Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Meerut Nagar Nigam House Tax: A Complete Guide to Calculation, Payment & Rebates 2024

Table of Contents

The Meerut Nagar Nigam house tax is a crucial annual property levy administered by the Municipal Corporation of Meerut to sustain and enhance civic infrastructure and services. Calculated based on factors like property size, location, and usage type, this tax forms the backbone of municipal revenue generation. The corporation has modernized its collection system by implementing digital and traditional payment channels, making it convenient for property owners to fulfil their tax obligations. The tax system balances revenue collection with citizen welfare with various rebates for timely payments and special categories. Understanding the nuances of house tax calculation, payment procedures, and available benefits helps property owners manage their tax responsibilities efficiently.

Meerut Nagar Nigam House Tax Quick Info

The Meerut Nagar Nigam house tax system operates under the UP Municipal Corporation Act, providing essential revenue for city development. Understanding the key aspects helps property owners comply with regulations, avoid penalties, and benefit from available rebates.

| Parameter | Details |

| Tax Authority | Meerut Municipal Corporation |

| Payment Frequency | Annual |

| Payment Methods | Online & Offline |

| Due Date | March 31st of each year |

| Late Payment Penalty | 1.5% per month |

| Senior Citizen Rebate | 10% |

| Early Payment Rebate | 5% |

How to Calculate Meerut Nagar Nigam House Tax

Property tax calculation in Meerut follows a structured formula based on the property's Annual Rental Value (ARV). The calculation considers various factors, including property size, location, usage type, and construction quality.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Formula: Annual House Tax = Annual Rental Value × Tax Rate

- Residential Properties: 12% of ARV

- Commercial Properties: 15% of ARV

Example: For a residential property with ARV of ₹1,20,000: House Tax = ₹1,20,000 × 12% = ₹14,400 annually

How to Pay Meerut Nagar Nigam House Tax?

Property owners in Meerut can choose between online and offline payment methods for their house tax. The Municipal Corporation has simplified the process to encourage timely payments and improve tax compliance.

Online Process

The digital payment system offers a convenient way to pay house tax from anywhere, anytime. This secure platform accepts various payment methods and provides instant confirmation.

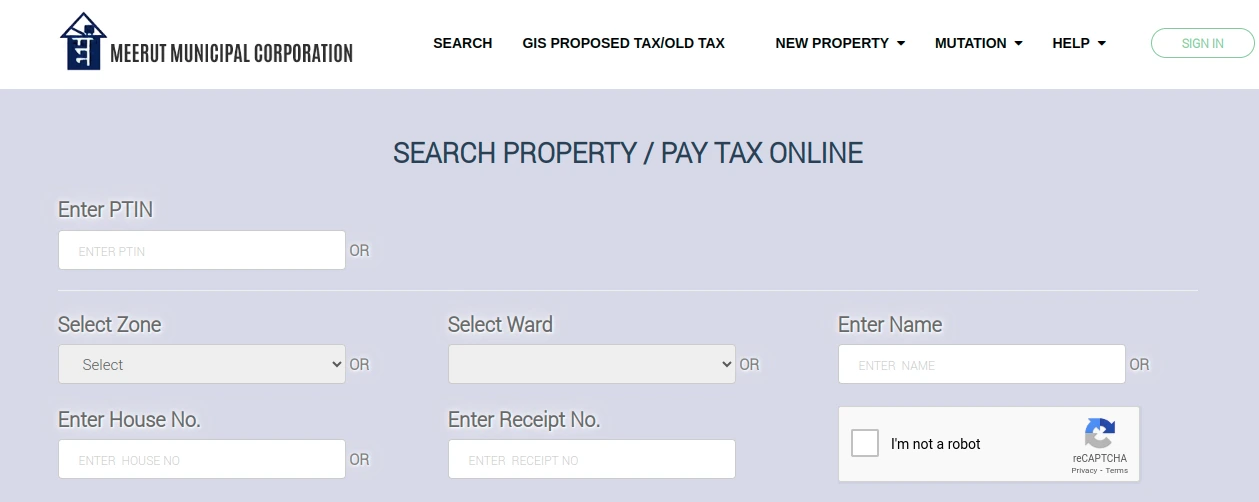

- Step 1: Visit the official Meerut Nagar Nigam website and locate the 'House Tax Payment' section. Ensure you have your property ID and previous payment details ready for reference.

- Step 2: Enter your property details, including the unique property ID, owner's name, and address. The system will display your current tax dues and any previous balance or penalties if applicable.

- Step 3: Select your preferred payment method: net banking, credit/debit card, or UPI. Complete the payment process following the on-screen instructions and save the transaction receipt.

- Step 4: Double-check all entered information before confirming payment. The system will generate a payment confirmation and receipt, which you should download and save for future reference.

Offline Process

Traditional offline payment methods remain available for those who prefer in-person transactions or face digital access challenges.

- Step 1: During working hours, visit your nearest Meerut Nagar Nigam office or authorized collection centre. Carry your property documents and previous tax receipts for verification.

- Step 2: Submit your property details to the tax collection officer, who will verify your information and calculate the applicable tax amount, including any pending dues or penalties.

- Step 3: Pay through cash, check, or demand draft. Ensure you receive an official receipt with the Nagar Nigam seal and authorized signature.

How to Download House Tax Receipts

Digital tax receipts provide easy access to payment records and serve as proof of tax payment for various purposes.

- Step 1: Log in to the Meerut Nagar Nigam website using your property ID and registered mobile number. Navigate to the 'Download Receipt' section in your dashboard.

- Step 2: Select the financial year for which you need the receipt. The system will display all payments made during that period with corresponding transaction details.

- Step 3: Click on 'Download Receipt' for the desired payment. Save the PDF receipt to your device and securely store it for future reference.

How to Download House Tax Receipts

The Meerut Nagar Nigam provides a straightforward digital system for downloading house tax receipts. Property owners can easily access their payment records through the official portal, which maintains a comprehensive database of all transactions. These digital receipts serve as official proof of payment for various purposes.

- Visit the official Meerut Nagar Nigam website and locate the "House Tax Receipt" section. Enter your registered mobile number and property ID in the designated fields. First-time users may need to complete a one-time registration process with basic property details.

- After successful login, select the relevant financial year from the dropdown menu for which you need the receipt. The system will display all transactions made during that period, including regular payments and any additional charges or rebates applied.

- Click the "Generate Receipt" button next to the desired payment entry. The system will process your request and create a PDF receipt for download. Ensure your browser allows pop-ups from the official website.

- Review the downloaded receipt for accuracy, checking all details, including property ID, owner name, payment amount, and transaction date. Store the digital receipt securely, and consider keeping both digital and printed copies for your records.

Meerut Nagar Nigam House Tax Charges

The Meerut Municipal Corporation implements a structured tax regime based on property type, usage, and location. The charges are calculated annually and vary depending on property size, construction type, and occupancy status. Understanding these charges helps property owners plan their tax obligations effectively.

| Property Type | Zone A | Zone B | Zone C |

| Residential (Self-occupied) | 12% of ARV | 10% of ARV | 8% of ARV |

| Residential (Rented) | 15% of ARV | 13% of ARV | 11% of ARV |

| Commercial | 18% of ARV | 16% of ARV | 14% of ARV |

| Industrial | 20% of ARV | 18% of ARV | 16% of ARV |

| Educational Institutions | 10% of ARV | 8% of ARV | 6% of ARV |

| Vacant Land | 5% of ARV | 4% of ARV | 3% of ARV |

Penalties for Late Payments

The Meerut Nagar Nigam enforces strict penalties for delayed house tax payments to ensure timely collection and maintain fiscal discipline. Property owners should be aware of these penalties and their implications on the total tax liability. The penalty structure is designed to encourage prompt payment compliance.

- For payments made after the due date, a basic penalty of 1.5% per month is charged on the outstanding tax amount. This compound interest accumulates until the full payment, including penalties, is cleared through proper channels.

- Property owners failing to pay tax for consecutive years may face additional surcharges of up to 20% of the total outstanding amount. The corporation may also initiate legal proceedings for severe tax evasion cases or prolonged defaults.

- Late payments can result in the placement of a tax lien on the property, restricting various property-related transactions. This includes limitations on property transfers, mortgage applications, and other municipal services until all dues are cleared.

- The Nagar Nigam may also impose administrative charges for processing late payments, ranging from ₹500 to ₹2000, depending on the delay period and outstanding amount. These charges are in addition to the regular penalty interest.

Rebates and Benefits on Meerut Nagar Nigam House Tax

The Meerut Nagar Nigam offers various rebates and benefits to encourage timely tax payments and support specific categories of property owners. These incentives include early payment discounts, senior citizen benefits, and special considerations for certain property types. Understanding these benefits can help taxpayers reduce their overall tax burden significantly.

Eligibility Criteria for Rebates and Benefits

The Municipal Corporation has established specific criteria for determining eligibility for various tax rebates and benefits. These criteria ensure a fair distribution of benefits while supporting deserving property owners. Understanding these requirements helps taxpayers determine which benefits they qualify for.

- Senior citizens (60 years and above) can avail themselves of a 10% rebate on their total house tax amount. To qualify for this benefit, the property must be self-occupied and registered solely in the senior citizen's name.

- Freedom fighters and their surviving spouses are eligible for a 15% rebate on house tax. To claim this special consideration, the property should be registered in their name and used primarily for residential purposes.

- Properties used exclusively for religious or charitable purposes may qualify for up to 50% tax exemption. The organization must be registered and provide proof of non-profit activities benefiting the community.

- Early payment rebates of 5% are available to all property owners who clear their annual tax dues within the first quarter of the financial year.

How to Avail Rebates and Benefits

Claiming rebates and benefits is designed to be straightforward while ensuring proper verification. Property owners must follow specific procedures to avail themselves of these benefits successfully.

- Submit a formal application to the Meerut Nagar Nigam tax department, either online through the official portal or in person at the municipal office. Include all required documents and mention the category of rebate being claimed.

- Schedule a verification appointment with the tax assessment officer, who will review your application and supporting documents. If necessary, this may include physical verification of the property.

- Complete any additional formalities requested by the tax department, such as providing clarifications or additional documentation. Keep following up on your application status through the provided tracking system.

- Once approved, ensure the rebate is properly reflected in your tax assessment. Maintain records of all communications and approvals for future reference.

Documents Required for Claiming Rebates

Proper documentation is crucial for successfully claiming tax rebates and benefits. The Meerut Nagar Nigam requires specific documents to verify eligibility and process rebate applications efficiently.

- Identity proof documentation including Aadhar card, PAN card, and age proof for senior citizen rebates. Additional category-specific certificates like freedom fighter certificate must be submitted in original for verification.

- Property ownership documents, including registry papers, latest tax payment receipts, and municipal survey numbers, should clearly show the applicant as the legitimate owner of the property.

- Category-specific documentation, such as income certificates, disability certificates, or trust registration documents for charitable properties, must be current and issued by authorized government agencies.

- Recent utility bills, residential proof, and self-occupation declaration where applicable. Photographs of the property may be required to verify usage and occupancy status.

Property Mutation Process of Meerut Nagar Nigam

Property mutation is the official process of transferring ownership records in municipal documents after a property sale or inheritance. The Meerut Nagar Nigam has streamlined this process to ensure smooth property transfers while maintaining accurate tax records. Timely mutation is crucial for avoiding future legal complications.

- Obtain and complete the official mutation application form from the Meerut Nagar Nigam website or office. Attach all required documents, including the registered sale deed, the previous owner's tax receipts, and the current owner's identification proof.

- Submit the application package to the designated mutation cell at the Nagar Nigam office. Pay the prescribed mutation fee, which varies based on property value and type. Collect the acknowledgement receipt with your application number.

- Schedule a property inspection with the municipal surveyor, who will verify the property details and boundaries. Ensure all property dimensions match the submitted documents and resolve any discrepancies identified during the inspection.

- Attend the hearing with the municipal authorities if required. Address any objections raised during the verification process and provide additional documentation if requested. The hearing date is usually communicated through registered mail.

- After approval, collect the mutation certificate and update the property tax records with your name. Review the new tax assessment and verify that all details have been correctly transferred to municipal records.

Benefits of Paying House Tax on Time

Timely payment of house tax offers numerous advantages beyond just avoiding penalties. The Meerut Nagar Nigam incentivizes punctual taxpayers through various benefits, contributing to individual advantages and community development.

- Access to special rebates and discounts, including early payment benefits of up to 5% on the total tax amount. Regular taxpayers may also qualify for additional seasonal discounts and promotional offers.

- Simplified property-related procedures, including faster processing of building permits, renovation approvals, and other municipal services. Good tax payment history establishes credibility with municipal authorities.

- Contribution to community development as tax funds are utilized for local infrastructure improvements, better sanitation services, and enhanced civic amenities in your neighbourhood.

- Protection from legal complications and property disputes. Regular tax payment records serve as additional proof of ownership and help maintain clear property documentation.

Recent Updates and Initiatives of Meerut Nagar Nigam

The Meerut Nagar Nigam continuously modernizes its tax collection and property management systems. Recent initiatives focus on digital transformation, improved citizen services, and transparent administration to enhance the overall tax payment experience.

- An integrated online payment portal was introduced, enabling 24/7 tax payment services. The new system includes multiple payment options, instant receipt generation, and real-time payment status tracking.

- Implement a GIS-based property mapping system for accurate property assessment and tax calculation. This digital initiative helps identify unauthorized constructions and ensures fair tax assessment across the city.

- Launch of mobile apps and SMS services for tax payment reminders, due date notifications, and instant updates about new policies or changes in tax regulations.

- Establishment of dedicated help desks and citizen service centres across different zones of Meerut. These centres assist with tax-related queries, document verification, and application submissions.

What you should know?

The Meerut Nagar Nigam house tax system supports municipal services and urban development. Through systematic collection and transparent utilization of tax revenue, the corporation maintains and enhances civic infrastructure, benefiting all residents. Modernizing tax payment systems, including digital platforms and simplified processes, has made it easier for property owners to fulfil their tax obligations. Staying updated with tax obligations, maintaining proper documentation, and utilizing available rebates can lead to significant savings for property owners. The recent technological initiatives and citizen-centric services introduced by Meerut Nagar Nigam reflect its commitment to improving taxpayer experience and administrative efficiency.

Frequently Asked Questions

Ans: Log into the Meerut Nagar Nigam website using your property ID or visit the nearest municipal office with your previous tax receipts. The system will display all pending dues, including applicable penalties or interest charges.

Ans: Late payments incur a penalty of 1.5% per month on the outstanding amount. Prolonged defaults may result in additional surcharges, property liens, and restrictions on property-related transactions until all dues are cleared.

Ans: No, tax rebates are property-specific and cannot be transferred. Each property must independently qualify for rebates based on ownership status, usage type, and other applicable criteria set by Meerut Nagar Nigam.

Ans: The standard mutation process typically takes 30-45 days, provided all documents are in order. The timeline may vary depending on property verification requirements, objections raised, and municipal authorities' current workload.

Ans: Properties under major renovation may qualify for partial tax relief during the construction period. However, owners must obtain prior approval from Meerut Nagar Nigam and submit regular progress reports to maintain the exemption status.

Recommended Reading

Capital Gains Tax on Inherited Property: Rules, Rates & Exemptions in 2025

December 31, 2024

101+ views

PCMC Property Tax Online: Download E-Receipt, Name Change, Rebate and More

December 30, 2024

7992+ views

KMC Property Tax Payment: A Step-by-Step Walkthrough

December 30, 2024

5808+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

December 26, 2024

12335+ views

Comprehensive Guide to Andhra Pradesh Property Tax Payment

December 24, 2024

5830+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

December 31, 2024

1003498+ views

Supreme Court Verdict on Society Maintenance Charges

December 17, 2024

59395+ views

December 26, 2024

51965+ views

All You Need to Know about Revenue Stamps

December 17, 2024

44422+ views

Stamp Duty and Registration Charges in Bangalore in 2025

December 17, 2024

43899+ views

Recent blogs in

Benami Transaction Act, 1988: Key Features, Legal Implications, and Penalties in 2025

January 3, 2025 by Ananth

Encumbrance Certificate Karnataka - Online and Offline Application Process in 2025

January 2, 2025 by Jessica Solomon

Non-Occupancy Charges: A Guide for Property Owners and Tenants

December 31, 2024 by Kruthi

Sale Deed: Your Guide to Property Ownership

December 31, 2024 by Kruthi

Small Cash Loan on Aadhar Card: Instant Approval, No Paperwork in 2025

December 31, 2024 by Kruthi

Join the conversation!