Table of Contents

Loved what you read? Share it with others!

Stamp Duty and Registration Charges in Thane 2025: Essential Information for Property Buyers & Seller

Table of Contents

Planning to invest in Thane’s real estate market? Get a clear understanding of the stamp duty and registration charges in Thane so you can make informed decisions. These charges are levied by the state government to validate property transactions, ensuring that the transfer of ownership is genuine and legally binding. In this article, you’ll learn an in-depth analysis of the charges, calculation methods, and payment processes involved in property registration.

Stamp Duty in Thane

Stamp duty is a tax levied by the Maharashtra government on property transactions, including buying, selling and transferring ownership of immovable properties in Thane. It is a mandatory payment required to legitimise property transactions and register documents. The primary goal of stamp duty is to validate property transactions, confirm ownership transfer, generate revenue for the state government, and prevent fraudulent activities.

Stamp Duty Rates in Thane

The stamp duty rate in Thane varies depending on the property type and owner’s gender. For residential properties, the state of Maharashtra charges 6% of the total property value as stamp duty, which includes 5% stamp duty and 1% local body tax. Several factors influence stamp duty rates in Thane, including property age, owner’s age, property type, location, and amenities.

Stamp Duty Rates for Male Property Owners

Male property owners in Thane are required to pay a stamp duty of 7% of the property value, which includes 5% stamp duty, 1% metro cess, and 1% local body tax for residential properties. For commercial properties, the stamp duty rate remains the same at 7% of the property value, comprising 5% stamp duty. Similarly, for plots or land, male owners must pay a stamp duty of 7% of the property value. In the case of gift deeds, the stamp duty rate ranges from 2% to 3% of the property value. For power of attorney, male owners are required to pay a stamp duty of ₹500 to ₹1000.

Stamp Duty Rates for Female Property Owners

Female property owners in Thane must pay a reduced stamp duty of 6% of the property value, which includes 4% stamp duty, 1% metro cess, and 1% local body tax for residential properties. For commercial properties, female owners also benefit from a lower stamp duty rate of 6% of the property value. Similarly, for plots or land, female property owners must pay a stamp duty of 6% of the property value. For power of attorney, female owners are required to pay a stamp duty of ₹500 to ₹1000.

Stamp Duty Rates for Joint Property Owners

Stamp duty rates for joint property owners in Thane vary depending on the owners' gender combination.

- Joint Ownership (Male + Female): The stamp duty rate is 7%, which includes 5% stamp duty, 1% local body tax, and 1% metro cess.

- Joint Ownership (Male + Male): The stamp duty rate is also 7%, with the same breakdown of 5% stamp duty and 1% local body tax.

- Joint Ownership (Female + Female): The stamp duty rate is 6%, consisting of 4% stamp duty and 1% local body tax.

Factors Affecting Stamp Duty in Thane

Here are some of the factors affecting stamp duty in Thane:

- Property Age: Newer properties may have higher stamp duty rates than older properties, as newer properties are typically more valuable.

- Property Location: Properties located in prime areas, such as central thane or areas with high demand, may attract higher stamp duty rates. Similarly, properties within municipal limits may have different rates than those outside.

- Owner’s Gender: Female property owners in Thane benefit from lower stamp duty rates (6%) compared to male owners (7%). This concession aims to promote women’s empowerment and encourage property ownership among women.

- Property Type: Different property types have varying stamp duty rates. For instance, commercial properties typically attract higher stamp duty rates than residential properties.

- Amenities: Properties with additional amenities, such as luxury features or proximity to infrastructure, may incur higher stamp duty rates.

Stamp Duty Registration Charges in Thane in 2024

Registration charges, also known as registration fees, are the costs associated with registering a property transaction with the relevant authorities in Thane. These charges are payable to the sub-registrar's office under the Registration Act of 1908. Understanding registration charges in Thane helps property buyers and sellers navigate the registration process efficiently.

Registration Charges for Properties Above ₹30 Lakh

For properties valued above ₹30 lakh, the registration fee is a flat of ₹30,000. To register properties above ₹30 lakh, owners must submit the required documents, like the sale deed, stamp duty receipt, property card, identity proof, and address proof.

Registration Charges for Properties Below ₹30 Lakh

For properties valued below ₹30 lakh, the registration fee is 1% of the property value. Stamp duty is payable, ranging from 6% to 7% of the property value. Additional charges, such as document scanning, indexing, and certification, may apply, ranging from ₹50 to ₹1000.

Factors Affecting Registration Charges in Thane

Here are the key factors affecting registration charges in Thane:

- Property Value: Registration charges are calculated as a percentage of the property value. Higher-value properties result in higher registration charges.

- Property Type: Different property types have varying registration charges. Commercial properties typically attract higher charges.

- Government Policies: Changes in government policies, laws, or regulations can impact registration charges.

- Market Trends: Registration charges may be adjusted based on market trends and economic conditions. During economic downturns, the government may reduce charges to stimulate property sales.

Calculating Stamp Duty and Registration Charges in Thane

When purchasing property in Thane, buyers must pay stamp duty and registration charges, which are mandatory for legal ownership transfer. Here’s how to calculate the stamp duty and registration charges in Thane:

Step-by-Step Guide to Calculate Stamp Duty in Thane

Here’s a step-by-step guide to calculate stamp duty in Thane:

- Determine the property value by obtaining a valuation report or using online tools.

- Identify the property type: residential, commercial, industrial, or agricultural.

- Determine the owner’s gender: male, female, or joint ownership.

- Check the applicable stamp duty rate: 7% for male owners and 6% for female owners.

- Calculate the stamp duty amount by multiplying the property value by the stamp duty rate.

- Add metro cess (1% of property value) and local body tax (1% of property value).

- Calculate the total stamp duty payable by adding the stamp duty amount and additional charges.

- Verify the calculation using the Maharashtra Government’s stamp duty calculator.

Step-by-Step Guide to Calculate Registration Charges in Thane

Here’s the step-by-step guide to calculate registration charges in Thane:

- Determine the property value by obtaining a valuation report or using online tools.

- Identify the property type: residential, commercial, industrial or agricultural.

- Determine the owner's gender: male, female or joint ownership.

- Calculate the stamp duty amount using the applicable rate, i.e. 7% for male owners and 6% for female owners.

- Calculate the registration fee: 1% of property value for properties below ₹30 lakh, ₹30,000 for properties above ₹30 lakh.

- Calculate the total registration charges by adding stamp duty, registration fee, and other charges.

- Verify the calculation using the Maharashtra Government’s registration charge calculator.

Examples of Stamp Duty and Registration Charges Calculation

Here are some examples of stamp duty and registration charges calculation:

Example 1: Residential property (Male Owner)

- Property value - ₹50 lakh

- Stamp duty rate - 7% (5% stamp duty + 1% metro cess + 1% local body tax)

- Stamp duty amount - ₹50 lakh × 7% = ₹3.5 lakh

- Registration fee - ₹30,000

- Total registration charges - ₹3.5 lakh + ₹30,000 = ₹3.53 lakh

Example 2: Residential property (Female Owner)

- Property value - ₹50 lakh

- Stamp duty rate - 6% (4% stamp duty + 1% metro cess + 1% local body tax)

- Stamp duty amount - ₹50 lakh × 6% = ₹3 lakh

- Registration fee - ₹30,000

- Total registration charges - ₹3 lakh + ₹30,000 = ₹3.03 lakh

Paying Stamp Duty and Registration Charges in Thane

In Thane, stamp duty and registration charges can be paid through online or offline. Here’s how to pay stamp duty and registration charges in Thane through both online and offline methods:

Online Payment Method

The online payment method for stamp duty and registration charges in Thane offers a convenient and secure way to pay fees through the Maharashtra government’s e-payment portal.

Steps to Pay Stamp Duty and Registration Charges Online

Here are the steps on how to pay stamp duty and registration charges online:

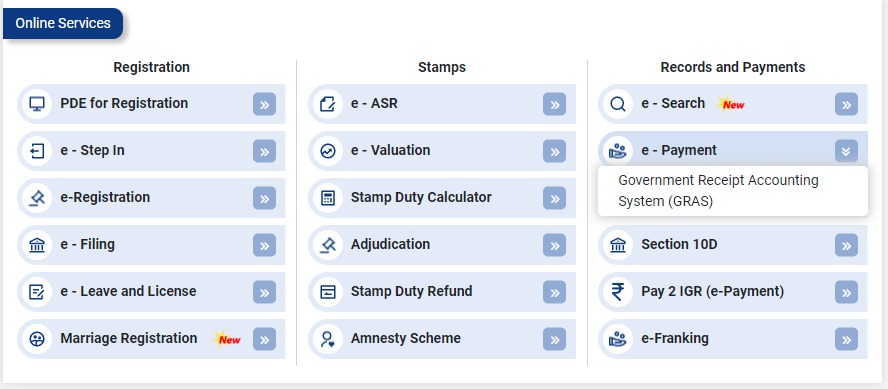

1. Visit the Maharashtra Government e-Payment portal (https://igrmaharashtra.gov.in/Home ).

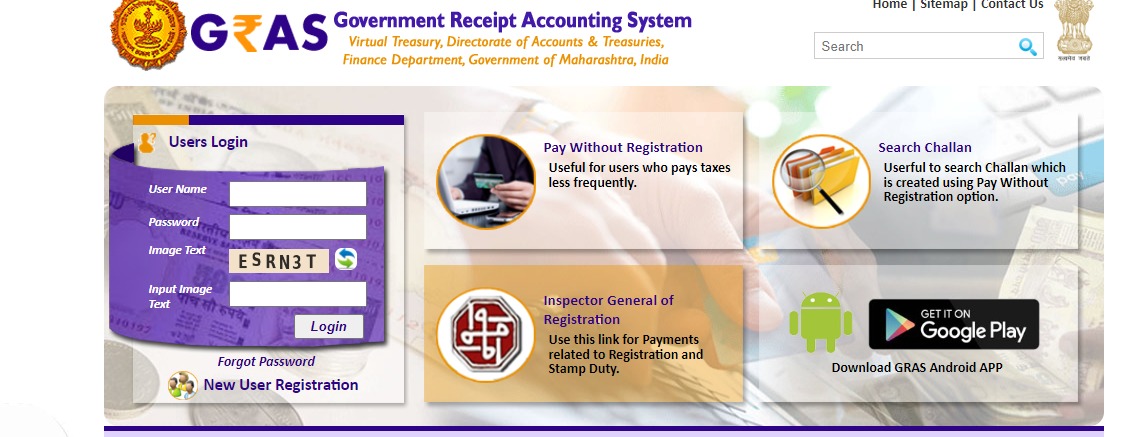

2. Click on “e-Payment” and select the “Government Receipt Accounting System (GRAS)” option.

3. Then click on the stamp duty and registration charges payment option.

4. Then, under the citizen option, click make payment to register your document option.

5. Enter required details: property value, owner’s name, property type, and location.

6. Calculate the stamp duty and registration charges using the online calculator.

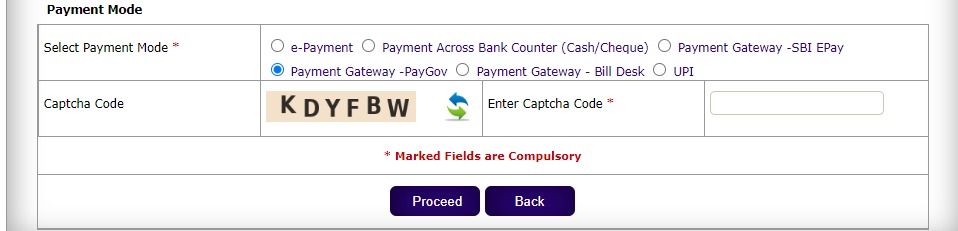

7. Select the payment option: net banking, debit/credit card, or UPI.

8. Make payment and receive payment confirmation.

9. Download and print payment receipt.

Offline Payment Method

The offline payment method for paying stamp duty and registration fees in Thane involves paying charges through authorised banks. This traditional payment method requires submitting physical documents and payment receipts to the Sub-Registrar’s office for registration.

Steps to Pay Stamp Duty and Registration Charges Offline

Here’s how to pay stamp duty and registration charges offline:

- Obtain a challan from the Sub-Registrar’s office or authorised banks.

- Fill in the challan with the required details: property value, owner’s name, property type, and location.

- Visit an authorised bank and deposit the payment.

- Receive a payment receipt and stamp duty challan.

- Submit the receipt and challan to the Sub-Registrar’s office.

Tax Benefits and Exemptions

Here are tax benefits and exemptions related to stamp duty and registration charges in Thane:

Tax Benefits:

- Exemption from stamp duty payment on property transfer between family members (spouse, parent, child).

- Concession in stamp duty for women owners (6% instead of 7%).

- Reduced stamp duty for senior citizens (5% instead of 7%).

- Exemption from payment of registration fees for properties below ₹5 lakh.

Exemptions:

- Properties owned by government entities, local authorities, and charitable trusts.

- Transfer of property due to inheritance or gift.

- Properties registered under the Maharashtra Housing and Area Development Act (MHADA).

- Properties registered under the Slum Rehabilitation Authority (SRA).

Concessions:

- 10% concession on stamp duty for properties registered within 6 months of purchase.

- 5% concession on stamp duty for properties registered within 1 year of purchase.

Deductions:

- Section 80C of the Income Tax Act: Deduction on stamp duty and registration fees.

- Section 24 of the Income Tax Act: Deduction on interest paid on home loan.

Claim Process:

Here’s how to claim tax deductions and benefits in Thane:

- Gather documents like sale deeds, gift deeds, wills, property cards, and identity proof.

- Apply to the Sub-Registrar’s office by attaching supporting documents.

- Verification of documents and eligibility.

- The Sub-Registrar will issue an exemption sanction order.

Stamp Duty Refund Process in Thane

The Department of Stamps and Registration has introduced a module to allow citizens to easily apply for a refund of stamp duty or registration fees. Here’s the stamp duty refund process in Thane:

- Accurately fill out the refund application form.

- Make changes to the data if needed.

- Complete the application and necessary affidavit.

- Submit the details and receive a Refund ID Number.

- Track the status of applications and receive updates via SMS.

- Download copies of letters issued by the authorities.

Helpline Number

Here are some of the helpline numbers for stamp duty and registration charges in Thane:

- Maharashtra Government’s Department of Registration and Stamps: 022-22166565

- Thane Municipal Corporation: 022-25344747

Pay Your Stamp Duty and Registration Charges with NoBroker

Stamp duty and registration charges in Thane play an important role in the property-buying process, impacting the overall cost of ownership. Understanding the applicable rates, exemptions, and calculation methods is essential for individuals and businesses. Still worried about how to make payments in Thane? NoBroker pay enables secure and convenient online payments for stamp duty and registration fees in Thane. You can also track payment status in real-time. Download the NoBroker app today!

FAQs About Stamp Duty and Registration Charges in Thane

Q1: How much is the stamp duty and registration charges for resale flats in Thane?

Ans: The stamp duty for resale flats in Thane ranges from 5% to 7% of the property value for male owners and 4% to 6% for female owners.

Q2: Are there any exemptions from stamp duty?

Ans: Yes, exemptions apply to senior citizens, women owners, and certain property types.

Q3: What documents are required for stamp duty and registration?

Ans: Sale deed, property card, identity proof, and payment receipts.

Q4: Can I claim tax benefits on stamp duty and registration charges?

Ans: You can claim tax benefits on stamp duty and registration charges under section 80C of the Income Tax Act.

Q5: What are the flat registration charges in Thane?

Ans: In Thane, flat registration charges are ₹30,000 for properties above ₹30 lakh and 1% of property value for up to ₹30 lakh.

Recommended Reading

Stamp Duty and Registration Charges in Bangalore in 2026

January 23, 2025

123094+ views

January 31, 2025

102186+ views

What are the current Stamp Duty and Property Registration Charges in Karnataka

January 23, 2025

82326+ views

Complete Details about Stamp Duty and Registration Charges in Telangana

January 31, 2025

80394+ views

Stamp Duty and Property Registration Charges in Mumbai 2026

January 23, 2025

63366+ views

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116952+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

201651+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

146104+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Rectification Deed Format and Process in India 2026

June 1, 2025

136368+ views

Loved what you read? Share it with others!

Recent blogs in

Article 35 I Lease Rent Deed: Process, Calculation and Legal Guidelines in 2026

March 9, 2026 by Kiran K S

Deed of Variation Lease: Meaning, Format & Legal Process Explained in 2026

March 9, 2026 by Manasvi Bachhav

Full RM + FRM support

Full RM + FRM support

Join the conversation!