Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

NDMC Property Tax: Pay Tax Online, Offline, Receipt Download 2025

Table of Contents

Are you aware that the NDMC property tax deadline is close? More importantly, have you completed your payment? NDMC property tax is an annual tax that property owners in North Delhi must pay to the North Delhi Municipal Corporation (NDMC). This tax applies to all residential, commercial, and industrial properties within the NDMC jurisdiction. The revenue collected helps maintain and improve public services and infrastructure in the area.

Property owners must calculate and pay their NDMC property tax in Delhi on time to avoid penalties. Various rebates and exemptions are available to eligible taxpayers, so it's important to stay informed about the latest updates and deadlines. Use this guide to understand the key aspects of NDMC property tax and ensure you fulfil your obligations efficiently.

NDMC Property Tax: A Quick Info

NDMC property tax is imposed on lands and buildings in New Delhi, and landowners must pay this tax.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Information | Details |

| Authority | North Delhi Municipal Corporation |

| Official website | https://www.ndmc.gov.in/ |

| Payment last date | Jun 30, 2025 |

| Address | NDMC Head Office Palika Kendra, Parliament Street, New Delhi - 110001 |

| Email ID | chairperson@ndmc.gov.in |

| Helpline number | 1533 |

Regions Covered by NDMC

The NDMC operates in several key regions within North Delhi. These regions include:

- Karol Bagh

- Rohini

- Civil Lines

- Narela

- Keshavpuram

- City HQs

- City SP Zone

NDMC Property Tax Bill Payment 2025

Paying NDMC property tax in 2025 is now hassle-free. You can choose to pay offline at ITZ cash counters or conveniently online from the comfort of your home.

How to Pay NDMC Property Tax Online in 2025

Paying your NDMC property tax online is straightforward and convenient. Here’s a detailed guide to help you complete the payment process:

- Visit the NDMC Portal: Open your web browser and visit the NDMC Portal.

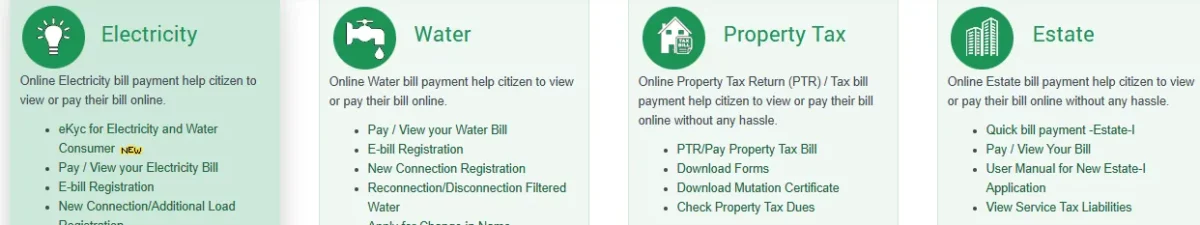

- Access Online Services: On the homepage, locate and click on the 'Online Services' tab.

This will take you to a new page with various online service options.

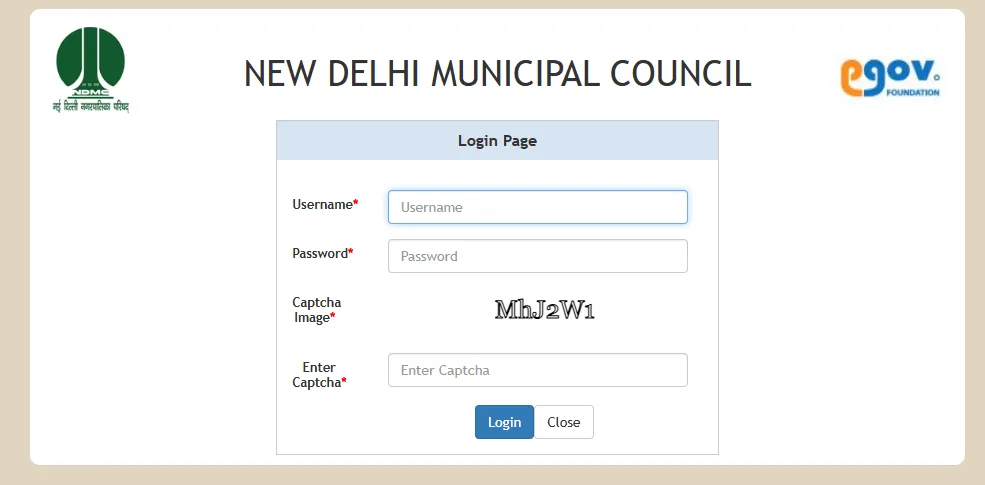

- Login: Under the 'property tax' section, click 'citizen login' to open a login page.

- Generate OTP: Enter your registered mobile number in the provided field and click on 'Generate OTP'. A unique code (One-Time Password) will be forwarded to your registered mobile number.

- Verify OTP: Enter the OTP received on your mobile into the designated field on the website and click 'Login'. This will log you into your property tax account.

- Access Payment Option: Go to the property tax payment section after logging in. Here, you will find payment options such as credit card, debit card, or net banking.

- Complete Payment: Follow the on-screen instructions to complete the payment process. Provide your payment information and verify the transaction.

- Receive Confirmation: A receipt will be generated once the payment is successfully processed. Please keep this receipt for your records or print it if needed. It serves as proof of payment.

How to Pay NDMC Property Tax Using NoBroker Pay?

You can also pay your North MCD property tax hassle-free through NoBroker Pay. Here are the steps:

- Access NoBroker Pay: Log in to your NoBroker Pay account or open our mobile app

- Select Bill Payment: Go to the bill payment section. Select the 'Property Tax' option.

- Enter Details: Provide your property ID or account number as required.

- Select Method of Method: Select the payment method of your choice from the provided options.

- Complete Payment: Follow the instructions to proceed with the transaction.

- Get Confirmation: Upon successful payment, you will receive a confirmation message. Save or print this message for your records.

How to Pay NDMC Property Tax Offline 2025

Paying your NDMC property tax offline is straightforward and convenient. Follow these steps to complete the payment process:

- Visit ITZ Cash Counters: Go to any ITZ cash counter located in North Delhi. These counters are set up specifically to handle NDMC property tax payments.

- Provide Necessary Documents: Bring your property ID and other required documents. Ensure you have all the necessary paperwork to avoid any delays.

- Complete Payment: You can pay using cash, cheque, credit card, or debit card. Opt for the payment method that matches your preferences.

- Collect Receipt: After making the payment, you will receive an acknowledgement slip. Keep this receipt as proof of payment for future reference.

Benefits of Online Payment of NDMC Property Tax

Paying your NDMC property tax online offers several benefits. Here are some key advantages:

- Convenience: You can pay your property tax from the comfort of your home. There is no need to visit any office or stand in long queues.

- Time-Saving: Online payments save you time. The process is quick; you can complete the payment in a few minutes.

- 24/7 Access: The online payment portal is accessible 24/7. You can pay your tax at any time that suits you.

- Secure Transactions: Online payments are secure. The NDMC portal uses encryption to protect your financial information.

- Instant Confirmation: After making the payment, you receive an instant confirmation. You can download and save the receipt immediately.

- Easy Record-Keeping: Online payments provide digital receipts, making tracking of your tax payments easy. You can access your payment history anytime.

How to Download NDMC Property Tax Receipt in 2025

Downloading your NDMC property tax receipt is simple and quick. Follow these steps:

- Visit the NDMC Portal: Open your web browser and go to the NDMC Portal.

- Login: Click on 'Online Services' and select 'Citizen Login' under the 'Property Tax' section. Please input your registered mobile number and select 'Generate OTP'. Enter the OTP received on your mobile and click 'Login'.

- Access Your Payment History: Once logged in, go to the property tax payment section. Look for the option to view your payment history or transaction details.

- Select the Relevant Payment: Find the receipt for the payment you need. Click on the payment to view more details.

- Download the Receipt: You will be able to download the receipt. Click on 'Download Receipt' and save the file to your device.

- Save or Print the Receipt: Once downloaded, save the house tax receipt for future reference or print it if needed.

Easy Guide to Using the NDMC Property Tax Calculator 2025

NDMC Property tax calculation can be done easily with the online property tax calculator. Here are the steps to help you determine your tax amount accurately:

1. Visit the NDMC Portal: Open your web browser and go to the NDMC Portal.

2. Access the Calculator: Go to the 'Online Services' section on the homepage and select 'Property Tax Calculator'.

3. Enter Property Details: Provide the necessary details about your property, including:

- Built-Up Area: The total constructed area, including walls.

- Property Classification: Whether it falls under residential, commercial, or industrial categories.

- Age of Property: Select the year of construction to apply the correct age factor.

- Usage Type: Indicate if the property is self-occupied or rented out.

- Input Location Details: Select the zone and category of your property (e.g., Karol Bagh, Rohini). This ensures the correct unit area value is applied.

4. Input Ownership Details: Specify whether the property is self-occupied or rented out. This affects the occupancy factor.

5. Review and Calculate: Click on the 'Calculate' button to view the estimated property tax amount. Before moving forward, double-check that all information is accurate.

6. Save or Print: You can save or print the calculated tax amount for your records.

NDMC Property Tax Rate 2025

Understanding the NDMC property tax rates for 2025 is crucial for property owners in North Delhi. The tax rates vary based on the property category, which is determined by its location and type. Here are the details:

1. Residential Properties:

- Category A: 12%

- Category B: 12%

- Category C: 11%

- Category D: 11%

- Category E: 11%

- Category F: 7%

- Category G: 7%

- Category H: 7%

2. Commercial Properties:

All categories (A to H) have a flat rate of 20%.

3. Industrial Properties:

- Category A: 15%

- Category B: 15%

- Category C: 12%

- Category D: 12%

- Category E: 12%

- Category F: 10%

- Category G: 10%

- Category H: 10%

What Each Category Represents?

- Category A: High-value areas such as premium residential and commercial zones.

- Category B: Upper-middle-class residential areas and busy commercial zones.

- Category C: Middle-class residential areas and standard commercial zones.

- Category D: Lower-middle-class residential areas and smaller commercial zones.

- Category E: Modest residential areas with limited commercial activity.

- Category F: Lower-income residential areas with minimal commercial activity.

- Category G: Peripheral residential areas with very limited commercial activity.

- Category H: Least developed or rural areas with negligible commercial activity.

NDMC Property Tax Rebate 2025

The NDMC offers several rebates on property tax payments to encourage timely payments and provide relief to specific categories of property owners. Here are the key rebates available for 2025:

1. Residential Properties:

50% Rebate: Applicable on the tax calculated on the rateable value up to Rs. 5 lakhs for properties used or to be used for residential purposes. The maximum rebate is Rs. 50,000.

2. Self-Occupancy Rebate:

25% Rebate: After the above rebate, this is applicable to self-occupied residential properties owned by senior citizens (60 years or older), women, or physically challenged persons. This rebate does not apply to portions of the property that are rented out or used for commercial purposes.

3. Non-Residential Properties:

50% Rebate: Applicable on the tax determined on rateable values up to Rs. 1 lakh for properties other than residential. The maximum rebate is Rs. 10,000.

4. Educational Institutions:

- 40% Rebate: For aided schools and colleges.

- 20% Rebate: For unaided schools. These rebates are on lands and buildings owned by societies or bodies. They do not apply to portions on rent, used for commercial purposes, or occupied for residential purposes by staff.

5. Special Exemptions:

100% Exemption: For vacant lands and buildings owned exclusively by war widows, gallantry award winners (Defense Forces, Police, Paramilitary Forces), and civilians who have received bravery awards of the highest order, including annual bravery awards given by the President of India. This exemption also applies to armed forces personnel who sustained 76% to 100% disability in war or war-like operations.

Conditions for Special Exemptions

- The property must be self-occupied for residential use and not let out.

- If the person has more than one property in Delhi, the exemption applies to only one property used for self-residence.

- The exemption is limited to the lifetime of the person concerned or, if posthumously awarded, to the lifetime of the widow.

Prompt Payment Rebate

- 10% Rebate: On the net tax payable after other rebates if paid by 30th September 2025.

- 5% Rebate: If paid after 30th September 2025 but before 31st December 2025.

NDMC Property Tax Transfer Online 2025

Transferring NDMC property tax online is a straightforward process. Here are the steps to follow:

- Visit the NDMC Portal: Open your web browser and go to the NDMC Portal.

- Login: Click on 'Online Services' and select 'Citizen Login' under the 'Property Tax' section. Enter your registered mobile number, click 'Generate OTP', then enter the OTP received on your mobile and click 'Login'.

- Access Property Transfer Section: After logging in, go to the property tax section and look for the option related to property transfer.

- Enter Property Details: Provide the details of the property you want to transfer. This includes the property ID, the current owner's details, and the new owner's details.

- Upload Required Documents: Upload the necessary documents such as the sale deed, ID proofs of both parties, and any other required documents.

- Submit the Application: Review all the details and uploaded documents that have been entered. Click on 'Submit' to send your application for property tax transfer.

- Receive Confirmation: Once the application is submitted, you will receive a confirmation message or email. The NDMC will review the application and process the transfer.

- Check Status: You can check the status of your transfer application on the NDMC portal. Log in and go to the application status section.

NDMC Property Tax Transfer Charges 2025

When transferring NDMC property tax, specific fees and duties apply based on the transferee's gender. Here are the details:

The transfer duty is a percentage of the property's value.

- For Women: The rate is 2% of the property's value for the share owned by a female transferee.

- For Men and Others: The rate is 3% of the property's value for shares owned by male transferees or other entities.

How to Use the NDMC Property Tax App in 2025

The NDMC Property Tax App simplifies the process of paying your property tax. Here’s a straightforward guide to help you use the app:

- Download the App: Access the Google Play Store or Apple App Store on your smartphone. Search for "NDMC Property Tax App" and download it.

- Download and launch the application: Download the app onto your device and open it.

- Login: Enter your registered mobile number. Click on "Generate OTP". Enter the OTP sent to your mobile and click "Login".

- Scroll to Property Tax Section: On the home screen, select the "Property Tax" option.

- Enter Property Details: Input your property ID or other required details to view your property tax information.

- View Tax Amount: The app will display the total property tax due for your property.

- Make a Payment: Choose your preferred payment method (credit card, debit card, or net banking). Enter the payment details and follow the prompts to complete the transaction.

- Download Receipt: Once the payment is successful, the app will generate a receipt. Keep or print the receipt for your personal records.

NDMC Property Tax Last Due Date 2025

The last date to pay your NDMC property tax for 2025 is June 30th. Ensure you complete your payment by this date to avoid any late fees or penalties. Timely payment helps keep your property records in good standing. For more information or to make a payment, visit the NDMC Portal.

NDMC Property Tax Helpline Number 2025

For any questions or issues regarding your NDMC property tax, you can contact the NDMC helpline. The contact details are as follows:

- NDMC Head Office:

- Palika Kendra

- Parliament Street, New Delhi-110001

- 24/7 Helpline (Toll-Free): 1533

- Exchange Number (PABX): 41501354 - 60

Latest News and Developments in NDMC Property Tax

The New Delhi Municipal Council (NDMC) will keep its property tax offices and collection counters open on Saturdays and Sundays in March (except gazetted holidays) to facilitate taxpayers. This includes offices at Palika Kendra, Sansad Marg, and counters at Gole Market and R.K. Puram.

NDMC manages about 15,600 properties, including 1,600 government-owned and 14,000 private, with 1,000 properties exempt from taxes. As of mid-February 2024-25, ₹807 crore was collected from 9,600 taxable properties, with a target of ₹1,150 crore for the financial year.

Over 3,200 taxpayers owe ₹200 crore in dues for three consecutive years. NDMC has issued 30-day show-cause notices to 380 defaulters and may take actions like property or account attachment for non-payment. Residents can pay property tax, electricity, water bills, and estate dues at these counters or through online platforms to avoid last-minute rushes.

Explore Property Tax Payment Options City-Wise in India

Manage NDMC Property Tax Payments Easily with NoBroker Pay!

Paying NDMC property tax on time is important to avoid penalties and keep your property records up to date. NoBroker makes this process easy and hassle-free.

With NoBroker Pay, you can pay your NDMC property tax online quickly and securely. This service helps you avoid long queues and ensures that your payment is processed on time. NoBroker Pay offers multiple payment options, making it convenient for everyone.

Paying your NDMC property tax on time is crucial to avoid extra charges and complications. Use NoBroker Pay to effectively manage your property tax payments and enjoy a hassle-free experience. Start using NoBroker Pay today and ensure your property tax is paid on time. Visit NoBroker Pay to get started.

Frequently Asked Questions

Ans: NDMC property tax is an annual tax that property owners in North Delhi must pay to the North Delhi Municipal Corporation.

Ans: All owners of residential, commercial, and industrial properties within the NDMC jurisdiction need to pay the property tax. The areas included in this jurisdiction are Karol Bagh, Rohini, Civil Lines, Narela, Keshavpuram, City HQs, and City SP Zone.

Ans: To complete the NDMC property tax login, visit the NDMC portal, click on 'Citizen Login', and enter your registered mobile number to generate an OTP for access.

Ans: You can check your NDMC property tax dues online by logging into the NDMC portal and going to the property tax section.

Ans: Failing to pay on time can result in penalties and interest on the outstanding amount.

Ans: Visit the NDMC official website and login using your credentials. Look for the property tax payment option and click on the payment history. Look for the receipt you want to download. Then, click on the print/download option.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

60198+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

48178+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

43042+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

38934+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

33239+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115328+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193113+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132422+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

127794+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!