Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

NMMC Property Tax Navi Mumbai - Online Payment, Bill Download 2025

Table of Contents

If you own a property in Navi Mumbai then you fall under the jurisdiction of the NMMC Property Tax Navi Mumbai. The NMMC charges property tax from all property owners which is an essential tax to pay to fund and properly operate roads, street lights, sewage, government hospitals, and other public services. For the NMMC Property Tax payment, property owners can pay online through the official website or offline by visiting the NMMC headquarters.

Citizens should pay the tax annually on time to avoid penalties or legal actions. To encourage timely payments, the NMMC offers rebates and has offered a 50% discount on penalties if the payment is made before March 31, 2025. The NMMC property tax bill payment online is an easy and smooth tax payment made in the comfort of your home. Various online payment options include UPI, credit/debit cards, and net banking.

NMMC Property Tax Navi Mumbai Quick Info 2025

| Information | Details |

| Official Website Link | https://nmmc.gov.in/navimumbai/ |

| Tax Payment due date | March 31, 2025 |

| Amnesty Scheme | 50% discount on penalties if dues are paid before March 31, 2025 |

| Penalty for late payment | 2% |

| Method for Tax Calculation | Capital Value System (CAS) |

| Tax Rates | The tax rate is based on the location and area |

| Payment method | Online via NMMC's official website, credit/debit cards, net banking, e-wallets, & UPI, and offline via the allotted wards |

| Properties for tax payments | Residential, Industrial and commercial lands |

| How to check Status | Visit the NMMC Property Tax website and check using the property code |

| Contact Details | Address: Plot No. 1, Palm Beach Road, CBD Belapur Sector 15, Navi Mumbai - 400614Helpline No:1800 222 309, 1800 222 310 |

NMMC Property Tax Offline Payment 2025

NMMC Property Tax Offline Payment 2025 Ward offices list

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Ward | Officer Name | Mobile Number | Phone Number | |

| Belapur | Shri. Shashikant Tandel | 9967243286 | 27570610 /27573826 | tandels@nmmconline.com |

| Nerul | Shri. Sanjay Tayde | 9819771386 | 27707669 | taydesanjay@nmmconline.com |

| Vashi | Shri. Mahendrasingh Thoke | 9322267258 | 27655370 /27659741 | thoke_m@nmmconline.com |

| Digha | Smt. Priyanka Kalsekar | 9321607876 | 27792410 | kalsekar_p@nmmconline.com |

| Ghansoli | Shri. Dattatray Nagare | 9892700098 | 27692489 | nagare_d@nmmconline.com |

| Turbhe | Smt. Angai Salunkhe | 9421858294 | 27834069 | angaisalunkhe@nmmconline.com |

| Airoli | Shri. Anant Jadhav | 9892736228 | 27792114 | jadhav_a@nmmconline.com |

| Koperkhairane | Shri.Ashok Madhavi | 9821338155 | 27542406 | madhaviashok@nmmconline.com |

NMMC Property Tax Online Payment 2025

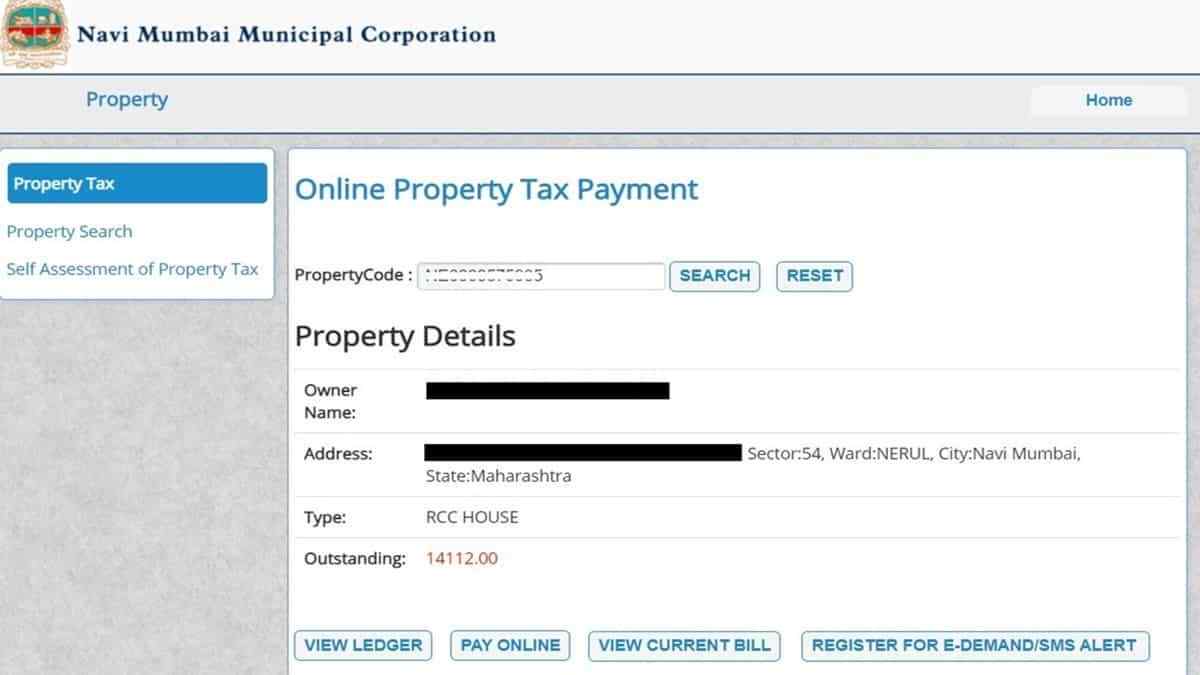

In today’s digital generation, everything is possible online only. Taxation and payments are not an exception. For NMMC Property Tax payment online, you have to follow some simple steps:

- Visit the official website of Navi Mumbai Municipal Corporation.

- Go to the payment page and enter your property code

- On entering the property code, all the details like the owner details, mobile number, address, id of the property would be spontaneously visible.

- Now Click on the “Pay Online” Button

- On redirection, you will now see multiple online payment modes available for your tax payment. Choose the desired mode of online payment and complete the payment procedure.

Screenshot source: https://www.thecurrentindia.com/tax/nmmc-property-tax-online-payment/

- You will receive an acknowledgement with the receipt ID and transaction information after you have completed your NMMC Online Property Tax Payment.

NMMC Property Tax Offline Payment

Not everyone is comfortable paying taxes online. Some might prefer to pay in person. Here are the details of the Navi Mumbai municipal corporation property tax bill payment via offline mode. The steps included in the offline process are given below:

Read: Lien on Property Explained: A Homeowner’s Guide to Protecting Your Investment

- The first step is the same as in online payment. Visit the official website and go to the payment page.

- Enter the property code and wait for your property details to load.

- After the details load, like the owner’s phone number, address, property ID, and others, verify them.

- Select the payment mode as offline.

- The next instruction is to download the challan and pay at the ward office.

- Irrespective of whether the mode of payment is online or offline, saving the tax receipt is essential. In case any property dispute arises, this would be helpful.

Navi Mumbai Property Tax Bill Download 2025

You directly download your NMMC property tax bill for 2024 from the Navi Mumbai Municipal Corporation (NMMC) website. Here's how:

- Visit the NMMC property tax portal: https://www.nmmc.gov.in/property-tax2

- Enter your property code and select "Property Tax".

- The website will display your property details, including the owner's name, address, property type, amount to be paid, and any penalties.

- You can review the details and proceed to download the bill.

How to Register for E-Demand/ SMS Alert for NMMC Property Tax?

To set up SMS alerts or e-demand alerts for your NMMC Property tax, click on the “E-Demand/ SMS Alerts” button on the website. This will lead you to a pop-up where you will need to fill out details like email ID, property code that you can find using the site’s code search option, and registered mobile number.

What is the Penalty for Late Property Tax NMMC?

If you do not pay your NMMC Property Tax on time and there is a delay, you will have to pay a penalty of 2% on the outstanding property tax amount, as per the NMMC rule. They can take strict actions like auctioning your property if you do not pay the tax on time. Always check the official website and pay any overdue bills if you have under the ‘view current bill’. Also, download the bill if you have paid for further references.

What is NMMC Property Tax Amnesty Scheme 2025?

Under the Amnesty Scheme, The Navi Mumbai Municipal Corporation (NMMC) property tax department has introduced a waiver scheme from March 10 to March 31, 2025, offering a 50% discount on the pending penalty tax dues. This will relieve people, but the tax should be paid in full before March 31, 2025.

NMMC Property Tax Transfer Online 2025

Currently, Navi Mumbai Municipal Corporation (NMMC) doesn't offer online property tax transfers. You can initiate the process by submitting an application at the concerned Ward office.

Here's a summary of the process for property tax transfer with NMMC:

- Required documents:

- Application form

- Stamp paper (Rs. 100) for agreement

- Property Tax Transfer document

- NOC from the Property Tax Department

- Copy of last paid water bill

- Process:

- Submit the application and documents at the Ward office.

- The Ward office will scrutinise the application and sanction it within 7 days.

- Once approved, you'll need to make the payment and sign an agreement at the Ward office.

- After successful completion, the name will be transferred and reflected in the bill.

NMMC Property Tax Transfer Charges 2025

The Property Tax Name change rates in Navi Mumbai are roughly Rs 210 per square metre (Built-up area) for Residential Properties (Flats) for 2025. The Water Bill Name Change is done after the Property Tax Name Change Procedure. The Charges for the same are Rs 800 for Residential Areas for 2025.

NMMC Property Tax Bill Search by Name

What to do if you somehow lose the property code and suddenly need to retrieve any details? For the entire process of the Navi Mumbai municipal corporation property tax bill search by name, here are the main steps:

- Visit the official website of NMMC and head to the property section.

- Here click on the “search by name” option.

- From the dropdown menu, select your ward and Enter your first and last names. You can also choose the housing society or your apartment name from the list.

- Now press the Search button and your property details will be visible on the screen.

Source: https://www.thecurrentindia.com/

- It is not necessary to include the building name, plot number/name or ward name, although doing so can help you receive more precise findings.

NMMC Property Tax Online Tax Payment Receipt

Saving receipts is an important task. If any legal dispute arises, it will serve as a legal piece of evidence. Steps to get the Navi Mumbai municipal corporation property tax payment receipt are here:

- Visit the official website of Navi Mumbai Municipal Corporation and go to the property tax page.

- In the search option, type the property code.

- All the details of the property will be displayed on the page.

- Click on the view ledger button, and a ledger with all the details of the previous tax payments will be displayed.

- Click on the receipt print icon to save the hard copy of the document for future reference.

NMMC Property Tax Online Name Change

You might need to change the name of the documents. As far as the Navi Mumbai municipal corporation property tax online name change is concerned, some steps would help the customers get their names changed.

- A receipt for the tax paid the last time is the first thing you need.

- A tax name change form is filled out appropriately.

- An attested copy of the deed of the transactions carried over time.

- Finally, you would need a no-objection certificate signed by the authorised housing society.

Benefits of Online Payment

Online payments offer a wide range of advantages for both consumers and businesses. Here are some of the key benefits:

Convenience:

- Anytime, Anywhere: You can make payments 24/7 from the comfort of your home or anywhere with an internet connection. No more rushing to banks or waiting in lines.

- Quick and Easy: Payments are processed instantly, eliminating the need for writing checks or mailing them.

Financial Management:

- Easy Tracking: Most online payment platforms offer detailed transaction history, allowing you to easily track your spending and manage your budget.

- Automated Payments: You can set up recurring payments for bills and subscriptions, ensuring timely payments and avoiding late fees.

For Businesses:

- Increased Sales: Offering online payment options can attract a wider customer base, especially those who prefer the convenience of digital transactions.

- Reduced Costs: Eliminates the need for processing checks and cash, saving time and money.

- Faster Transactions: Instant payments improve cash flow and streamline business operations.

NMMC Property Tax Rate 2025

The NMMC Property Tax Rate varies for different types of property. Below is the complete breakdown to understand better:

| Tax Type | Residential Property | Commercial Property | Industrial Property |

| Water Tax | 1% | 4% | 0% |

| Sewage Tax | 3% | 7% | 0% |

| General Tax (including 0.5% fire tax0 | 23.50% | 32.50% | 40.50% |

| Steet Tax | 2.67% | 3.33% | 8.44% |

| Sewage befit tax | 1% | 2% | 0% |

| Tress Cess | 0.50 | 0.50% | 0.50% |

| Municipal Education Tax | 1% | 4% | 4% |

| Total | 32.67 | 53.33% | 53.33% |

| Government taxes | 6% | 15% | 15% |

| Total | 38.67% | 68.33% | 68.33% |

NMMC Property Tax Calculator 2024

The basis of the Navi Mumbai municipal corporation property tax calculator calculation depends on the value of the property concerned. This value itself decides the rate at which the tax should be imposed on the land/property. You can estimate your annual property tax burden in Maharashtra by using a "property tax calculator maharashtra" online tool. The Navi Mumbai municipal corporation itself announces it every year and the factors determining the value for a particular year are:

- The type of construction of the property

- The rate of the rent the property owner collects

- The uses, additions, and extensions of the concerned property

Customers can utilise this formula by going to the online tax calculator at the official website of NMMC and calculating it there itself. For residential properties, this tax is about 38.7% of the rateable value of the property. The property's rateable value is calculated based on various factors and helps in involving reasonable costs such as taxes and other formalities.

In the case of commercial or non-residential property, the value of the same tax hikes at 68.33%of the rateable value. Besides, it is easy to calculate the rateable value by deducting 10% of the statutory portion from the expected annual rent rate.

Areas under NMMC

The first and most important factor to consider is if you are covered by the NMMC. It has a total size of 108.5 square kilometres. Vashi, Belapur, Turbhe, Nerul, Airoli, Ghansoli, and Koparkhairane are all directly under the NMMC. If you own property in these wards, you will be subject to the NMMC's restrictions, which are similar to those that apply to Greater Mumbai. To get a clear idea of what you would have to pay, use the property tax calculator - Navi Mumbai.

Checking Your Property Tax Value

So, before you pay your NMMC property tax bill online, you'll need to consider and figure out how much you'll have to pay. A simple procedure can be used to accomplish this.

There is a "Self Assessment of Property Tax" option on the left-hand side of the website. You will be taken to a new page where you must fill in some vital facts such as the Ward number, plot type, occupancy status, and if the property is for residential, commercial, or industrial use. Your property tax bill online for Navi Mumbai will be computed automatically and displayed on the screen once you have entered all of the required information.

If you're wondering how this is done, you should know that the NMMC property tax is computed using the property's market value.

Assume you purchase a property in your name at market value. The price you paid for it now determines how much property tax you will have to pay. If the property's market value rises, your property tax value will rise as well. Your property tax value decreases as the market value decreases. So, this is how the calculation system works.

NMMC Property Tax App 2024

The NMMC e-Connect app is a mobile application designed by Navi Mumbai Municipal Corporation (NMMC) to provide citizens with a convenient way to access various civic services. Let's delve into its details:

Features:

- Service Registration: The app simplifies registering for various NMMC services, aiming for a more transparent and user-friendly experience. [It's unclear exactly which services are available on the app currently, but keep reading to find how to get the app and see for yourself.]

- Grievance Redressal: Citizens can register complaints and grievances related to civic issues directly through the app. The app also offers features like:

- Automatic department selection for your grievance.

- Uploading photos for better explanation.

- Receiving SMS and email updates on the grievance status.

- Providing feedback on the service received.

- Improved User Interface: The app boasts a user-friendly interface for a smooth experience.

NMMC Property Tax: Delay Payment Charges on Failure of Payment

The NMMC has strict rules on the payment of property taxes. The failure to pay property tax on time accrues Delay Payment Charges (DPC). The DPC is a penalty charge placed over the principal amount owed to the NMMC. Defaulters will have to pay the usual property tax and the DPC. Navi Mumbai Mahanagar Palika Tax is typically due by February 15th of each year. Failure to do so could result in strict action being taken as per NMMC rules, including confiscation of property.

NMMC Property Tax Helpline number 2025

The Navi Mumbai Municipal Corporation has a helpline number for people seeking information about property taxes, bill payments, bill downloads, and other issues. Simply call 1800222309 or 1800222310.

Legal Services Offered by NoBroker

NoBroker provides legal assistance specifically tailored to property transactions. Here's an overview of our services:

- Document Scrutiny: Our legal team reviews essential documents like title deeds and sale agreements to identify potential issues before finalising the property deal.

- Protection Measures: We safeguard you from fraudulent practices by checking for any existing legal disputes on the property and verifying ownership.

- Service Packages

- Buyer Assistance: We offer guidance and support throughout the buying process.

- Registration: We manage property registration, saving you time and effort.

- On-Demand Services: If you don't need a full package, we provide specific services like property title checks, guidance on market value, assistance with missing documents, and verification of occupancy certificates.

- Free Consultation: NoBroker provides a free consultation to discuss your needs and offer initial legal advice related to property.

- NoBroker Pay: By using NoBroker Pay, you can ensure a secure and convenient way to make your KMC property tax payments. Additionally, you can track all your payments in one place.

How to Book NoBroker Legal Services

Follow these simple steps to secure our services for a smooth and hassle-free experience:

- Begin by downloading the NoBroker app or visiting our website.

- Navigate to the NoBroker Legal Services section.

- Browse through the various service packages we offer, including drafting agreements, property verification, and legal consultations.

- Once you choose a service, fill in the necessary details and complete the form.

- After submitting your form, our NoBroker experts will reach out to you for further details, either through a phone call or a chat window. You can also book a free consultation call for additional enquiries.

- Our legal services page also features online rental agreements that can be directly purchased and customised on the NoBroker website.

Why Choose NoBroker Legal Services

Here are some of the key reasons to choose NoBroker legal services:

- Convenience: NoBroker emphasises the ease of their service. You can complete legal tasks from the comfort of your home without needing to visit a lawyer's office.

- Affordability: We offer competitive pricing on our legal services compared to traditional lawyers, ensuring value for money.

- Experienced Lawyers: NoBroker collaborates with seasoned lawyers (minimum 15 years of practice) who are qualified by the Bar Council.

- Streamlined Process: We simplify the legal process by providing pre-defined packages and managing communication with the lawyer on your behalf.

- Technology-Driven: NoBroker utilises technology for tasks like document management to enhance efficiency and improve service delivery.

Explore Property Tax Payment Options City-Wise in India

Easy and Efficient Legal Help for Your Property Matters with NoBroker

As a diligent and responsible taxpayer, these are the key aspects you should be aware of regarding the NMMC property tax. Besides the offline method, you could opt to pay NMMC property tax online, which is hassle-free and saves time. To know more about different types of property taxes, you can visit our site. If you are still confused about how the NMMC property tax works, you can contact our NoBroker legal experts to seek guidance and support. Additionally, you can track all your payments in the NoBroker Pay app. Our secure platform also streamlines the stamp duty process. Download the app today!

Frequently Asked Questions

Ans: is the tax that the Navi Mumbai Municipal Corporation imposes on the land and property owners of the Navi Mumbai region.

Ans: There are two ways to pay the tax. Either you can opt for the offline method or the online method. For both, you need to visit the website. The NMMC Property tax online payment is online and offline. Download the copy of the challan and pay in the ward office.

Ans: Visit the official website of NMMC. Search the website for the option that lets you view the bill. You can download it as a pdf or print it.

Ans: Like every other option, the option for the name change is available on the official website. However, all the documents must be available for uploading while trying to change the name.

Ans: In case of any problem, one-call assistance is available at the NMMC property tax contact number. For other grievances, visit the official website.

Ans: Navi Mumbai falls under the jurisdiction of the Navi Mumbai Municipal Corporation (NMMC) for property tax purposes. So, you would pay NMMC property tax, not CIDCO property tax. CIDCO likely refers to the City and Industrial Development Corporation of Maharashtra, which might be involved in land development projects but wouldn't handle property tax collection in Navi Mumbai.

Ans: To register online, go to the official website and click on the relevant section like Property Tax and register.

Ans: 1. To pay the bill, citizens can visit the official website or My NMMC App through Google Playstore.

2. Click on the water bill section

3. Add consumer number or property code

4. Review details before paying

5. Select payment mode

6. Make payment

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

60246+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

48253+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

43098+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

38975+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

33273+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115422+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193416+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

132986+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

128176+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!