's office responsible for the area where the property is situated.

- Visit the office and enquire about the guidance value for your specific property type and location.

- Verify the most current guidance value based on their records.

- Take note of the guidance value and any other relevant details provided by the sub-registrar.

Key Factors that Determine the Guidance Value in Bangalore

The guidance value in Bangalore is determined by several key factors, which help the government assess a minimum value for properties in different areas. These factors include:

1. Location: The property's location is the primary factor affecting guidance value. High-demand areas with better infrastructure and accessibility, like Koramangala, Whitefield, and Indiranagar, generally have a higher guidance value than less developed or more peripheral areas.

2. Land Use Type: Whether the property is residential, commercial, or industrial plays a significant role. Commercial properties tend to have higher guidance values due to their income-generating potential, whereas residential properties may vary based on their type and use.

3. Proximity to Key Infrastructure: Properties near metro stations, highways, and commercial hubs are valued higher. Areas near IT parks or upcoming developments will also have a higher guidance value.

4. Market Trends: While the guidance value is government-determined, it is influenced by real estate market conditions. A booming real estate market or an area that’s becoming more popular will see an increase in guidance value.

5. Property Type: The type of property, whether it’s a single-family home, apartment, or land, will impact the guidance value.

List of Sub-Registrar Offices in Bangalore (Urban)

| Rajajinagar District | Basavanagudi District | Shivajinagar District | Gandhinagar District | Jayanagar District |

| Rajajinagar | Basavanagudi | Shivajinagar | Gandhinagar | Jayanagar |

| Yashwanthpaura | Chamarajapete | Indiranagar | Malleshwaram | Santhinagar |

| Vijayanagar | Banashankari | Halsuru | Ganganagar | BTM Layout |

| Srirampuram | Anekal | Banasawadi | Hebbal | Kengeri |

| Peenya | Attibele | KR Puram | Kacharakanahalli | Rajarajeshwari Nagar |

| Laggere | Sarjapura | Mahadevapura | Byatarayanapura | JP Nagar |

| Nagarbhavi | Jigani | Bidarahalli | Yelahanka | Bommanahalli |

| Madanayakanahalli | Varthur | Jala | Begur | |

| Dasanapura | Hesaraghatta | Tavarekere |

List of Sub-Registrar Offices in Bangalore (Rural)

- Nelamangala

- Doddaballapura

- Devanahalli

- Hoskote

Sub Registrar Guidance Value in Bangalore

Here is the sub-registrar guidance value in Bangalore 2023 for different areas.

| AREA | RATES (PER SQ MT) |

| VANI VILAS MARKET TO D. BANUMALAH CIRCLE ON SAYYAJI RAO ROAD | ₹32,000 |

| BANUMALAH CIRCLE TO K.R. CIRCLE | ₹68,200 |

| K.R. CIRCLE TO AYURVEDA HOSPITAL CIRCLE | ₹1.15 LAKH |

| AYURVEDA HOSPITAL TO RMC CIRCLE | ₹49,100 |

| RMC CIRCLE TO HIGHWAY CIRCLE | ₹32,600 |

| KUMBARAKOPPAL MAIN ROAD | ₹1,29,000 |

| KUMBARAKOPPAL CROSSROADS | ₹9,600 |

| KUMBARAKOPPAL INNER CROSSROADS | ₹9,900 |

| KUMBARAKOPPAL COLONY | ₹6,500 |

| KUMBARAKOPPAL SOUTH SIDE | ₹13,000 |

| GOKULAM MAIN ROAD | ₹38,400 |

| GOKULAM CROSS ROAD | ₹19,800 |

| GOKULAM IST & 2ND STAGE | ₹25,000 |

| GOKULAM 3RD STAGE | ₹28,000 |

| GOKULAM 4TH STAGE | ₹20,000 |

| CONTOUR ROAD EWS | ₹19,700 |

| KARNATAKA SLUM DEVELOPMENT BOARD HOUSES | ₹8,600 |

| BOGADI 1ST & 2ND STAGE | ₹28,000 |

| JANATANAGAR | ₹11,800 |

| SRIRAMPURA 1ST STAGE | ₹23,000 |

| SRIRAMPURA 2ND STAGE | ₹24,000 |

| METAGALLI MAIN ROAD | ₹18,300 |

| HALESORU | ₹8,500 |

| AMBEDKAR COLONY | ₹3,500 |

| B.M SRI NAGAR MAIN ROAD | ₹10,100 |

| B.M SRI NAGAR CROSS ROAD | ₹8,300 |

| KARAKUSHALA NAGAR | ₹5,400 |

Sub Registrar Guidance Value in Bangalore

| AREA | RATES (PER SQ MT) |

| VANI VILAS MARKET TO D. BANUMALAH CIRCLE ON SAYYAJI RAO ROAD | ₹32,000 |

| BANUMALAH CIRCLE TO K.R. CIRCLE | ₹68,200 |

| K.R. CIRCLE TO AYURVEDA HOSPITAL CIRCLE | ₹1.15 LAKH |

| AYURVEDA HOSPITAL TO RMC CIRCLE | ₹49,100 |

| RMC CIRCLE TO HIGHWAY CIRCLE | ₹32,600 |

| KUMBARAKOPPAL MAIN ROAD | ₹1,29,000 |

| KUMBARAKOPPAL CROSSROADS | ₹9,600 |

| KUMBARAKOPPAL INNER CROSSROADS | ₹9,900 |

| KUMBARAKOPPAL COLONY | ₹6,500 |

| KUMBARAKOPPAL SOUTH SIDE | ₹13,000 |

| GOKULAM MAIN ROAD | ₹38,400 |

| GOKULAM CROSS ROAD | ₹19,800 |

| GOKULAM IST & 2ND STAGE | ₹25,000 |

| GOKULAM 3RD STAGE | ₹28,000 |

| GOKULAM 4TH STAGE | ₹20,000 |

| CONTOUR ROAD EWS | ₹19,700 |

| KARNATAKA SLUM DEVELOPMENT BOARD HOUSES | ₹8,600 |

| BOGADI 1ST & 2ND STAGE | ₹28,000 |

| JANATANAGAR | ₹11,800 |

| SRIRAMPURA 1ST STAGE | ₹23,000 |

| SRIRAMPURA 2ND STAGE | ₹24,000 |

| METAGALLI MAIN ROAD | ₹18,300 |

| HALESORU | ₹8,500 |

| AMBEDKAR COLONY | ₹3,500 |

| B.M SRI NAGAR MAIN ROAD | ₹10,100 |

| B.M SRI NAGAR CROSS ROAD | ₹8,300 |

| KARAKUSHALANAGAR | ₹5,400 |

How can we appeal against the wrong guidance value in Bangalore?

If you believe that the guidance value assigned to your property in Bangalore is incorrect or outdated, you can appeal through both online and offline methods.

Offline Method:

- Visit the official Kaveri Online Services portal.

- Log in and select the 'guidance value' option.

- Submit a complaint detailing the discrepancy and supporting documents such as recent sale deeds, property valuation reports, or other relevant evidence.

- A government official will physically inspect and compare your property with similar properties in the area.

- The findings may be used to revise the guidance value or reject the appeal. The entire process typically takes a few weeks.

Offline Method:

- Determine which sub-registrar office has jurisdiction over your property's location.

- Visit the sub-registrar's office and file a formal complaint along with the supporting documents.

- The sub-registrar will review your submission and may conduct further investigations before making a decision.

New Guidance Value in Bangalore for Agricultural Land (Per acre)

Here is the land guidance value in Bangalore:

| Agriculture land (Kushki) at Ajjayyanahundi | ₹51 lakh/acre |

| Thari land at Ajjayyanahundi | ₹53 lakh/acre |

| House sites at Ajjayyanahundi | ₹4,750/sq.mt |

| House sites approved by the Development Authority | ₹10,900/sq.mt |

| Agricultural land (Kushki) at Chowdahalli | ₹30 lakh/per acre |

| Agricultural land at Ayarahalli | ₹8.5 lakh/acre |

| Thari land at Ayarahalli | ₹9 lakh/acre |

| Govt Uthanahalli (MUDA limits) | ₹32 lakh/acre |

| Inam Uthanahalli | ₹8 lakh/acre |

| Amchawadi Village in Yelwal Hobli | ₹3.50 lakh/acre |

| Anandur | ₹20 lakh/acre |

| Yelwal Hobli MUDA limits, Mysuru-Hunsur Road | ₹35 lakh/acre |

| Anaganahalli under Mysuru West Office limits | ₹8 lakh/acre |

| Arasinakere | ₹5 lakh/acre |

| Udbur (MUDA Limits) | ₹22 lakh/acre |

| Kadakola | ₹35 lakh/acre |

Guidance Value in Bangalore in Prime Areas

| CUNNINGHAM ROAD (CHANDRIKA HOTEL TO BALEKUNDRI CIRCLE) | ₹2,78,600 |

| LAVELLE ROAD | ₹2,07,900 |

| M.G.ROAD, BRIGADE ROAD, RESIDENCY ROAD | ₹1,95,500 |

| 12TH MAIN, HAL 2ND STAGE | ₹1,11,800 |

| DEFENSE COLONY, INDIRANAGAR | ₹1,71,800 |

| CMH ROAD, 1ST TO 12TH CROSS | ₹1,43,200 |

| 9TH MAIN, JAYANAGAR | ₹3,87,500 |

| DOLLARS COLONY, RMV 2ND STAGE | ₹1,84,000 |

| SAMPIGE ROAD, MALLESHWARAM | ₹2,05,000 |

| SADASHIVANAGAR (C.V. RAMAN AVENUE TO BHASHYAM CIRCLE) | ₹2,58,200 |

| SANKEY TANK ROAD | ₹2,70,000 |

| DR. RAJKUMAR ROAD | ₹1,61,500 |

| ESI HOSPITAL ROAD, RAJAJINAGAR | ₹1,10,000 |

| NANDIDURGA ROAD | ₹1,75,000 |

| BANNERGHATTA MAIN ROAD (HOSUR ROAD TO DAIRY CIRCLE) | ₹1,53,000 |

| VITTAL MALLYA ROAD | ₹2,08,900 |

These are the rates of guidance value for property registration in Bangalore.

How to Book Your Legal Expert Services With NoBroker?

Paying the guidance value of a property in Bangalore is very important as it will help you avoid legal disputes around the property. As a responsible homeowner or buyer, you should be aware of the government guidelines for guidance value calculation and property tax collection. There is no room for any mistakes in these complicated legal matters, and it’s always advisable to bank on the expertise of professional lawyers and consultants to help you with the formalities and paperwork. If you need help with guidance value in Bangalore, property registration, encumbrance certificate, loan assistance, etc., reach out to the legal experts at NoBroker. Get all your real estate queries resolved without any complications. Drop a comment about your requirement, and our executive will be in touch with you shortly.

Frequently Asked Questions

Ans. The guidance value of a property is the minimum amount at which the property registration should take place. This cut-off amount is determined by the state’s Department of Stamps and Revenues.

Ans. A property's guidance value indicates the property tax associated with it. Paying the property registration charges means the prospective buyer is now registered as the legal owner of the property. This is important as it avoids real estate feuds and disputes. real estate feuds and disputes around the property.

Ans. Cunningham Road has the highest guidance value in Bangalore. The guidance value for property registration in Bangalore’s Cunningham Road is RS 2,78,600.

Ans. The state government has slashed the guidance value in Bangalore for 3 months starting from Jan 1, 2023 to Mar 31, 2023

Ans. The guidance value of a property in Bangalore is dependent on a lot of factors including the number of floors, area, locality, amenities etc. That is the primary reason why guidance value in Bangalore differs from location to location.

Ans. To find the guidance value of a property in Bangalore, visit the official web portal of the Department of Stamps and Revenue. Fill in the required details and get details about the guidance value in Bangalore.

Recommended Reading

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

120385+ views

How to Get a Stay Order in India: Step-by-Step Legal Process in 2025

May 31, 2025

92369+ views

FSI in Mumbai 2025: Calculate FSI in Mumbai Municipal Corporation

January 31, 2025

90365+ views

BBMP e-Aasthi: Search Property Details, Download Certificates, and Check Status Online

April 10, 2025

85521+ views

What are the current Stamp Duty and Property Registration Charges in Karnataka

January 23, 2025

77765+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115276+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

192898+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

131997+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

127512+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!