Table of Contents

Looking for a Home Loan? Check your eligibility for FREE now!

Buying your dream house? Calculate your Home Loan EMI for FREE!

Get Home loans Quick! Enjoy the lowest interest rates in the market!

Paying high interest? Switch now to pay the lowest interest rates in the market!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

How to File an ITR? e-Filing Income Tax Returns Made Easy

Table of Contents

ITR Filing—an Overview

The income tax return is the document filed by an individual or a company to the income tax authorities. It is a form that taxpayers use to declare their income and calculate their tax liability.

Just about every Indian citizen has to file an income tax return. Filing Income Tax returns can seem overwhelming with all the jargon involved. The Income Tax Department of India has made it extremely easy to file income tax returns with the advent of e-filing.

If you are wondering how to file an income tax return in India, you are not alone. If you are earning any income, you must file a tax return. If you don't do this, you could face dire consequences.

Looking for a Home Loan? Check your eligibility for FREE now!

Buying your dream house? Calculate your Home Loan EMI for FREE!

Get Home loans Quick! Enjoy the lowest interest rates in the market!

Paying high interest? Switch now to pay the lowest interest rates in the market!

This blog will look at how to file an income tax return, the different factors that come into play and how they can help you get a better return.

How to Register on the e-Filing Portal?

An e-filing portal is a governmental website created for citizens, usually to e-file taxes, apply for licenses and other government services.

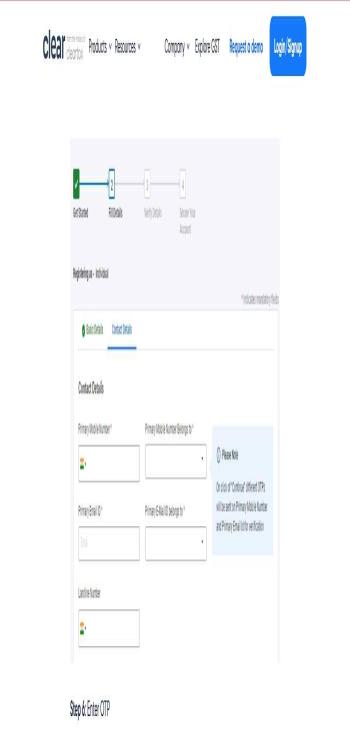

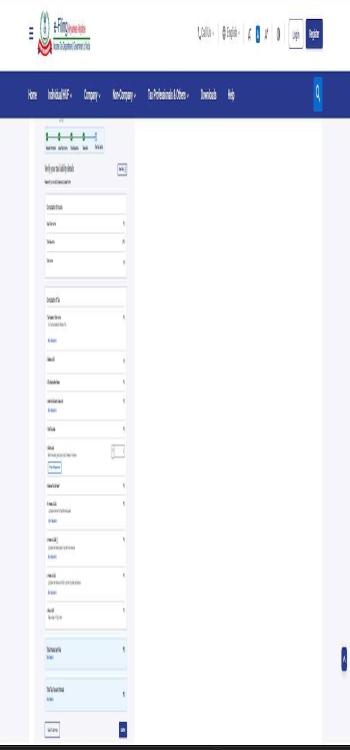

However, in recent years, more and more people are becoming aware of the e-filing portal and are registering for the same. The steps to register on the e-filing portal are outlined below:

- Navigate to the authorized income tax e-filing portal

- Click on Register on the right top corner of the screen

- Select the taxpayer category you belong to from the dropdown and click on Continue

- If you are an individual taxpayer, enter and validate your PAN number.

- Confirm if you want to register as an individual taxpayer and click on continue

- Under the Basic Details enter your name, date of birth, gender, and residential status.

- Click on Continue to proceed to validate the registration process.

- For the validation process, furnish your mobile number, email address, and postal address.

- Enter the OTP sent to your registered mobile number and email address.

- Next, go through the details you have entered and make changes if necessary

- Once you have successfully verified your details, set a password in accordance with the guidelines.

- Once you click on Register you will be redirected to the acknowledgement page.

- A confirmation of your registration will be sent to your email address and registered mobile number.

Note: If you are a Chartered Accountant or an external agency, you will be required to mention your membership number and other required details.

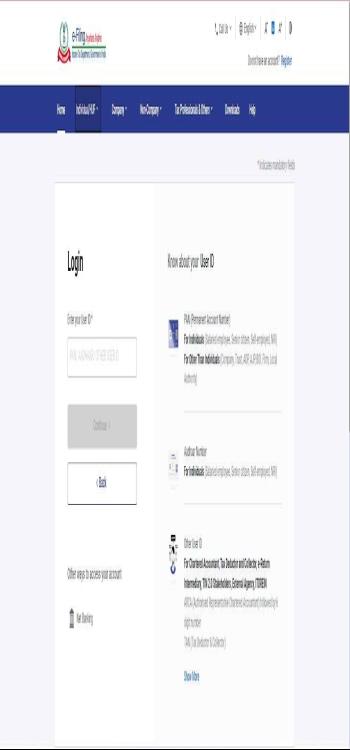

How to Login on the e-Filing Portal?

There needs to be more clarity around some of the most basic steps involved in the process, like logging in, uploading documents and the like.

Here are step-by-step instructions on how to log in and get to the right place when you are ready to file your returns online.

- Navigate to the authorized income tax e-filing portal

- Click on ‘Login’ in the top right corner of the screen

- Enter your credentials (i.e. PAN/ Aadhar Card number and password)

- Click on ‘Continue

Documents Required to e-File an ITR

You must have certain documents handy when e-filing your income tax return (ITR).

Once all the documents are ready, you can log in to the e-filing portal of the Income Tax Department and submit your ITR. Here's a quick rundown of what you'll need to have on hand:

- PAN Card: This is your identification number; you'll need it to file your taxes.

- Salary Slips: The latest salary slips include HRA, transport, and other allowances.

- Form 16: Issued by the employers at the end of the fiscal year

- Form 26AS: Keep in mind to double-check that the TDS in Form 16 matches the TDS in Part A of your Form 26AS.

- Receipts to claim deductions and exemptions under Section 80C to Section 80U (i.e. proof of capital gains, health insurance premium, education loan receipts, home loan documents, etc.)

- Bank/Post office investment certificates: Interest derived from bank account: bank passbook or FD certificate

How to File ITR Online on the Income Tax Department Portal?

The official website for filing ITR in India is incometaxindiaefiling.gov.in. On this website, income tax filing for individuals and businesses can be done, check the status of their returns, and access other related services. Follow the steps to file your income tax return:

- Navigate to the authorized income tax e-filing portal

- Click on Login in the top right corner of the screen

- Enter your credentials and click on Continue

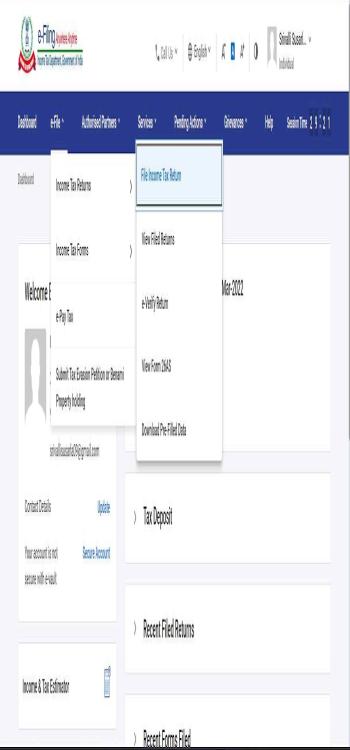

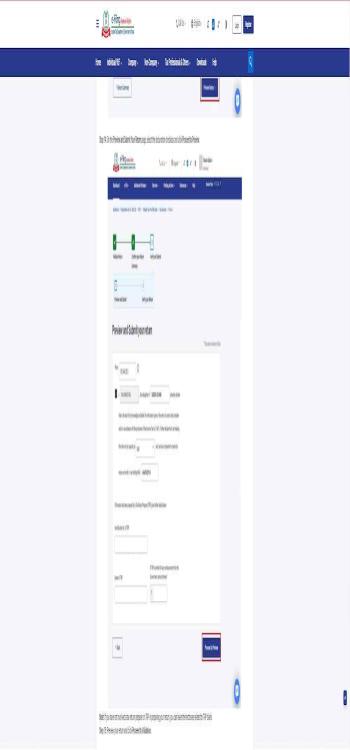

- On the dashboard, under the e-file tab click on File Income Tax Return

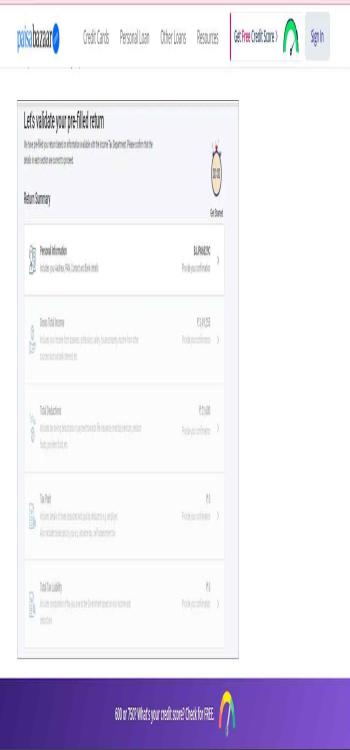

- Next, you will be redirected to a new page where you have to validate the pre-filled information.

- In the section for Gross Total Income, you must evaluate the pre-filled information and confirm your income source details from all salary, house property, capital gains, business, and other sources. If applicable, you will also be asked to provide any additional information, such as exempt income.

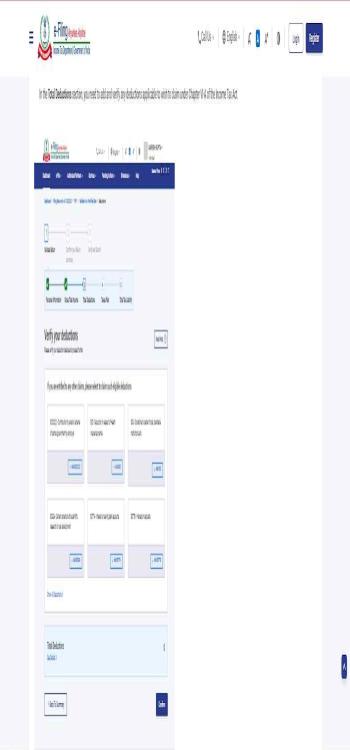

- Under the deductions, add all the deductions applicable to the claim under Chapter VI-A of the Income Tax Act, 1961.

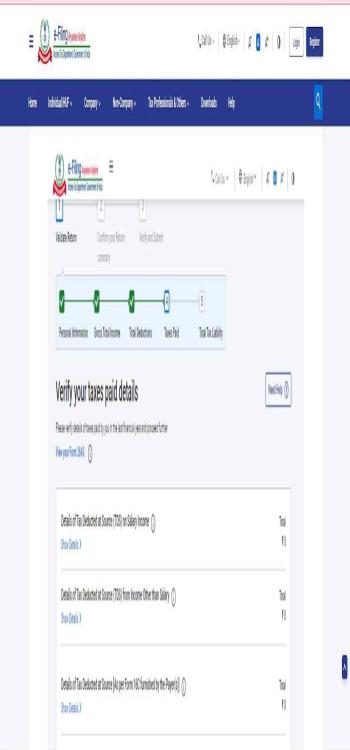

- Next, verify the taxes paid during the previous year under the Tax Paid section

- You must review the tax liability computed due to the previous sections in the Total Tax Liability section.

- Verify all the details and click on Proceed

- Now a summary of the tax computation will be displayed on the screen.

- You will have the option to Pay Now or to Pay Later and click on Preview Returns

- If you choose Pay Now, select the preferred bank for tax payment.

- On successful payment, click on Return to Filing

- You will be redirected to the summary page, here click on Preview Return

- The ITR declaration page will be displayed on your screen; accept the declaration and click on Proceed to Preview

- Preview your ITR summary and click on Proceed to Validation

- On successful validation, e-verify your ITR

- After e-Verifying your ITR, a success message and Transaction ID are provided. You'll also get a confirmation message on your mobile and email.

How to Get a Copy of ITR?

To downloadform 16 you can either e-file and download it online or request it from the income tax department:

- Navigate to the authorized income tax e-filing portal

- Click on Login in the top right corner of the screen

- Enter your credentials and click on Continue

- On the dashboard, under the e-file tab, click on View Filed Returns

- To download the ITR form, click on Download Form for the corresponding assessment year.

How to Check ITR Status Online?

The process of checking the status of an Income Tax Return (ITR) online is simple, convenient and secure. It enables taxpayers to conveniently track their ITR filing status and receive timely updates on the same.

- Navigate to the official website of income tax e-filing portal

- Click on Income Tax Return (ITR) Status under the Quick Links.

- Furnish your acknowledgement number and registered mobile number and click on Continue.

- Enter the OTP sent to your registered mobile number and click on Submit.

- You will be redirected to a new page that will display the real time ITR status.

How to Check ITR Refund Status Online?

You can check your ITR refund status through the Income Tax e-Filing Portal or the TIN NSDL Portal.

Via Income Tax e-Filing Portal

- Navigate to the authorized income tax e-filing portal

- Click on Login in the top right corner of the screen

- Enter your credentials and click on Continue. The status will be displayed on your screen.

Via NSDL Portal

- Go to the official website of NSDL

- Enter your PAN number, assessment year, and the captcha verification code.

- Click on Proceed. The ITR refund status will be displayed on your screen.

Eligibility Criteria for ITR 1, ITR 2, ITR 3, and ITR 4 Forms

ITR Forms 1, 2, 3, and 4 are the Income Tax Return forms used in India for individuals and businesses to file their tax returns. These forms are used to report income earned during the financial year and to calculate the tax liability of the individual or business.

ITR 1: Also known as Sahaj, is for individuals who have income from salary or pension, or have a total income of less than 50 lakhs per year. This form is for individuals who have a single source of income and do not have any additional income from house property, capital gains, or other sources. It is also used by individuals who are not required to maintain books of accounts and have no business income.

ITR 2: ITR 2 is for individuals and HUFs (Hindu Undivided Families) who do not have income from profits and gains of business or profession. This form is used by individuals who have income from multiple sources such as salary, house property, capital gains, or other sources. It is also used by individuals who are required to maintain books of accounts, but do not have any business income.

ITR 3: ITR 3 is for individuals and HUFs who have income from profits and gains of business or profession. This form is used by individuals who have income from a business or profession and are required to maintain books of accounts. It is also used by individuals who have capital gains or losses from the transfer of capital assets.

ITR 4: ITR 4 is filed by small business owners who do not keep books of accounts but keep a sales ledger in estimated volume, i.e. internet merchants, dealers, distributors, and manufacturers, among others. Additionally, freelancers and professionals (i.e. chartered accountants, lawyers, and doctors).

Recent ITR Updates: The Common ITR Form

The Common ITR Form is the new standard for filing income taxes in India. It was proposed by the Central Board of Direct Taxes on 1st November 2022 and replaced the old ITR forms except ITR-7. The simplified process and a better UI interface have been designed keeping in mind the needs of the taxpayers.

The merged form, according to CBDT, focuses on high functionality, systematic method, and enhanced scope of pre-filing. "It will also facilitate reconciliation of third-party data available with the Income-tax Department vis-a-vis the data to be reported in the ITR, to reduce the compliance burden for the taxpayers," the CBDT circular states.

How Can NoBroker Help?

With the end of the financial year approaching, it's time to start thinking about filing your taxes.

Filing your taxes doesn't have to be a stressful process. Just take some time to gather the necessary documentation, choose the right form, and follow the step-by-step process. Do that, and you'll be on your way to a stress-free tax season.

If you require expert assistance, NoBroker's tax specialists are available to assist you. They will take the time to understand your unique needs, review your documents, and help make the tax filing process as smooth as possible. If you have any query, please leave a comment below and one of our experts will reach out to you soon.

FAQ's

Ans. No, senior citizens are not fully exempt from filing ITR. However, in Budget 2021, Section 194P was established to exempt those seniors over the age of 75 from filing their income tax returns under certain conditions.

Ans. You may face certain penalties if you don't file your ITR in India. For instance, you may have to pay a late filing fee of INR 5,000. Additionally, no loss deducted from "earnings and gains of business or profession" or "capital gains" can be carried forward by the taxpayer.

Ans. In accordance with Section 203AA of the Income Tax Act of 1961, Form 26AS is a consolidated credit statement produced at the end of each fiscal year.

Ans. An individual whose annual income is less than the threshold, i.e. INR 2,50,000 is not required to file ITR.

Ans. Filing an Income Tax Return (ITR) in India is important for various reasons. It helps the government keep track of the individual's income, assesses the tax liability, and claims any tax refunds. Filing an ITR is also important from a financial perspective. It helps individuals save money by claiming deductions and exemptions. Additionally, it also helps in applying for loans and credit cards.

Loved what you read? Share it with others!

Most Viewed Articles

Update Your Aadhaar Card Address: Quick and Convenient

January 31, 2025

23891+ views

HDFC Bank Holidays: State-Wise List of Holidays for HDFC Bank in 2025

January 25, 2025

23872+ views

What Is a Good Cibil Score? Learn Seven Ways to Improve Credit Score

January 31, 2025

22275+ views

State Bank of India Bank Holidays List 2025: State-Specific and Nationwide Dates for 2025

January 2, 2025

18022+ views

PNB Bank Holidays List: State-Wise Bank Holidays Lists in 2025

January 9, 2025

17574+ views

Recent blogs in

UCO Bank Holidays: List of State-Wise Bank Holidays in UCO Bank in 2025

April 1, 2025 by Priyanka Saha

Bandhan Bank Holidays: List of State-Wise Bank Holidays in Bandhan Bank in 2025

April 1, 2025 by Krishnanunni H M

Tax Deduction Under Section 80g of the Income Tax Act

January 31, 2025 by Kruthi

What Is a Good Cibil Score? Learn Seven Ways to Improve Credit Score

January 31, 2025 by Kruthi

Join the conversation!