Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Property Tax Thane Maharastra Payment - Online, Offline and Download Bill

Table of Contents

Thane Property Tax is the Thane municipal corporation tax paid by property owners in place of the civic maintenance of the area. The Thane Mahanagar Palika collects the property tax in Thane twice a year, once by April 1st and then the second round of collection is completed by October 1st. Currently, the TMC property tax rate is 38.67%.

The government has made it very easy for property owners to get their queries resolved easily and get any information related to property tax in Pune. Thane Municipal Corporation uses both online and offline methods for the collection of property tax in Thane. Property owners can pay the offline Thane Mahanagar Palika property tax at all the municipal centres within the city. The payment can be made via cash or cheque at the Thane Municipal Corporation branch offices.

For online mode, TMC has introduced their very own web portal that acts as an all-out information source for the Thane municipal tax payments. The online portal conveniently provides all the TMC property tax details and offers multiple payment modes. After payment, the property owners can also download the TMC property tax online payment receipt. Let’s take a look at the procedure to pay property taxes online in Thane and download the Thane property tax payment receipt.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Property Tax Thane Explained

| Official Website | https://propertytax.thanecity.gov.in/ |

| Last due date | 15th June 2024 |

How to Pay TMC Property Tax Online 2024

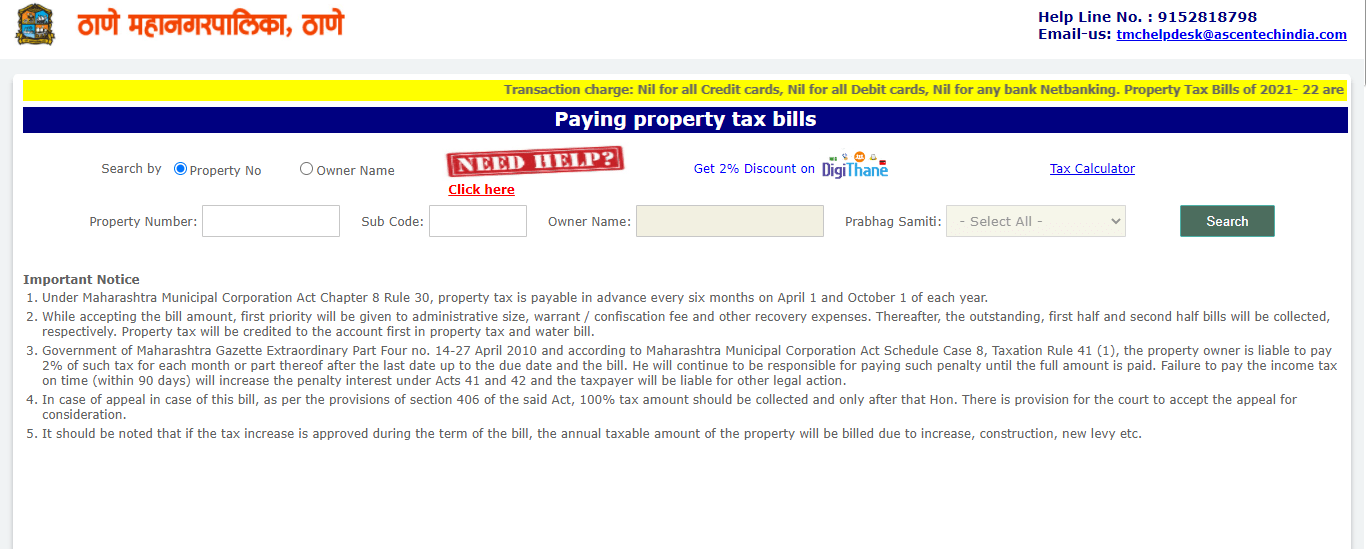

To make the process of collection of property tax in Thane convenient, the Municipal Corporation launched the online portal. This portal helps the property owners pay taxes online and get help related to any queries they may have. The entire process of paying property tax bills online in Thane can be completed in a few clicks from the convenience of your home. Here is a step-by-step guide to paying the property tax in Thane online:

- Visit https://propertytax.thanecity.gov.in/

- Search your property using the filters. You can select using your name if you are the owner or make the search using the property number.

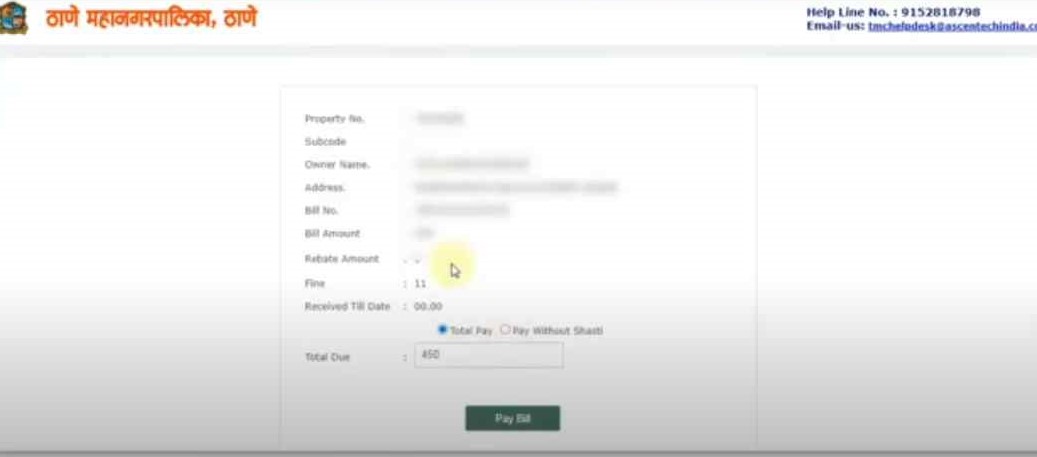

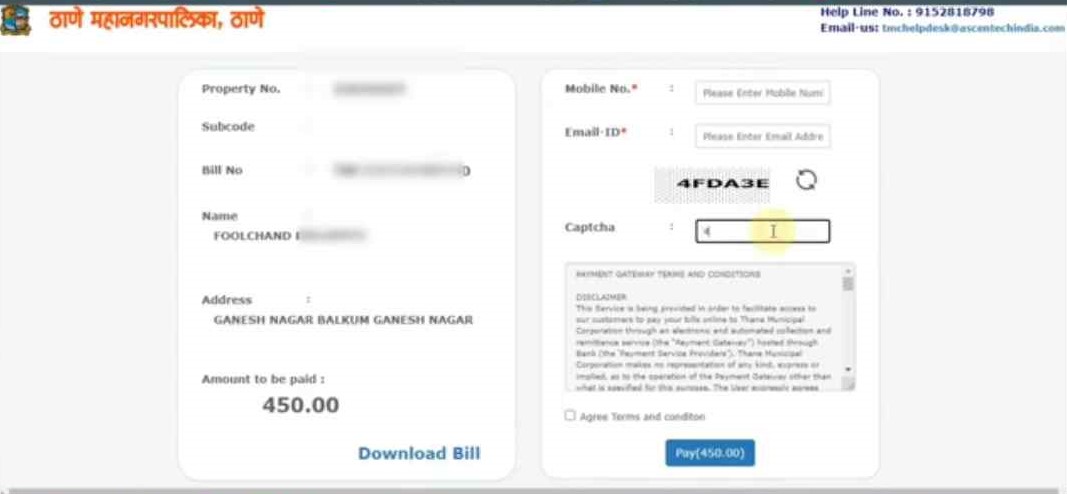

3. Fill in the required details like mobile number, e-mail id etc and get yourself registered with TMC.

4. After the registration, you will be able to see the check property tax in Thane. Click on pay now to pay your dues.

5. Pay using your credit or debit card or you can use other options like UPI too.

TMC Property Tax Bill Download

After the payment of the TMC property tax bills online, homeowners can download the TMC property tax payment receipt as well. Here are the steps to download the property tax bill online Thane:

- Visit https://propertytax.thanecity.gov.in/

- Fill in the required details, and submit the documents.

- Make the payment using your preferred payment method.

- After payment is successful, click on the download arrow in the top right corner for the TMC property tax bill downloaded receipt.

How to Pay Property Tax Thane Offline?

To submit your property taxes, stop by the TMC office. To pay the tax amount specified in the bill, go to the tax payment counter and submit property information. Demand draft, cheques, or cash are all acceptable forms of payment for taxes.

You might be required to provide the following property details-

- Owner Name

- Colony name

- Property type

- Property zone

- Property ward number

- Property ID

TMC Property Tax Calculator 2024

TMC uses the following formula to calculate property tax in Thane:

Property tax Thane = Tax rate x Total carpet area/area of land if the land is vacant x usage factor x age factor x floor factor x type of building. If you are a property owner from Thane, this simple formula will help you calculate the property tax in Thane.

For making the process of property tax online payment in Thane convenient, the TMC property tax bill can be paid after having a rough approximation of the exact amount. The TMC property tax payment calculator helps in getting approximate TMC Thane property tax. Here is a link to the official TMC property tax bill online checking Thane calculator.

How to Change Name on TMC Property Tax Records Online?

During any property transaction, transferring ownership is very important. It is equally important to make changes in property tax records. In Thane, the Municipal Corporation requires an official application to be filed by the property owner to initiate the process of property tax name change Thane online. For filing an online application, visit https://propertytax.thanecity.gov.in/.

The offline application for property tax Thane name change in records should be filed to the commissions of revenue along with the following records attested:

- Receipts of previously paid property taxes

- NOC from your housing society/ association

- A copy of the sale deed

- Government-authorised Identification proof

Both these procedures undergo strict review from the municipal authorities and the entire process may take 15-30 days. From the filing of the application to changing the name in property tax Thane records, everything can be conveniently done on the web portal by Thane Mahanagar Palike.

TMC property tax Last due date 2024

Pay the tax before 15th June 2024 and avail 10% discount on the second semester General Tax. For online tax payments, no fees are applicable.

Thane City Property Tax Rebates and Penalties

Property owners in Thane will incur a 2 per cent monthly penalty for any tax payments that are late. The penalty will have to be paid by the taxpayer every month until the entire sum is paid. If the property tax is not paid in full within the allotted 90 days, penalty interest will be imposed in addition to any other possible legal measures against the taxpayer. If owners don't pay their taxes, the government may even seize the property.

When you pay your property taxes late and TMC collects the unpaid TMC property tax bills, TMC will also deduct the recovery costs.

The Thane Municipal Corporation gives early taxpayers incentives that range from 2 to 3 per cent of their outstanding balance.

Thane City Property Tax: Exemptions and Concessions

If a property owner pays their unpaid tax payment before the due date, they are eligible for a discount of 2–3 %. In addition, TMC recently approved a resolution exempting homes with up to 500 square feet of space from paying property taxes. This decision was passed by the State Government, which also pledged to waive 31% of the property tax for similar flats inside Thane Municipal Corporation boundaries. The exemption is now in force as of April 2024. The TMC coffers would be burdened with a revenue load of Rs 45 crores.

Additionally, property owners that fall into one of the following categories are often eligible for property tax discounts. Before paying your TMC property tax bill, see if you fall within one of the following categories:

- People with impairments who own property.

- Female property holders

- Senior citizens who own real estate.

- Agricultural properties

- Educational establishments.

- Owners who were formerly in the Army or the Navy.

TMC Helpline Number

The Thane Municipal Corporation (TMC) helpline number is a crucial resource for residents of Thane seeking information or assistance regarding various municipal services, including property tax.

Help Line No. : 9152818798

Property Tax Thane: Latest News

Thane Municipal Corporation is contemplating a property tax waiver for houses and residences with an area of up to 500 sq ft in Thane City. This was recently announced by Eknath Shinde, Urban Development Minister, Maharashtra. A similar waiver was announced in Mumbai which has given the government a significant boost with property registrations. These cities are managed by the Shiv Sena’s Maha Vikas Aghadi (MVA) government. Both Mumbai and Thane face civic elections soon.

TMC Commissioner Dr Vipin Sharma has urged officials to enhance their vigilance in collecting property and water taxes, ensuring compliance with the uniform code and timely payment for the efficient functioning of the civic body. To facilitate this, the commissioner has established a dedicated team to focus on collecting property taxes from 176 blocks initially.

TMC has streamlined the process of paying property taxes in Thane, including convenient options for viewing and downloading payment receipts. Timely payment is crucial to avoid late payment charges and potential legal consequences for non-compliance.

Legal Services Offered by NoBroker

NoBroker provides legal assistance specifically tailored to property transactions. Here's an overview of our services:

- Document Scrutiny: Our legal team reviews essential documents like title deeds and sale agreements to identify potential issues before finalising the property deal.

- Protection Measures: We safeguard you from fraudulent practices by checking for any existing legal disputes on the property and verifying ownership.

- Service Packages

- Buyer Assistance: We offer guidance and support throughout the buying process.

- Registration: We manage property registration, saving you time and effort.

- On-Demand Services: If you don't need a full package, we provide specific services like property title checks, guidance on market value, assistance with missing documents, and verification of occupancy certificates.

- Free Consultation: NoBroker provides a free consultation to discuss your needs and offer initial legal advice related to property.

- NoBroker Pay: By using NoBroker Pay, you can ensure a secure and convenient way to make your KMC property tax payments. Additionally, you can track all your payments in one place.

How to Book NoBroker Legal Services

Follow these simple steps to secure our services for a smooth and hassle-free experience:

- Begin by downloading the NoBroker app or visiting our website.

- Navigate to the NoBroker Legal Services section.

- Browse through the various service packages we offer, including drafting agreements, property verification, and legal consultations.

- Once you choose a service, fill in the necessary details and complete the form.

- After submitting your form, our NoBroker experts will reach out to you for further details, either through a phone call or a chat window. You can also book a free consultation call for additional enquiries.

- Our legal services page also features online rental agreements that can be directly purchased and customised on the NoBroker website.

Why Choose NoBroker Legal Services

Here are some of the key reasons to choose NoBroker legal services:

- Convenience: NoBroker emphasises the ease of their service. You can complete legal tasks from the comfort of your home without needing to visit a lawyer's office.

- Affordability: We offer competitive pricing on our legal services compared to traditional lawyers, ensuring value for money.

- Experienced Lawyers: NoBroker collaborates with seasoned lawyers (minimum 15 years of practice) who are qualified by the Bar Council.

- Streamlined Process: We simplify the legal process by providing pre-defined packages and managing communication with the lawyer on your behalf.

- Technology-Driven: NoBroker utilises technology for tasks like document management to enhance efficiency and improve service delivery.

Convenient Legal Assistance for All Your Property Requirements with NoBroker

For any queries regarding Property Tax Thane, feel free to contact the legal experts at NoBroker, offering reliable and affordable real estate consultation services. Still worried about TMC property tax payments? With NoBroker Pay you can simplify the payment process. Seamlessly pay your TMC property tax online through our secure platform – saving you time and ensuring on-time payments to avoid penalties. Visit NoBroker Pay today to experience a hassle-free way to manage your SMC property tax dues. Download the app today! Leave your questions or comments below, and our team will promptly assist you.

For any queries regarding Property Tax Thane, feel free to contact the legal experts at NoBroker, offering reliable and affordable real estate consultation services. Leave your questions or comments below, and our team will promptly assist you.

Frequently Asked Questions

Ans: The current property tax rate in Thane is 38.67%.

Ans: Homeowners can pay their property tax dues at the offices of the Municipal corporation of Thane. The payment can also be made online at the official website of Thane Municipal Corporation.

Ans. Property tax is important for the government as it helps them maintain the infrastructure within their premises. From maintenance of drainage to the collection of garbage, all these tasks are completed with the taxes acquired by the government. Property tax is a significant source of income for the government and hence, it should be paid timely for the development of the area.

Ans: TMC uses a simple formula to calculate the property tax, Thane:

Property tax Thane = Tax rate x Total carpet area/area of land if the land is vacant x usage factor x age factor x floor factor x type of building.

Ans: There are provisions to make the payments even after you miss the first deadline. With late payment charges, the homeowners can pay the property taxes and avoid any legal notice. If property tax Thane is not paid after reminders and legal notice, the municipal corporation has the right to seize your property and auction it or declare it illegal.

Ans: You can pay your Thane property tax online by visiting the Thane Municipal Corporation website (https://propertytax.thanecity.gov.in/) and following the prompts for "Online Services" or "Property Tax Payment." Enter your property details and choose your preferred online payment method.

Recommended Reading

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

December 26, 2024

11426+ views

Comprehensive Guide to Andhra Pradesh Property Tax Payment

December 24, 2024

5334+ views

GHMC Property Tax: How to Calculate and Pay Tax Online?

December 23, 2024

11223+ views

BDA Property Tax Bangalore 2025 - Online Payment, Receipt Download

December 18, 2024

9412+ views

Save on Taxes with HRA: Everything you need to know about house rent allowance under section 10 13A

December 17, 2024

10402+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

August 24, 2023

1002727+ views

Supreme Court Verdict on Society Maintenance Charges

December 17, 2024

54883+ views

December 26, 2024

42612+ views

Stamp Duty and Registration Charges in Bangalore in 2025

December 17, 2024

40414+ views

All You Need to Know about Revenue Stamps

December 17, 2024

39423+ views

Recent blogs in

December 26, 2024 by Suju

Understanding a Coparcener and Property Rights in a Hindu Undivided Family

December 26, 2024 by Vivek Mishra

Cancellation of Sale Deed: How It Works?

December 26, 2024 by Prakhar Sushant

Understanding Joint Ownership of Property: A Smart Approach to Investment

December 26, 2024 by Prakhar Sushant

Property Mutation: A Vital Step in Property Ownership

December 26, 2024 by Kruthi

Join the conversation!