Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Property Tax in India: Online Payment, Calculation, and Bill Download 2025

Table of Contents

The fee you pay to the local government for owning a property is called property tax. You pay this kind of tax once or twice every year. This is also known as house or real estate tax. You pay house tax for the buildings on the land you own. It doesn’t matter whether the buildings are houses or offices and whether they are occupied, vacant or demolished. However, if the land has no buildings constructed on it, then you do not have to pay any tax.

Every responsible citizen should pay their property tax on time. As a good citizen, it is your duty to pay tax for the property you own, be it residential or commercial property. Here’s everything you need to know about property tax. Read on to learn how to calculate and pay property tax only and why it is important.

Why is Property Tax Important?

Property tax is important as it helps the government a lot. Our government uses the money collected from taxes to take care of the things we, the citizens, need. For example, it is used to fix and build new roads, repair sewer pipes, and ensure the streetlights work. The tax money is also used to keep the parks clean and safe.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Who Pays Property Tax to the Government?

It is very important for all property owners to learn who is responsible for paying the tax. Many property owners have the misconception that they do not have to pay the tax as they are not using the property. They think the people who are using the property, like the tenants, need to pay the tax. This is, however, wrong. It is the property owners who need to pay the tax.

Types of Property Tax

The property tax for different properties is different. It is based on the type of property you own. There are four kinds of properties. Understanding the difference can help you understand the tax you must pay.

Residential Property

- Individual Houses are separate homes like detached houses and bungalows, where families stay.

- Apartments: These are buildings with different flats in it. This kind of property is found in cities. This can be of different types like cooperative societies and builder floors. These buildings have many homes stacked on top of each other.

Commercial Property

- Office Spaces: These are places where people work. They can be big buildings or shared office spaces.

- Shops: Shops can be small or large and are found in standalone buildings or malls.

- Special Commercial Properties: This includes hotels and restaurants. They have different rules and taxes compared to shops and offices.

Industrial Property

- Factories: These are large places where things are made. They are different from shops and offices.

- Warehouses: These are big storage spaces for goods. They are important for businesses that need to store products.

Vacant Land

- Tax on Vacant Land: Land that does not have any buildings on it, their tax is charged in a special way. Sometimes, land used for farming does not get taxed.

How to Calculate Property Tax?

The good news is that the tax you must pay on your property will vary from state to state and region to region. So, if you have a house in Mumbai and a house in Chennai, and they are the same size, you will be paying two very different amounts as property tax for each home.

This is because different tax collecting bodies have different ways to decide the property tax you pay. When you think of it, the whole thing might not seem fair, so to bring in some transparency and consistency, there is a general guideline that all tax collecting bodies use; this is based on the formula –

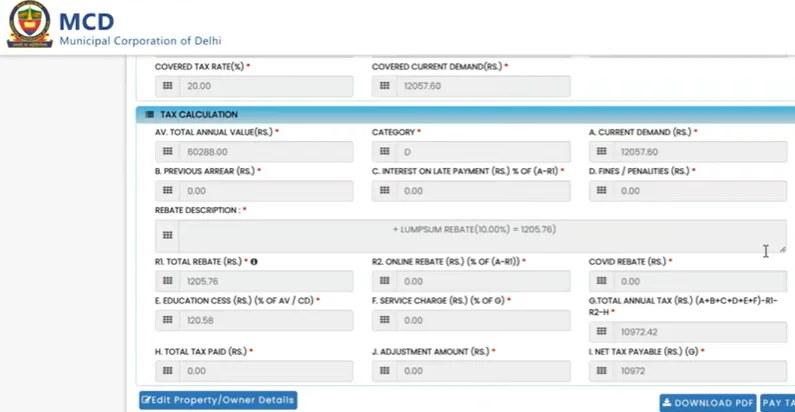

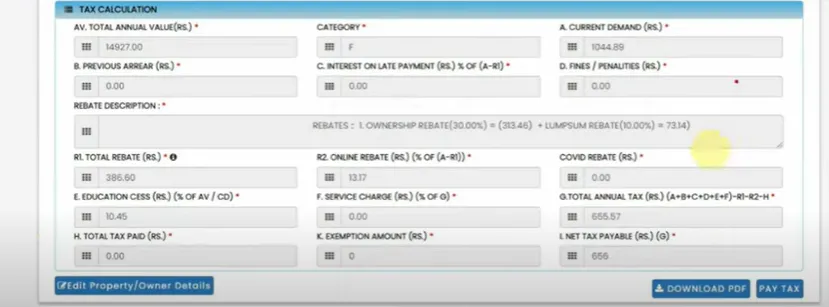

Property tax 2025-2026 = Base value x built-up area x age of the property x type of property/building x category of usage x floor factor.

In this formula, you can see the factors based on which your property tax value is calculated. The main factors are the value of the land, the amount of space that is used for construction and the amount of open space, the age of the property, the property type (commercial or residential), the category of usage i.e. self-owned or rented, and if it is a single storey building or a multi-storey building.

You can use this basic formula to get a rough estimate of how much property tax you will need to pay. Or if you’re wondering how to calculate property tax online, don’t worry, there are plenty of property tax calculators that you can use. There are also property tax online calculators that are present on the online portals for each state.

Methods Used to Calculate Property Tax

The above formula is just a guideline as to how state governments calculate how much property tax you should pay. Along with these, there are different methods used to calculate property tax, such as–

Capital Value Systems

This is a fairly straightforward way of property tax calculation; in this method, the market value of your property is used as the basis on which property tax is levied. The value of the property is fixed by the government based on the location of your property, and this rate is revised annually. Once a value is assigned to your property, you will pay a percentage of that as property tax.

Unit Area Value System

Here in this method, a price per unit value of the built-up area or carpet area of the property is fixed. This per-unit price is based on things like land price, usage of the property, location and expected returns. Once this number is arrived at, you will have to multiply it into the built-up area of your property. In cities like Bengaluru, New Delhi, Kolkata, Ahmedabad, Hyderabad and Patna, this method is favoured.

Annual Rental Value System

In this method, property tax is calculated and collected based on the annual ‘rentability’ of your property. Hence, it is also called the rateable value system. The municipal body will estimate a rental value based on the location, amenities, size of the property, distance to landmarks etc. It is not based on how much rent the owner collects annually but on the capacity of gross annual rent that it can bring. Cities like Chennai and Hyderabad follow this system.

Flat Rate Method

The flat rate method for calculating property tax is straightforward and easy to understand. Unlike other methods that consider various factors like rental value or market value, this method applies a fixed tax amount based on predefined categories. Typically, the tax amount is determined by the property size, type (residential or commercial), and location.

For example, a municipal corporation may set a flat rate of ₹10 per square foot for residential properties and ₹20 per square foot for commercial properties. If you own a residential property that is 1,000 square feet, your property tax would be:

Property Tax= Flat Rate * Property Area

Property Tax= ₹10 * 1,000

Property Tax= ₹10,000

This method is popular in some regions because it simplifies the tax calculation process, making it transparent and predictable for property owners. It eliminates the need for complex assessments and valuations. However, it may not always reflect the true value or potential income of the property and can sometimes be perceived as unfair by those whose properties differ significantly in value but fall under the same category. Despite its simplicity, it is less commonly used compared to more dynamic methods like the Annual Rental Value or Capital Value System.

According to the law, the owner of the property is the person who is held responsible for paying property tax. Tenants will not be held accountable if property tax is not paid, the onus to pay the tax is on the owner of the property alone.

The Different Methods Available to Pay Property Tax

The most traditional way to pay your property tax is at the municipal corporation office closest to you, i.e. in the area where your property is located. In larger cities and towns, a few municipal corporation offices tie up with a select few banks. These banks are authorised to collect property tax on behalf of these corporations.

When you visit a physical office to make your property tax payments, you will need to keep your ‘property tax number’ or ‘Khatha number’ ready. You can pay the amount using cash or cards at these offices.

Read: Property Tax Hyderabad – How to Pay Property Tax Online in Hyderabad

As India has progressed, you can easily pay your property tax online. The property tax online payment option is preferred as you can do it anywhere and anytime. This is a much more flexible and convenient way to pay your property tax.

Calculating Your Property Tax

Property tax is calculated by keeping different factors in mind. These factors are discussed in detail below.

Factors Affecting Property Tax

Property tax is influenced by several factors. Knowing these can help you understand why your tax amount may vary.

- Area of the Property: The built-up area and carpet area play a key role in tax calculations. Built-up area includes the entire property, while carpet area covers only the usable space inside.

- Location (City, Zone): Property tax rates change based on the location within a city. Properties in prime locations often have higher tax rates compared to those on the outskirts.

- Age of the Property: Older properties may have lower taxes due to depreciation. As a property age, its value may decrease, which can reduce the tax amount.

- Type of Property (Residential, Commercial, etc.): Different types of properties have different tax rates. Residential properties usually have lower rates than commercial or industrial ones.

- Amenities Offered: Features like a swimming pool or gym can increase the property tax. More amenities often mean higher taxes because they add value to the property.

Steps to Calculate Property Tax Online

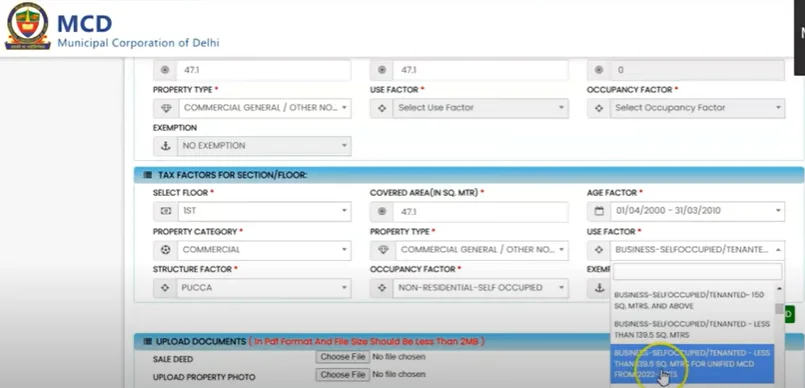

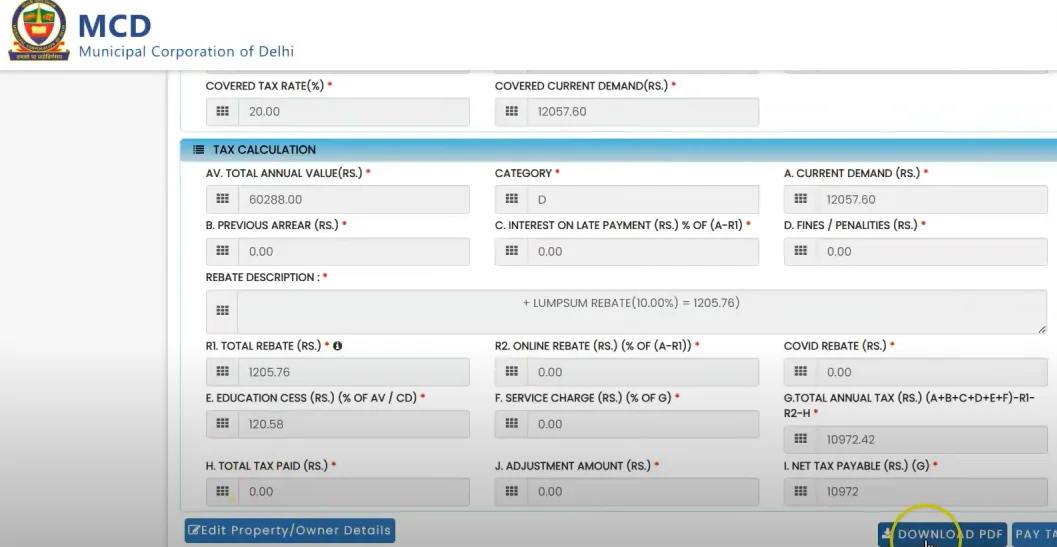

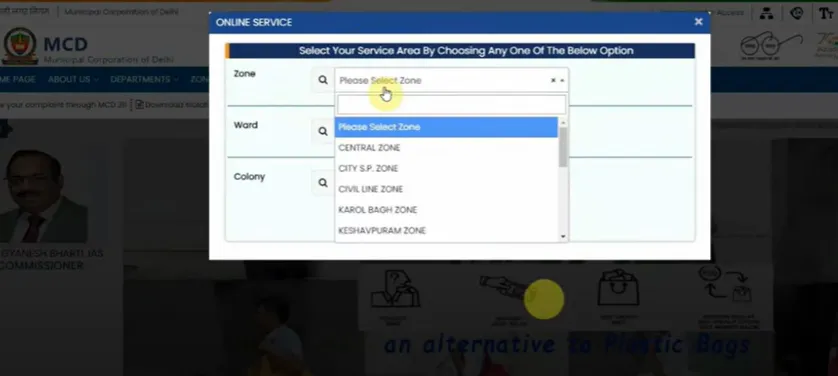

Calculating your property tax online is simple and quick. Here we are talking about MCD (Municipal Corporation of Delhi) as an example to explain the steps to calculate the property tax online. Follow these steps to use the property tax calculator.

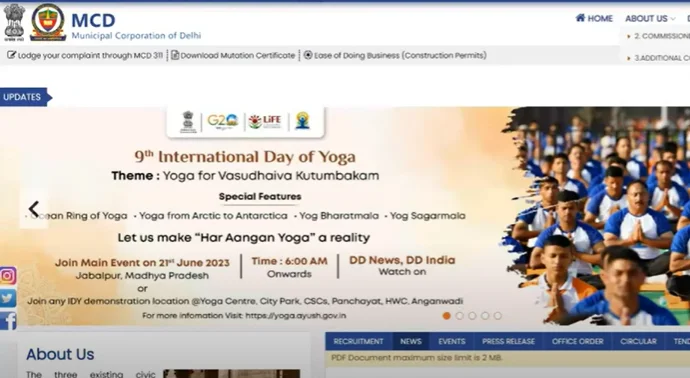

Step 1: Visit the Official Website

Go to the MCD's official website.

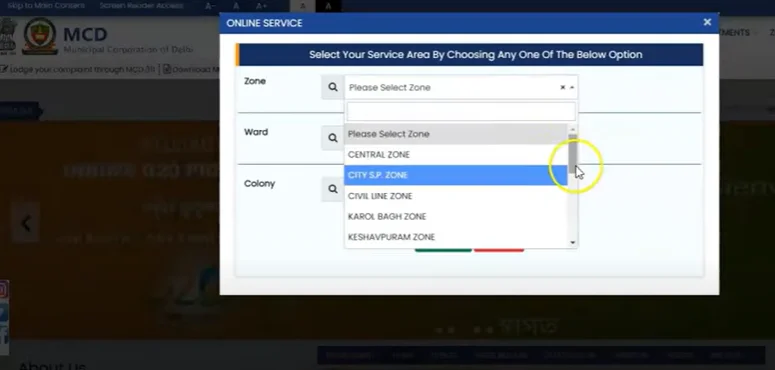

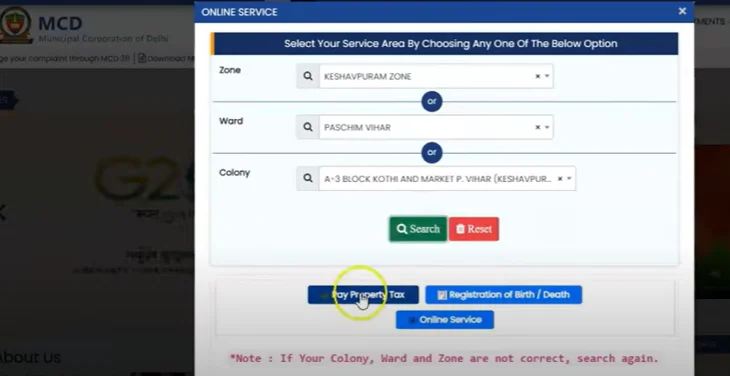

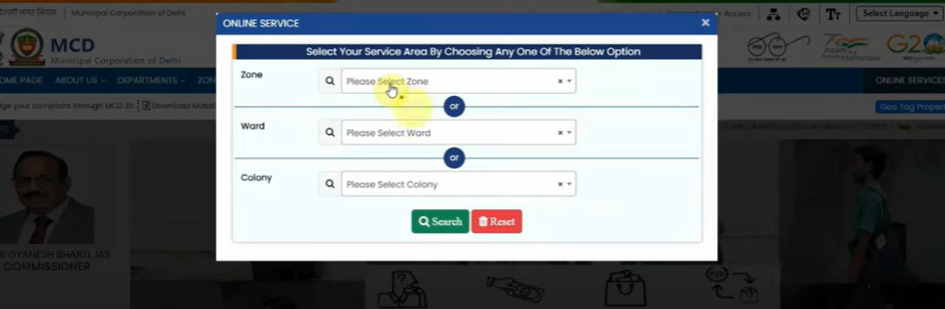

Step 2: Select Online Service

Find and click on the ‘Online Services’ option on the top right.

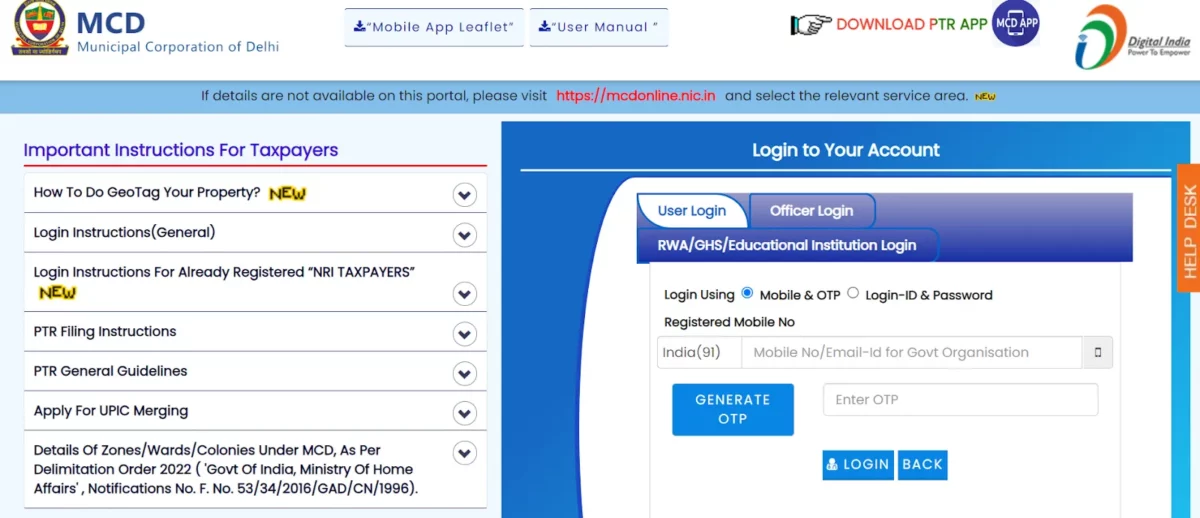

Step 3: Login or Register

If you already have an account, log in. If not, register by providing the required details.

Step 4: Enter Property Details

Fill in the details of your property, including the type, location, and area.

Step 5: Calculate Tax

Click on the 'Calculate Tax' button to see the amount you need to pay.

Step 6: Review and Pay

Review the calculated tax amount. Proceed to pay online using the available payment methods.

Alternative Methods

If you prefer not to use the online method, there are other ways to find property tax assessment details:

- Municipal Office Visits: Visit your local municipal office. The staff can help you with the property tax assessment and payment.

- Helpline Numbers: Call the municipal helpline numbers. They provide information and assistance regarding property tax.

How to Pay Property Tax Online?

Now paying property tax has become very simple. You can pay your Property Tax from the comfort of your home as they have come up with an online payment option. There are several benefits of paying property tax online. These are discussed below.

Steps to Pay Property Tax Online:

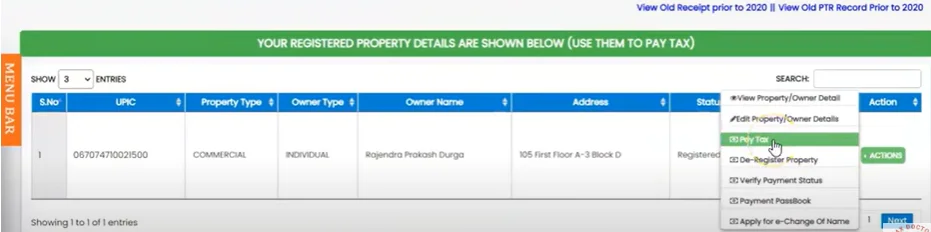

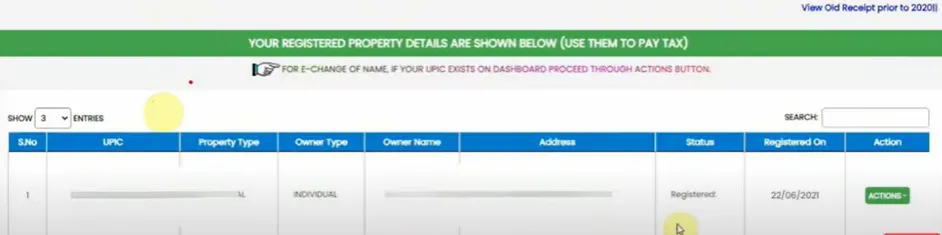

Paying your property tax online is simple, fast, and can be done from anywhere and at any time. You can pay easily using your phone, home PC, or laptop. Let’s take an example of MCD while explaining the steps of how to pay the property tax online.

Step 1: Visit the MCD Website

Open your browser and go to the official MCD website.

Step 2: Select Property Tax

Find and click on the 'property tax' option on the homepage.

Step 3: Login or Register

If you have an account, log in with your details. If you are a new user, register by providing the necessary information.

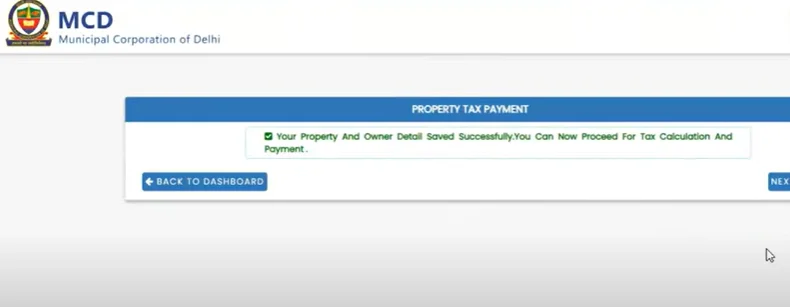

Step 4: Enter Property Details

Fill in the required details about your property, such as the property ID, address, and area.

Step 5: Calculate Tax

Click on the 'Calculate Tax' button to see the tax amount you need to pay.

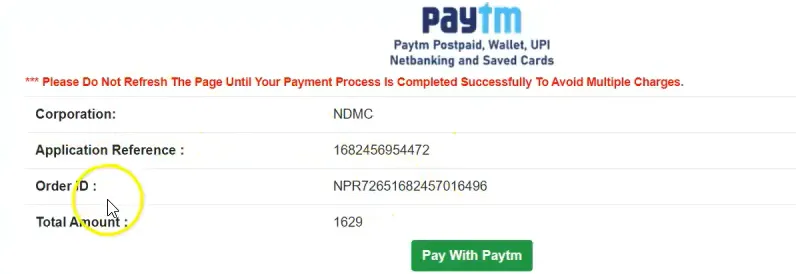

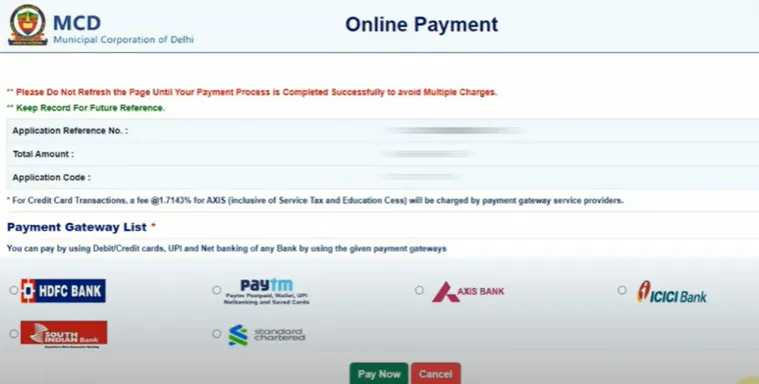

Step 6: Select Payment Method

Choose your preferred payment method. You can use a debit card, credit card, or net banking.

Apart from the official websites, you can also make payments through NoBroker Pay.

How to Download Property Tax Receipts?

You can easily download the receipt after you pay your property tax online. Follow these steps to get your receipt quickly.

- Log in to Your Account: Visit the website where you paid your property tax. Log in with your username and password.

- Go to Payment History: Once logged in, find the ‘Property Tax’ then go to ‘Property Tax Receipts’ section. This is usually located in the main menu or under your profile.

- Fill in the Details: Write down the details of the property tax payment you made. Click on it to view the details.

- Download the Receipt: You will see an option to download or print the receipt. Click on the 'Download' button to save the receipt to your device.

- Print or Save Future Reference: Make sure to save the downloaded receipt in a safe place. You might need it for future reference or proof of payment.

Benefits of Online Payment

Paying property tax online has many benefits. It is convenient, fast, and secure.

- Convenience: You can access the online payment system 24/7. This means you can pay your taxes anytime, from anywhere.

- Speed: Online payments are instant. You get payment confirmation right away. This saves you time compared to traditional methods.

- Security: Online payments are secure. Transactions are encrypted, which protects your personal and financial information.

- Digital Records: When you pay online, you get digital records. These records are easy to store and find. You can use them for future reference if needed.

- Other Benefits: Online payments reduce the need for paperwork. They also help in avoiding long queues at municipal offices. This makes the process more efficient and less stressful.

How Do You Pay Property Tax Using NoBroker Pay?

Paying your property tax with NoBroker Pay is easy and secure. Follow these simple steps to manage your dues without any hassle.

- Access NoBroker Pay: Log in to your NoBroker Pay account. You can also use their mobile app for easy access.

- Go to Bill Payment: Go to the bill payment section once logged in. Look for the 'property tax' category. In the search bar, type the name of the property tax, for example, ‘EDMC property tax’, and select it.

- Enter Your Details: Input your customer ID or account number. This will fetch your tax details.

- Choose a Payment Method: Select from the available payment options like net banking, credit card, or debit card.

- Complete the Payment: Follow the prompts to finalise the transaction. Make sure all details are correct.

- Stay Updated with Payment Confirmation: You will receive a confirmation message once your payment is processed. Save this confirmation for your records as proof of payment.

How to Pay Property Tax Through Google Pay?

Now, you can even pay your property tax online using Google Pay. This is a great option for those always on the go, and you can do it on the app on your phone. Here’s how you pay your property tax for 2023-2024 on Google Pay –

- Open the app

- Go to Bill Payments

- Under ‘Categories’ choose Municipal tax/ services

- Find your correct city/municipal corporation

- Link your account

- Fill in the requested details like property ID, mobile number, etc.

Once your account is created, the payment process is fast and without any complications.

Exemptions and Concessions that are Available When You Pay Property Tax

Although we all have to pay property tax, there are a few exceptions to the rule. The government has made a list of people and types of properties that are exempt from paying property tax, such as–

- Any building/plot that has been occupied for a specific purpose like worship, burial, heritage, etc.

- Any property that is used for charity purposes.

- Any property or building that is used for agricultural purposes is exempt, excluding property that is used as a dwelling.

- Property with its interest vested in a corporation; here, the corporation is charged the primary tax.

- Property owned and self-occupied by a war widow, a winner of a gallantry award.

Read: No HRA? Know What Section 80GG of the Income Tax Act Means for You.

Concessions and rebates are provided for –

A concession of 30% is allowed for women, senior citizens and those who are physically challenged.

Other Rebates –

- A 30% rebate is allotted for ex-servicemen.

- A 20% rebate is allotted for group housing flats for a specific time in a financial year.

These concessions are only if a property is self-occupied and used for residential purposes.

Fines and Penalties for Late Payment of Property Tax

There is no way to completely escape from paying your property tax (apart from those exempted). This is why you should not try to avoid paying these taxes. If you pay your property tax late, you are liable to pay a fine for late payment.

The fine you will pay is generally calculated based on a certain percentage of the amount due. This interest rate varies from state to state; some states have no fines, while others charge anywhere from 5% to 20%.

Property Tax by City

Property tax rates and calculation methods vary across major Indian cities. The table below compares these methods and rates, along with links to the respective city government websites for detailed information.

| Property Tax guide City-Wise | Calculation Method | Rate | Government Website |

| Property Tax Mumbai | Capital Value System (CVS) | Percentage of market value based on locality | Brihanmumbai Municipal Corporation (BMC) |

| Property Tax Delhi | Unit Area Value System (UVS) | Unit area value x Built-up area x Occupancy factor x Age factor x Use factor x Floor factor | Municipal Corporation of Delhi (MCD) |

| Property Tax Kolkata | Unit Area Value System (UVS) | Unit area value x Built-up area | Kolkata Municipal Corporation (KMC) |

| Property Tax Bengaluru | Unit Area Value System (UVS) | Unit area value x Built-up area x Occupancy factor | Bruhat Bengaluru Mahanagara Palike (BBMP) |

| Property Tax Hyderabad | Unit Area Value System (UVS) | Unit area value x Built-up area x Slab Rate Factor (based on annual rental value) | Greater Hyderabad Municipal Corporation (GHMC) |

Latest News on New Property Tax Rules 2025

The Income Tax Bill 2025, introduced in the Lok Sabha on February 13, 2025, brings notable changes to how a property’s annual value is calculated. The annual value will be determined as the higher of the expected rent or the actual rent received. For vacant properties, the rent earned during the period of occupancy will be based on the rent earned.

Property owners can claim a 30% deduction on the annual value. Interest deductions on loans for self-occupied properties are capped at ₹2 lakh per year if the construction or acquisition is completed within five years of borrowing, while no such cap applies for rented properties.

Unsold flats or commercial units will have a nil annual value for two years after receiving the completion certificate. Capital gain exemptions can be availed if a new property is purchased within two years or constructed within three years.

However, the exemption gains will be treated as long-term capital gains if the new property is sold within three years. The exemption under the revised rules is capped at ₹10 crore in case of reinvestments.

Source: Deccan Herald

Explore Property Tax Payment Options City-Wise in India

Get Expert Legal Assistance With NoBroker Legal Services

Are you unsure how to pay your property tax? Comment below, and we can help you through the process.

For those NRIs who have vacant homes in India, don’t worry, we can help you too. NoBroker NRI services can help you look for tenants and maintain your house even when you don’t reside in India. NoBroker NRI services can even help you find a buyer and save on taxes!

If you’re still looking to buy a house and are worried about property tax, we can help you buy a home within your budget and WITHOUT paying any brokerage. NoBroker has plenty of homes for you to choose from, no matter your desire or budget. Just click below to start your search.

Frequently Asked Questions

Ans: Property tax is a tax imposed on property ownership, including land and any improvements like buildings. Both individuals and organizations who own property are responsible for paying it.

Ans: The property tax amount is set by the local government or municipal corporation and is calculated based on several factors, including the property's value, size, location, and usage.

Ans: Property tax is not a one-time payment; it is usually paid annually or semi-annually to the local government or municipal authority. The specific payment schedule may vary by location.

Ans: Property tax generally applies to all types of real estate, including residential and commercial properties, whether occupied, rented out, or left unoccupied. However, vacant plots of land without any adjoining construction are often exempt.

Ans: You may be exempt from property tax for vacant land without any buildings, but exemptions vary by location and local tax regulations. You must to check with your local government or municipal authority for specific eligibility criteria.

Ans: Real estate property taxes are annual fees levied by local, state, or central governments on property ownership for real estate, rented properties, houses, and office buildings.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

61636+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

50162+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

44369+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

39821+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

34122+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116750+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

199681+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

144373+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

135177+ views

Recent blogs in

What Is Cidco Lease Deed: Types, Tenure, Rights and Responsibilities in India 2026

February 20, 2026 by Ananth

Perpetual Lease Deed: Meaning, Rights, Benefits and Registration Process in India 2026

February 20, 2026 by Vivek Mishra

Ground Lease Vs Land Lease: Meaning, Key Features and Legal Distinctions in 2026

February 20, 2026 by Vivek Mishra

Lease Extension Agreement: Required Documents, Cost and Registration in India 2026

February 20, 2026 by Ananth

Mobile Home Lease Agreement: Types, Rights, Rules & Legal Requirements in 2026

February 20, 2026 by Ananth

Full RM + FRM support

Full RM + FRM support

Join the conversation!