Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Nagar Nigam Gorakhpur House Tax Online and Offline Payment: Calculation and Receipt Download

Table of Contents

The Nagar Nigam Gorakhpur house tax system is an important revenue source for the city's development and maintenance of civic amenities. Gorakhpur property owners must pay this annual tax, which is calculated based on factors like property size, location, and usage type. The municipal corporation has modernized its tax collection system by introducing digital payment options while maintaining traditional offline methods. With various rebates and benefits available for different categories of property owners, understanding the tax structure and payment processes is essential for timely compliance and avoiding penalties. This comprehensive guide covers everything from calculation methods to recent updates in the taxation system.

Nagar Nigam Gorakhpur House Tax Quick Info

The Gorakhpur Municipal Corporation manages house tax collection to maintain and develop civic infrastructure. Understanding the key aspects of house tax payment helps property owners fulfil their obligations efficiently and avoid penalties.

| Parameter | Details |

| Payment Frequency | Annual |

| Payment Methods | Online & Offline |

| Due Date | March 31st of each financial year |

| Late Payment Penalty | 1% per month |

| Rebate for Senior Citizens | 10% of total tax amount |

How to Calculate Gorakhpur Nagar Nigam House Tax

The house tax calculation in Gorakhpur follows a standardized formula based on the Annual Rental Value (ARV) of the property. The municipal corporation considers various factors to determine the final tax amount.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Formula: House Tax = Annual Rental Value × Tax Rate Annual Rental Value = (Covered Area × Base Rate per sq. ft × Location Multiplier) × 12 months

Example:

- Property Size: 1000 sq. ft

- Base Rate: ₹15 per sq. ft

- Location Multiplier: 1.2

- Tax Rate: 10% Annual Rental Value = (1000 × 15 × 1.2) × 12 = ₹216,000 House Tax = ₹216,000 × 10% = ₹21,600

How to Pay Nagar Nigam Gorakhpur House Tax?

Gorakhpur property owners can choose between online and offline payment methods for their house tax. The municipal corporation has implemented a user-friendly system to facilitate convenient tax payments.

Online Process:

The digital payment system offers a convenient way to pay house tax from anywhere, anytime. The process is secure and provides instant payment confirmation.

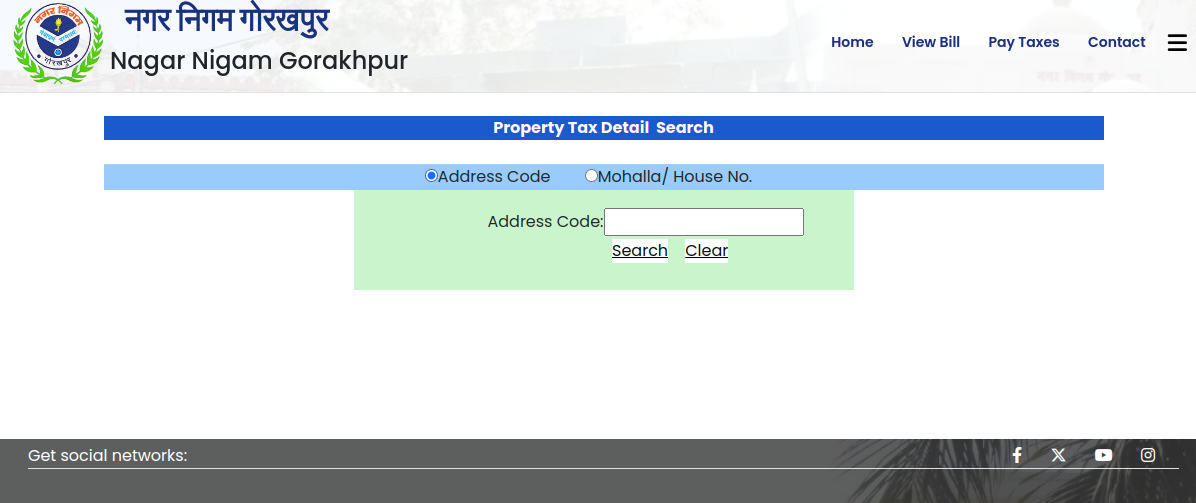

- Step 1: Visit the official Nagar Nigam Gorakhpur website and navigate to the 'House Tax Payment' section. Register as a first-time user, or log in with your existing credentials.

- Step 2: Enter your property ID or use the search function to locate your property details. Verify all information displayed, including ownership details and tax amount calculations.

- Step 3: Select your preferred payment method from available options (Net Banking, Credit Card, Debit Card, or UPI). Complete the payment process by following the on-screen instructions.

- Step 4: Download and save the payment receipt for future reference. The system automatically updates your payment status in the municipal records.

Offline Process

Traditional offline payment methods remain available for those who prefer in-person transactions or face digital accessibility issues.

- Step 1: Visit the nearest Nagar Nigam Gorakhpur office during working hours (Monday to Saturday, 10 AM to 5 PM). Carry your property documents and previous tax receipts.

- Step 2: Obtain a tax assessment form from the tax department counter. Fill in all required details accurately, including your property information and owner details.

- Step 3: Submit the completed form and the necessary documents to the tax assessment officer. Wait for the verification process and tax amount calculation.

- Step 4: Pay at the designated cash counter using cash or check. Collect your official tax receipt and keep it safe.

How to Download House Tax Receipts

Downloading your Nagar Nigam Gorakhpur house tax receipt is a straightforward process that can be completed in a few simple steps:

- Step 1: Visit the official Nagar Nigam Gorakhpur website

- Step 2: Click on the 'House Tax' section

- Step 3: Select the 'Download Receipt' option

- Step 4: Enter your Property ID/Tax Assessment Number

- Step 5: Provide the payment reference number

- Step 6: Click on 'Generate Receipt'

- Step 7: Download and save the PDF receipt for your records

Gorakhpur Nagar Nigam House Tax Charges

The Nagar Nigam Gorakhpur implements a comprehensive tax structure based on property type, usage, location, and construction quality. Understanding these charges helps property owners plan their finances and ensure compliance with municipal regulations. The tax rates are reviewed periodically to align with the city's development needs.

| Property Category | Zone A (Prime) | Zone B (Commercial) | Zone C (Residential) | Zone D (Outskirts) |

| Residential (Self-Occupied) | 12% of ARV | 10% of ARV | 8% of ARV | 6% of ARV |

| Residential (Rented) | 15% of ARV | 13% of ARV | 11% of ARV | 9% of ARV |

| Commercial | 20% of ARV | 18% of ARV | 15% of ARV | 12% of ARV |

| Industrial | 18% of ARV | 16% of ARV | 14% of ARV | 10% of ARV |

| Mixed Use | 16% of ARV | 14% of ARV | 12% of ARV | 8% of ARV |

| Vacant Land | 5% of ARV | 4% of ARV | 3% of ARV | 2% of ARV |

Penalties for Late Payments

The Nagar Nigam Gorakhpur enforces strict penalties for delayed house tax payments to ensure timely collection and maintain fiscal discipline. Property owners should be aware of these charges and submit their payments before the due date to avoid additional financial burdens.

- Basic Penalty Rate: A monthly interest rate of 1% is charged on the outstanding amount, calculated from the first day after the due date. This compounds monthly and continues until the full payment is made.

- Additional Surcharge: After three months of default, an additional surcharge of 5% on the total outstanding amount is levied. This includes both the original tax amount and accumulated interest.

- Legal Proceedings: Defaulters who have been unpaid for more than six months may face legal action, including property sealing notices. Additional legal charges and court fees may be added to the outstanding amount.

- Recovery Charges: If the Nagar Nigam initiates recovery proceedings, all associated costs, including notice generation and enforcement team expenses, are added to the defaulter's account.

- Service Restrictions: Prolonged defaults may result in restrictions on municipal services and delays in processing other property-related applications or permits.

Rebates and Benefits on Gorakhpur Nagar Nigam House Tax

Nagar Nigam Gorakhpur offers various rebates and benefits to encourage timely tax payments and support specific categories of property owners. These incentives include early payment discounts and special considerations for senior citizens, freedom fighters, and disabled individuals, making property tax payments more manageable for eligible citizens.

Eligibility Criteria for Rebates and Benefits

Understanding eligibility requirements is crucial for property owners to take advantage of available tax benefits. The Nagar Nigam has established clear criteria to ensure fair distribution of rebates while maintaining transparency in the process.

- Senior Citizen Category: Property owners aged 60 years and above qualify for a 10% rebate on their total house tax amount. The property must be self-occupied and registered solely in their name or jointly with their spouse.

- Early Payment Discount: Property owners who pay their annual tax within the first quarter (April-June) are eligible for a 5% early bird discount. This applies to all property categories regardless of ownership status.

- Freedom Fighter Benefits: Freedom fighters or their surviving spouses can avail of up to a 25% rebate on house tax. The property must be self-occupied and not exceed 2000 square feet in built-up area.

- Disabled Person Category: Physically disabled property owners with disability certificates are eligible for a 15% rebate. The property should be their primary residence and registered in their name.

How to Avail Rebates and Benefits

Claim rebates by submitting applications and necessary documentation to the Nagar Nigam office. Following the correct procedure ensures smooth processing and timely approval of benefits.

- Online Application: Submit your rebate application through the official portal by logging into your account. Upload all required documents and select the appropriate rebate category from the available options.

- Document Verification: Schedule an appointment with the tax assessment department to have your documents physically verified. Carry original copies of all submitted documents for authentication.

- Rebate Processing: The tax department processes your application within 15 working days after verification. Once approved, the revised tax amount will be reflected in your next payment cycle.

- Annual Renewal: Some rebates require annual renewal of applications. Submit renewal documents at least 30 days before the start of the new financial year to ensure continuous benefits.

Documents Required for Claiming Rebates

To facilitate the smooth processing of rebate claims, Nagar Nigam Gorakhpur requires specific documents based on the rebate category being claimed. Having these documents ready helps expedite the approval process.

- Identity and Age Proof: Submit government-issued photo ID, age proof (for senior citizens), and Aadhaar card. These documents establish your identity and eligibility for specific category-based rebates.

- Property Ownership Documents: Provide property registry, latest tax receipt, and mutation certificate if applicable. These documents verify your ownership status and property details for rebate calculation.

- Category-Specific Certificates: Depending on the rebate category, submit a disability certificate, freedom fighter certificate, or other relevant documentation. Ensure all certificates are current and issued by authorized authorities.

- Income Proof: Present income tax returns or pension documents where applicable. This helps verify eligibility for income-based rebates and ensures appropriate benefit allocation.

Property Mutation Process of Nagar Nigam Gorakhpur

Property mutation transfers ownership records in municipal documents after a property sale, inheritance, or gift transfer. Nagar Nigam Gorakhpur has streamlined this process to ensure smooth ownership transitions and maintain accurate property records for tax assessment purposes.

- Application Submission: Visit the Nagar Nigam office or access the online portal to submit the mutation application form. Include all necessary ownership transfer documents, current owner's NOC, and pay the prescribed mutation fees for initial processing.

- Document Verification: The municipal corporation's legal team verifies all submitted documents, including sale deeds, previous tax receipts, and identity proofs. They cross-check property details with existing records to ensure accuracy and legitimacy.

- Public Notice Generation: Nagar Nigam issues a public notice for ownership change, which is displayed for 30 days. This allows stakeholders to raise objections, if any. The notice is published both online and at the municipal office.

- Site Inspection: Municipal officers physically inspect the property to confirm details mentioned in the application. They prepare a detailed report that includes property measurements and current usage patterns.

- Final Approval and Record Update: The mutation certificate is issued after addressing any objections and completing verification. The property tax records are updated with new owner details for future tax assessments.

Benefits of Paying House Tax on Time

Timely payment of house tax helps avoid penalties and contributes to various personal and community benefits. The Nagar Nigam encourages punctual payments through incentives and improved service delivery.

- Early Payment Discounts: Property owners who pay their taxes before the due date can avail special rebates, typically ranging from 5-10% of the total tax amount, resulting in significant annual savings.

- Uninterrupted Municipal Services: Regular tax payments ensure continuous access to essential services like water supply, waste management, and street lighting. The Nagar Nigam prioritizes service delivery to compliant areas.

- Hassle-Free Documentation: Timely taxpayers receive priority processing for various municipal services, including building permits, renovation approvals, and other property-related certificates.

- Property Value Enhancement: Areas with high tax compliance often receive better infrastructure development, which increases property values and improves living conditions for residents.

Recent Updates and Initiatives of Gorakhpur Nagar Nigam

Nagar Nigam Gorakhpur continuously introduces new initiatives to improve tax collection efficiency and enhance taxpayer convenience. These updates reflect the corporation's commitment to digital transformation and citizen service.

- Digital Payment Integration: The municipal corporation has integrated multiple digital payment options, including UPI, net banking, and mobile wallets, making tax payments more accessible and convenient for property owners.

- Mobile App Launch: A dedicated mobile application now allows taxpayers to view property details, pay taxes, and download receipts directly from their smartphones, enhancing accessibility and reducing paperwork.

- GIS Mapping Implementation: The corporation has initiated GIS-based property mapping to improve tax assessment accuracy and identify unauthorized constructions, ensuring fair tax distribution across the city.

- Taxpayer Awareness Programs: Regular workshops and awareness camps are organized to educate property owners about tax calculations, payment procedures, and available rebates, promoting better compliance.

- Green Building Incentives: New initiatives include special tax rebates for buildings incorporating eco-friendly features like rainwater harvesting and solar panels, promoting sustainable urban development.

What you should know?

The Nagar Nigam Gorakhpur house tax system is vital in maintaining and developing the city's infrastructure. Through systematic collection and efficient utilization of tax revenue, the municipal corporation ensures continuous improvement of civic amenities and public services. The introduction of digital payment options and various rebates and benefits has made tax compliance more accessible and rewarding for property owners. The transparent mutation process and timely payment benefits encourage responsible property ownership and contribute to the city's organized growth. As Gorakhpur continues to develop, staying updated with tax obligations and utilizing available benefits helps property owners contribute effectively to the city's progress while maintaining their property records accurately.

Frequently Asked Questions

Ans: You can check your outstanding house tax by visiting the official Nagar Nigam Gorakhpur website and entering your property ID. Alternatively, visit the municipal office with your previous tax receipts for a detailed dues statement.

Ans: Missing the deadline results in a monthly penalty of 1% on the outstanding amount. Prolonged defaults may lead to additional surcharges, legal proceedings, and potential restrictions on municipal services for your property.

Ans: No, house tax rebates are property-specific and cannot be transferred. Each property requires a separate rebate application based on ownership and category eligibility criteria.

Ans: The complete mutation process typically takes 45-60 days, including the 30-day public notice period. This timeline may vary depending on document verification and the resolution of any objections raised during the process.

Ans: Yes, Nagar Nigam offers a 2% additional discount on digital payments to encourage online transactions. This discount is in addition to other applicable rebates and helps reduce processing time and paperwork.

Recommended Reading

Capital Gains Tax on Inherited Property: Rules, Rates & Exemptions in 2025

December 31, 2024

101+ views

PCMC Property Tax Online: Download E-Receipt, Name Change, Rebate and More

December 30, 2024

7995+ views

KMC Property Tax Payment: A Step-by-Step Walkthrough

December 30, 2024

5808+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

December 26, 2024

12335+ views

Comprehensive Guide to Andhra Pradesh Property Tax Payment

December 24, 2024

5830+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

December 31, 2024

1003498+ views

Supreme Court Verdict on Society Maintenance Charges

December 17, 2024

59399+ views

December 26, 2024

51965+ views

All You Need to Know about Revenue Stamps

December 17, 2024

44423+ views

Stamp Duty and Registration Charges in Bangalore in 2025

December 17, 2024

43901+ views

Recent blogs in

Benami Transaction Act, 1988: Key Features, Legal Implications, and Penalties in 2025

January 3, 2025 by Ananth

Encumbrance Certificate Karnataka - Online and Offline Application Process in 2025

January 2, 2025 by Jessica Solomon

Non-Occupancy Charges: A Guide for Property Owners and Tenants

December 31, 2024 by Kruthi

Sale Deed: Your Guide to Property Ownership

December 31, 2024 by Kruthi

Small Cash Loan on Aadhar Card: Instant Approval, No Paperwork in 2025

December 31, 2024 by Kruthi

Join the conversation!