Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Property Tax Chennai Online Payment 2025

Table of Contents

As citizens of India, we must pay taxes. Property tax is an essential aspect of India’s taxation system, serving as a vital source of revenue for local governing bodies. This guide will provide you with a comprehensive overview of Property Tax Chennai, including its calculation methods, online payment procedures, and crucial resources. It is a mandatory levy imposed on individuals or entities who own immovable properties within the jurisdiction of a particular municipality or panchayat.

Chennai, the capital city of the southern Indian state of Tamil Nadu, follows a comprehensive property tax system. The Chennai Municipal Corporation, also known as the Greater Chennai Corporation, is responsible for assessing and collecting property tax within its jurisdiction.

While many individuals rely on financial advisors and accountants for tax calculation, it is possible to understand and calculate Chennai Corporation property tax with some basic knowledge.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

This blog will guide you through the process of determining their property tax obligations. By gaining this knowledge, residents can navigate the tax calculation process with confidence.

| Official link | https://www.tn.gov.in/service/dept/43255/2371 |

| Due-Date | 31 September and 31 March of each financial year. |

Chennai Property Tax An Overview

In Chennai, residents have the convenience of paying their property taxes, locally known as 'south vari,' online. However, offline payment options are also available for those who prefer it. The Chennai City Municipal Corporation (CCMC) Act stipulates that the value of buildings should include the price of the location and its surrounding premises.

To calculate the annual value of lands and buildings, the gross yearly rent generated per month or year is considered. This information helps determine the Assessed Value (AV) of a property, which is set at 10% of the annual rent for the specific building and its surrounding area.

The property tax rate in Chennai varies depending on the type of property. Understanding the definitions of residential and non-residential properties is crucial before calculating the payment amount. Residential properties encompass individually owned houses and apartments that are not rented out for commercial purposes. Non-residential properties, on the other hand, include shopping malls, IT parks, office buildings, and other commercial establishments.

Exemption

Properties owned by the Central Government and buildings occupied by foreign missions are exempted from paying the Chennai property Tax.

Concessions:

- 20% rebate on monthly RLV in case of semi-permanent buildings.

- 25% rebate on monthly RLV for non-rented residential buildings and 10% rebate in case of the owner-occupied commercial portion of the building.

- A minimal percentage of (1%) depreciation is also provided every year for buildings more than four years old (subject to a maximum rebate of 25%).

Property Tax Chennai Rate 2024

Chennai Corporation tax rate is varied based on the property type. For example, the Property Tax rate of residential properties ranges from Rs 0.60 per square ft to Rs 2.40 per square ft. On the other hand, property tax per square foot for non-residential projects, including those leased to businesses, costs between Rs 4 per square ft and Rs 12 per square ft.

Property Tax Chennai Zone Details 2024

- Zone System: The Greater Chennai Corporation (GCC) is divided into 15 zones for administrative purposes.

- Tax Rates: Property tax rates in Chennai are based on the property's type (residential or non-residential) and its size (plinth area). Residential property tax rates typically range from ₹0.60 to ₹2.40 per square foot, while non-residential rates range from ₹4 to ₹12 per square foot.

| Zone | Division |

| Zone 1 | Thiruvottiyur |

| Zone 2 | Manali |

| Zone 3 | Madhavaram |

| Zone 4 | Tondiarpet |

| Zone 5 | Royapuram |

| Zone 6 | Thiru-Vi-Ka Nagar |

| Zone 7 | Ambattur |

| Zone 8 | Anna Nagar |

| Zone 9 | Teynampet |

| Zone 10 | Kodambakkam |

| Zone 11 | Valasaravakkam |

| Zone 12 | Alandur |

| Zone 13 | Adyar |

| Zone 14 | Perungudi |

| Zone 15 | Sholinganallur |

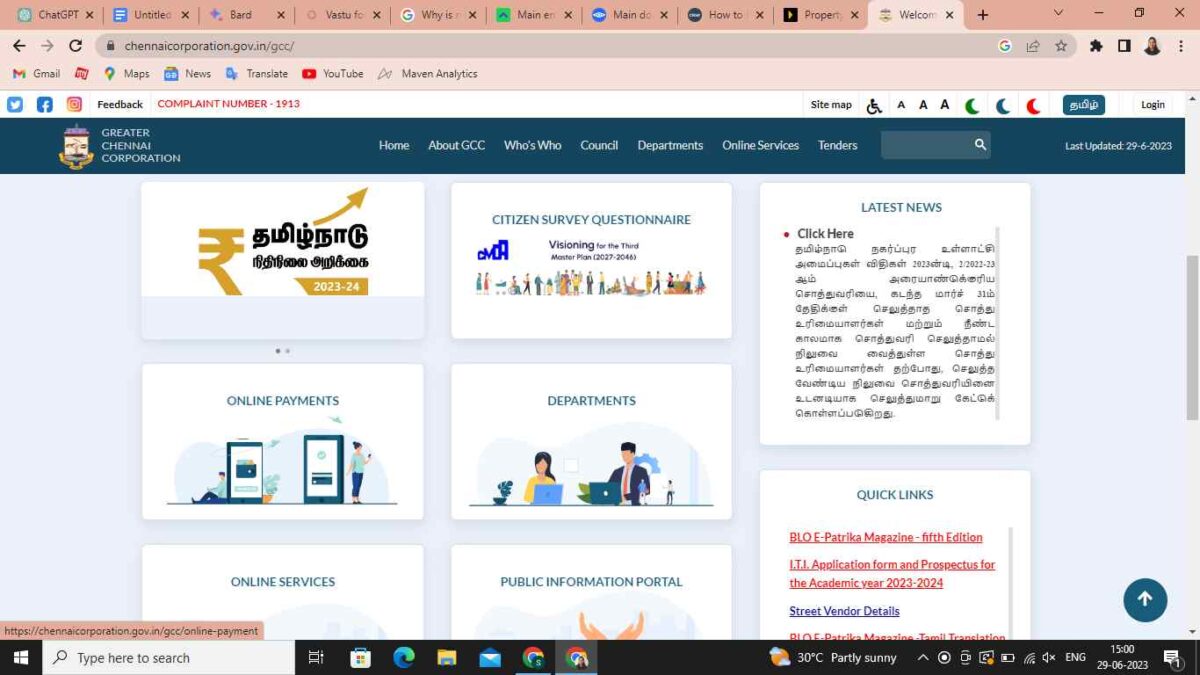

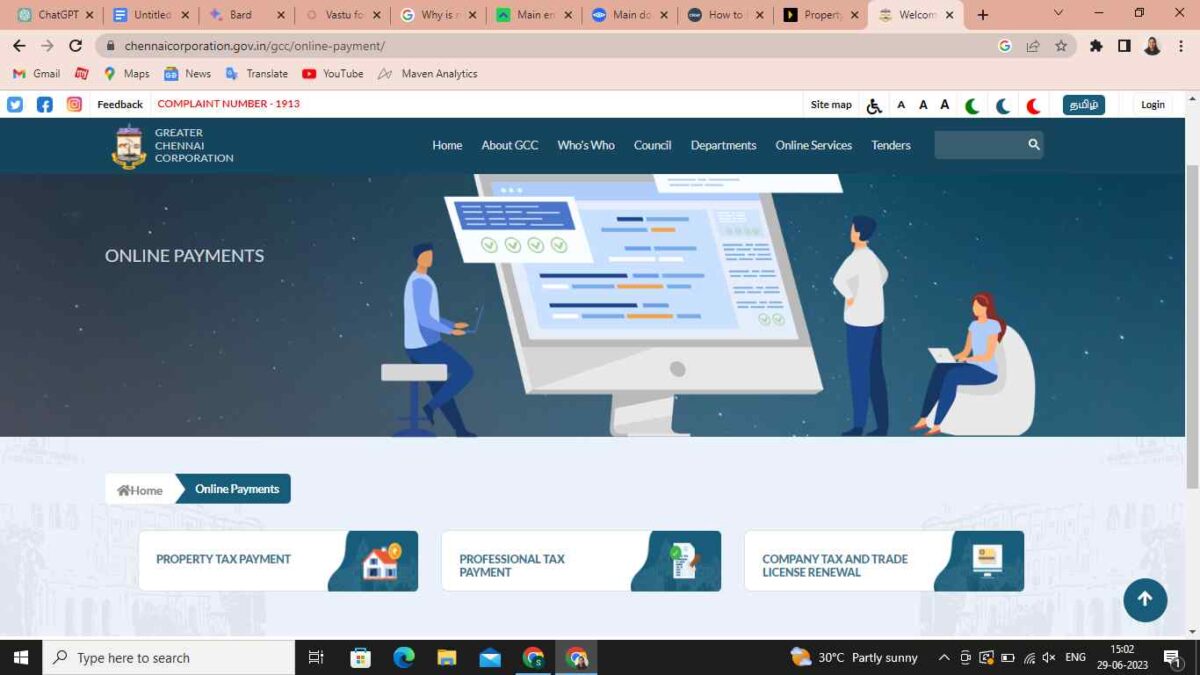

How to Pay Property Tax Online in Chennai?

To make the payment process convenient and efficient, the Chennai Municipal Corporation has introduced online payment options. The post-pandemic world has seen a lot of digitisation efforts and as such, it has now become much more convenient for citizens to make their property tax online payment in Chennai. While searching for your Chennai property tax information, unfortunately, the Greater Chennai Corporation website doesn't currently offer a search by name.

This guide will outline the steps involved in paying property tax online in Chennai, providing property owners with a hassle-free method to fulfill their tax obligations

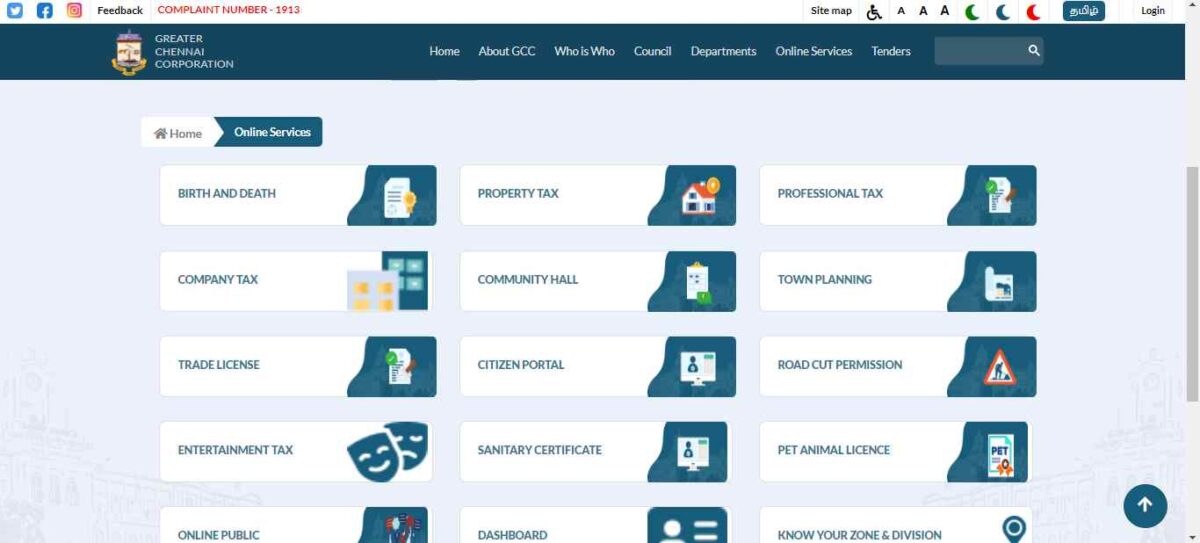

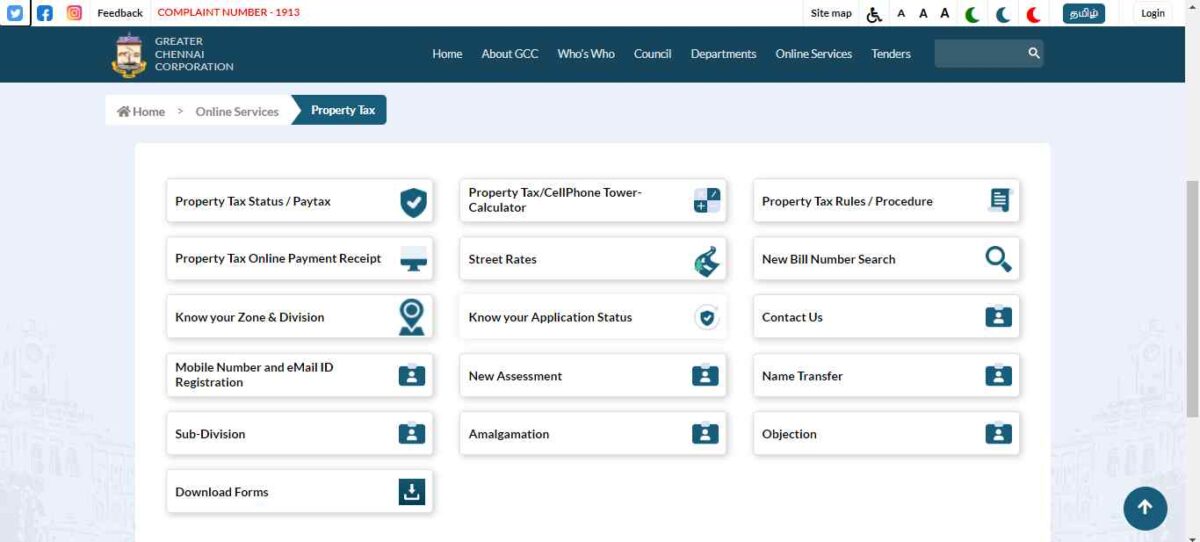

- Navigate to the official website of Greater Chennai Corporation.

- Scroll down and click on the Online Payments Tab.

- You will be redirected to a new page, here Click on Property Tax Payment

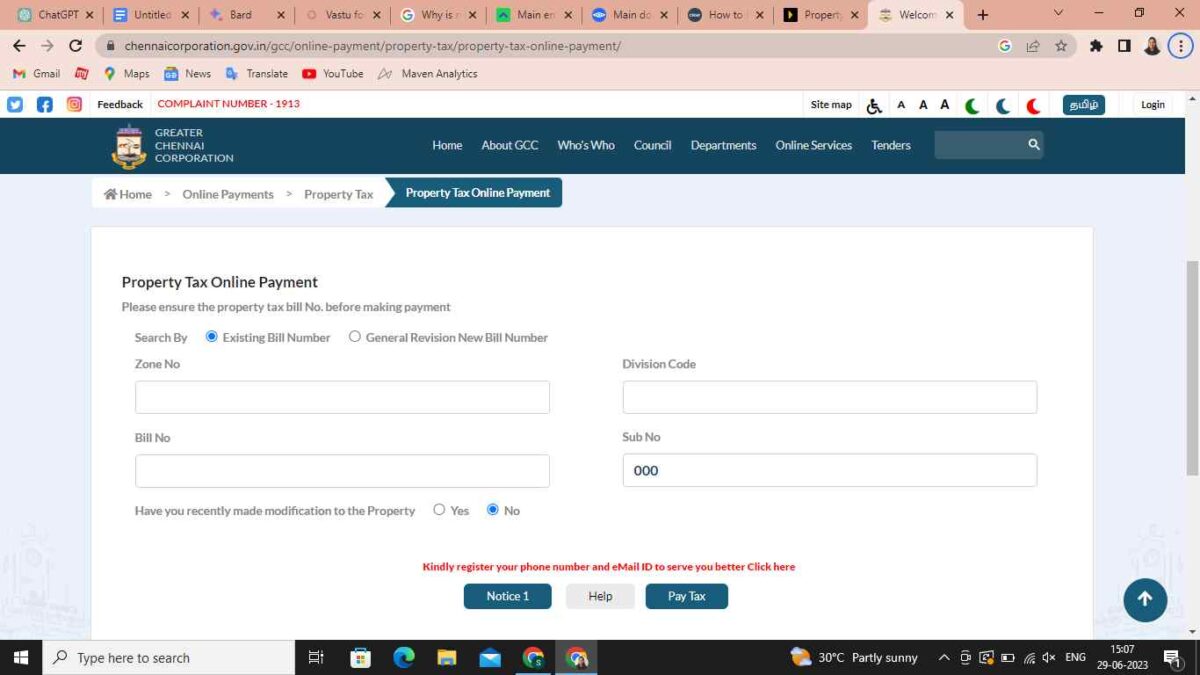

- Your browser will be redirected to a new page, here click on Property Tax Online Payment.

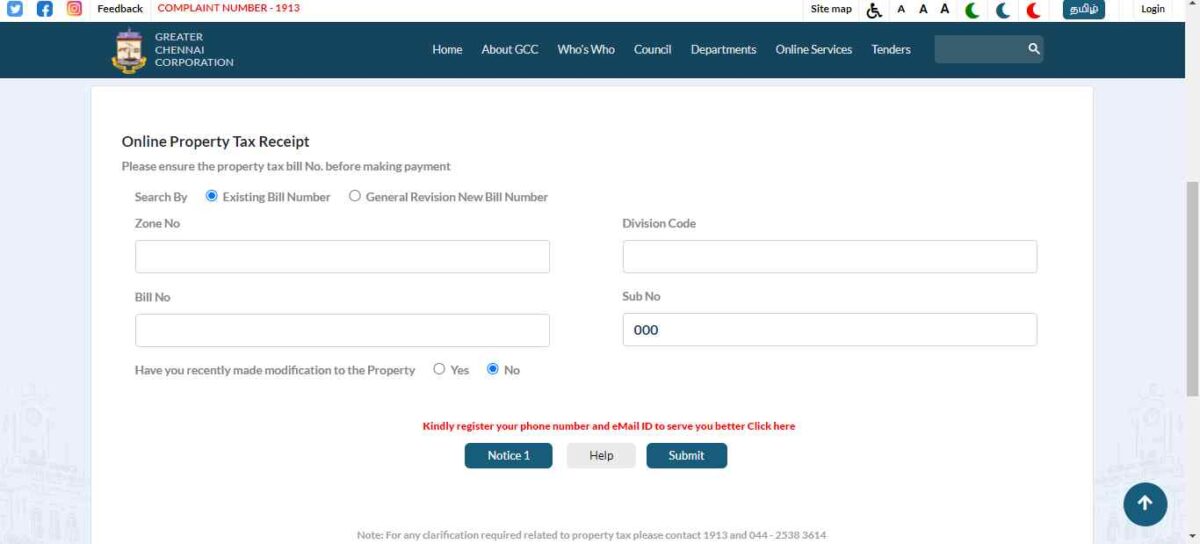

- Furnish the basic details of your property including zone number, division code, bill number, and sub number. Click on Pay Tax.

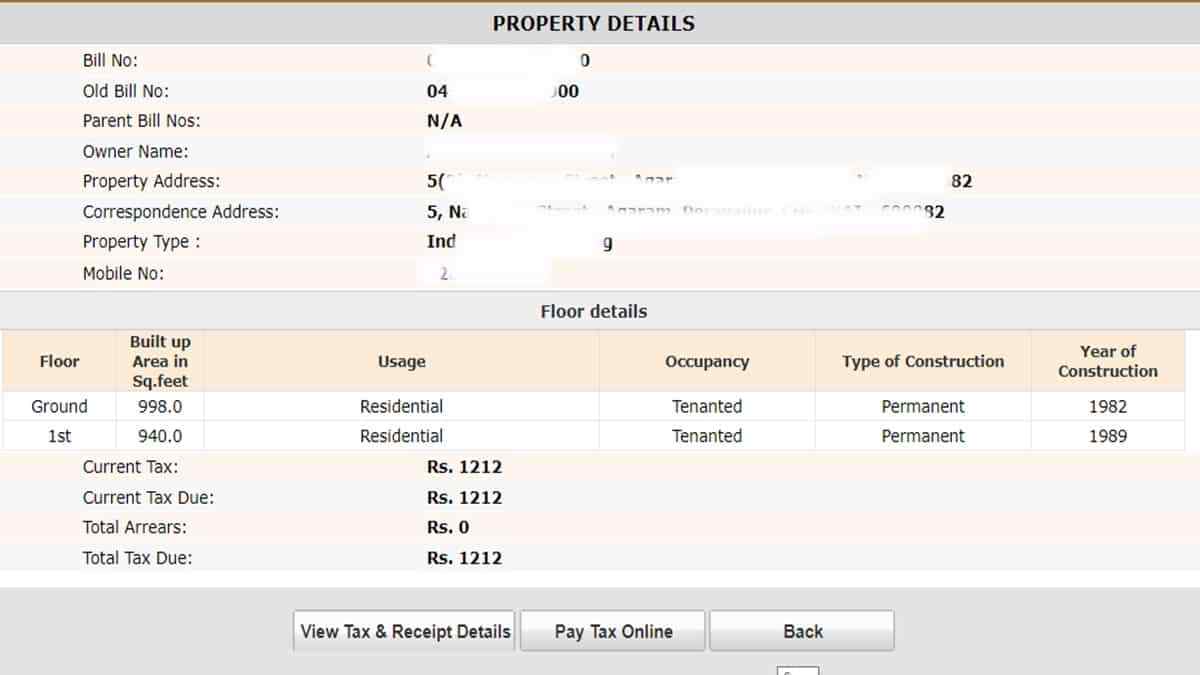

- Now, your browser will display tax amount payable. On successful completion of the payment, you will receive a payment receipt for future reference.

Property Tax Chennai Last Date 2024

Staying informed about the last date for property tax payments in Chennai is crucial to avoid penalties and ensure compliance. While the specific deadline may vary, it's typically towards the end of the financial year. The GCC has urged residents to pay property tax for the first half of 2024-25 before April 30 to get an incentive of 5%. The property tax due date in Chennai is September 30 and March 31 every year.

Property Tax Chennai Name Change 2024

If you've undergone a name change and need to update your property tax records in Chennai for the year 2024, follow these simple steps:

- Obtain Legal Documentation: Get official documents reflecting your new name, such as a marriage certificate or name change affidavit.

- Visit the Corporation Office: Visit the nearest Greater Chennai Corporation office in your area.

- Submit Required Documents: Present your legal documents to the designated officer and fill out any necessary forms for name change.

- Update Property Tax Records: The officer will process your request and update your property tax records with the new name.

Verify Changes: Double-check your property tax records online or through physical receipts to ensure that the name change has been accurately reflected.

How to Download Property Tax Receipts Online in Chennai?

After you pay your property taxes it is important to keep track of all the records of all your Greater Chennai corporation property tax online payments. But how do you download the receipt online? Here's how:

- Navigate to the official website of Greater Chennai Corporation

- Under the Online Services tab click on Property Tax

- You will be redirected to a new page, here Click on Property Tax Online Payment Receipt

- Furnish the basic details of your property i.e. zone number, division code, bill number, and sub number. Click on Submit.

- You can see the list of all your past payments as well as a complete list of the receipts. This is also where you can check the Greater Chennai Property Tax status.

- You can download a copy of the receipt and save it for future reference.

How to Pay Property Tax in Chennai Offline?

While online payment methods are becoming increasingly popular and convenient, some individuals may prefer to pay their property tax offline. Here’s a guide on how to pay property tax in Chennai offline, allowing property owners to fulfil their obligations through traditional means:

Government tax collectors

You can pay your property tax in cash or by cheque/DD drawn in favour of The Revenue Officer, Corporation of Chennai at any of the government tax collectors' offices. The list of government tax collectors' offices can be found on the Greater Chennai Corporation website.

Banks under a walk-in payment system

You can also pay your property tax at any of the following banks under the walk-in payment system:

- Indian Overseas Bank

- City Union Bank

- Karur Vysya Bank

- HDFC Bank

- IDBI Bank

- Canara Bank

- Tamil Nādu Mercantile Bank

- Kotak Mahindra Bank

- Lakshmi Vilas Bank

- Yes Bank

- IndusIand Bank

To pay your property tax at a bank, you will need to bring your property tax bill and a valid ID proof. You can pay the tax in cash or by cheque/DD drawn in favour of The Revenue Officer, Corporation of Chennai.

E-Seva centres

There are several E-Seva centres (Common Service Centres) in Chennai where you can pay your property tax. The list of E-Seva centres can be found on the Tamil Nadu Arasu Cable Television Corporation website.

To pay your property tax at an E-Seva centre, you will need to bring your property tax bill and a valid ID proof. You can pay the tax in cash or by credit/debit card.

Tamil Nadu Arasu Cable Television Corporation (TACTC)

You can also pay your property tax at any of the TACTV counters located in the Greater Chennai area. To pay your property tax at a TACTV counter, you will need to bring your property tax bill and a valid ID proof. You can pay the tax in cash or by credit/debit card.

Things to keep in mind when paying your property tax offline:

- You will need to have your property tax bill handy.

- You will need to provide a valid ID proof.

- You can pay the tax in cash or by cheque/DD.

- You will receive a receipt for your payment.

- The due date for house tax payment in Chennai is September 30 and March 31 every year.

- If you pay your property tax after the due date, you will be subject to a penalty.

After making a successful payment, you will be notified via text message confirming the receipt of your request. Subsequently, the assessor will review your application and assess the newly constructed property.

Once the assessment is completed, the assessor will submit your file to the relevant officer, who will further forward it for approval to the Assessment Committee. It is important to note that this proposal is subject to additional verification. Once the assessment is approved by the Greater Chennai Corporation, you will receive an SMS alert informing you of the approval.

Property Tax Chennai Calculation 2024

A property tax calculator is a useful tool for estimating the amount of property tax you owe on your home or property. Local governments levy property tax based on the property's assessed value. However, the actual tax amount depends on various factors such as the property's value, the tax rate in your area, and any applicable exemptions or deductions.

To access the Tamil Nadu property tax calculator, simply visit the official portal and provide details like the building type, location, occupancy type, and floor information. However, it's important to remember that relying solely on this calculator may not provide a complete picture, as mentioned on the website.

Alternatively, you can calculate the precise Chennai corporation property tax amount by using th e property tax calculation formula provided:

Property tax = Annual rental value * Tax rate * (1 - Depreciation)

Example: Suppose you own a residential property in Chennai with an annual rental value of INR 10,000. The tax rate for residential properties in Chennai is 6.75%. The depreciation for a 10-year-old building is 10%.

In this case, your property tax liability would be calculated as follows:

Property tax = INR 10,000 * 6.75% * (1 - 10%) = INR 593.75

Note:

- The annual rental value is the estimated monthly rental value of your property multiplied by 12.

- The tax rate is the percentage of the annual rental value that you are required to pay in property tax.

- The depreciation is the amount of value that is deducted from the annual rental value of your property due to wear and tear.

Fixing the Annual value for land (Lease/Rented)

Monthly rental value (as per agreement) x 12 = Annual Value

Since depreciation is not allowed for vacant land: Rent per 2,400 square ft = Rs 8.00 per month.

Annual value (Rs 8.00 x 12) = Rs 96 per month.

Therefore, the annual rental value (land being separate): Annual rental value – 10% x (MRV x 12).

The half-yearly property tax is calculated as a percentage of the annual rental value. See the below-mentioned figures for reference.

| Annual Value | Half-year tax (as a percentage of annual value) | |||

| General Tax | Education Tax | Total | Lib. (less) | |

| Re 1 to Rs 500 | 3.75% | 2.50% | 6.25% | 0.37% |

| Rs 501 to Rs 1,000 | 6.75% | 2.50% | 9.25% | 0.67% |

| Rs 1,001 to Rs 5,000 | 7.75% | 2.50% | 10.25% | 0.77% |

| Rs 5,001 and above | 9.00% | 2.50% | 11.50% | 0.90% |

Property Tax Chennai concessions

- 10% library cess as mandated under the general tax section of the property tax.

- Except those with terrace roofs, tiled houses get a 20% rebate over the monthly rental value.

- Individually owned houses get a whopping 25% rebate in the monthly rental value.

- There is a 10% rebate over monthly rental value for those commercial structures that the owner owns.

- A depreciation of 1% is given every year for every building over four years old. However, there is a maximum limit of 25%.

What happens in case of any default?

If you fail to pay Property Tax on time, there is a 2% penalty for defaulters. This penalty is charged automatically along with the assessed value. A grace period of 15 days is usually given.

How to get Property Tax Chennai Receipt 2024?

On the official website, click on the option 'Online Payment Receipt.' In the next step, you will be required to choose the zone number, division code, and bill number. Enter these details, and you will get your property tax receipt online.

You can find your Chennai Property Tax receipt here.

You can check the Chennai Corporation Property Tax Status here.

Property Tax Chennai Status 2024

Checking your property tax status in Chennai for the year 2024 is crucial for residents to ensure compliance and avoid penalties. Here's a simple guide on how to verify your property tax status:

- Visit the Chennai Corporation Website: Go to the official website of the Greater Chennai Corporation.

- Navigate to Property Tax Section: Find the section dedicated to property tax or online services.

- Enter Property Details: Input your property identification details, such as the Assessment Number or PID.

- Check Status: View your property tax status to see if payments are up-to-date or if there are any outstanding dues.

- Take Necessary Action: If there are dues, promptly arrange payment to avoid penalties and maintain compliance with Chennai's property tax regulations.

Property Tax Chennai App

Accessing property tax information and making payments in Chennai has never been easier with the Property Tax Chennai app. Here's how to use it:

- Download the App: Search for "Property Tax Chennai" on your app store and download the official app developed by the Greater Chennai Corporation.

- Register/Login: Create an account or log in using your existing credentials to access the app's features.

- View Property Details: Enter your property identification details to view your property tax assessment, dues, and payment history.

- Make Payments: Conveniently pay your property tax dues directly through the app using various payment options available.

Receive Updates: Stay informed about important announcements, deadlines, and notifications related to property tax in Chennai.

What is Vacancy Remission?

According to the Chennai City Municipal Corporation (CMCC) Act, 1919, Section 105, if any individually owned building or rented accommodation is vacant for more than 30 days in a half-year period, the Commissioner can remit a small portion of the Property Tax. However, this forgiven amount should not exceed one-half of the part of the tax related to the building.

Steps you can take to combat corruption

Paying online is no doubt more accessible, and there is less chance for any corrupt practices. For example, you can pay Chennai corporation property tax online without the need to communicate with officials. However, suppose you want to pay offline, but government officials are asking for a bribe, you must inform the Directorate of Vigilance and Anti-Corruption at 24615989 / 24615929 / 24615949.

List of Zones under Greater Chennai Municipal Corporation

The Greater Chennai Municipal Corporation (GCMC) is the governing body responsible for the administration and development of the city of Chennai, India. The corporation is divided into multiple zones, each with its own distinct geographical area and administrative functions. These zones play a crucial role in managing various civic amenities and services within their respective jurisdictions. Below is a list of zones that fall under the Greater Chennai Municipal.

| No | Zone | Division | Assembly constituency |

| 1 | Thiruvottiyur | 1 – 14 | Thiruvottiyur |

| 2 | Manali | 15 – 22 | Thiruvottiyur/Madhavaram/Ponneri |

| 3 | Madhavaram | 23 – 33 | Madhavaram |

| 4 | Tondiarpet | 34 – 48 | Perambur/RK Nagar/Royapuram |

| 5 | Royapuram | 49 – 63 | Royapuram/Harbour/Egmore/Chepauk-Tiruvallikenni |

| 6 | Thiru. Vi. Ka. Nagar | 64 – 78 | Kolathur/Thiru. Vi. Ka. Nagar/Egmore |

| 7 | Ambattur | 79 – 93 | Ambattur/Maduravoyal(Part) |

| 8 | Anna Nagar | 94 – 108 | Villivakkam/Egmore/Anna Nagar |

| 9 | Teynampet | 109 – 126 | Thousand Lights/Chepauk-Thiruvallikeni/Mylapore |

| 10 | Kodambakkam | 127 – 142 | Maduravoyal (Part)/Virugambakkam/T.Nagar/Saidapet |

| 11 | Valasaravakkam | 143 – 155 | Maduravoyal |

| 12 | Alandur | 156 – 167 | Alandur/Pallavaram/Sholinganallur (Part) |

| 13 | Adyar | 168 – 180 | Saidapet/Mylapore/Velachery |

| 14 | Perungudi | 181 – 191 | Velachery (Part)/Alandur (Part)/Sholinganallur |

| 15 | Sholinganallur | 192 – 200 | Sholinganallur |

Chennai Property Tax Latest News

A decrease in revenue through property tax in the upcoming financial year is estimated.

It is estimated that during the FY 2021-22, the revenue generated by the authorities through property tax, rents, collection of charges, and government allocations, is set to decrease as compared to the previous financial year. This is the first revenue downfall in the last three years.

Property tax collected in 2020

Interestingly, during the COVID-19 pandemic, property tax collection in 2020 was not affected. The Corporation has collected more property tax than the previous year. The Corporation has already collected about 45% of the targeted tax revenue this year, which is Rs 350 crores by March 2021.

Property tax collected

2018- 142 crores

2019 -132 crores

2020- 152 crores

The civic body reduces penalties on delayed payments

Considering the ongoing COVID-19 pandemic, the civic body has decided to relieve the property tax penalties this year. The previous penalty rate over delayed property tax payment was 2%, which is now being slashed down to 0.5% from October 2020 to March 2021.

As per the records up to October 2020, 1.3 lakh assessees have already paid their property tax, and 10.9 lakh more are awaited to make the tax payment for October 2020 to March 2021. If you have already paid your taxes, you will be charged an adjusted amount in the next tax cycle.

Solid Waste Disposal Tax Rolled Back

Starting 1st January 2021, the local authority was in favour of levying a garbage disposal tax on residents along with the property tax. However, this decision has received mixed responses from taxpayers. Also, in a recent protest outside the municipal office, Pallavaram demanded that the garbage tax in their area be removed. Some others allege that authorities have been coercing suburban residents to pay the garbage tax when revoked in the city.

When it comes to property tax Chennai is quite serious about it. It is imperative to pay property taxes in Chennai punctually. The tax revenues are beneficial for upliftment and infrastructural development in the city. However, due to our busy lives, most of us don't have the time to delve into all the details but our experts at NoBroker are ready to help with all the necessary information and property tax calculations.

Frequently Asked Questons

Ans: Greater Chennai Municipal Corporation collects the Chennai Property Tax.

Ans: Yes, you can pay property tax in Chennai both online and offline.

Ans: You can visit the official website and fill in the required details to submit them.

Ans: You can draw up a cheque/Demand Draft favouring "The Revenue Officer, Corporation of Chennai '' and make payments through any TACTV counters in the Greater Chennai area.

Ans: Yes, the Chennai Municipal Corporation has many helpline numbers to call to register complaints against corrupt officials.

Recommended Reading

Chennai Metro Green Line 2025: Route, Map, Timing and Fares

January 10, 2025

11135+ views

Tambaram Corporation Property Tax Tamil Nadu: Online Payment and Bill Download 2025

January 9, 2025

5939+ views

The Ultimate Guide to Top MNC Companies in Chennai: Everything You Need to Know

December 31, 2024

6070+ views

Find Out More About the Top Construction Companies in Chennai

December 31, 2024

17696+ views

Capital Gains Tax on Inherited Property: Rules, Rates & Exemptions in 2025

December 31, 2024

164+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

December 31, 2024

1004374+ views

December 26, 2024

63183+ views

Supreme Court Verdict on Society Maintenance Charges

December 17, 2024

63017+ views

All You Need to Know about Revenue Stamps

December 17, 2024

51573+ views

Stamp Duty and Registration Charges in Bangalore in 2025

December 17, 2024

46840+ views

Recent blogs in

How to Apply Encumbrance Certificate in Tamilnadu Online and Offline 2025

January 9, 2025 by Kruthi

Apply Encumbrance Certificate Online and Offline: Update and Download Certificate 2025

January 9, 2025 by Kruthi

Tambaram Corporation Property Tax Tamil Nadu: Online Payment and Bill Download 2025

January 9, 2025 by Suju

Join the conversation!