Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Your Guide to NPS Tax Benefits Under Section 80CCD

Table of Contents

Planning for retirement is crucial for a secure future. Individuals seek investments for growth and tax benefits. The National Pension System (NPS) is gaining popularity as one such avenue. NPS Tax Benefits under Section 80CCD provide a structured platform for individuals to build a retirement corpus through systematic contributions during their working years while availing significant tax benefits. Regulated by the Pension Fund Regulatory and Development Authority (PFRDA), NPS offers attractive tax-saving opportunities under Section 80CCD of the Income Tax Act.

In this comprehensive guide, we delve into the intricacies of NPS tax benefits under Section 80CCD, shedding light on how individuals can maximise their savings while planning for their retirement. From understanding the provisions of Section 80CCD to exploring the tax benefits available for both employees and self-employed individuals, we aim to provide clarity and insight into this important aspect of financial planning.

Join us on this journey as we navigate through the nuances of NPS tax benefits, empowering you to make informed decisions and take proactive steps towards securing your financial future.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Understanding NPS Tax Benefits under Section 80CCD

NPS offers attractive tax benefits to encourage individuals to save for retirement systematically. To fully grasp the advantages of NPS contributions in terms of tax savings, it's essential to understand the specifics of these benefits under Section 80CCD of the Income Tax Act.

Overview of Section 80CCD

Section 80CCD of the Income Tax Act allows taxpayers to claim deductions for contributions made towards certain pension schemes, including the National Pension System (NPS). This section encompasses both employee and self-employed contributions, providing tax relief to individuals regardless of their employment status.

Explaining the Different Sub-sections of Section 80CCD

- Section 80CCD(1): This sub-section allows taxpayers to claim deductions on contributions made to their NPS Tier-I account. The maximum deduction available under this section is up to 10% of the individual's salary (for employees) or gross income (for self-employed individuals), subject to a limit of ₹1.5 lakh per financial year, combined with Section 80C deductions.

- Section 80CCD(1B): Introduced in Budget 2015, this sub-section provides an additional deduction of up to ₹50,000 under NPS exclusively for contributions made to NPS Tier-I accounts. This additional tax benefit under nps Section 80CCD(1), allows taxpayers to enhance their tax savings further

- Section 80CCD(2): This sub-section pertains to employer contributions to the NPS on behalf of employees. Employers can contribute up to 10% of the employee's salary (basic salary + dearness allowance) to their NPS Tier-I account without any monetary limit. However, the employer's contribution is taxable as perquisite in the hands of the employee.

Tax Benefits for Employees

Employees contributing to the National Pension System (NPS) through salary deduction enjoy specific tax benefits under Section 80CCD. Understanding these income tax benefit under NPS is essential for employees to optimise their tax planning and maximise their savings for retirement.

Tax Benefits on Employee Contributions:

- Salary Deduction: Employees can contribute a portion of their salary towards their NPS Tier-I account through voluntary salary deduction. These contributions are eligible for tax deductions under Section 80CCD(1), subject to certain limits.

- Deduction Limit: The maximum deduction available on employee contributions to NPS is up to 10% of the employee's salary (basic salary + dearness allowance), excluding other allowances. This deduction is part of the overall limit of ₹1.5 lakh available under Section 80C of the Income Tax Act.

Tax Treatment of Employer Contributions

- Employer's Contribution: In addition to employee contributions, employers may also contribute to their employees' NPS accounts as part of their retirement benefits package. These contributions are eligible for tax benefits under Section 80CCD(2).

- Perquisite Tax: While employer contributions to NPS are tax-free in the hands of the employee, they are treated as perquisites and added to the employee's taxable income. However, the employer's contribution is deductible for tax purposes, subject to certain conditions.

Tax Benefits for Self-Employed Individuals

Self-employed individuals have the opportunity to avail tax benefits by contributing to the National Pension System (NPS) voluntarily. Understanding these benefits is essential for self-employed individuals to plan their tax strategy effectively while building a secure retirement fund.

Tax Benefits on Voluntary Contributions

- Voluntary Contributions: Self-employed individuals can make contributions to their NPS Tier-I account voluntarily. These contributions are eligible for tax deductions under Section 80CCD(1), providing an avenue for tax savings while saving for retirement.

- Deduction Limit: The maximum deduction available on voluntary contributions to NPS is up to 10% of the individual's gross total income, excluding deductions under Section 80C. This deduction is part of the overall limit of ₹1.5 lakh available under Section 80C of the Income Tax Act.

Calculating Tax Deductions under Section 80CCD(1B)

- Additional Deduction: In addition to the deduction available under Section 80CCD(1), self-employed individuals can claim an additional deduction of up to ₹50,000 under Section 80CCD(1B) for contributions made to their NPS Tier-I account.

- Maximising Tax Savings: By utilising both deductions under Section 80CCD(1) and Section 80CCD(1B), self-employed individuals can maximise their tax savings and build a substantial retirement corpus over time.

How to Avail NPS Tax Benefits

Availing tax benefits under the National Pension System (NPS) involves several steps, from enrolling in the scheme to claiming deductions on contributions made. Understanding the process is essential for individuals looking to maximise their tax savings while planning for retirement.

Enrolling in NPS and Obtaining PRAN

- Registration: Individuals interested in joining NPS can register online through the NPS website or approach a Point of Presence (PoP) service provider.

- Permanent Retirement Account Number (PRAN): Upon registration, individuals receive a Permanent Retirement Account Number (PRAN), which serves as a unique identifier for their NPS account.

Making Regular Contributions to NPS Tier-I Account

- Contribution Channels: Contributions to NPS can be made through various channels, including online banking, mobile apps, and authorised PoP service providers.

- Tier-I Account: It's important to ensure that contributions are directed to the NPS Tier-I account, as only contributions to this account are eligible for tax deductions under Section 80CCD.

Filing Income Tax Returns and Claiming Deductions

- Reporting Contributions: Individuals must report their NPS contributions while filing their income tax returns.

- Claiming Deductions: Taxpayers can claim deductions on their NPS contributions while computing their total taxable income. Deductions can be claimed under Section 80CCD(1) for employee contributions, Section 80CCD(1B) for additional contributions, and Section 80CCD(2) for employer contributions.

Tax Benefits on Partial Withdrawal from NPS Account

Partial withdrawal from the National Pension System (NPS) is allowed under specific circumstances, providing flexibility to subscribers in managing their finances during their retirement years. While partial withdrawals offer liquidity, they also come with certain tax implications and benefits that individuals need to consider.

Conditions for Partial Withdrawal

- Superannuation: Subscribers can make partial withdrawals from their NPS accounts upon reaching the age of superannuation (usually between 58 and 60 years, depending on the subscriber's choice).

- Specific Purposes: Partial withdrawals are permitted for specific purposes such as higher education, marriage, medical treatment of self, spouse, children, or dependent parents, and purchase or construction of a residential house.

Tax Benefits on Partial Withdrawal

- Partially Tax-Free: Under the current tax regulations, partial withdrawals from NPS accounts are partially tax-free. While the withdrawn amount is not taxable up to a certain limit, any excess withdrawal beyond the prescribed limit is subject to taxation.

- Tax-Free Portion: The tax-free portion of partial withdrawals is determined based on specific rules and limits set by the Income Tax Department. Generally, up to 25% of the subscriber's contributions (excluding contributions made by the employer) is tax-free, subject to certain conditions.

- Taxable Portion: Any partial withdrawal exceeding the tax-free limit is considered taxable income in the hands of the subscriber and is subject to taxation as per the prevailing income tax rates applicable for the relevant financial year.

Additional Considerations

While understanding the basics of NPS tax benefits is crucial for effective tax planning, there are additional factors and considerations that individuals should take into account when participating in the National Pension System. These factors can impact the overall effectiveness of NPS as a tax-saving and retirement planning tool.

Flexibility and Portability of NPS Investments

- Investment Options: NPS offers flexibility in choosing investment options based on risk appetite and investment goals. Subscribers can opt for various asset classes, including equity, corporate bonds, government securities, and alternative investments.

- Portability: NPS accounts are portable across employment and locations, allowing individuals to continue their contributions seamlessly even if they change jobs or relocate.

Withdrawal Rules and Tax Implications on Maturity

- Maturity Options: Upon reaching retirement age or attaining superannuation, subscribers can withdraw a portion of their NPS corpus as a lump sum and use the remaining amount to purchase an annuity for regular income.

- Tax Implications: While the lump sum withdrawal is partially tax-free, the annuity income is taxable as per the prevailing income tax rates. Understanding the tax implications at the time of withdrawal is essential for effective retirement planning.

Comparison with Other Tax-Saving Investment Options

- Evaluating Alternatives: Individuals need to compare NPS with other tax-saving investment options such as EPF, PPF, and ELSS to determine the most suitable investment strategy based on their financial goals, risk tolerance, and tax-saving objectives.

- Diversification: Diversifying investment portfolios across different tax-saving instruments can help mitigate risks and maximise returns over the long term.

Tax Benefits to Corporates/Employers

Corporates and employers play a pivotal role in facilitating employee retirement savings through the National Pension System (NPS). By offering contributions to employees' NPS accounts as part of their benefits package, corporates and employers not only provide a valuable retirement savings option but also enjoy tax benefits and enhance their employee benefits package.

Employer Contributions to NPS

- Contribution Options: Employers have the option to contribute to their employees' National Pension System (NPS) accounts as part of their employee benefits package.

- Eligibility: Any corporate entity, including companies, organisations, and institutions, can make contributions to their employees' NPS accounts.

Tax Implications for Employers

- Tax Deductions: Contributions made by employers to employees' NPS accounts are eligible for tax deductions under Section 80CCD(2) of the Income Tax Act.

- Deduction Limit: Employers can claim tax deductions on their contributions to employees' NPS accounts, up to 10% of the employee's salary (basic salary + dearness allowance).

- No Monetary Limit: Unlike contributions made by employees, there is no monetary limit on the employer's contributions to NPS accounts for tax deduction purposes.

Compliance Requirements

- Reporting and Documentation: Employers are required to maintain proper records and documentation of contributions made to employees' NPS accounts.

- Compliance with Regulations: Ensuring timely contributions and compliance with reporting requirements laid down by the Pension Fund Regulatory and Development Authority (PFRDA) and the Income Tax Act is essential for employers to avail tax benefits and maintain regulatory compliance.

Benefits for Employers

- Employee Retention and Engagement: Offering NPS contributions as part of the employee benefits package can enhance employee retention and engagement by providing a valuable retirement savings option.

- Tax Savings: Availing tax deductions on employer contributions to employees' NPS accounts can help reduce the overall tax liability of the organisation.

Avail NPS Tax Benefits under Section 80CCD with NoBroker Tax Experts

Availing tax benefits under the National Pension System (NPS) can significantly enhance your retirement planning while reducing your tax liability. Understanding the provisions of Section 80CCD of the Income Tax Act and leveraging the tax benefits available for both employees and self-employed individuals is crucial for maximising your savings and securing your financial future.

With the assistance of NoBroker Tax Experts, you can navigate the complexities of NPS tax benefits with ease. Whether you're an employee looking to optimise your contributions through salary deductions or a self-employed individual seeking to enhance your tax savings, our team of experts is here to guide you every step of the way.

From enrolling in NPS and understanding contribution limits to filing income tax returns and claiming deductions under Section 80CCD, NoBroker Tax Experts provide personalised assistance tailored to your specific needs and financial goals.

Take the first step towards securing your retirement and maximising your tax savings by availing NPS tax benefits under Section 80CCD with NoBroker Tax Experts today.

Let us help you build a solid financial foundation for the future, starting with your retirement planning through the National Pension System.

Reach out to NoBroker Tax Experts now and embark on your journey towards a financially secure tomorrow.

Frequently Asked Questions

Ans: The National Pension System (NPS) is a voluntary retirement savings scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). It allows individuals to contribute towards their retirement corpus and avail tax benefits under Section 80CCD of the Income Tax Act. Contributions to NPS qualify for tax deductions, helping individuals save on their taxable income.

Ans: Both employees and self-employed individuals are eligible to avail tax benefits under NPS Section 80CCD. Employees can contribute to NPS through salary deductions, while self-employed individuals can make voluntary contributions. However, there are specific limits and conditions that individuals must meet to qualify for tax deductions.

Ans: The maximum deduction allowed under NPS Section 80CCD is up to 10% of the individual's salary (for employees) or gross total income (for self-employed individuals), subject to a limit of ₹1.5 lakh per financial year. Additionally, self-employed individuals can claim an additional deduction of up to ₹50,000 under Section 80CCD(1B) for contributions to their NPS accounts.

Ans: Yes, partial withdrawals from NPS accounts are allowed under certain circumstances, such as higher education, marriage, purchase/construction of a house, and treatment of critical illnesses. However, the tax implications of partial withdrawals vary depending on the purpose and amount withdrawn. Certain withdrawals may be exempt from tax, while others may be taxable.

Ans: NoBroker Tax Experts provide personalised assistance and guidance on NPS tax benefits under Section 80CCD. They can help you understand the eligibility criteria, contribution limits, and tax implications of NPS contributions. Whether you're an employee or a self-employed individual, NoBroker Tax Experts can help you optimise your tax savings and retirement planning through NPS.

Recommended Reading

Panchkula Property Tax: Payment Methods and Receipt Download 2025

February 12, 2025

3018+ views

Simple Introduction to Indian Property Tax

January 31, 2025

5221+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

18513+ views

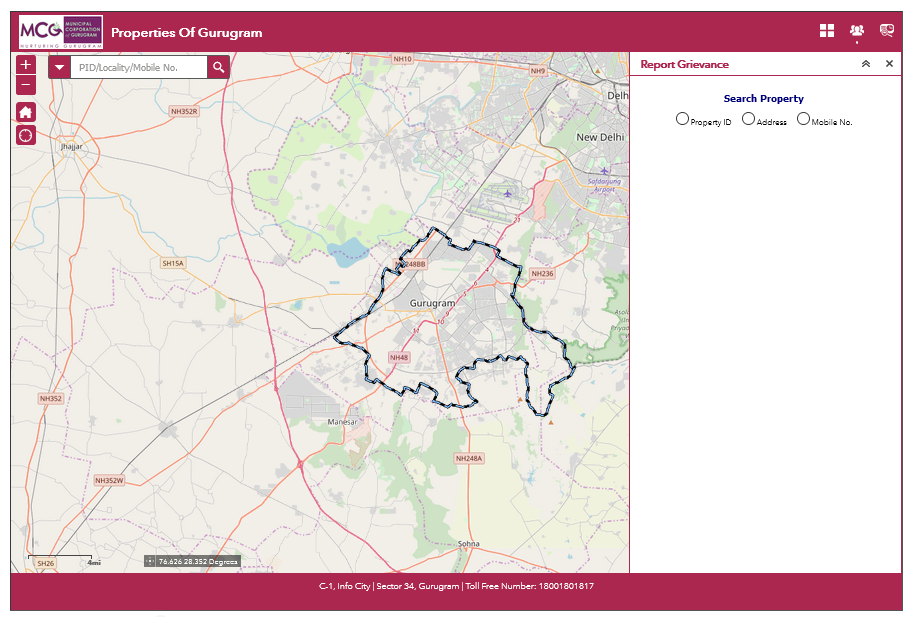

Property Tax Gurgaon Online: About Property Tax in Gurugram

January 31, 2025

5554+ views

Property Tax Hyderabad - How to Pay Property Tax Online in Hyderabad

January 31, 2025

4172+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1095181+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

March 3, 2025

126728+ views

Supreme Court Verdict on Society Maintenance Charges

January 31, 2025

92581+ views

All You Need to Know about Revenue Stamps

January 31, 2025

74454+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

69551+ views

Recent blogs in

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

March 3, 2025 by Suju

Panchkula Property Tax: Payment Methods and Receipt Download 2025

February 12, 2025 by Suju

How to get Non-Encumbrance Certificate Online and Offline: Download and Check Status 2025

February 11, 2025 by Vivek Mishra

e-Aasthi BBMP: Search Property Details, Download Certificates, and Check Status Online

February 5, 2025 by Suju

Simple Introduction to Indian Property Tax

January 31, 2025 by NoBroker.com

Join the conversation!