Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

An In-Depth Look at Property Registration in Bangalore

Table of Contents

The best feeling ever is to have a house of your own, a place that you can call home. When dealing with something so important it becomes crucial to know the prerequisites of buying a home. Registration of property is one of the most vital processes when purchasing a house or property. Property registration is a legal matter, and you should always try to hire a professional to avoid any errors in technicalities.

What is Property Registration?

Property registration is the complete and final document or agreement that is signed by the two parties involved in the deal of property. The seller and the buyer are involved in the process of registration of the property. If a property is registered, that means that the buyer holds legal ownership of that property, and that person is responsible for the property. The process of property registration is done in the sub-registrar office. The property registration document is a complete and final agreement that is signed between two parties. Registration of property in India is regulated by the Registration Act, 1908.

What is the Importance of Property Registration?

It is really important to register your property as without this document you can lose possession of your property. There is no legal validity of an unregistered property. Even if you've bought the property and have all the other documents if you don't have the registration documents then anyone can raise a legal dispute over that property. Registering a property legalizes that you have complete and valid ownership of the property, and it provides you with the title of possession of the property. An unregistered property cannot be accepted as evidence in any court case.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

What is Guidance Value?

The guidance value in Bangalore, and more broadly in real estate in India, refers to the minimum price at which a property must be registered during sale or transfer. This value is set by the government and serves several purposes:

- Basis for Stamp Duty and Registration Fees: The guidance value helps in determining the stamp duty and registration fees for property transactions. These fees are calculated as a percentage of the property’s value, and the guidance value serves as the lower limit for these calculations.

- Prevention of Undervaluation: It prevents the undervaluation of property during transactions. By setting a minimum value, the government ensures that property is not registered for a price lower than its real worth, which helps in curbing tax evasion.

- Revenue for the Government: Since stamp duty and registration fees are major sources of revenue for the state government, the guidance value aids in securing appropriate revenue from property transactions.

- Reference for Property Buyers and Sellers: It provides a reference point for buyers and sellers in the property market, helping them to understand the minimum legal value at which they can transact.

The guidance value can vary depending on the area, the type of property, and its amenities. It's updated periodically to reflect changes in the real estate market. For property registration in Bangalore, knowing the guidance value is crucial, as it significantly impacts the financial aspects of property transactions.

How does the Process of Property Registration in Bangalore Take Place?

You can register your property online as well as offline in Bangalore. It can be hectic and confusing to get your property registered. Here is a step-by-step guide on property registration in Bangalore.

Online method

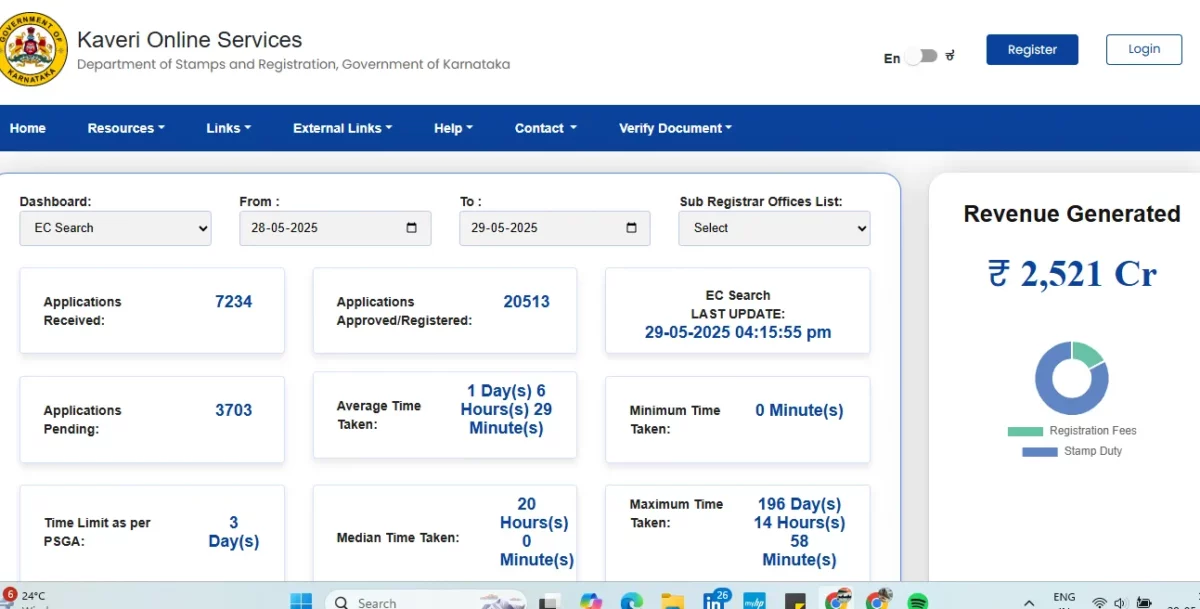

The government of Karnataka has introduced an online method of registration of property. You can comfortably register your property on Kaveri. Kaveri is a web portal that provides various government document-related online services. These services include registration of property, guideline values, encumbrance certificate, etc. To register your property in Bangalore, you have to follow the given steps-

The government of Karnataka has introduced an online method of registration of property. You can comfortably register your property on Kaveri. Kaveri is a web portal that provides various government document-related online services. These services include registration of property, guideline values, encumbrance certificate, etc. To register your property in Bangalore, you have to follow the given steps-

1. Open The Kaveri Web Portal

Visit the Kaveri online services web portal. The link to the portal is- https://kaverionline.karnataka.gov.in.

2. Log In or Register New Account

If you already have an account then you should log in with your credentials. In case you are a new user then register a new account and provide the required details.

3. Fill in The Required Details

After this, click on the document registration option. In this section, enter your details such as the number of parties involved in the formation of the document, date of sale deed, name of the witness, buyer, and seller.

4. Provide Valid ID Documents

After filling in all the details, choose the ID proof that you’ll be providing which is your Aadhar card number or other identification documents.

5. Insert Relevant Details

Now you’ll be redirected to the property details page. Fill in all the details. These details include the type of land that is non-agricultural or agricultural, district, sub-registrar office under whose jurisdiction the property falls. Make sure to write the guideline value. Then calculate the resultant stamp duty.

6. Upload Valid Documents

Upload the required documents like address proof and sale deed.

7. Initiate Payment

Select the method of payment. Add details like challan number, cheque number, and date of challan. Then you can book an appointment at the sub-registrar office where you have to submit the required documents on the scheduled date.

Offline method

This method is more time-consuming than the online method. You have to visit the sub-registrar office of the area in which the property is present. There you'll have to provide the required documents and both the seller and the buyer have to sign the registration document. Along with this, you have to bring two witnesses. After paying the registration fee and stamp duty you can collect the registration document after the time specified by the sub-registrar.

Documents required for Property Registration Process in Bangalore

The flat registration process in Bangalore is a legal process under the state’s regulation. This is why you need to have all required documents in place to ensure a smooth and fast process. The documents required for property registration in Bangalore are as follows-

- All title documents

- Sanctioned building plan

- RTC- Rights and Tenancy corps

- Registered Development Agreement (if property is a joint property)

- Encumbrance Certificate

- Copies of all previous agreements

- Sale Agreement

- Conversion order

- Absolute sale deed in present seller’s name

- Paid tax receipts

- Khata certificates

- Occupancy/possession certificate from builder

How Much Does It Cost to Register Your Property in Bangalore?

Property registration in Bangalore requires you to pay the registration fee, stamp duty, and challan fee. Along with this, you have to pay some additional surcharges.

The registration fee for property registration in Bangalore is 1% of the property value.

The additional charges are of three types- BBMP and village area cess, BMRDA and surcharges, BBMP and corporation surcharges. These are 10%, 2%, and 3% on stamp duty respectively.

You also have to pay stamp duty which is 5.6% of the value of the property.

To calculate the stamp duty, you can use the stamp duty calculators available online. All you have to do is enter the details of your property and click on the calculate option. The calculator will automatically provide you the estimated stamp duty of your property. Read more about stamp duty from here.

Bangalore Property Registration Details: Time Required

Depending on whether or not you have all the documents in place, the land registration process in Karnataka can take anywhere from 5-14 days. Make sure you have all the relevant documents before you head to the sub-registrar's office. A good rule of thumb would be to also carry multiple copies of all the important documents.

Latest Updates on Property Registration in Bangalore

In recent years, the government of Karnataka has decreased stamp duty charges. Properties ranging between Rs. 35 lakhs to Rs. 45 lakhs have a stamp duty of 3%. Any property that is above Rs. 45 lakhs will have a stamp duty of 5%. This decrease in stamp duty charges is an attempt to encourage people to purchase more property. For property registration in Bangalore, if the property is valued at less than Rs. 35 lakhs then the stamp duty will be decreased.

Property registration in Bangalore is required for you to have legal ownership of the property. By doing so you decrease the chances of disputes over possession of the property. The process of property registration can be done online as well as offline.

For online registration, you have to visit Kaveri online services which is the official web portal of the Karnataka Government for registration and other documentation. Offline registration is done in the sub-registrar office of the property's district.

While dealing with legal matters like property registration in Bangalore you should make sure to avoid any space for errors and mistakes. For this purpose, you should always prefer the help of a professional lawyer or consultant. You can find all the proper related services at NoBroker. If you need help with property registration, encumbrance certificate, loan assistance, etc. You can depend on the expert team at NoBroker. Get assistance with the legalities of buying or selling property. You can rest easy and rely completely on NoBroker to get the best property-related services.

Frequently Asked Questions

When you're purchasing a property in Bangalore and you haven't gotten it registered then that means you don't have the ownership of the property. Your property is at high risk of legal disputes. By doing property registration you can have the title of possession of the property.

The Karnataka government has recently reduced stamp duty on properties to boost sales and increase state revenue. The new rates are 5% for properties above Rs. 45 lakh and 3% for those below Rs. 45 lakh.

The Indian government, under the Registration Act of 1908, mandates property registration. This process is a significant revenue source for state governments. Legally, property owners must register their property and pay applicable taxes, including registration fees and stamp duty. Without registration, a property lacks legal ownership.

In Bangalore, stamp duty is set at 5.6% of a property's value and can be calculated online using stamp duty calculators. To calculate, first enter the property's state and its value. If the property value is unknown, determine it by checking the guideline and market values. After entering the value, simply press the calculate button to find out the stamp duty for the property.

Recommended Reading

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

122442+ views

BBMP e-Aasthi: Search Property Details, Download Certificates, and Check Status Online

April 10, 2025

87449+ views

What are the current Stamp Duty and Property Registration Charges in Karnataka

January 23, 2025

81908+ views

Tamil Nadu Property Registration: Online and Offline Process, Charges and Documents in 2026

May 31, 2025

78006+ views

EC Online Bangalore: Importance, Online Application and Status Check in 2026

June 1, 2025

69742+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116748+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

199656+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

144348+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135156+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Mobile Home Lease Agreement: Types, Rights, Rules & Legal Requirements in 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!