Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

SBI Home Loan Interest Certificate: Benefits, Offline and Online Options, Get via Yono App in 2025

Table of Contents

Did you know you can reduce your taxable income with the SBI home loan interest certificate? The SBI home loan interest certificate is a vital document the State Bank of India (SBI) provides to its home loan borrowers. This certificate proves the interest paid on your home loan, making it easier to claim deductions on your taxable income. In this blog, you’ll learn the importance, benefits, and process of obtaining an SBI home loan interest certificate.

What is the SBI Home Loan Interest Certificate?

The SBI home loan interest certificate is a document provided by the State Bank of India (SBI) to its home borrowers, stating the amount of interest paid on their home loan during a particular financial year. This certificate is typically issued at the end of each financial year and serves as proof of interest paid, making it easier for borrowers to claim tax benefits.

The SBI home loan interest certificate contains the following:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

- Borrower’s name and loan account number.

- Interest paid on the home loan during the financial year

- Period of which the interest was paid

- Outstanding principal amount

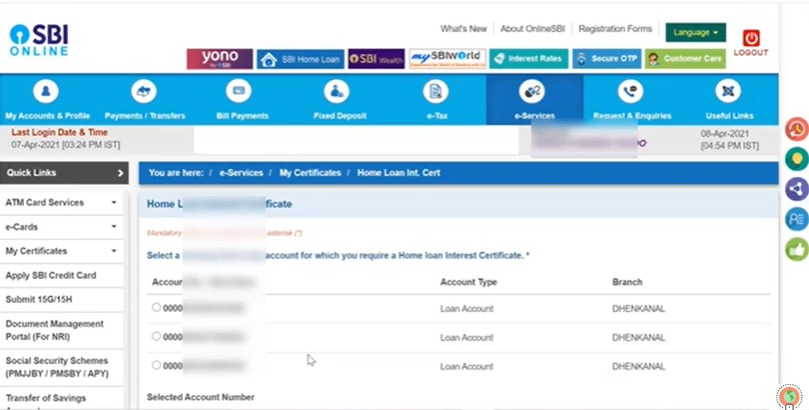

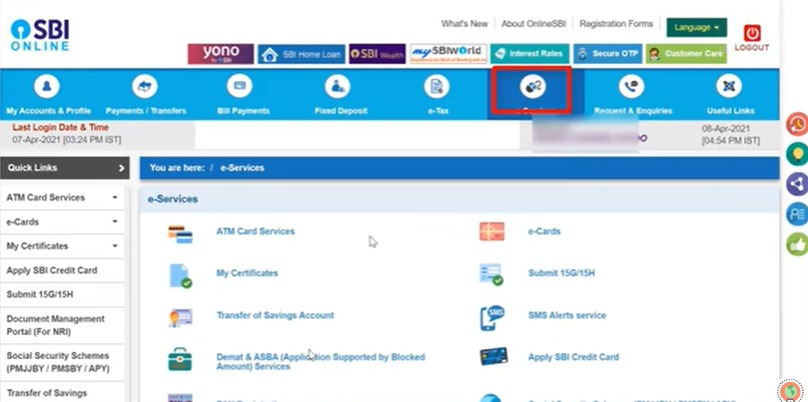

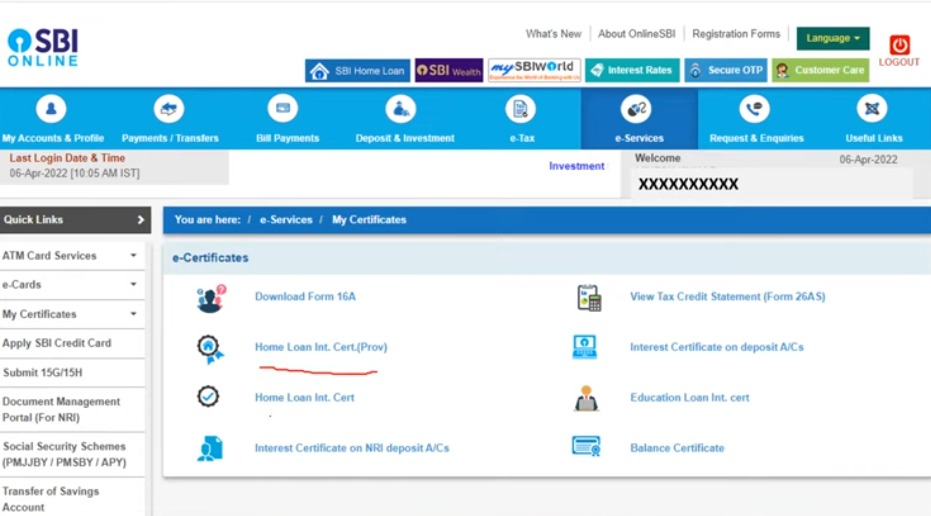

How to Download the Home Loan Interest Certificate SBI Online?

SBI home loan interest certificate is crucial for borrowers to take advantage of tax benefits and reduce tax liability. To download the home loan interest certificate from SBI online, follow these steps:

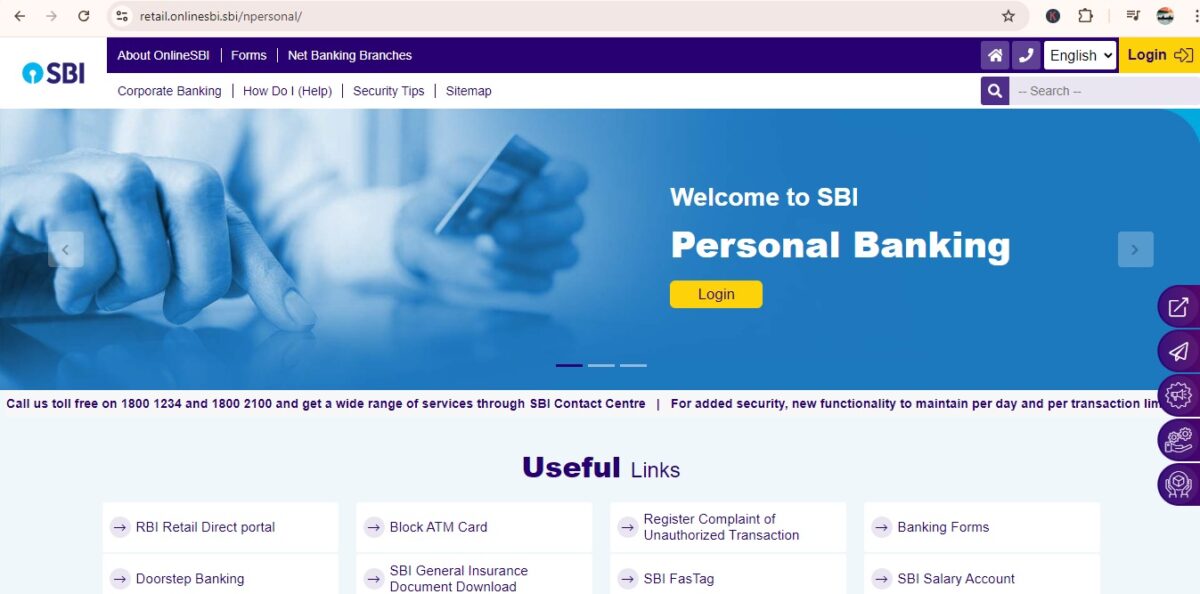

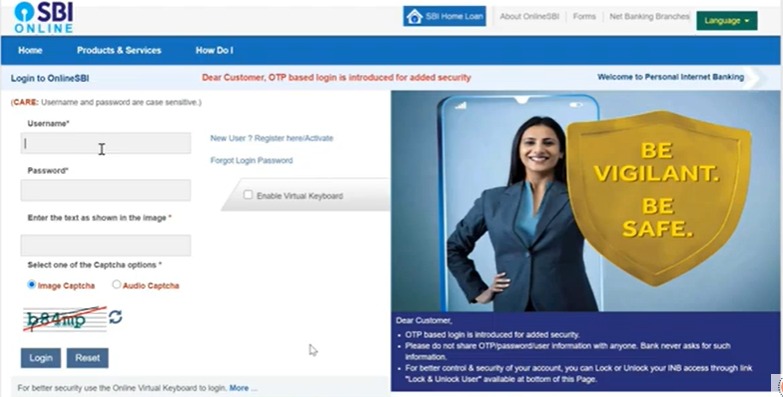

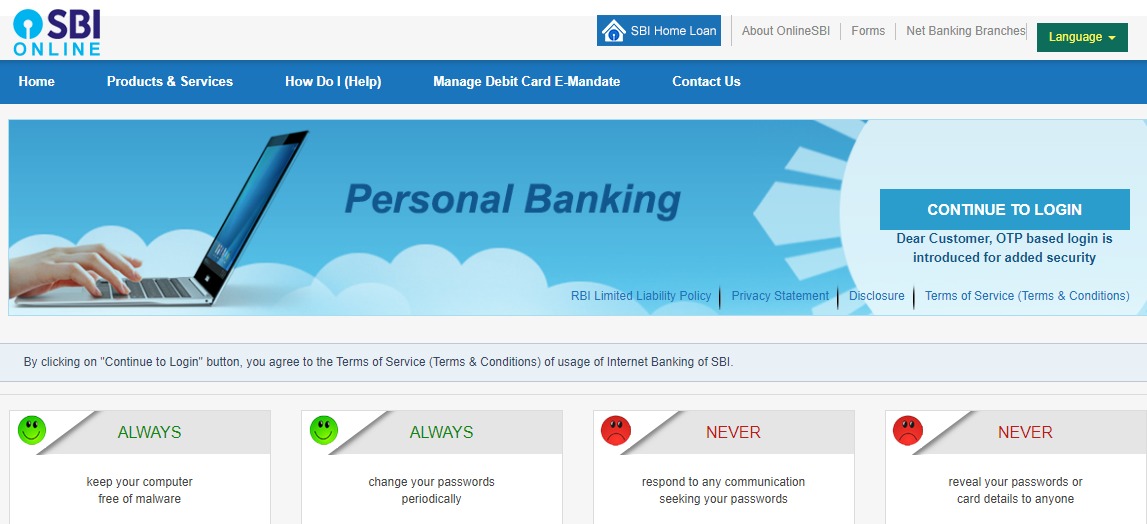

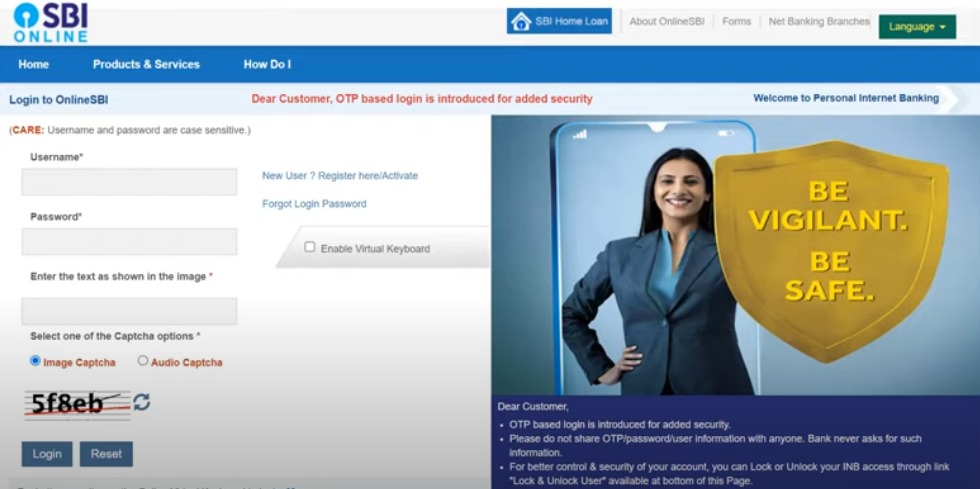

1. Visit the SBI online portal at http://retail.onlinesbi.sbi/npersonal.

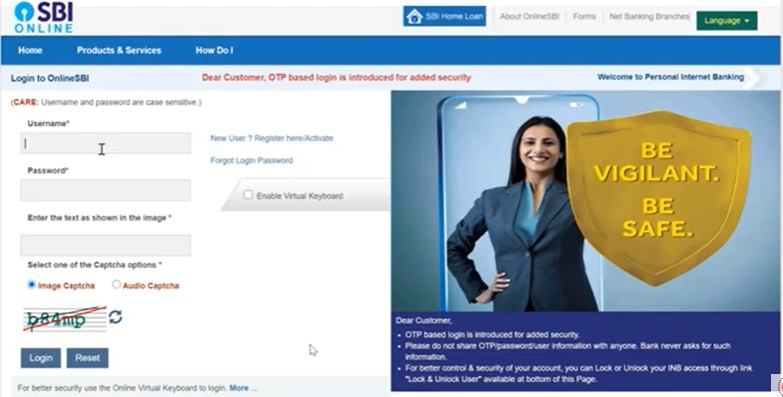

2. Sign into your account using your username and password.

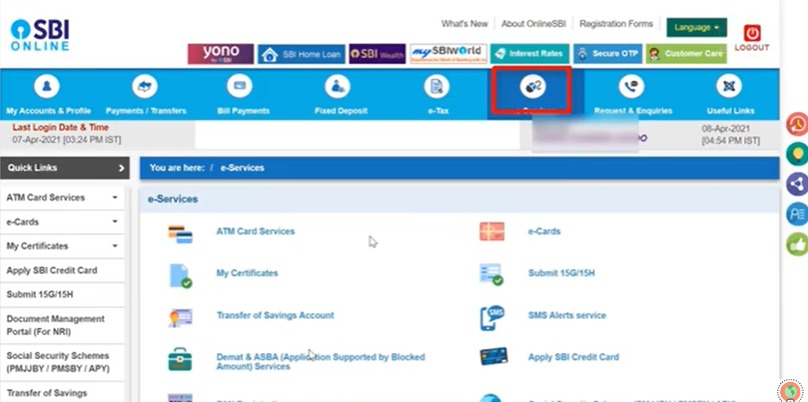

3. Click on the “E-Services “ tab.

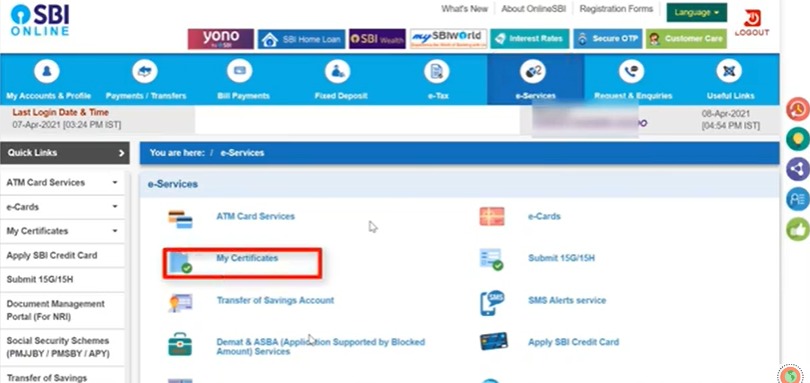

4. Click on the “My Certificates” option.

5. Select the financial year for which you want to download the certificate.

6. Click on the “Download” button.

8. The certificate will be downloaded in PDF format.

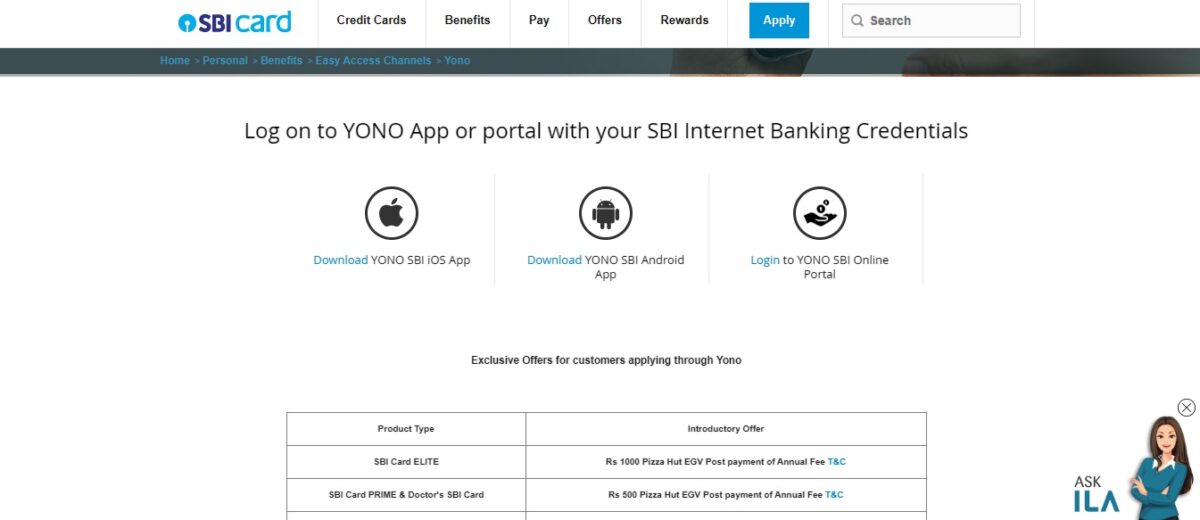

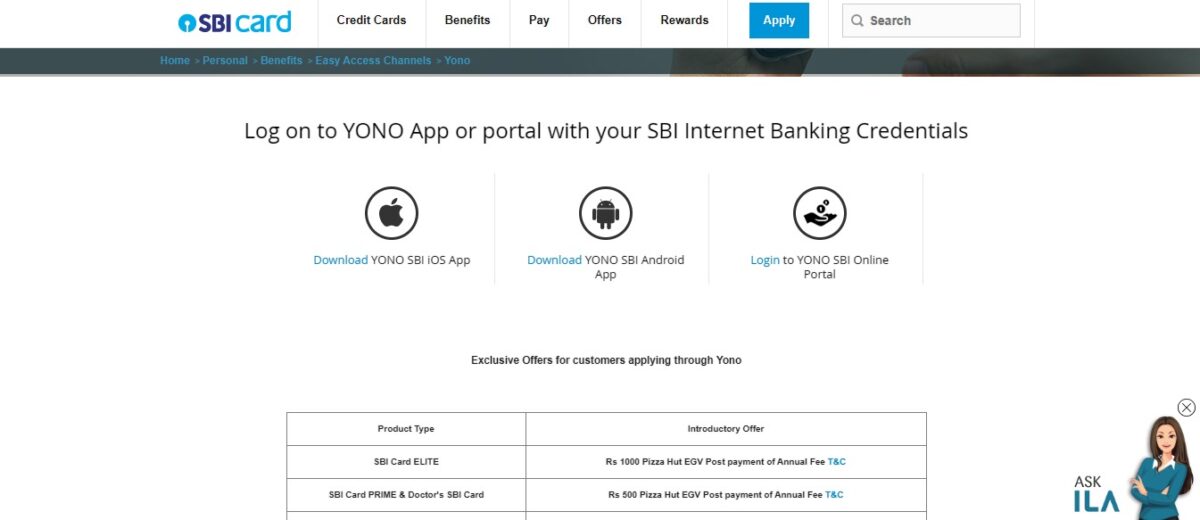

How to Download the Home Loan Interest Certificate from SBI YONO App

You can also download the home loan certificate from the SBI YONO app. Here’s how to download the certificate from the SBI YONO app:

1. Download and install the SBI YONO app on your mobile device.

2. Log into the app by entering your username and password.

3. Click on the “Home Loan” option.

4. Select the “TDS Enquiry” option.

5. Select the financial year you want to download the certificate.

6. Click on the “ Download” button.

7. The certificate will be downloaded in PDF format.

How to get the Home Loan Interest Certificate from SBI Offline?

To obtain the home loan interest certificate from SBI offline, follow these steps:

- Locate the nearest SBI branch.

- Visit the branch with your loan account passbook and proof of identification (Aadhar/PAN card).

- Meet the bank representative and request for the home loan interest certificate.

- Provide the required documents and loan account details.

- The representative will generate and hand over the certificate to you.

SBI Home Loan Interest Certificate Benefits

SBI home loan interest certificate has many benefits. Here are the benefits of obtaining an SBI home loan interest certificate:

- Enables balance transfer of your home loan to another lender with the certificate.

- It reduces taxable income, resulting in lower tax liability.

- It simplifies the tax filing processes.

- It supports tax planning and financial planning.

- You can get documented proof of interest paid on your home loan, making it easier to claim tax benefits.

What is the SBI Home Loan Provisional Certificate?

The SBI home loan provisional certificate is a temporary document issued by the State Bank of India (SBI) to its home loan borrowers. It provides provisional details of the interest paid on their home loan for a specific financial year. The provisional certificate is subject to change based on the actual interest paid on the home loan. Borrowers should verify the details with SBI before using the certificate for tax purposes.

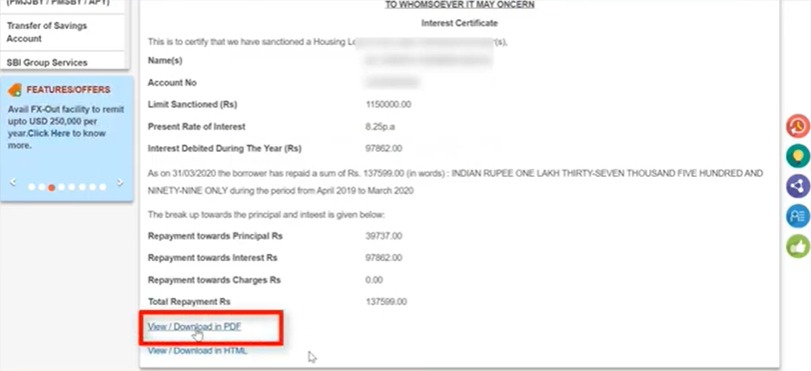

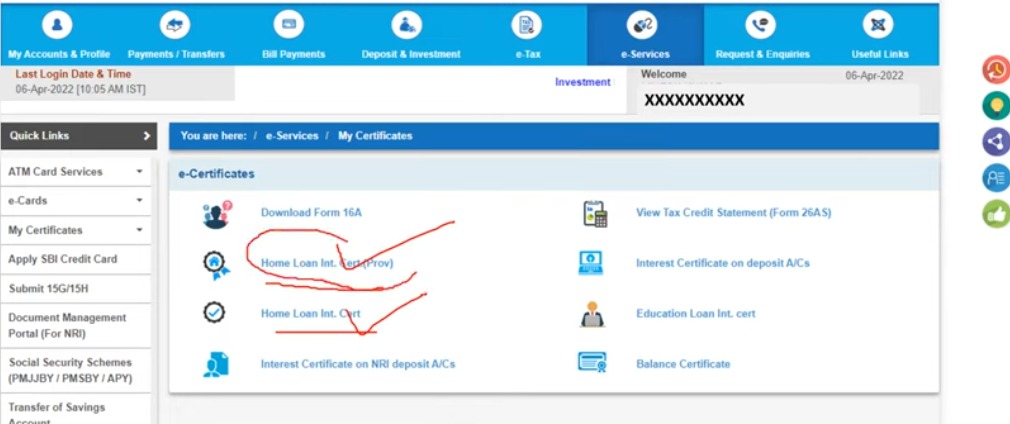

How to Download the SBI Home Loan Provisional Interest Certificate Online?

To download the SBI home loan provisional interest certificate online, follow these steps:

1. Visit the SBI online portal at https://retail.onlinesbi.sbi/retail/login.htm

2. Sign into your account using your username and password.

3. Click on the “E-Services“ tab.

4. Click on the “Provisional Interest Certificate” option.

5. Select “ download in pdf” option.

6. The certificate will be downloaded in the pdf format.

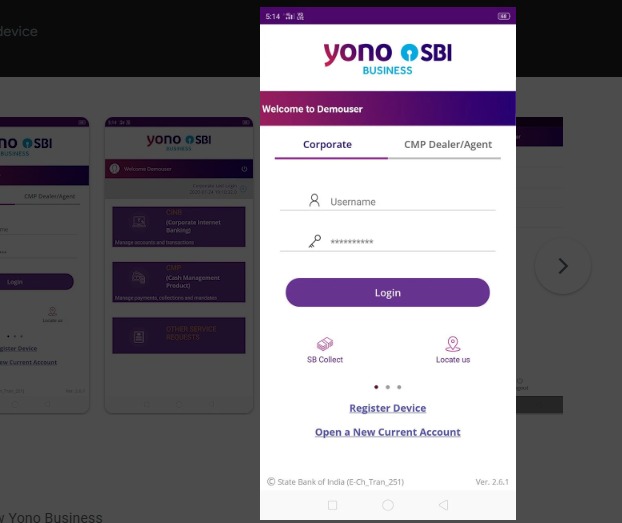

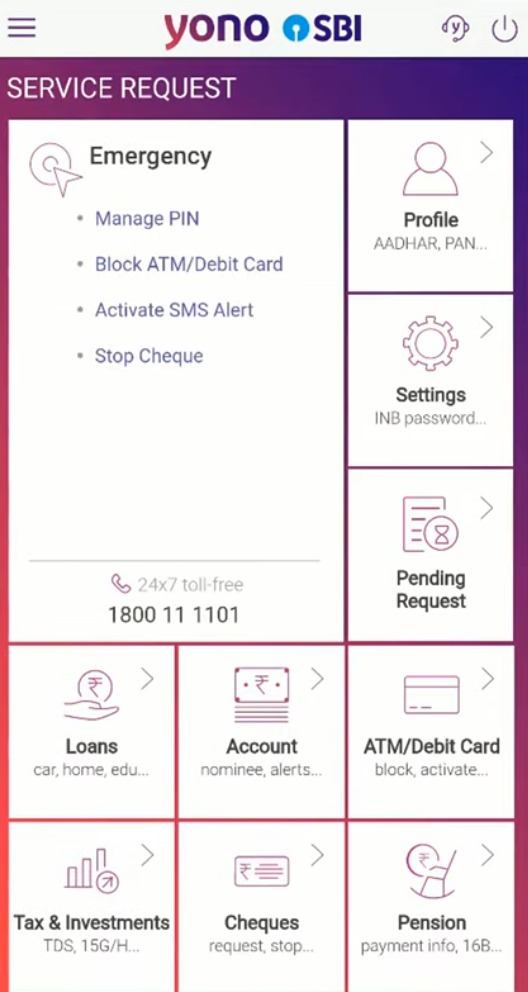

How to Download SBI Home Loan Provisional Interest Certificate Through YONO App

Here’s how to download SBI home loan provisional certificate through YONO app:

1. Download YONO app and install the app.

2. Login using the credentials.

3. Click on the “Service Request” option.

4. Select “Loan” option.

5. Select the financial year for which you want to download the certificate.

6. Click on the “Download” option.

7. The certificate will be downloaded in the pdf format.

What is the SBI home loan statement?

Owning a home is a dream for many, and the State Bank of India (SBI) provides convenient and flexible home loan options to help make this dream a reality. When you avail of an SBI home loan, it's essential to understand the concept of a home loan statement. Let's delve into what an SBI home loan statement entails:

Meaning and Significance:

- The SBI home loan statement is a document that provides a comprehensive overview of your home loan account.

- It contains essential details such as the loan amount, interest rate, repayment schedule, outstanding balance, and the amount paid towards principal and interest.

- The statement serves as a financial record and helps you track the progress of your loan repayment.

Obtaining the SBI Home Loan Statement:

SBI provides multiple methods to access your home loan statement conveniently.

- SBI YONO: If you have registered for SBI YONO, you can log in to the YONO app or website to view and download your home loan statement.

- SBI Online Banking: Through the SBI online banking portal, you can access your home loan statement by logging in to your account.

- SMS: You can also request your home loan statement by sending an SMS to the designated SBI number with the required keyword.

Importance of the SBI Home Loan Statement:

- Monitoring Loan Progress: The statement allows you to monitor your home loan's progress, including the outstanding balance and the portion of each payment that goes towards principal and interest.

- Financial Planning: With the statement, you can plan your finances effectively by understanding the remaining tenure, upcoming EMIs, and the impact of prepayments, if any.

- Tax Benefits: The home loan statement provides crucial information for claiming tax benefits on the principal and interest components of your loan.

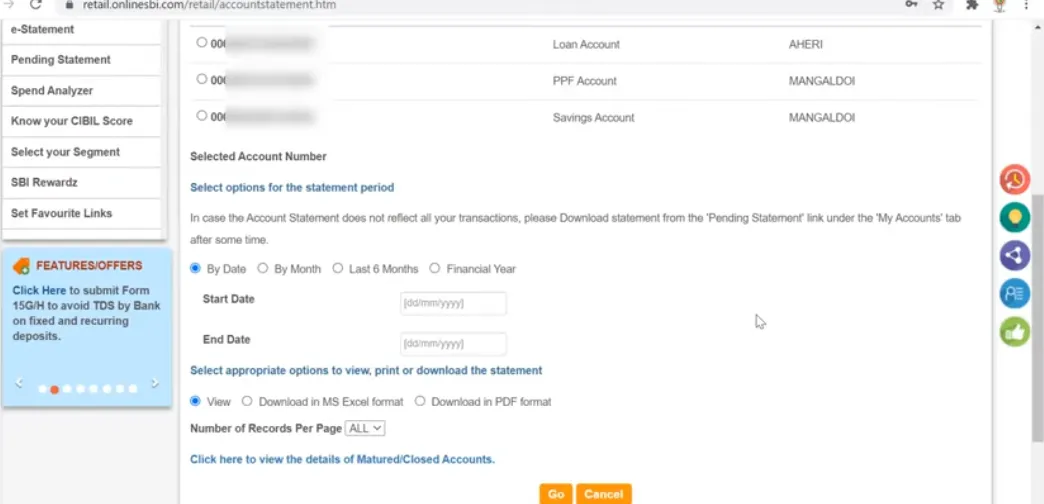

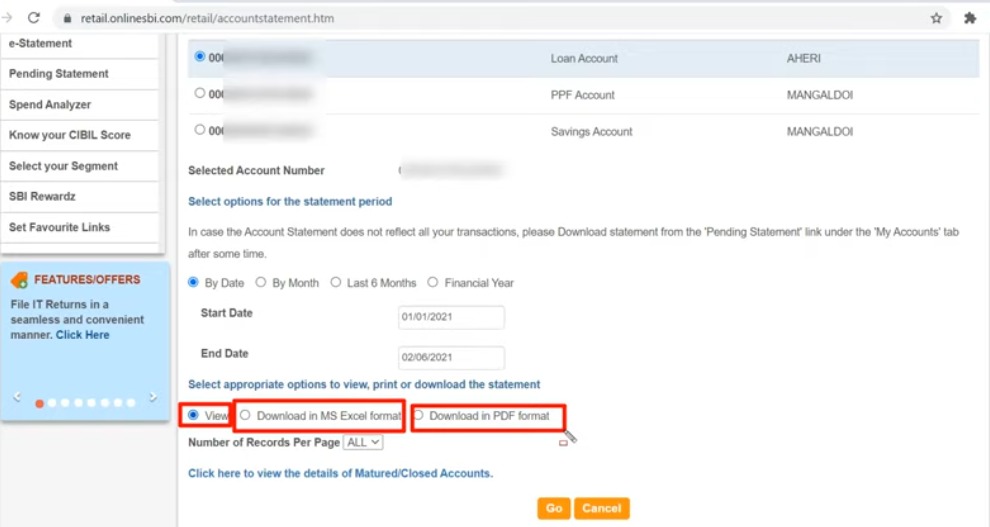

How to Download Loan Statement from SBI Online?

Both online and offline execution are viable options for this activity. You may receive the SBI Home Loan Statement by following the step-by-step method that is provided below, which will take you through the whole process:

1. Visit the SBI portal at https://retail.onlinesbi.sbi/retail/login.htm

2. Login using all the credentials.

3. Select the “Account Statement” option.

4. Select the type of loan account.

5. Enter the start and end date of your loan statement.

6. Select the “Download on PDF Format” option and click the ok button.

7. Your SBI home loan statement will be downloaded in pdf format.

Why do you need a Home Loan Interest Certificate?

A home loan interest certificate lets you claim tax benefits and align with tax laws. Here’s why you need a home loan certificate:

- Tax Benefits: This certificate helps you claim tax deductions on the interest paid on your loan under Section 24 of the Income Tax Act, 1961.

- Proof of Interest Paid: The certificate serves as proof of interest paid on your home loan, making it easier to claim tax benefits.

- Loan Account Details: The certificate contains essential details, such as the loan amount, interest rate, and repayment schedule.

- Tax Filing: The certificate is required when filing tax returns, as it provides the necessary information to claim tax deductions.

- Audit and Verification: The certificate may be required during tax audits or verification processes to validate the interest paid on your home loan.

- Loan Transfer or Closure: The certificate is required when transferring or closing your home loan account.

Advantages of Using SBI Home Loan Statement

House loan borrowers get a document known as a House Loan statement, which is intended to help them keep track of the amount of principal they have paid back on their home loans.

This document includes details on the overall amount paid and the outstanding amount as of the current date. Access to this information is beneficial when creating plans and preparing for one's future financial situation. It is also helpful to grasp the financial implications that would arise from the prepayment of the loan. This is because prepayment of the loan would result in financial ramifications.

Access to SBI Home Loan Statement and the Interest Certificate

You can access the statements and certificates for loans in SBI bank anytime during the year. You can either collect it from any SBI Home Loans office during their business hours or download it online and follow the processes explained above to do so.

You may also get a Provisional Interest Statement before the end of the current fiscal year, but, the detailed SBI interest certificate online for the previous fiscal year will only be available after the year has ended. A detailed home loan interest statement is required to prepare one's income tax return and financial planning for the next calendar year.

Getting an SBI home loan could be tricky. An expert will understand your requirements and guide you to the best home loan option according to your budgetary requirements. Comment below this article, and our executive will contact you soon.

NoBroker's Home Loan Services:

At NoBroker, we understand the significance of a seamless home loan experience. We offer various services to assist you throughout your home loan journey.

- Hassle-free Loan Comparison: Use our platform to compare different home loan options from various banks, including SBI, based on interest rates, tenure, and other parameters.

- Expert Guidance: Our team can guide you through the home loan process, helping you understand the documentation requirements, eligibility criteria, and loan repayment options.

- Online Application: Apply for an SBI home loan through NoBroker's platform, saving time and effort with our streamlined online application process.

FAQs: SBI Home Loan Interest Certificate

Ans: The Full form of SBI is the State Bank of India. It is the largest government and public-owned bank in India, offering home loans to millions of people every year.

Ans: SBI customers can go to the most convenient branch, hand in a written application that includes all of the essential information, and then quickly acquire the certificate.

Ans: If you go to onlineSBI.com, you can successfully download the certificate and print it.

Ans: The interest certificate for an SBI house loan can be used to summarise your home loan account and is useful for claiming tax benefits and understanding your loan's status. It also helps you keep track of your mortgage.

Ans: In 2025, SBI will offer home loans at 8% interest per annum, lower than most non-public banks offer. Both ICICI and HDFC will offer rates of 8.5% to 8.9% for home loans in 2025.

Recommended Reading

Home Loan Provisional Certificate

January 31, 2025

2771+ views

Loved what you read? Share it with others!

Most Viewed Articles

Home Loan Interest Rates for All Banks in March 2025

March 4, 2025

32715+ views

SBI Home Loan Interest Rates - Updated in March 2025

March 4, 2025

27585+ views

SBI Home Loan Interest Certificate: Benefits, Offline and Online Options, Get via Yono App in 2025

January 31, 2025

26996+ views

ICICI Home Loan Interest Rates - Updated in March 2025

March 4, 2025

24389+ views

Top 10 Housing Finance Companies in India

January 31, 2025

18583+ views

Recent blogs in

Union Bank Home Loan Interest Rates - Updated in March 2025

March 4, 2025 by NoBroker.com

SBI Home Loan Interest Rates - Updated in March 2025

March 4, 2025 by Siri Hegde K

IDBI Home Loan Interest Rates - Updated in March 2025

March 4, 2025 by NoBroker.com

HDFC Home Loan Interest Rates - Updated in March 2025

March 4, 2025 by NoBroker.com

Join the conversation!