Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Revenue Stamp in India: Meaning, Types, Uses, Legal Value & Where to Buy in 2025

Table of Contents

A revenue stamp is a small piece of paper that proves that the government tax or fee has been paid on the document. Introduced under the Indian Stamp Act, 1899, it is helpful for legal purposes, such as financial agreements, including rent receipts, contracts, and affidavits. The stamp shows that the document has been officially recognised and can be used in court. It is used by individuals, businesses, and legal professionals to prevent fraud and ensure tax compliance. As time changes, the concept of revenue stamps online has also gained popularity, making it easier for people to access and validate documents digitally. Understanding what a revenue stamp is will help you to stay informed and legally secure.

What is a Revenue Stamp?

It is a small stamp used on the document to show that the government verifies it. The main purpose is to provide proof of payment to the government. In India, the most commonly used revenue stamp is ₹1 and is usually affixed to transactions above ₹5,000. People can buy stamps at post offices, courts, or licensed stamp vendors. As everything is digital, people can also buy them online.

Revenue Stamp Requirement

A revenue stamp is required on certain documents to make them legally valid and to show that the government duty has been paid. It is mainly used in financial transactions and legal documents, such as a rental agreement, to avoid further disputes. Below are a few examples where it is required and why:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Document Type | When a Revenue Stamp is needed |

| Rent Receipt | When the monthly rent cash payment exceeds ₹5,000 |

| Affidavit | When it is notarised or presented in court |

| Agreement/Contract | When it involves a money transaction |

| Acknowledgement of Payment | For cash payment of ₹5,000 or more |

| Loan repayment receipt | When the repayment is done in cash and is above ₹5,000 |

| Gift Deed | When money or property transfer is involved |

| Commission Receipt | When commission paid in tax is more than ₹5,000 |

| Court Documents | For legal submission or a court requirement |

Types and Denominations of Revenue Stamps

Revenue stamps come in different types and values, depending on their purpose and use. They help make the document legal and are used for both court and non-court matters. The ₹1 revenue stamp is the most common stamp used in India. To make it legally valid, it is stuck on a cash payment receipt, over ₹5,000. This stamp will prove that the transaction occurred and is widely accepted in rent payments, loan repayments, and commission receipts. ₹1 revenue stamp is easily available and inexpensive.

Higher-value stamps are available in the market if people are looking for them. They can be ₹10, ₹20, ₹30, ₹100, or even more. They are usually used for legal purposes, like agreements, affidavits, and property transactions. Each stamp, whether it is ₹1 or more, has its own purpose, and the revenue stamp price depends on the document type and the money involved.

Type of Stamps

There are two different types of stamps: Judicial and Non-Judicial Stamps.

- Judicial Stamps: The Judicial stamps are used in court cases in legal proceedings (when you file a petition)

- Non-Judicial Stamps: Non-Judicial stamps are used for non-court matters like agreements, bonds, and affidavits.

The Revenue Stamp 'Receipts' Includes

- Acknowledging the receipt of any money, cheque, or promissory note, or any bill of exchange, or

- Acknowledging the receipt of any other movable property in satisfaction of a debt, or

- Acknowledging the satisfaction or discharge of any debt or demand, or any part of a debt or demand, or

- Which signifies or imports any such acknowledgement; and whether it is assigned to the same person or not.

Directorate of Registration and Stamp Revenue

Each city has their own directorate and revenue stamp use. This system acts as the collector of revenue stamps and their charges. Each state has their website for the directorate which makes transactions and records faster and more transparent.

Where can I get Revenue Stamps?

If you are wondering where to buy a revenue stamp, then your answer is easy. Revenue Stamps are available at all postal offices. Postal offices have made official comments that the revenue stamps are not available anywhere else, but you can find them in local shops, where you would have to pay a slightly higher price.

- Revenue stamp price in the Post Office - 100 paisa

- Revenue stamp cost in local shops - Re. 1

Digital Alternatives: E-Stamping

E-stamping is an easy and secure way to pay stamp duty online instead of using paper revenue stamps. It is a modern method that was introduced to reduce fraud and make the process faster and more reliable.

Benefits of E-Stamping

- Fast & Paperless: You do not need to visit the stamp vendor to buy a revenue stamp.

- Tamper Proof: Each e-stamp has a unique number that makes it safe.

- Hassle Free: You can buy a stamp from anywhere, and it saves time.

- Legally Valid: Digital stamps are legally valid and are accepted by the court and government offices.

Rent Receipt with Revenue Stamp

To claim HRA tax benefits, salaried individuals must submit rent receipts with a ₹1 revenue stamp, especially if rent exceeds ₹3,000 - ₹5,000 per month. The revenue stamp is used as proof of rent payment, even for digital transactions. It's not mandatory to provide a rent agreement, but the tenancy must be legally valid. Revenue stamps are available at post offices; avoid unreliable online sources to prevent using fake or invalid ones.

Who is Eligible for HRA?

If you live in rental housing and HRA is included in your pay, you can claim deductions. If you live in rental housing and are a salaried individual, you can take advantage of HRA exemptions to save money on taxes under Section 10 (13A) of the IT Act. HRA tax deduction is available to self-employed professionals under Section 80GG of the statute.

Rent Receipts and Their Benefits

A rent receipt is a record of a tenant's payment of rent to their landlord. When the landlord collects the rent from the tenant, he gives the tenant a rent receipt. If you are eligible, it can be used for legal concerns or tax benefits. Before the end of the financial year, you must submit vital documents to your employers, such as rent receipts and a rent agreement, in order to claim House Rent Allowance (HRA). If the rent exceeds Rs 1 lakh per annum, the landlord's PAN number is also necessary.

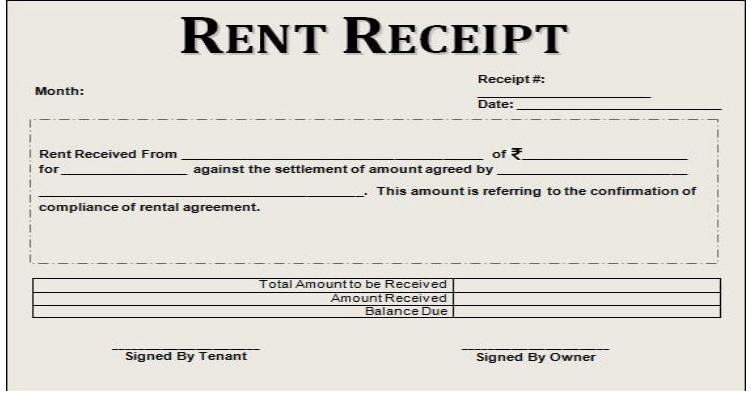

What are the Components of a filled Rent Receipt with a Revenue Stamp?

After generating a rent receipt online with a revenue stamp, check the receipt. To remain valid, rent receipts must include the following information:

- The landlord's name

- The tenant's name

- The property's address

- Term of Rental

- Amount of rent

- Payment method for rent (cash, cheque, online payment)

- The tenant's signature

- The landlord's signature

- If the cash payment is greater than Rs 5,000 per receipt, a revenue stamp required for cash payment is mandatory.

- If your yearly rent payment exceeds Rs 1 lakh or Rs 8,300 per month, you must provide the landlord's PAN.

Rent Receipt Format with Revenue Stamp

The photo below is an accurate representation of the rent receipt.

Revenue stamps have stayed in India for a long time and have increased to grow relevant. Revenue stamps are required for rent receipts, and all its details have been explained above. If you have more questions about stamp revenue, drop a comment here, and our team at NoBroker will get back to you promptly. Or head to NoBroker Forum to have all your questions answered. For any legal queries please contact our legal team by clicking the link below.

FAQs

Ans. Latest revenue stamps are easily available at your local shops and revenue stamp post offices. They do not cost more than Re 1.

Ans. If payment in cash exceeds Rs. 5000, a stamp must be placed on the receipt. A rent receipt with a revenue stamp becomes a legal document, indicating that payment has been received by the recipient and paid by the payer.

Ans. If you are not eligible for House Rent Allowance and have not claimed any expense for rent paid under any other provision of the income tax act, you can deduct the amount paid under Section 80GG.

Ans. If the landlord does not have a PAN card and charges more than Rs 1 lakh in annual rent, he must produce a written declaration along with Form 60. These documents can subsequently be submitted to the tenant's employer in order to receive HRA deductions

Ans. You may not be eligible to claim HRA exemption if your landlord does not give you a rent receipt. Before renting an apartment, make sure you and your landlord agree to a revenue stamp on the rent receipt.

Ans. You can get a revenue stamp at a post office, a court stamp vendor, or a licensed stamp store. You can also opt for an online stamp, which is easily available.

Recommended Reading

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115503+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

128528+ views

Revenue Stamp in India: Meaning, Types, Uses, Legal Value & Where to Buy in 2025

January 31, 2025

127962+ views

How to Get a Stay Order in India: Step-by-Step Legal Process in 2025

May 31, 2025

92779+ views

Doctrine of Adverse Possession: What It Means and How to Claim Property Rights in 2025

May 28, 2025

89550+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115503+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193637+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

133420+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

128528+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!