Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

A Comprehensive Step-by-Step Guide to Property Tax Coimbatore Online Payment

Table of Contents

Property tax is a direct tax levied by the local government on properties, including residential, commercial, and industrial properties, within its jurisdiction. The Coimbatore Municipal Corporation (CCMC) is responsible for assessing and collecting property tax in Coimbatore.

The Coimbatore City Municipal Corporation, the municipal body that administers the city of Coimbatore in the Indian state of Tamil Nadu, receives a significant portion of its income from the collection of property taxes.

The tax amount is determined based on the annual rental value or the capital value of the property, depending on the type of property and the prevailing guidelines set by the municipal corporation. This blog will cover the different aspects of paying house taxes in Coimbatore.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

How to Pay Coimbatore Property Taxes Online in Coimbatore?

Coimbatore has embraced digitalization by offering online payment options for property taxes. Here’s how -

- Navigate to the official website of Coimbatore City Municipal Corporation

- Under the Online Tax Payment tab, click on Pay Your Taxes Online.

- You will be redirected to the CCMC login page. Here, under Quick Links click on Quick Payments

- Under the Make Payment tab, select Property Tax

- You will be redirected to the Payments page, here, select the municipality corporation. Enter the Assessment Number and Old Assessment Number.

- The payment page will be displayed on the screen. Select your preferred payment gateway and click on Make Payment.

- On successful payment, you will receive an acknowledgement receipt. Save it for future reference.

Property Tax Payment Receipt: CCMC

Upon the successful completion of the Coimbatore Corporation's property tax online payment process, a comprehensive property tax online receipt will be generated. This receipt will serve as proof of payment and will contain all the necessary details pertaining to the transaction.

The details include the unique application number, assessment year, amount of property tax due, designated payment site, any applicable cess, advances made, and the total payable amount for the Coimbatore corporation property tax online payment.

This receipt acts as an official document, providing a clear record of the payment made towards Coimbatore's property tax, and serving as a reliable reference for future inquiries and documentation purposes.

Documents Needed to Make an Online Payment for The Coimbatore Property Tax

You must have all the necessary paperwork before you try to beat the deadline for paying the property tax in Coimbatore. The following papers are necessary to conduct an assessment of property tax:

- Form for requesting an assessment of property taxes

- Evidence of one's ownership of property

- Official documents of both the approved construction plan and the building licence

Coimbatore Property Tax Calculator

To determine your Coimbatore Corporation property tax dues CCMC offers an online property tax calculator. This user-friendly tool enables property owners in Coimbatore to calculate their property tax obligations accurately before proceeding with their online home tax payments.

To use the calculator, you will need to provide the following information:

- Total Building Plinth Area

- Approved Building Area

- Unapproved Building Area

- Building Usage

- Building Location

- Building Type

- Age of the Building

- Ward

CCMC determines the assessed value of your property, which is based on the market value determined by an independent appraiser. The tax rate applied to your property is set by the CCMC, taking into account factors such as property type, location, and assessed value.

To fulfil your property tax obligations, you are required to make two instalment payments each year. The due dates for these instalments are March 31 and September 30. By adhering to these payment deadlines, you can ensure timely and proper payment of your property tax to the CCMC.

When assessing the property tax, factors such as the market's prevailing rent per square foot for similar properties are taken into consideration, especially if the property is intended for owner occupation. In such cases, the rent per square foot serves as an indicator of the property's monthly rental value (MRV).

On the other hand, if the property is leased, the MRV specified in the rental agreement is considered for the assessment. These factors play a vital role in determining the property tax amount accurately.

How to Make an Offline Payment for the Property Tax in Coimbatore?

There are two convenient options available to make your Coimbatore property tax payment: paying at the ward office or an authorized bank or e-Seva centre. Here's how you can proceed with each method:

Paying at the Ward Office

a. Visit the ward office located in the area where your property is situated.

b. Carry the following essential documents with you:

- Property tax assessment number

- Proof of identity (e.g., Aadhaar card, driving license, passport)

- Proof of address (e.g., electricity bill, water bill, rent agreement)

c. Complete the payment slip provided by the ward office and pay the outstanding amount.

d. Upon successful payment, you will receive a receipt as proof of your transaction.

Paying at an Authorized Bank or e-Seva Centre:

a. Locate an authorized bank or e-Seva centre in Coimbatore that accepts property tax payments.

b. Gather the following necessary documents:

- Property tax assessment number

- Proof of identity (e.g., Aadhaar card, driving license, passport)

- Proof of address (e.g., electricity bill, water bill, rent agreement)

c. Present the required documents to the staff at the bank or e-Seva centre and make the payment for the due amount.

d. Following a successful transaction, you will be issued a receipt to serve as proof of your payment.

Additionally, in Coimbatore, several authorized banks and e-Seva centres accept property tax payments. Some of the recognized banks include:

- City Union Bank

- Canara Bank

- HDFC Bank

- Indian Overseas Bank

- IDBI Bank

- Karur Vysya Bank

- Kotak Mahindra Bank

- Lakshmi Vilas Bank

- Tamilnad Mercantile Bank

How do I Change my Name in Coimbatore's Online Property Tax Filing?

Citizens can submit applications for name transfers on property tax using the CCMC site. A person must provide the company with an application and supporting documentation. Application forms may be picked up at the information

centre in any ward office.

The necessary documents for changing one's name on a paid property tax online Coimbatore

- The legally required proof of ownership papers

- documents establish your right to inherit the property if the current owner passes away.

- If the former owner passes away, a copy of their death certificate.

- A recent copy of the receipt for taxes that have been paid

Property Tax Payment Deadline in Coimbatore

Payments for property taxes are typically due on the 31st of March and the 31st of September of each year. If you cannot pay the tax by the deadline, you will be subject to a penalty equal to one per cent of the entire tax amount for each month you are late.

The following calculation may be used to determine your half-yearly property tax online payment in Coimbatore:

Total property tax = Annual property tax / 2

- Annual property tax = Assessed value of property x Tax rate

- Assessed value of property = Market value of property x Depreciation factor

- Market value of property = (Total built-up area x Building usage rate) + (Land value)

CCMC Water Tax Payment: Online

Coimbatore residents are provided with a convenient option to make online payments for various municipal services through the official Coimbatore City Municipal Corporation portal. The portal not only enables citizens to pay their water tax electronically but also offers the flexibility to pay Coimbatore corporation house tax and property tax online.

To access this facility, individuals need to log in to the portal, where they can conveniently manage and settle their water tax obligations digitally. This streamlined process saves time and effort for the residents of Coimbatore, ensuring a more efficient and user-friendly experience for online transactions related to municipal taxes.

Tax Breaks and Exemptions on Real Estate Transactions in Coimbatore

If you own property in the city of Coimbatore, you are eligible for one of two different kinds of tax deductions:

- The deduction that is standard

- The interest that is accrued on a loan.

If the income from your home(s) is more than 30 percent of their combined yearly net worth, then that income is exempt from taxation. This restriction, however, does not apply to you if you own the house in which you reside.

The interest that is paid on the principal amount of a home loan that is used for the purchase, renovation, or building of a house is exempt from taxation. In this scenario, you have a legal obligation to submit an application for interest exemptions on the principal amount prior to acquiring the Coimbatore property tax payment online or finishing the building work on it.

Paying property tax in Coimbatore (online or offline) is fairly easy but knowing how the property tax is calculated can be tricky. If you need help in addressing queries regarding property tax calculation or payment, you can consult the experts at NoBroker. They will understand your problems and guide you to the best solution. If interested, please leave a comment below this article; our executive will be in touch with you soon.

FAQs

Yes, the website URL of Coimbatore municipal corporation is https://www.ccmc.gov.in/ccmc/

According to the information provided in this article, the receipt for the Coimbatore Property Tax may be created when an online payment has been made on the official site maintained by the CCMC. You may acquire a hard copy of the receipt by downloading it and then using it.

The 31st of March and the 31st of September are typically the dates by which payments related to property tax in Coimbatore are expected to be made.

The official CCMC site, which allows residents of Coimbatore to pay their property tax online, also offers the capability for residents of Coimbatore to pay their water tax online. Residents can log in to the site to pay their water taxes electronically.

Yes, you can pay property tax in Coimbatore via credit and debit cards.

Recommended Reading

Simple Introduction to Indian Property Tax

January 31, 2025

4935+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

15049+ views

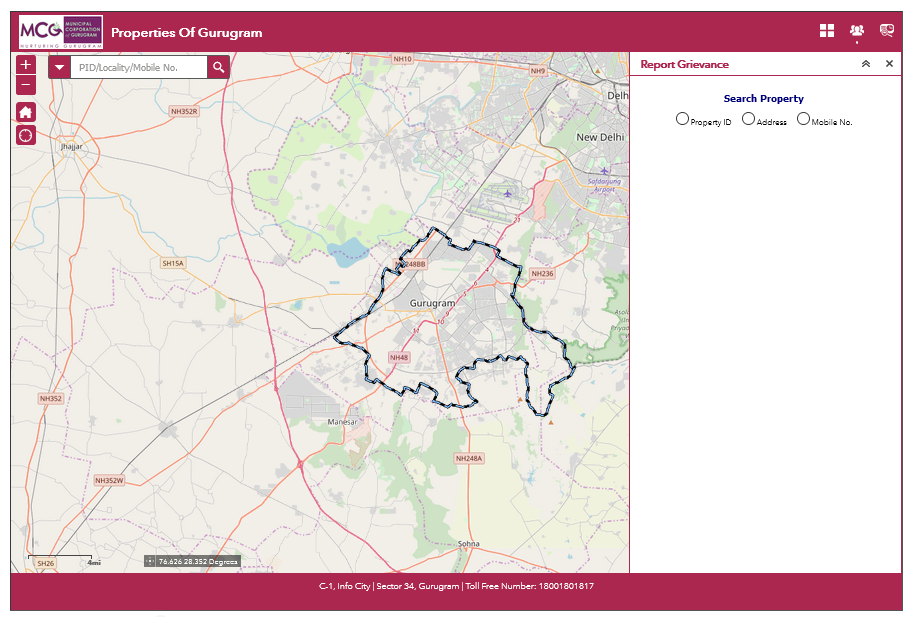

Property Tax Gurgaon Online: About Property Tax in Gurugram

January 31, 2025

4987+ views

Property Tax Hyderabad - How to Pay Property Tax Online in Hyderabad

January 31, 2025

3679+ views

Property Tax: Online Payment, Calculation, and Bill Download 2025

January 31, 2025

5900+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1047494+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

February 5, 2025

92464+ views

Supreme Court Verdict on Society Maintenance Charges

January 31, 2025

75974+ views

All You Need to Know about Revenue Stamps

January 31, 2025

63642+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

55871+ views

Recent blogs in

e-Aasthi BBMP: Search Property Details, Download Certificates, and Check Status Online

February 5, 2025 by Suju

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

February 5, 2025 by Suju

How to get Non-Encumbrance Certificate Online and Offline: Download and Check Status 2025

February 5, 2025 by Vivek Mishra

Simple Introduction to Indian Property Tax

January 31, 2025 by NoBroker.com

Sales Agreement: Process, Format and More 2025

January 31, 2025 by Vivek Mishra

Join the conversation!