Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Karnataka Land Records: Revolutionising Access with Bhoomi Portal

Table of Contents

Karnataka Land Records is stepping into the digital age with the Bhoomi portal, revolutionising how to land information is accessed and managed. This landmark initiative by the Department of Survey and Land Records not only fights corruption but also makes land records readily available to the public. Dive into our latest blog to explore how this digital transformation is making a difference for landowners and farmers across Karnataka.

Karnataka Land Records

Bhoomi, Karnataka's land records portal, is a massive step in modernising how land is managed. Land records in India are notoriously difficult to find and maintain. Documents are stored across a variety of different government departments in a variety of formats. The government in Karnataka has long been moving land records online to make this paperwork easier to maintain and more efficient to work with.

To modernise the process, the Karnataka state government launched what is known as Bhoomi.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

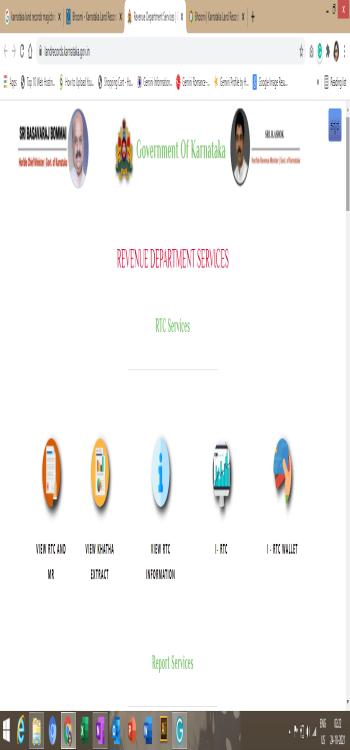

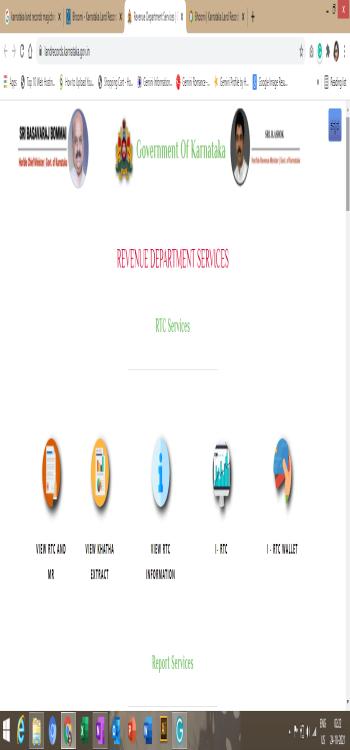

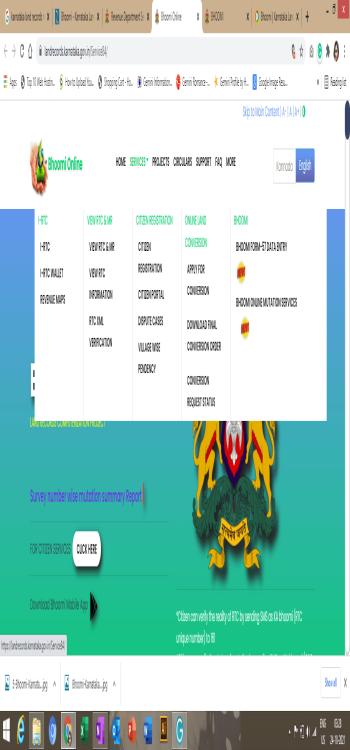

Launched in 2000, Bhoomi aims to ease access to digitised land records (RTCs), streamlining data retrieval. The platform offers a suite of services like viewing maps, applying for conversions, mutations, and more, supported by over 6,000 physical centers across Karnataka's 175 taluks.

The official portal of Karnataka government land records is https://landrecords.karnataka.gov.in/. Through this website, one can also check the gram panchayat land records of Karnataka.

Benefits of Bhoomi Portal for Farmers

Farmers in Karnataka benefit from Bhoomi — online land records. The Bhoomi site has limited the discretion of government authorities. Bhoomi presently provides the following services to farmers:

- When applying for a loan or any other reason, a farmer can immediately obtain a copy of the land registry paperwork using Bhoomi.

- Obtaining a printed copy of the Record of Rights, Tenancy, and Crops (RTC) may be done online by entering the owner's name or plot number.

- When a land parcel is sold or inherited, farmers can use mutation requests to change land records).

- A farmer can verify the progress of a mutation application by accessing the Bhoomi portal.

- If and when the revenue inspector does not finish the mutation before 50 days, a farmer may seek another official at the Taluk level to approve the modification.

- Crop information is provided in the online RTC, which assists farmers in insuring their crops.

- Crop records in the RTC can be utilised for claim reasons.

- Bhoomi expedites the resolution of land disputes needed by courts, such as notifications sent to persons concerned about the mutation.

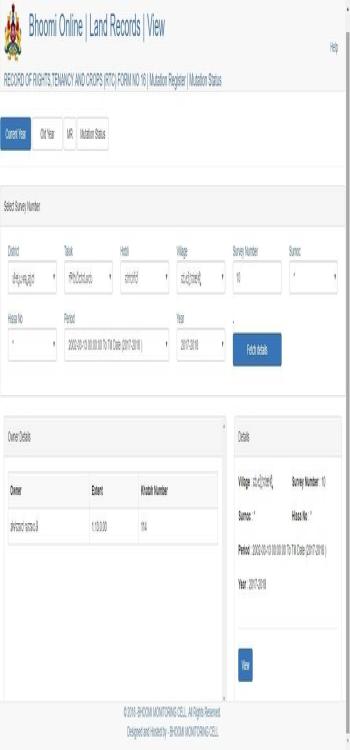

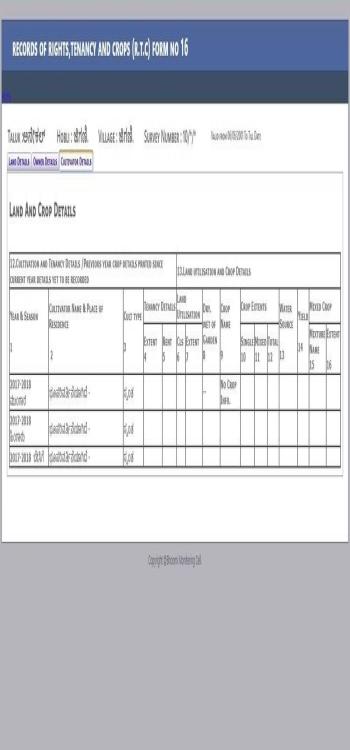

Karnataka Land Records RTC

RTC is an abbreviation for Record of Rights, Tenancy, and Crop Information. RTC or Pahani, as the name implies, holds land information (agricultural land). The following information is accessible on the Bhoomi portal:

- Details about the landowner

- Land Area Measurement Type

- Water cost

- Type of soil

- Flood zone for agricultural, commercial, non-agricultural, and residential purposes

- Liabilities arising from the nature of the land's possession

- Tenancy

Crops are produced in the Land RTC (Pahani), which aids in discovering land titles and is used for a variety of other purposes. For village lands, RTCs are usually given in hectares or acres, only with the Tahsildar or Deputy Tahsildar signatures.

How To Check Land Records in Karnataka (RTC) Online - View & Download

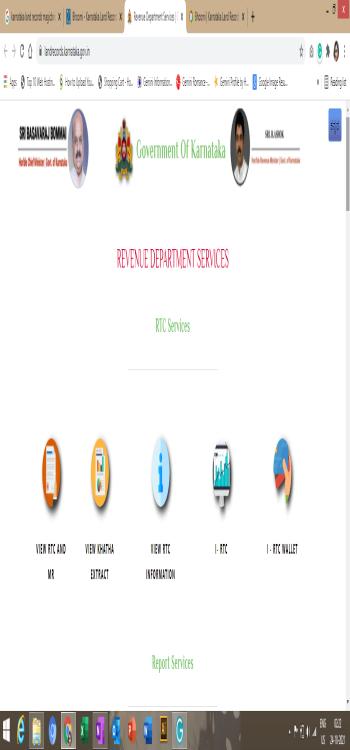

To check and download the land records of Karnataka RTC online, the user must follow the processes outlined below.

Step 1: Go to the Karnataka Online Land Records website.

Step 2: From the Home Page, select an i-RTC option. This page will be redirected to another page.

Step 3: On this page, enter your name, a 10-digit cell phone number, email address, and your Aadhaar Card number.

Step 4: After entering all of your information, click the Proceed button.

Step 5: On this screen, enter the following information:

Surnoc, Hissa number, Hobli, Taluk, District, Survey number and RTC Validity

Step 6: After inputting all of your information, click on the retrieve details button.

Step 7: Land record information will be shown. To display the RTC, select the View RTC option.

Step 8: After viewing the RTC, choose the Pay and Download option.

Please keep in mind that there is an Rs. 10-15 fee for downloading RTC.

Step 9: After making your decision and declaration, click the Pay Now button.

Step 10: The site will be diverted to the SBI website. The applicant may pay the fee in any of the following ways:

- Internet Banking

- Debit Card

- Debit Card

Step 11: Following successful payment, the RTC will be displayed in PDF format. The RTC is now available for download by the applicant.

If You Do Not Want to Download the RTC, You Can Use the Following Method to View It Online

Step 1: From the Home Page, choose the first option, 'View RTC and MR'. You will be redirected to the next page.

Step 2: From this portal, the applicant can obtain RTC for the current and previous years.

Step 3: Fill out all of the required information.

Step 4: After inputting all of your information, click on the fetch details button.

Step 5: Land record information will be shown. To display the RTC, select the View RTC option. The applicant can now save RTC as a picture.

To View RTC Details Survey No. Wise / Owner Wise / Registration Number / Date Wise

Step 1: From the Karnataka Land Records homepage, select the View RTC information option.

Step 2: Click on the radio button. Survey No. or Owner No. or Registration Number/Date No.

Step 3: Enter the necessary information and click 'View Land Data.'

How To Check RTC Information in Bhoomi

Step 1: From the Bhoomi homepage, select the View RTC information option.

Step 2: To obtain the information, the applicant must enter the following information: District, Hobli, Taluk, Village, and Survey Number.

Step 3: After filling out all of the information, the applicant must click on the fetch details button.

Step 4: RTC land data will be displayed.

Step 5: If the application requires information about the owner. On this screen, the applicant must pick the owner information option.

Step 6: Select the cultivator details option to fetch information about the land and crops.

What is Property Mutation?

Property mutation is the process of shifting title ownership of a property from one individual to another.

You may register for a mutation by going to the Kiosk centre and presenting the land-related documentation with your mutation application. The centre will offer you an acknowledgement number, which you may use to check the progress of your mutation application later.

How to Get a Mutation Report from the Bhoomi Portal

Step 1: Go to the Bhoomi homepage. Under Bhoomi services, select 'View RTC and MR' on the mutation report webpage.

Step 2: To verify the Mutation status, select the 'Mutation Report (MR)' option.

Step 3: Fill in the blanks with the district name, Village, Survey Number, Taluk, Hobli, Hissa /number and Surnoc Number. After you've input all of the information, click 'Fetch Details.'

Step 4: The Mutation data will be presented on the website based on the information you submitted.

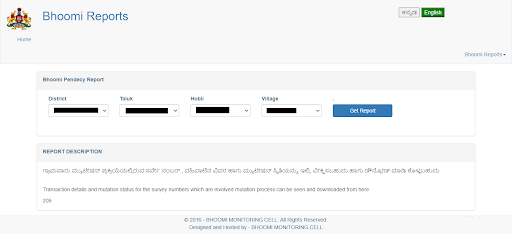

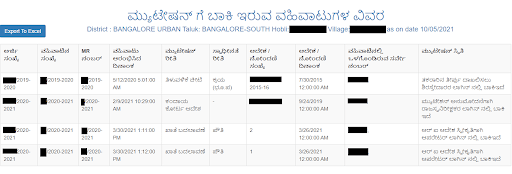

MR - Check Entire Village Land Records in Karnataka

The following are the measures to check the MR status of the entire village lands:

Step 1: Go to the official Bhoomi website.

Step 2: Select the 'Village Wise Pendency' option from the 'Services' menu.

Step 3: Enter the district, taluk, hobli, and village, and click the 'Get Report' option.

Step 4: A list of all outstanding mutations for that village's lands will show, together with data such as the application number, MR number, number of transactions, order/registration number and date, survey number, and mutation status.

How to Check Land Records in Bangalore

The official website for determining the land survey records of Karnataka is available here: https://landrecords.karnataka.gov.in/.

From the home page, go to Bhoomi, the official Karnataka land records website where one may check all the survey settlement and land records of Karnataka. Then, click on the image next to "Bhoomi" to be taken to a new window where you may look around the page to see what services are available.

"Click here" for citizen services in the next window. Then, choose from various alternatives, including revenue maps, I-RTC, citizen portals, and much more. Each of these alternatives will provide the customer with different functionality relating to land and property in Bangalore.

Then choose "see RTC & MR." You will be led to another window that will offer all the possibilities for searching for the appropriate properties. Whether you are trying to search land records by name in Karnataka or by survey number, you will find it here.

Enter the essential information and click the "retrieve details" button to obtain the appropriate information.

Pahani Online - How To Get Land Records for Mysore, Belgaum And Gulbarga

Pahani land records of Karnataka are quickly obtaining the ORIGINAL RECORD OF RIGHTS on the Internet at any time and from any place. You may receive your RTC from any location by paying Rs. 10 digitally.

To get the land records of pahani Karnataka, go to http://www.landrecords.karnataka.gov.in and select the i-RTC wallet option. The RTC wallet system enables any local entrepreneur to register an online account with the Revenue Department, deposit up to Rs 1000 in the RTC wallet, and issue RTC at a rate of Rs 10 per RTC. Local entrepreneurs can maintain topping up to Rs 1000 at any moment and hence continue giving RTCs.

You no longer need to go to the Taluk or Nadakacheri offices to acquire your RTC. Instead, you can obtain it from the comfort of your own home.

Revenue Department for Land Records Mysore: Location: DC Office | City: MYSURU | PIN Code: 570005

Revenue Department for Land Records Belgaum: Location: 2nd Floor, DC Office | City: Belagavi | PIN Code: 590001

Revenue Department for Land Records Gulbarga: Location: City Survey Office, Vikas Bhavan | City: Gulbarga | PIN Code: 585101

To guarantee that all land records are freely accessible, the Karnataka State Remote Sensing Applications Centre (KSRSAC) assists the revenue department's survey settlement branch by digitising the revenue maps. The KSRSAC has been tasked with digitising the hissa (plots part of the primary survey numbers) Bhoomi land records maps Karnataka. They would take up a two-year-old project for Rs 25 crores. This is not the same as submitting all maps to Bhoomi.

According to official data, over 1.25 lakh applications have languished for three years to update the RTC portal. According to the authorities, the pending case results from the property's mutation and transfer of ownership around its original dimensions.

Visitors can also call the Karnataka Bhoomi RTC monitoring cell at the number provided:

Contact us at 8277864065/67/68.

Email address: bmchelpdesk.s@gmail.com

To stay updated regarding the Karnataka Land Records, keep reading TheNoBrokerTimes.

Frequently Asked Questions

Ans. An Akarband Document Karnataka is a land record that details the survey and measurements of land parcels in Karnataka, used for verifying land ownership and dimensions.

Ans. Yes, city survey records online in Karnataka can be accessed through the Bhoomi portal, offering digital land records and related services.

Ans. The govt of Karnataka Department of Survey Settlement and Land Records provides digital access to land records, facilitates mutation and conversion applications, and offers map viewing and land dispute resolution services.

Ans. The land survey department in Karnataka provides services such as land surveying, mapping, issuing land records, and handling disputes related to land ownership and boundaries.

Ans. Yes, records are available for all districts, including over 6,000 Gram Panchayats across 175 taluks.

Recommended Reading

Property Rates in Bangalore in 2025: Current Price for Residential and Commercial Spaces

March 13, 2025

24893+ views

20 Best Schools in Bangalore: Admission Process with Fee Structure in 2025-26

March 12, 2025

20191+ views

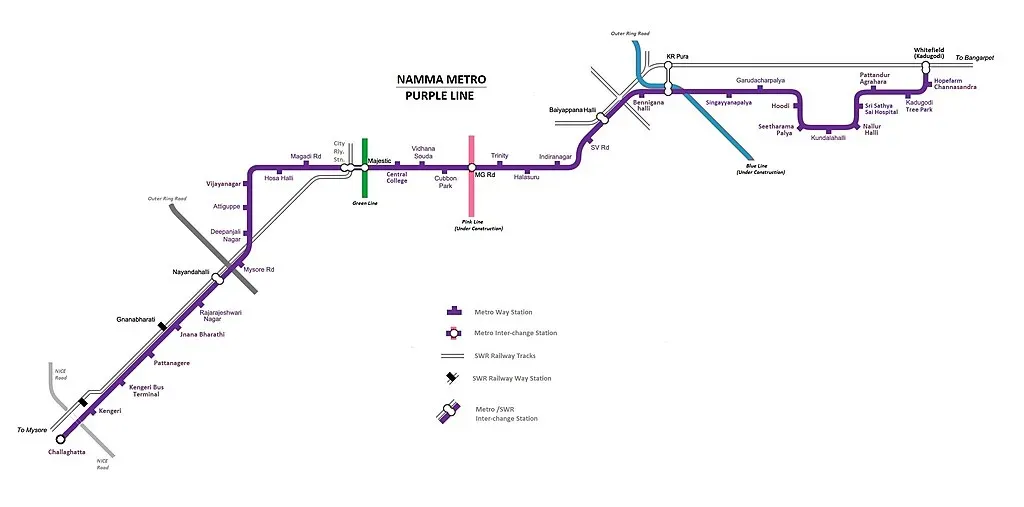

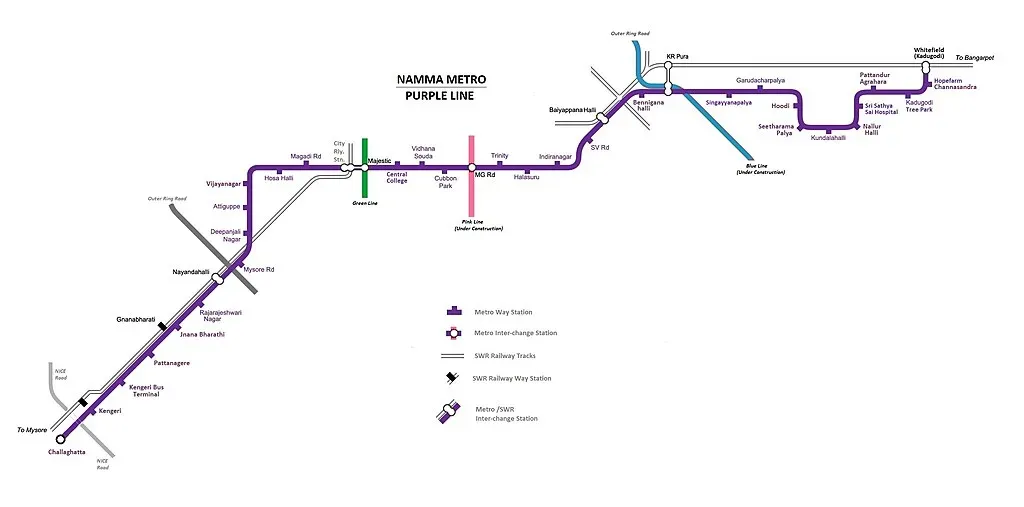

Whitefield Metro Station Bangalore: Station List, Timing, Map and Fares in 2025

March 3, 2025

279+ views

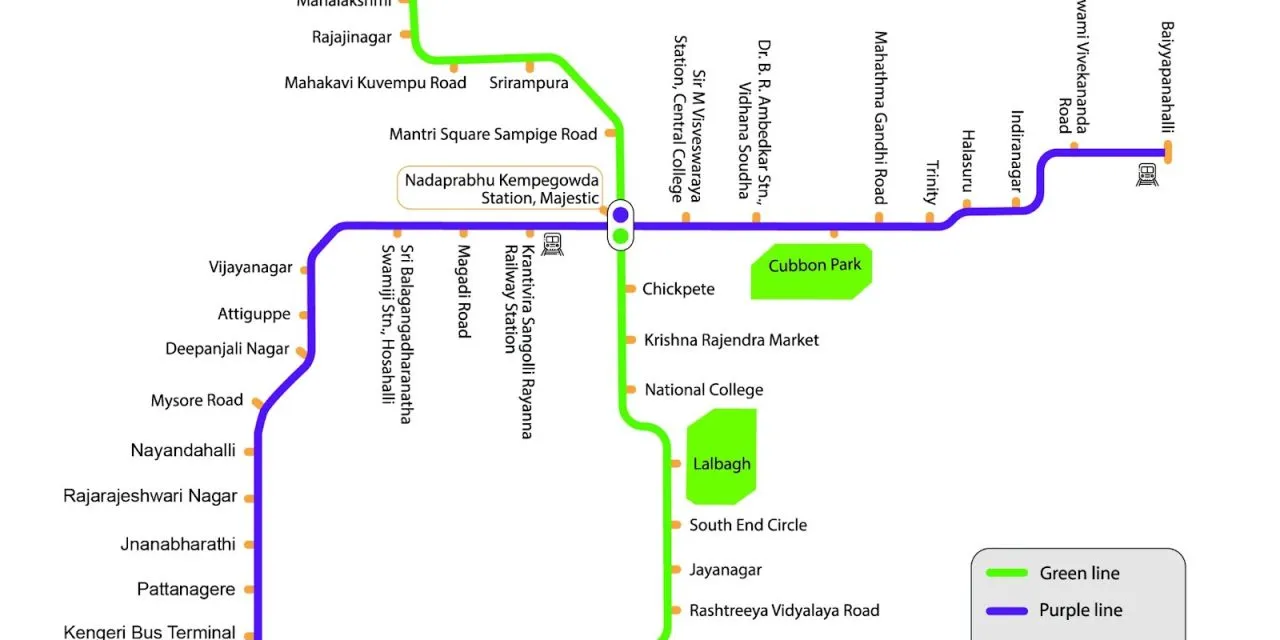

Jalahalli Metro Station Bangalore: Maps, Routes, Timings, Parinking and Fares in 2025

March 3, 2025

427+ views

Garudacharapalya Metro Station Bangalore: Map, Routes, Timings, Parking and Fares in 2025

March 1, 2025

162+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1095106+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

March 3, 2025

126187+ views

Supreme Court Verdict on Society Maintenance Charges

January 31, 2025

91926+ views

All You Need to Know about Revenue Stamps

January 31, 2025

74304+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

69126+ views

Recent blogs in

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

March 3, 2025 by Suju

Panchkula Property Tax: Payment Methods and Receipt Download 2025

February 12, 2025 by Suju

How to get Non-Encumbrance Certificate Online and Offline: Download and Check Status 2025

February 11, 2025 by Vivek Mishra

e-Aasthi BBMP: Search Property Details, Download Certificates, and Check Status Online

February 5, 2025 by Suju

Simple Introduction to Indian Property Tax

January 31, 2025 by NoBroker.com

Join the conversation!