Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Everything You Need to Know About Indemnity Bond

Table of Contents

An indemnity bond serves as security, guaranteeing compensation in the event of a personal loss or default on a loan payment. It protects the bondholder and ensures the fulfilment of contractual obligations. If the principal fails to meet the agreement, they must settle the bonded amount, including legal expenses, using personal and corporate assets. Negotiable terms apply, and approval hinges on the signing of the surety bond.

What is an Indemnity Bond?

An indemnity bond meaning in English is a legal document that gives you the right to collect compensation from the principal for a claimed situation. Concerning the agreement, the company is mandated to pay a premium. For this, the surety company is supposed to pay a premium. The bonded contractor earlier is expected to settle this premium with the surety company; otherwise, the company can sue the contractor.

Understanding indemnity bond terms is crucial to avoid potential consequences like damaging a company's reputation, incompetence, and legal action due to non-payment of claims. This article provides detailed knowledge of indemnity bonds in Hindi, making it easier to grasp.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Indemnity Bond for Property

An Indemnity bond is signed by a surety company when a property deal is finalised. The surety company will put forward a demand on the bonded contractor to complete a project. For example, suppose the bonded contractor fails to complete the projector; the surety company must get it done by another contractor.

When are Indemnity Bonds Needed?

Indemnity bonds are needed in different scenarios. It is needed for the following situations

- Borrowing money from banks.

- For the release of payment

- In the event of losing a fixed deposit receipt

- Transfer property to legal heirs

- Property transfer,

- On the occasion of death claims

- Electricity connection transfer

- Government Indemnity schemes

These bonds are enforced to provide legal protection to the agreed parties. Having an indemnity bond helps projects to progress professionally and ethically

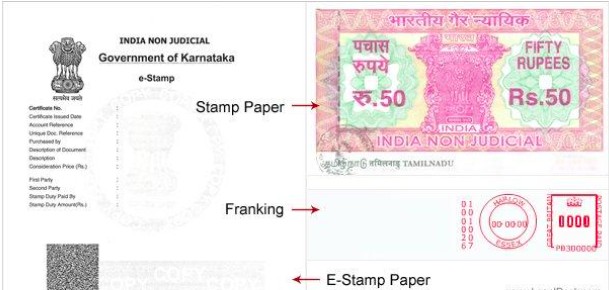

How is Stamp Duty Calculated on an Indemnity Bond?

Stamp duty on an indemnity bond is determined by the value declared within the bond and the prevailing stamp duty rates set by the state government. Understanding the process of calculating stamp duty is essential for ensuring compliance with legal requirements.

1. Determine the Value: The value stated in the indemnity bond reflects the maximum liability that the indemnifier agrees to cover. This value serves as the basis for calculating stamp duty.

2. Check Stamp Duty Rates: Each state imposes its own stamp duty rates, which can vary based on factors such as the transaction's nature and value. Consult the official stamp duty schedule provided by the state government to ascertain the applicable rates.

3. Apply Stamp Duty Rate: Once the bond's value is established, apply the relevant stamp duty rate to calculate the duty payable. This calculation yields the amount required to fulfill the stamp duty obligation.

4. Make Stamp Duty Payment: To comply with legal regulations, purchase non-judicial stamp paper of the appropriate value corresponding to the calculated stamp duty. Affix the stamp paper to the indemnity bond as proof of payment.

5. Execute and Register the Bond: After paying stamp duty, execute the indemnity bond by signing it alongside the other party/parties involved. Depending on local regulations, the bond may need to be registered with the relevant authority to validate its legality.

6. Ensure Compliance: It's crucial to ensure accuracy in stamp duty calculation and payment to prevent legal issues or challenges to the bond's validity in the future. By adhering to prescribed procedures, parties can fulfil their legal obligations and safeguard their interests effectively.

How to Fill an Indemnity Bond?

- Begin by obtaining the official indemnity bond form from the relevant authority or legal entity.

- Carefully read through the instructions provided on the form to ensure compliance with all requirements.

- Fill in the details accurately, including the names and addresses of the indemnifier (the party providing the indemnity) and the indemnity holder (the party being indemnified).

- Clearly state the purpose of the indemnity bond and provide specific details regarding the obligations and liabilities being covered.

- Specify the duration or period for which the indemnity bond is valid, if applicable.

- Include any additional terms or conditions agreed upon by both parties to the indemnity agreement.

- Sign the indemnity bond in the presence of witnesses or a notary public, as required by local regulations.

- Review the completed form thoroughly to ensure all information is correct and legible before submitting it to the appropriate authority or party.

Difference between affidavit and indemnity bond

Understanding the differences between affidavits and indemnity bonds is crucial for navigating legal processes and contractual obligations. Below is a comparison outlining the key distinctions in their nature, legal standing, purpose, and other relevant parameters.

| Parameters | Affidavit | Indemnity Bond |

| Nature of the Document | Sworn Statement made voluntarily by the affiant under oath | Legal contract between two parties, where one party agrees to indemnify the other against specified losses or liabilities |

| Legal Standing | Typically used as evidence in legal proceedings | Legally binding document enforceable in courts of law |

| Purpose | To provide a sworn statement or declaration of facts | To secure one party against potential losses or liabilities arising from specific actions or situations |

| Execution | Prepared by the affiant and usually requires notarisation | Drafted by legal experts and executed by both parties involved |

| Scope of Coverage | Usually pertains to factual statements or assertions | Covers indemnification against potential losses, damages, or liabilities |

| Notarisation | May require notarisation depending on legal requirements | Notarisation may not always be necessary, but can add validity |

| Common Uses | Commonly used in legal proceedings, real estate transactions, and various official matters | Utilised in financial transactions, contracts, agreements, and insurance policies |

What are the Different Types of Indemnity Bonds?

Indemnity bonds come in various forms, each tailored to specific situations and requirements. Understanding the different types of indemnity bonds is essential for individuals and businesses seeking financial protection against potential losses or liabilities.

- Contract Indemnity Bonds: These bonds are commonly used in construction and service contracts to ensure that one party fulfils its obligations and compensates the other party for any losses incurred due to breaches of contract terms.

- Court Indemnity Bonds: Also known as judicial bonds, these are required by courts as a condition for granting certain legal remedies such as temporary restraining orders, injunctions, or appeal bonds. They provide assurance that the party seeking relief will compensate the opposing party if the court rules against them.

- Fiduciary Indemnity Bonds: These bonds are often required for individuals appointed to manage assets or finances on behalf of others, such as trustees, executors, or guardians. Fiduciary bonds protect beneficiaries from financial harm resulting from mismanagement or misconduct by the fiduciary.

- Customs Indemnity Bonds: Issued to importers and exporters by customs authorities, these bonds guarantee payment of customs duties, taxes, and other charges associated with international trade transactions. They ensure compliance with customs regulations and facilitate the smooth movement of goods across borders.

- Title Indemnity Bonds: Commonly used in real estate transactions, title indemnity bonds provide protection against defects in property titles that may arise after the purchase. These defects could include undisclosed liens, encumbrances, or errors in the title documents.

- Employee Indemnity Bonds: Employers may obtain these bonds to protect against losses resulting from fraudulent or dishonest acts committed by their employees, such as theft, embezzlement, or forgery.

- Surety Indemnity Bonds: Often confused with insurance, surety bonds guarantee the performance of a contract or obligation by one party to another. If the bonded party fails to fulfil its obligations, the surety (usually an insurance company) compensates the obligee for any resulting losses.

Under What Conditions is an Indemnity Bond Imposed?

The indemnity bond is imposed during an event of an infringement of the terms in the contract. The liability arises due to a breach, and the party under fault is entitled to bear the expense of compensation to the other party.

How Does an Affidavit and Indemnity Bond Differ?

An affidavit is like a statement of the oath, which ensures that the statements made are true and correct to the best of an individual's knowledge. The document states that no material info or knowledge is concealed. However, the Indemnity bond is a document providing security to a party that will be given compensation in case of breach of contract. The compensation may be monetarily or in any medium, as agreed upon in the bond.

Common Types of Indemnity Bond Used in General Corporate Transactions

Apart from insurance policies, Indemnity bonds are drawn between employer and employee. The bond ensures that the employee serves the employer for a specific period. If the employee breaches the contract and leaves the service before completing the term, the employee is entitled to pay monetary compensation.

An indemnity bond is also created by those who have lost a Share Certificate. The bond states that the Share certificate is genuinely lost and requests processing a New Share Certificate. The bond offers the applicant indemnity of all costs and expenses associated with the issuing of the new share certificate.

An Indemnity bond may be provided to an Educational Institution/Company when they want to apply for alternation on the basic details of a student concerned to indemnify any types of losses that may occur as a setback of the changes when the basic details were altered. Government authorities and independent contractors may sign an Indemnity bond. These bonds can be enforced between various parties based on the variety of transactions made.

Read: Important Details About Delhi Rent Control Act That Every Delhite Should Know

Benefits of Indemnity Bond

- Indemnity bonds can be restructured to cover any expected loss. Both parties associated with the contract will know what should be paid under what circumstances.

- The bond protects the first party from losses if the principal fails to abide by the agreed-upon obligations.

- Indemnity bonds are surety bonds. Commerce or transactions do not occur if no mechanism assures payment. It is a promise by the guarantor to pay the obligation if he fails to fulfil the contract terms.

- These bonds guarantee financial reimbursement for any harm caused due to illegal activity.

- A principal signing an indemnity agreement states to take full financial responsibility in the case of bond claims. Therefore, all the charges belong to them rather than the surety.

Features of Indemnity Bond

- Arranged in terms of trust between the parties involved - This contract depends on mutual trust between individuals.

- Takes care of the loss associated with the contract only - It covers the compensation only for the events mentioned in the contract. The promiser is liable to bear those events only.

- All terms considered must be admissible in front of Law. The terms associated with the bond should be legal.

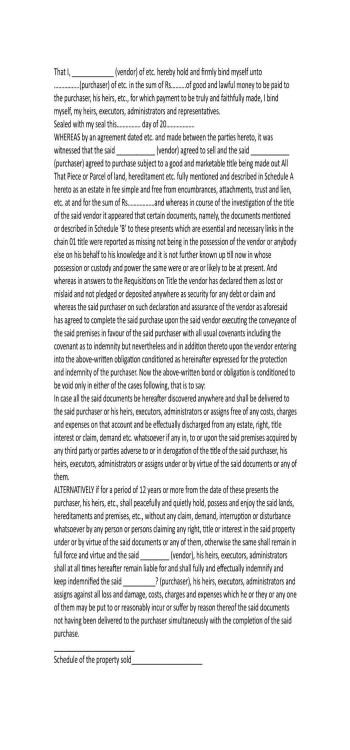

Sample Indemnity Bond Format

An indemnity bond is a legal document that is drafted. The documents needed to be drafted on a stamp paper and the value of the paper varies from state to state.

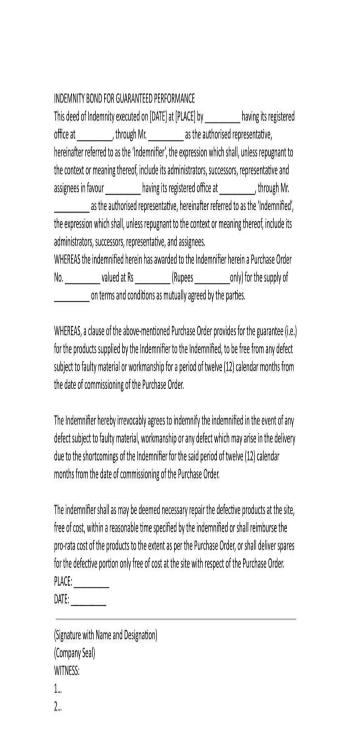

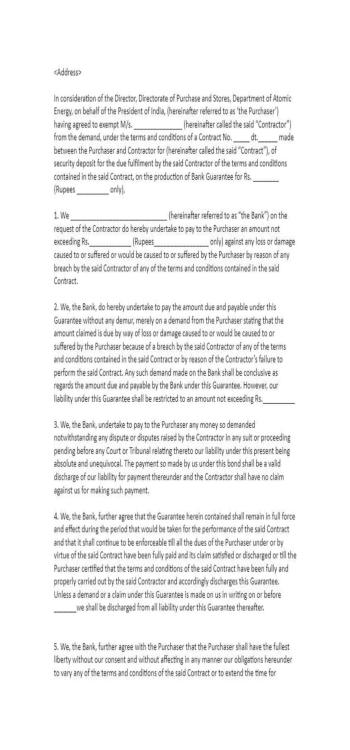

Indemnity Bond Format for Bank

An indemnity bond for a bank is a legal document that is used as a guarantee for the bank in case of any financial loss or damage caused by the borrower. It is typically used for loan or credit applications.

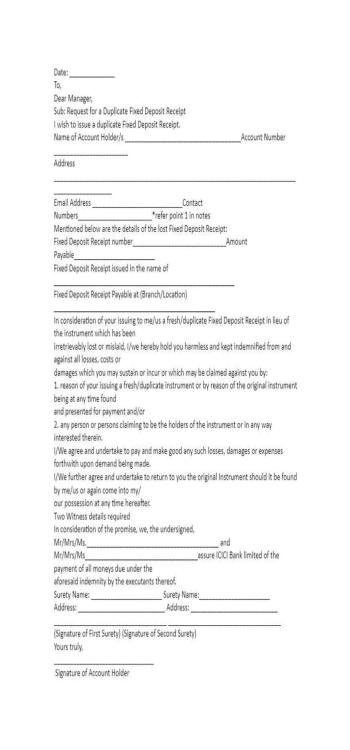

Indemnity Bond Format for Lost Fixed Deposit Receipt

An indemnity bond for a lost fixed deposit receipt is a legal document that serves as a guarantee for the bank in case the original fixed deposit receipt is lost. It typically includes details about the depositor, deposit amount and maturity date.

Indemnity Bond Format for Release of Payment

An indemnity bond for release of payment is a legal document that serves as a guarantee for the payee in case the payment is not made as per the agreed terms. It typically includes details about the payer, payment amount and payment terms.

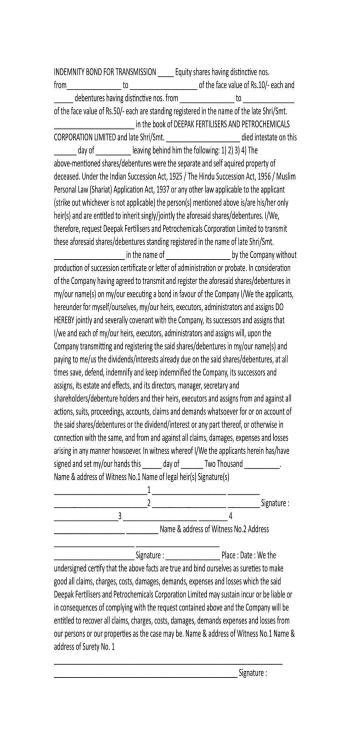

Indemnity Bond Format for Legal Heirs

An indemnity bond for legal heirs is a legal document that serves as a guarantee for the legal heirs of the deceased in case of any financial loss or damage caused due to their inheritance.

Indemnity Bond Format for Housing Society?

An indemnity bond for a housing society is a legal document that serves as a guarantee for the society in case of any financial loss or damage caused by the member. It typically includes details about the member, their responsibilities, and any liabilities.

Indemnity Bond Format for Loss of Property Documents

An indemnity bond for loss of property documents is a legal document that serves as a guarantee for the property owner in case the original property documents are lost. It typically includes details about the property, its ownership and any outstanding liabilities.

Indemnity Bond for Electricity Connection and Indemnity Bond for Electricity Transfer

An indemnity bond for electricity connection is a legal document that serves as a guarantee for the electricity provider in case of any financial loss or damage caused by the consumer, and an indemnity bond for electricity transfer is a legal document that serves as a guarantee for the new electricity consumer in case of any financial loss or damage caused by the previous consumer.

Indemnity Bond Format for Death Claim

An indemnity bond for death claim is a legal document that serves as a guarantee for the insurance company in case of any financial loss or damage caused due to a death claim. It typically includes details about the deceased, the death claim amount and any outstanding liabilities.

As you must have guessed by reading the information highlighted in the article, an indemnity bond is a crucial document that is used to get everything done from getting an electricity connection to the transfer of property.

The formats are different and depend on the reason for which the applicant needs an indemnity bond. If you need legal help regarding your property, you will certainly find a trusted advisor on NoBroker. Please leave a comment below this article; our executive will be in touch with you soon.

FAQs

Ans: In simple words, an indemnity bond is a legally binding document that assures a party that the money will get compensated in case of a loss or fraudulent activity from the other parties involved in the transaction.

Ans. There is no standardised sample format for the indemnity bond. The format for an indemnity bond for the property is different to that of a death claim. Thus, it is important to get the right indemnity bond.

Ans. Indemnity bonds are issued by 3rd party institutions such as banks or insurance companies.

Ans. Typically, an indemnity bond is signed by the party that is at risk of losing money/property and the parties that are liable to pay or are buyers of the asset.

Ans. Yes, stamp paper is necessary for the indemnity bond and the price depends on the rules of the state. For example, the price of stamp paper is Rs. 100 in Maharashtra and may go up-to Rs. 300 in other states in India.

Ans: A deed of indemnity bond is a legal document used in India to protect a person or organization from financial loss due to the actions of another. The bond is typically used in situations where one party is taking on financial risks, such as in construction or real estate projects.

Ans: A one-line bond request is a concise and straightforward statement requesting the issuance of a bond, typically used in legal or financial contexts to initiate the bond application process with minimal complexity or detail.

Ans: The indemnity bond stamp paper value represents the amount of stamp duty paid to legalise the bond, ensuring its validity and enforceability in legal proceedings.

Ans: An indemnity bond for property is a legal document used to indemnify against potential losses or liabilities related to a property transaction, ensuring protection for both parties involved.

Recommended Reading

All You Need to Know About Property Disputes and How to Avoid Them

January 16, 2025

5419+ views

Legal Documents You Need To Buy And Sell Property: Essential Guide

January 15, 2025

10960+ views

Non-Occupancy Charges: A Guide for Property Owners and Tenants

December 31, 2024

9230+ views

Franking Charges Explained: Meaning and Benefits

December 31, 2024

1046381+ views

A Comprehensive Guide to E Stamp and E Stamping Process

December 30, 2024

15801+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

December 31, 2024

1046381+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

January 16, 2025

78652+ views

Supreme Court Verdict on Society Maintenance Charges

December 17, 2024

70539+ views

All You Need to Know about Revenue Stamps

December 17, 2024

59392+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

51810+ views

We’d love to hear your thoughts

Join the conversation!

Recent blogs in

Stamp Duty and Property Registration Charges in Mumbai 2025

January 23, 2025 by Kruthi

What are the current Stamp Duty and Property Registration Charges in Karnataka for 2025?

January 23, 2025 by Prakhar Sushant

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025 by Vivek Mishra

Malcom Rudat

Everyone loves it whenever people come together and share thoughts. Great site, stick with it!

July 12, 2022, 2:05 am