Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

MCD Property Tax Complete Guide

Table of Contents

Understanding transfer charges in MCD property tax is essential for Delhi residents navigating the real estate market. In this blog we'll delve into the significance of transfer charges, why they are levied, and how they impact property transactions in Delhi. Let's simplify this complex aspect of property ownership for a clearer understanding.

House Tax New Delhi: MCD property tax calculator Delhi

All property owners in Delhi are supposed to pay a property tax to the Municipal Corporation of Delhi (MCD). This tax is levied on all the real estate properties falling under the jurisdiction of MCD. Now, this tax varies from property to property depending on the tax rate determined by the government. Let’s take a look at how the taxes are calculated in different zones of Delhi and calculate the property tax in Delhi online.

| Information | Details |

| Authority | Municipal Corporation of Delhi (MCD) |

| Who Pays | Owners of residential and commercial properties within MCD jurisdiction (East Delhi, North Delhi, South Delhi) |

| Tax Base | Annual Rental Value (ARV) for properties |

| Rate | Varies depending on the ARV and property type (residential/commercial) |

| Payment Options | Online portal, designated banks, mobile app (MCD311) |

| Last Due Date | Typically two installments - June 30th and December 31st (subject to change, refer to official website) |

| Official Login Link | MCD Website: https://mcdonline.nic.in/ |

MCD Commercial Property Tax

Property tax rate in Delhi

| Category | The tax rate for commercial property (in %) | The tax rate for industrial property (in %) |

| A | 20 | 15 |

| B | 20 | 15 |

| C | 20 | 12 |

| D | 20 | 12 |

| E | 20 | 12 |

| F | 20 | 10 |

| G | 20 | 10 |

| H | 20 | 10 |

House Tax South Delhi

Residents of South Delhi pay taxes to the SDMC. South Delhi is divided into five zones - Central Zone, South Zone, West Zone, Najafgarh Zone and Headquarters respectively. These individual zones are then divided into various colonies and wards. The calculation of the South Delhi Municipal Corporation house tax is based on the unit area system.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Property tax = The annual value of a property x present rate of tax

The annual value of the property is calculated based on the area of the property, unit area value per square meter, occupancy factor, age factor, structure factor, use factor, and flat factor.

South Zone of SDMC Includes

Colonies: Hauz Khas, Nehru Place, Saket, Lado Sarai, Safdarjung Enclave, JJ Colony (Khanpur), Satya Niketan, Delhi University South Campus

Wards: Greater Kailash I, Tilak Nagar, Hauz Khas, Gulmohar Park, Vasant Vihar, Mehrauli, Devli, R K Puram, Chattarpur, Saket Subhash Nagar, Pushp Vihar Janakpuri West, Pratap Nagar, Rajouri Garden, Uttam Nagar, Malviya Nagar, Tagore Garden, Nangal Raya

West Zone of SDMC includes:

Colonies: Rajouri Garden (WZ Area), Uttam Nagar, Subhash Nagar, Hari Nagar

Wards: Pratap Nagar, Janakpuri West, Nangal Raya, Subhash Nagar, Rajouri Garden, Tilak Nagar, Tagore Garden, Uttam Nagar

Central Zone of SDMC includes -

Colonies: Lajpat Nagar, HUDCO Place, Friends Colony, Kasturba Niketan, Sarita Vihar, South Extension, Greater Kailash, Govind Puri, Okhla Vihar, Jasola

Wards: Sewa Nagar, Darya Ganj, Defence Colony, Nizamuddin, Jangpura, Okhla, Bhogal, Kalkaji, Sangam Vihar West, Chirag, Tughlakabad, Harkesh Nagar Sriniwaspuri, Badarpur

Najafgarh zone of SDMC includes -

Colonies: Geetanjali Park, JJ Colony Nangloi, Jeevan Niketan, Kamla Market, Harijan Colony, Prem Nagar, Sultan Puri, Nazaf Garh, Roshan Pura, Shiv Vihar Neelwal

Wards: Nangloi, Pira Garhi, Bijwasan, Roshanpura, Isapur, Sagarpur, Madhu Vihar, Matiala, Mahipalpur, Kakrola, Dabri, Sultanpur Majra

House Tax North Delhi

Residents of North Delhi pay house tax to NDMC (North Delhi Municipal Corporation) division of MCD. NDMC has divided the area into seven different zones with separate colonies and wards. Seven zones of North Delhi are Headquarters, Karol Bagh, City SP Zone, Civil Lines, Narela, Rohini and Keshav Puram.

Keshav Puram zone of NDMC includes -

Colonies: Maurya Enclave, Pitampura, Vishakha Enclave, Shalimar Bagh Rishi Nagar Apna Ghar Appt.

Wards: Pitampura, Model Town, Kamla Nagar, Rani Bagh, Sangam Park, Paschim Vihar, Kohat Enclave

Rohini zone of NDMC includes -

Colonies: Nangloi Village, Nai Basti, Ram Nagar, Rohini Sector - 10, Rohini Sector - 5,6,11,12, Rohini Sector-1, Shiv Colony Budh Vihar

Wards: Rohini-B, Rohini-E, Rohini-F, Rohini-G, Mangol Puri-A, Mangol Puri-B, Mangol Puri-C, Mangol Puri-D, Nangloi, Budh Vihar, Vijay Vihar

Narela Zone of NDMC includes -

Colonies: Rohini Sector-27, Rohini Sector-28, Rohini Sector-29, Rohini Sector-30, Rohini Sector-31, Rohini Sector-32, Rohini Sector-33, Rohini Sector-33

Wards: Bawana, Rohini-C, Rohini-D, Rani Khera, Begumpur, Alipur

City SP zone of NDMC includes -

Colonies: Jama Masjid, Meena Bazar, Khush Dil, Chandrawal Village, Baradari

Wards: Shastri Nagar, Delhi Gate, Ajmeri Gate, Chandni Chowk, Lines, Delhi Gate, Masjid, Ram Nagar

Karol Bagh zone of NDMC includes -

Colonies: Arya Naga, Chuna Mandi, Kucha Tiku Sah, Pahar Ganj, Ram Nagar, Shora Kothi, Punjab Garden, SBM Colony, Ramesh Nagar

Wards: Inderpuri, Karol Bagh, Kirti Nagar, Naraina, Pahar Ganj, Ramesh Nagar,West Patel Nagar, Rajinder Nagar

Civil Line zone of NDMC includes -

Colonies: Burari, Saroop Vihar, Zindpur, Yuvraj Colony, Shankarpura, Nathu Colony, Burari Extn. Colony

Wards: G.T.B. Nagar, Shanti Nagar, Mukund Pur, Mukherjee Nagar, Kamal Pur, Burari, Adarsh Nagar, TimarPur

House Tax East Delhi

East Delhi is classified into two zones known as Shahdara North and Shahdara South respectively. These zones are then divided into wards and colonies.

Shahdara North zone of EDMC includes -

Colonies: Arvind Nagar, Shastri Park (Seelampur), Gautampuri (Jaffrabad), Kardampuri, Mustafabad

Wards: Babar Pur, Usmanpur, Yamuna Vihar, Maujpur, Karawal Nagar East

Shahdara South zone of EDMC includes -

Colonies: Ghazipur Dairy Farm, Nanakpura Shakarpur, Usha Enclave, Societies, Shashi Garden

Wards: Trilokpuri East, Dallupura, Mayur Vihar Phase, Kondli, Shakarpur, Mandawali

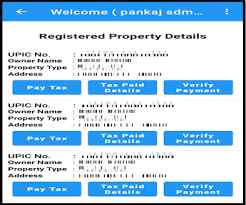

MCD Property Tax Login 2024

In 2024, accessing your MCD property tax account online is crucial for Delhi residents to manage their tax obligations conveniently. Here's a simple guide on how to login into your MCD property tax account for the year 2024:

- Visit the MCD Official Website: Begin by visiting the official website of the Municipal Corporation of Delhi (MCD) through your web browser.

- Navigate to Property Tax Section: On the MCD website homepage, locate the section dedicated to property tax. This section may be labelled as "Property Tax" or "Online Services".

- Find the Login Option: Within the property tax section, look for the option to log in to your account. This option is typically located at the top-right corner of the webpage.

- Enter Your Credentials: Click on the login option, and you will be redirected to the login page. Enter your mobile number and OTP in the respective fields.

- Access Your Account: After entering your login credentials, click on the "Login" or "Sign In" button to access your MCD property tax account.

- View Your Property Tax Details: Once logged in, you will be able to view details of your property tax assessment, including dues, payments, and any other relevant information.

- Update Information (if necessary): If you need to update any information in your MCD property tax account, such as contact details or property ownership details, you can do so within your account settings.

- Make Payments: If you have outstanding property tax dues, you can make payments conveniently through your MCD property tax account using various online payment methods.

- Logout Securely: After completing your tasks, don't forget to logout from your MCD property tax account to ensure the security of your personal information.

MCD Property Tax Online Bill Payments 2024

Delhi Nagar Nigam house tax payment can be made only through the MCD official website. Over the last year, a lot of user interface changes have been introduced to the website to make the process of house tax payment in Delhi a lot more convenient. Once you reach the MCD portal, you will see that there are three different options for North MCD, South MCD and East MCD. If you are not sure which municipal corporation to pay tax to, you can check the detailed area wise list mentioned on SDMC, EDMC and NDMC's official website.

Please note that the payments for west Delhi MCD property tax are covered by South MCD as there’s no separate MCD department of the west or south-west area of Delhi.

For filing property tax under SDMC, EDMC and NDMC, click on the respective link. You will be redirected to a services page from where you must select Property Tax. Use Citizen's login option and sign in with the registered mobile number. Once done, you can click on the terms and conditions checkbox and proceed to the next step. Select whether you are paying the property tax for the first time or not and then enter your property ID. Click on compute tax and then proceed with the internet banking process for MCD house tax online payment in Delhi. After the payment is successful, click on 'generate Challan' to download the receipt for future references.

If you do not pay the house tax on time, MCD charges 1% fine for each month delayed on the unpaid amount. After the payment is done, make sure that your account does not show any pending balance.

For more assistance on:

- online house tax payment north Delhi, go to https://services.india.gov.in/service/detail/pay-property-tax-online-in-north-delhi-municipal-corporation-delhi

- online house tax payment south Delhi and west Delhi, go to https://services.india.gov.in/service/detail/pay-property-tax-online-in-south-delhi-municipal-corporation-delhi

- east Delhi property tax online payment, go to https://services.india.gov.in/service/detail/pay-property-tax-online-in-east-delhi-municipal-corporation-delhi-1

How To Pay MCD Property Tax Online Through NoBroker Pay?

If you are still confused about paying the MCD property tax you can try our NoBroker Pay Services for a hassle-free payment experience. You can follow these steps:

- Open the NoBroker App.

- Go to the NoBroker Pay option.

- Select the bill payment option.

- Select Municipal Taxes.

- Select your state and enter the Property ID

- Finally, make the payment.

MCD Property Tax Receipt Download 2024

In 2024, obtaining a copy of your MCD property tax receipt is essential for Delhi residents to maintain accurate records and track their tax payments. Here's a guide on how to download your MCD property tax receipt for the year 2024:

- Visit the MCD Official Website: Start by visiting the official website of the Municipal Corporation of Delhi (MCD) using your preferred web browser.

- Navigate to Property Tax Section: Once on the MCD website homepage, locate the section dedicated to property tax. This section may be labelled as "Property Tax" or "Online Services".

- Login to Your Account: If you have a registered account on the MCD website, log in using your credentials. If not, you may need to create an account to access certain features.

- Access Receipt Download Option: After logging in, navigate to the section where you can download property tax receipts. This option is usually found under the "View/Download Receipts" or similar category.

- Select the Receipt: Once you've accessed the receipt download section, choose the specific property tax receipt that you wish to download. You may need to enter details such as the assessment year or property identification number (PID) to locate the correct receipt.

- Download the Receipt: After selecting the desired receipt, look for the download option, typically represented by a download icon or a "Download" button. Click on this option to initiate the download process.

- Review the Downloaded Receipt: Once the download is complete, open the receipt file to review its contents. Ensure that all information, including the payment amount and property details, is accurate.

- Store the Receipt: After reviewing the downloaded receipt, save it to a secure location on your device or print a hard copy for your records. This receipt serves as official proof of your property tax payment for the year 2024.

Mcd Property Tax Status 2024

Checking your MCD property tax status for 2024 is crucial for Delhi residents to ensure compliance and avoid penalties. You can verify your property tax status in the following ways:

- Visit MCD Official Website: Go to the Municipal Corporation of Delhi (MCD) website.

- Navigate to Property Tax Section: Find the section related to property tax.

- Enter Property Details: Input your property identification details.

- Check Status: View your property tax status, indicating if payments are up-to-date or if there are any outstanding dues.

Take Necessary Action: If there are dues, promptly arrange payment to avoid penalties.

House Tax Calculator for Delhi

MCD calculates house tax based on a unit area system. The property tax amount is the product of Annual value and rate of tax.

Annual value is the product of numerous factors like:

Unit area value - Per square meter value assigned to the covered area of the property.

| Category | Unit area value (Rs per sq metre) |

| Category A | 630 |

| Category B | 500 |

| Category C | 400 |

| Category D | 320 |

| Category E | 270 |

| Category F | 230 |

| Category G | 200 |

| Category H | 100 |

Unit area of the property - MCD calculates area based on the total built-up area, instead of considering carpet area.

Age factor - Based on the age of the property, this factor deviates between 0.5 and 1. Newer properties tend to have a higher factor because of increased market value.

| Year of construction | Age factor |

| Pre 1960 | 0.5 |

| 1960-69 | 0.6 |

| 1970-79 | 0.7 |

| 1980-89 | 0.8 |

| 1990-99 | 0.9 |

| Post-2000 | 1 |

Use factor - Based on the purpose of the property, the usage factor is determined. Residential properties have lower use factors than commercial buildings.

| Property category | Use factor assigned |

| Residential property | 1 |

| Non-residential public use | 1 |

| Non-residential public utility | 2 |

| Industry, entertainment and clubs | 3 |

| Restaurants, hotels of 2-star rating and below | 4 |

| 3-star rating and above restaurants, hotels, Towers, Hoarding etc. | 10 |

Structure factor - RCC (Reinforced cement concrete) construction properties tend to attract higher taxes than low-value construction properties.

| Construction type | Structure factor assigned |

| Pucca (RCC Construction) | 1.0 |

| Semi-pucca Property | 1.0 |

| Kuchha Property | 0.5 |

Usage factor - Self-occupied properties have lower taxes than rental income-generating properties.

| Occupancy type | Occupancy factor assigned |

| Self-occupied property | 1.0 |

| Rental income generating property | 2.0 |

| Vacant plot | 0.6 |

House Tax Rate in Delhi 2024

| Category | Property Tax Rate for Residential Property | Tax Rate for Commercial Property | Tax Rate for Industrial Property |

| A | 12% | 20% | 15% |

| B | 12% | 20% | 15% |

| C | 11% | 20% | 12% |

| D | 11% | 20% | 12% |

| E | 11% | 20% | 12% |

| F | 7% | 20% | 10% |

| G | 7% | 20% | 10% |

| H | 7% | 20% | 10% |

Exemption on House Tax in Delhi

There are certain exemptions granted by MCD for property tax, they are states below:

- Vacant plots or buildings that are used for charitable purposes or as heritage land, public burial ground or place of worship.

- Agricultural plot or building.

- Any land or building granted to corporations.

- Residential property of any ex-servicemen or widow of a martyr.

- Any property of a martyred rin the paramilitary or police duty.

- Properties that are owned by physically disabled south MCD employees, who are working full-time.

- Athletes/sportspersons who have won international medals or awards.

House Tax Delhi - Rebates

There are certain rebates granted by MCD for property tax-

- If you pay the entire tax amount at once during the first quarter of the year, you will receive a 15% rebate on the total amount payable.

- DDA/CGHS flats of 100 square meters or less receive a 10% rebate on the total annual amount.

- Women homeowners, physically disabled individuals and senior citizens receive a 30% rebate for one property.

- Ex-servicemen get a 30% rebate on the total property tax amount.

- Group housing flats can claim a 20% rebate till 30th June of the financial year.

Latest News for MCD Property Taxpayers

- No Extension for Geo-Tagging: The deadline for property owners to geo-tag their properties on the MCD Mobile App has passed. Those who haven't done so yet will not be eligible for the 10% rebate on advance tax payments.expand_more

- Property Tax Collection Down: The Municipal Corporation of Delhi (MCD) witnessed a drop in property tax collection for the 2023-24 financial year.expand_more The collection dipped by 11.5% when compared to the previous year, with fewer taxpayers and lower overall revenue.expand_more

- Focus on Increasing Collection: Despite the dip, MCD remains committed to increasing property tax collection. They're exploring technological solutions like geo-tagging to improve efficiency and potentially raise more revenue in the coming year.

- Amnesty Scheme Not Renewed: There's no news on a revival of an amnesty scheme for property tax defaulters. If you have outstanding property tax dues, it's advisable to settle them as soon as possible to avoid penalties.

All urban and local bodies collect taxes for the welfare of citizens and the facilitation of basic amenities. In the capital of India, house tax Delhi is collected by the Municipal Corporation of Delhi (MCD). MCD is further divided into South Delhi Municipal Corporation (SDMC), the North Delhi Municipal Corporation (NDMC) and the East Delhi Municipal Corporation (EDMC). All property owners are liable to pay house tax on an annual basis to the respective branch of MCD. Certain rebates and exemptions are also granted to property owners in specific conditions.

Still, looking for a property in Delhi? NoBroker could help you find brokerage-free homes! Click on the link below and start your home search the smart way.

Frequently Asked Questions

Ans:If you end up misplacing your property tax ID, get in touch with an official from MCD who can help you get a new one. You will also be fined for the re-allotment process.

Ans: SDMC overlooks any matters related to West Delhi. You can also check the colony and ward list for the same.

Ans: MCD calculates property tax by following the 'Unit Area System.' Property tax is the product of annual value and current tax rate.

Ans: No, EDMC does not accept manual property tax payments anymore.

Ans: Ex-servicemen are liable for a 30% rebate on property tax in Delhi.

Ans: MCD residential property tax rate in South Delhi is 12%.

Recommended Reading

Top 20 Posh Areas in Delhi: Most Expensive & Best Residential Areas in Delhi

January 5, 2025

64692+ views

Capital Gains Tax on Inherited Property: Rules, Rates & Exemptions in 2025

December 31, 2024

122+ views

Take A Look at These Ultra Luxury Apartments in Delhi and Pick Your Dream Home

December 30, 2024

6600+ views

PCMC Property Tax Online: Download E-Receipt, Name Change, Rebate and More

December 30, 2024

8153+ views

KMC Property Tax Payment: A Step-by-Step Walkthrough

December 30, 2024

5911+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

December 31, 2024

1003825+ views

Supreme Court Verdict on Society Maintenance Charges

December 17, 2024

60518+ views

December 26, 2024

55975+ views

All You Need to Know about Revenue Stamps

December 17, 2024

46906+ views

Stamp Duty and Registration Charges in Bangalore in 2025

December 17, 2024

44928+ views

Recent blogs in

Benami Transaction Act, 1988: Key Features, Legal Implications, and Penalties in 2025

January 3, 2025 by Ananth

Encumbrance Certificate Karnataka - Online and Offline Application Process in 2025

January 2, 2025 by Jessica Solomon

Non-Occupancy Charges: A Guide for Property Owners and Tenants

December 31, 2024 by Kruthi

Sale Deed: Your Guide to Property Ownership

December 31, 2024 by Kruthi

Small Cash Loan on Aadhar Card: Instant Approval, No Paperwork in 2025

December 31, 2024 by Kruthi

Join the conversation!