Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

Table of Contents

Owning a property in Mumbai comes with its fair share of expenses. From hefty down payments to recurring expenses such as maintenance fees, utilities, and property taxes, being a property owner in Mumbai demands careful financial planning.

Property tax in Mumbai is levied by the Municipal Corporation of Greater Mumbai (MCGM) on property owners within its jurisdiction. BMC property tax is a local tax imposed on property owners to fund various city civic services and infrastructure development.

In this guide, we will explore MCGM property tax in detail, shedding light on who is required to pay it and providing valuable insights into the payment procedure and related aspects.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

MCGM Property Tax: Key Details

| Information | Details |

| Authority | Municipal Corporation of Greater Mumbai (MCGM) |

| Who Pays | Owners of residential and commercial properties within MCGM jurisdiction |

| Tax Base | Annual Rateable Value (ARV) for properties |

| Rate | Varies depending on the ARV and property type (residential/commercial) |

| Payment Options | Online portal, designated banks, MCGM collection centers |

| Last Due Date | Typically June 30th (subject to change, refer to official website) |

| Official Login Link | https://ptaxportal.mcgm.gov.in/ |

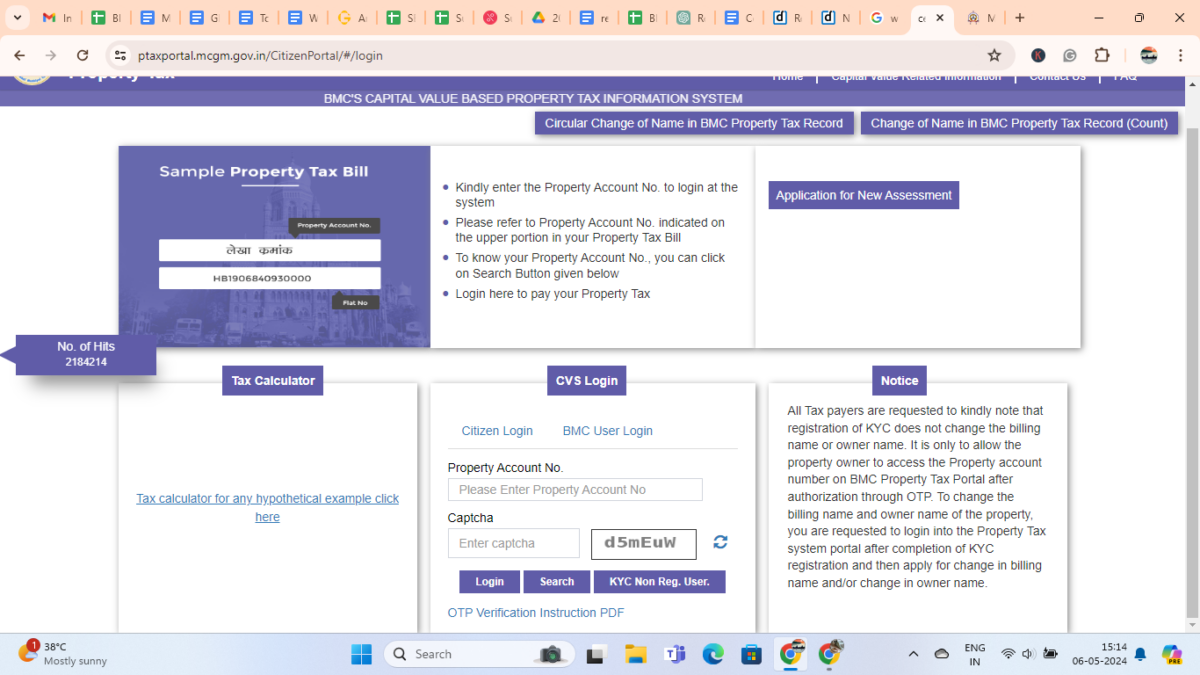

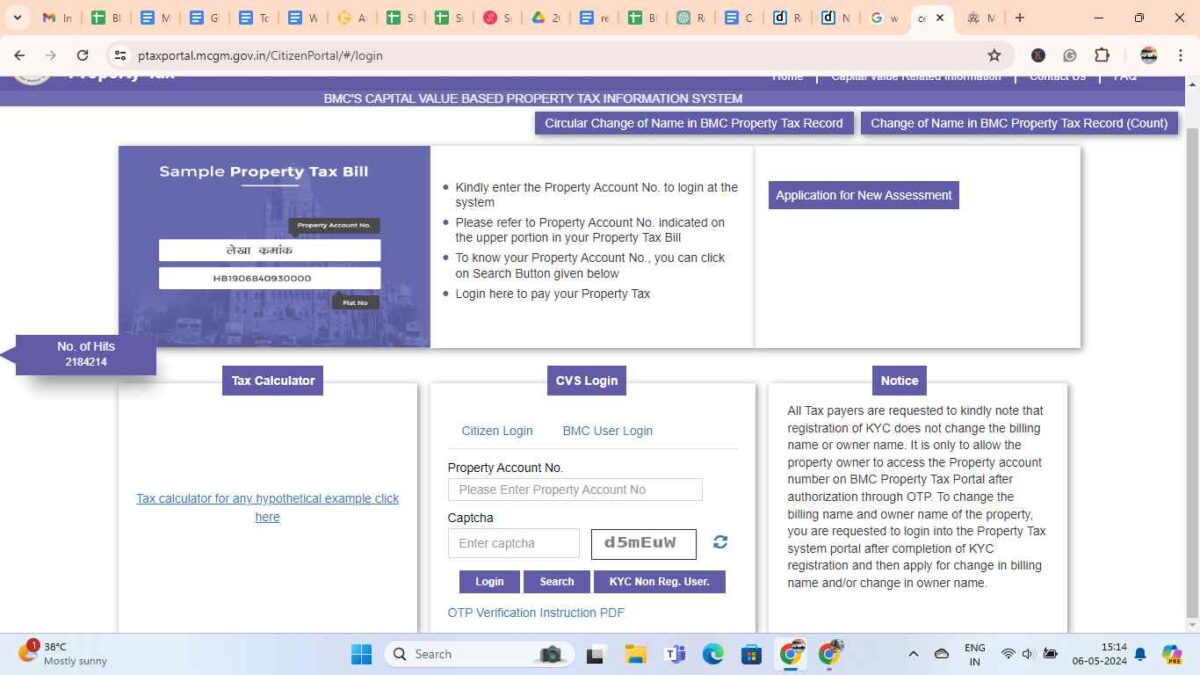

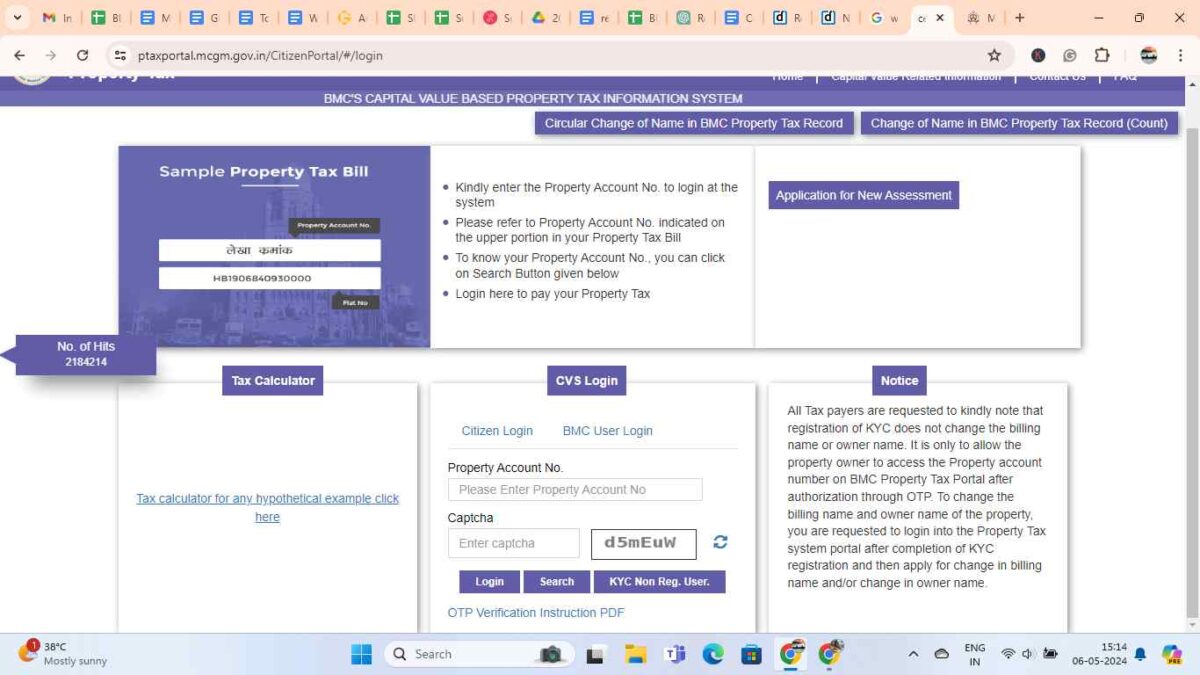

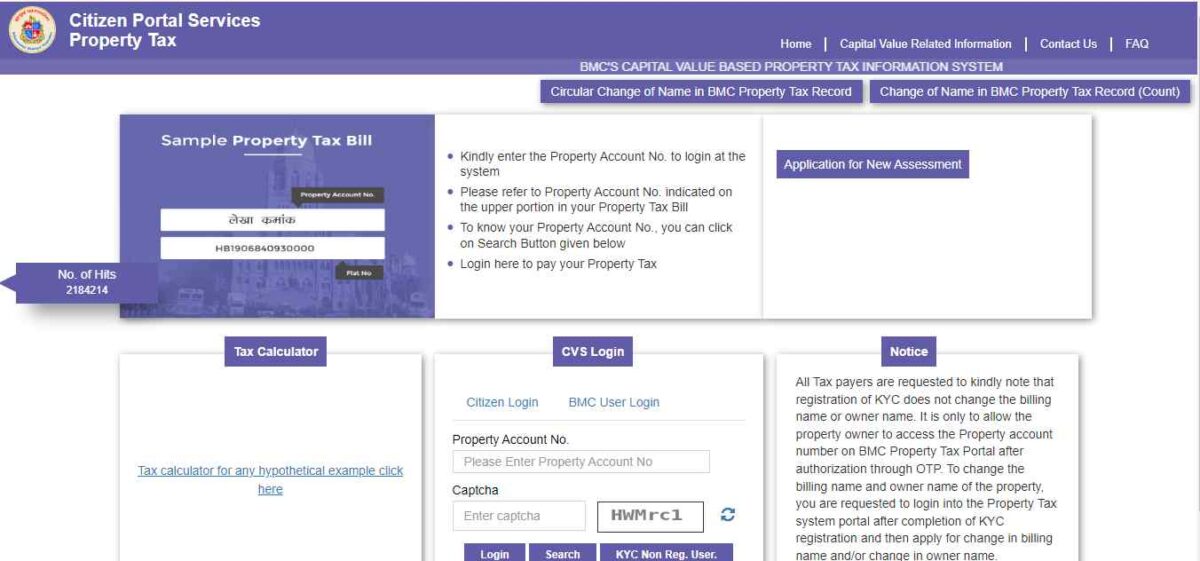

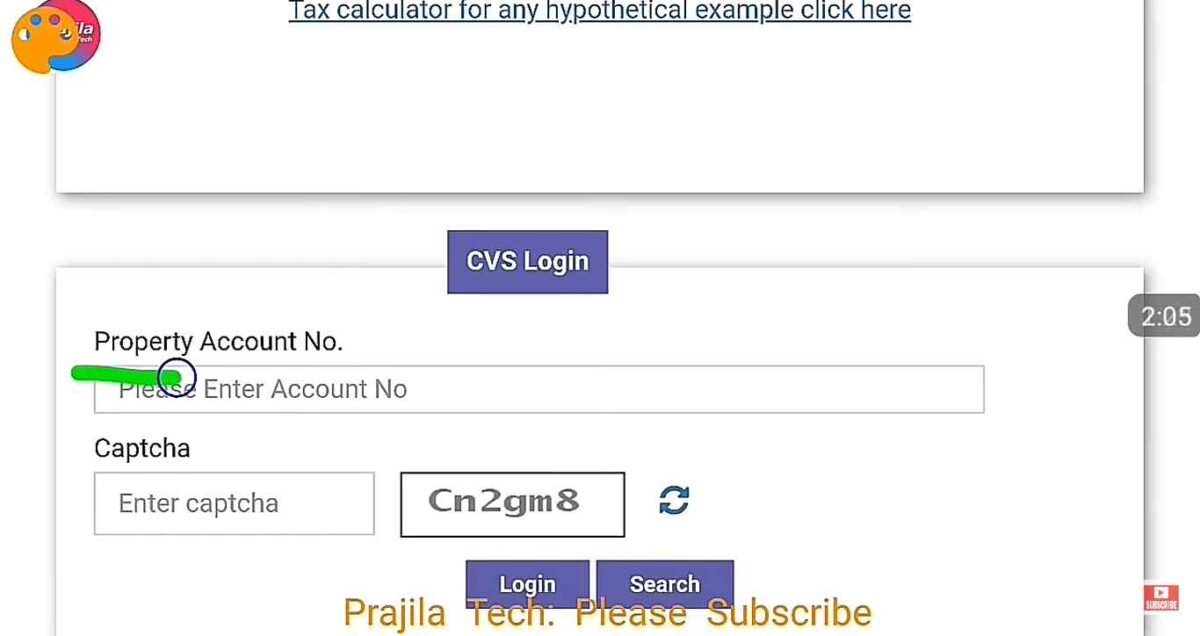

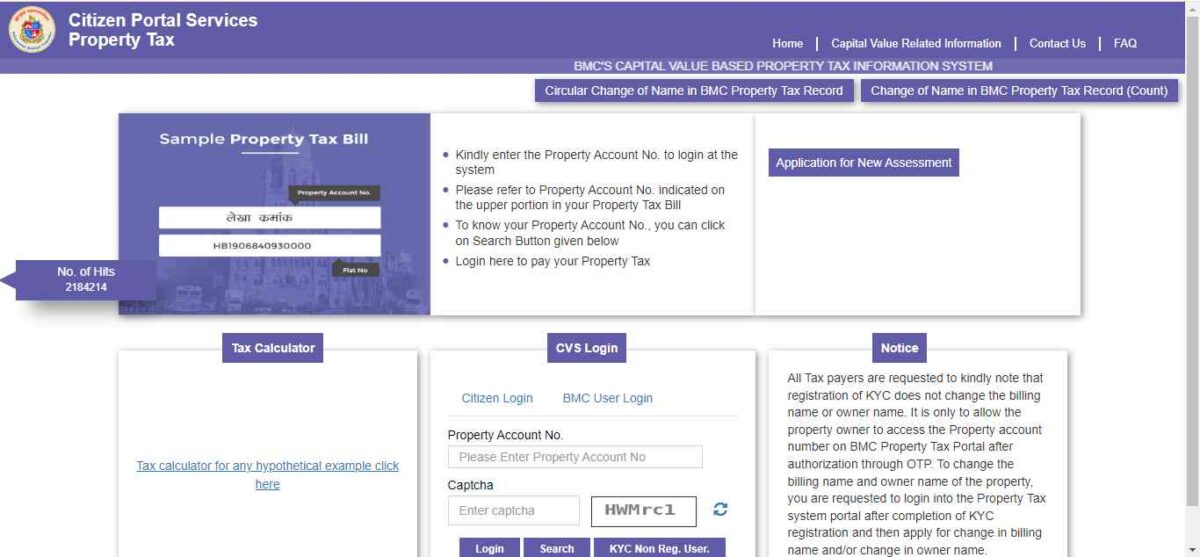

MCGM Property Tax Login

You can access the MCGM Property Tax login on the MCGM Citizen Portal: https://ptaxportal.mcgm.gov.in/

- You'll need your property account number to log in.

- If you don't know your property account number, you can likely find it on a previous property tax bill or by searching on the portal using your ward, name, and address.

- Be sure to enter the CAPTCHA code correctly when logging in.

How to Check the Property Tax Mumbai Bill on the MCGM Website?

MCGM provides an online platform where you can access and view your property tax bill. By following the steps, you can conveniently view your property tax bill and stay updated on your tax obligations.

- Navigate to the official website of MCGM

- Login by furnishing the property account number and the captcha.

- Next, enter the OTP sent to your registered email ID and mobile number.

- Your account on the MCGM website will be redirected, and you will be able to view your outstanding and paid property tax Mumbai bills.

MCGM Property Tax Portal

The MCGM Property Tax Portal is located at: https://ptaxportal.mcgm.gov.in/. This is the official website for all your property tax needs in Mumbai.

Here's what you can do on the MCGM Property Tax Portal:

- View your property tax bill: Access and review your current and past property tax bills.

- Calculate your property tax: Use the online calculator to estimate your property tax dues based on details like ward number, area, and building type.

- Pay your property tax online: Make secure payments using various options like credit card, debit card, net banking, or Paytm wallet.

MCGM Property Tax Calculation Method

MCGM calculates property tax based on the capital value of the property, considering factors such as location, property type, construction type, occupation status, and floor space index.

Rate Value Method

Previously, the method of calculating property tax in MCGM/BMC was based on the rate value of the property. This rate value was determined by multiplying the market value of the property by a fixed percentage. Property tax levied by the Brihanmumbai Municipal Corporation (BMC) is essential for funding various civic services and infrastructure projects in Mumbai. Subsequently, the tax rate was applied to the rate value to determine the property tax amount.

While this method was simple and straightforward, it had its limitations. One major drawback was that the rate value did not consider the fluctuating market values of properties. As a result, property tax calculations using this method often failed to accurately reflect the current value of properties, leading to potential discrepancies in tax amounts.

Capital Value Method

In the new method of calculating property tax in MCGM/BMC, the focus shifts to the capital value of the property. This capital value is determined by multiplying the market value of the property by a specific factor established by the MCGM.

Once the capital value is determined, the applicable tax rate is applied to calculate the property tax amount. The capital value method brings improved accuracy to property tax calculations compared to the older rate value method.

By considering the current market value of the property, the capital value method ensures that property tax assessments align more closely with the property's actual worth. Moreover, this method promotes transparency as the factors utilized in determining the capital value are made available to the public by the MCGM..

Weights for ‘construction type’, in units:

| Bungalows and RCC construction | 1 Unit |

| Other than RCC (semi-permanent /chawls) | 0.60 Units |

| Under-construction or vacant land | 0.50 Units |

Weights for ‘age of building’, in units:

| Properties constructed before 1945 | 0.80 units |

| Properties constructed between 1945 and 1985 | 0.90 Units |

| Properties constructed after 1985 | 1 Unit |

Weights for ‘user category’ in units:

| Hotels and like businesses | 4 units |

| Commercial properties | 3 units |

| Industries and factories | 2 units |

| Residential and charitable institutions | 1 unit |

MCGM Property Tax Calculation 2025

Calculating your MCGM/BMC property tax online is a convenient way to determine your tax liability. Property tax on commercial property in Mumbai is calculated based on the capital value of the building, which considers factors like location, size, and market value. By following a specific formula that considers various factors, you can accurately calculate your property tax obligation:

- Navigate to the official website of MCGM Tax Portal

- Click on the link under Tax Calculator

- Furnish the all the details required and click on Calculate the Tax

- The BMC Mumbai property tax payment will be displayed on the screen

MCGM Property Tax Formula

In 2015 the MCGM introduced the new system of calculating property tax, i.e. capital value system. Under this system, the tax is calculated based on the property's capital value, which is its market value. The capital value is determined by the MCGM based on the property's location, size, age, and construction type.

The tax is calculated as follows:

Property tax = Tax rate x Capital value

[Capital value: Market value of the property x Total carpet area x Weight for construction type x Weight for the age of the building.]

Here is an example of how to calculate property tax using the MCGM formula:

- Suppose you own a residential property in Mumbai with a market value of ₹10,000,000. The property is a bungalow that was built in 2000 and has a carpet area of 1000 square feet.

- The tax rate for residential properties in Mumbai is 0.02%. The capital value of your property is ₹1,000,000 (market value x 0.1).

- Your property tax is ₹2000 (tax rate x capital value).

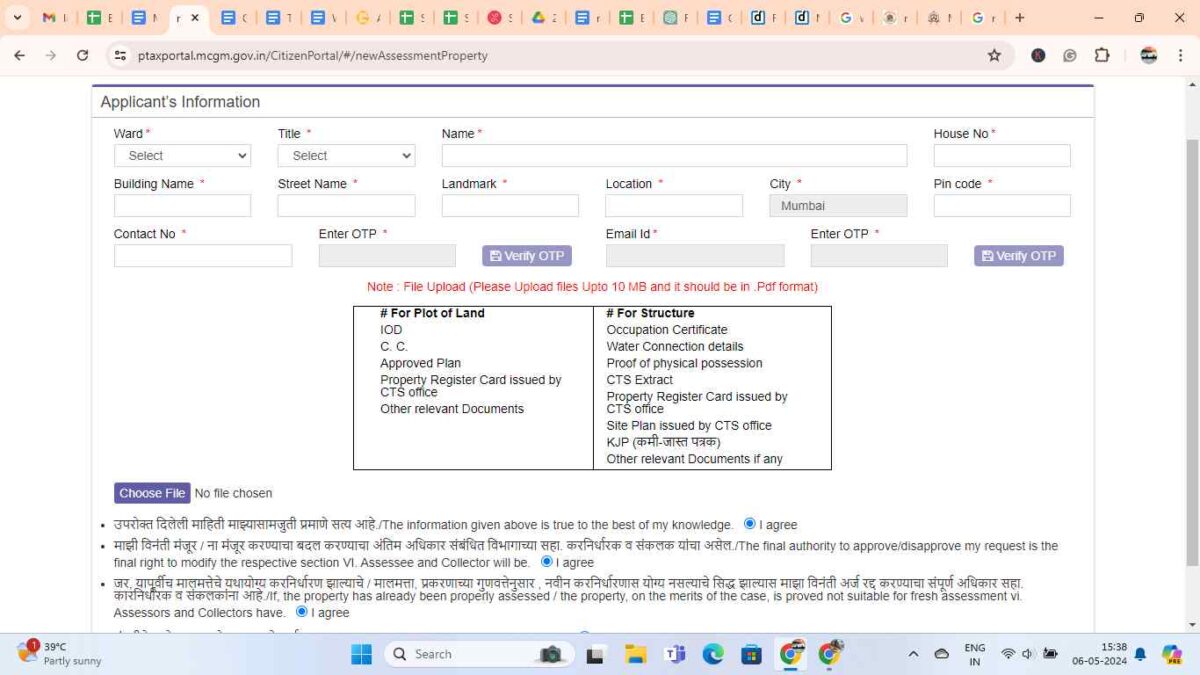

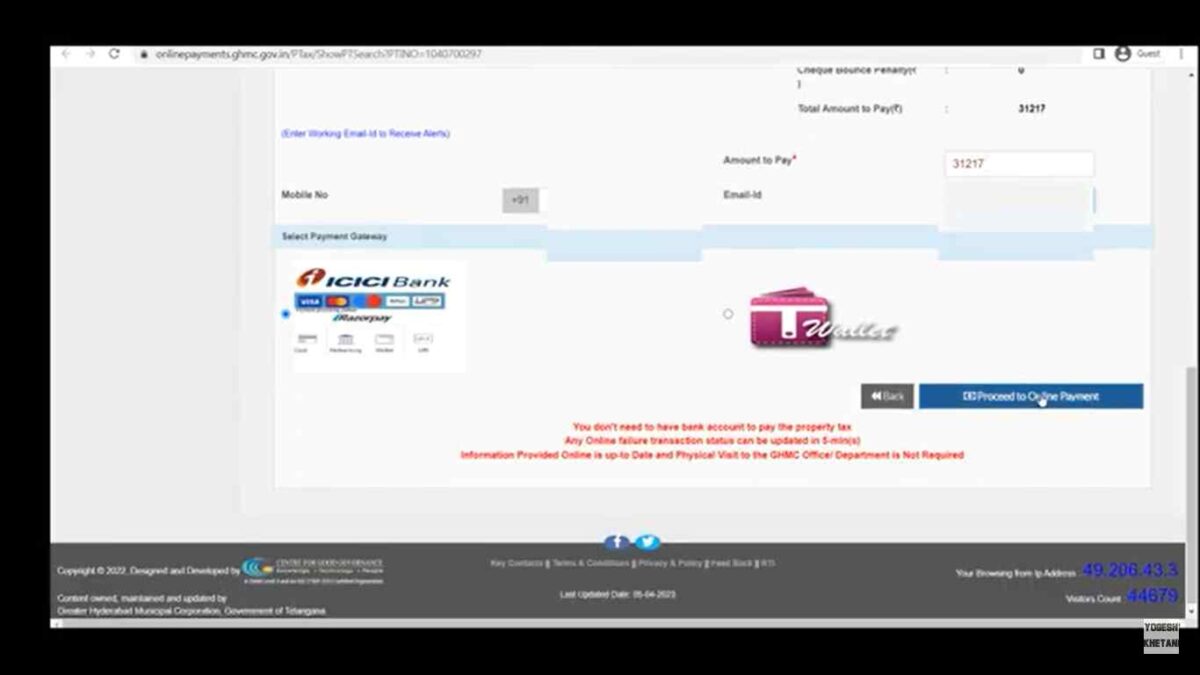

How to pay MCGM Property Tax Online 2025?

To pay MCGM (Municipal Corporation of Greater Mumbai) Property Tax online, follow these steps for a convenient and hassle-free experience.

- Navigate to the official website of MCGM Tax Portal

- Navigate to Citizen Services, then select Property Tax.

3. Login by furnishing the property account number and the captcha.

4. Next, enter the OTP sent to your registered email ID and mobile number.

5. Verify the displayed property details and enter the tax amount to be paid. The payment is processed on a first-in-first-out (FIFO) basis.

6. Choose your preferred payment method, such as net banking, credit, or debit card, and make the payment.

7. After the successful payment, a receipt will be generated for future reference.

MCGM Property Tax Bill Download 2025

Unfortunately, the MCGM Property Tax Portal currently doesn't offer a direct download option for your property tax bill. However, you can still access and view your bill electronically through the portal. Here's how:

1. Access the MCGM Property Tax Portal:

Go to the official MCGM Property Tax Portal: https://ptaxportal.mcgm.gov.in/.

2. Login or Register:

- If you have an existing account, log in using your property account number and CAPTCHA code.

- If you're a new user, you'll need to register first by providing details like your property address and creating a username and password.

3. View Your Bill:

Once logged in, locate the option to view your property tax bill. It might be labelled as "View Bill," "Property Tax Statement," or something similar.

4. Print or Save the Bill (Alternative):

While downloading isn't available, you can achieve a similar outcome by:

- Printing the bill: Once you've accessed your bill on the screen, use your browser's print function to print a physical copy for your records.

- Taking a screenshot: Capture an image of the bill displayed on your screen using a screenshot tool. You can then save the screenshot as a PDF or image file on your device.

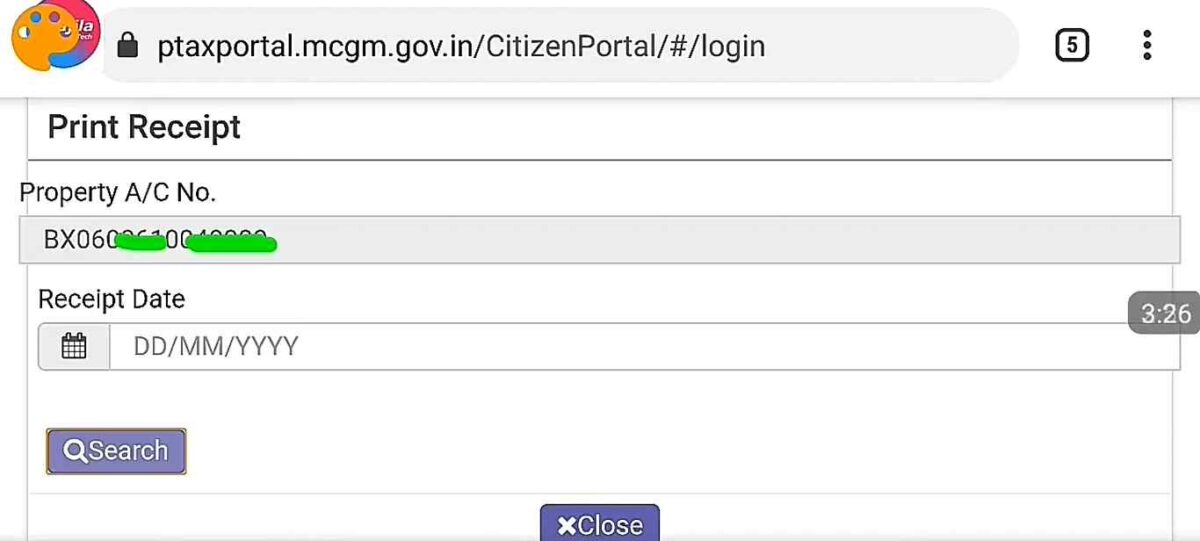

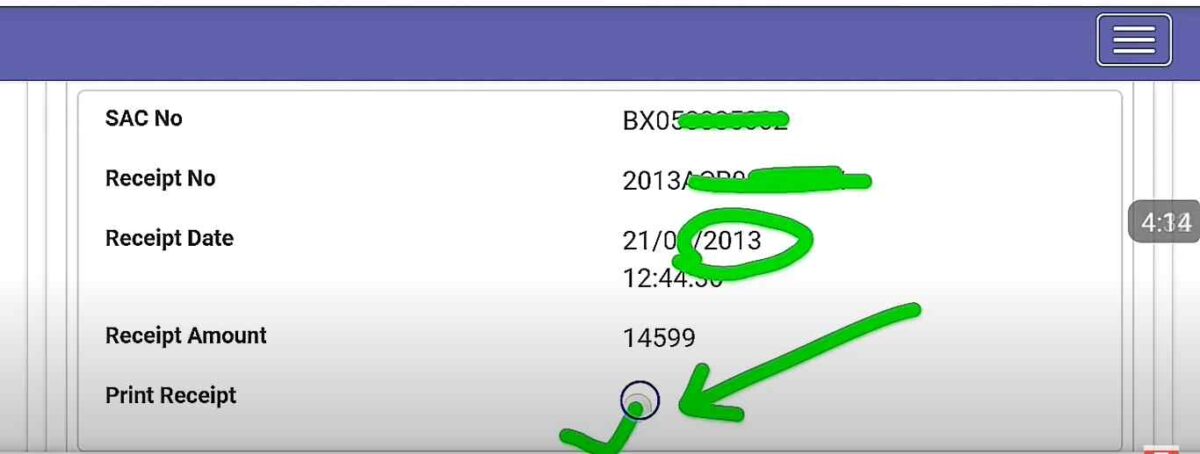

MCGM Property Tax Receipt Download 2025

There isn't a clear confirmation on the MCGM Property Tax Portal itself about directly downloading your 2025 payment receipt. However, there are a couple of ways you can potentially access a copy of your receipt:

- Online Receipt Viewing:

- Login to the MCGM Property Tax Portal: https://ptaxportal.mcgm.gov.in/.

- Once logged in, navigate to the section for payment history or transaction history. This might be labelled differently, so look for options related to past payments.

- If the portal allows viewing past receipts, you should be able to see the details of your 2025 payment, potentially including a downloadable receipt option.

- Email Confirmation:

- When you make an online payment on the MCGM portal, it's possible you might receive a confirmation email with the payment details attached as a PDF receipt.

- Check your email inbox for messages from MCGM or a payment processor used during the transaction (like a bank or payment gateway). The email might contain a link to download the receipt as well.

How to Pay MCGM Property Tax Offline?

Apart from online payments, BMC property tax payments can also be made offline through multiple channels:

- Help Centers and Citizen Facilitation Centers: Visit designated help centers or citizen facilitation centers to make your property tax payment in person.

- Assistant Revenue Officers' Office: Make the payment at the office of Assistant Revenue officers.

- Payment Methods: Offline payments can be made using cash, cheque, demand draft (DD), or UPI payment methods.

- Receipt: Upon payment, a receipt will be provided, which should be securely kept as proof of payment.

MCGM Property Tax Due Date and Penalty Charges

The due date for MCGM property tax is annually on 3rd June. If the tax is not paid by the due date, a penalty of 2% will be charged on the remaining amount. Additionally, the penalty will increase by 1% for each subsequent month that the tax remains unpaid.

How to Get BMC Property Tax Bill on E-Mail?

To receive your BMC (Brihanmumbai Municipal Corporation) property tax bill via email, you can follow the simple process mentioned below. By opting for this convenient method, you can easily access and manage your property tax information digitally:

- Visit the MCGM portal and locate the notification for Know Your Customer (KYC).

- Click on the KYC notification and proceed to fill out the required form.

- Provide your email ID and mobile number during the KYC process.

- Upload the necessary documents as per the instructions on the website.

- After completing the KYC, you will receive a confirmation link in your registered email.

- Click on the confirmation link to verify your email address.

- Once the KYC is successfully completed and confirmed, you will start receiving alerts, notifications, and property tax bills on your registered email ID.

- This ensures the timely receipt of bills and helps you avoid penalties for delayed MCGM property tax payments.

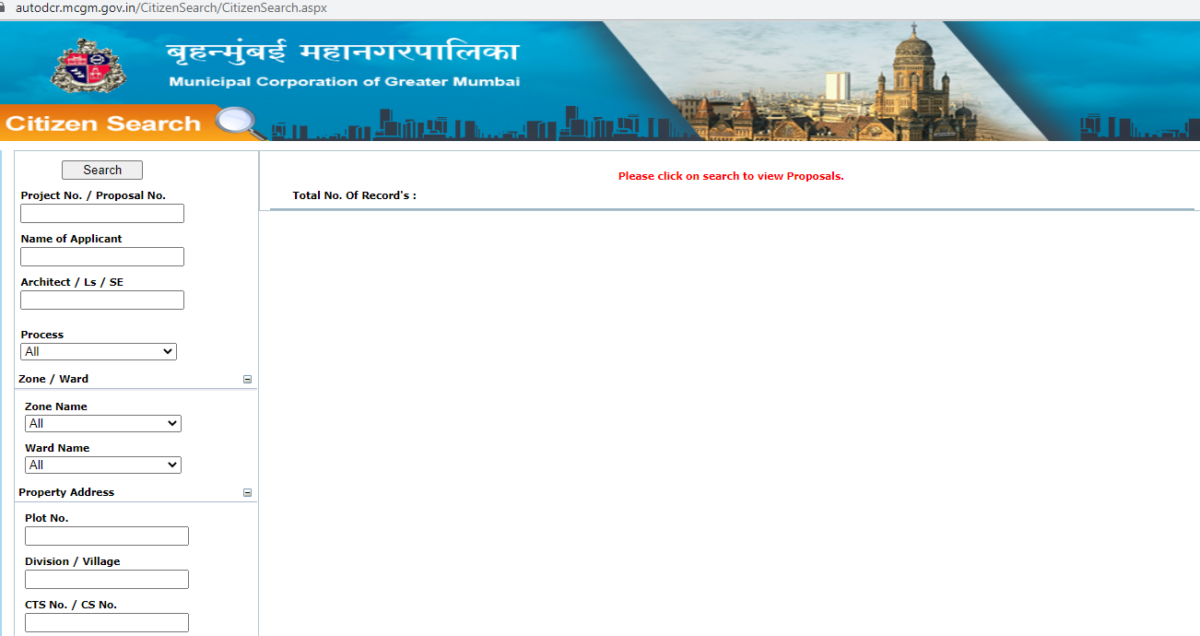

How to Do Property Tax Name Change Online in Mumbai?

If you need to change the name on your property tax in Mumbai, follow these steps for a smooth and convenient online process to update the information accurately.

- Changing the name on your MCGM property tax can be done without incurring fees and through an online portal.

- The process takes around 3 days, compared to 15 days if done at the SRO office. No property card submission is required as the change is based on registered sales deeds.

- The name change reflects simultaneously on the property card, which can be verified on the portal under 'View Detail'.

Mumbai Property Tax Exemption

Mumbai Property Tax Exemption provides relief to eligible property owners. These exemptions include:

- Properties exclusively used for public worship or charitable purposes are eligible for an exemption from property tax.

- Properties belonging to Diplomatic or Consular Missions of foreign states, as specified by the Government, are also exempt from property tax.

- Houses or flats measuring less than 500 square feet are exempt from the payment of property tax.

- Flats or houses measuring between 500 to 700 square feet are eligible for a 60% concession on property tax.

MCGM Property Tax - Early Bird Scheme

The Municipal Corporation of Greater Mumbai (MCGM) offers the Early Bird Scheme as a rebate initiative to incentivize timely property tax payments. By taking advantage of this scheme, citizens who pay their property tax before the due date can enjoy certain benefits.

The scheme grants a 2% rebate on the first installment and a 4% rebate on the second installment of the property tax. It's important to note that the due date for property tax payments in Mumbai is June 3rd each year.

To participate in the Early Bird Scheme, you have the option to pay your property tax online or through a bill collector. For further details and comprehensive information about the Early Bird Scheme, it is advisable to visit the official MCGM website. This scheme provides an opportunity to save money while fulfilling your property tax obligations in a timely manner.

MCGM Property Tax Latest News

7th April 2023

The Municipal Corporation of Greater Mumbai (BMC) and Bloomberg Philanthropies are collaborating to redesign 20 high-risk intersections, including Amar Mahal Junction, which has witnessed the highest number of fatalities in the city. The redesign will focus on improving pedestrian crossings, adding refuge areas, and implementing traffic calming measures.

6th March 2023

The Municipal Corporation of Greater Mumbai (MCGM) has been awarded "E-governance Initiative of The Year" for its Property Tax Intelligent Solution (PTIS) developed by SAS. The solution has helped detect fraud, prevent revenue leakages, and increase tax revenues using advanced analytics.

21st February 2023

The Income Tax Appellate Tribunal (ITAT) in Delhi has ruled that if a registered sale deed does not specify the ownership share of a husband and wife in a property, they will be considered equal owners. In a specific case, the ITAT upheld the taxation of INR 9.8 lakh in the wife's hands for the notional rent of a jointly owned vacant property.

19th November 2022

The Brihanmumbai Municipal Corporation (BMC) has decided not to revise the capital value of properties in Mumbai, despite already raising property tax bills in September. The government directed the BMC to provide relief due to financial losses caused by the pandemic. However, this decision is expected to result in a revenue loss of Rs 1,117 crore for the city.

29th August 2022

The Comptroller and Auditor General (CAG) of India reveals that property tax collection in Maharashtra's urban local bodies had an efficiency of only 53% from 2015-16 to 2019-20. The Brihanmumbai Municipal Corporation (BMC) performed poorly with a collection rate of just 28%.

How Can NoBroker Help?

In conclusion, paying your MCGM property tax on time is crucial for compliance and avoiding penalties. Stay informed, utilize online portals, and seek assistance from reliable platforms to manage your property tax efficiently and contribute to the development of your city.

NoBroker Legal services offer expert guidance and assistance in handling legal aspects related to MCGM property tax, ensuring compliance and addressing any legal concerns that may arise. Their comprehensive services can simplify and streamline your property tax management experience while ensuring you meet all necessary requirements.

Frequently Asked Questions

Ans: MCGM property tax is a tax levied by the Municipal Corporation of Greater Mumbai (MCGM) on the annual value of immovable property in Mumbai. The tax is calculated on the basis of the property's location, size, and market value.

Ans: The owner of the property is liable to pay MCGM property tax. If the property is rented out, the tenant is also liable to pay the tax, in addition to the landlord.

Ans: To pay your property tax, access the BMC online portal for property tax payment, register or log in, and follow the prompts to complete your transaction securely and efficiently.

Ans: To view your Brihanmumbai Property Tax dues, visit the MCGM portal, navigate to the property tax section, and enter your property ID.

Ans: Not paying MCGM property tax incurs a late fee, interest on the overdue amount, and potential legal action for enforcement. Prompt payment is advised to avoid such consequences.

Recommended Reading

Comprehensive Guide to Andhra Pradesh Property Tax Payment

December 24, 2024

5327+ views

GHMC Property Tax: How to Calculate and Pay Tax Online?

December 23, 2024

11210+ views

Real Estate Trends and Property Rates in Mumbai for 2025

December 19, 2024

20305+ views

BDA Property Tax Bangalore 2025 - Online Payment, Receipt Download

December 18, 2024

9402+ views

FSI in Mumbai 2025: Calculate FSI in Mumbai Municipal Corporation

December 18, 2024

21972+ views

Loved what you read? Share it with others!

Most Viewed Articles

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

December 26, 2024

11411+ views

Top 5 Natural Ways to Keep Insects Away

January 2, 2024

7419+ views

August 16, 2016

6205+ views

September 21, 2016

5936+ views

5 Places to Visit Near Bangalore

September 29, 2016

3050+ views

Recent blogs in

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

December 26, 2024 by Jessica Solomon

Top 5 Natural Ways to Keep Insects Away

January 2, 2024 by NoBroker.com

October 4, 2016 by NoBroker.com

5 Places to Visit Near Bangalore

September 29, 2016 by NoBroker.com

September 21, 2016 by Vivek Mishra

Join the conversation!