Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Stamp Duty and Registration Charges in Navi Mumbai: What Homebuyers Need to Know 2025

Table of Contents

Did you know that stamp duty in Navi Mumbai is 6% of the market value? Stamp duty and registration charges in Navi Mumbai are mandatory fees paid to the Maharashtra government to verify the authenticity of property ownership. When buying or selling a property in Navi Mumbai, understanding the stamp duty and registration is pivotal to ensure a smooth and compliant transaction. In this blog, you’ll learn about current rates, calculations, exemptions and concessions in Navi Mumbai.

Stamp Duty in Navi Mumbai

Stamp duty is a type of tax levied by the Maharashtra government on property transactions, including buying, selling, and transferring ownership of immovable properties in Navi Mumbai. It is a mandatory payment required to legitimise and register property documents. The stamp duty rate for males is 6%, and for females, it’s 5% of the property value.

How Stamp Duty is Calculated in Navi Mumbai

Stamp duty in Navi Mumbai is determined on the ready reckoner rate or the property value, whichever is higher. Here are steps on how stamp duty is calculated in Navi Mumbai:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

- Visit the stamp duty calculator website of Navi Mumbai - https://igrmahhelpline.gov.in/stamp-duty-calculator.php

- Select the type of stamp duty from the options like - sale deed, gift deed, agreement to sale, leave and licence, or equitable mortgage.

- Then, select your municipality/corporation from the options given.

- Enter the details like consideration amount and market value and click submit. (Note: You will get the market value under the e-ASR section of https://igrmaharashtra.gov.in/Home website.)

- Then, you will get the stamp duty details.

Factors Affecting Stamp Duty in Navi Mumbai

Here are the factors affecting stamp duty in Navi Mumbai:

- Type of Property: The type of property, whether residential, commercial, or plot/land, plays a significant role in determining stamp duty rates in Navi Mumbai. The property’s value, either market value or agreement value, whichever is higher, serves as the basis for determining stamp duty.

- Location: The property’s location also affects the stamp duty, with properties closer to infrastructure and amenities attracting higher rates. The property’s size, including the built-up and carpet areas, also influences the stamp duty calculation.

- Government Policies: Changes to the Maharashtra Stamp Act, 1958, and state government notifications can lead to fluctuations in the stamp duty rates. Municipal Corporation regulations and amendments also impact stamp duty calculations.

- Transaction Type: The type of transaction (sale, gift, mortgage, lease) affects stamp duty rates. Payment structures, such as cash or instalments, and agreement terms also influence stamp duty.

- Other Factors: Exemptions and concessions, such as those for first-time homebuyers or affordable housing, may apply. Stamp duty rates vary depending on the specific location within Navi Mumbai.

Registration Charges in Navi Mumbai

Registration charges in Navi Mumbai refer to the fees paid to the Maharashtra government for registering property documents, which ensures legitimacy and property ownership. The property registration charge is 1% of the property value.

How Registration Charges are Calculated in Navi Mumbai

Here’s how to calculate registration charges in Navi Mumbai:

- For properties above ₹30 Lakh, the registration fee is ₹30,000.

- For properties below ₹30 Lakh, the registration fee is 1% of the property value.

Factors Affecting Registration Charges in Navi Mumbai

Here are the factors affecting registration charges in Navi Mumbai:

- Property Type: Residential, commercial, or plot/land properties have different stamp duty rates.

- Property Value: Market or agreement value determines registration fee and stamp duty.

- Property Size: The built-up area and carpet area affect registration charges.

- Location: Proximity to infrastructure, amenities, and services influences property value.

- Amenities and Facilities: Availability and quality of amenities contribute to property value.

Stamp Duty and Registration Charges for Different Types of Property Owners

Stamp duty and registration charges in Navi Mumbai vary by property type and owner category. Here are the stamp duty and registration fees for different types of property owners:

| Type of Property Owners | Stamp Duty Rates | Registration Charges |

| Males | 6% of the market value | 1% of the property value |

| Females | 5% of the market value | 1% of the property value |

| Joint ownership (Male + Female) | 6% of the market value | 1% of the property value |

| Joint Ownership (Male + Male) | 6% of the market value | 1% of the property value |

| Joint Ownership (Female + Female) | 5% of the market value | 1% of the property value |

Stamp Duty and Registration Charges for Resale Flats in Navi Mumbai

For resale flats in Navi Mumbai, stamp duty is 5% of the property’s market or agreement value, whichever is higher. The registration fee ranges from 0.5% to 1% of the property’s value. Women buyers, senior citizens, and government employees are eligible for a 1% concession on stamp duty.

Factors Affecting Stamp Duty and Registration Charges for Resale Flats in Navi Mumbai

Here are the factors affecting stamp duty and registration charges for resale flats in Navi Mumbai:

- Property: The type of property determines the applicable stamp duty rate. Property value, either market or agreement value, serves as the basis for determining stamp duty and registration charges. Location, particularly proximity to infrastructure and amenities, influences property value. The age of the property also affects stamp duty, with older properties potentially attracting lower rates.

- Ownership: The owner’s residence status affects tax implications. Women buyers and senior citizens are eligible for concessions. The owner’s profile, including income and occupation, influences registration charges.

- Economic Factors: Market fluctuations impact property values. Inflation affects, and interest rates also influence property values.

- Documentation: Proper documentation ensures seamless registration. Also, compliance with regulations avoids additional costs.

How to Pay Stamp Duty and Registration Charges in Navi Mumbai

Paying stamp duty and registration charges is a major step in property transactions in Navi Mumbai. The Maharashtra Government mandates payment of 5% stamp duty and 1% registration fee on property sales. To ensure secure registration, it’s essential to follow the prescribed procedures. By following these steps, property buyers can securely complete their transactions.

Step-by-Step Guide for Paying Stamp Duty and Registration Charges Online in Navi Mumbai

Here is the step-by-step guide for paying stamp duty and registration charges online in Navi Mumbai:

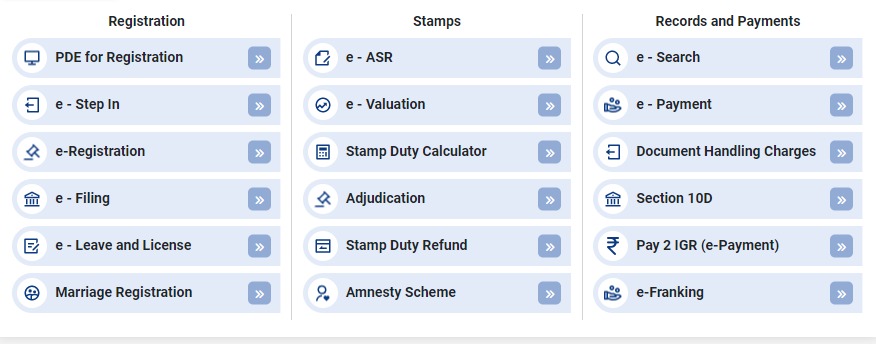

1. Visit the Maharashtra Stamp Duty and Registration Department website - https://igrmaharashtra.gov.in/Home

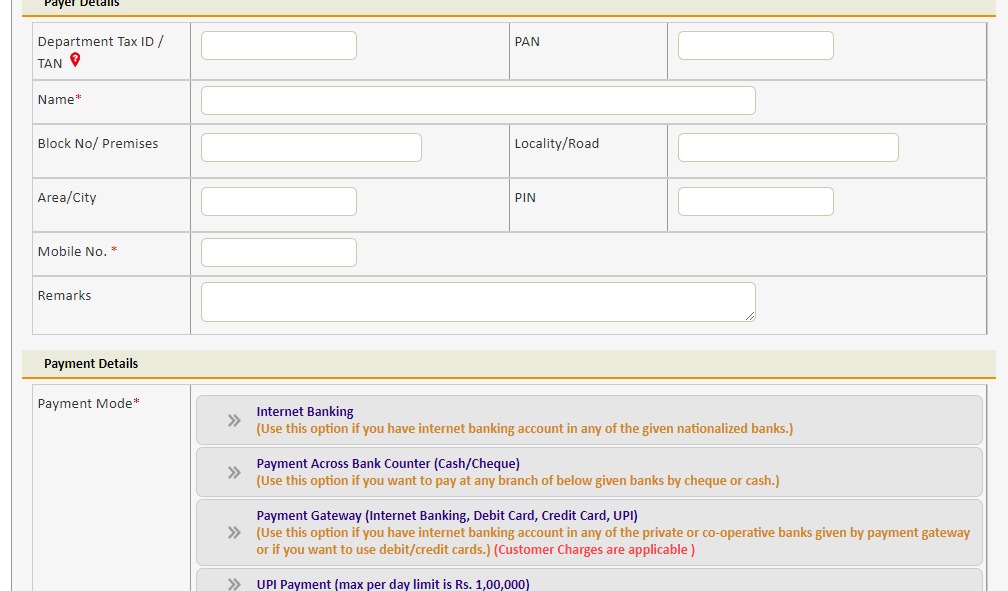

2. In the home section, click on the e-payment option.

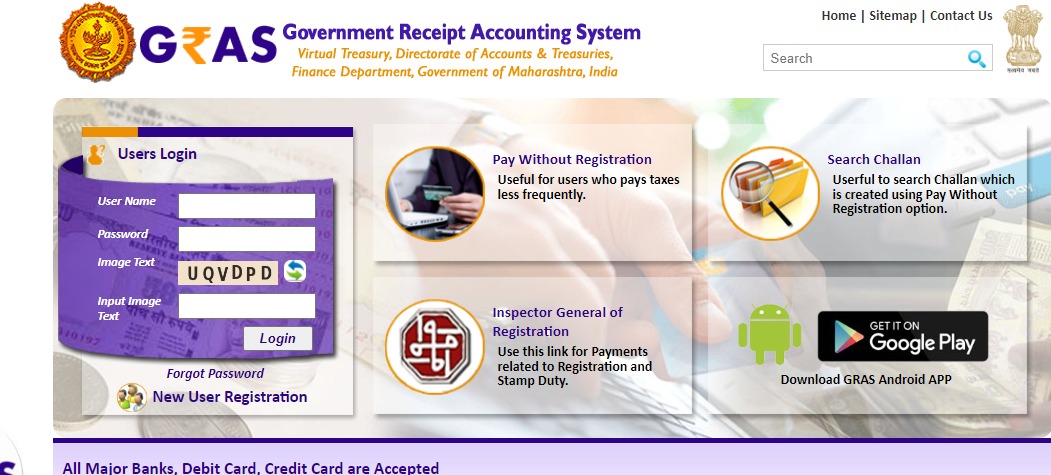

3. Then, you’ll be redirected to the GRAS page. Click on the pay without registration option.

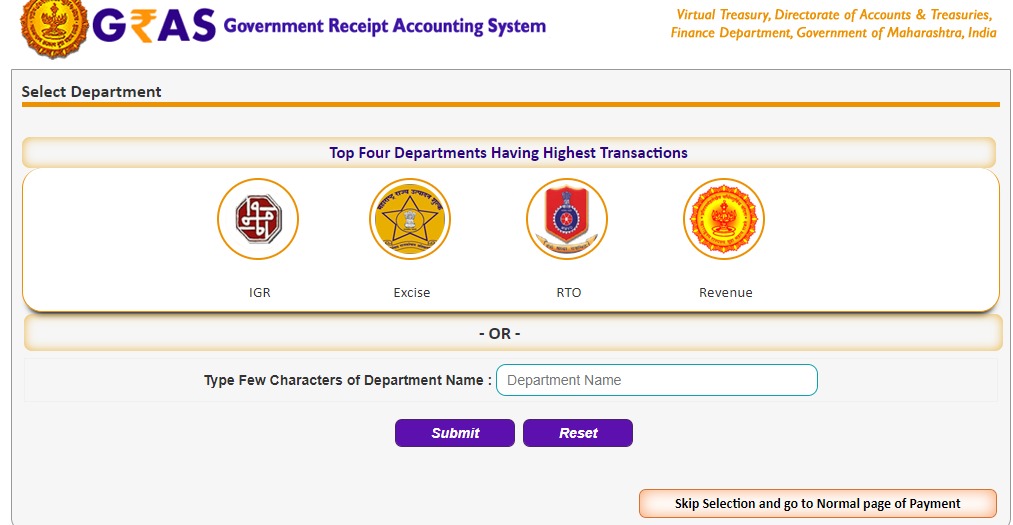

4. Next, click on the IGR option.

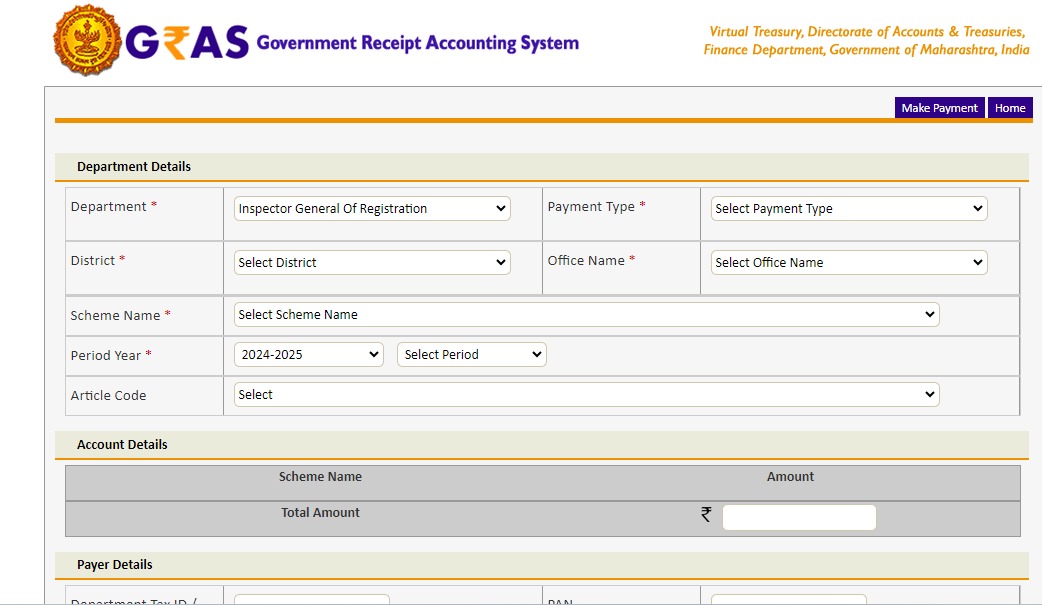

5. Fill in all the details.

6. Make the payment through net banking, credit/debit cards, or UPI and click the submit button.

7. Collect the receipt for future reference.

Step-by-Step Guide for Paying Stamp Duty and Registration Charges Offline in Navi Mumbai

Paying stamp duty and registration offline has two methods: Stamp paper and franking. Here is the step-by-step guide for paying stamp duty and registration charges offline in Navi Mumbai:

Stamp Paper:

- Purchase stamp paper from authorised vendors.

- Ensure the stamp paper value matches the calculated stamp duty.

- Execute the document on the stamp paper.

- Get the document verified by a Sub-Registrar.

- Register the document at the Sub-Registrar.

E-Franking:

- 1. Visit the Maharashtra Stamp Duty and Registration Department website - https://igrmaharashtra.gov.in/Home.

- In the home section, click on the e-franking option.

- Login using the credentials.

- Complete all the details and make the payment.

- Generate an e-stamp certificate.

Tax Benefits and Exemptions

Residents of Navi Mumbai can claim deductions under 80C of the Income Tax Act for home loan repayment and interest. Additionally, property tax relief is granted for small houses under 500 sq ft in Navi Mumbai. Women buyers in Navi Mumbai receive a 1% rebate on stamp duty. The Maharashtra Government offers subsidies up to 2.5 lakhs for affordable housing.

Streamline Your Stamp Duty Payments With NoBroker

Understanding stamp duty and registration charges is significant for property transactions in Navi Mumbai. You can navigate this complex process efficiently by familiarising yourself with rates, exemptions, and payment methods. Still worried about paying stamp duty rates in Navi Mumbai? NoBroker Pay helps you make payments securely, and you can track all your transactions in real time. Download the app today!

FAQs About Stamp Duty and Registration Charges Navi Mumbai

Q: What is the stamp duty rate in Navi Mumbai?

Ans: The current stamp duty in Mumbai is 6% for male and 5% for female owners.

Q: How is stamp duty calculated in Navi Mumbai?

Ans: Stamp duty is calculated depending on the property’s market or agreement value, whichever is higher.

Q: What are the registration charges for a flat in Navi Mumbai?

Ans: Registration charges for a flat in Navi Mumbai are 1% of the property’s market value.

Q: What documents are required to register for a Navi Mumbai flat?

Ans: Documents required include a sale deed, stamp duty payment receipt, and identity proof.

Q: What is the deadline for paying Navi Mumbai stamp duty and registration charges?

Ans: The deadline is 4 months from the property transfer date.

Recommended Reading

4 Legendary Mumbai Cafes You Need to Visit Now

January 31, 2025

2566+ views

The Cost of Living in Mumbai vs Bangalore 2025

January 31, 2025

6760+ views

Transport in Bangalore Vs. Transport in Mumbai

January 31, 2025

8100+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

15048+ views

List of Best Schools in Mumbai with Fee Structure 2025

January 31, 2025

9917+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1047491+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

February 5, 2025

92457+ views

Supreme Court Verdict on Society Maintenance Charges

January 31, 2025

75972+ views

All You Need to Know about Revenue Stamps

January 31, 2025

63641+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

55863+ views

Recent blogs in

e-Aasthi BBMP: Search Property Details, Download Certificates, and Check Status Online

February 5, 2025 by Suju

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

February 5, 2025 by Suju

How to get Non-Encumbrance Certificate Online and Offline: Download and Check Status 2025

February 5, 2025 by Vivek Mishra

Simple Introduction to Indian Property Tax

January 31, 2025 by NoBroker.com

Sales Agreement: Process, Format and More 2025

January 31, 2025 by Vivek Mishra

Join the conversation!