Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Find Out How to Check your CIBIL Score Online, Its Benefits, Affecting Factors and More!

Table of Contents

A person's creditworthiness is indicated by their CIBIL score, a three-digit numerical expression that runs from 300 to 900 and is based on a thorough analysis and examination of their credit files and history. The Credit Information Bureau (India) Ltd., a credit rating company authorised by the Reserve Bank of India, provides the CIBIL score.

Individuals can access CIBIL scores and credit records, in addition to banks and non-banking financial companies (NBFCs). These ratings are based on your credit history, which might include everything from a history of loan payback to a history of credit card repayment.

The only factor used to generate your CIBIL score, which ranges from 720 to 900, is your credit history and behaviour. It provides the borrower with a number of advantages, including quick approvals, lower interest rates, and a larger loan amount.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

A borrower with a high CIBIL score has a better chance of receiving the best interest rate and goes through the loan approval procedure more quickly.

Therefore, it follows that a score between 700 and 900 will be regarded as good.

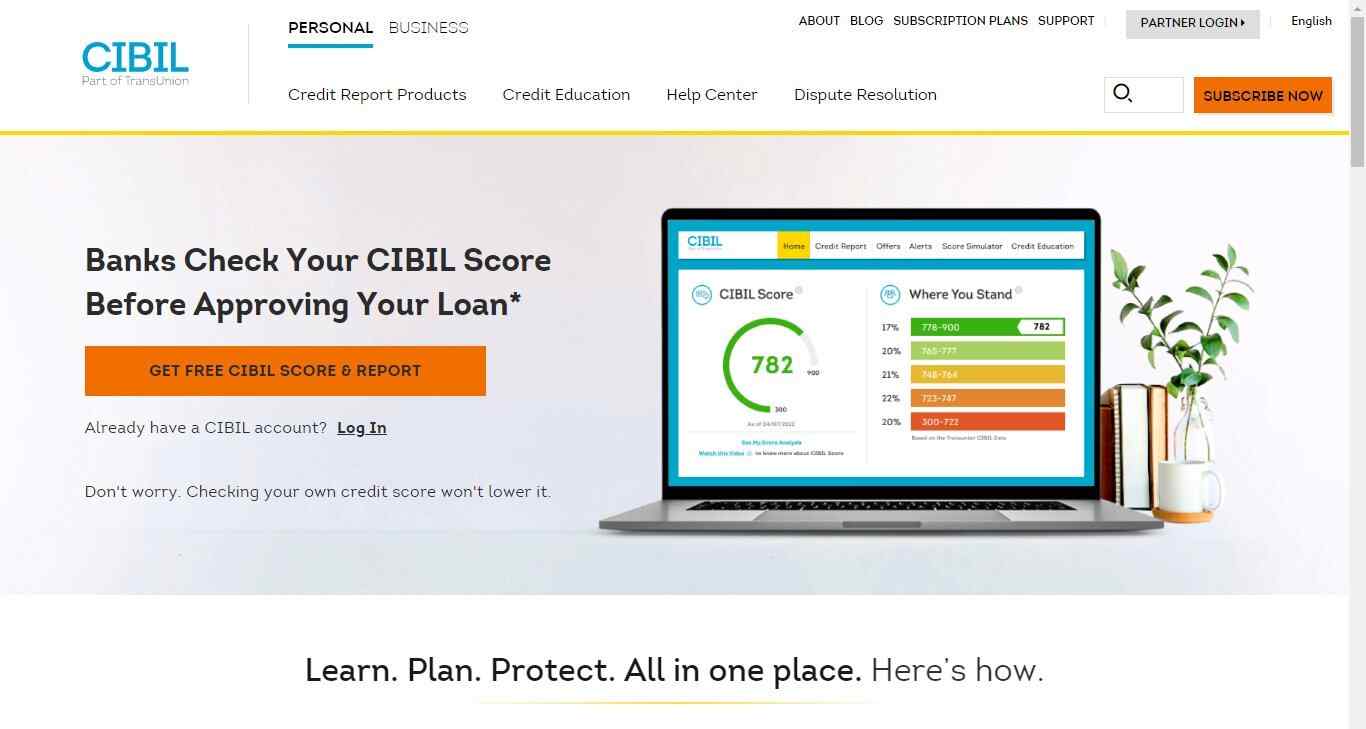

How to Check My CIBIL Score Online? : A Step-By-Step Guide

Get access to your CIBIL score for free by following this step-by-step guide. Empower yourself with valuable credit information as you easily check and monitor your CIBIL score online.

- Head to the official CIBIL website and select the “Get Free Cibil Score and Credit Report” option.

- Enter the required information like your name, date of birth, email address, pin code, phone number and attach an ID proof like Aadhar card, Passport, PAN card or voters ID. Click on “Accept and Continue”.

- Verify the OTP sent to your phone number by typing it in the next window and click “continue”. If you do not receive the OTP on the first attempt, click on “resend OTP” and follow the steps.

- Once the OTP is verified you can click on the “go to dashboard” button which will lead you to myscore.cibil.com

- Here click on member login to be able to check your credit score.

Credit Bureaus in India: Promoting Financial Transparency

In the realm of Indian finance, four credit bureaus hold the key to credit histories: TransUnion CIBIL, Equifax, Experian, and CRIF Highmark. Credit bureaus play an important role in the Indian financial system by providing lenders with information about borrowers' creditworthiness.

Here’s a brief overview of the four credit bureaus in India:

TransUnion CIBIL: Established in 2000 with its headquarters in Mumbai,TransUnion CIBIL is India's leading credit bureau, providing lenders and borrowers with comprehensive credit information to make informed financial decisions.

Equifax: In India, Equifax was granted the Certificate of Registration in 2010 by the RBI. The company is a global credit bureau offering valuable insights and credit solutions, empowering lenders and individuals to navigate the lending landscape with confidence.

Experian: Established in 2009, Experian is a trusted credit bureau with a vast data network, delivering comprehensive credit information and innovative solutions to lenders and individuals in India.

CRIF Highmark: Established in 2007, CIRIF Highmark is known for its cutting-edge analytics, offering lenders and borrowers advanced credit information and insights for effective decision-making.

What are the Benefits of a Good CIBIL Score?

A high CIBIL score is important and offers numerous benefits. Therefore, before asking for a loan, a potential borrower needs to be aware of the advantages. The following are some advantages of having a higher CIBIL score:

1. Lower borrowing rates

The biggest advantage of having a high CIBIL score is a reduction in interest rates. The likelihood of default affects the interest rate. As a lender, a high credit score assures you that the borrower will make timely and regular loan repayments. Because there is little chance of default, your lender can charge you a lower interest rate.

2. Higher Credit Limits

Your reliability and responsibility as a borrower are demonstrated by a high CIBIL score. Because of this, the lender might be more willing to grant you a larger credit limit on your card or a larger loan sum.

3. Higher Chances of Loan Approval

When you apply for a loan or credit card, every lender retrieves your credit report and examines your credit score. A hard inquiry is what it is, and each time one is made, your credit score is lowered. If your application is denied, the consequences could be disastrous.

However, if you have a high credit score and a solid credit history, which includes a history of making loan payments on time and regularly, your chances of getting your loan approved are very high.

A strong credit score also shows that you have not racked up debt that would make it impossible for you to repay the loan amount by taking out many loans from various lenders. Because the lender is certain that the loan will be repaid in full and on time, the approval prospects are quite high and practically guaranteed.

If your CIBIL score is between 700 and 900, you can expect a home loan for up to 80% of the total cost of the property.. Since personal loans are unsecured loans, these standards cannot be expected in this situation.

As a result, the loan amount will be determined by the purpose for which it is being used as well as your CIBIL score. There is no specific minimum CIBIL score for car loans, but it is recommended to have a score above 700 to be assertive when applying.

CIBIL Score Ranges and How They Are Perceived by Lenders

Wondering what is the maximum CIBIL score? CIBIL scores range from 300-900. A score of 700 or above is ideal. The following are the possible CIBIL scores and how lenders perceive them-

750- 900: A CIBIL score between 750 and 900 is very good. It implies that you have a reliable payment history and have made credit payments on time. Banks will give you loans and credit cards because they believe you have a low risk of defaulting.

650- 749: If your CIBIL score is between 650 and 749, you are on the correct track. You should maintain your good credit habits to raise your rating even higher. Lenders will take your credit application into account and make you a loan offer. However, you might not yet have the negotiating strength to secure the best deal.

550- 649: A CIBIL score between 550 to 649 is regarded as fair. However, since this is still below the ideal CIBIL score range, only a few lenders would think about extending you a loan. It implies that you have had trouble making on-time payments of the bills. The loan's interest rate may be higher. To get better loan terms, you must make genuine efforts to raise your CIBIL score.

350- 549: A CIBIL score between 350 and 549 is regarded as being below average. It indicates that you have missed payments on loan EMIs or credit card bills. You will find it challenging to obtain a loan or credit card if your CIBIL score is in this range because you run a high risk of defaulting on your obligations.

NA/NH: Your CIBIL score will be NA/NH if you have no credit history, which denotes that it is either "not relevant" or "no history." You won't have a credit history if you've never used a credit card or applied for a loan. By using credit, you can access credit goods and establish a credit history.

Credit score monitoring platforms in India have reported that the average CIBIL score in India for the financial year 2022 was 715.

CIBIL Score Check Online: 4 Factors that Affect Your CIBIL Score

1. Type of Credit and Duration

The length of time since you initially opened a credit account is the age of your credit history. The average number of years that you have held a credit account is taken into account by CIBIL. It helps to raise your score to have a healthy mix of secured and unsecured loans.

A healthy credit mix indicates that you have a lot of experience managing various kinds of accounts. You are a low-risk borrower if you have a solid repayment history and a long credit history. It is best to begin establishing your credit history as soon as possible because it will be beneficial later on when you want to buy a house or a car.

2. Payment History

You must pay your monthly credit card bills and loan EMIs on time in order to keep your score good. Your credit score will be affected if you are making late payments or default on EMIs. Regularly missed payments are another sign that you have trouble maintaining good credit.

According to a recent CIBIL analysis, 30-day delinquency can result in a 100-point drop in your score.

3. Credit Utilisation Ratio

Your CIBIL score is unaffected by having a loan or several credit cards. Your score will drop, nevertheless, if your credit usage percentage is high. The ideal amount to spend from your credit limit is no more than 30%.

A higher credit utilisation ratio indicates that your debt load has been growing and that you are more likely to become insolvent. Keeping track of your credit card spending will help you avoid going over your credit limit.

4. Credit Inquiries

Credit inquiries are yet another factor considered when calculating your score. Every time you apply for a loan or credit card, the lender will check your credit history. It is known as a hard inquiry.

Your rating will be affected if you apply for credit multiple times in a short period of time. Therefore, it is advised that you distribute your credit application submissions over the year rather than doing it all at once.

Factors that Positively Affect CIBIL Score

- Paying credit card bills by the due date or earlier.

- Paying all of your full credit card bills on time. Paying up all of the dues each month rather than just the minimum amount due.

- Keeping your credit card balance between 20 and 30 per cent of its real limit.

- Consistently making your loan payments on time or early.

- Avoiding excessive leverage.

- Maintaining a healthy balance between secured and unsecured credit.

- Periodic monitoring of credit score.

- Ensuring that the credit report is accurate by periodically reviewing it.

- Obtaining copies of your own credit reports rather than relying on the financial institutions

- Keeping up-to-date financial records without any missed payments or outstanding debts.

Factors that Negatively Affect CIBIL Score

- Having a lot of unsecured debt, like credit card debt and numerous personal loans.

- Having a bad credit history or none at all.

- Receiving denials for several unsecured loan applications.

- Irregular loan repayment, utility bill payment, and EMI payback behaviour.

- Frequently asking to have your credit card limit increased.

- Shutting down credit cards with a large credit limit.

- Turning into a defaulter by not paying credit card bills, paying them late, or paying sporadically.

- Keeping your credit usage ratio high (at least 40% of your credit limit).

- Having only loans and credit cards. Instead, focus on keeping both types of credit in good balance.

- Avoid requesting credit from several banks and other lenders at the same time.

- Becoming ineligible to pay as a guarantor for friends or family members

- Closing long-standing credit accounts that are old.

- Not periodically reviewing credit scores.

- A long period of time without challenging errors in your credit report.

How is CIBIL Score Calculated?

There are 5 main aspects that are taken into consideration when calculating your CIBIL score. They are-

Previous Loans, Defaults and Penalties

- Secured loan repayment delays or defaults have a more detrimental effect than unsecured loan defaults.

- More damage is caused by recent write-offs than by previous ones.

- Lenders have recorded write-offs of prior obligations lower rating

- More write-offs result in a lower score.

Secured and Unsecured Loan and Credit Card Debts:

- Low score due to high credit card balances

- Use of credit cards more often than secured loans is discouraged.

- Score is raised by fewer such accounts and a history of frequent payments.

Past Payments:

- A list of all previous payments

- A lower score results from delayed payments.

- Recent payment delays have a greater detrimental effect.

- A higher score is obtained by consistently making payments on time.

Several Loan Enquiries:

- Numerous loan inquiries to obtain loans are a sign of "credit-hungry" behaviour, which lowers score.

Loan to Income Proportion:

- Low loan balances are a sign of responsible credit usage, which raises credit scores.

- High loan balance lowers rating.

Why do Lenders Look for a Good CIBIL Score in Borrowers?

If a CIBIL score is between 700 and 900, it is considered as good. Banks and NBFCs will take this into account when evaluating a loan application for the majority of retail loans, whether it be a home loan or a car loan.

When applying for a loan, having a high CIBIL score, also known as a credit score, has many advantages, including:

- An expedited and speedy loan application process

- Loan documentation process that is simpler

- Reduced loan interest rates

- A larger loan amounts

- Longer or more accommodating repayment terms

- You have a choice between different lenders so you may choose the loan that's ideal for you. Such a credit score will also result in a faster and much more simple documentation process. If you have a CIBIL score between 700 and 900, you can expect a house loan for up to 80% of the total cost of the property.

Tips to Improve Your CIBIL Score: 5 Strategies to Follow

Wondering how to increase your CIBIL score immediately? A high CIBIL score is crucial since it influences whether or not banks will grant you a particular amount of credit. Your chances of receiving an easier credit approval increase with a high CIBIL score.

Here are five strategies to raise your CIBIL score.

1. Do not Overuse your Credit

The most crucial thing to remember when using credit cards is to keep your cool. Verify that you are not using up all of your credit. Spending more than 50% of your credit card limit is not recommended until your CIBIL score reaches 750.

2. Increase your Credit Limit

Your credit limit is the maximum sum you are permitted to borrow with your card. Request a credit limit increase from your credit card company.

3. Pay your Bills on Time

Make sure to pay all of your bills on time to demonstrate that you can effectively manage your debt. To keep your credit score high, avoid making late payments on your bills. Never make partial payments because doing so could indicate that you are an unreliable credit user and lower your CIBIL score.

4. Check and Keep Track of your CIBIL Score

Knowing your CIBIL score on a regular basis can help you understand your credit situation. By requesting a subscription-based credit score, you can keep track of your CIBIL score.

Additionally, you can monitor your score utilising the CIBIL report from the top Indian credit bureaus. Seeing if there are any mistakes or misleading information about your credit account is another reason to verify your CIBIL score.

5. Take a Look at your Credit Report

It is advisable to examine your credit report because it can contain inaccuracies in addition to keeping an eye on your CIBIL Score. It is recommended to regularly evaluate your credit report so that you may make any necessary corrections.

What is a Credit Report and How is it Different from a Credit Score?

A credit information report, or CIBIL report, is a record of all of your borrowings and repayment history. This information, together with other factors that have an impact on your financial situation, is used to calculate your CIBIL score or rating.

In India, CIBIL ratings are now used as the standard for creditworthiness. Even though Experian Credit Information Company India Pvt Ltd. began offering credit scores in recent years, CIBIL was the first foreign credit bureau to offer credit ratings in India. It is important to recognise the value of credit checks.

Managing your credit score is crucial to managing your finances. However, managing all your financial aspects can be a very daunting task. When key milestones of your life like securing loans for your dream home rely on having a respectable CIBIL score, it would be imperative for you to get professional advice. Head over to NoBroker financial services and get in touch with our financial experts to help keep your credit score up.

FAQ's

650 is quite near to the 670–739 range for a good credit score. With some effort, you could be able to improve your score to that level or even higher, giving you access to a wider selection of credit and loans with lower interest rates.

Pay your bills on time and build up a high score if you want to raise your CIBIL score. Use a service that enables automated bill payment to avoid worrying about missing due dates. There is such a thing as too much: Apply for credit responsibly. Do not take on much debt at once.

Your CIBIL score will decrease if you make late payments on loans or just pay the minimum balance on credit card bills. Your CIBIL score will drop if you miss payments or default on your EMIs, which constitutes bad credit.

Negative (-1) or NH credit scores indicate that you have no credit history. It means that a person does not have any credit accounts and has not yet obtained any loans or credit from which to establish credit profiles.

Obtaining a personal loan is not in and of itself detrimental to your credit score. However, it can have a short-term negative impact on your credit score and make it more challenging for you to get new credit before the existing loan is repaid. Ensure you make timely payments towards the loan so there is no further damage to your CIBIL score.

Loved what you read? Share it with others!

Most Viewed Articles

Home Loan Interest Rates for All Banks in 2026

May 7, 2025

51808+ views

SBI Home Loan Interest Rates - Updated in 2026

May 7, 2025

50721+ views

SBI Home Loan Interest Certificate: Benefits, Offline and Online Options, Get via Yono App in 2026

January 31, 2025

36938+ views

ICICI Home Loan Interest Rates - Updated in May 2025

May 7, 2025

29743+ views

HDFC Home Loan Interest Rates - Updated in May 2025

May 7, 2025

27327+ views

Recent blogs in

Full RM + FRM support

Full RM + FRM support

Join the conversation!