Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Demystifying TDS on Commission under Section 194H of the Income Tax Act

Table of Contents

Commission or brokerage is a fee a broker or agent charges for their services in facilitating a transaction between two parties. It is a form of compensation for the broker's time, effort, and expertise in matching buyers and sellers, negotiating the transaction terms, and completing the paperwork.

What is Section 194H of the Income Tax Act, of 1961?

Section 194H of the Income Tax Act, 1961 deals with Tax Deduction at Source (TDS) on commission or brokerage by a resident individual. Under this section, any person (except for an individual or Hindu Undivided Family) paying commission or brokerage to a resident person is liable to deduct TDS at 5%.

The TDS should be deducted either at the time of payment or credit of the commission or brokerage, whichever is earlier. However, this section does not include commissions earned through insurance sales. If the payable amount exceeds INR 15,000, the TDS is mandatory. The individual who pays the commission or brokerage is liable for TDS under Section 194H since the commission or brokerage is a source of income.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

When Does TDS under Section 194H Need to be Deducted?

Under Section 194, entities are authorised to deduct TDS in two situations:

- When commission or brokerage amount is credited to the payee's account

- When commission or brokerage is paid to the payee's account through cash, demand draft or cheque.

Note: TDS is typically deducted between April and February and must be deposited by the 7th of the following month. For instance, if TDS on brokerage is deducted on 15th April, it must be deposited on or before 7th May.

Exemption on TDS on Commission

- TDS is not applicable when the amount of brokerage or commission is less than Rs. 15000 in a fiscal year.

- If employers pay commissions to employees, TDS is deducted under Section 192.

- Commission accrued on insurance income is exempt from TDS, and commission paid to loan underwriters is excluded from TDS on commission.

- Individuals holding lower TDS or NILTDS certificates from an authorized body are exempt from TDS.

- Payments made to the Financial Corporation under the purview of the central finance bill are exempt from TDS.

- Charges for providing warehouse services are also exempt from TDS.

- Interest accrued from the NRE account and payouts made by the Reserve Bank of India to banking institutions are exempt from TDS.

- Income generated from interest accrued on a savings account, recurring deposits, NSC, Kisan Vikas Patra, Indra Vikas Patra, etc., are exempt from TDS.

- Brokerage paid for issuing securities to the public is exempt from TDS.

- The commission charged on debit or credit card transactions between an acquirer bank and a merchant establishment is not included in Section 194H of the Income Tax Act.

What is the Interest Rate under Section 194H [TDS on Commission]?

The current rate of TDS on commission is 5%. However, it is worth noting that the rate was reduced to 3.75% for transactions conducted between May 14, 2020, and March 31, 2021. It is also important to note that if the commission or brokerage paid to a resident person exceeds Rs.15,000 in a year, TDS must be deducted at a rate of 5%.

If the deductee does not quote PAN, the rate of TDS on commission will be 20% in all cases. Additionally, TDS on commission applies to individuals and organizations that pay commission, including payments, commission, etc., on the sale of lottery tickets. Those who wish to apply for a lower TDS rate on commission may do so by filling out Form 13 and submitting it to the assessing officer under Section 197 of the Income Tax Act.

Note: The exemption of TDS on interest from listed debentures has been removed, meaning that tax has to be deducted on interest on such specified securities

Under What Circumstances TDS u/s 194H is Not Deductible?

TDS u/s 194H is not deductible in certain circumstances:

- If the amount or aggregate amounts of income to be credited or paid during the financial year are at most INR 15,000, no deduction shall be made under this section.

- Furthermore, if the amount of such income or the aggregate of such income credited or paid or likely to be credited or paid during the financial year to the account of or the payee does not exceed the prescribed limit, then no TDS u/s 194H is deductible.

- Additionally, TDS deduction under section 194H shall not apply to the payment of insurance commission, as this is covered under section 194D.

Note: The TDS rate for commission u/s 194H is 5%, with no surcharge or Health & Education Cess, and the rate of TDS will be 20% in all cases if the deductee does not quote PAN.

What is the Time Limit for Depositing TDS?

The time limit for depositing TDS (Tax Deducted at Source) on Commission varies depending on the payment entity.

- If the payment is made by or on behalf of the government, TDS must be deposited on the same day without using any challan form.

- For payments made in any other case, TDS must be deposited on or before seven days from the end of the month in which the deduction is made, accompanied by an income tax challan.

Note:

- A late filing fee may apply if TDS is not filed within the due date. The amount of the late filing fee varies depending on the delay in filing and the TDS amount due.

- If TDS is not deposited in whole or in part, interest at a rate of 1.5% per month or part of the month will be charged for the period from the date TDS was deducted to the actual date of deposit.

When Can Entities Claim NIL Tax or Lower Deduction Under Section 194H?

The TDS under Section 194H of the Income Tax Act applies to commission or brokerage payments. TDS must be deducted under Section 194H when the amount of commission or brokerage is credited to the payee's account or paid to the payee's account through cash, demand draft, or cheque.

However, under Section 197 of the Income Tax Act, 1961, entities can apply for a lower or NIL tax TDS certificate from the Income Tax Department. To be eligible for a lower or NIL-tax TDS certification under Section 197, the total income tax liability of the entity should be lower than the amount of TDS deducted in a given fiscal year. This means that if the TDS deducted is more than the total income tax liability, the entity can claim a lower TDS certificate to reduce the amount of TDS deduction.

The required documents include the following:

- Copies of assessment orders of the last three fiscal years

- PAN card

- Financial statement and audit report of the previous three fiscal years

- Income statement for the last 3 fiscal years and projection of earnings for the current fiscal year

- Income tax returns of the last 3 fiscal years with acknowledgement and enclosures

- TDS account number of paying parties, and e-TDS returns of the last 2 fiscal years

How Can NoBroker Help?

Section 194H of the Income Tax Act of 1961 is of significant importance regarding TDS on commission and brokerage. It mandates the deduction of TDS by the payer on any commission or brokerage exceeding INR 15,000 at a rate of 5%. This section aims to ensure that the government receives a certain percentage of the income generated through such transactions and to prevent tax evasion.

NoBroker Legal Services can assist with complying with Section 194H of the Income Tax Act, 1961, which pertains to TDS on commission and brokerage payments. Our team of experts can provide guidance on the legal requirements of this section and help ensure compliance by assisting with TDS deductions and filing returns. Additionally, the team can advise on the time of TDS deduction, which should be done at the earlier time of credit of commission or brokerage to the payee's account or the time of payment in cash or other modes.

FAQ's

Ans. Section 194H of the Income Tax Act mandates a tax deduction of 5% on commission or brokerage payments made to resident individuals or entities when the amount exceeds Rs. 15,000 in a financial year. The rate was 3.75% from May 14, 2020, to March 31, 2021, at a reduced rate as per COVID-19 relief measures.

Ans. To file a TDS return for commission payments, you must provide details about each deductee, including PAN, name, status, the amount paid, TDS deducted, date of deduction, date of payment/credit, and the section under which TDS is deducted. You can file TDS returns online through the government's e-filing website or seek assistance from a qualified tax professional.

Ans. If you have earned income from commission or brokerage, you must report it under the head "Profits and Gains from Business or Profession" while filing income tax returns. You should use the ITR-3 form if you are a partner in a partnership firm or a business proprietor, including those earning commission income.

Ans. You can claim various deductions and exemptions to reduce your taxable income and save tax on commission income. Some standard deductions include professional expenses, rent, interest on business loans, and depreciation on business assets. You can also invest in tax-saving instruments such as National Pension Scheme (NPS), Public Provident Fund (PPF), Equity-Linked Saving Scheme (ELSS), etc., to claim deductions under section 80C of the Income Tax Act.

Ans. As per Section 194H of the Income Tax Act, any person, except an individual or a Hindu Undivided Family, who pays commission or brokerage to a resident exceeding Rs. 15,000 in a financial year is liable to deduct TDS. The TDS must be deducted at 5% and deposited with the government by the 7th of the subsequent month.

Recommended Reading

BDA Property Tax Bangalore 2025 - Online Payment, Receipt Download

December 18, 2024

9169+ views

Save on Taxes with HRA: Everything you need to know about house rent allowance under section 10 13A

December 17, 2024

10252+ views

November 26, 2024

427+ views

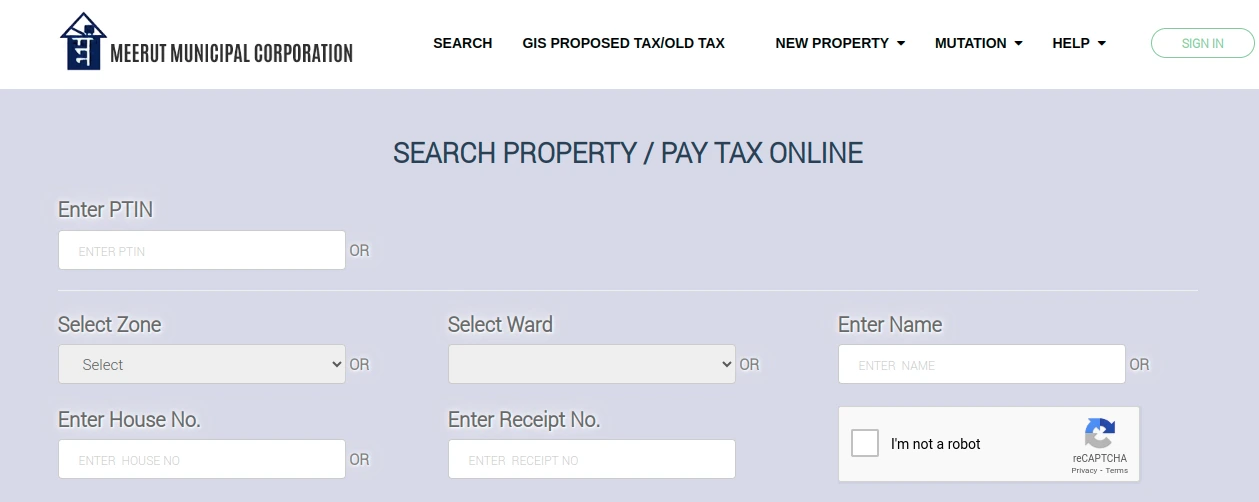

Meerut Nagar Nigam House Tax: A Complete Guide to Calculation, Payment & Rebates 2024

November 26, 2024

557+ views

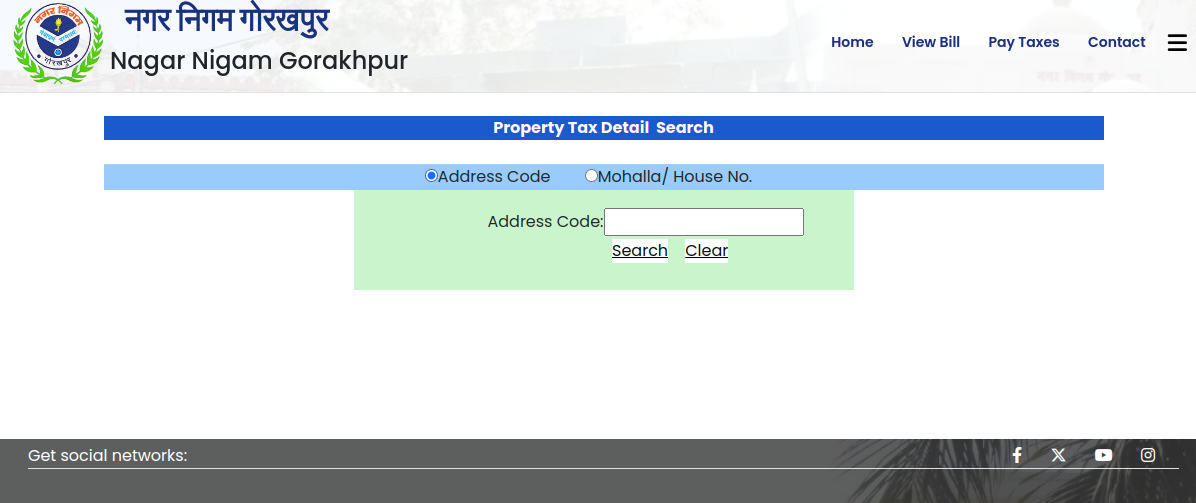

Nagar Nigam Gorakhpur House Tax Online and Offline Payment: Calculation and Receipt Download

November 26, 2024

333+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

August 24, 2023

1002349+ views

Supreme Court Verdict on Society Maintenance Charges

December 17, 2024

52934+ views

Stamp Duty and Registration Charges in Bangalore in 2025

December 17, 2024

38790+ views

December 9, 2024

38366+ views

All You Need to Know about Revenue Stamps

December 17, 2024

37344+ views

Recent blogs in

Succession Certificate: Fee, Documents, and Format

December 20, 2024 by Kruthi

Stamp Duty and Property Registration Charges in Hyderabad

December 20, 2024 by Jessica Solomon

Special Power of Attorney: Important Insights for 2025

December 19, 2024 by Jessica Solomon

Ensure The Smooth Transfer of Properties by Obtaining Your Tamil Nadu Varisu Certificate

December 19, 2024 by Kruthi

Allotment Letter: Types, Format of Writing & More 2025

December 19, 2024 by Kruthi

Join the conversation!