Real Estate Legal Guide

Shop The Rent Agreement Template Online With Documents and Benefits

A shop rent agreement is a pivotal document that outlines the terms and conditions between a landlord and a tenant for the rental of commercial property. It delineates the responsibilities

December 30, 2024 by Priyanka Saha

Explore all blogs

Sale Deed: Your Guide to Property Ownership

Confused what is sale deed certificate?A sale deed is a vital legal document confirming property ownership transfer from seller to buyer, establishing proof of ownership. It's executed after agreeing on sale terms and conditions. This document transfers property rights and must be checked

Written by Kruthi

Published on December 31, 2024

Small Cash Loan on Aadhar Card: Instant Approval, No Paperwork in 2025

Small loans using Aadhaar cards have become a helpful solution for many Indians in need of money. Your Aadhaar card now makes it easier to get assistance without the hassle of lengthy paperwork or complicated processes. These loans are simple and accessible, offering a quick way to manage

Written by Kruthi

Published on December 31, 2024

Structure Stability Certificate: Ensuring Building Safety

Are you planning to purchase an existing property or have concerns regarding the stability of your building? In this blog, we will help you understand the importance of structural stability certificates and the requirements for obtaining them. Read on to learn how NoBroker can assist you

Written by Siri Hegde K

Published on December 31, 2024

The Legal Implications Of The Difference Between Ancestral Property And Inherited Property In India

Indian property laws can be confusing for many people, especially when it comes to ancestral and inherited property. This blog will help you understand the differences between these two types of property, their legal and tax implications, and how you can protect your rights as a property

Written by Siri Hegde K

Published on December 31, 2024

Floor Space Index (FSI) in Bangalore: Everything You Need to Know

In the bustling market of Bangalore, where every square foot counts, Floor Space Index (FSI) stands as the arbiter of a property's true potential and value. Wondering how it could be the game-changer in your next real estate

Written by Prakhar Sushant

Published on December 31, 2024

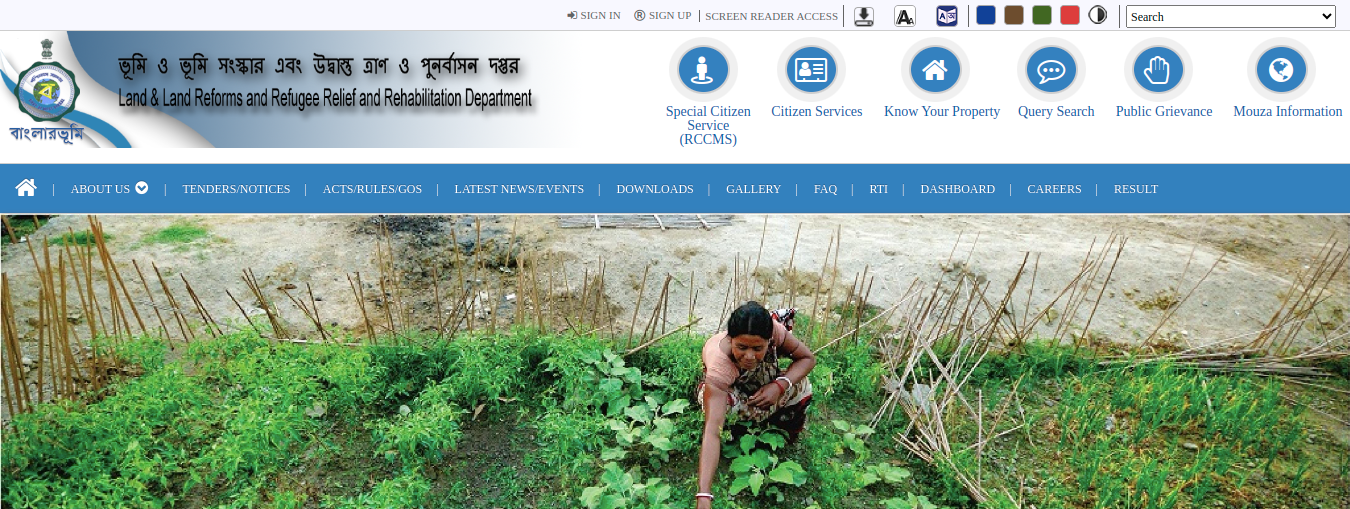

Banglarbhumi West Bengal Land Records and Khatian: Online/Offline Registration, Track Status and Mouza 2025

Banglarbhumi, also known as Banglarbhumi, is an online website portal to access the West Bengal land records. This initiative by the government of West Bengal is taken to make the citizens more accessible to any information related to land. The Banglarbhumi government website offers infor

Written by Kruthi

Published on December 31, 2024

Occupancy Certificate: Meaning, Importance, Documents and More

Stepping into another echelon of society, your home not only renders you with a sense of gratification but also security. But what if this security is not secure? Read more to find out about the Occupancy Certificate and how it can turn out to be a lifesaver.

Written by Kruthi

Published on December 31, 2024

Uttar Pradesh Rent Control Act Explained

The Uttar Pradesh Cabinet has promulgated the Uttar Pradesh Regulation of urban Premises Tenancy Ordinance, 2021. This law, also known as the UP-rent control act, has come into effect on January 11 2011. The new law will be replacing the UP Urban Buildings (Regulation of Letting, Rent and

Written by Vivek Mishra

Published on December 31, 2024