Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

KDMC Property Tax Kalyan Dombivli: Online, Offline Payment, Download Bill and Check status in 2025

Table of Contents

Do you need clarity to understand the KDMC property tax payments? Then you’re at the right place. The Kalyan Dombivli Municipal Corporation, also known as KDMC, oversees the Thane district neighbourhood of Kalyan Dombivli. The KDMC property tax was started in 1982, and its main office is in Kalyan. KDMC is responsible for developing and maintaining the infrastructure and public services of the twin localities of Kalyan and Dombivli.

The property tax you pay is the municipal corporation’s primary funding source for maintaining and improving the community’s infrastructure and public services. Collecting this Kalyan Dombivli Municipal Corporation property tax is essential to create funds for the local government. The money from this revenue generation, essential for promoting public welfare, is used to maintain and construct other public amenities. Therefore, you must pay the overdue property taxes within the allotted time frame.

KDMC Property Tax: A Quick Info 2025

Here is the quick info for KDMC property tax 2025:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Authority | Kalyan Dombivli Municipal Corporation |

| Official Website | https://kdmc.gov.in/kdmc/CitizenHome.html |

| Last due date | March 31st 2025 |

| Email ID | commissionerkdmc@gmail.com |

| Helpline Number | 18002337383 |

KDMC Property Tax Components in 2025

You'll see that there are several parts to the KDMC property tax online payment process. Which are:

- General tax

- Road tax

- Conservancy tax

- Conservancy benefit tax

- Water supply benefit tax

- Kalyan MC education tax

- Education cess (residential)

- Tree tax

- SWM charges

- Penal interest

KDMC Property Tax Online Login Process in Official Website

Follow these steps to log in to KDMC's citizen services:

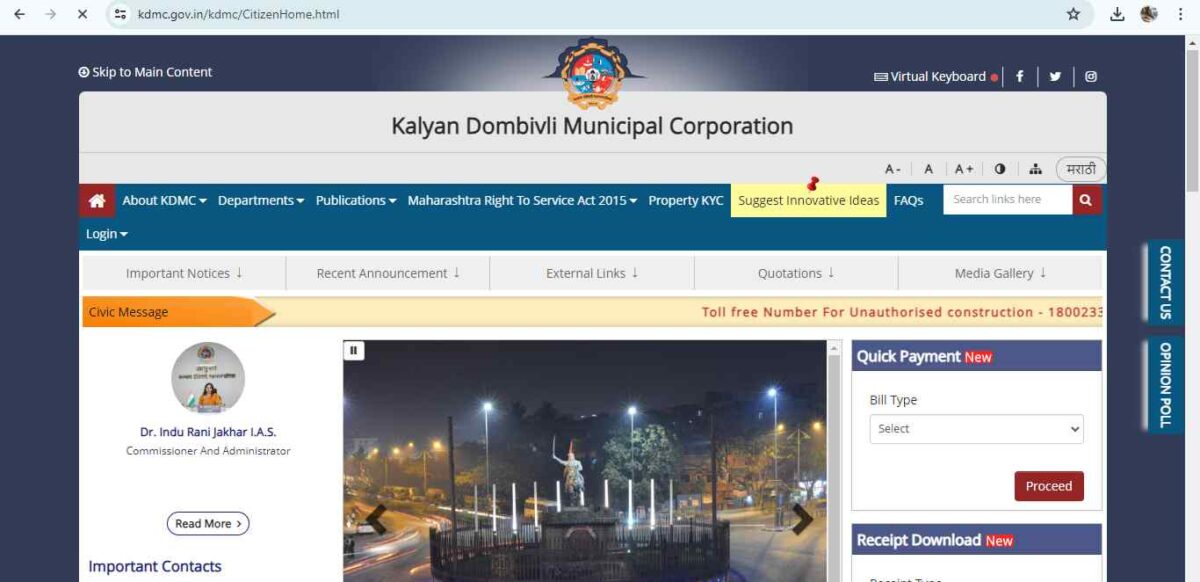

1. Visit the official KDMC website and locate the "RTS & citizen services login" tab in the top right corner of the homepage.

2. To log in, enter your user ID, password, and verification details. If you don't have an account, click "Register Me" to proceed.

3. Fill out the KDMC registration form with your name, gender, date of birth, email address, phone number, verification code, and profile picture.

4. Accept the terms and click the submit button to complete the registration process.

5. After receiving a KDMC registration acknowledgement, log in to access KDMC citizen services on the website.

6. Once you have applied for any KDMC service by providing the necessary documentation and paying the fees, you will receive a special application number for tracking the service status.

7. Upon completion, the KDMC property tax certificate will be posted on the online page, and you will be notified of its status via SMS and email.

8. To download the KDMC property tax bill, visit the KDMC portal and find the "KDMC property tax view bill" option.

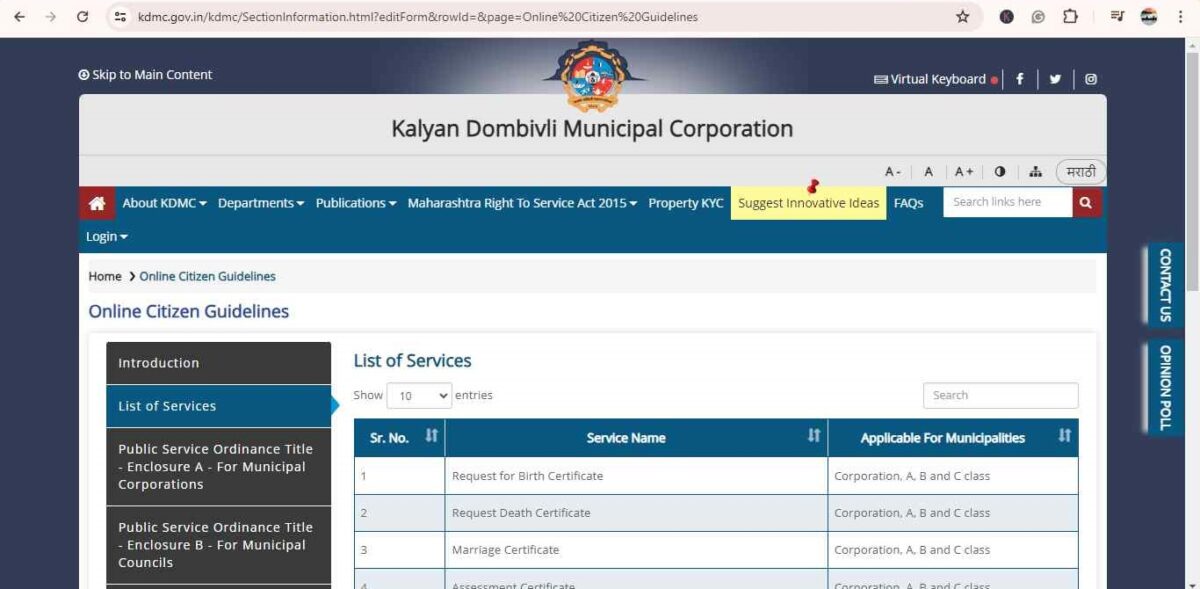

9. For information on the duration of each KDMC service, click on "Online citizen rules" at the bottom of the KDMC homepage.

10. If you are dissatisfied with service delays or have grounds for rejection by KDMC, you can file complaints through the KDMC web page.

How to Pay KDMC Property Tax Online 2025

Online property tax payments are available on the KDMC website. You must take the following actions:

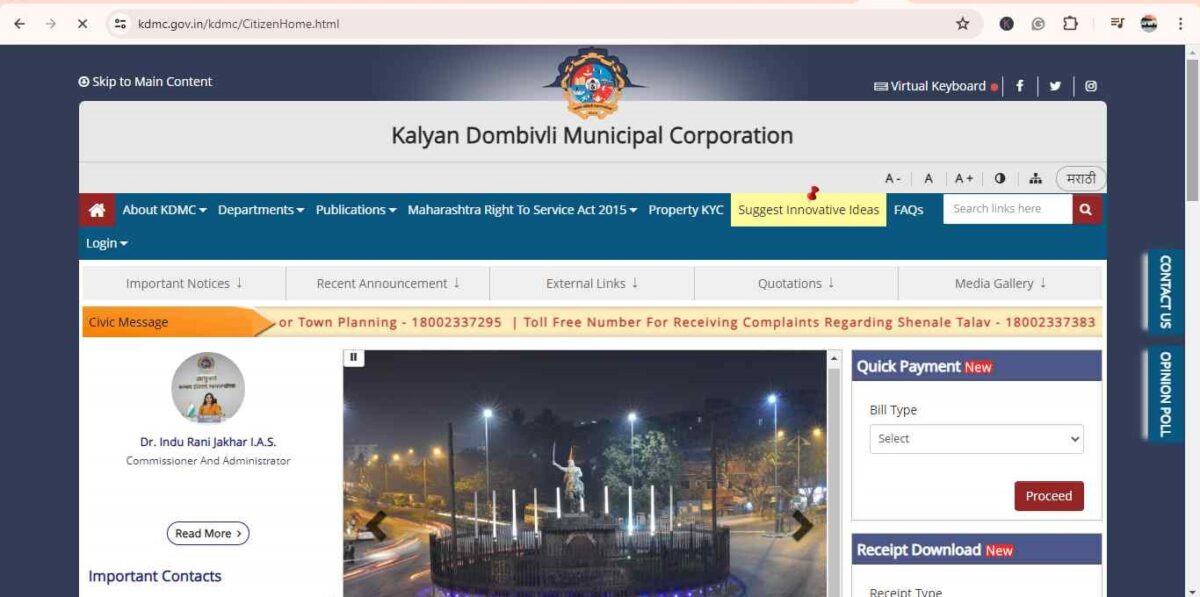

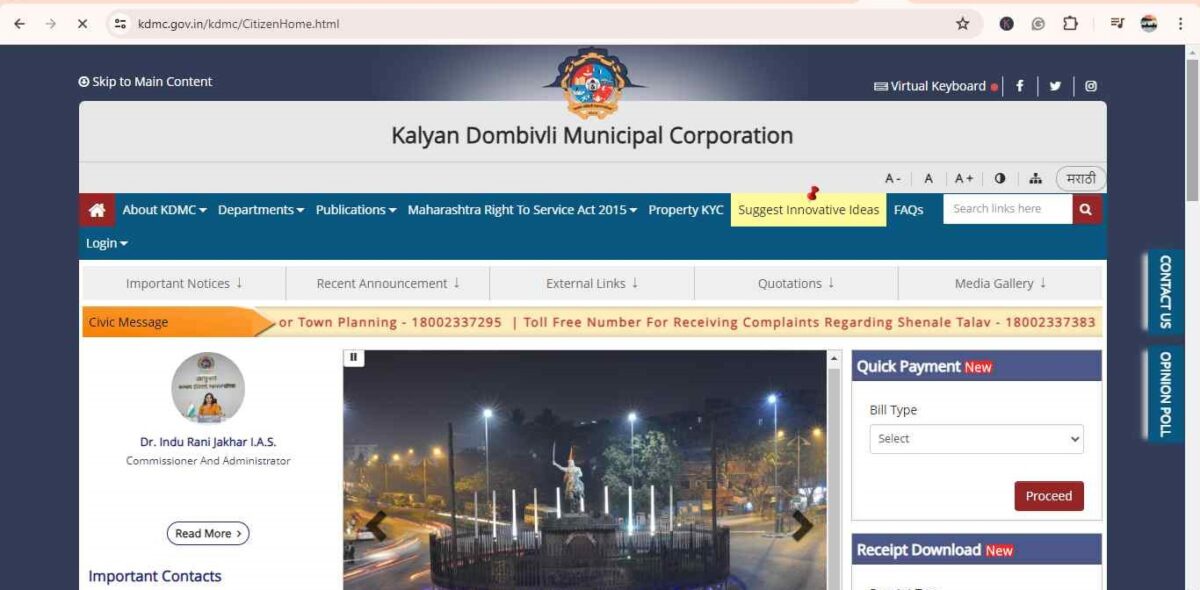

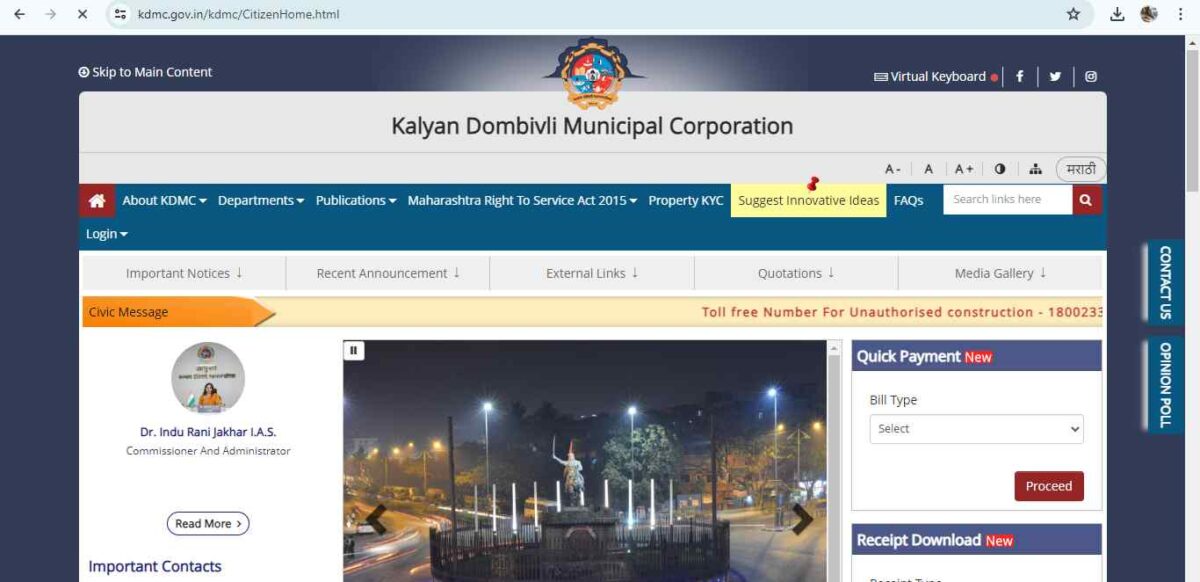

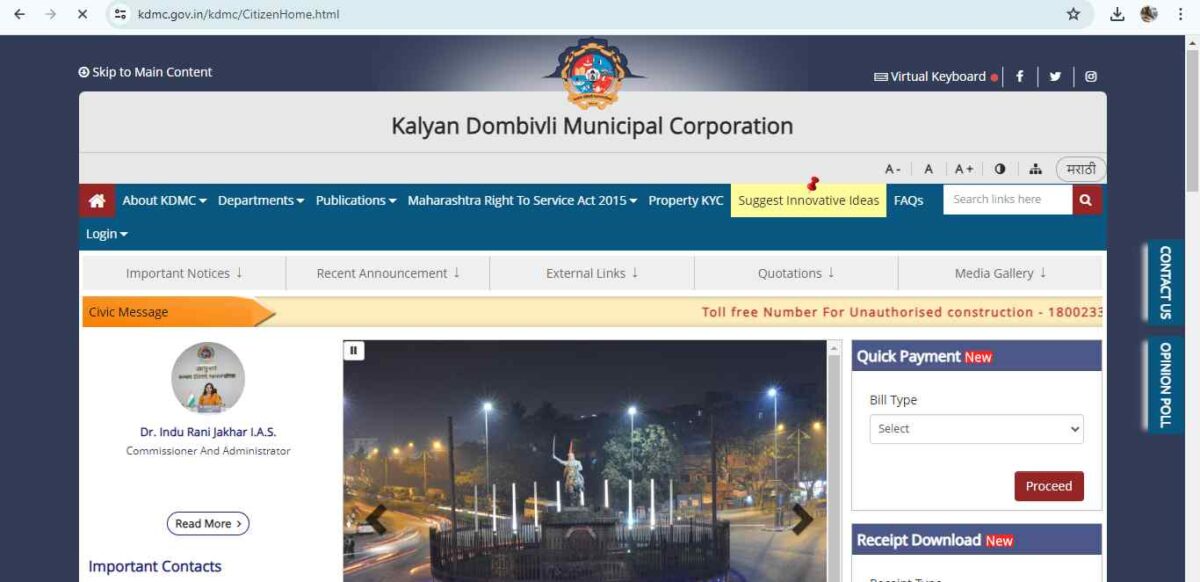

1. Visit the KDMC webpage - https://kdmc.gov.in/kdmc/CitizenHome.html

2. Click the Proceed button in the Quick Payment section after choosing the property bill from the Bill type drop-down box.

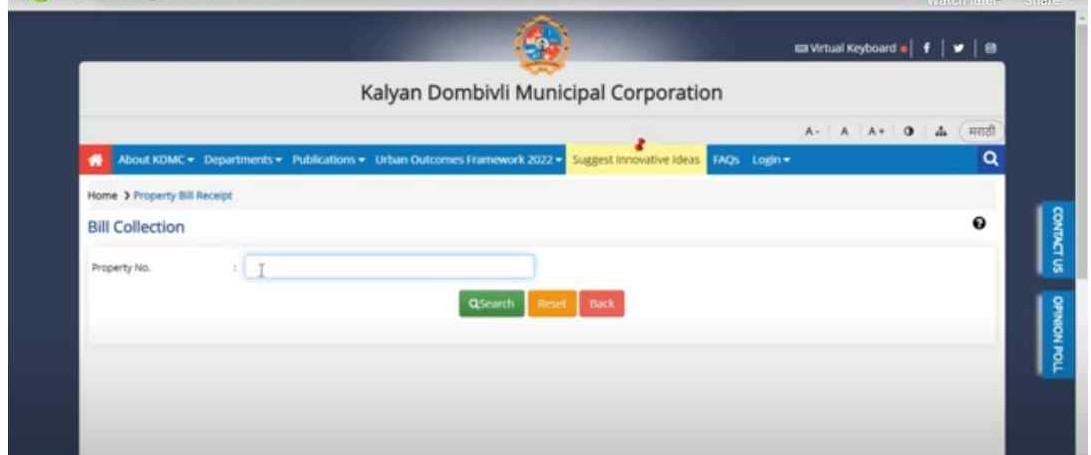

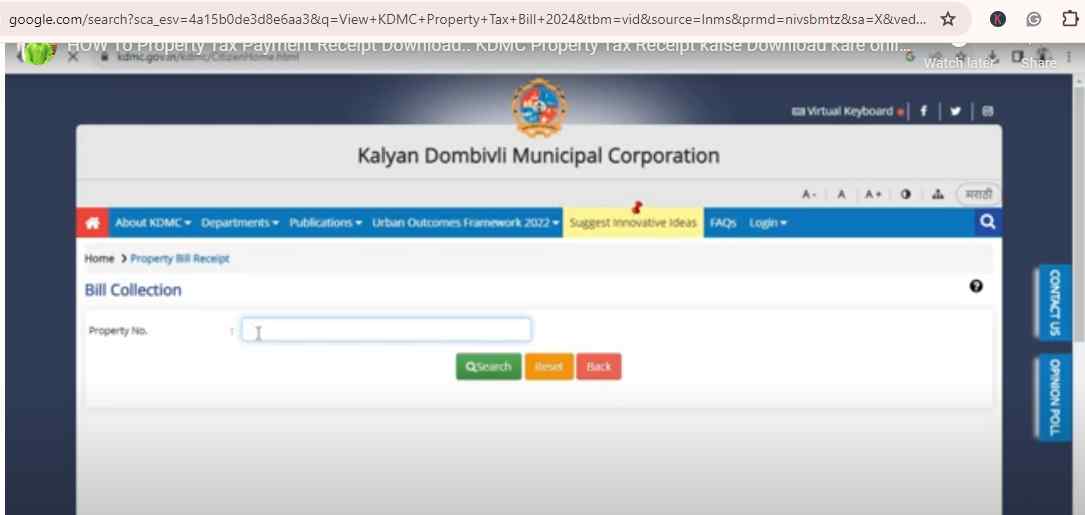

3. Press the Search button after entering the property number.

4. Select the apartment number, then click the Search button again.

5. Verify the property details and the amount of owed taxes. After inputting the chosen payment amount, click the submit button.

6. Select a payment gateway, enter your registered phone number and email address, and then click the Pay button.

7. After clicking this, you can purchase through the payment portal. Three methods are available to you for paying the bill: internet banking, UPI, and credit/debit cards.

8. You can view the property tax view bill KDMC online.

How to Use the KDMC App to Pay KDMC Property Tax Online?

You can also pay your Kalyan Dombivli property taxes online using the KDMC app on your smartphone. The app is free to download and install on Android and iOS smartphones.

Follow these instructions to deposit the KDMC property tax after installing the KDMC Android phone:

- You can sign up for the app by providing your full name, birthdate, mobile number, Aadhaar number, email address, and property address. Then, click the submit button.

- Enter the OTP sent to your mobile number and press submit.

- Set a strong password for your account.

- Log in using your mobile number and the password you created.

- Choose the real estate taxes option.

- Enter the information for your property, your flat, the owner's name, the amount you wish to pay in dues, your phone number, your email address, and the payment gateway you like.

- To finish the transaction, click the pay button.

How to Pay KDMC Property Tax using Paytm App?

Using PAYTM is perhaps the easiest way to Pay your KDMC Property Tax. Additionally, you can use your Paytm wallet to pay KDMC property taxes online.

- From the financial services menu, select Municipal Tax.

- Select the Property tax symbol for Kalyan Dombivli Municipal Corporation.

- Type in the address of your property and press the Get Tax Amount button.

- From there, you can use UPI or the Paytm wallet to pay your KDMC property taxes

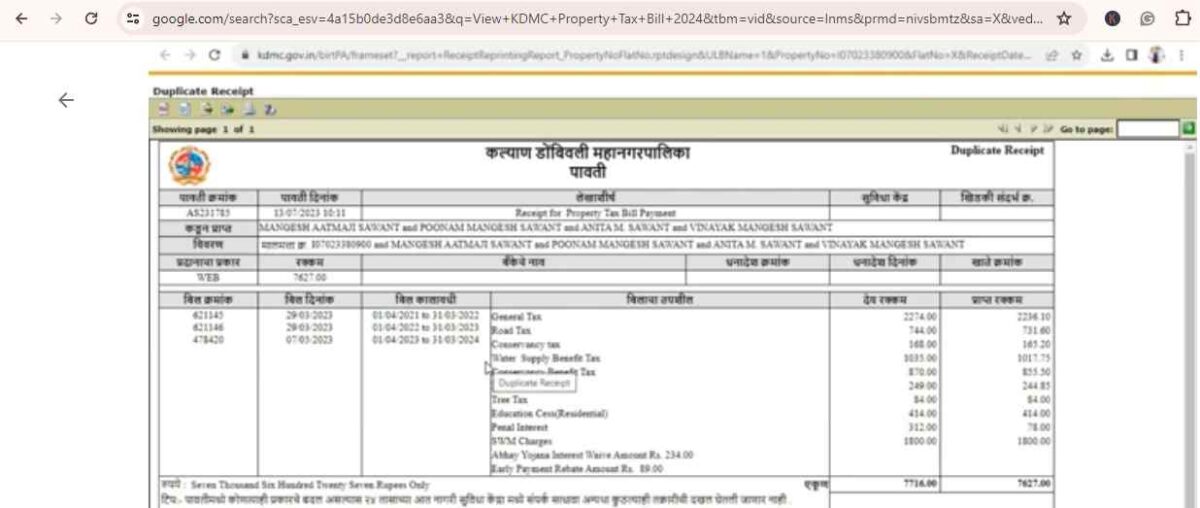

How do KDMC Property Tax Bill Download 2025?

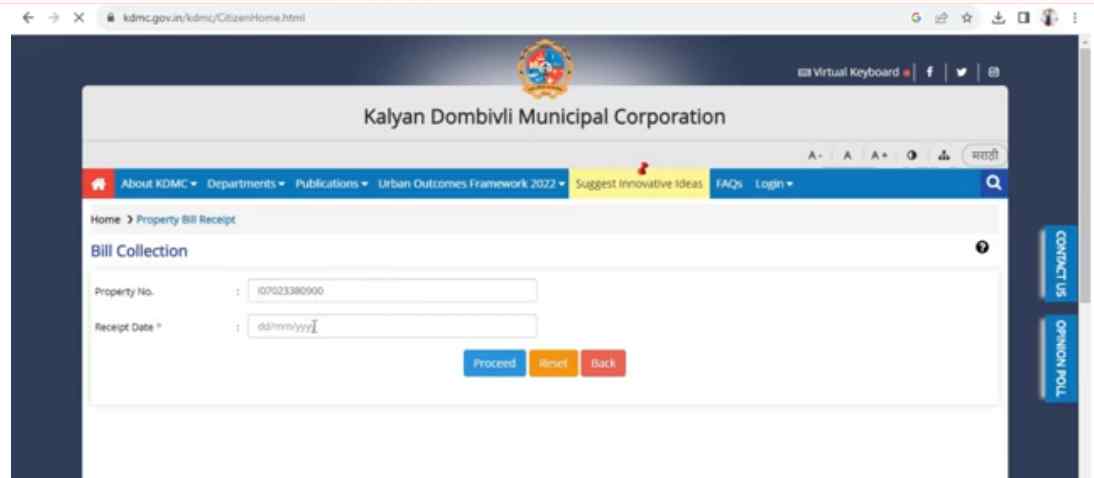

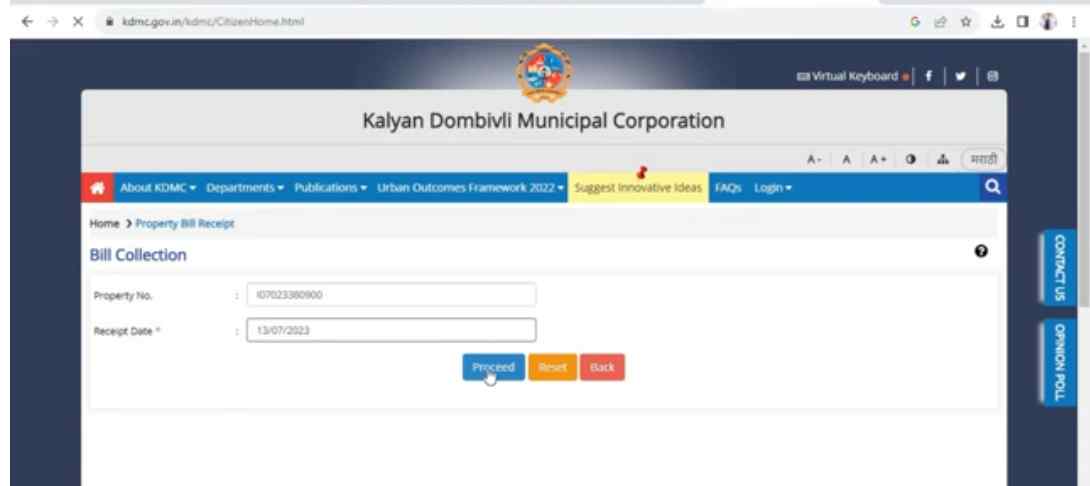

- To get the KDMC property tax receipt, select the receipt type—property bill or application no. from the selection box.

- After selecting the property bill, you must input the property number, flat number, and receipt date and click proceed to obtain a duplicate KDMC property tax bill.

- If you choose the application number, you will be directed to a new page where you must enter the application number and date before pressing the download receipt button.

Step-by-Step Guide to KDMC Property Tax View Bill

Following steps for the KDMC Property Tax Bill:

Step 1: Visit the Official KDMC Website

Begin by accessing the official website of the Kalyan-Dombivli Municipal Corporation (KDMC). Look for the "Quick Payment" section on the right side of the homepage. Within this section, you will notice an option labelled "Bill Type." Click on it to proceed with viewing your pending KDMC Property Tax.

Step 2: Select "Property Bill" from the Dropdown Menu

Upon clicking "Bill Type," a dropdown menu will appear. From the list of options, choose "Property Bill" and click on "Proceed." This action will direct you to a new page dedicated to property tax-related information.

Step 3: Enter Property Details and Initiate the Search

On the newly opened page, you will come across two empty tabs, each prompting you to enter specific property details. These tabs are labelled "Property No" and "Old Property No." Input the corresponding number in the appropriate tab depending on the available information. Once you have entered the necessary details, click the search button to retrieve the relevant information about your pending KDMC property tax.

The above straightforward steps answer the question ‘how to check KDMC property tax online’. Following them, you can easily access and review your KDMC property tax bill online. Staying informed about your tax obligations is essential, and this guide will help you easily navigate the process.

KDMC Water Bill Online Payment

Paying a KDMC water bill requires the same steps as paying a KDMC property tax, except that one must choose the water bill payment option when making a KDMC payment. After that, enter the customer number to continue paying your KDMC water bill.

You can also apply for a plumber’s or a plumber’s licence renewal to disconnect your water connection and get permission to start a new one through KDMC. You can learn more about the documentation needed for a certain service when you click on it. For instance, if you go to the KDMC home page and click “new water connection permit,” you will arrive here. You can click on apply in this situation since no document is needed. You can continue using the service after being directed to the citizen login page.

View KDMC Property Tax Bill 2025

Below is the following steps:

Step 1: Visit the KDMC website: https://www.kdmc.gov.in/

Step 2: Look for the section on Property Tax. It might be under "Online Services" or "Quick Payment".

Step 3: You'll likely be asked to enter property details like property type, zone, ward, and property number.

Step 4: Once you enter the details, you should be able to see your property tax bill for 2025.

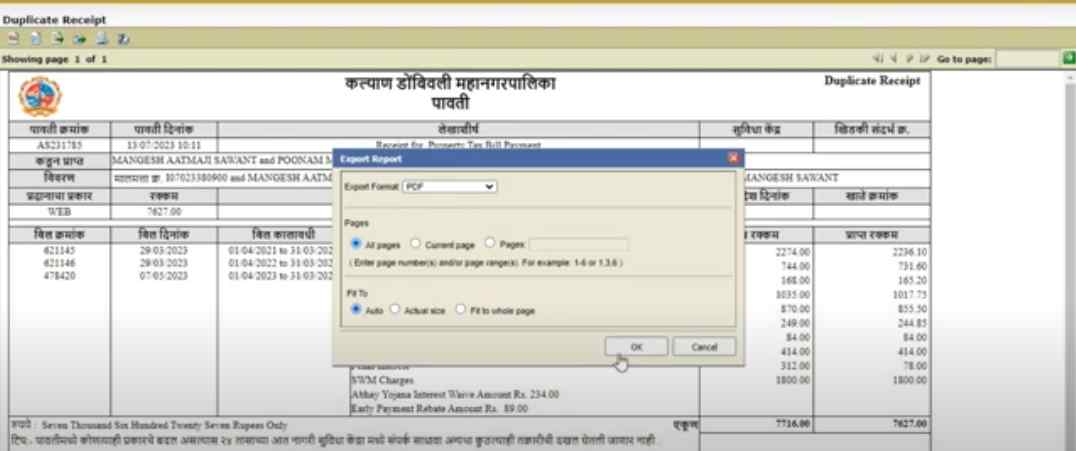

Download KDMC Property Tax Receipt (PDF) 2025

- Visit the KDMC website: https://www.kdmc.gov.in/

- Locate the section for "Property Tax" or "Online Services."

- Look for an option like "Receipt Download" or "Duplicate Receipt."

- You'll likely be given two choices:

- Property Bill: Enter your property details like property number and receipt date.

- Application Number: If you have a specific reference number for the payment, enter that and the corresponding date.

- Once you enter the required information, download the receipt in PDF format.

Track KDMC Property Tax Payment Status 2025

- Visit the KDMC website: https://www.kdmc.gov.in/

- Look for the section on "Property Tax" or "Online Services." It might also be under "Quick Payment."

- You'll likely find an option for "Payment Status" or "Track Payment."

- There are usually two ways to track your payment:

- Property Details: Enter your property details, such as the type and number (some resources suggest including the old property number, too).

- Payment Reference: If you have a receipt or transaction reference number, you can enter that instead.

- Once you submit the details, the website should display your payment status for 2025. It should indicate whether the payment is "Paid" or "Pending."

KDMC Property Tax Offline Payment 2025

You can still make an offline payment for your KDMC property tax for 2025, even though the deadline for potential discounts has passed. Here's how:

Visit the KDMC Office:

- Locate the nearest Kalyan Dombivli Municipal Corporation (KDMC) office. You can find a list of office locations on the KDMC website (https://www.kdmc.gov.in/) or by calling their helpline (contact information should also be available on the website).

- Department: Enquire about the specific department that handles property tax payments. It might be the Tax Collection Department or a similar unit.

Documents Required:

- Property Tax Bill: Bring a copy of your 2025 property tax bill.

- Payment Amount: Have the exact amount ready in cash or a demand draft (DD) made payable to "Kalyan Dombivli Municipal Corporation."

Payment Process:

- Approach the designated counter for property tax payments.

- Submit your documents (property tax bill and payment) to the official.

- You might receive a receipt or acknowledgement for your payment.

Challenge KDMC Property Tax Assessment 2025

The process to challenge your KDMC property tax assessment for 2025 will likely involve a combination of online submissions and potentially visiting the KDMC office in person. Here's a general guide:

Online Research:

- KDMC Website: The KDMC website (http://www.belagavicity.mrc.gov.in/en/home) has a section on property tax assessments or disputes. You might also find an online form to initiate the process.

- Assessment Details: Gather documents related to your property tax assessment for 2025. This might include the property tax bill, property valuation details, and any supporting documents you wish to include in your challenge.

Grounds for Challenge:

Common reasons to challenge your property tax assessment include:

- Valuation Errors: If you believe the market value assigned to your property is incorrect, you can provide evidence to support a lower valuation.

- Incorrect Measurements: Ensure the property area mentioned in the assessment matches your records.

- Exemptions: Check if your property qualifies for any exemptions that might have been overlooked.

Supporting Documents:

- Recent property valuation reports by a certified valuer

- Sale deeds of similar properties in your area

- Receipts for renovation or repairs that might have lowered the property value

- Documents proving exemption eligibility (if applicable)

Online Submission (if available):

- If the KDMC website offers an online form for contesting assessments, use it to submit your challenge. Attach scanned copies of your supporting documents.

KDMC Property Tax Rates & Calculator 2025

Unfortunately, KDMC doesn't have a single, fixed property tax rate. The amount you pay depends on several factors, including:

- Property Type: Residential properties typically have lower rates than commercial ones.

- Property Size: Larger properties generally have higher taxes due to their value.

- Location: Properties in premium areas might have higher tax rates due to market valuation.

Property Age: Older properties might have varied rates based on their depreciation.

KDMC Pay KDMC Property Tax Online 2025 Tax Calculation

Those who have already paid their KDMC property taxes online know a self-assessment option is available. What exactly is this self-evaluation? You can determine the amount of property tax you will be required to pay for your property by entering some data about it. How is this calculation carried out? What bases does it have? Understanding the KDMC property tax computation process and factors is necessary for this. The KDMC follows the capital-based calculation rule like the other Mumbai municipal corporations.

The amount of tax you must pay will depend on the market value of your property under this scheme. As an illustration, if your property has a high market value, your property tax value will also be on the upper end of the spectrum, and vice versa. Therefore, your property tax assessment will alter over time and respond to market fluctuations. How will you find out what your annual property tax value is? KDMC property tax bills are printed and generated, and you can verify them online before paying your KDMC property tax online or picking them up at their office and mailing them to you.

The following factors are multiplied by the basis to determine the KDMC property tax:

- Built-up area

- Age factor

- Base value

- type of building

- Category of use

- Floor factor

Online tax calculators are available to taxpayers. The interest charged on property taxes typically ranges from 5% to 20%. Additionally, certain states don't impose any additional late payment penalties. It would be best if you spoke with KDMC officials to learn about late property payments or interest rates. KDMC must pay tax on property in Dombivli and Kalyan.

Formula:

The Kalyan Dombivli property tax will change over time based on the property's value. Therefore, residential property tax rates are often less expensive than commercial ones.

KDMC real estate taxes = built-up area x building type x age x floor x base value x use category

Taxpayers can compute their owed taxes using the KDMC House Tax online calculators, accessible through the municipal corporations' web portal.

KDMC Property Tax Last Date 2025

Quickly settle your dues by searching your KDMC property tax by name on their website. The last date to pay your KDMC Property Tax for 2025 has passed. Based on several sources, the deadline to benefit from any reduction in penalties and interest is March 31st, 2025. This information was included in the Abhay Yojana scheme offered by KDMC earlier this year.

KDMC Property Tax Refunds and Penalties

Under certain conditions, a KDMC property tax reduction may be provided. In addition, a discount on KDMC property tax may be offered for specific circumstances. On the other hand, if you don't pay the property tax on time, you risk incurring a 5–20 per cent interest charge.

KDMC Mobile Application

Downloading the KDMC mobile app from the Google Play Store or the Apple Store enables you to use various services and pay the KDMC water and property taxes.

Recent Updates of KDMC Property Tax 2025

The Kalyan-Dombivli Municipal Corporation (KDMC) has collected ₹392 crore in property taxes from residents of Kalyan and Dombivli for the fiscal year 2024-2025. Despite this achievement, the civic body fell short of its targeted collection of ₹500 crore. Additionally, KDMC has collected ₹64 crore in water taxes from the twin cities.

KDMC launched the Abhaya Yojana from March 1 to March 15, 2025, offering a 100% waiver on interest and penalties for overdue property tax payments to encourage timely payments and reduce outstanding dues. Due to a positive response, the deadline for the scheme has been extended to March 31, 2025.

Legal Services Offered by NoBroker

NoBroker provides comprehensive legal assistance tailored to property transactions. Here's an overview of our services:

- Document Scrutiny: Our legal team examines essential documents like title deeds and sale agreements to identify potential issues before finalising the property deal.

- Protection Measures: We help safeguard you from fraudulent practices by checking for any existing legal disputes on the property and verifying ownership.

- Packages: NoBroker offers various legal service packages. These can include:

- Buyer Assistance: We provide guidance and support throughout the buying process.

- Registration: We handle property registration, saving you time and hassle.

- On-Demand Services: If you don't need a full package, we offer specific services like property title checks, guidance on market value, assistance with missing documents, and verification of occupancy certificates.

- Free Consultation: NoBroker offers a free consultation to discuss your needs and provide initial legal advice related to property.

- NoBroker Pay: By using NoBroker Pay, you can ensure a secure and convenient way to make your KMC property tax payments. Additionally, you can track all your payments conveniently in one place.

How to Book NoBroker Legal Services?

Here are the simple steps to secure our services for a smooth and hassle-free service:

- Download/Visit the NoBroker app.

- Visit the NoBroker Legal Services page.

- Explore the different service packages offered. We cover tasks like drafting agreements, property verification, and legal consultations.

- Decide on a service, fill in the necessary details and complete the form.

- Then, our NoBroker experts will contact you for further details. This contact might be through a phone number or a chat window. You can also book a free consultation call for further enquiries.

- NoBroker's legal services page also highlights online rental agreements, which can be purchased and customised directly on the NoBroker website.

Why Choose NoBroker Legal Services?

Here are some key reasons to choose NoBroker legal services:

- Convenience: NoBroker emphasises the simplicity of their service. You can complete legal tasks from home without visiting a lawyer's office.

- Affordability: We offer competitive pricing for our legal services compared to traditional lawyers, ensuring cost-effective solutions.

- Experienced Lawyers: NoBroker works with seasoned lawyers (minimum 15 years of practice) qualified by the Bar Council.

- Streamlined Process: We simplify the legal process by providing pre-defined packages and managing communication with the lawyer on your behalf.

- Technology-Driven: NoBroker utilises technology for tasks like document management to enhance efficiency and improve service delivery.

Explore Property Tax Payment Options City-Wise in India

NoBroker: Simplifying Legal Processes for Your Property Transactions

While challenges were encountered, such as underutilised modules and data reliability issues, KDMC property tax remains committed to refining its systems. By addressing these concerns, including input controls, validation checks, and security measures, KDMC strives to optimise the accounts module for property tax.

For reliable assistance in property tax management and expert guidance on legal matters, seize the opportunity to book a free consultation with NoBroker’s skilled professionals. Choose NoBroker Pay. Using this, you can be assured of a secure and convenient way to pay your VVMC property tax. Also, track all your payments conveniently in one place. Our secure and convenient platform simplifies the stamp duty process. Download the app today!

Frequently Asked Questions

Ans: To print your KDMC property tax bill, visit the official website of KDMC and navigate to the section for property tax. Locate the option to view or download the bill, and select the print option to obtain a physical copy of the bill.

Ans: The penalty for property tax in KDMC is typically levied at a rate of 2% per month on the outstanding amount.

Ans: To find your KDMC property number, you can refer to your property documents or visit the official KDMC website and search for your property using your name, address, or survey number. You can also contact the KDMC directly for assistance in retrieving your property number.

Ans: The Kalyan-Dombivli Municipal Corporation (KDMC) was formed on 1st October 1983.

Ans: To check if your property is KDMC-approved, visit the official Kalyan-Dombivli Municipal Corporation (KDMC) website and look for the section or option related to property verification. Enter the necessary details of your property, such as the property number or address, and the website will provide information regarding its KDMC approval status.

Ans: Visit the KDMC website: https://www.kdmc.gov.in/. Locate the section for "Property Tax" or "Online Services." Look for an option like "Property Bill Payment" or similar. Enter your property details, such as the type and number of the property. Some resources suggest including the old property number as well. Once you enter the details, you'll see your property tax information for 2025, including the amount due. Choose your preferred payment method. Follow the on-screen instructions to complete the payment.

Ans: Visit the KDMC website: https://www.kdmc.gov.in/. Look for the section on "Property Tax" or "Online Services." You might find an option like "Property Bill" or "Property Tax Payment." Enter your property details, such as the type and number of the property. Some resources suggest including the old property number as well. Once you enter the details, you should be able to see your property tax bill for 2025, including the amount due.

Ans: KDMC uses two main methods to calculate property tax. The Unit Area System (UAS) method applies tax rates per square metre. The specific rate depends on the property size and its designated use (residential, commercial, etc.). In the Capital Value Method, the property tax is a percentage of the property's market-assessed value.

Ans: The last date to benefit from penalty reductions and interest typically falls on March 31st. However, you can still make payments after this date. Late payment penalties might apply. It's recommended to check the KDMC website for the latest information on due dates and penalties.

Ans: Assuming by "transfer" you mean "pay," follow steps 1-3 mentioned in the answer to check your bill online. Look for a "Pay Now" or "Make Payment" option. Choose your preferred payment method (credit card, debit card, net banking, UPI). Follow the on-screen instructions to complete the payment.

Ans: Visit the KDMC website and navigate to the "Property Tax" section. Look for an option like "Receipt Download" or "Duplicate Receipt." You might be given two choices: enter your property details or a specific reference number and corresponding date for the payment. Once you enter the required information, download the receipt in PDF format.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

60183+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

48160+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

43031+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

38923+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

33234+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115308+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193046+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132262+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

127681+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!