Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Kanpur Nagar Nigam House Tax Online, Offline Payment, Calculation and Tax Charges for 2025

Table of Contents

Kanpur Nagar Nigam house tax is a mandatory annual assessment levied on property owners within the municipal jurisdiction, serving as a crucial revenue source for the city's development and maintenance. This comprehensive guide demystifies the various aspects of property tax, from calculation methods and payment procedures to rebates and recent digital initiatives. Whether you're a first-time property owner or a long-term resident, understanding these tax obligations is essential for maintaining compliance and avoiding penalties. With online and offline payment options, multiple rebate schemes, and a transparent mutation process, Kanpur Nagar Nigam has streamlined tax collection, making it more accessible and convenient for property owners.

Kanpur Nagar Nigam House Tax Quick Info

The Kanpur Nagar Nigam house tax is a crucial revenue source for the city's development and maintenance. This tax applies to all residential and commercial properties within the municipal limits, with rates varying based on property type, size, and usage.

| Parameter | Details |

| Tax Authority | Kanpur Nagar Nigam |

| Payment Frequency | Annual |

| Due Date | March 31st of every financial year |

| Payment Modes | Online and Offline |

| Late Payment Penalty | 1% per month |

| Rebate Period | April 1st to June 30th |

How to Calculate Kanpur Nagar Nigam House Tax

The house tax calculation in Kanpur follows a structured formula based on the property's Annual Rental Value (ARV). This system ensures fair taxation while considering various factors like property location, usage, and construction type.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Formula: House Tax = Annual Rental Value (ARV) × Tax Rate ARV = Built-up Area × Base Rate × Multiplying Factors (Location, Age, Type of Construction)

Example: For a 1000 sq. ft residential property:

- Base Rate: ₹10 per sq. ft

- Location Factor: 1.2

- Age Factor: 0.9

- Type Factor: 1.0 ARV = 1000 × 10 × 1.2 × 0.9 × 1.0 = ₹10,800 House Tax (at 10% rate) = ₹10,800 × 0.10 = ₹1,080

How to Pay Kanpur Nagar Nigam House Tax?

Kanpur Nagar Nigam offers convenient payment options for house tax, including both online and offline methods. Property owners can choose their preferred payment mode based on their comfort level with digital transactions. The process has been streamlined to ensure hassle-free tax payments and immediate receipt generation.

Online Process

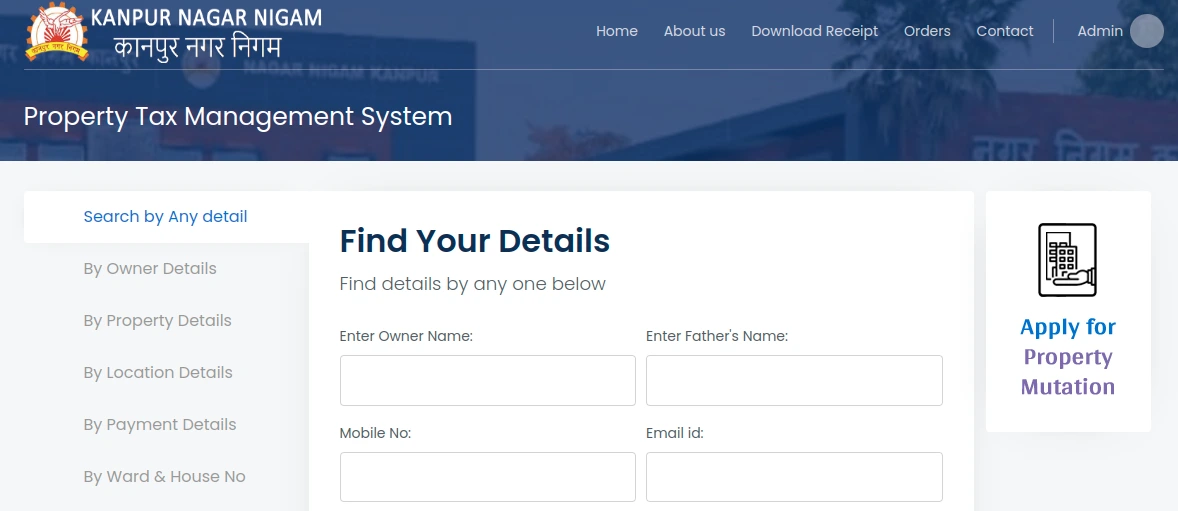

The online payment system for Kanpur Nagar Nigam house tax provides a convenient 24/7 payment facility through the official portal. This digital platform ensures secure transactions and instant receipt generation, saving property owners time and effort.

- Step 1: Visit the official Kanpur Nagar Nigam website and navigate to the 'House Tax Payment' section. Look for the prominent payment button on the homepage. This will direct you to the tax payment portal, where all property-related services are listed.

- Step 2: Enter your property identification details in the designated fields, including your house tax ID or property number. If applicable, the system will retrieve your property information and display the current outstanding amount and any previous dues or penalties.

- Step 3: Review the displayed tax amount and carefully verify all property details. Check for any applicable rebates or additional charges affecting the final payment amount. The system will automatically calculate eligible discounts based on the payment timing.

- Step 4: Select your preferred payment method from the available options, such as net banking, credit card, debit card, or UPI. The portal integrates with multiple payment gateways to ensure secure transactions and provides various convenient payment options.

- Step 5: Complete the payment process by following the payment gateway instructions. After successful payment, save and download the electronic receipt generated by the system. Keep this receipt safe as proof of payment for future reference.

Offline Process

For those who prefer traditional payment methods, Kanpur Nagar Nigam maintains various collection centres across the city. This system accommodates residents who are more comfortable with in-person transactions or need assistance with their tax payments.

- Step 1: Collect all necessary documents including property identification papers, previous tax receipts, and identity proof. Visit your nearest Kanpur Nagar Nigam office or authorized collection centre during working hours with these documents.

- Step 2: Approach the dedicated house tax collection counter and submit your property details to the official. The staff will verify your information in their system and generate a payment challan with the current tax amount and any applicable charges.

- Step 3: Make the payment using acceptable modes like cash, demand draft, or banker's cheque. The payment should be in favour of "Kanpur Nagar Nigam" and include the correct reference number assigned to your property.

- Step 4: Collect the official receipt from the counter staff after payment verification. Check all details on the receipt including the amount paid, date, and property identification number before leaving the counter.

- Step 5: Keep the original receipt in a safe place and make photocopies for your records. This receipt serves as proof of payment and will be required for future reference or during property-related transactions.

How to Download House Tax Receipts

Kanpur Nagar Nigam provides a straightforward digital system for downloading house tax receipts. Through the official portal, property owners can easily access their payment history and download receipts for both current and previous years, making it convenient to maintain tax records.

- Step 1: Navigate to the official Kanpur Nagar Nigam website and locate the 'Download Tax Receipt' section. The portal's homepage features a dedicated button for downloading tax receipts, making it easily accessible to all property owners.

- Step 2: Enter your property details, including your unique property ID or house tax assessment number. The system requires accurate information to retrieve your payment records and generate the corresponding receipt for download.

- Step 3: Select the financial year you need the receipt from the dropdown menu. The portal maintains records for several years, allowing you to access historical payment data and download multiple receipts as needed.

- Step 4: Click 'Generate Receipt' and verify the payment details displayed on the screen. The system will preview the receipt containing all relevant information, including payment date, amount, and property details.

- Step 5: Download the receipt in PDF format and save it for your records. It's recommended to keep both digital and printed copies of these receipts as they serve as official proof of tax payment.

Kanpur Nagar Nigam House Tax Charges

Kanpur Nagar Nigam implements a structured house tax charging system based on various property parameters. The charges vary depending on property type, location, usage, and built-up area. Understanding these charges helps property owners plan their tax payments effectively.

| Property Type | Location Category | Tax Rate (% of ARV) |

| Residential - Self Occupied | Premium Areas | 10% |

| Residential - Self Occupied | Regular Areas | 8% |

| Residential - Rented | All Areas | 15% |

| Commercial | Premium Areas | 20% |

| Commercial | Regular Areas | 18% |

| Industrial | All Areas | 22% |

| Educational Institutions | All Areas | 12% |

| Mixed Use Properties | Premium Areas | 18% |

| Mixed Use Properties | Regular Areas | 15% |

Penalties for Late Payments

Kanpur Nagar Nigam imposes strict penalties on delayed house tax payments to ensure timely collection. Understanding these penalties is crucial for property owners to avoid additional financial burdens. The penalty structure is designed to encourage prompt payment compliance.

- Basic Penalty Rate: A monthly interest rate of 1% is charged on the outstanding tax amount. This penalty accumulates immediately after the due date and continues until the full payment is made, significantly increasing the total payable amount.

- Compound Interest Accumulation: The penalty amount compounds every quarter, making it particularly burdensome for long-term defaulters. Property owners should note that this can result in the penalty amount becoming substantial over time.

- Legal Consequences: Extended payment delays may result in legal notices and potential property seizure proceedings. The Nagar Nigam has the authority to initiate legal action against persistent defaulters after serving multiple notices.

- Recovery Charges: Additional recovery charges are levied when the Nagar Nigam has to initiate special recovery proceedings. These charges include administrative costs and legal fees associated with the recovery process.

- Service Restriction: Defaulters may face restrictions in accessing various municipal services and obtaining necessary certificates. This can affect property-related transactions and other municipal approvals until all dues are cleared.

Rebates and Benefits on Kanpur Nagar Nigam House Tax

Kanpur Nagar Nigam offers various rebates and benefits to encourage timely tax payments and support specific categories of property owners. These incentives include early payment discounts, special considerations for senior citizens, and exemptions for certain property categories, making tax payments more manageable for eligible residents.

Eligibility Criteria for Rebates and Benefits

Understanding eligibility criteria is crucial for property owners to avail themselves of various tax benefits. Kanpur Nagar Nigam has established clear guidelines to determine who qualifies for different rebates and concessions based on various factors.

- Senior Citizens (60 years and above): Property owners aged 60 or more qualify for a special 10% rebate on their total house tax amount. This benefit applies to one self-occupied residential property registered under their name, promoting financial security for elderly citizens.

- Early Payment Discount: Property owners who pay their annual house tax within the first quarter (April-June) are eligible for a 5% rebate on the total amount. This incentive encourages timely payments and helps maintain a steady revenue flow.

- Freedom Fighters and Their Dependents: Direct dependents of recognized freedom fighters can receive up to a 50% rebate on house tax for one residential property. This benefit honours their contribution to the nation's independence struggle.

- Disabled Property Owners: Individuals with certified disabilities are eligible for a 15% rebate on house tax for their self-occupied residential property. This support helps reduce their financial burden and promotes inclusive development.

- Women Property Owners: Single women property owners or widows qualify for an additional 5% rebate on their house tax. This benefit aims to provide financial support and encourage property ownership among women.

How to Avail Rebates and Benefits

Claiming rebates and benefits is streamlined to ensure eligible property owners can easily access these advantages. The correct procedure ensures timely approval and benefits application to your tax assessment.

- Submit an Application: File a formal application through the official portal or visit the nearest Nagar Nigam office. Include all required documents and mention the specific rebate category you're applying for.

- Undergo Verification: Authorized officials will verify property details and submit documents. This process includes physical verification of the property if required, and validation of all supporting documents.

- Track Application Status: You can monitor your application status through the online portal or by visiting the office. Regular follow-ups ensure smooth processing and timely resolution of any queries raised during verification.

- Receive Confirmation: Once approved, you'll receive official confirmation of the rebate allocation. The reduced tax amount will be reflected in your next tax assessment or adjusted against current dues.

- Annual Renewal: Some rebates require annual renewal to confirm continued eligibility. Mark important dates and submit renewal applications before the deadline to maintain benefits.

Documents Required for Claiming Rebates

Proper documentation is essential for successful rebate claims. Kanpur Nagar Nigam requires specific documents to verify eligibility and process rebate applications efficiently.

- Identity and Age Proof: Submit government-issued photo ID cards like Aadhaar, PAN, or voter ID. Senior citizens must provide age proof through relevant documents to qualify for age-based rebates.

- Property Ownership Documents: Include property registration papers, latest tax receipts, and mutation certificate if applicable. These documents establish your ownership rights and eligibility for specific rebates.

- Category-Specific Certificates: Freedom fighter certificates, disability certificates, or widow certificates must be submitted based on the rebate category. These documents should be current and issued by authorized authorities.

- Income Proof: Some rebate categories require income verification through salary slips, pension documents, or income certificates. This helps ensure benefits reach the intended beneficiaries.

- Residential Status Proof: Submit utility bills or other documents proving self-occupation of the property. This is particularly important for rebates that apply only to self-occupied properties.

Property Mutation Process of Kanpur Nagar Nigam

Property mutation is a crucial process that transfers property ownership records in Kanpur Nagar Nigam's database after a property sale, inheritance, or gift transfer. This process ensures that house tax bills and other municipal communications are directed to the current property owner.

- Collect Required Documents: Gather all necessary paperwork, including the sale deed, previous tax receipts, and identity proof. The new owner must ensure all documents are current and properly attested before initiating the mutation process.

- Submit Online Application: Access the Kanpur Nagar Nigam portal and fill out the mutation application form. Upload scanned copies of all required documents and pay the prescribed mutation fee using the available online payment options.

- Schedule Property Inspection: A municipal officer will conduct a physical verification of the property. They will verify property dimensions, current usage, and other relevant details to update the municipal records accurately.

- Document Verification: The legal team reviews all submitted documents to ensure compliance with property transfer regulations. Any discrepancies found during this stage must be addressed promptly to avoid delays.

- Obtain No Objection Certificate: Clear any pending house tax dues and obtain a No Objection Certificate. This document confirms that there are no outstanding liabilities against the property.

- Final Approval and Record Update: The mutation certificate is issued after successful verification. The new owner's details are updated in the municipal records, and subsequent tax bills will be generated in their name.

Benefits of Paying House Tax on Time

Timely payment of house tax offers numerous advantages beyond just avoiding penalties. It contributes to personal benefits for property owners and collective community development through improved municipal services.

- Early Payment Rebates: Qualify for substantial early bird discounts and special rebates. Property owners who pay within the first quarter often receive up to 5% reduction in their total tax liability.

- Hassle-Free Property Transactions: Maintain clean property records for smooth future transactions. Up-to-date tax payments facilitate faster processing of property-related documents and mutations.

- Enhanced Credit Score Impact: Regular tax payments can positively influence your financial profile. Many financial institutions consider municipal tax payment history while processing loans or mortgages.

- Access to Municipal Services: Ensure uninterrupted access to essential civic services. Regular taxpayers often receive priority in municipal service requests and grievance resolutions.

- Contribution to City Development: Support local infrastructure development and maintenance. Your timely payments help fund various civic projects, improving the overall quality of life in your area.

Recent Updates and Initiatives of Kanpur Nagar Nigam

Kanpur Nagar Nigam continuously modernizes its systems and introduces new initiatives to improve tax collection efficiency and enhance taxpayer convenience. Recent updates focus on digital transformation and citizen-friendly services.

- Digital Payment Integration: Implementation of advanced online payment systems including UPI, mobile wallets, and net banking options. This upgrade has significantly reduced payment processing time and improved transaction success rates.

- Mobile App Launch: Introduction of a dedicated mobile application for tax-related services. Property owners can now manage their tax payments, download receipts, and track applications through their smartphones.

- Automated Assessment System: Development of an AI-powered property assessment system. This initiative ensures more accurate and fair tax calculations based on current property values and usage patterns.

- Grievance Redressal Portal: Launch of an online platform for addressing taxpayer concerns and disputes. The system provides real-time tracking of complaint resolution and facilitates faster problem-solving.

- Green Tax Incentives: Special rebates will be introduced for properties implementing eco-friendly measures. This initiative encourages sustainable development and environmental conservation within the city.

What you should know?

The Kanpur Nagar Nigam house tax system plays a vital role in the city's development and maintenance of civic infrastructure. Through its modernized payment systems, comprehensive rebate structure, and transparent mutation processes, the municipal corporation has made tax compliance more accessible and convenient for property owners. The recent digital initiatives and citizen-centric approaches demonstrate the corporation's commitment to improving service delivery and taxpayer experience. With ongoing updates and technological advancements, the Kanpur Nagar Nigam continues to streamline its processes, making it easier for citizens to fulfil their civic duties. Property owners who stay informed about these changes and maintain timely tax payments avoid penalties and actively participate in the city's progressive development agenda.

Frequently Asked Questions

Ans: Visit the Kanpur Nagar Nigam website and enter your property ID or house number in the tax inquiry section. The system will display your outstanding amount, payment history, and applicable penalties or rebates.

Ans: Late payments incur a monthly penalty of 1% on the outstanding amount. Extended delays may result in legal notices, service restrictions, and potential property seizure proceedings after multiple warning notices.

Ans: No, house tax rebates are property-specific and cannot be transferred. Each property must independently qualify for rebates based on ownership details and eligibility criteria set by Kanpur Nagar Nigam.

Ans: The standard mutation process typically takes 15-30 working days, provided all required documents are correctly submitted and verified. Delays may occur if additional verification or document submission is required.

Ans: Newly constructed residential properties may receive a tax holiday for the first year after completion, subject to proper documentation and timely application. Commercial properties are not eligible for this exemption.

Recommended Reading

Simple Introduction to Indian Property Tax

January 31, 2025

4935+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

15049+ views

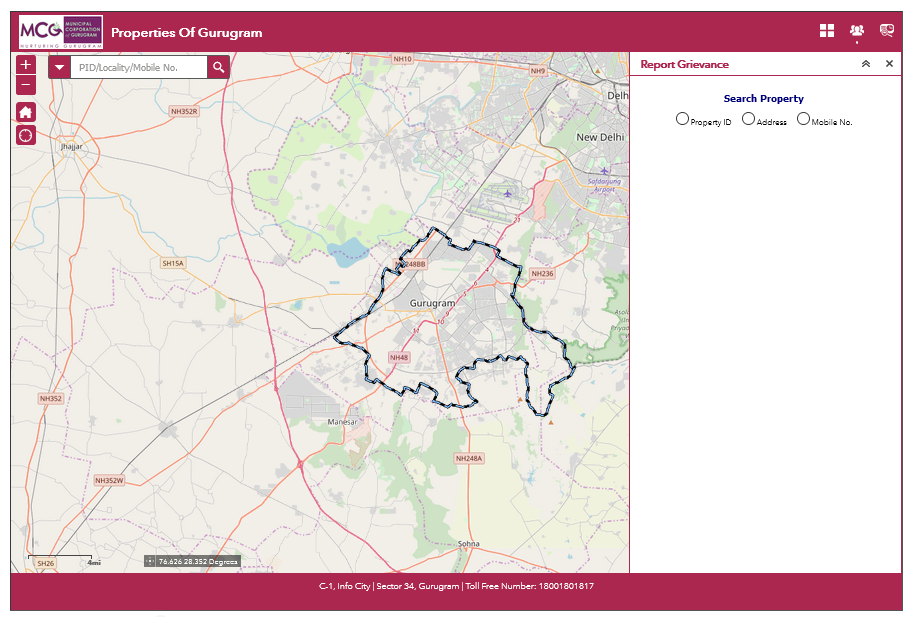

Property Tax Gurgaon Online: About Property Tax in Gurugram

January 31, 2025

4986+ views

Property Tax Hyderabad - How to Pay Property Tax Online in Hyderabad

January 31, 2025

3679+ views

Property Tax: Online Payment, Calculation, and Bill Download 2025

January 31, 2025

5900+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1047493+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

February 5, 2025

92461+ views

Supreme Court Verdict on Society Maintenance Charges

January 31, 2025

75972+ views

All You Need to Know about Revenue Stamps

January 31, 2025

63642+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

55871+ views

Recent blogs in

e-Aasthi BBMP: Search Property Details, Download Certificates, and Check Status Online

February 5, 2025 by Suju

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

February 5, 2025 by Suju

How to get Non-Encumbrance Certificate Online and Offline: Download and Check Status 2025

February 5, 2025 by Vivek Mishra

Simple Introduction to Indian Property Tax

January 31, 2025 by NoBroker.com

Sales Agreement: Process, Format and More 2025

January 31, 2025 by Vivek Mishra

Join the conversation!