Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

PAN Card: Uses and Importance, How to Apply & Eligibility

Table of Contents

The Permanent Account Number is an alphanumeric key (ten characters) used as an identifier for every individual/enterprise paying tax in India. It is issued by the Income Tax Department and serves as a unique identity. Hence two individuals or entities cannot have the same PAN.

A PAN Card is mandatory to participate in the Indian economy as a legal resident of India. Under Section 139A of the Income Tax Act of 1961, the government formally introduced the PAN Card. The previous system, known as GIR (General Index Register Number), was largely unsuccessful, and this was done to fix it. The GIR's main flaw was that it needed to issue unique numbers to taxpayers, which often resulted in confusion and tax avoidance.

History of PAN in India

The PAN was implemented in 1972 and was an optional document till it was made mandatory for all taxpayers in 1976. The initial series of numbers were allotted ward-wise, but this system was renewed post-1995.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Before PAN, a GIR number was used to identify taxpayers. It was unique to a particular ward or the assessing officer of the ward. It was also a manual system. The GIR numbers, however, were expected at the national level. This led to many errors and miscalculations over time.

Pan Card Issuance Key Details from Tax Information Network of Income Tax Department:

| Issuing Authority | Income Tax Department of India |

| Validity | Lifetime |

| Customer Care Number | 020-27218080 |

| Official Website | https://www.protean-tinpan.com |

| tininfo@nsdl.co.in |

Why Must You Have a PAN Card?

In addition to serving as Proof of Identity and personal information like your address and date of birth, having a PAN Card also helps in many other ways.

- It is mandatory for filing taxes.

- It is used for the registration of businesses.

- It also helps with certain financial transactions.

- It allows individuals and groups to open and operate bank accounts.

- It can be used to get a phone, gas, etc.

- Mutual Fund Investments require a PAN for e-KYC.

Importance and Uses of a PAN Card

A PAN Card is vital for the Income Tax Department to track and identify every tax-paying individual or group. It helps the department link all tax transactions, returns on income, TDS/TCS credits, correspondence and specified transactions. It also allows easy access to information regarding borrowings, business activities and investments.

Who Should Have A PAN Card?

A PAN Card is issued to all companies, groups or individuals (resident and non-resident) who pay taxes in India.

The PAN needs to be held by every individual or group:

- If the cumulative accessible income equals or exceeds the amount of the least taxable income.

- For every person engaged in business or occupation, a total income exceeds 5 lakh INR.

- Every charitable trust is required to file returns under Section 139(4A).

- Every person who is willing to be part of a PAN mandatory transaction.

- Every non-individual entity whose financial transactions exceed the amount of INR 2.5 lakh in a fiscal year.

- Every importer/exporter needs an Import Export Code.

- Every individual is set to receive a particular sum after tax deductions.

- Any individual or group involved in storing, producing or manufacturing excisable goods.

- Individuals are liable to pay service tax.

Transactions Where Quoting PAN is Mandatory

The following transactions cannot be carried out without having a PAN.

- Sale/purchase of any motorised vehicles, excluding two-wheelers.

- Opening an account with a banking or cooperative banking institution, excluding a basic savings bank deposit account and a time deposit.

- Exceptions for time deposits are for transactions exceeding INR 50,000 or totalling 5 lakh in a fiscal year with:

- A post office

- A banking or cooperative banking institution

- A non-banking financial company

- A Nidhi, as mentioned in Section 406 of the Companies Act.

4. Applying for a Debit or Credit Card.

5. Opening a Demat account with a participant, depositary, custodian of securities, or any other individual with SEBI.

6. Payments in cash exceed INR 50,000 for a singular hotel or restaurant bill.

7. Payments in cash exceed INR 50,000 regarding foreign travel or purchase of foreign currency.

8. Payment of a transaction exceeding INR 50,000 made for purchasing a Mutual Fund in units.

9. Payment of a transaction exceeding INR 50,000 made to a company for purchasing its debentures and bonds.

10. Payment of a transaction exceeding INR 50,000 made to the Reserve Bank of India for purchasing its bonds.

11. Deposits exceed INR 50,000 with a banking or cooperative banking institution.

12. Payments made in cash exceeding INR 50,000 for bank drafts, cheques, or pay orders, issued by a bank or cooperative bank.

13. Payment of transaction exceeding INR 50,000 regarding Life Insurance made to the insurer.

14. A contract for buying/selling securities (excluding shares) that exceeds the amount of INR 1 lakh per transaction.

15. Sale or purchase of shares of a company not listed in a recognised stock exchange involving a transaction exceeding 1 lakh.

16. Sale or purchase of an immovable asset, the value of which exceeds 10 lakh.

17. Sale or purchase of goods other than the ones listed above involve transactions exceeding two lakhs.

7 Different Types of PAN Cards

PAN Cards are differentiated into 7 categories based on the type of holder. They are:

- Individual: This is issued to an individual taxpayer of India.

- HUF Hindu Undivided Family: This is issued to a family where all the male members have descended from a single ancestor, their wives and unmarried daughters.

- Firms/Partnerships: Firms and limited liability partnerships have a separate PAN

- Company: This is issued to companies and is used to file and track their tax transactions.

- Foreigner: Foreign nationals or NRI use this type of PAN Card.

- Society: Societies registered under the Societies Registration Act use this Card.

- Trust: This is issued to charitable trusts, educational and medical institutions, universities, and others.

Structure of The Card

Every PAN Card has the same format used in the ten-character alphanumeric key.

The structure used while assigning the original PAN card number conveys valuable information. Every Card has the following details mentioned about the holder.

- Name: A Card may be in the name of a person or company

- Name of father: This applies to individual Cardholders only

- Date of birth: The actual date of birth for individuals and the date of registration for companies.

- PAN number: This is a unique identity that the Card grants.

- Photograph: Every individual Cardholder has their image on the bottom right. For companies/groups, no picture is present.

- Signature: Every Card has the signature of the holder.

Meaning of the Letters and Numbers in the PAN Card

- The first three letters in every PAN Card are a set of three alphabets.

- The fourth character reveals the status of the holder. The different variations are:

- A- Association of persons (AOP)

- P- Individual

- B- Body of individuals (BOI)

- C- Company

- G- Government agency

- L- Local Authority

- J- Artificial Juridical Person

- H- Hindu Undivided Family (HUF)

- F- Firm or Limited Liability Partnership

- T- Trust

3. The fifth character in the PAN uses the first letter of the holder's surname. For instance, Rohit Kumar's PAN would use K as the fifth character in the key. For non-individual holders, the fifth character is simply the first letter of the holder's name.

4. The following four characters are numbers that may include any combination taken from between 0001-9999.

5. The tenth and last digit in the PAN is always an alphabet.

Documents Required for Application

To PAN apply, individuals, groups, trusts, companies, and others need to provide proof of identity and address (POI and POA). The options are listed below.

| Individuals | Aadhaar, Passport, Driving License and Voter ID |

| Companies registered in India | Certificate of registration issued by the Registrar of Companies |

| Firms/Partnerships (LLP) | Certificate of registration issued by the Registrar of Firms, Limited Liability Partnership Deed |

| Society | Certificate of Registration Number from the Registrar of Co-operative Society or Charity Commissioner |

| Trust | Trust Deed or Certificate of Registration Number issued by a Charity Commissioner |

| Hindu Undivided Family (HUF) | Affidavit of HUF issued by the head of the family with POIs and POAs |

| Foreigners | Passport, PIO/OCI Card issued by the Govt. of India, Bank statement from the residential country, NRE bank statement of India |

Cost of Application

Due to there being various kinds of PAN Cards, the charges are as follows:

| Parameters | Fee | GST @ 18% | Total |

| FOR APPLICATION ON PHYSICAL PAN Card | |||

| Sending physical Cards to India | INR 86.00 | INR 15.48 | INR 101.48 |

| Sending physical Cards outside India | INR 857.00 | INR 154.26 | INR 1,011 |

| FOR APPLICATION OF e-PAN Card | |||

| The communication address is in India | INR 56.00 | INR 10.08 | INR 66.08 |

| The communication address is outside of India | INR 56.00 | INR 10.08 | INR 66.08 |

There are no additional costs involved in the PAN application process. Any person or group engaged in the activity of charging applicants extra money for the form or application should be reported to the local authorities.

TIN (PAN/TDS) Branch Offices?

You can visit multiple branch offices across the country to seek assistance regarding PAN.

- New Delhi: 409/410, Ashok Estate Building, 4th floor, Barakhamba Road, Connaught Place, New Delhi- 110001.

- Chennai: 6A, 6th Floor, Kences Towers, 1 Ramkrishna Street, North Usman Road, T. Nagar, Chennai – 600 017.

- Kolkata: 5th Floor, The Millenium, Flat No. 5W, 235/2A, Acharya Jagdish Chandra Bose Road, Kolkata – 700 020.

- Ahmedabad: Unit No. 407, 4th floor, 3rd Eye One Commercial Complex Co-op. Soc. Ltd., C. G. Road, Near Panchvati Circle, Ahmedabad, Gujarat– 380006.

How to Apply for a PAN Card?

The Income Tax Department of India has permitted UTI Technologies and Services Limited (UTIITSL) and National Securities Depository Limited (NSDL) to erect and run PAN service centres nationwide. UTIITSL and NSDL have established service centres and TIN Facilitation Centres in all major regions of India.

So, to own a PAN Card apply online by filling in the form 49A/ 49 AA (resident/ non-resident) information, attaching the relevant and required documents and submitting the fees quoted for PAN application at any UTIITSL or NSDL centre. Alternatively, users can apply online via the UTIITSL or NSDL PAN Card website.

How to Fill the Form to Apply for PAN Card Filling the Form?

Form 49A or 49AA should be filled in carefully; this guide will help you do so.

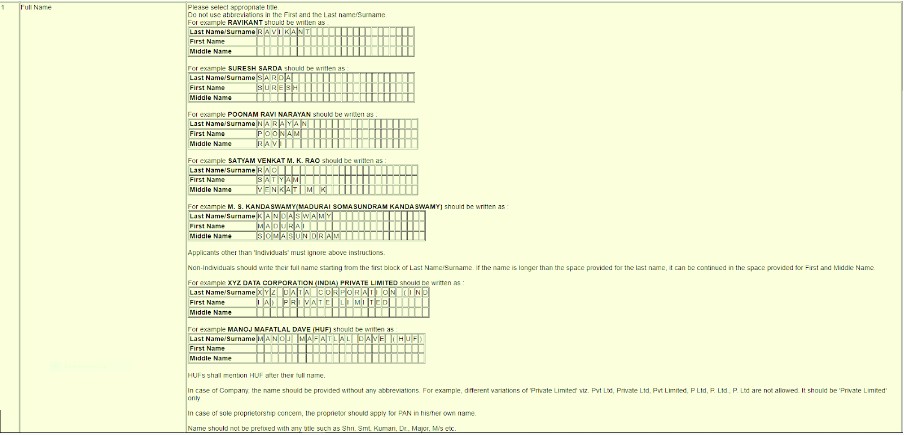

1. Full Name

The first section of Form 49A pertains to the name of the applicant. Here applicants must fill in their first, middle and last names. Proper care should be taken in terms of spaces and punctuation between names. The image above also helps illustrate the methods to be used by groups, companies, HUFs and others.

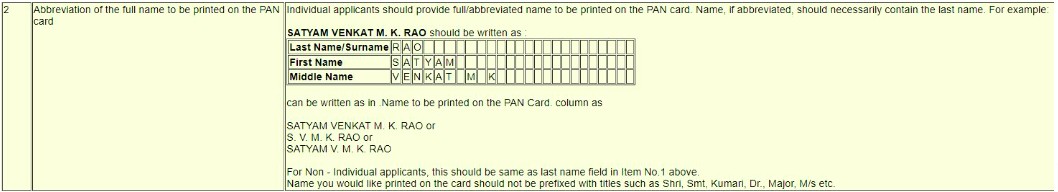

2. Abbreviation of the full name to be printed on the PAN Card

In the next section, applicants need to fill in their preferred abbreviation to be printed on the PAN Card. Individuals may use whatever abbreviation they want but it must always contain the last name like in the image above.

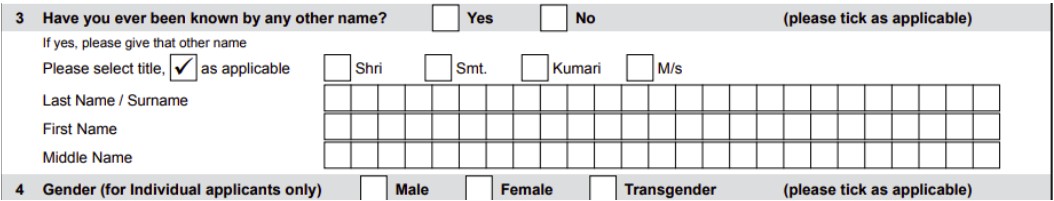

3. Have you ever been known by any other name

If an applicant chooses ‘Yes’, the same rules to write the name as point number 1 apply here as well.

4. Gender

This section is pretty self-explanatory and is mandatory for individuals. Companies, groups and others may leave this empty.

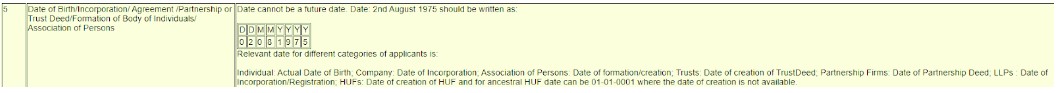

5. Date of Birth

As the name suggests, this section needs to be filled with the information pertaining to the Date of Birth of the applicant. For obvious reasons, the date cannot be in the future and must be filled in the DD/MM/YYYY format. The boxes are placed accordingly.

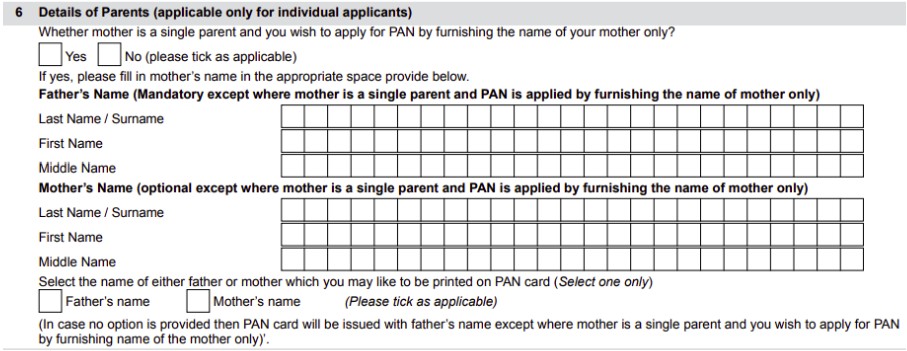

6. Details of Parents

Selecting ‘Yes’ or ‘No’ is mandatory in the field which reads: ‘Whether the mother is a single parent and you wish to apply for PAN by furnishing the name of our mother only.

Yes, should be checked only if (i) the Applicant’s mother is a single parent and (ii) the Applicant wishes to use the mother’s name only. In such cases, the field reading ‘Father’s name should be left blank.

The number should be checked for all other cases. This also makes mentioning the Father’s name mandatory. The mother’s name remains optional.

Applicants should select the parent’s name they want on the Pan Card. It can be either the mother or father in normal cases.

All rules regarding entering the names of individuals remain the same as point number 1.

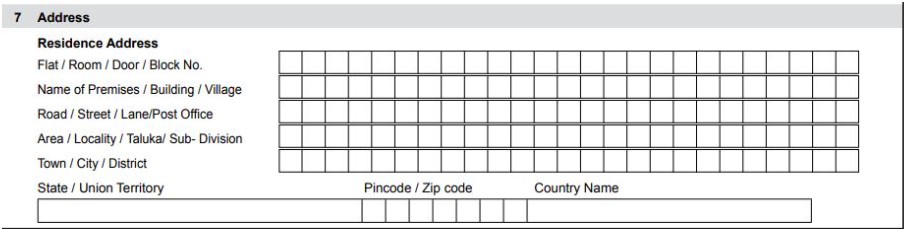

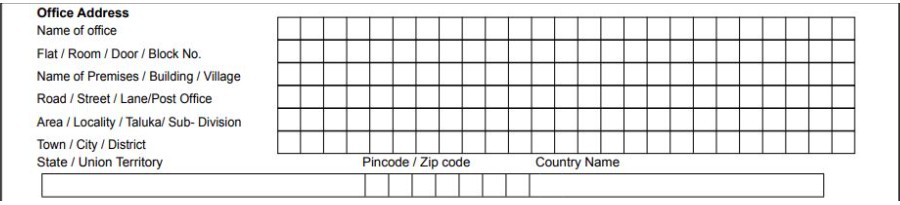

7. Address

Applicants need to fill out details regarding their residential and office addresses in this section.

The Residential Address section is mandatory for individuals, HUF, BOI, AOP and AJP. Others may leave this space blank.

In the Office Address section, individuals who have a source of income or business need to fill in the details. For firms and LLPs, local authorities, trusts and companies this section is mandatory.

8. Address of Communication

Here individuals, HUFs, BOI, AJP and AOP should indicate where they would like to receive all communication, (R)Residence or (O)Office. All other parties must select ‘O’.

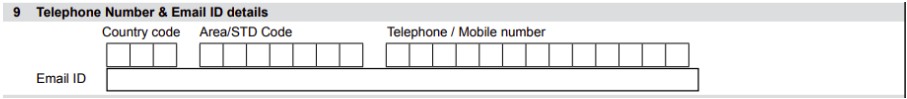

9. Telephone Number and e-mail ID

Applicants must mention their points of contact in this section. All telephone/mobile numbers must include the ISD and STD codes. For instance, A number from Delhi reading 23555705 must be entered like: (i) Country code- 91 (ii) Area/STD code- 11 (iii) 23555705.

A working telephone/mobile number or valid email address is mandatory for all applicants as all further communications will be carried out by using them.

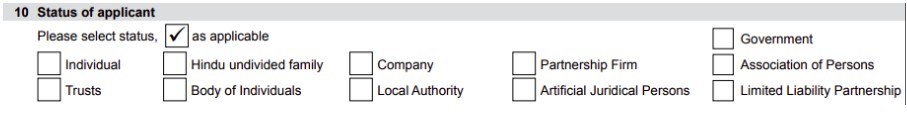

10. Status of Applicant

This section is mandatory for all applicants. LLPs will get a PAN with the ‘Firm’ status.

11. Registration Number

This is a mandatory section for companies, firms, LLPs, and other groups.

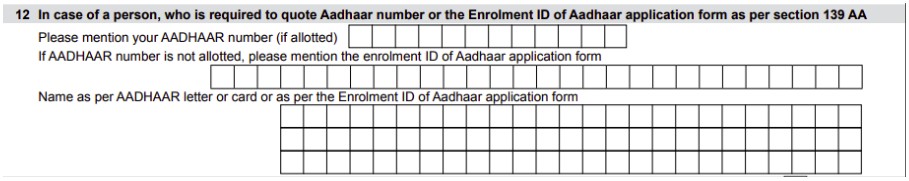

12. Aadhar number

This section is mandatory for all citizens of India.

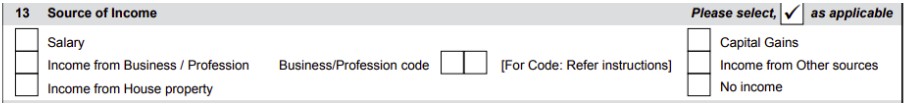

13. Source of Income

Selecting at least one source of income is mandatory. In case the option ‘Income from Business/Profession’ is selected, an appropriate code should be mentioned. The codes are:

| CODE | BUSINESS/PROFESSION | CODE | BUSINESS/PROFESSION |

| 01 | Medical Profession and Business | 11 | Films, TV and other entertainment |

| 02 | Engineering | 12 | Information Technology |

| 03 | Architecture | 13 | Builders and Developers |

| 04 | Chartered Accountant/Accountancy | 14 | Members of the Stock Exchange, Share Brokers and Sub-Brokers |

| 05 | Interior Decoration | 15 | Performing Arts and Yatra |

| 06 | Technical Consultancy | 16 | Operation of Ships, Hovercrafts, Aircraft or Helicopters |

| 07 | Company Secretary | 17 | Flying Taxis, Lorries, Trucks, Buses or other commercial vehicles |

| 08 | Legal Practitioners and Solicitors | 18 | Ownership of Horses or Jockeys |

| 09 | Government Contractors | 19 | Cinema Halls and Other Theatres |

| 10 | Insurance Agency | 20 | Others |

14. Name and Address of Representative Assessee

The Income Tax Act allows representation via Representative Assessees (RA). This section is mandatory for all RAs that fall under the categories listed in Section 160 of the Income Tax Act, 1961.

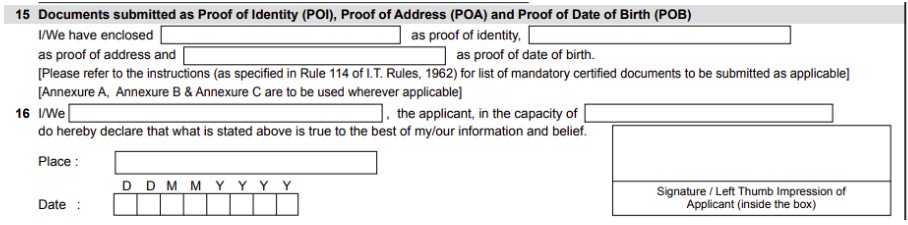

15. Documents submitted as Proof of Address (POA), Proof of Identity (POI) and Proof of Birth (POB).

This is a mandatory section and all documents submitted should be in the name of the applicant.

What Is Instant e-PAN?

The Income Tax Department of the Government of India also has the function of allotting an instant PAN Card to an individual based on their Aadhar Number. However, this facility can only be used if:

- The individual still needs to be assigned a PAN.

- The individual's mobile number is linked to their Aadhar number.

- The individual's complete DOB is mentioned on the Aadhar Card.

- The individual is not a minor at the time of application.

How to get an Instant e-PAN?

Once the above conditions are met, an individual can follow the steps mentioned below to attain an Instant e-PAN that can also be used as a physical PAN.

- Open the e-Filing home and select Instant e-PAN.

- On the next page, select Get New e-PAN.

- On the Get New e-PAN page, enter the 12-digit Aadhar Number and select the box beside 'I confirm.

- Check the 'I have read the consent terms and agree to proceed further' option and click continue.

- On the OTP Validation page, enter the OTP received on the mobile number linked with the Aadhar Number. Check the box which reads 'Validate the Aadhar details with UIDAI' and select continue.

- On the Validate Aadhar Details Page, accept the terms and click continue.

After successful submission, a success message will be displayed, accompanied by an acknowledgement number. This number must be noted down and kept safely for future reference. A similar confirmation message will be sent to the mobile number linked to the Aadhar.

How to Update or Edit Your PAN Card Details?

Sometimes individuals make errors while submitting the details needed to apply for a PAN Card. In such scenarios, they may correct or update the data via the NSDL. Once there, they must visit the 'Update PAN' section and select 'Correction' from the existing PAN data menu.

A copy of either a Proof of Identity or Address must be submitted while filing this request.

Guide for Filling out the Updated PAN Card Form

Updating or correcting the details on a PAN Card is very important. Here are a few things you should keep in mind.

- Fill in the latest and most relevant info accurately using block letters.

- Don’t use salutations such as Mr, Ms., Dr. and others.

- Always fill in your current phone number and address– you don’t want the PAN to get sent to an address where you have trouble reaching.

- Documents must be self-attested.

Things to Do in Case of a Lost PAN Card

Is your PAN Card lost? If you lose your physical PAN Cards, applying for a duplicate online or offline is quite simple. Filling and submitting the form titled 'Request for New PAN Card or/ and Changes or Correction in PAN Data' will resolve the issue. A copy of an FIR can also be attached. If the individual needs to remember the PAN, they can use the 'Know Your PAN' feature launched by the Income Tax Department.

Linking PAN and Aadhar Card

It is mandatory in India to connect your PAN and Aadhar Cards.

As of July 1, 2017, section 139AA (Finance Act) of the Income Tax Act states that every individual possessing an Aadhar number must mention it while applying for a PAN. The enrollment ID may be submitted in case of applied but not allotted Aadhar numbers. The same applies to PAN holders applying for Aadhar numbers, an intimation must be sent to link the two, or the PAN will be deemed inoperative.

How to Link Your PAN Card With Aadhar Card

There are three modes individuals can use to link their Aadhar and PAN. They are:

1. Linking PAN and Aadhar Via SMS

Send an SMS to 567678 or 56161 from the registered mobile number. The message should be in the format: UIDPAN<SPACE><12-Digit Aadhaar Number><10-Character PAN>. For instance, UIDPAN 123456789012 BFHPV0572E

2. Linking PAN and Aadhar Online

Individuals can visit the NSDL or UTIITSL website and select the 'Link Aadhar to PAN' option. This will redirect users to the income tax website. Alternatively, individuals can also do so by visiting the e-Filing portal.

3. Offline Method of Linking PAN and Aadhar

Individuals can also fill in a physical form to link the two documents. This needs to be submitted along with copies of both documents.

What Happens When an Individual/Group Doesn't Have a PAN?

Having a PAN is almost mandatory in today's day and age. It makes things a lot easier and more convenient. Not having a PAN results in the following:

- A flat 30% tax deduction from all income and wealth owned by an individual or group liable to pay tax in India.

- Businesses need to be able to conduct most financial transitions.

- Not being able to purchase immovable property or assets over ten lakhs.

- Not being able to buy a motorised vehicle other than two-wheelers.

- Need to be able to open bank accounts.

PAN Card Application Tracking

One can verify their PAN Card application's progress in several ways. The most obvious way would be to use the 15-digit acknowledgement number you were given after a successful application.

Here are the steps that you have to follow.

- Go to the NSDL website.

- Select the "Track PAN Status" option from the available choices.

- Under "Application Type," select "PAN-New/Change Request" and click the button.

- Enter your 15-digit confirmation code.

- After entering the security code, click the "Submit" button.

Your PAN application status will be displayed on the following screen.

Tracking PAN Card Transactions

The Income Tax Department of the Government of India has allotted an ITBAN-PAN for every registered PAN Card holder. The Income Tax Business Application-Permanent Account Number helps the department keep a close eye on all transactions and makes tax calculations much more manageable. The ITBAN-PAN has allowed all PAN Card tracking to move over to software.

According to research conducted by the Tax Justice Network, by 2020, corporate tax evasion by MNCs had cost India 57.4% of its total Income Tax revenue. Over Rs.300,000,000,000 in income was lost due to tax evasion and avoidance by private businesses and individuals (42.6 per cent).

Still not enough to convince you to look up "how to apply for a PAN Card" online? Consider that the document's usefulness in other contexts has multiplied immensely in recent years. As a result, it is now complicated to function without a PAN Card.

If you still have questions and need answers, check out the NoBroker Blog legal section if you need assistance with rental agreements and tenant verification. Non-residents can check out the Nobroker NRI services portal for ease of use.

FAQ's

Ans. Yes, applying for a PAN Card can be done online and offline. For online users, you need to visit either the NSDL, UTIITSL or eFiling portal to gain access to Form 49A/49AA. A PAN is necessary for selling, purchasing or renting a house throughout India.

Ans. No, the application for a PAN Card needs to be done via form 49A/49AA. This form needs to be filled in and accompanied by Proof of Identity, Proof of Address and Proof of Date of Birth.

Ans. In such cases, the PAN associated with income tax should be retained and the additional one submitted for cancellation. Owning multiple PANs can result in severe legal actions being taken against you.

Ans. The procedure mainly remains the same, apart from the form being 49AA instead of 49A. Additionally, NRIs need different documents to be submitted along with the application.

Ans. No, the 49A/49AA are free of cost, whether online or offline. They should be reported if anyone is trying to charge money for the form. However, there is a fee that needs to be submitted while submitting the form.

Ans. A PAN number, short for Permanent Account Number, is a unique identification code assigned to individuals and businesses in the United Kingdom for tax and financial purposes. It serves as a vital reference for taxation, financial transactions, and official documentation.

Ans. A PAN card, or Permanent Account Number card, is an essential document in India. It serves as a unique identification for financial transactions and taxation purposes, making it crucial for filing income tax returns, opening bank accounts, and conducting various financial activities in the country.

Ans. The full form of a PAN card in India is the "Permanent Account Number" card, which is a unique identification number issued by the Income Tax Department to track financial transactions and tax-related activities of individuals and entities.

Loved what you read? Share it with others!

Most Viewed Articles

SBI Bank Holidays List Across India: National, State-wise and Weekend Closures in 2026

December 24, 2025

40009+ views

HDFC Bank Holidays List in 2026: National, State-Wise and Weekly Closures

December 26, 2025

38727+ views

Update Your Aadhaar Card Address: Quick and Convenient

January 31, 2025

34071+ views

Bandhan Bank Holidays 2026: List of National, Festival & State-Wise Dates

December 24, 2025

32859+ views

Canara Bank Holidays List in 2026: National, State-wise and Weekend Closures

December 24, 2025

32227+ views

Recent blogs in

UCO Bank Holidays List: National and State-Wise Branch Closures in 2026

December 26, 2025 by Priyanka Saha

HDFC Bank Holidays List in 2026: National, State-Wise and Weekly Closures

December 26, 2025 by Priyanka Saha

Indian Bank Holidays List in 2026: State-Wise National and Regional Bank Holidays

December 26, 2025 by Suju

Full RM + FRM support

Full RM + FRM support

Join the conversation!