Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Rental Agreement Bond Papers: Sample, Assistance & more!

Table of Contents

Rental transactions are a fundamental aspect of the real estate world, and the paperwork involved can sometimes seem overwhelming. One crucial document that plays a significant role in rental agreements is the rental agreement bond paper. In this comprehensive guide, we will explore the ins and outs of rental agreement bond papers, why they are crucial, and how they benefit both tenants and landlords.

Understanding Rental Agreement Bond Papers

Rental agreement bond papers, often referred to as rental bonds, are legal documents that serve as a financial guarantee in rental agreements. These papers outline the terms and conditions of the rental, including the amount of money held as a security deposit and the conditions for its release.

The purpose of rental agreement bond papers is to protect the interests of both parties involved—the tenant and the landlord. They provide a clear framework for managing the security deposit and settling any disputes that may arise during or after the tenancy.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

How do Rental Bonds Work?

Rental bonds work by collecting a specific amount of money, known as bond money, from the tenant at the beginning of the rental agreement. This money acts as a security deposit, ensuring that the tenant fulfils their obligations, such as paying rent on time and maintaining the property in good condition.

The process of collecting and managing rental bonds typically involves holding the funds in a separate account or bond management platform. This account ensures that the bond money for rental property is safeguarded until the end of the tenancy. While traditional rental agreements might be printed on bond paper in some locations, the specific requirement depends on whether you plan to register the agreement.

Using bond management platforms can streamline this process for both tenants and landlords. These platforms provide transparency and ease of access to information regarding the bond, making it simpler to handle the deposit and any potential claims or refunds.

Government Rental Bonds Online

In some regions, government rental bonds online programs exist to provide an additional layer of security for tenants and landlords. These programs are designed to offer government-backed rental bonds, often with reduced administrative fees and added protection.

Utilising government rental bonds online can provide several advantages, including greater financial security, reduced administrative burdens, and peace of mind for both tenants and landlords. To access these services, tenants and landlords can inquire with their local housing authorities or visit official government websites.

- Month-to-Month Lease (Short-Term): This agreement renews automatically each month unless either party gives notice to terminate. It provides flexibility but may have higher rent.

By Purpose

- Residential Lease: This is the most common type, used for renting houses, apartments, or other living spaces.

- Commercial Lease: This is used for renting commercial properties like offices, retail spaces, or warehouses.

By Ownership Transfer Option

- Rent-to-Own Agreement: This allows the tenant the option to purchase the property after a set rental period. There are two variations:

- Lease Option Agreement: The tenant has the option to buy, but it's not mandatory.

- Lease-Purchase Agreement: The tenant is obligated to purchase the property at the end of the lease.

Rental Bond Assistance

Not all tenants can easily afford the upfront payment of a rental bond. For those in need of financial assistance, various options and resources are available. Some government programs or agencies offer rental bond assistance to eligible individuals or families.

These assistance programs can help tenants secure a rental property by providing financial support for the rental bond. Eligibility criteria and application processes may vary by location, so tenants should research available resources in their area.

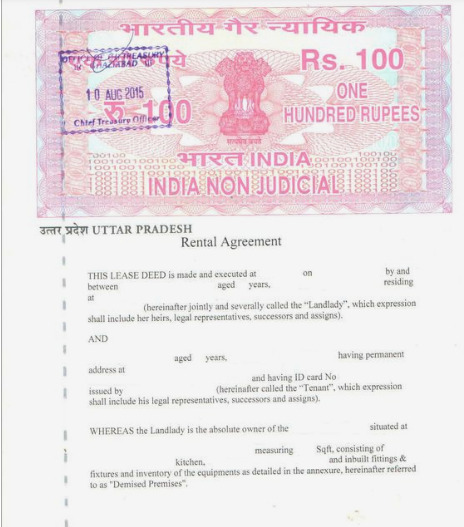

Bond Paper Sample

The Importance of Rental Bond Receipts

Rental bond receipts play a crucial role in ensuring transparency and accountability in rental agreements. For tenants and landlords alike, these receipts serve as documented proof of the security deposit payment.

Rental bond receipts should include essential information such as the amount paid, the date of payment, the property address, and the names of both the tenant and the landlord. Having a well-documented receipt can help prevent disputes and misunderstandings regarding the bond's amount or its return at the end of the tenancy.

Deposit Bonds for Rental Properties

Deposit bonds offer an alternative to traditional cash security deposits in rental agreements. Unlike cash deposits, deposit bonds are issued by insurance companies and act as a guarantee to the landlord.

Tenants can benefit from deposit bonds as they don't require a large upfront cash payment. However, it's essential to understand the potential drawbacks, such as the cost of purchasing the bond and the fact that tenants may still be responsible for any damage or unpaid rent.

Using Rental Bond Management Platforms

Managing rental bonds efficiently is crucial for both tenants and landlords. Fortunately, several rental bond management platforms are available online to streamline this process.

These platforms offer features such as secure deposit storage, automated notifications for rent payments, and easy tracking of bond-related transactions. Tenants can also explore tenancy agreements on such platforms, enabling them to create and manage comprehensive rental agreements, thus ensuring a smooth and organised rental experience.

Sample Rental Agreement Template

To help you get started with creating a rental agreement, we've provided a sample rental agreement template below. Please note that rental laws and regulations may vary by location, so it's essential to customise this template according to your specific needs and consult local legal resources if necessary.

[Sample Rental Agreement Template]

[Your Name/Landlord's Name], hereafter referred to as the "Landlord," and [Tenant's Name], hereafter referred to as the "Tenant," hereby agree to the following terms and conditions for the rental of the property located at [Property Address]:

1. Rental Property Description:

Describe the property being rented, including the address and any specific details.

2. Rental Term:

Specify the start date and duration of the rental agreement.

3. Rent Payment:

State the monthly rent amount, due date, and preferred payment method.

4. Security Deposit:

Mention the amount of the security deposit, how it will be held, and conditions for its return.

5. Maintenance and Repairs:

Clarify responsibilities for property maintenance and repairs.

6. Termination of Agreement:

Outline the process for terminating the rental agreement, including notice periods.

7. Additional Terms:

Include any additional terms or rules specific to the rental property.

8. Signatures:

Allocate a section for both the landlord and tenant to affix their signatures and date the agreement.

Please note that this is a sample template and should be customised to adhere to local rental laws and regulations. Consult with legal professionals if you have any questions or concerns about your rental agreement.

Rent Agreement Stamp Paper

In India, the need for stamp paper on a rental agreement depends on whether you plan to register the agreement or not:

- Unregistered Agreement: If your rental agreement is for less than 12 months, you can print it on a stamp paper with a minimum value, which is commonly Rs 100. However, specific requirements can vary by state. The rent agreement stamp paper value is ₹100

- Registered Agreement: For agreements lasting 12 months or more, it's recommended to get the agreement registered at the Sub-Registrar's office. The stamp duty for a registered agreement is based on the rent amount and agreement duration, not a flat fee.

Legal Considerations

Rental agreement bond papers are subject to legal regulations that vary by location. It's essential to be aware of the legal aspects that govern rental bonds in your area. Local rental laws and regulations may dictate the maximum amount for security deposits, the timeline for returning deposits, and other crucial details.

To ensure compliance with the law, tenants and landlords should educate themselves about the specific regulations in their region. Legal resources and local housing authorities can provide valuable information and guidance regarding rental agreement bond papers. Additionally, it's essential to be aware of common pitfalls and mistakes when creating rental agreements. For insights on what to avoid, check out our blog on "Mistakes to Avoid in Rental Agreement."

How Can NoBroker Help?

In conclusion, rental agreement bond papers are indispensable tools for both tenants and landlords. They establish clear guidelines for managing security deposits, safeguarding financial interests, and ensuring a fair and transparent rental process. However, navigating the legal intricacies of rental agreements can be daunting, especially when considering local regulations and potential disputes.

That's where NoBroker Legal Services comes to your assistance. Our team of experienced legal professionals is here to help you attain a rental agreement that protects your interests and complies with all relevant laws and regulations.

Don't let legal uncertainties stand in your way. Contact NoBroker Legal Services today to get the expert assistance you need in crafting and managing your rental agreement. Finding your peace of mind is just one click away!

Frequently Asked Questions

Ans: A rental agreement bond for rental property serves as a financial guarantee in rental agreements. It outlines the terms and conditions of the rental, including the security deposit, and plays a vital role in protecting the interests of both tenants and landlords.

Ans: A rental bond works by collecting a specific amount of money, known as bond money, from the tenant at the start of the rental agreement. This money acts as a security deposit to ensure that the tenant fulfils their obligations, such as paying rent on time and maintaining the property.

Ans: Yes, some regions offer government-backed rental bonds online programs. These programs provide government-backed rental bonds with benefits like reduced administrative fees and added security. These services can offer reassurance to both tenants and landlords.

Ans: Yes, there are options and resources available for tenants who need assistance with paying their rental bond. Some government programs or agencies offer rental bond assistance to eligible individuals or families. To access these services, tenants can inquire with their local housing authorities or visit official government websites.

Ans: Rental bond management platforms offer various benefits. They provide secure deposit storage, automated notifications for rent payments, and easy tracking of bond-related transactions. These tools streamline the rental bond process, making it more efficient and organised for both tenants and landlords.

Ans: The security deposit held in a rental agreement bond paper serves as a financial safety net. It can be used to cover unpaid rent, repair damages beyond normal wear and tear, or any other agreed-upon expenses at the end of the tenancy.

Ans: Yes, rental bonds are often issued as a bond certificate or insurance policy, while traditional cash security deposits involve a direct payment of money. Rental bonds may offer advantages like lower upfront costs, but tenants should be aware of their obligations.

Ans: Many regions have regulations that dictate the maximum amount a landlord can charge as a security deposit. It's crucial to be aware of local laws to ensure compliance and fairness in rental agreements.

Ans: Disputes related to the rental bond should be resolved through a fair and transparent process. Typically, both parties should document the property's condition at the beginning and end of the tenancy. If a dispute arises, mediation or legal channels may be necessary.

Ans: Not adhering to the terms outlined in a rental agreement bond paper can lead to legal consequences. Consequences may include the forfeiture of the security deposit, legal actions, or financial penalties, depending on the nature of the breach.

Recommended Reading

All You Need to Know About Property Disputes and How to Avoid Them

January 16, 2025

5534+ views

Non-Occupancy Charges: A Guide for Property Owners and Tenants

December 31, 2024

9355+ views

Uttar Pradesh Rent Control Act Explained

December 31, 2024

10030+ views

Leave and License Agreements: Meaning, Calculator, Format and Registration in 2025

December 31, 2024

15941+ views

The House Construction Agreement: The Key to a Successful Dream Project

December 27, 2024

5880+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

December 31, 2024

1046753+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

January 16, 2025

83459+ views

Supreme Court Verdict on Society Maintenance Charges

December 17, 2024

72337+ views

All You Need to Know about Revenue Stamps

December 17, 2024

60826+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

53065+ views

Recent blogs in

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

January 28, 2025 by Nivriti Saha

Stamp Duty and Property Registration Charges in Mumbai 2025

January 23, 2025 by Kruthi

What are the current Stamp Duty and Property Registration Charges in Karnataka for 2025?

January 23, 2025 by Prakhar Sushant

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025 by Vivek Mishra

Join the conversation!