Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Stamp Duty in Andhra Pradesh: Rates and Regulations in 2025

Table of Contents

Did you know that the stamp duty in Andhra Pradesh is 5% of the property value? Stamp duty, a mandatory tax levied by the government, is significant in determining the overall cost of buying and selling in Andhra Pradesh. Get familiar with the state’s stamp duty rates to minimise costs. In this blog, you’ll learn more about the applicable rates, exemptions, and calculation methods to make informed decisions.

Stamp Duty Rates in Andhra Pradesh

Stamp duty is a mandatory tax on property transactions in Andhra Pradesh, ranging from 4-7% of the property value. The rates vary based on property type, location, and ownership. The stamp duty rates for males and females are the same.

Stamp Duty Rates for Different Types of Property Transactions

In Andhra Pradesh, stamp duty rates vary across transactions, properties, and ownership types. Here are the stamp duty rates for different types of property transactions in Andhra Pradesh:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

| Transaction Type | Andhra Pradesh Stamp Duty Rates |

| Sale of immovable property | 5% |

| Construction agreements | 5% |

| Development agreements | 5% |

| Agreement of sale-cum-GPA | 6% |

| Lease agreements | 0.4% (for less than a decade)0.6% (for more than a decade) |

| Mortgage agreements | 0.1% |

Factors Affecting Stamp Duty in Andhra Pradesh

Stamp duty in Andhra Pradesh is influenced by several factors, impacting the overall tax liability. Here are the factors affecting stamp duty in Andhra Pradesh:

- Property Location: Stamp duty rates vary significantly depending on whether the property is located in urban or rural areas, with urban areas typically attracting higher rates. For instance, properties within municipal corporation limits have higher stamp duty rates compared to those in development authority areas.

- Property Age: Older properties may qualify for lower stamp duty rates or exemptions, especially if they are heritage buildings or historic structures.

- Property Owner’s Age: Senior citizens (65+ years) are eligible for exemptions and concessions on certain transactions, such as gift deeds.

- Property Owner’s Gender: In Andhra Pradesh, both male and female property owners has to pay stamp duty of 5% of property value. There is no special concession for females, unlike in other states.

- Property Type: Different property types have distinct stamp duty rates, ranging from 2-7%, with residential, commercial, agricultural, industrial and open plots attracting varying rates.

- Amenities: The availability of amenities, such as infrastructure development, connectivity, and social amenities, impacts property value and stamp duty.

Calculation of Stamp Duty in Andhra Pradesh

Stamp duty calculation in Andhra Pradesh involves determining the applicable rate based on property type, location, and owner characteristics.

Step-by-Step Guide to Calculate Stamp Duty in Andhra Pradesh

Here is the step-by-step guide to calculate stamp duty in Andhra Pradesh:

1. Visit the official IGRS AP website at igrs.ap.gov.in.

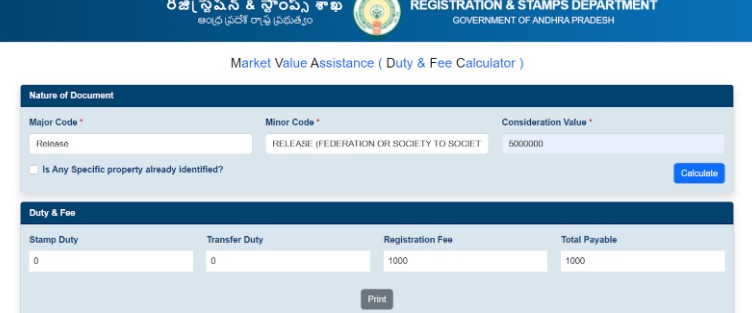

2. Click on the “Stamp Duty Fee Calculator” link in the home section of the website.

3. Select the transaction type (sale, gift, partition, mortgage, lease, etc.) from the dropdown menu.

4. Fill in the property details like major code, minor code, and consideration value.

5. Then, click the calculate button.

Calculation of Stamp Duty Based on Property Value

Stamp duty in Andhra Pradesh is calculated based on the market value or ready reckoner rates.

Here is the calculation of stamp duty based on property value:

- For properties valued up to ₹50 lakhs - The stamp duty rate is 5%

- For properties valued between ₹50 lakhs to ₹1 crore - The stamp duty rate is 6%

- For properties valued above ₹1 crore - The stamp duty rate is 7%

Example:

- Property Value - ₹65 Lakhs

- Stamp duty rate - 6%

- Stamp duty = Property value × Stamp duty rate = ₹65 lakh × 6% = ₹3.9 Lakhs

Calculation of Stamp Duty Based on Transaction Value

The stamp duty can be calculated based on the transaction value in certain cases. This applies only when the transaction value is lower than the market value. Here is the calculation of stamp duty based on transaction value:

Example:

- Transaction value - ₹35 Lakhs

- Stamp duty rate - 5%

- Stamp duty = Transaction value × Stamp duty rate = ₹35 lakh × 5% = ₹1.75 Lakhs

Payment of Stamp Duty in Andhra Pradesh

Stamp duty in Andhra Pradesh can be paid online or offline. Here is how to pay stamp duty in Andhra Pradesh:

Online Payment for Stamp Duty in Andhra Pradesh

The government of Andhra Pradesh offers online payment of stamp duty through the IGRS AP website (igrs.ap.gov.in). Citizens can securely pay stamp duty online through various payment gateways like net banking, credit/debit cards, and UPI.

Steps to Pay Stamp Duty in Andhra Pradesh Online

Here are the steps on how to pay stamp duty in Andhra Pradesh online:

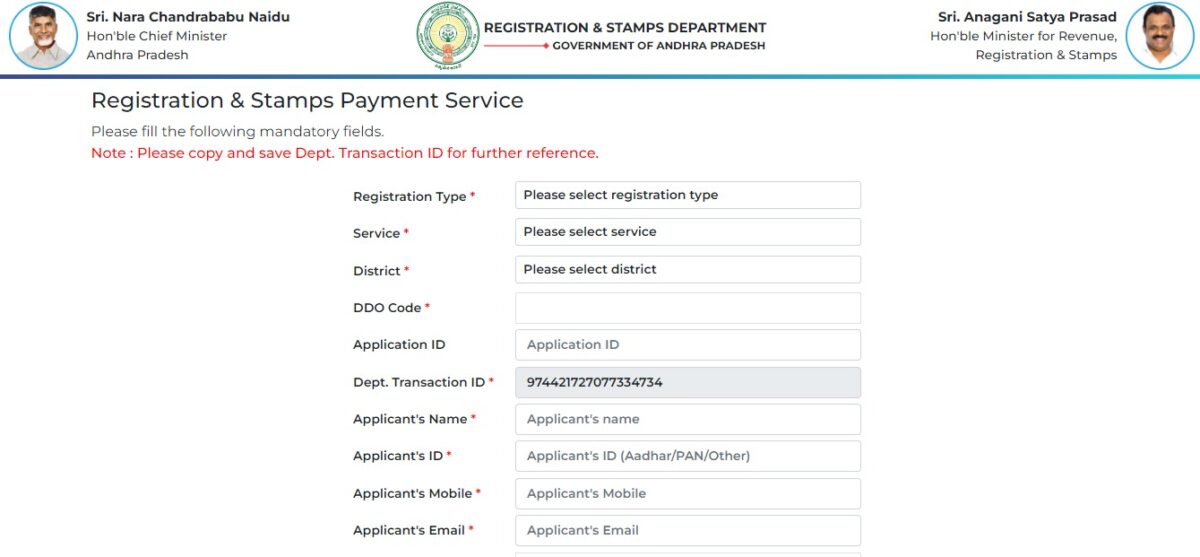

1. Visit the IGRS AP website - https://registration.ap.gov.in/igrs

2. Under online services, click the payment option.

3. Enter all the details in the form and click submit.

4. Finally, make the payment using your preferred payment methods, like debit/credit card, UPI, or net banking.

Offline Payment for Stamp Duty in Andhra Pradesh

In Andhra Pradesh, you can pay stamp duty offline through Sub-Registrar offices, authorised banks, or stamp vendors.

Steps to Pay Stamp Duty in Andhra Pradesh Offline

Here are the steps to pay stamp duty in Andhra Pradesh:

- Visit the Sub-Registrar's office.

- Fill in the stamp duty form.

- Submit the required documents using the completed form.

- Make the payment through DD, cash or cheque.

- Collect the stamp duty certificate from the Sub-Registrar office.

Registration Charges in Andhra Pradesh

Registration charges in Andhra Pradesh are fees levied by the government for registering property documents ensuring secure and legitimate transactions. The registration charges in Andhra Pradesh are 1% of the property.

Registration Charges for Different Types of Property Transactions

The Andhra Pradesh government levies registration charges for various property transactions to ensure safe dealings. Here are the registration charges for different types of property transactions:

| Property Transaction | Registration Charges |

| Sale deed | 0.5% |

| Gift deed | 0.5% |

| Settlement | 0.5% |

| Exchange | 0.5% |

| Agreement of sale-cum-GPA | ₹2000 |

| Development agreement-cum-GPA | 0.5% |

| Release | 0.5% |

| Power of attorney | 0.5% |

| Certificate of sale | 0.5% |

| Decree | 0.5% |

| Conveyance | 0.5% |

| Pari Passu charge | 0.5% |

| Lease | 0.5% |

| Licence | 0.5% |

| Mortgage | 0.5% |

| Deposit of title deeds | 0.5% |

| Release of deposit of title deeds | 0.5% |

Online Property Registration in Andhra Pradesh

Property registration in Registration in Andhra Pradesh is a mandatory process that records property transactions, ensuring safe ownership of property and preventing disputes.

Steps for Online Property Registration in Andhra Pradesh

Here are the steps for online property registration in Andhra Pradesh:

- Visit the official IGRS AP website (https://registration.ap.gov.in/igrs ) and click the “online services” option.

- Select the vendor for registration services from the list of authorised vendors.

- Click “proceed” to move to the next page for the district property registration.

- Fill out the online registration application form with the required details.

- The system will calculate the stamp duty and registration fees based on the property details.

- Pay online through net banking, UPI or credit/debit card.

- Upload all the required documents.

- Schedule an appointment at the Sub-Registrar's office for document verification.

- Visit the Sub-Registrar's office with original documents for verification.

- Collect the registration certificate from the Sub-Registrar office or download it from the IGRS AP website.

Documents Required for Property Registration in Andhra Pradesh

Certain documents are required to register the property in Andhra Pradesh. Here are the documents required for property registration in Andhra Pradesh:

- Gift deed of immovable property

- Leases of immovable property

- Aadhar card

- Voter ID

- Passport size photographs

- Passport

Tax Benefits and Exemptions

In Andhra Pradesh, property tax benefits and exemptions are available to eligible individuals. Property tax exemptions apply to residential buildings with Annual Rental Value (ARV) below ₹600. Citizens can claim a 5% rebate on timely payment and an additional 40% rebate for self-occupied residential buildings. Property tax can be paid through the Commissioner and Directorate of Municipal Administration’s website.

Tax Deduction Under Section 80C of the Income Tax Act

Section 80C of the Income Tax Act 1961 provides tax deductions for investments and expenses, reducing taxable income. Section 80C deductions are subject to change. Consult tax professionals or refer to the Income Tax Department’s website for updates.

Eligibility and Claim Process

To claim deductions under section 80C, you must be a resident individual or a Hindu Undivided Family (HUF).

Here is how to claim a deduction in Andhra Pradesh:

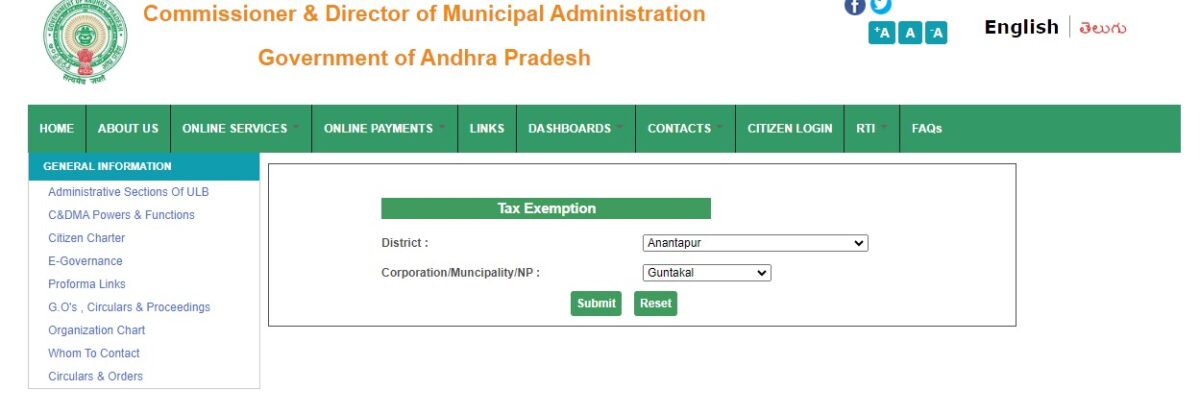

1. Visit the https://cdma.ap.gov.in/en website.

2. Under online services, click the “property tax” button.

3. Then click “File your tax exemption” option.

4. Then, enter your district and municipality from the list and click submit.

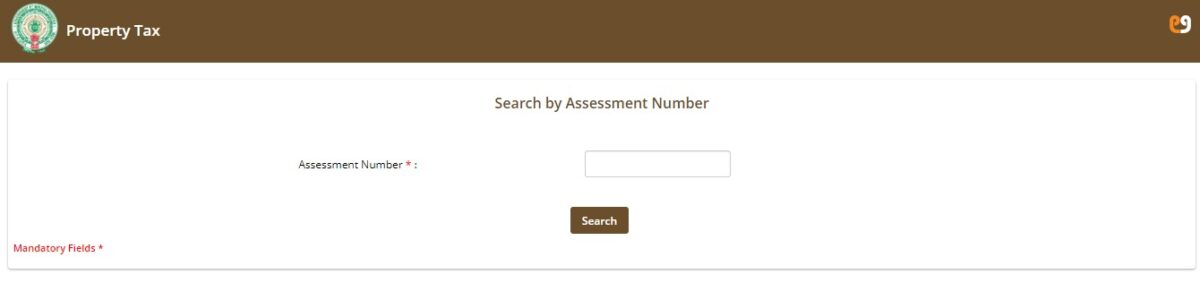

5. Next, enter your assessment number and click the search button.

6. Then pay using UPI, net banking or credit/debit cards.

7. Download the receipt for future reference.

Stamp Duty Refunds

In Andhra Pradesh, stamp duty refunds are processed through the Stamps and Registration Department. Refunds are issued through online applications on the Andhra Pradesh Government’s website or manual submissions at district Sub-Registrar offices. Eligible individuals can claim refunds for excess/incorrect payments within 6 months from the payment date.

Eligibility

Here is the eligibility for stamp duty refund:

- Excess or incorrect stamp duty payment.

- Payment mode on cancelled/invalid documents.

- Duplicate document

- Payment made on documents not registered.

Process

Here is the process for a stamp duty refund:

- Apply to the concerned District Collector/Sub Collector/Deputy Collector under Section 2(9) of the Indian Stamp Act, 1899, through the Sub-Registrar. Make sure to mention the reason for seeking a refund and attach the original challan and receipt issued by the designated bank.

- The Sub-Registrar will verify the records to ensure the challan and receipt are genuine and not utilised. Then, they will submit it to the Deputy Collector.

- The Deputy Collector will scrutinise the application and issue proceedings to refund the amounts to your original bank.

Make Your Stamp Duty Payments with NoBroker Pay

The stamp duty in Andhra Pradesh plays a crucial role in property transactions, ensuring legitimacy and revenue generation for the state government. Understanding stamp duty rates, exemptions, and refund procedures is essential for property buyers and sellers. To simplify your property transactions, choose NoBroker Pay, your trusted partner for secure payments. We provide real-time payment tracking for transparency and offer dedicated customer support for assistance. Download NoBroker Pay today!

FAQs About Stamp Duty in Andhra Pradesh

Q1: What are the house registration charges in Andhra Pradesh?

Ans: The house registration charges in Andhra Pradesh include stamp duty (5-7%), registration fee (0.5-1%), and other miscellaneous charges.

Q2: What is the land registration fee in Andhra Pradesh?

Ans: The land registration fee in Andhra Pradesh is 0.5-1% of the property value.

Q3: What are the mortgage registration fees in Andhra Pradesh?

Ans: Mortgage registration fees in Andhra Pradesh range from 0.5 - 1% of the loan amount.

Q4: What are the registration charges in AP for land?

Ans: The registration fees in AP for land include stamp duty (5-7%) and registration fee (0.5-1%).

Q5: What is e-stamp paper Andhra Pradesh?

Ans: E-stamp paper Andhra Pradesh is an electronic stamp paper used for property registrations, replacing traditional physical stamp papers.

Q6: How to obtain e-stamp paper in AP?

Ans: E-stamp paper in AP can be obtained online through the SHCIL website or from authorised vendors.

Recommended Reading

Stamp Duty and Property Registration Charges in Mumbai 2025

January 23, 2025

23370+ views

What are the current Stamp Duty and Property Registration Charges in Karnataka for 2025?

January 23, 2025

34569+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

51073+ views

IGRS AP Online - Application, Registration, Stamp Duty & More

January 15, 2025

7968+ views

A Detailed Guide on Stamp Duty and Property Registration Charges in Haryana

December 31, 2024

11283+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

December 31, 2024

1046190+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

January 16, 2025

76831+ views

Supreme Court Verdict on Society Maintenance Charges

December 17, 2024

69617+ views

All You Need to Know about Revenue Stamps

December 17, 2024

58664+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

51073+ views

Recent blogs in

Stamp Duty and Property Registration Charges in Mumbai 2025

January 23, 2025 by Kruthi

What are the current Stamp Duty and Property Registration Charges in Karnataka for 2025?

January 23, 2025 by Prakhar Sushant

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025 by Vivek Mishra

Join the conversation!