Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Mira Bhayander Property Tax Payment: Understanding Payment and Bill Download

Table of Contents

Paying Mira Bhayander Property Tax can often present a perplexing and time-intensive endeavour, particularly for individuals unaccustomed to its intricacies. If you happen to possess property within the bounds of Mira Bhayander, acquiring a comprehensive comprehension of the property tax framework and familiarizing yourself with the necessary procedures for tax remittance becomes paramount. Such knowledge not only guarantees adherence to statutory regulations but also serves as a shield against potential sanctions or judicial measures.

In this blog post, we will provide a comprehensive guide to Mira Bhayandar Municipal Corporation property tax payment. We will cover topics such as the purpose of property tax, who is responsible for paying it, how to calculate your property tax bill, the due date for payment, and the various methods available for paying your taxes.

Additionally, we will also provide information on the Mira Bhayander Property Tax bill download, and its in-depth process of property tax payment in the locality and offer you all the information you need to stay on top of your tax obligations.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

A Look at Property Tax Payment in Mira Bhayander

Before we dive into the details of paying property tax, it is important to understand what property tax is and why it is levied.

Definition of Property Tax

Property tax is a tax levied by local authorities on the ownership of a property. The tax is based on the value of the property, and is typically used to fund local public services such as schools, roads, and public utilities.

Why Pay Property Tax in Mira Bhayander?

Mira Bhayander is a city in the Thane district of Maharashtra, India. Property tax, also known as property rate, is a tax levied on properties, such as houses, lands, and buildings, by the local government. The property tax payment for Mira Bhayander is usually done annually, based on the value of the property.

To make the property tax payment in Mira Bhayander, you may visit the official website of the Mira Bhayandar Municipal Corporation Property Tax and look for the option to pay property tax online. You may also be able to pay property tax in person at the MBMC office or authorized banks, by submitting the necessary forms and documents.

It is important to note that the procedure and amount of property tax payment may vary depending on the specific location within Mira Bhayander and the type of property you own.

In Mira Bhayander, property tax is levied by the MBMC and is an important source of revenue for the corporation. By paying your property tax, you are contributing to the development and maintenance of the city and ensuring that essential public services are maintained.

Checking and Downloading Your Property Tax Bill

Now that we have a basic understanding of property tax in Mira Bhayander, let's take a look at how you can view and download your property tax bill.

How to Check Your Property Tax Bill Online

The MBMC has made it easy to view your property tax bill online. Simply visit the MBMC's official website, and navigate to the Property Tax section. From there, you can enter your property's assessment number and view your bill.

Here are the steps for checking and downloading your property tax bill in Mira Bhayander:

- Visit the official website of the Mira Bhayander Municipal Corporation (MBMC).

- Look for the option to view your property tax bill and payment history.

- Enter the necessary information, such as your property address or tax assessment number, to search for your property tax bill.

- Review the details of your property tax bill, including the amount due, the due date, and any payment history.

- Download or print a copy of your property tax bill for your records.

Note that the process for checking and downloading your property tax bill in Mira Bhayander may vary depending on the specific procedures and technology used by the MBMC. If you have any difficulties accessing your property tax bill, you may contact the MBMC for assistance.

Downloading Your Property Tax Bill

Once you have viewed your property tax bill, you have the option to download a copy for your records. To do this, simply click the Download button on the bill screen and save a copy to your computer.

Paying Your Property Tax in Mira Bhayander

Now that you have your property tax bill, it's time to make the payment.

How to Pay Your Mira Bhayander Property Tax Online

The MBMC offers several options for paying your property tax, including online payment through the official website, payment at designated banks, and payment through the MBMC's mobile app.

To pay property tax in Mira Bhayander, you can follow these steps:

- Visit the official website of the Mira Bhayander Municipal Corporation (MBMC) and look for the option to pay property tax online.

- Register for an account on the website, if you do not already have one.

- Log in to your account and enter your property details, such as the property address, tax assessment number, and the financial year for which you want to pay the tax.

- Calculate the property tax due using the online calculator provided on the website.

- Review the tax amount and confirm the payment.

- Choose a payment method, such as credit card, debit card, net banking, or UPI, and follow the prompts to complete the payment.

- Print or save the Mira Bhayander Property Tax receipt downloaded for your records.

It is also possible to pay property tax in person at the MBMC office or at authorized banks. In this case, you may need to fill out a physical form and submit it along with the payment.

Verifying Your Mira Bhayander Property Tax Payment Status

Verifying the payment status of your Mira Bhayander Property Tax is a pivotal task to prevent legal complications and maintain compliance. To perform this verification, carefully follow the step-by-step process outlined below:

1. Visit the Official MBMC Website: Initiate the procedure by navigating to the official Mira Bhayander Municipal Corporation (MBMC) website: www.mbmc.gov.in.

2. Access the Property Tax Payment Section: Within the website's interface, locate and select the 'PROPERTY TAX PAYMENT' option available in the menu bar.

3. Explore the Tax Bill Section: Inside the 'PROPERTY TAX PAYMENT' category, you will find the 'VIEW YOUR TAX BILL' option. Click on it to proceed.

4. Provide Property Details: Enter precise details about the property, including the property owner's name, property location, and property type. Once the information is accurately filled, initiate the search by clicking the 'SEARCH' button.

5. Unveil Your Payment Status: Upon completing the above steps, the system will display the current payment status of your property tax. This status update will explicitly indicate whether the payment has been successfully processed, is pending, or involves any outstanding dues.

By adhering to these clear-cut instructions, you can effectively uncover the precise status of your Mira Bhayander Property Tax payment. This proactive approach empowers you to promptly address any discrepancies and ensures your unwavering commitment to adhering to property tax regulations.

Changing Your Property Tax Details Online in Mira Bhayander Municipal Corporation

When alterations are needed for your property tax information, such as a name or address change, Mira Bhayander Municipal Corporation (MBMC) offers a user-friendly online portal. This allows you to easily refine your details, ensuring accurate property tax billing.

How to Update?

To modify property tax information through MBMC's online platform:

- Visit MBMC's official website.

- Find the property tax detail update option.

- Access your account or create one.

- Enter revised details (address, contact, or bank info).

- Verify accuracy; await MBMC validation.

- Confirm changes and retain a copy.

Note that process variations may exist. For assistance, contact MBMC directly.

Smooth Transition with MBMC:

For any issues during online property tax detail updates, MBMC provides direct support. Seek guidance and ensure a seamless property tax process.

MBMC Property Tax Bill Helpline: Effortless Assistance at Your Fingertips

The MBMC Property Tax Bill Helpline is your dedicated support channel for all matters related to property tax bills. Should you have questions or require clarification about your property tax bill, don't hesitate to connect with us. Feel free to drop an email with your queries to propertytax@mbmc.gov.in, using the subject line "MBMCPROPERTYOL" along with your Property Number and/or Transaction ID for swift resolution. Alternatively, you can reach out directly by calling 28192828-ext 333. Our experts are here to provide you with accurate information and guidance, ensuring a seamless property tax experience in Mira Bhayander.

NoBroker Can Help with Your Property Tax Needs

Paying property tax in Mira Bhayander is an important responsibility for property owners. By understanding the process of checking your property tax bill, downloading a copy, and making a payment, you can ensure that your property tax obligations are met and that you are contributing to the development and maintenance of the city. If you’re struggling to understand the property tax payment process in Mira Bhayander, or if you need help with your property tax bill, NoBroker can help. Our team of experts can assist with all your property tax needs, including bill payment and Mira Bhayander Municipal Corporation Property Tax receipt generation.

FAQs

To acquire a Mira Bhayander Property Tax duplicate bill, you can visit the official website of MBMC and navigate to the 'Property Tax Payment' section. There, select 'View Your Tax Bill' and input your property details to generate the duplicate bill.

Yes, you can pay your property tax online in Mira Bhayander by visiting the official website of the MBMC and following the instructions to make an online payment.

If you don't pay your property tax in Mira Bhayander, you may be subject to penalties, interest charges, and legal action, including the seizure of your property.

Yes, you may be eligible for a rebate on your property tax in Mira Bhayander, depending on your circumstances. Check with the MBMC for information on rebates and other concessions.

You can check your property tax status in Mira Bhayander by visiting the official website of the MBMC and looking for the option to view your tax bill and payment history. Alternatively, you can contact the MBMC directly for information on your property tax status.

Recommended Reading

Simple Introduction to Indian Property Tax

January 31, 2025

4935+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

15049+ views

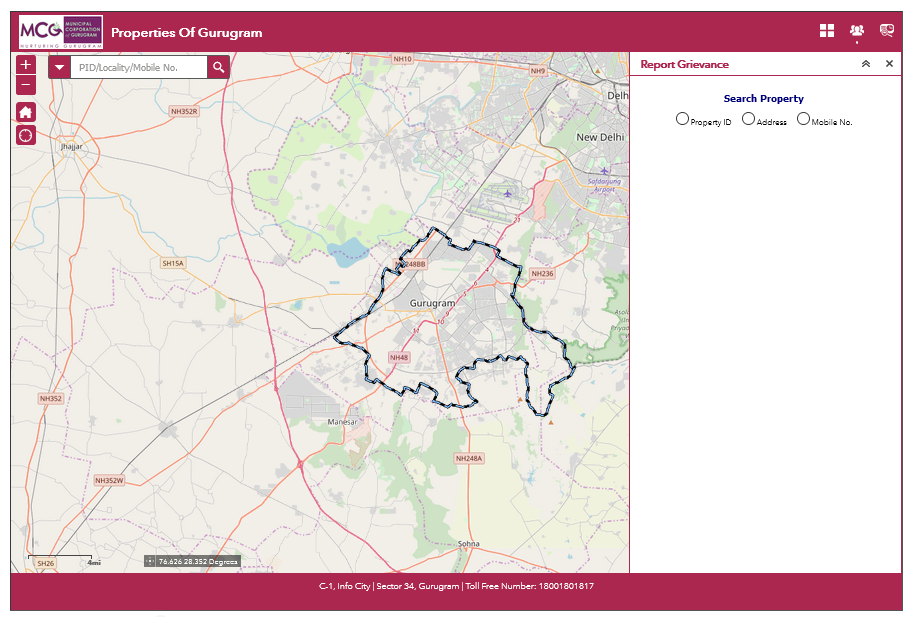

Property Tax Gurgaon Online: About Property Tax in Gurugram

January 31, 2025

4986+ views

Property Tax Hyderabad - How to Pay Property Tax Online in Hyderabad

January 31, 2025

3679+ views

Property Tax: Online Payment, Calculation, and Bill Download 2025

January 31, 2025

5900+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1047494+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

February 5, 2025

92463+ views

Supreme Court Verdict on Society Maintenance Charges

January 31, 2025

75973+ views

All You Need to Know about Revenue Stamps

January 31, 2025

63642+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

55871+ views

Recent blogs in

e-Aasthi BBMP: Search Property Details, Download Certificates, and Check Status Online

February 5, 2025 by Suju

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

February 5, 2025 by Suju

How to get Non-Encumbrance Certificate Online and Offline: Download and Check Status 2025

February 5, 2025 by Vivek Mishra

Simple Introduction to Indian Property Tax

January 31, 2025 by NoBroker.com

Sales Agreement: Process, Format and More 2025

January 31, 2025 by Vivek Mishra

Join the conversation!