Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

What are the current Stamp Duty and Property Registration Charges in Karnataka for 2025?

Table of Contents

Planning to buy property in Karnataka? Do you know how much you’ll need to pay in stamp duty? Stamp duty in Karnataka is a tax levied by the state government on the transfer of ownership of immovable properties. The Karnataka Stamp Act of 1957 governs the state's stamp duty collection. The duty is payable on various instruments, including sale deeds, gift deeds, and lease agreements. It varies depending on the type of property and its location. Understanding stamp duty in Karnataka is essential for individuals and organisations involved in property transactions.

Stamp Duty and Registration Charges in Karnataka 2025

While applying for a home loan, you should be aware of the prevailing stamp duty charges that you will have to pay when you buy a property. If you are looking to buy a property in Bangalore, the latest stamp duty in Bangalore apply to your condition.

The stamp duty amount will be calculated based on the factors mentioned above for registration and stamp duty charges in Bangalore.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

The stamp duty for property registration in Karnataka was slashed earlier this year in an attempt to revitalise the real estate market. The global real estate market took a major toll with the coronavirus-induced lockdowns wreaking havoc everywhere.

The current stamp duty and registration charges in Karnataka are 3% for all properties worth up to Rs 45 lakhs, 2%, for properties worth up to Rs 20 lakhs and 3% for properties worth more than Rs 20 lakhs but less than Rs 45 lakhs.

| Category | Stamp Duty in Karnataka | Registration Charges |

| Male | 5% (Above Rs 45 lakh)<br>3% (Rs 21-45 lakh)<br>2% (Below Rs 20 lakh) | 1 % of the property’s value |

| Female | Same as Male | 1 % of the property’s value |

| Male + Female | Same as Male | 1 % of the property’s value |

Stamp Duty Charges In Karnataka:

- For male buyers: E stamp paper charges in Karnataka: 5% of the property value for properties above Rs 45 lakh; 3% for properties between Rs 21-45 lakh; and 2% for properties below Rs 20 lakh.

- For female buyers: Same rates as male buyers.

- For male + female joint buyers: Same rates as male buyers.

- For male + male joint buyers: Same rates as male buyers.

- For female + female joint buyers: Same rates as male buyers.

Registration Charges in Karnataka: 1% of the property value for all categories (male, female, male+female, male+male, female+female).

Gift Deed Registration Charges in Karnataka

Gift deed registration in Karnataka involves a legal process to transfer ownership of property or assets as a gift from one person to another. The registration charges for a gift deed typically include stamp duty, registration fees, and other applicable charges.

| Description of the document | Stamp duty fees | Registration fees |

| Gift deed | ||

| a). If the donee is not a family member of the donor | 5% on the market value + surcharge + additional duty | 1% |

| b). If the donee is a specific family member of the donor | ₹5000 - BMRDA, BBMP, City Corporation₹3000 - City/Municipal/Town Panchayath₹1000 - Others | ₹500 - fixed |

Gift Deed Registration Charges for Family Members

The Karnataka registration charges for a gift deed transferring property to a family member are significantly lower than transfers involving non-family members. This is implemented to encourage property transfers within the families.

The stamp duty for family members is highly concessional. Stamp duty on gift deeds in blood relations in Karnataka is typically 0.5% of the property's market value, whichever is lower. The registration fee for family members is 1% of the property's market value. This fee is applicable in addition to the stamp duty.

e-Stamp Paper Commission Charges in Karnataka

e-Stamp paper is a convenient and secure way to pay stamp duty for property transactions, agreements, and other legal documents in Karnataka. The e-stamping system is managed by the Stock Holding Corporation of India Limited (SHCIL), ensuring a fraud-proof method for stamp duty payment.

| Amount | Commission |

| ₹20 - ₹100 | ₹10 |

| ₹101 - ₹5000 | ₹15 |

| ₹5001 - above | No commission |

Recent Development: Karnataka Government Urged to Revise Guidance Value for Property Registration

The Confederation of Real Estate Developers’ Association of India - Karnataka and the Forum for People’s Collective Action (FPCE), advocating for homebuyers, have jointly requested the state government to reevaluate the guidance value for property registration.

They propose using the guidance value at the time of the homebuyer's sale agreement with the developer, rather than the date of property registration.

Santosh Patil, a founding member of FPCE, emphasized that this change would alleviate the financial burden on already stressed homebuyers, especially those with loans.

Suresh Hari, Secretary of CREDAI - Karnataka, noted that while luxury housing is unaffected, the increased guidance value has imposed significant pressure on mid- and lower-income housing projects.

As of January 2025, the property registration charges in Karnataka comprise stamp duty, registration fees, and additional surcharges. Effective October 1, 2023, Karnataka witnessed an increase in the guidance value, directly impacting property-related taxes.

As stamp duty is calculated as 5% of the guidance value, this increase proportionally raised property taxes, set at 2% of the stamp duty paid on the property.

Karnataka to slash Stamp Duty on flats below Rs 45 Lakhs

The Karnataka Legislative Assembly has amended the Karnataka Stamps Act, 1957, reducing the stamp duty on property purchases from 5% to 3%. The aim is to boost the real estate market after pandemic-induced lockdowns and address the issue of vacant flats. First-time buyers of properties worth 35 lakhs to 45 lakhs will now pay a reduced 3% stamp duty. The government plans to consider further revisions on e-stamp paper commission charges in Karnataka for other property categories.

Karnataka House Registration Charges

The site registration charges in Karnataka include stamp duty, registration fees, and other applicable surcharges as mandated by the government. If you have taken a new property in the state of Karnataka, stamp duty and registration charges must be paid to the Department of Stamps and Registration, Government of Karnataka.

In the case of urban areas, the BBMP sets the surcharge at 2% and the cessation at 10%. So, the effective tax rate is 5.6%. The buyer may have to pay a 3% surcharge for the same property in a rural area, leading to a higher effective tax rate of 5.65%.

| Type of Fee | Amount |

| Registration charge | 1% of the property value |

| BMRDA and other Surcharges | 3% on stamp duty |

| BBMP and Corporation Added Surcharges | 2% on stamp duty |

| BBMP, BMRDA and Village Areas Added Cess | 10% on the stamp duty |

How to Calculate Registration Charges and Stamp Duty in Karnataka

The Karnataka government offers a user-friendly online tool for calculating stamp duty charges within the state. This web application efficiently computes the stamp duty based on the provided information. Here's a step-by-step guide to calculating stamp duty and registration charges:

- Step 1: Visit the Kaveri Online Services Portal, the official platform of the Karnataka stamp and registration department, at https://kaverionline.karnataka.gov.in/Layout/Layout .

- Step 2: Navigate to the 'Stamp Duty and Registration Fee Calculator' tab.

- Step 3: You will be directed to the calculator interface.

- Step 4: Input details such as Region type, Indicative market value, and Indicative Consideration Amount.

- Step 5: Click the 'Calculate' button.

The calculator will then display the following information

- Government Duty

- Surcharge Value

- Cess Value

- Total Stamp Duty

- Total Registration Fees

How to Pay Stamp Duty and Registration Fees in Karnataka

In Karnataka, you can pay the stamp duty for property transactions through both online and offline methods. Here's a step-by-step guide on how to pay stamp duty in Karnataka:

Online Method: Stamp duty payment online, Karnataka

- Visit the official website of the Department of Stamps and Registration, Karnataka (https://kaverionline.karnataka.gov.in/Layout/Layout)

- Look for the "Online Payment" or "E-Payment" section on the website's homepage.

- Click on the option related to "Payment of Stamp Duty."

- You will be directed to a new page where you need to select the type of document (e.g., Sale Deed, Gift Deed, Lease Deed, etc.).

- Enter the required details about the property, transaction, and parties involved.

- Calculate the stamp duty amount based on the details provided.

- Choose the payment method (Netbanking, credit/debit card, or other available options) and make the payment.

- After successful payment, you will receive a payment receipt and a digitally stamped document.

Offline Method: Stamp duty payment offline, Karnataka

- Visit the nearest Sub-Registrar's office or the designated bank authorized to collect stamp duty.

- Obtain the required stamp duty payment challan/form from the office or bank.

- Fill in the details about the property, transaction, and parties involved in the form.

- Calculate the stamp duty amount based on the details provided and pay the amount in cash or through demand draft.

- After payment, you will receive a receipt as proof of payment.

Points to Consider Before Paying Stamp Duty in Karnataka

Before you pay stamp duty in Karnataka, there are a few things you should think about:

- The issuance date of the Karnataka stamp paper must be within 6 months of the transaction date.

- Before registration, all stamp-eligible assets must be stamped.

- Individuals participating in the transaction must sign the stamp paper.

- The adhesive stamp that was removed during execution cannot be used again.

- Gift Deed Registration Charges in Karnataka are transferred to a non-family member: 5% of the property's market value plus surcharges and cess, plus a 1% registration cost of Rs.1000 + surcharge + cess and a set registration fee of Rs.500 for a transfer to a family member.

Refund Process for Stamp Duty in Karnataka

It's crucial to note that the procedure for obtaining a stamp duty refund can differ from one Indian state to another. In Karnataka, if a sales deed is cancelled, property buyers have the option to request a refund of 98% of the paid stamp duty by filing a refund application.

To initiate the stamp duty refund process in Karnataka, it is imperative to submit both the original agreement and the original cancellation deed along with the refund application. It is also advisable to reach out to the nearest sub-registrar's office, where you can obtain specific guidance and requirements for the stamp duty refund application in Karnataka.

Factors Affecting Stamp Duty in Karnataka

Here are the major factors deciding stamp duty in Karnataka:

| Factors | Stamp Duty Rates and Registration Charges in Karnataka |

| Age and gender | In Karnataka, senior citizens pay a cheaper stamp duty rate. This has a huge impact on the charges. Furthermore, men in India must pay a 2 percent higher stamp duty. This does not apply to the state of Karnataka. |

| Property location | Stamp duty rates are often higher in urban areas, while stamp duty rates are lower outside of these locations. |

| Property age | The stamp duty is based on the overall worth of the house or property, with the age of the property being a significant factor. People should be aware that older homes are less costly than newer homes. |

| Basic amenities | Stamp tax is greater on properties with basic amenities such as lifts and swimming pools. Property value will increase. |

Are Tax Benefits Available on Stamp Duty and Registration Charges?

Section 80C of the Income Tax Act of 1961 allows for tax deductions on stamp duties and registration fees. The maximum deduction is ₹1,50,000. in this case.

Commercial properties, residential plots, and resale property, on the other hand, are not entitled to this tax benefit. This tax break is only available to new homes.

These are some important data about stamp duty and registration fees in Karnataka. Knowing the stamp duty rates and payment procedures makes the process go more smoothly.

Stamp Duty and Registration Charges in Karnataka on Other Services

When it comes to property transactions in Karnataka, understanding the applicable stamp duty and registration charges is essential. This table provides a comprehensive overview of the charges for various deeds, including adoption deeds, conveyances, gift deeds, lease agreements, and more.

| Sr No | Document/Deed | Stamp Duty Charges (In Rs) | Registration Charges (In Rs) |

| 1 | Adoption Deed | 500 | 200 |

| 2 | Affidavit | 20 | - |

| 3 | Agreement related to Deposit of Title Deeds | 0.1% of Market Value (Min: Rs 500, Max: Rs 50,000) | 0.1% of Market Value (Min: Rs 100, Max: Rs 10,000) |

| 4 | Conveyance (including flats) | 5% on market value + Surcharge + Additional duty | 1% |

| Conveyance by BDA/KHB | 5% on Consideration value + Surcharge + Additional duty | 1% | |

| 5 | Exchange Deed | 5% on market value + Surcharge + Additional duty | 1% |

| 6 | Gift Deed | (i) If Donee is not a family member: | |

| 5% on market value + Surcharge + Additional duty | 1% | ||

| (ii) If Donee is a specified family member: | |||

| Rs. 1000 + Surcharge and Additional levy | Rs. 500 fixed | ||

| 7 | Lease Only | (a) More than 30 yrs or perpetuity | On Market Value/AAR + advance + premium + deposit + fine (whichever is higher) |

| Lease of property between Family members | Rs 1000/- | Rs 500/- | |

| 8 | Partition | (a) Non-Agriculture Properties in Municipal limits | Rs 1000 per share |

| (b) Agricultural Land registration charges in Karnataka | Rs 250 per share | ||

| (c) Movable property | Rs 250 per share | ||

| 9 | Power of Attorney (PoA) | For Registration, one or more documents | Rs 100 |

| Assigning one or more people in a single transaction | Rs 100 | ||

| 10 | Reconveyance of mortgage property | Rs. 100 | Rs. 100 |

| 11 | Release | (i) When Release is not between family members | 5% on market value |

| (ii) Between family members | Rs 1000/- | ||

| 12 | Settlement Deed | (i) Not among the family members | 5% on market value + Additional duty |

| (ii) Property settlement between the family members | Rs 1000 + Additional duty | ||

| (iii) Settlement Revocation | Rs. 200 | ||

| 13 | Surrender of Lease | Rs. 100 | Rs. 100 |

| 14 | Transfer of Lease | (a) If the remaining period is fewer than 30 years | 5% on the consideration value |

| (b) Where the remaining period is greater than 30 years | 5% on market value | ||

| 15 | Trust Deed Revocation | Maximum Rs. 200 | Rs. 100 |

| 16 | Will deed | NIL | Rs. 200 |

| 17 | Will Deed Cancellation | Rs. 100 | Max Rs. 200 |

For instance, if you're planning an adoption, you'll need to pay a stamp duty of Rs 500 and a registration charge of Rs 200. On the other hand, an agreement related to the deposit of title deeds would incur a stamp duty of 0.1% of the market value, with a minimum of Rs 500 and a maximum of Rs 50,000, along with a registration charge of 0.1% of the market value, with a minimum of Rs 100 and a maximum of Rs 10,000 as per Karnataka registration act.

Similarly, if you're involved in a lease agreement, the stamp duty would vary based on the lease term and whether it involves family members or not.

Disclaim Remember, these rates are subject to change, and it's essential to verify the latest charges with the Karnataka state government before proceeding with any property-related transactions. Always seek professional advice to ensure a smooth and hassle-free process.

The state government’s decision to slash stamp duty and registration charges in Karnataka comes as a strong initiative to boost the property market in rural areas. However, the stamp duty in Karnataka across the most in-demand category of Rs. 50 lakhs to Rs 1 crore remains at 5%. The guidelines and regulations have also been changed recently and it can get very confusing to calculate and pay the stamp duty in Karnataka. All of this can be done in a matter of minutes with expert legal assistance from NoBroker by clicking below or just commenting on this blog and we will reach out to you.

Frequently Asked Questions

Ans: The Government levies a fixed tax on the transactions of property. This tax is known as stamp duty tax.

Ans: In urban areas, the BBMP levies a 10% cess value along with a 2% surcharge on the sale of a property.

Ans: The revised rates now stand at 3% for properties valued at INR 45 lakh or less, 2% for properties valued below INR 20 lakh, and 5% for properties valued at over INR 45 lakh. This reduction in stamp duty is expected to make homeownership more accessible and affordable, providing a potential boost to the real estate sector.

Ans: Department of Stamps and Registration, Government of Karnataka is responsible for collecting and maintaining stamp duty records.

Ans: The stamp duty in Karnataka is calculated based on the guidelines set by the Department of Stamps and Registration, Government of Karnataka. The total stamp duty charges include the cess and corporation surcharges

Ans: The plot registration charges in Karnataka include stamp duty and registration fees, which are calculated based on the guidance value or market value of the property, whichever is higher. As of January 2025, the stamp duty for plots is 2% for properties valued up to ₹20 lakh, 3% for properties valued between ₹21 lakh and ₹45 lakh, and 5% for properties above ₹45 lakh.

Ans: House registration charges in Karnataka are similar to plot registration charges, involving stamp duty and registration fees. The new rates for house properties as of January 2025 are 2% stamp duty for properties valued up to ₹20 lakhs, 3% stamp duty for properties valued between ₹21 lakhs and ₹45 lakhs, and 5% stamp duty for properties valued above ₹45 lakh. The registration charge is 1% of the property value.

Ans: The new stamp duty rates in Karnataka, effective October 1, 2023, are as follows: 2% for properties up to ₹20 lakh, 3% for properties between ₹21 lakh and ₹45 lakh, and 5% for properties valued above ₹45 lakh.

Recommended Reading

Property Rates in Bangalore in 2025: Current Price for Residential and Commercial Spaces

March 13, 2025

24929+ views

20 Best Schools in Bangalore: Admission Process with Fee Structure in 2025-26

March 12, 2025

20214+ views

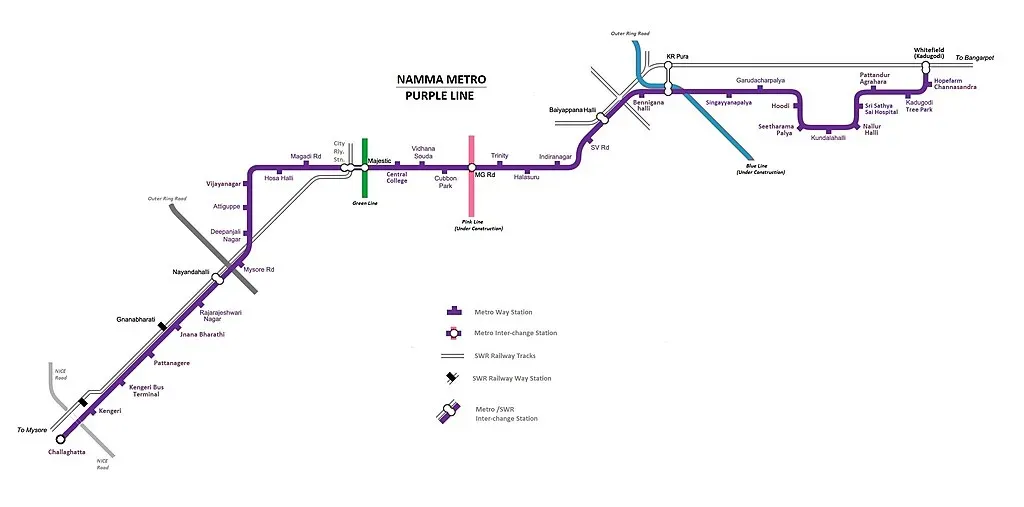

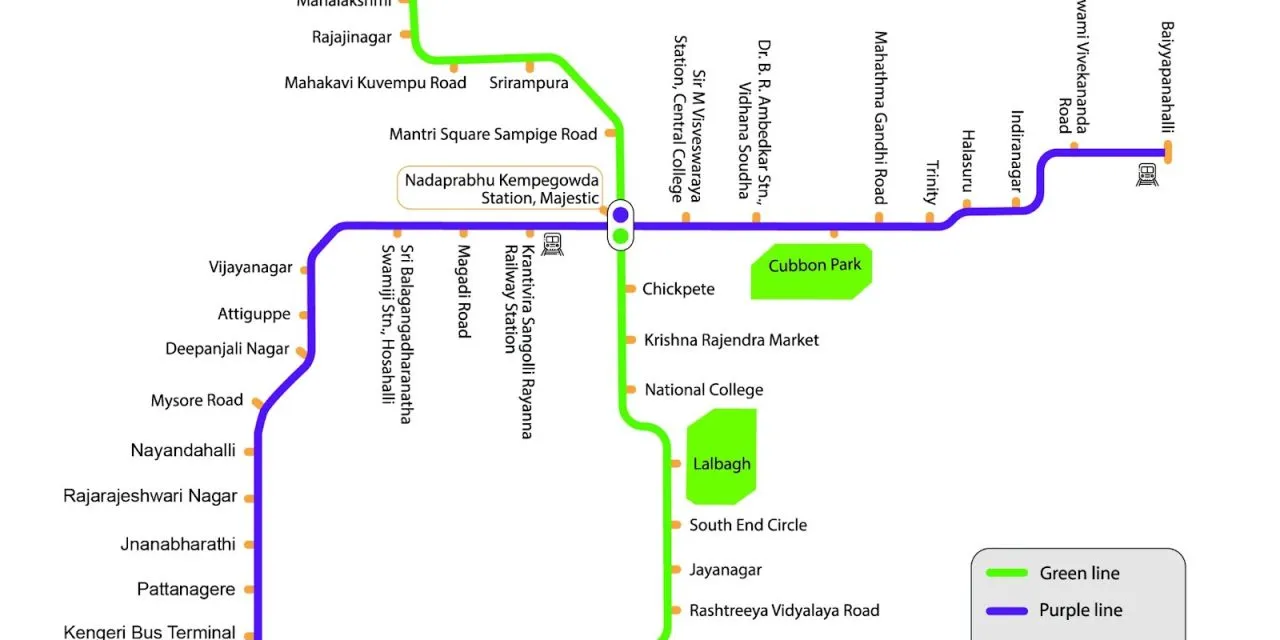

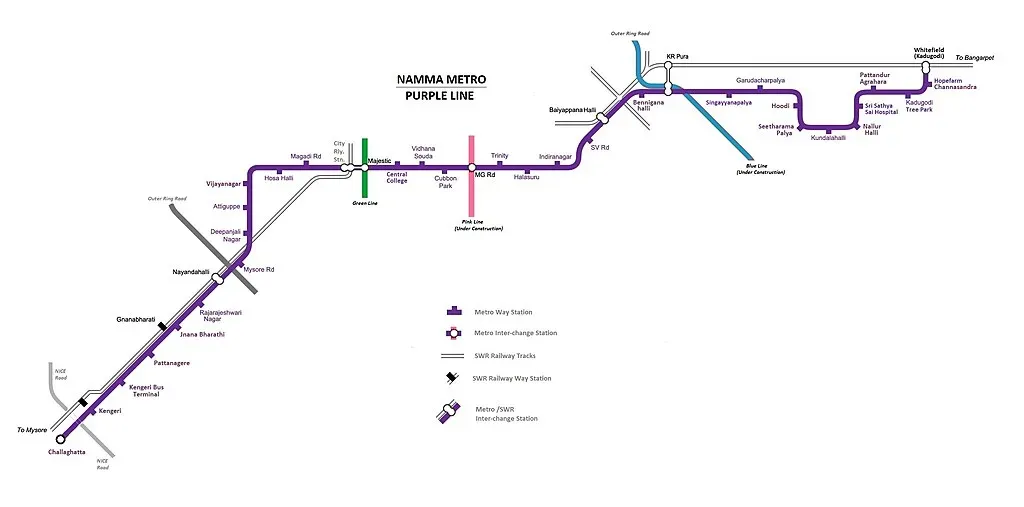

Whitefield Metro Station Bangalore: Station List, Timing, Map and Fares in 2025

March 3, 2025

284+ views

Jalahalli Metro Station Bangalore: Maps, Routes, Timings, Parinking and Fares in 2025

March 3, 2025

437+ views

Garudacharapalya Metro Station Bangalore: Map, Routes, Timings, Parking and Fares in 2025

March 1, 2025

162+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1095121+ views

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

March 3, 2025

126310+ views

Supreme Court Verdict on Society Maintenance Charges

January 31, 2025

92022+ views

All You Need to Know about Revenue Stamps

January 31, 2025

74340+ views

Stamp Duty and Registration Charges in Bangalore in 2025

January 23, 2025

69212+ views

Recent blogs in

What is the BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025?

March 3, 2025 by Suju

Panchkula Property Tax: Payment Methods and Receipt Download 2025

February 12, 2025 by Suju

How to get Non-Encumbrance Certificate Online and Offline: Download and Check Status 2025

February 11, 2025 by Vivek Mishra

e-Aasthi BBMP: Search Property Details, Download Certificates, and Check Status Online

February 5, 2025 by Suju

Simple Introduction to Indian Property Tax

January 31, 2025 by NoBroker.com

Join the conversation!