Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Pay Rent with Credit Card: Experience Secure Online Rent Payments

Table of Contents

Credit and debit cards have become our top choice to make payments online and offline. We use it for small purchases at local shops as well as large purchases like gold, TVs and more. Credit card companies reward us for using cards and so do online shopping sites. Let's take a brief look at the Pros and Cons of paying your rent through a credit card and find out how to pay rent through a credit card.

Are you ready to revolutionize your rent payments? Discover how to pay rent with a credit card and unlock a world of rewards and convenience. In this blog, we'll delve into the Pros and Cons of this innovative method, helping you make informed decisions. From earning rewards to streamlining your payments, we'll cover it all. Don't miss out on this game-changing information – read on to transform your rent payment experience today.

Can I Pay Rent With a Credit Card?

Numerous individual landlords and property managers often restrict rent payments to cash or checks, avoiding credit cards due to associated charges or the complexities of processing such payments. Larger property management companies might offer card payment options.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Landlords accepting direct credit card payments bear merchant processing fees, often transferring these costs to renters alongside the rent. The convenience fee for card payments usually ranges from 2.5% to 2.9%, seemingly modest but cumulatively significant. A $1,400 monthly rent with a 2.5% processing fee adds an extra $35. In a year, this accumulates to $420, about 30% of a single month's rent. While reward-earning credit cards could offset some costs, complete elimination is improbable.

When landlords don't accept cards, third-party online services can mediate payments to landlords while potentially reporting to credit agencies. Autopay options can prevent late fees, yet these services levy charges. Plastiq, for instance, charges a 2.85% fee per rent payment.

The Pros and Cons of Paying Rent Using a Credit Card

| Pros | Cons |

| Earn rewards: Points, air miles, cashback, and discounts can be obtained through credit card payments. | Convenience fees: Landlords often pass on processing fees to renters, adding extra cost to the payment. |

| Convenient payments: Credit and debit cards are widely used for various transactions. | Additional expenses: Fees associated with using a third-party service to pay rent with a credit card can accumulate. |

| Possibility of discounts: Credit cards may offer significant discounts during sales or festivals. | Limited acceptance: Many individual landlords and property managers don't accept credit card payments for rent. |

| Build credit: Some third-party online services that process rent payments can report them to credit bureaus, helping you build credit. | Reliability concerns: Landlords might prefer cash or checks due to the potential complexities of credit card payments. |

| Automatic payments: Setting up autopay with third-party services can help avoid late payments. | Not fee-free: While rewards can offset costs, they may not eliminate the additional fees associated with credit card payments. |

| Online payment option: Some third-party services enable you to pay rent online, improving payment convenience. |

Read: Everything you need to know about TDS on rent

Factors to Consider Before Paying Rent With a Credit Card

Verification and Payment Process

Once your provided details are verified, initiating your inaugural online rent payment becomes possible. The rental amount will be debited and directly transferred to your landlord's account. Rest assured, each transaction adheres to the highest security standards, facilitated by a PCI compliant payment gateway. While the payment might take up to 2 working days to reflect in your landlord’s account, you and your landlord will be notified of the successful transaction via SMS.

Simplified Process for Landlord

Your landlord need not be registered on NoBroker to receive the rent, nor is it necessary for them to follow up with you regarding the payment status. The payment will be accurately recorded in their account and statement, accompanied by a clear description such as "October Rent Payment from Sachin". The month will be specified based on your payment date, and the name will be selected from the details you provide. Moreover, auto-generated rent receipts for all transactions via NoBroker Pay will be at your disposal. These receipts can be employed to claim HRA exemptions during your income tax filing.

Additional Benefits

After completing your payments, you become eligible to earn NoBroker rent payment cashback, reward points, or air miles. The rewards vary based on your credit/debit card, contingent upon the bank and account type. To explore available offers, it’s advisable to connect with a representative from your bank. For instance, if you hold an Amex Platinum Travel Credit Card and your annual rent is Rs. 4,00,000, you could earn up to Rs. 30,000 in a year when paying your rent online.

Why Choose NoBroker to Pay Rent Using Your Credit Card?

In conclusion, paying rent with a credit card can truly redefine your rental experience. By embracing this method, you can earn rewards while ensuring secure and convenient transactions. However, navigating this process on your own might be challenging, and finding the right assistance is essential. This is where NoBroker Pay comes to help. With our expertise and user-friendly platform, we make the journey seamless. Start using NoBroker Pay for a swift, hassle-free solution to your rent payment needs.

FAQs

Ans. Absolutely, you can now conveniently settle your house rent using your credit card through NoBroker Pay. By registering with NoBroker Pay, you can make monthly rent payments and even earn rewards like cashback, miles, and points on your credit card.

Ans. Yes, paying your rent using a credit card through NoBroker Pay is highly recommended. Our platform ensures secure transactions with encryption and doesn't store sensitive financial data. Utilizing your credit card for payments can save you money with exciting offers like cashback, reward points, and fuel points.

Ans. To make secure online rent payments with a credit card, simply register on NoBroker Pay. The process is swift and straightforward, and your financial information remains protected. NoBroker Pay guarantees instant and safe rent transfers.

Ans. Once your NoBroker Pay account is approved, you can make rent payments at any time. With our 24/7 Instant Transfers feature, payments are transferred to your landlord instantly upon payment submission.

Ans. Optimal and highly recommended, pay your house rent online through NoBroker Pay using your credit card. This secure method offers instant transfers, encrypted transactions, and potential rewards of up to ₹30,000. Additionally, you receive immediate payment receipts, simplifying HRA claims.

Ans. While some landlords may still prefer cash payments, the majority now prefer cashless methods due to online convenience and safety. NoBroker Pay allows secure credit card payments for your rent, ensuring instant payments for your landlord and rewarding benefits for you.

Ans. NoBroker Pay extends beyond house rent payments. You can also utilize it for:

Society Maintenance

Office/Shop Rent

Token Amount (for property reservation)

Property Deposit (advance for property rental)

Recommended Reading

Best Rent Payment Mobile App: List of Top 10 Apps in India to Pay Rent Online

January 15, 2025

30753+ views

Rupay Vs Visa Vs Mastercard: Learn About How RuPay Card is Different From Visa And Mastercard

January 31, 2025

29922+ views

Pay Rent with Credit Card: Experience Secure Online Rent Payments

August 18, 2023

12803+ views

Best App to Pay Rent: Ultimate Guide for Digital Transactions

January 31, 2025

11821+ views

Balance Transfer Credit Cards: A Smart Debt Management Solution

August 18, 2023

5775+ views

Loved what you read? Share it with others!

Most Viewed Articles

August 12, 2025

449334+ views

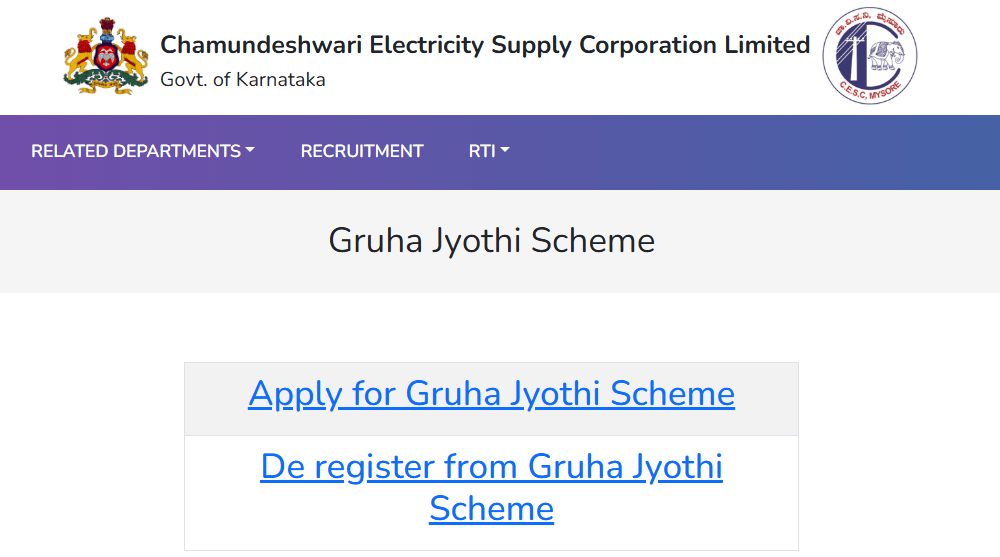

Gruha Jyothi Scheme Karnataka: Application Process, Eligibility and Documentation in 2026

September 12, 2025

68804+ views

How to Apply Online LPG Gas Connection: Application Process, Documents and Fees in 2026

June 1, 2025

59423+ views

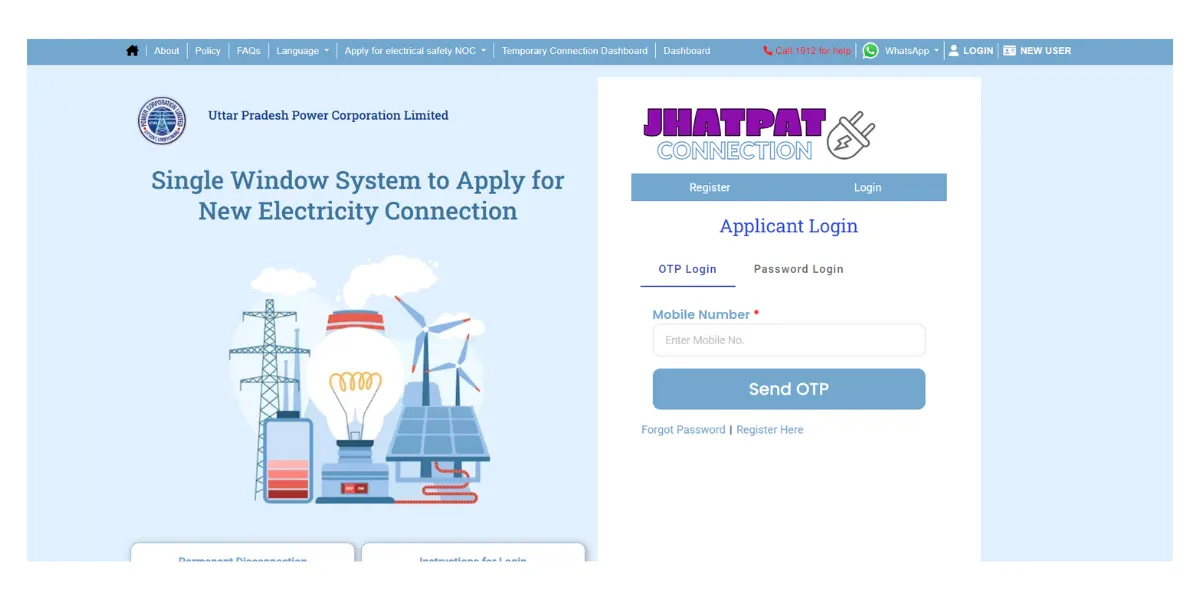

UPPCL Jhatpat Portal for New Electricity Connection: Process, Status Tracking and Charges in 2026

January 31, 2025

49575+ views

May 24, 2025

44172+ views

We’d love to hear your thoughts

jayesh

They started charging fee - 99 extra charged for the payment. Very unprofessional service - they advertise as no fee but actually charge,

March 1, 2019, 11:41 amparam

Hi, Can u tell me the final payment to be paid if I want to pay rent of Rs. 18000 along with breakup of charges. Are u accepting Diners club cards...???

June 7, 2020, 1:37 pmsathish

No broker - rent pay - what is minimum amount and max amount can be transfer

June 8, 2020, 10:52 pmNoBroker.com

Hi Sathish, There is no Minimum amount for rent payments. The maximum amount depends on payment which type of rent you're paying: 1. House Rent - the maximum is Rs.3 lakhs 2. Commercial Rent - the maximum is Rs.8 lakhs We hope this helps! Team NoBroker

June 10, 2020, 3:35 pmsachin

hi what is the terms and condition. i am not finding it on your webpage also nothing on payzapp. i want to know documents required.

June 8, 2020, 11:24 pmNoBroker.com

Hi Sachin, You can find the terms and conditions here- https://www.nobroker.in/terms-and-condition (Point Q). The only document you need is a valid Rental Agreement. Thanks, Team NoBroker

June 10, 2020, 4:08 pmJoin the conversation!

Recent blogs in

NBPDCL Bill Payment Online: Check, Download & Pay Bihar Electricity Bill in 2026

February 19, 2026 by Manu Mausam

CSPDCL Bill Payment Online: How to Check Bill Status and Download Receipt in 2026

February 18, 2026 by Manu Mausam

MPEB Bill Payment Online: Check, Download & Pay MP Electricity Bill in 2026

February 18, 2026 by Manu Mausam

JBVNL Bill Payment Online: Check Bill Status and Payment Methods in 2026

February 18, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

jayesh

They started charging fee - 99 extra charged for the payment. Very unprofessional service - they advertise as no fee but actually charge,

March 1, 2019, 11:41 amNoBroker.com

Hi, We charge a nominal convenience fee of Rs. 149 towards a seamless rent payment experience. The actual charges incurred by us for the payment gateway are much higher than this. Also,the fee is much lower when compared to the rewards you would be earning from credit card payments.

April 3, 2019, 5:17 pm